Topic overview

A supplier invoice is an external voucher listing the amounts due for the delivered items.

The creation of the supplier invoice is the closure of the actual purchase process. A supplier is first prompted with a purchase order to deliver goods. Normally, the items are then delivered and the receipt of goods is entered in the system. The goods are credited to the inventory on the receipt of goods.

A supplier invoice listing the payment to be effected for the delivered items is then issued by the supplier when receipt of goods is confirmed. The supplier invoice can also be issued before receipt of goods. There may be other invoices issued by the same supplier or another one that are related to the same delivery or order. This invoice contains supplementary costs such as those for the transportation of the goods.

The Supplier invoices application creates, verifies and posts supplier invoices. It also forwards the information to Financial Accounting for the payment of invoice. During this process, it is verified whether the payments for delivered items or supplementary costs to be distributed are also applicable for a previous commercial transaction such as a purchase order or receipt of goods.

If you work in a multi-site system, supplier invoices will be generated for inter-company billings as well. These supplier invoices belong to internal billing category. If other costs such as transport costs come into play for internal deliveries between organizations, supplier invoices of Supplementary cost invoices for distribution category can also be created besides internal supplier invoices. These supplier invoices are connected with a receipt of goods from distribution. For more information on the topics, please refer to their corresponding articles Multi-site and Inter-company billing.

If the values in a supplier invoice and those saved in the purchase order are not the same, you can also generate a credit note for the difference (correction supplier invoice). This credit note can be sent as a charge display to the supplier.

Besides, the application of credit note method can be agreed upon with suppliers. In such a case, a supplier invoice will be automatically generated when the receipt of goods is posted and, with relevant settings, can also be posted immediately. For more information on this topic, refer to the article Procedures: Credit note method.

This article describes how to map supplier invoices for ordered items or consignment goods in the ERP system. You can find out more about the interconnection a supplier invoice can have with other applications and business entities and how it is connected with the business processes.

All fields and functions of the Supplier invoices application are described in detail in the article Supplier invoices.

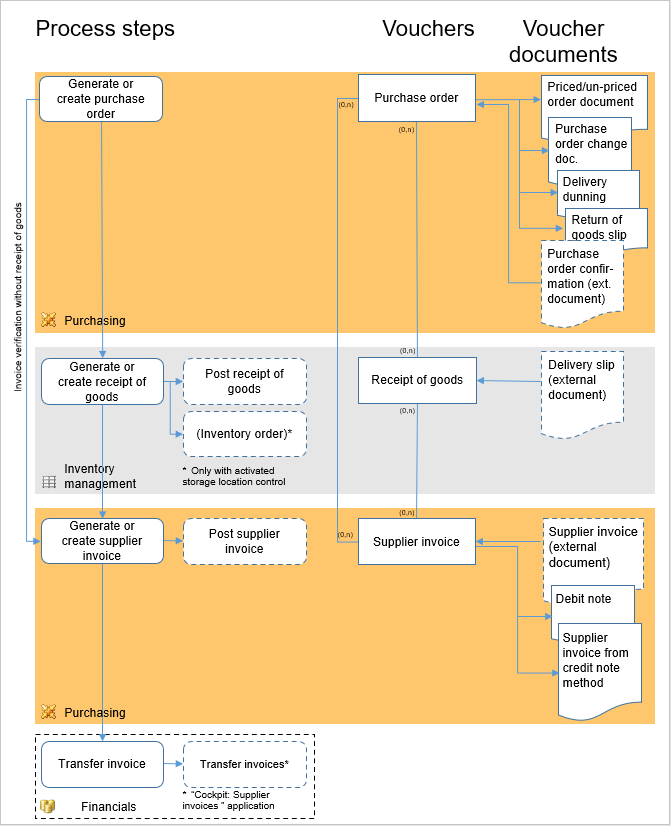

Processes and voucher references chain

Business processes for supplier invoices and the subsequent interconnection with other applications and business entities have been described below.

Internal supplier invoices are automatically posted after generation and can no longer be edited. The following explanations about processing steps and facilities are applicable to external supplier invoices.

For more information on internal supplier invoices, refer to the article Inter-company billing.

Process chart

Process description

The supplier invoice process starts with the purchase order. The order is the basis for receipts of goods as well as supplier invoices. Receipts of goods and supplier invoices can refer to several purchase orders, and purchase orders can show multiple references to receipts of goods and supplier invoices if, for example, partial quantities of an order line item are delivered and invoiced. Supplier invoices without voucher reference and consignment withdrawal invoices constitute exceptions. There are no references to purchase orders for such vouchers.

