Topic overview

Bonuses in Purchasing are subsequent payments for a part of a supplier’s turnover in a certain time period. The payment can be made by:

- debiting the supplier’s account

- credit notes

Bonus-relevant turnovers are always based on:

- supplier invoices

- credit notes

The following is specified in the Purchasing bonus agreements application:

- suppliers with whom agreements are entered into

- items that are bonus-relevant

Definition of terms

A bonus normally is:

- a remuneration awarded to a partner

- a loyalty reward usually awarded to a partner in the form of a credit note

- a thank you for long-term business relationships (bonus category: fixed amount) or for a specified turnover level (bonus categories: volume-based rebate, increase-based rebate).

Price component types contain price component settings which are used for pricing. It is possible to specify:

- whether cash discounts or packaging quantities are to be taken into account for pricing

- whether a price component is to be used for entire orders or only for individual line items

A specific price component category is assigned to each price component type.

Master data

Purchasing bonus agreement types

The purchasing bonus agreement types specify the category of purchasing bonus agreement. In addition, you can create various default values and organization- and content-based authorizations for purchasing bonus agreements

There are three categories of purchasing bonus agreement types available in the system:

- volume-based rebate (sales bonus) – bonus is paid as a percentage of the reached certain turnover level

- increase-based rebate – once a certain turnover level is reached (base amount), the percentages achieved in excess of this amount are entered and assigned to bonus levels. It is also paid as a percentage from the turnover

- fixed amount – a fixed amount is paid as a promotional allowance, advertising allowance, etc., irrespective of reaching a turnover target

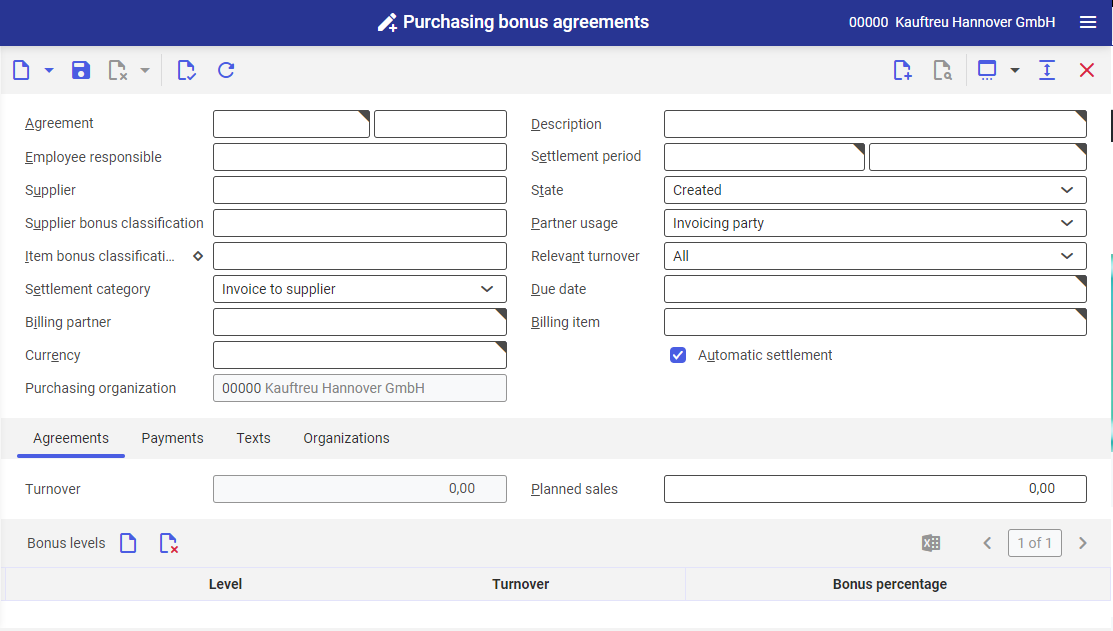

Purchasing bonus agreements

Purchasing bonus agreements specify the contractual terms.

They contain information about:

- the supplier(s) belonging to a supplier bonus classification

- the time periods that are to be considered for the bonus calculation

- the date of maturity

- the partner usage that is relevant to the supplier invoice selection:

- supplier

- invoicing party

- the items that are considered (inclusion) and are not considered (exclusion) in the bonus by means of the purchasing item bonus classifications

- the currency in which the bonus will be paid

Purchase price component types

The purchase price component types whether or not surcharges and discounts are relevant to the bonus. These specifications affect the calculation of the supplier invoice line items that determine the bonus-relevant turnover besides the turnover revenues (line item net amounts). Therefore, it is possible to calculate a purchasing bonus based on the gross purchase prices, e.g., by marking all discounts as non-bonus-relevant.

