Topic overview

Bonuses are subsequent payments for turnover levels achieved with a customer during a defined time period. The payment can be made actively through:

- debiting the customer’s account

- credit notes

Bonus-relevant turnovers are always based on:

- customer invoices

- credit notes

The following is specified in the Bonus agreements application:

- customers with whom agreements are entered into

- items that are bonus-relevant

Definition of terms

A bonus normally is:

- a remuneration awarded to a partner

- a loyalty reward usually awarded to a partner in the form of a credit note

- a thank you for long-term business relationships (bonus category: fixed amount) or for a specified turnover level (bonus categories: volume-based rebate, increase-based rebate).

Price component types contain price component settings which are used for pricing. It is possible to specify:

- whether cash discounts or packaging quantities are to be taken into account for pricing

- whether a price component is to be used for entire orders or only for individual line items

Master data

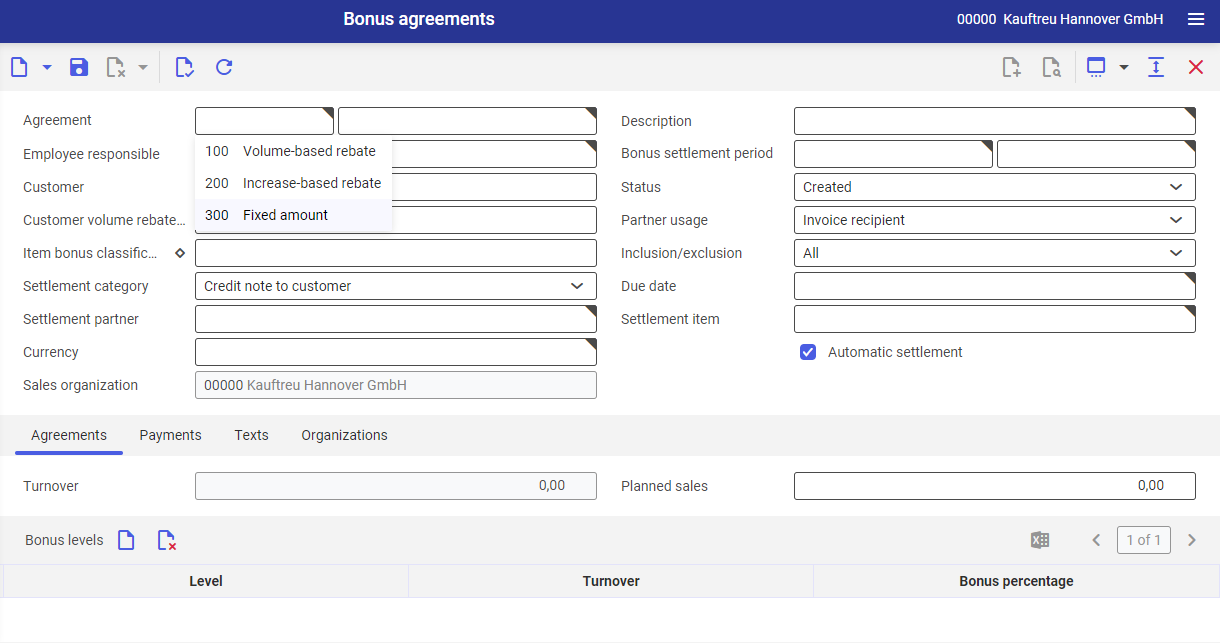

Sales bonus agreement types

The sales bonus agreement types specify the category of sales bonus agreement.

There are three categories of sales bonus agreement types available in the system:

- volume-based rebate (sales bonus) – bonus is paid as a percentage of the reached certain turnover level

- increase-based rebate – once a certain turnover level is reached (base amount), the percentages achieved in excess of this amount are entered and assigned to bonus levels. It is also paid as a percentage from the turnover

- fixed amount – a fixed amount is paid as a promotional allowance, advertising allowance, etc., irrespective of reaching a turnover target