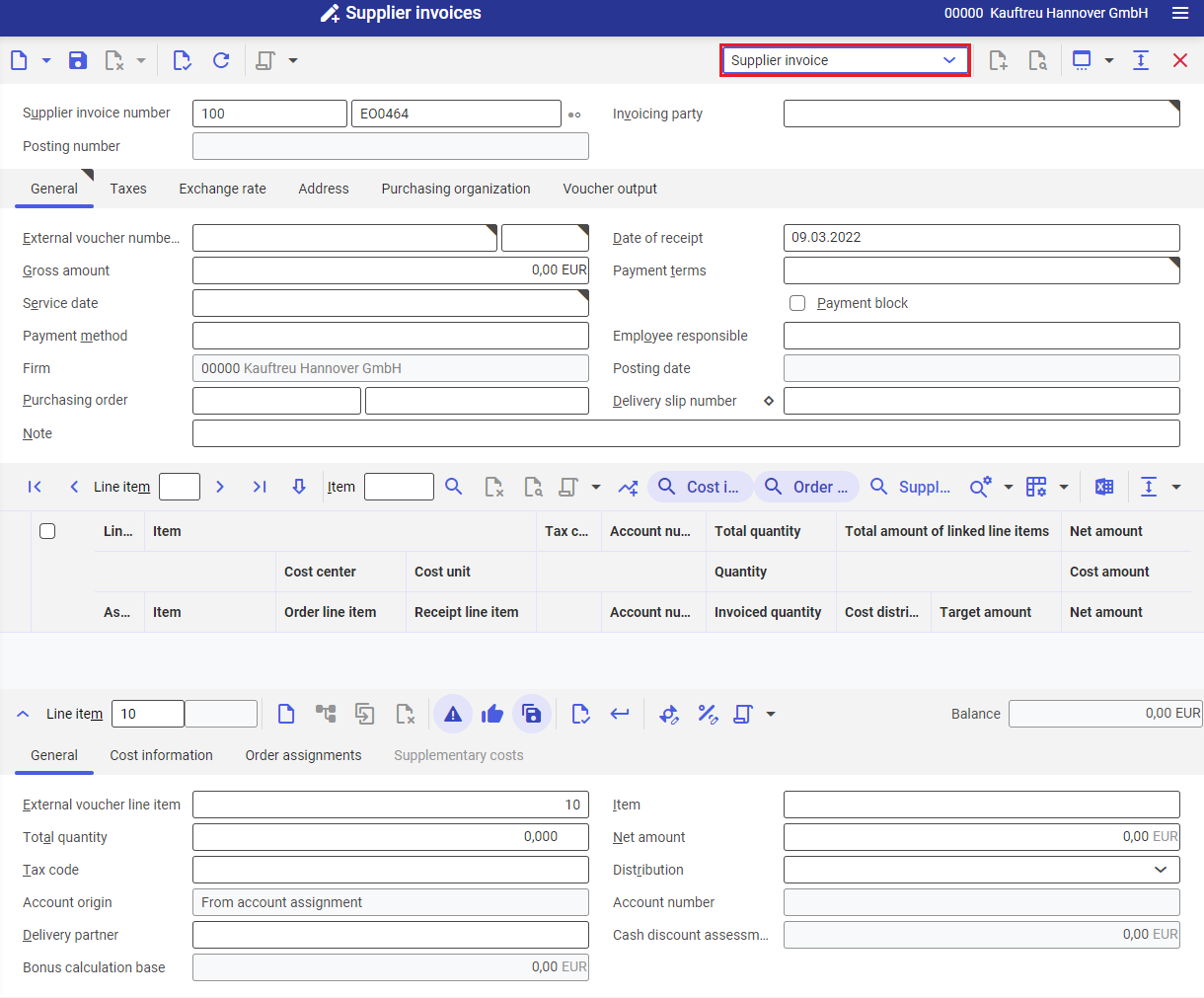

The amounts for delivered items mentioned in the invoice must be entered in the Supplier invoices application in Supplier invoice view. The individual supplier invoice line items can contain a reference to both different purchase orders and receipt of goods line items.

Receipt of goods posting and supplier invoice indicates the closure of the actual purchase process. Settling an invoice is part of Financials.

For more information on the purchasing statistics, refer to articles Data warehouse and statistics and Purchasing statistics.