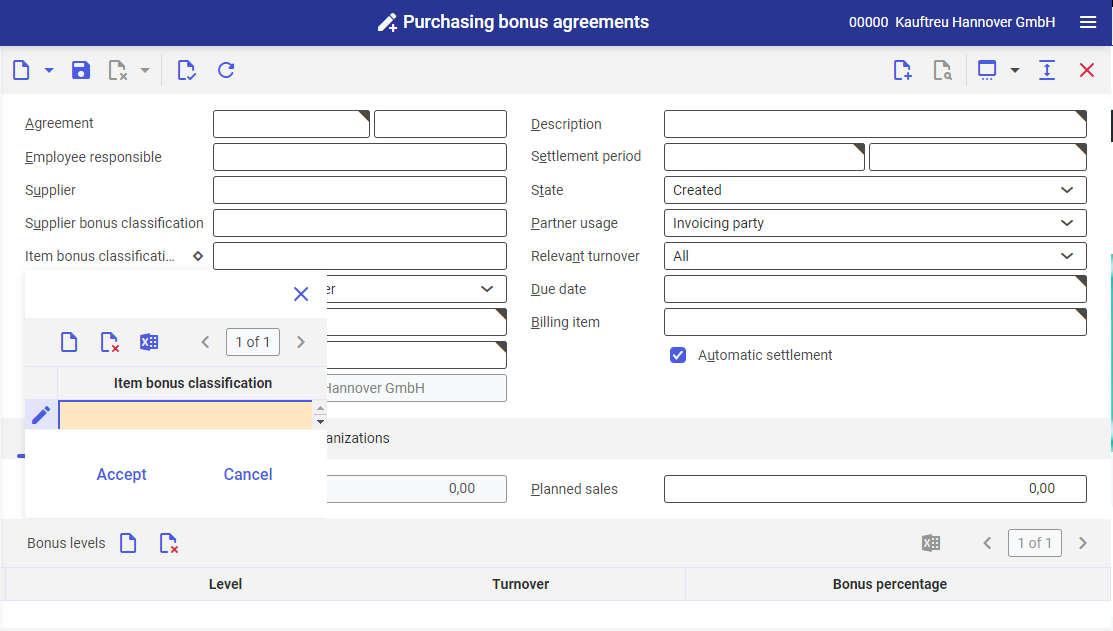

Purchasing item bonus classification

By assigning items to purchasing item bonus classifications and specifying nodes or leaves of the classification in the purchasing bonus agreement, items can be included or excluded from the bonus calculation. To do so, first assign the requested items to the nodes or leaves of the purchasing item bonus classification. Afterwards, you can set various nodes or leaves to calculate the bonus in a bonus agreement and, based on the setting for the relevant turnovers, only include selected items and exclude others.

