Topic overview

The following article contains information on the Financials view of the Partners application.

Detailed information on the Partners application may be found in the article Partners.

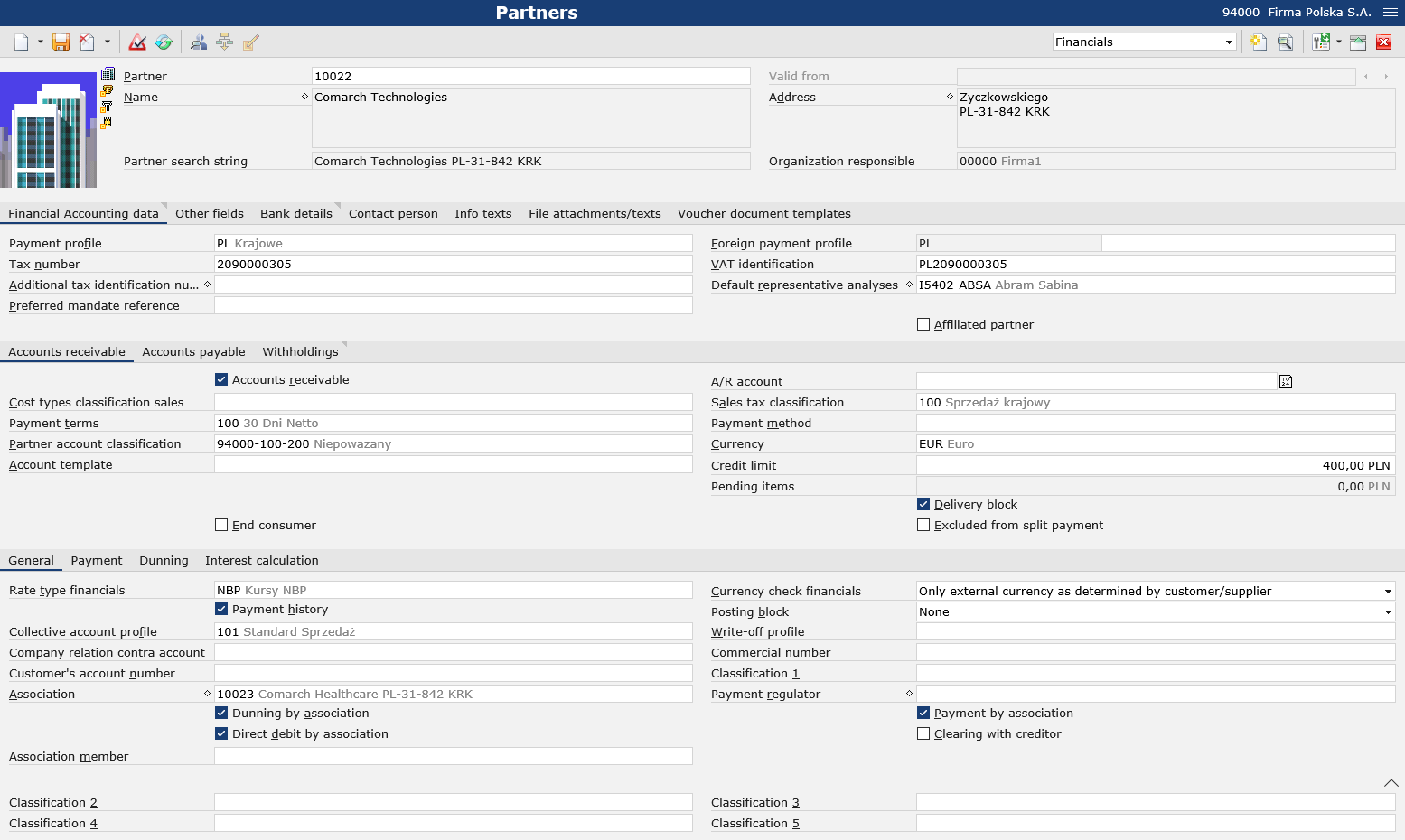

Work pane, Financials view

The Financials view is composed of the following tabs:

- Financial Accounting data

- Other fields

- Bank details

- Contact person

- Info texts

- File attachments/texts

- Voucher document templates

Financial Accounting data tab

The Financial Accounting data tab allows the user to enter, display, and edit basic financial data related to a given partner.

- Payment profile – it contains information on payment codes used for a given partner. Payment profiles may be added in the Payment profiles application. Payment codes included on a given payment profile may be entered on the Bank details tab. The field is required.

- Foreign payment profile – it contains information on payment codes used for a given partner. Foreign payment profiles may be added in the Foreign payment profiles application. The field is not required.