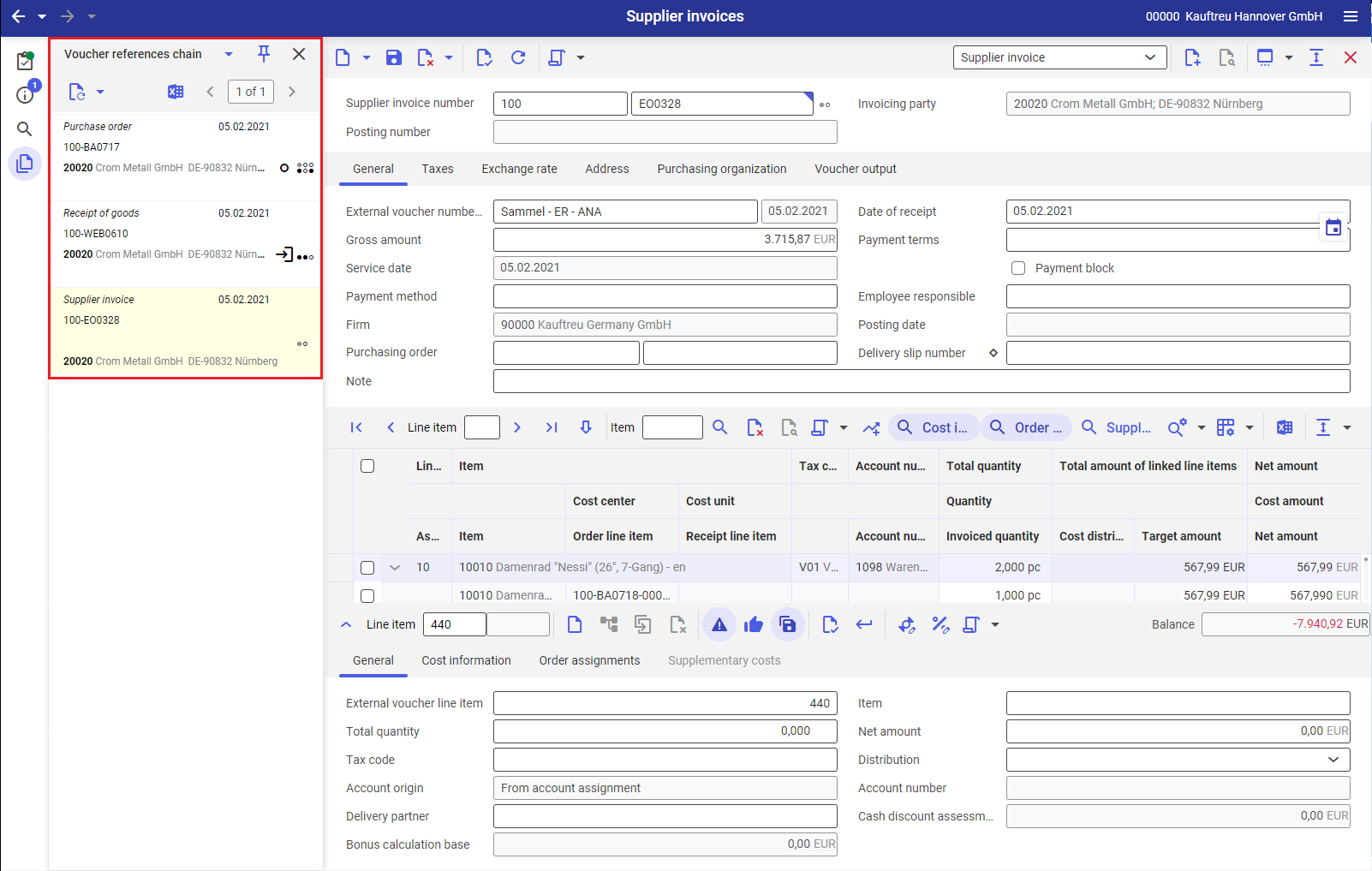

Voucher references chain

All displayed vouchers can be recalled through the voucher references chain. The voucher references and quantities of a supplier invoice line item will be displayed if the line item is selected. The voucher references chain is activated with the button ![]() .

.

Voucher references differentiate between:

For more information on the voucher references chain, refer to the article Voucher references chain.

External supplier invoice

In the voucher references chain for an external supplier invoice, the following upstream vouchers are visible if they are connected with the supplier invoice through a voucher reference:

Voucher | Conditions for display |

|---|---|

A supplier invoice can be connected to the purchase order in Supplier invoices application by two methods:

Supplier invoice line items can be:

Alternatively, supplier invoice line items can be:

Purchasing type receipts of goods are suitable for this purpose. Since every Purchasing type receipt of goods must have a reference to an order, the supplier invoice is also indirectly connected with this purchase order through a voucher reference. This voucher reference is saved. |

|

| Supplier invoice line items are generated from receipt of goods line items in the Supplier invoices application or connected manually or automatically with receipt of goods line items. Only Purchasing type receipt of goods are suitable in the Supplier invoice view. | |

| A supplier invoice is connected through a third-party order with the sales order. Supplier invoice line items receive a purchase order reference in the Supplier invoices application or a purchase order reference is assigned manually or automatically to already created supplier invoice line items. This purchase order is connected to a sales order through a voucher reference and involves a third-party order. Third-party order supplier invoice line items can have no reference to a receipt of goods. | |

Supplier invoices for a consignment withdrawal declaration can be generated using the Generate supplier invoices… action in the Cockpit: Consignment withdrawal declarations application. A supplier invoice of the Consignment withdrawal invoice category alternatively can be connected to a consignment withdrawal declaration in the Supplier invoices application as follows:

Supplier invoices for a consignment withdrawal declaration can be generated using the Generate supplier invoices… action in the Cockpit: Consignment withdrawal declarations application. A supplier invoice of the Consignment withdrawal invoice category alternatively can be connected to a consignment withdrawal declaration in the Supplier invoices application as follows:

|

It is possible to cancel an already posted supplier invoice with the Cancel supplier invoice action. The canceled voucher is then visible in the voucher references chain.

Voucher | Conditions for display |

|---|---|

| A cancelation voucher is generated on cancelation of a supplier invoice, which corresponds inversely with the supplier invoice. The quantities or amounts in the cancelation voucher contain reversed marks. Both vouchers have Canceled status. |

Internal supplier invoice

In the voucher references chain for an internal supplier invoice, following upstream vouchers are visible if they are connected with the supplier invoice through a voucher reference:

Voucher | Conditions for display |

|---|---|

| A customer invoice and an inverse supplier invoice are generated during the inter-company billing between two companies. They are connected through a voucher reference. | |

| If items are distributed through a distribution order between sites belonging to different companies, these items must be billed internally. In such a case, the supplier invoice has a voucher reference to the sales order. In the supplementary cost invoice for distribution view of the Supplier invoices application, the references to distribution orders are always generated manually through receipt of goods from distribution. This is the only way to create a voucher reference chain between distribution order and supplier invoice. |

|

| In case of central purchasing, a company within a concern purchases items for another company. The purchasing company receives the external supplier invoice from the supplier, while the other company receives the items. Since the supplier invoice and receipt of goods voucher go to different companies, an inter-company billing must be carried out on the basis of the receipt of goods. Corresponding customer and supplier invoices are generated with inter-company billing. Both invoices are connected with the basic purchase order through a voucher reference. | |

| In case of an internal third-party order, a company sells items that are owned by another company of the same concern. The selling company sends the customer invoice to the customer, while the other company delivers the items. Since the customer invoice and delivery have been sent by different companies, an inter-company billing must be carried out on the basis of the delivery. Corresponding customer and supplier invoices are generated with inter-company billing. Both invoices are connected with the basic sales order through a voucher reference. |

Supplier invoice categories

The following supplier invoice categories can be differentiated in Comarch ERP Enterprise:

- Supplier invoices

- Supplementary cost invoices

- Supplier invoices without voucher reference

- Correction supplier invoices

- Supplementary cost invoice for distribution

- Consignment withdrawal invoices

Supplier invoices

Supplier invoices are invoices that a supplier uses to charge provided items or services. In each case, the invoice is based on a purchase order directly or indirectly assigned through a receipt of goods.

For more information, refer to the article Supplier invoices.

Supplementary cost invoices

Supplementary cost invoices are separate invoices issued by a supplier for supplementary costs incurred during delivery, but are not included directly in the purchase price of the individual item. In contrast to the supplier invoice, in which the delivery of stock items is billed, only billing items are used in the supplementary cost invoice. Costs such as freight costs, insurance costs or customs duties can be billed for these billing items.

If you want to bill the supplementary costs in a separate supplementary cost invoice, you can create it in the Supplier invoices application in Supplementary cost invoice view. In a supplementary cost invoice, the invoicing party can be different from the invoicing party of the assigned purchase orders.

The supplementary costs are allocated to existing invoice line items in both cases, that is to say, they are distributed to the assigned order line items. The user can specify the calculation basis on which the system is to recommend any distribution. A sub-division is permissible on the basis of quantity, value, weight, volume or any other factor to be entered manually. The supplementary costs can be allocated according to reason in this way.

