In a multi-company environment, a situation in which the sales organization is a company different than the inventory owner, is possible. In such case, the function of inter-company billings is necessary, which enables automatic billing of transactions between the company organizations.

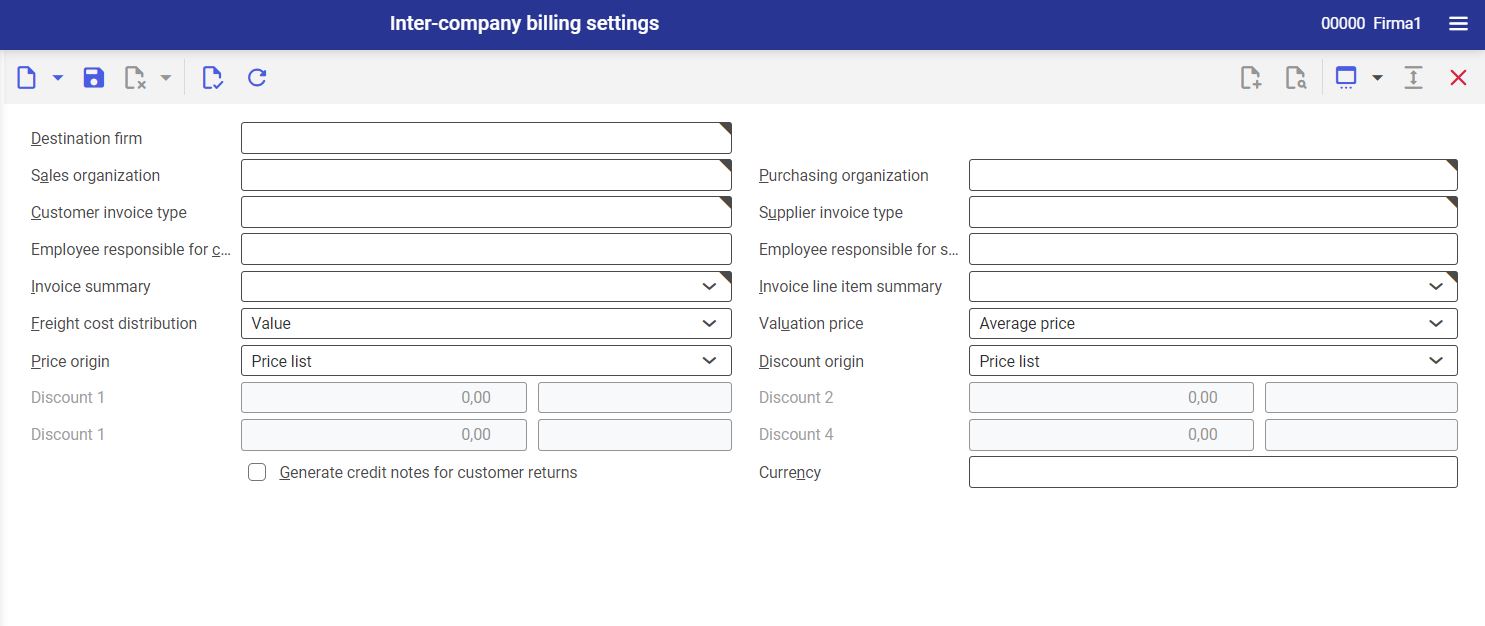

The Inter-company billing settings application allows for defining details of inter-company billings between selected organizations, e.g., types of invoices, sources of prices and freight costs.

In the application, the standard buttons are available and the following fields:

- Destination firm (mandatory field) – source organization, within which actions requiring the inter-company billing, are executed (organization visible on the application bar in the right corner). Additionally, defined settings for inter-company billings will refer to selected organization.

- Sales organization (mandatory field) – sales organization on behalf of which customer invoices are generated for inter-company billings. The organization must be a sales organization and must be the supplier for the organization selected in the Purchasing organization field.

- Purchasing organization (mandatory field) – purchasing organization for which supplier invoices are generated for inter-company billings. The organization must be a purchasing organization and must be the customer for the organization selected in the Sales organization field.