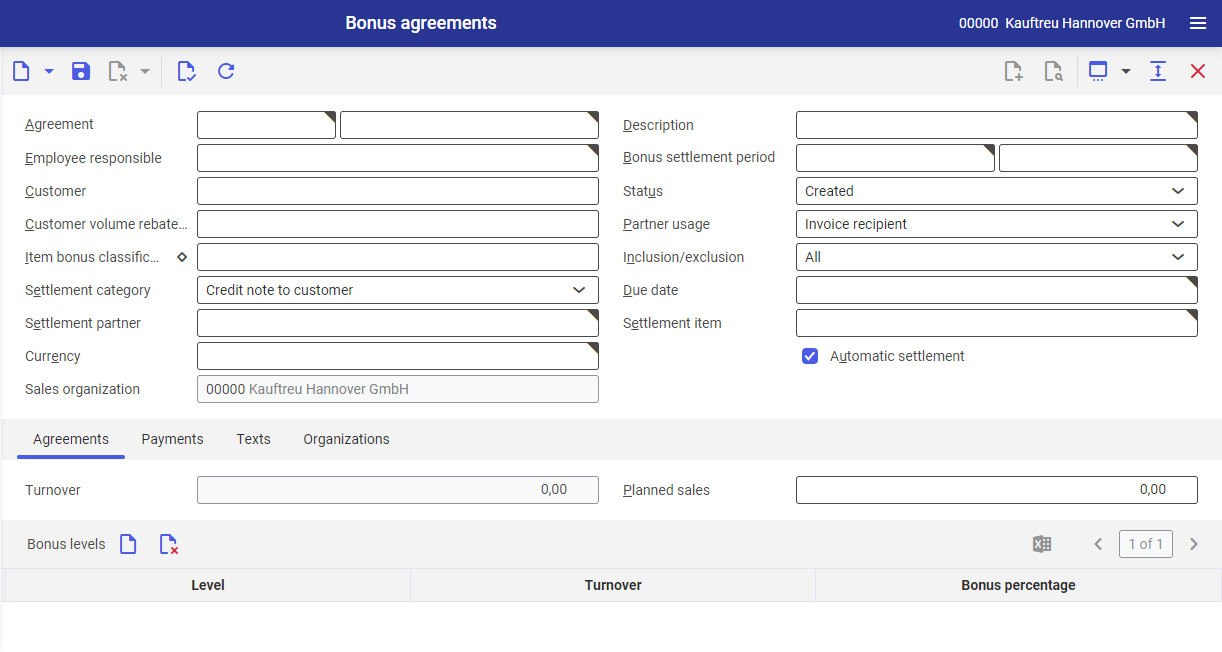

Sales bonus agreements

Sales bonus agreements are used to specify the contractual terms.

They contain information about:

- the customer(s) belonging to a customer bonus classification

- the time periods that are to be considered for the bonus calculation

- the date of maturity

- the partner usage that is relevant to the customer invoice selection:

- invoice recipient

- ordering party

- delivery recipient

- the items that are considered (inclusion) and are not considered (exclusion) in the bonus by means of the sales item bonus classifications

- the currency in which the bonus will be paid

Sales price component types

The sales price component types specify whether or not surcharges and discounts are relevant to the bonus. These specifications affect the calculation of customer invoice line items that determine not only the turnover revenues (line item net amounts) but also the bonus-relevant turnover.

Therefore, it is possible to calculate a bonus based on the gross sales price, e.g., by marking all discounts as non-bonus-relevant.