For more information, refer to the article Supplementary cost invoices.

Supplier invoices without voucher reference

Supplier invoices without voucher reference do not have any references to purchase orders or receipt of goods in the system. You can use this category for processes such as saving of invoices created in other systems. These invoices are transferred to the financial accounting as supplier invoices and supplementary cost invoices. Such invoices can be entered in the header with a reference text.

For more information, refer to the article Supplier invoices without voucher references.

Correction supplier invoices

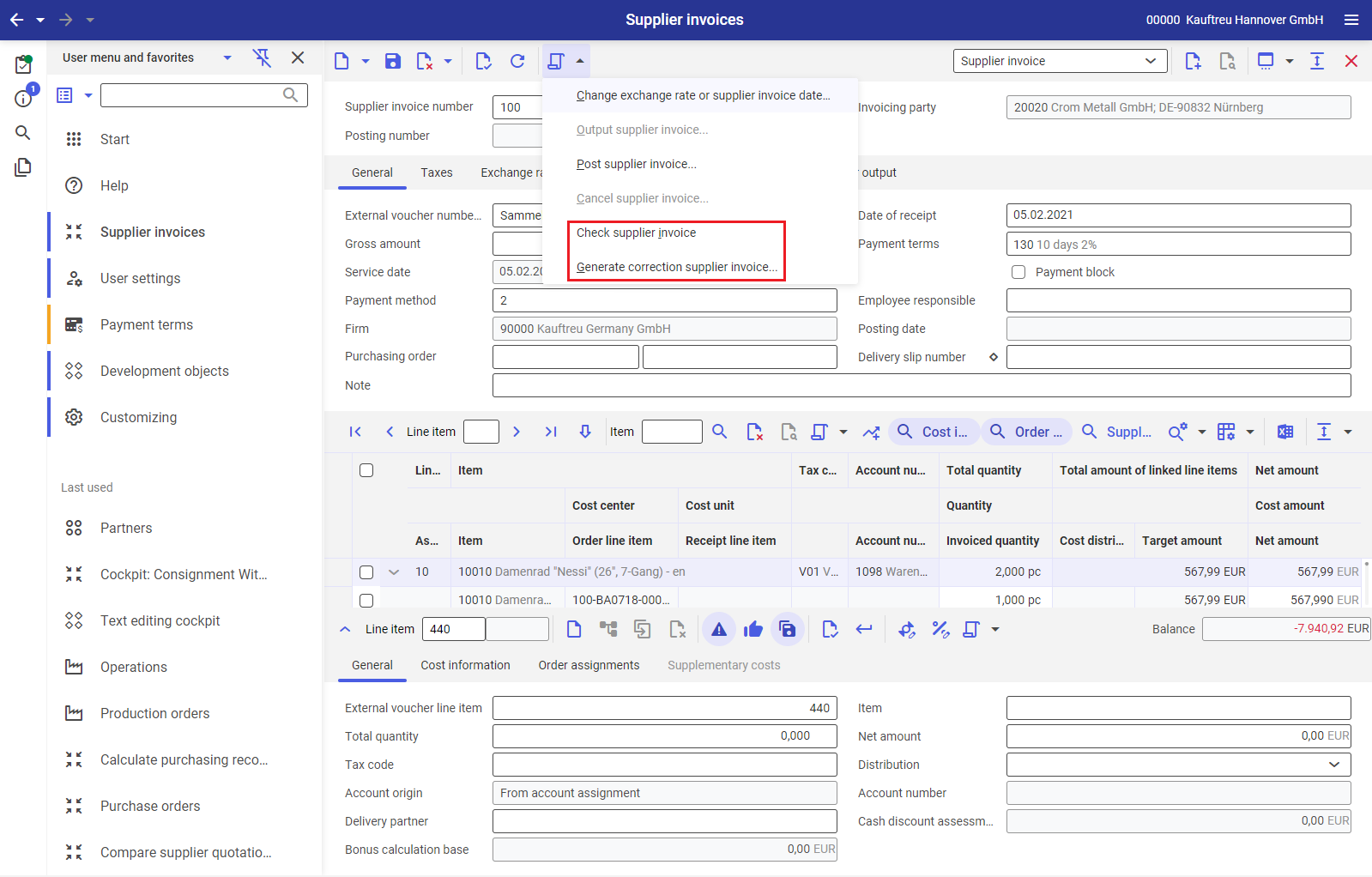

With the help of the actions Verify supplier invoice automatically or Verify supplier invoice in the Supplier invoices application, the system can validate the values in supplier invoice and purchase orders. If any differences are noticed in amounts or quantities, a credit note can be generated in form of a correction supplier invoice that is used to settle differences.

For more information on correction supplier invoices, refer to the article Correction supplier invoices.

Supplementary cost invoice for distribution

If supplementary costs are incurred when items are distributed to various companies of a corporation, they can be created separately in the Supplementary cost invoices from distribution view of the Supplier invoices application.

Consignment withdrawal invoices

The supplier invoice category Consignment withdrawal invoice is available for invoices from suppliers concerning goods withdrawals within the scope of a consignment transaction. Consignment withdrawal invoices are generated from consignment withdrawal declarations or they are manually created and then assigned to consignment withdrawal declarations.

Within the scope of a consignment, the goods of a supplier (consigner) are provided in a consignment warehouse directly at the customer’s (consignee). The business transaction and the transfer of ownership only take place when the goods are issued from the consignment warehouse, i.e. when the goods are used or resold by the customer. Such issue is referred to as consignment withdrawal. At agreed intervals, the customer informs the supplier about the consignment withdrawals, using a consignment withdrawal declaration. Invoices are made out based on these withdrawal declarations.

Processing steps

Supplier invoices and supplementary cost invoices are posted with reference to a purchase order. Therefore, the invoice line items must have a reference to at least one purchase order or receipt of goods line item. A similar reference must be given for supplier invoices, whereas with supplementary cost invoices, such a reference may be provided but not necessarily. Consignment withdrawal invoices must provide a reference to consignment withdrawal declarations.