- Tax number – a tax identification number defined in the Countries application

- VAT identification – a company identification for intra-community transactions between VAT payers from EU countries; defined in the Countries application. The field is not required.

- Additional tax identification number – it allows the user to enter an additional EU TIN number. The field is not required.

- Default representative analyses – this field enables the selection of a sales representative. The user can assign multiple representatives, using the

button. Assigning a sales representative makes it possible to filter and analyze trial balance data based on such a representative. For instance, the user may check how many customers associated with a given sales representative have overdue payments.

button. Assigning a sales representative makes it possible to filter and analyze trial balance data based on such a representative. For instance, the user may check how many customers associated with a given sales representative have overdue payments. - Preferred mandate reference – this field is filled in on the basis of data configured in the Mandate application. The field makes it possible to enter a SEPA mandate that should be used as a proposal for SEPA direct debits for a given partner.

- Affiliated partner – this parameter is responsible for whether the TP procedure will be automatically assigned to VAT account entries generated from logistic documents or postings. The parameter is dedicated to Polish organizations.

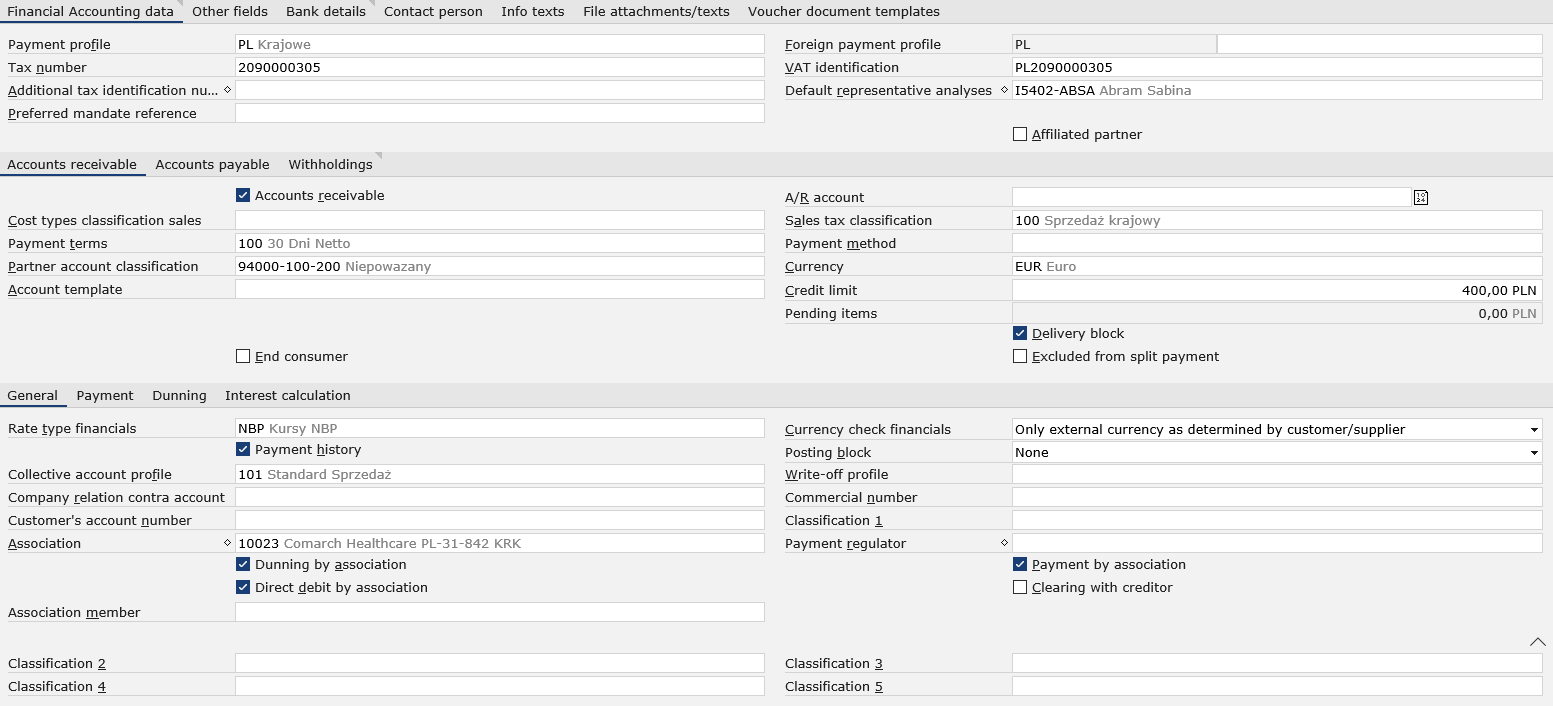

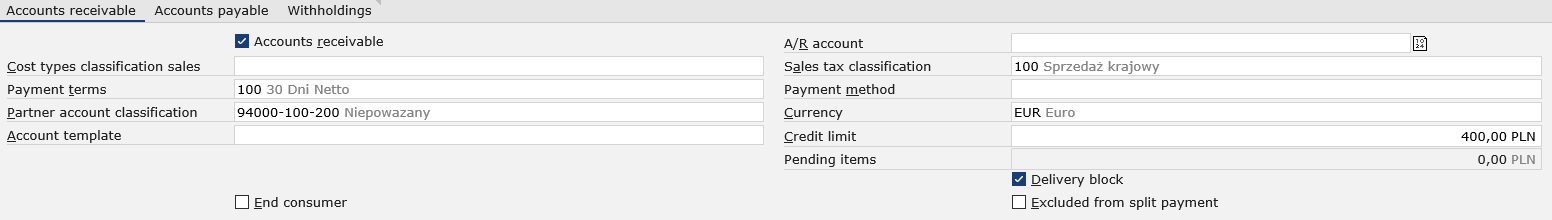

Accounts receivable tab

This tab makes it possible to define additional information on the account payable. Available fields:

- Accounts receivable – selecting this parameter activates the account receivable role. For the partner to receive the account receivable role, it is necessary to define financial accounting data and information on the Accounts receivable tab. If only the fields on the Accounts receivable tab are completed, the account receivable role will be disabled for the partner.

- A/R account – the account receivable’s number in financial accounting. If the field is not filled in, the system automatically enters the partner number. With the button on the right of the field, the user can also generate a number through the number range saved in the Customizing application (Partners function).

- Cost types classification sales – it makes it possible to filter data concerning cost types or limit such data in reports and summaries. Classifications are used in controlling processes.

- Sales tax classification – it is a classification used to automate sales processes to which tax codes with a defined tax rate can be assigned automatically. More information may be found in the appropriate help article.

- Payment terms – this field enables the user to determine a default due date for a given partner. More information may be found in the appropriate help article.

- Payment method – in this field, the user can determine the identification of any existing payment method (e.g. Cash or Bank transfer) or select it using the value assistant. The method will be used as default in sales documents. Payment methods can be configured in the Payment methods application.

- Partner account classification – in this field, it is necessary to assign an account classification to be used for specifying appropriate revenue accounts when posting sales documents. More information may be found in the appropriate help article.

- Currency – the partner’s default currency to be used in documents issued for that partner

- Account template – this field makes it possible to use an account template to be used when creating account receivable records. The field is not used in CFE.