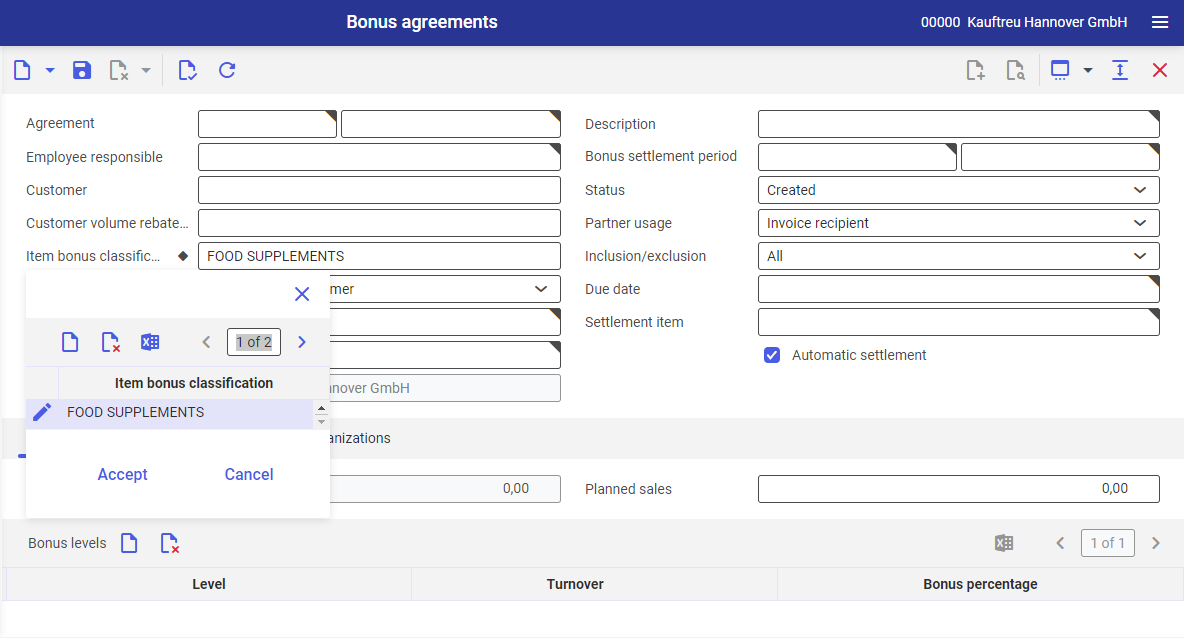

Sales item bonus classifications

By assigning items to sales item bonus classifications and specifying nodes or leaves of the classification in the sales bonus agreement, it is possible to include or exclude all items below the specified node of the classification in the bonus calculation.

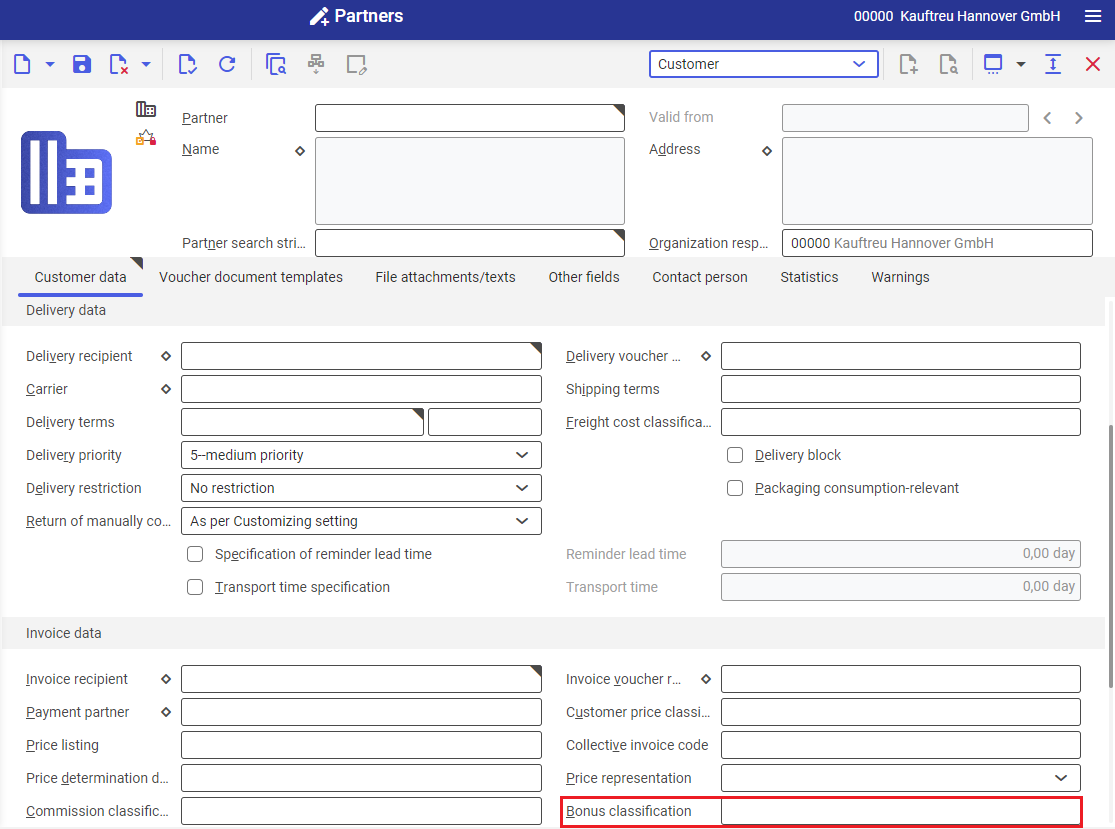

Customer volume rebate classification

The leaves of the customer volume rebate classification can be assigned in the Customer view of the Partners application. Depending on the relevant partner usage (invoice recipient, ordering party, or delivery recipient) specified in the sales bonus agreement, you can include multiple customers when determining the turnovers by indicating a node of the customer volume rebate classification.

In this way it is possible, for example, to define group agreements for the turnovers of all customers belonging to an association and to make payments to the association as a settlement partner.