First, create the invoice header manually. Then create or generate one or more invoice line items and assign these line items to existing purchase order or receipt of goods line items. Assign the line items of a consignment withdrawal invoice to the consignment withdrawal declarations.

You can assign several purchase order or receipt of goods line items and/or withdrawal declaration line items to one invoice line item until the invoice line item amount is completely assigned. Similarly, a purchase order or receipt of goods line item and/or a withdrawal declaration line item can also be assigned in several invoices.

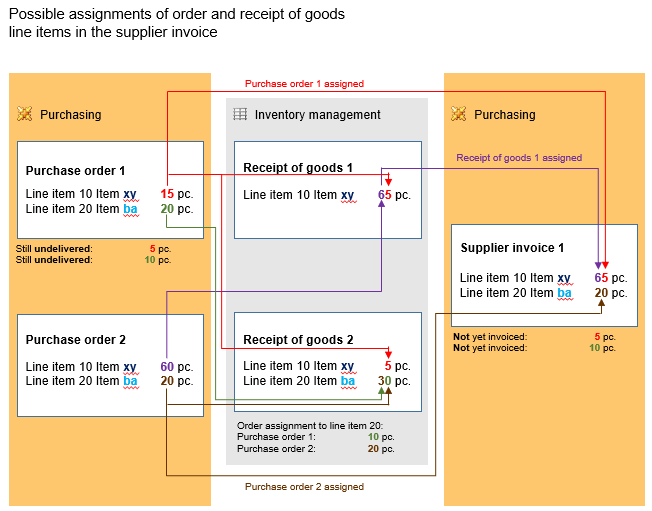

The following example shows the various assignment possibilities for supplier invoice line items.

The item xy of purchase order 1 is delivered in two parts:

- five pieces delivered in receipt of goods 1

- five in receipt of goods 2

- five pieces have not been delivered yet

In receipt of goods 1, sixty pieces of item xy have been delivered from purchase order 2. This purchase order has been delivered completely.

Thirty pieces of item ba have been delivered in receipt of goods 2. From these, ten pieces from purchase order 1 and twenty from purchase order 2 are returned. Ten pieces of item ba from purchase order 1 have not been delivered yet.

Sixty-five pieces of item xy are billed in the supplier invoice. From these, sixty are those ordered in purchase order 2 and delivered in receipt of goods 1. The order line item 10 of order 2 has also been delivered and invoiced. The other five pieces billed are from order 1. They were assigned directly to the order and not to the receipt of goods. From order line item 10 of order 1 (fifteen pieces), five pieces have been invoiced and ten pieces delivered, the order line item has been partly delivered and partly invoiced.

Twenty pieces of item ba from order 2 have been billed in the supplier invoice. They have been assigned directly to the order and not to a receipt of goods. The line item 20 of order 2 has also been delivered and invoiced. The line item 20 of order 1 has not yet been invoiced.