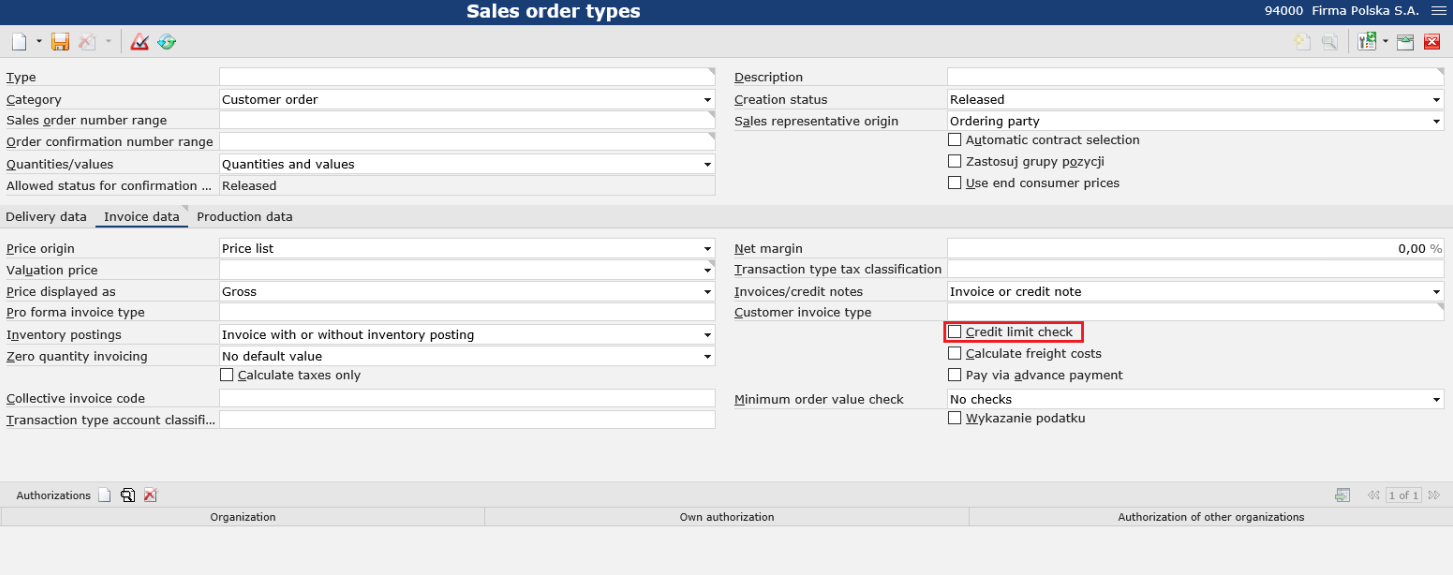

- Credit limit – it allows the user to set a limit valid for an account receivable; if such a limit is exceeded, the system will display an appropriate message, provided that a relevant parameter has been selected for a given document type. The message is displayed e.g. when issuing a sales order document if the Credit limit check parameter is selected for a relevant document type in the Sales order types application.

- Pending items – unpaid line items for delivered goods or services – receivables arising when a customer invoice is generated or a supplier invoice is received after payment terms are taken into account

- Delivery block – selecting this parameter makes it possible to block deliveries for a given partner, e.g. if this partner has uncompleted payments

- End consumer – this parameter indicates whether the customer is an end consumer. Price lists for end consumers may be assigned in the Customer view. The parameter can be selected if a tax number is entered for the partner.

- Excluded from split payment – selecting this parameter excludes a given payment from the split payment mechanism. The parameter is dedicated to Polish organizations.

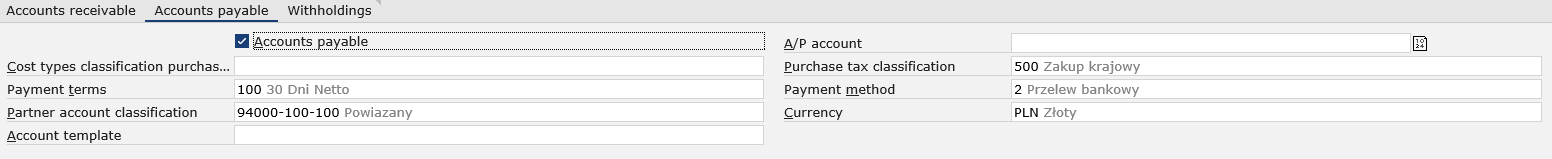

Accounts payable tab

- Accounts payable – selecting this parameter activates the account payable role. For the partner to receive the account payable role, it is necessary to define financial accounting data and information on the Accounts payable tab. If only the fields on the Accounts payable tab are completed, the account payable role will be disabled for the partner.

- A/P account – the number of the account payable entered for financial accounting purposes. If the field is not filled in, the system automatically enters the partner number. With the button on the right of the field, the user can also generate a number through the number range saved in the Customizing application (Partners function).

- Cost types classification purchasing – it is a classification used for mapping cost assignments in controlling processes

- Purchase tax classification – it is a classification used to automate purchase processes to which tax codes with a defined tax rate can be assigned automatically. More information may be found in the appropriate help article.

- Payment terms – this field enables the user to determine a default due date for a given partner

- Payment method – in this field, the user can determine the identification of any existing payment method (e.g. Cash or Bank transfer) or select it using the value assistant. Payment methods can be configured in the Payment methods application.

- Partner account classification – in this field, it is necessary to enter an account classification to be used for assigning appropriate general ledger accounts when posting documents in purchase processes

- Currency – the partner’s default currency to be used in documents issued for that partner

- Account template – this field makes it possible to use an account template to be used when creating account payable records. The field is not used in CFE.