Partners and items

Assignments to the customer volume rebate classification can be made in the application:

- Partners under the view

- Customers

Item assignments to the sales item bonus classification can be made in the application:

- Item under the following views:

- Sales

- Customer classification

- Customers

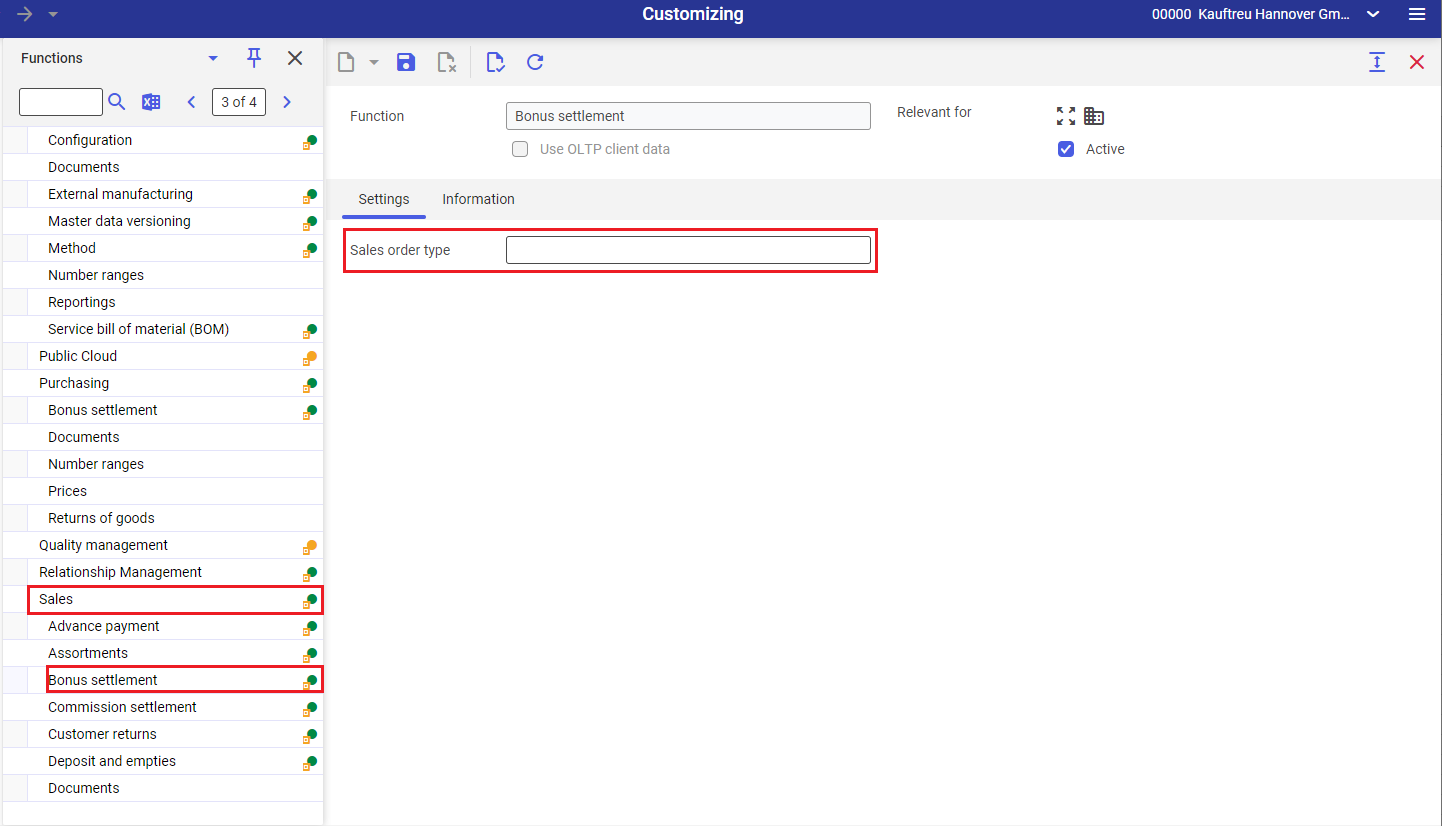

Customizing

In the application Customizing -> Sales -> Bonus settlement, you define which sales order type is to be used for settlement of bonuses.