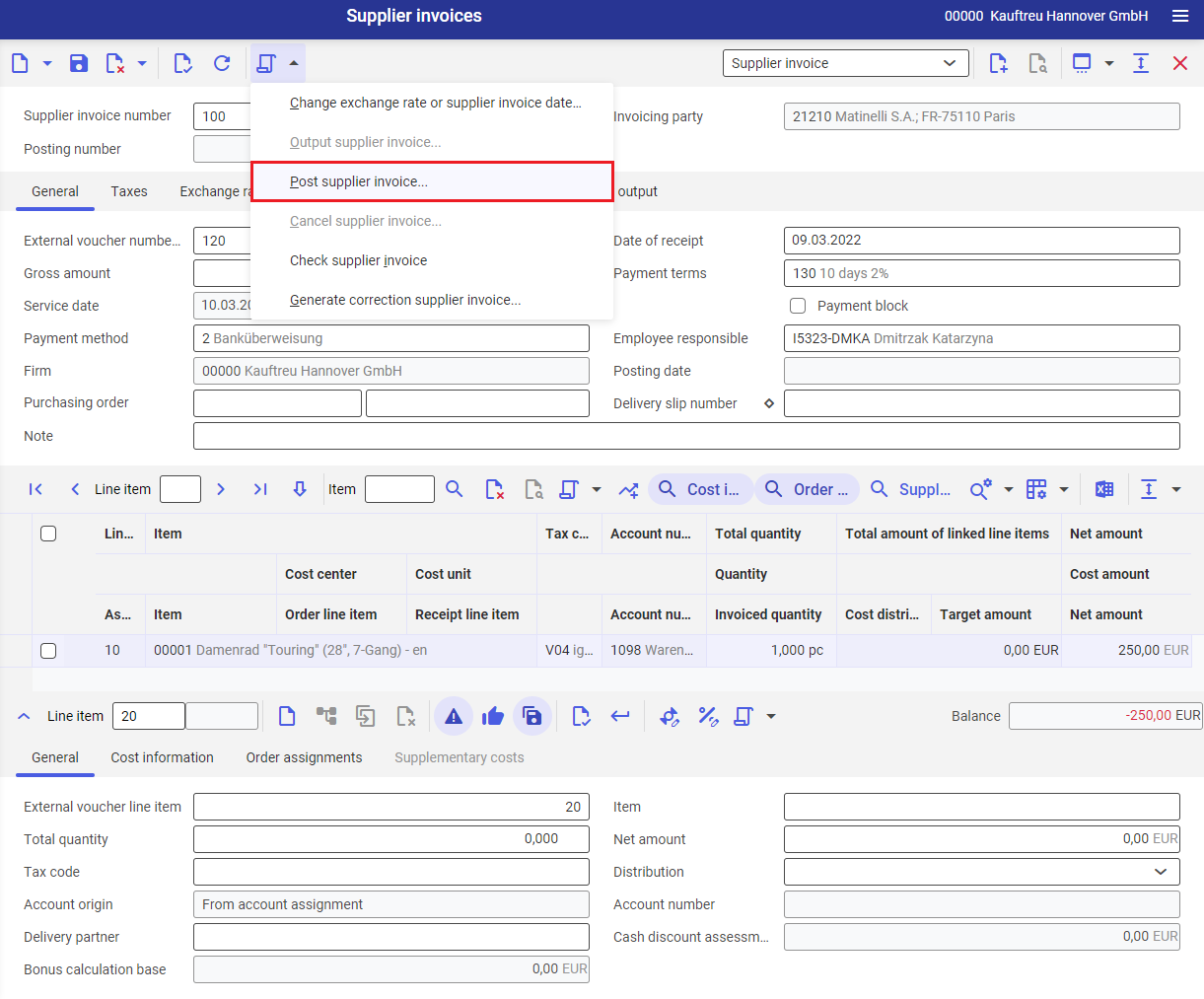

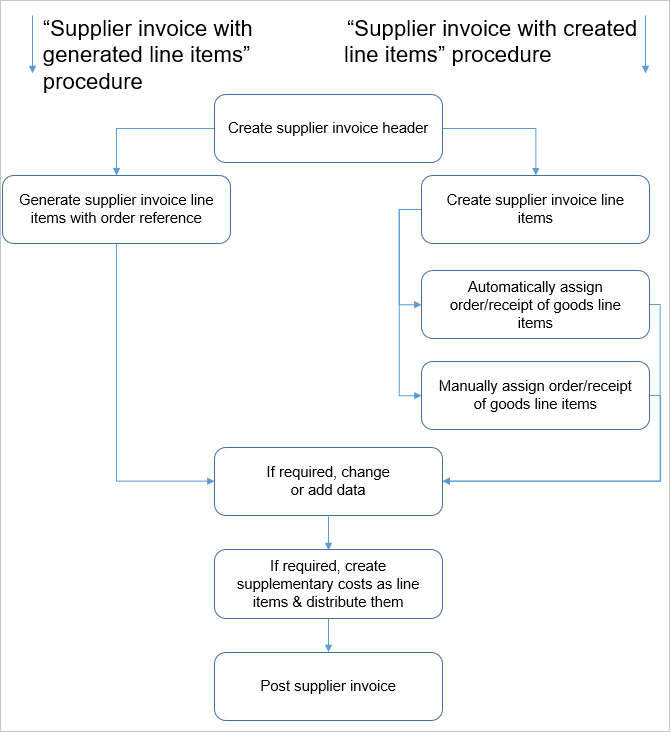

Process steps for supplier invoices

There are two basic possibilities to assign one or more purchase order line items to a supplier invoice line item:

- generate supplier invoice line items with a reference to purchase order line items:

- In this case, the supplier invoice line items and their relationship is added simultaneously to purchase order line items. If supplier invoice line items are generated from receipt of goods line items, this relationship is also saved.

- manually create supplier invoice line items:

- In this case, you must generate a relationship between the supplier invoice line item and at least one purchase order line item. You can select this assignment yourself or let the system determine it automatically. If receipt of goods line items are involved, the relationship with receipt of goods line items will be saved in addition to the relationship with the purchase order.

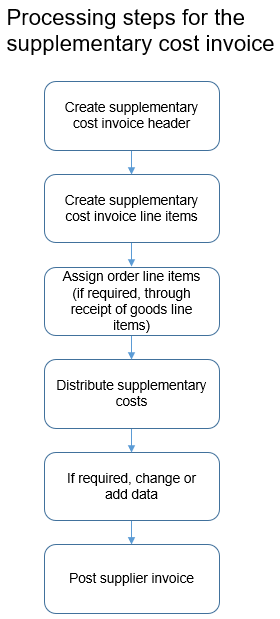

Process steps for supplementary cost invoices

The supplementary cost invoice is edited with the following process steps:

- first create the supplementary cost invoice header and one or more supplementary cost invoice line items.

- then distribute the invoice line items to existing purchase order line items. To do so, manually assign one or more purchase order line items to supplementary cost invoice line items. Alternatively, you can assign individual supplementary cost invoice line items through receipt of goods line items. Since every receipt of goods line item has a reference to an order line item, a reference to an order line item is accepted here. The net amount of the supplementary cost invoice line item is subsequently allotted to the assigned purchase order line items.

- the supplementary cost invoice can be posted only if the net amounts of all supplementary cost invoice line items have been completely allotted to the assigned order line items.

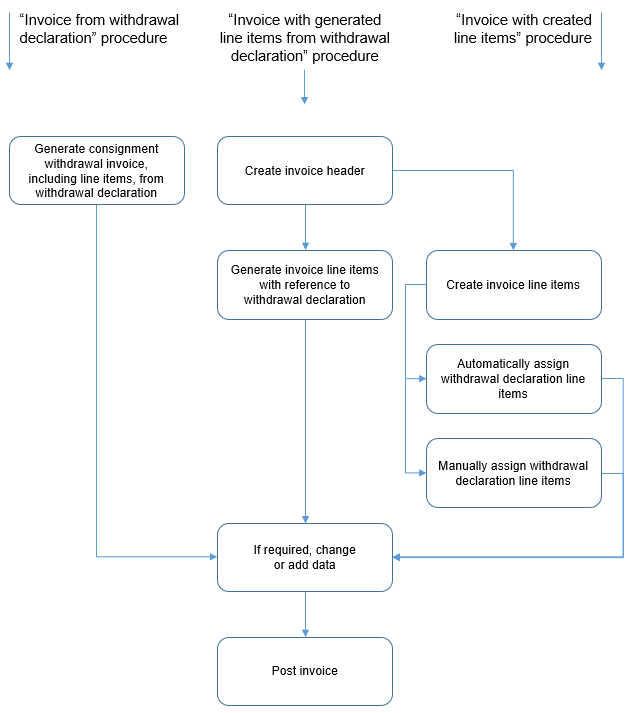

Process steps for consignment withdrawal invoices

The required reference between consignment withdrawal invoices and consignment withdrawal declarations can be established as follows:

- consignment withdrawal invoices are either manually created or generated from consignment withdrawal declarations. Generated invoices already contain line items with reference to the withdrawal declaration line items.