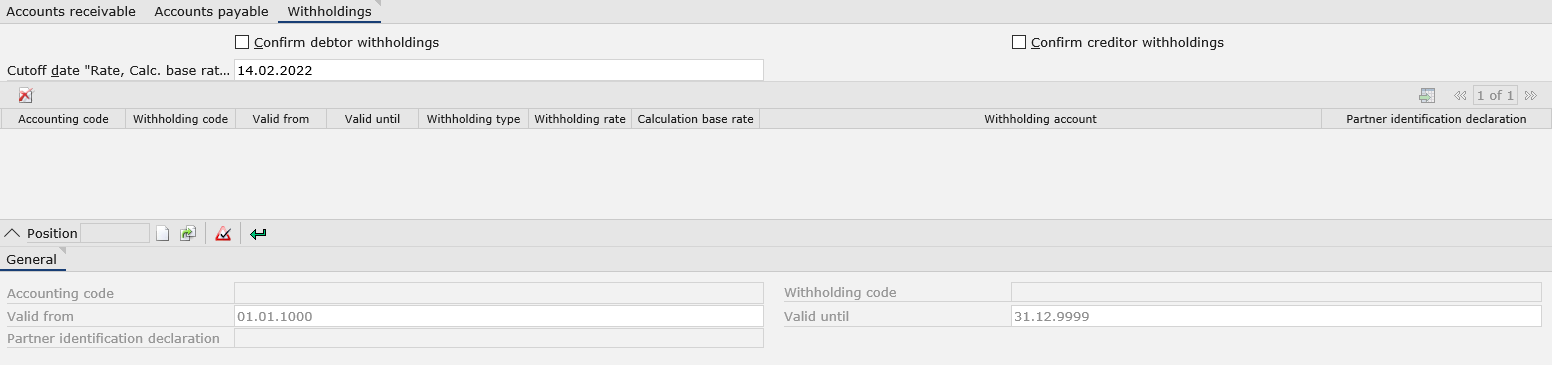

Withholdings tab

- Confirm debtor withholdings – this parameter allows the automatic posting of customer retentions. If the parameter is deactivated, withholdings from this customer are automatically posted both in the data transfer process and in direct postings in the financial framework. If the parameter is activated, withholdings must also be confirmed in postings completed in automatic processes. The posting of withholdings directly in the Posting financial accounting application is blocked.

- Confirm creditor withholdings – this parameter allows the automatic posting of creditor retentions. If the parameter is deactivated, withholdings from this creditor are automatically posted both in the data transfer process and in direct postings in the financial framework. If the parameter is activated, withholdings must also be confirmed in postings completed in automatic processes. The posting of withholdings directly in the Posting financial accounting application is blocked.

- Cutoff date “Rate, Calc. base rate, Account” – it allows the user to enter the key date up to which, for example, an income tax withholding may be made. If no reference date is specified, the current date is decisive as the reference date.

The table on the Withholdings tab makes it possible to define how withholdings should be calculated. Below the table, there is an editor allowing the user to create new entries and edit existing ones. The table is composed of the following columns:

- Accounting code – available options include: Accounts receivable and Accounts payable

- Withholding code – this field allows the selection of a withholding code defined in the Withholding codes application

- Valid from – a date from which a given withholding code is valid for a selected accounting code

- Valid to – a date to which a given withholding code is valid for a selected accounting code

- Partner identification declaration – this field is used for setting a declaration concerning partner identification; a text entered in this field is displayed in the declaration printout. The field is not required.

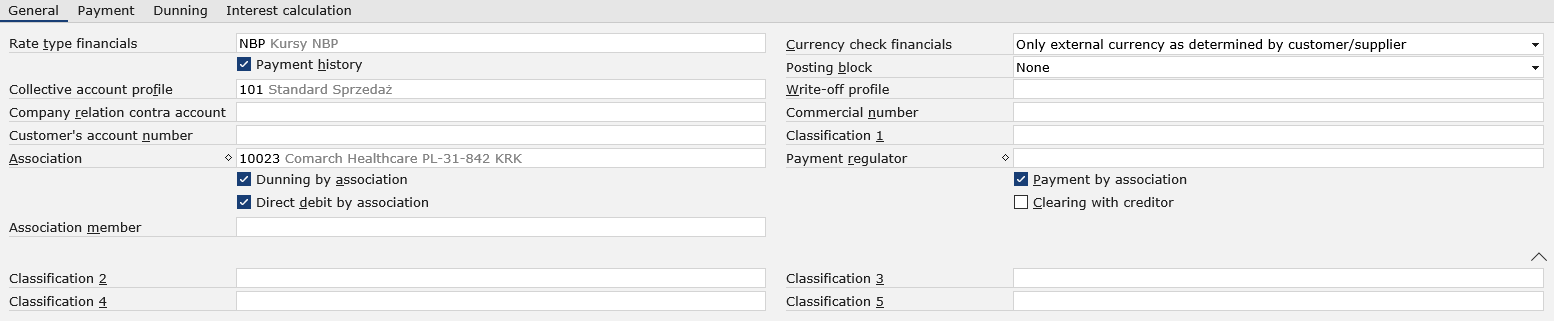

General tab

This tab makes it possible to enter additional financial information related to a given partner role (account receivable or payable). The tab contains the following fields:

- Rate type financials – it is a rate type used in financial accounting when adding a posting recorded in a foreign currency. The field indicates which table the rate type is taken from.