Sales bonus settlement

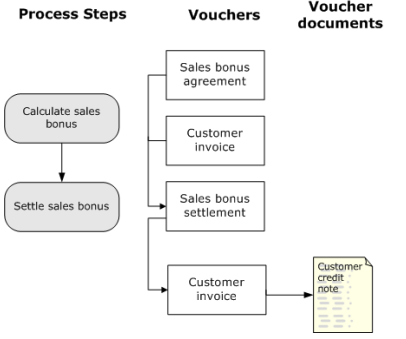

The chart below presents the steps of sales bonus settlement:

Sales bonus settlement steps

Processing steps

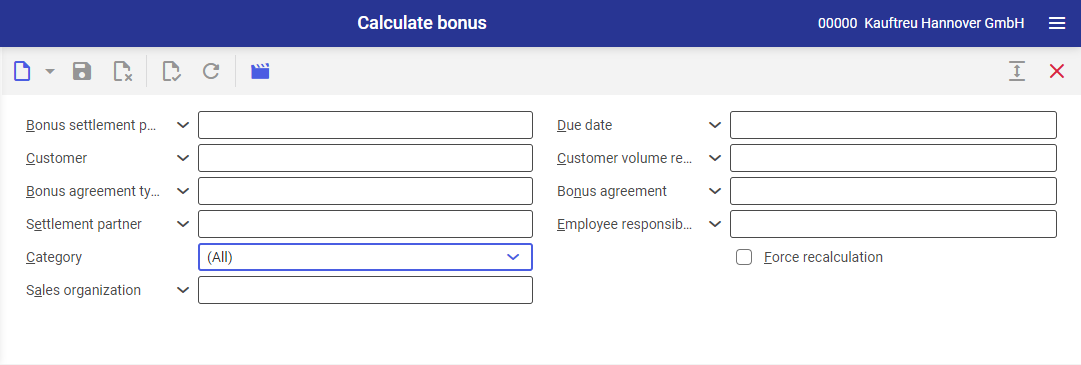

Bonuses are calculated with the Calculate bonus application using the selection criteria entered there.

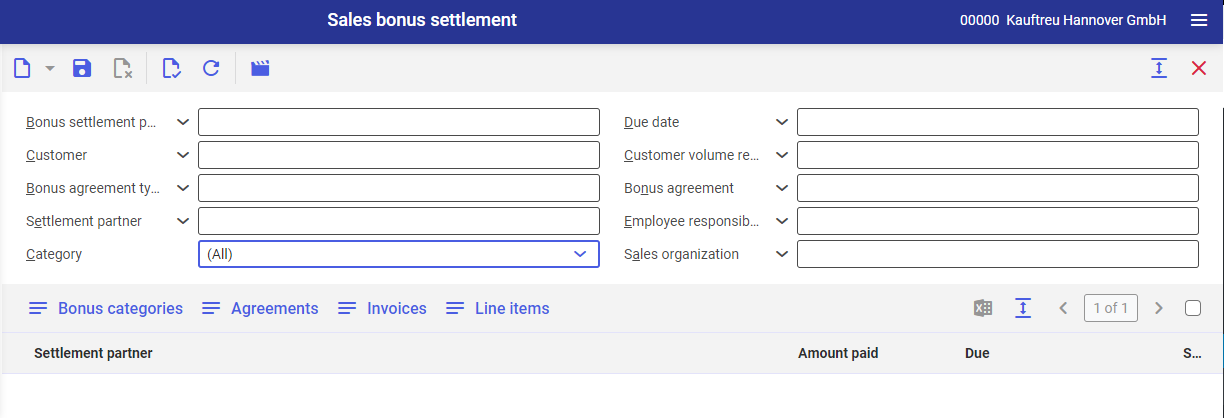

The calculation results are displayed in the Sales bonus settlement application.

For sales bonus agreements that are marked for automatic settlement, sales orders can be created with the amounts calculated previously or with subsequently modified amounts.

The sales orders created must then be invoiced. The created customer invoice is automatically entered as a payment in the corresponding sales bonus agreement.

For sales bonus agreements marked for manual settlement, the bonus settlement can be used for determining the bonus amount. The sales order with the corresponding line items can be created manually. Then, a corresponding customer invoice can be generated from this order. The assignment of the customer invoice in the sales bonus agreement is also performed manually.

Content-based authorizations of sales bonus settlement

The results of the sales bonus settlement are also available to business partners. Thus, customers can open the Sales bonus settlement application and view the sales bonus settlements for all sales bonus agreements to which they are assigned as a settlement partner.

Sales representatives can view the sales bonus settlements of all settlement partners to which they are assigned as a sales representative. The actual settlement can only be performed by employees.