- Customer invoice type (mandatory field) – type of generated customer invoices

- Supplier invoice type (mandatory field) – type of generated supplier invoices

- Employee responsible for customer invoices – employee responsible for the customer invoice. If, during the creation of the inter-company billing, it is impossible to select the customer, the user executing the billing is selected.

- Employee responsible for supplier invoices – employee responsible for the supplier invoice. If, during the creation of the inter-company billing, it is impossible to select the customer, the user executing the billing is selected.

- Invoice summary (mandatory field) – allows for specifying the criterion for generating invoices during the inter-company billings. The following values are available:

- Per posting date – the invoice is generated for the organization of the inventory owner for each posting date

- Per period – one collective invoice is generated for the billing period of the organization of the inventory owner

- Per call-up – the invoice is generated for the inventory owner

- Invoice line item summary (mandatory field) – allows for specifying the criterion of line item grouping for created invoices. Characteristics:

- Item

- Unit

- Invoicing terms

- Payment terms

- Tax code

The following line item grouping criteria are available:

- Don’t summarize – an invoice line item is created for each billing line item

- Per order

- Per invoice summary

- Per posting date

- Per period

An invoice line item is created for all billing line items with matching characteristics.

- Freight cost distribution – allows for specifying the criterion of freight cost distribution on the invoice. Available values:

- Quantity

- Value

- Weight

- Volume

- Valuation price – allows for defining the valuation source for the invoice line items. The following options are available:

- Billing price 1

- Billing price 2

- Billing price 3

- Billing price 4

- Billing price 5

- Inventory count price

- Last cost price

- Average price

The billing prices and the inventory count price are retrieved from the application Items, Financials view, tab Warehouse data. If the price is not defined in the Warehouse data tab, it will be retrieved from the tab General in the Financials view, without any reference to the storage place. Alternatively, the inventory count price can be calculated during the inventory process. If it is not possible to calculate the last cost price or the average price, the system applies the billing price 1.

- Price origin – allows for specifying the price origin. Available values:

- Price list – the prices are determined on the basis of the price list

- Price list, manual – the system tries to determine the prices on the basis of the price list, if it is not possible, it is necessary to enter the prices manually

- Manual – the prices are entered manually for the line items of the inter-company billing

- Discount origin – allows for specifying the origin of discounts. Available values:

- Price list – the discount is determined on the basis of the price list

- Manual – fields Discount 1-4 are made available for edition, which allows for defining discount rates manually

- Discount 1-4 – these fields allow for defining the discounts manually. The fields are divided into two parts. In the first part, the percentage value of the discount is defined. In the second part, the sales price component type to which the discount refers, is selected. It is possible to select the following types: Discount and with active Header discount parameter. The fields can be edited, if in the field Discount origin, the value Manual is selected.

- Generate credit note for customer returns – this parameter allows for creating billings for customer returns. If it is active, the organization being the owner of the target warehouse will receive the credit note from the organization being owner of the source warehouse, after the inter-company billing is made for the return. If the function is active, the organization being the owner of the source warehouse, receive an outgoing invoice from the organization being the owner of the target warehouse.

- Currency – allows for selecting the currency in which inter-company billings will be carried out. The target company currency is set as default.

Customizing

There are no settings in the Customizing application for the Inter-company billing settings application.

Business entities

For the application Inter-company billing settings, the following business entity is relevant: com.cisag.app.multiorg.obj.Organization, which belongs to the group of business entities com.cisag.app.multiorg.MasterData. It is used, for example, to:

- assign permissions

- set activity definitions

- import or export data

Authorizations

Authorizations can be assigned both through authorization roles and by assigning organizations. Technical documentation Authorizations contains rules regarding authorization handling.

Special features

There are no special features for the Inter-company billing settings application.

Organizational assignments

Inter-company billings will be visible for the user only if the partner, in their base data, has an organization attached to at least one of the following organization structures assigned:

- Financials

Authorizations for Business Partners

The Inter-company billings application is not released for the business partners.