- Currency check financials – it determines under what rules the documents of a given partner are to be posted:

-

- Only main currency – only in the main currency of the user’s company

- Only external currency as determined by customer/supplier – only in a currency entered on the partner’s form in the Currency field

- Main currency or external currency as determined by customer/supplier – in the main currency or in a currency entered on the partner’s form

- Any currency – in any currency the user specifies

- Payment history – selecting this parameter makes it possible to create a payment history containing information on the type and method of payments received from a given partner (e.g. related to the timeliness or amount of a payment)

- Posting block – this field specifies whether postings can be created for a given partner. Available options include:

- None – this option means that no posting block has been set for a given partner

- Blocked for dialog posting – this option means that only manual posting has been blocked

- Blocked for batch posting – this option means that posting with the use of a batch application has been blocked

- Generally blocked – this option means that posting is blocked for a given partner

- Collective account profile – this field is used to specify groups of accounts to which transactions will be posted. As part of collective account profiles, it is possible to determine groups for assets or liabilities. The field is required.

- Write-off profile – this field is used to specify a write-off profile that handles the automatic write-off of missing amounts

- Company relation contra account – this field is used for posting if the partner belongs to a company group. The number of a contra account entered will be changed with the entries defined in the group relation and the posting will be executed for this account.

- Commercial number – in this field, a number from the commercial register or a personal number can be assigned. For some EU states, this entry is necessary.

- Customer’s account number/Supplier’s account number – in this field, it is necessary to enter an identification number. The number may be printed in delivery documents and dunning letters.

- Classification 1 – in this fields, it is necessary to select a classification to which the partner is to belong. Classifications can be created in the Classifications application.

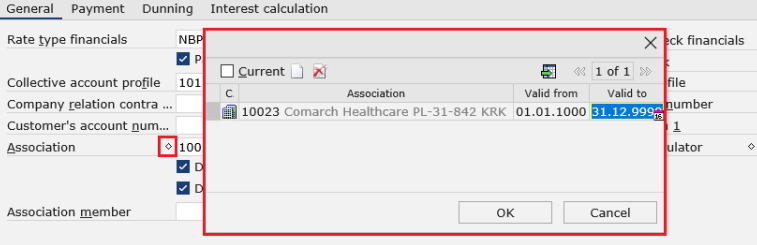

- Association – this field enables the user to enter one or more associations to which the partner belongs using the

button. This way, a partner relationship of the Association category will be created. If the partner is an association itself, this partner needs to be entered in the field. Assignment to an association is not permanent, it can be changed at any time. The aim of associations is to centralize postings, create credit limits and analyses for all members of a given association.

button. This way, a partner relationship of the Association category will be created. If the partner is an association itself, this partner needs to be entered in the field. Assignment to an association is not permanent, it can be changed at any time. The aim of associations is to centralize postings, create credit limits and analyses for all members of a given association.

- Payment regulator – it is a partner responsible for regulating payments. The user can add multiple persons using the

button and entering appropriate partner numbers. If the field remains empty, payments will be completed by the defined partner.

button and entering appropriate partner numbers. If the field remains empty, payments will be completed by the defined partner. - Dunning by association – this parameter makes it possible to address dunnings to a previously selected association. The field is only active if the partner belongs to an association or constitutes an association itself. Dunnings and account statements can be addressed either directly to an association member or to an association. If they are to be addressed to an association, the parameter should be selected.

- Payment by association – this parameter makes it possible to assign a previously selected association as a payment regulator

- Direct debit by association – this parameter makes it possible to perform the direct debit procedure through a previously selected association

- Clearing with creditor/Clearing with debtor – this field is active if the partner is identified both as an account receivable and payable. The field makes it possible to use so-called compensations to offset receivables against payables.

- Association member – this field allows the user to enter an association member. The field is only active if the partner belongs to an association. To enter an association member, the user needs to specify a number used for this personal account by the assigned association.

- Classifications 2-5 – additional classifications

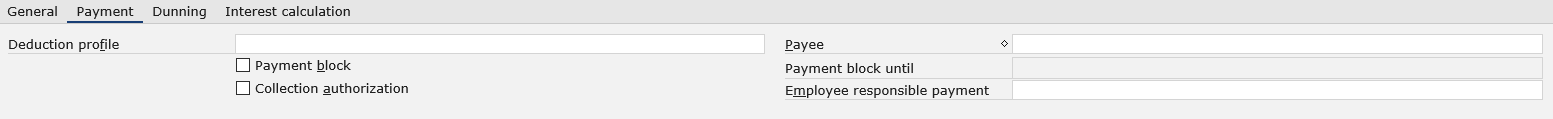

Payment tab

- Deduction profile – it allows the selection of different deduction conditions used when paying for receivables or payables. Deductions may include, for instance, discounts, bonuses, commissions, etc. Deduction profiles can be created in the Deduction profiles application.