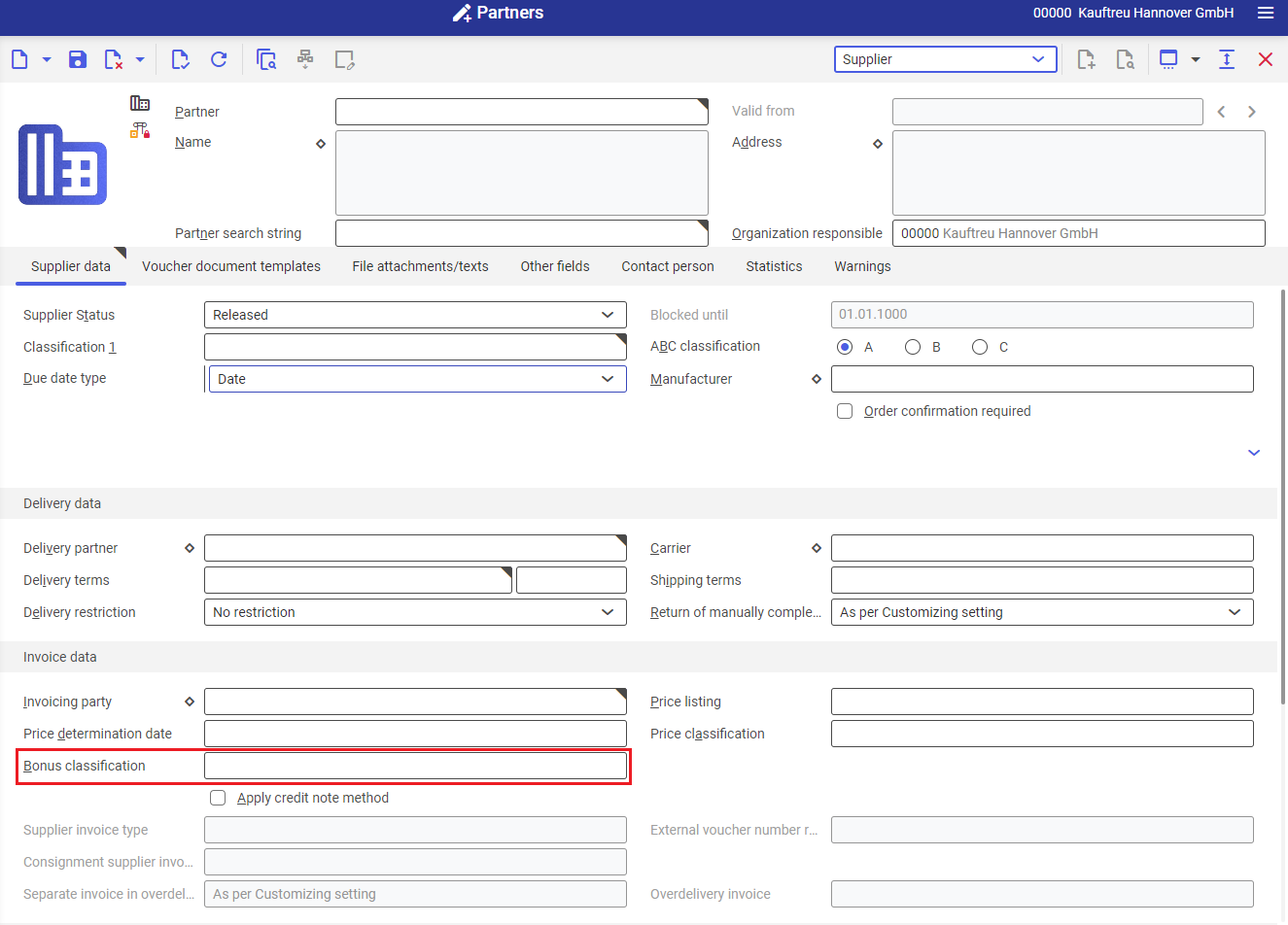

Supplier volume rebate classifications

By means of the supplier bonus classification, partners can be included or excluded from the bonus calculation. The leaves of the supplier volume rebate classification can be assigned in the Supplier view of the Partners application. Depending on the relevant partner usage (supplier, invoicing party) specified in the purchasing bonus agreement, you can include multiple suppliers when determining the turnovers by indicating a node of the supplier volume rebate classification.

In this way it is possible, for example, to define group agreements for the turnovers of all suppliers belonging to an association and to make payments to the association as a settlement partner.

Partners and items

Assignments to the supplier volume rebate classification can be made in the application:

- Partners under the view

- Supplier

Item assignments to the purchasing item bonus classification can be made in the application:

- Items under the following view:

- Purchasing

- Supplier

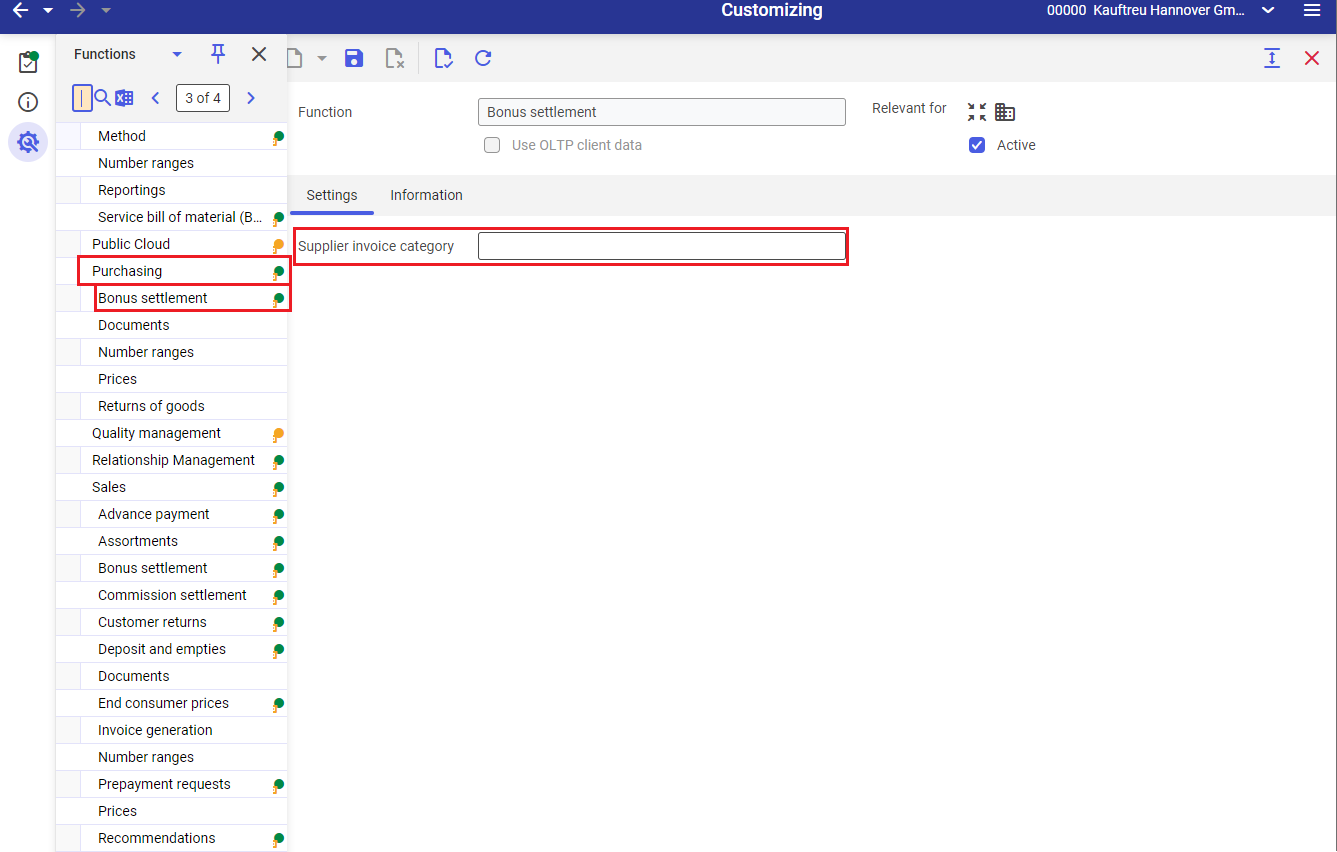

Customizng

In the application Customizing -> Purchasing-> Bonus settlement, you define which supplier invoice type is to be used for the bonus settlement.

Purchasing bonus settlement

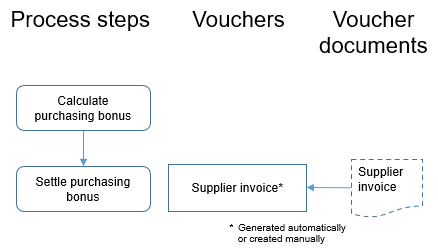

The chart below presents the steps of purchasing bonus settlement:

Purchasing bonus settlement steps

Processing steps

Bonuses are calculated with the Calculate purchasing bonus application using the selection criteria entered there.

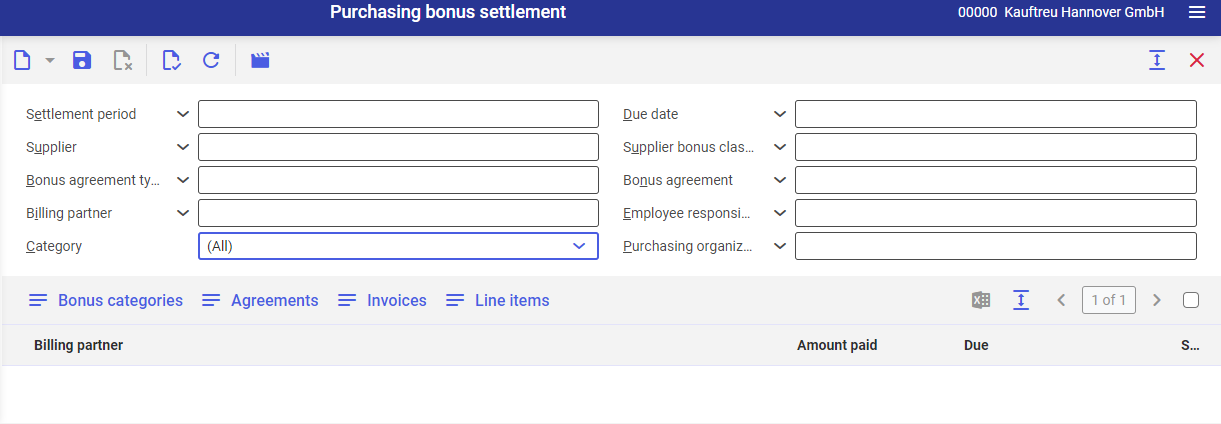

The calculation results are displayed in the Purchasing bonus settlement application.

For purchasing bonus agreements that are marked to be settled automatically, supplier invoices are generated with the previously calculated or later changed amounts. The generated supplier invoice is automatically entered as payment in the corresponding purchasing bonus agreement.

For purchasing bonus agreements marked for manual settlement, the purchasing bonus settlement can be used for determining the bonus amount. The supplier invoice with the corresponding line items must be created and posted manually. The supplier invoice in the purchasing bonus agreement is also assigned manually in this case.

Content-based authorizations

The results of the purchasing bonus settlement are also available to business partners. Thus, suppliers can open the Purchasing bonus settlement application and view the purchasing bonus settlements for all purchasing bonus agreements to which they are assigned as settlement partner. The actual settlement can only be performed by employees.

The purchasing bonus agreement can likewise be viewed by assigned suppliers.