- for manually created invoices, you can either manually create line items or have them generated by the system. Generated invoice line items are already assigned to withdrawal declaration line items.

- on the other hand, you can either manually assign manually created invoice line items to the appropriate withdrawal declaration line items or have them assigned automatically.

It is not possible to create and distribute supplementary costs for consignment withdrawal invoices.

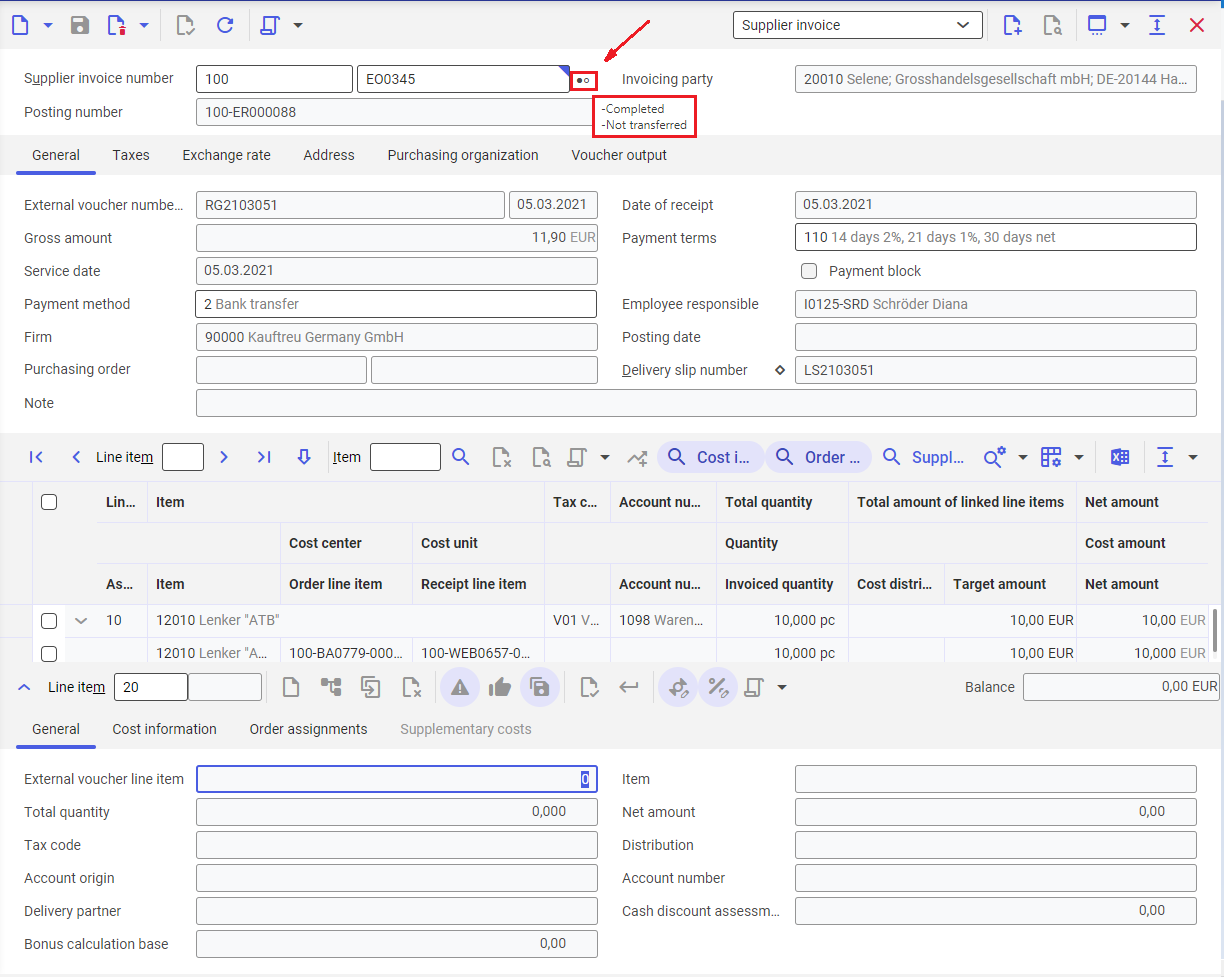

Status and status changes

The status information of the supplier invoice is an additional inherent information element. The user can quickly get an idea of the current batch status of the supplier invoice through this information.

Statuses are shown at the entire supplier invoice and individual invoice line item levels. The supplier invoice header combines the statuses of individual invoice line items. The voucher status symbol is presented by the Supplier invoice status field and its name is displayed upon hovering the mouse cursor over the symbol.

A supplier invoice uses the following statuses:

- General status – status of the entire voucher. Available values:

- Released – automatically assigned to the supplier invoice by the system if the supplier invoice header has been created and saved

- Completed – assigned to the invoice line items if the supplier invoice has been posted and all line items are completed. All fields are displayed only if no changes are possible for completed line items and supplier invoices.

- Canceled – assigned to a supplier invoice, if an already posted supplier invoice has been canceled.

- Invalid – posting and canceling of supplier invoices takes place blockwise. Therefore, the first block, for instance, can be posted and an error message can stop the complete posting through correction postings. In such a case, the supplier invoice cannot be changed, but can be reposted or canceled. However, the error cause must be remedied first.

- Pending items status – displays whether the supplier invoice has already been forwarded to financial accounting and whether a partial or complete payment has arrived. The payment declaration must come from Financial Accounting in order to ensure that the Pending items status can be displayed properly. Available values:

- Not transferred – this status is valid until the supplier invoice is transferred to Financials.

- Transferred – this status is valid when the supplier invoice is transferred to Financials.

- Paid in part – this status is valid when the supplier invoice is paid partially.

- Paid in full – this status is valid when the supplier invoice is paid entirely.

- Canceled – this status valid when the supplier invoice line item is canceled.