- Payee – in this field, it is possible to enter a payment recipient differing from the partner. If a different payment recipient is defined, bank details (bank code, bank account number) as well as a payment type and identification will be taken over by the payment recipient, and any open items will be transferred to the different bank account or collected from that bank account.

- Payment block – selecting this parameter excludes a given partner from payment transactions. This means that open items will not be taken into account at any time point in a payment proposal.

- Payment block until – it allows the user to specify a date until which payments are to be blocked

- Collection authorization – this parameter is used to verify whether the partner is authorized to collect payments directly from a company account in the case of automated posting procedures. If it is not selected, an error message will be displayed for a corresponding automatic posting.

- Employee responsible payment – in this field, it is possible to enter an employee responsible for payments; the employee must be a valid contact person from the Partners application. The employee specified in this field may be selected for a payment proposal list so that a payment can be processed with reference to that employee.

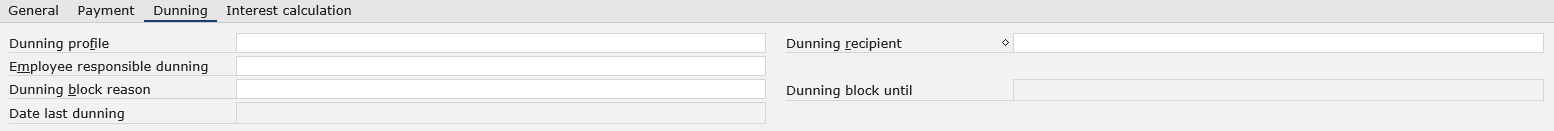

Dunning tab

- Dunning profile – it is used for specifying parameters for the partner, determining how many dunning levels, at what intervals, for which dunning charges, etc., open items should be dunned

- Dunning recipient – in this field, the user can enter a dunning recipient differing from the partner. Dunnings will then be received not by the partner but by the different recipient entered here, e.g. a parent company. The system makes it possible to enter multiple dunning recipients with the use of the

button.

button. - Employee responsible dunning – in this field, it is possible to enter a partner responsible for dunnings. Partner data entered in this place will be printed in created dunnings.

- Dunning block reason – it allows the user to specify a reason for which the creation of a dunning has been blocked

- Dunning block until – in this field, it is possible to enter a date until which the possibility to send dunnings to the partner is blocked

- Date last dunning – this field is filled in automatically and shows the last date on which the partner received a dunning

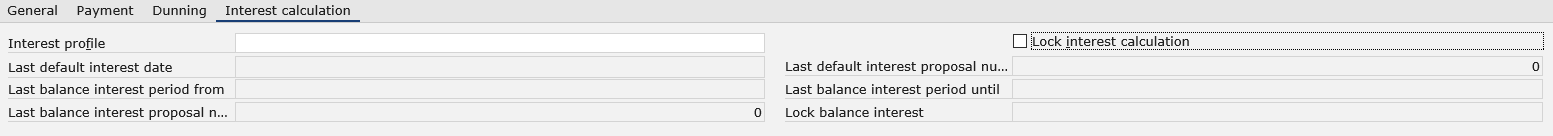

Interest calculation tab

- Interest profile – in this field, the user can enter the code of an existing interest profile. The interest profile contains information on default interest calculation and balance interest. It is not necessary to specify an interest profile if a default interest profile is to be used for a given account.

- Lock interest calculation – this parameter determines whether the partner’s account is to be excluded from interest calculations

- Last default interest date – it displays the date of the last interest calculation run for the partner’s interest on arrears

- Last default interest proposal number – it displays the proposal number of the last interest calculation run for the partner’s interest on arrears

- Last balance interest period from – it displays a period from which a balance interest for this account has last been calculated

- Last balance interest period until – it displays a period up to which a balance interest for this account has last been calculated

- Last balance interest proposal number – it displays the number of the last interest proposal calculated automatically in the Cockpit: Interest calculation application with the use of the [Generate interest proposal…] action

- Lock balance interest – it displays the proposal number of the open balance interest which contains this account and thus locks it for other interest proposals

Other fields tab

The Other fields tab allows the user to enter additional fields, e.g. if such user-defined fields are required to provide additional information. User-defined fields are associated with a business object; therefore, they must be defined independently in all views.

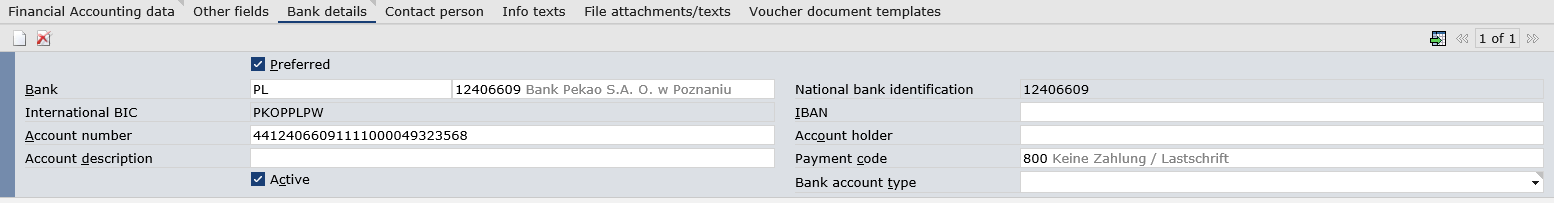

Bank details tab

The Bank details tab allows the user to specify the partner’s bank accounts to which payments will be made. It is possible to enter multiple bank account numbers for a single partner.

- Preferred – selecting this parameter assigns a given bank account as default if multiple bank accounts have been defined

- Bank – in this two-part field, the user can enter bank identification data. In the first field, enter the country in which the bank has its office. In the second field, enter the bank’s identification.

- National bank identification – it is a required field, used to make bank identification easier and faster. The field’s value is retrieved from the Banks application (National bank identification field).

- International BIC – it displays a BIC number; the field’s value is retrieved from the Banks application (International BIC field)

- IBAN – it allows the user to enter an IBAN number (“International Bank Account Number”). The IBAN number helps unify identification criteria for international bank transfers.

- Account number – in this field, enter a bank account number

- Account holder – this field makes it possible to enter the name of an account holder if it is different from that of the partner

- Account description – in this field, the user can enter any description of the account

- Payment code – in this field, the user can define a payment method for payment transactions (e.g. bank transfer/check). If a payment method has been defined as part of bank details, only that method will be permitted for payment transactions. Payment codes may be defined in the Payment codes application.

- Active – selecting this parameter activates bank details and makes it possible to use them in payment transactions

- Bank account type – in this field, it is necessary to select an appropriate bank account type; available options include Ordinary or Current. The field is only relevant on the Japanese market.

Contact person tab

The Contact person tab makes it possible to enter the details of a contact person. To add a contact person, select the [New] button. On the tab, the user may indicate which partner is to be a contact person, to which partner relationship category that person belongs, or whether the partner is to be a preferred contact person; also, it is possible to enter additional information, such as an occupation, phone number, or e-mail address.

Info texts tab

The Info texts tab allows the user to enter additional texts for the partner. They may be used e.g. in printouts.

- Number – in this field, a number can be assigned to a text being added

- Text group – in this field it is possible to assign a group previously defined in the Text groups application

- Auto display – in this field, the user may select whether a created text should be displayed

- Message type – it is a selection field with the available options of Information and Warning

- Text – in this field, the user may enter any appropriate text

File attachments/texts tab

The tab allows the user to enter additional attachments or text information. The tab contains the following columns:

- Number – the number of an added text module. If no number is given, the system assigns one automatically.

- Voucher – it is a voucher category in which the text module is to be used, e.g. Prepayment confirmation or Debtor credit confirmation

- Attachment/text category – it is a category attached to the voucher document, e.g. Header text, Footer text, Item text, E-mail file attachment

- Text module – it makes it possible to enter an existing text module, e.g. from the Base view

- Attachment/Text – this column displays an excerpt from the text module

Above the table, there is the language selection menu, allowing the user to save content in a selected language.

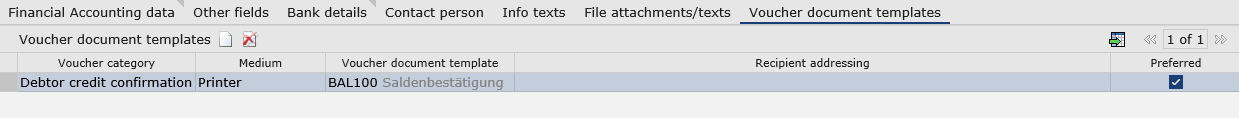

Voucher document templates tab

This tab makes it possible to adjust settings for relevant voucher document templates for the partner that will be used in report printouts or when sending such printouts via e-mail. For instance, a prepayment confirmation may always be printed using a specific template defined in the Customizing application (Documents function).

Documents function in Customizing application