Tax exemptions

Tax exemptions are possible in some countries under certain conditions. Before you enable the tax exemptions option integrated within the ERP system, ensure that you adhere to the legal regulations applicable to you.

The following data can be saved per company in the application for tax exemptions:

- date and amount to which a tax exemption is applicable

- type of tax exemption (date or date and amount)

- partner tax classification used for tax exemption

The total of all supplier invoices created up to now are accumulated for controlling the upper limit.

The following process is carried out in a supplier invoice for a Date and amount tax exemption:

- When you create a new supplier invoice or add a new line item to an existing supplier invoice, it is immediately checked whether the date or value upper limit connected to the amount of tax exemption has been exceeded. If it has, a tax code valuation takes place the way it is used for inapplicable tax exemptions. If the upper limit has not been exceeded yet, the invoice recipient tax classification of the invoicing party is replaced with the partner tax classification created in the Tax exemptions This is also applicable if the upper limit is crossed with this particular invoice. With every save, the total of all supplier invoices created is also updated. If the upper limit is overshot with this invoice, information can be output through a workflow event (com.cisag.app.financials.TaxExemptionExceeded). This process is reduced for the Date tax exemption category to checking the invoice date. The tax code determined this way can be manually changed later.

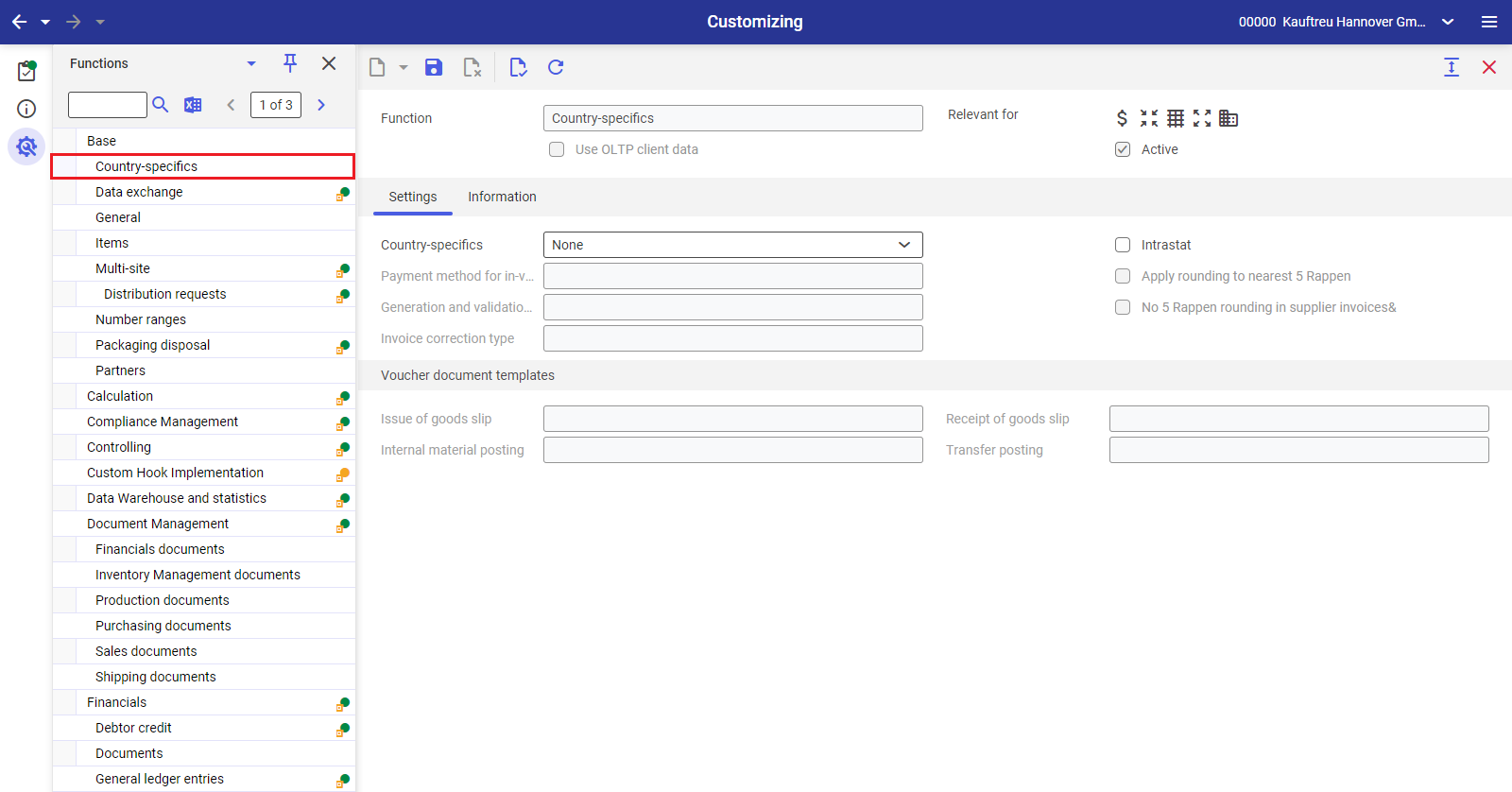

Country specifics – Switzerland

The characteristics for different countries such as Switzerland, Italy, Czech Republic, Poland, and France described below can be activated in the Country-specifics function of the Customizing application.

It is normal in Switzerland to commercially round off invoice amounts to 5 Rappen. If rounding to the nearest Rappen is enabled, the total net amount and sums of tax amounts per tax code and sign (plus/minus) are rounded off in the supplier invoice. A rounding at line item level is not performed.

The ISR number text field is displayed in the header for entering an inpayment slip reference number. If an ISR number has been entered, the amount in the field will be accepted in the Gross amount field when it has 0 as amount.

If a number has been entered in the ISR number field, the system verifies whether the entry is in a valid format for an inpayment slip with reference number. The ISR number amount must correspond with the gross amount. If the amounts do not match, a warning is displayed and payment method optionally saved in Customizing is accepted. A warning is also displayed if the format is not valid or has expired.

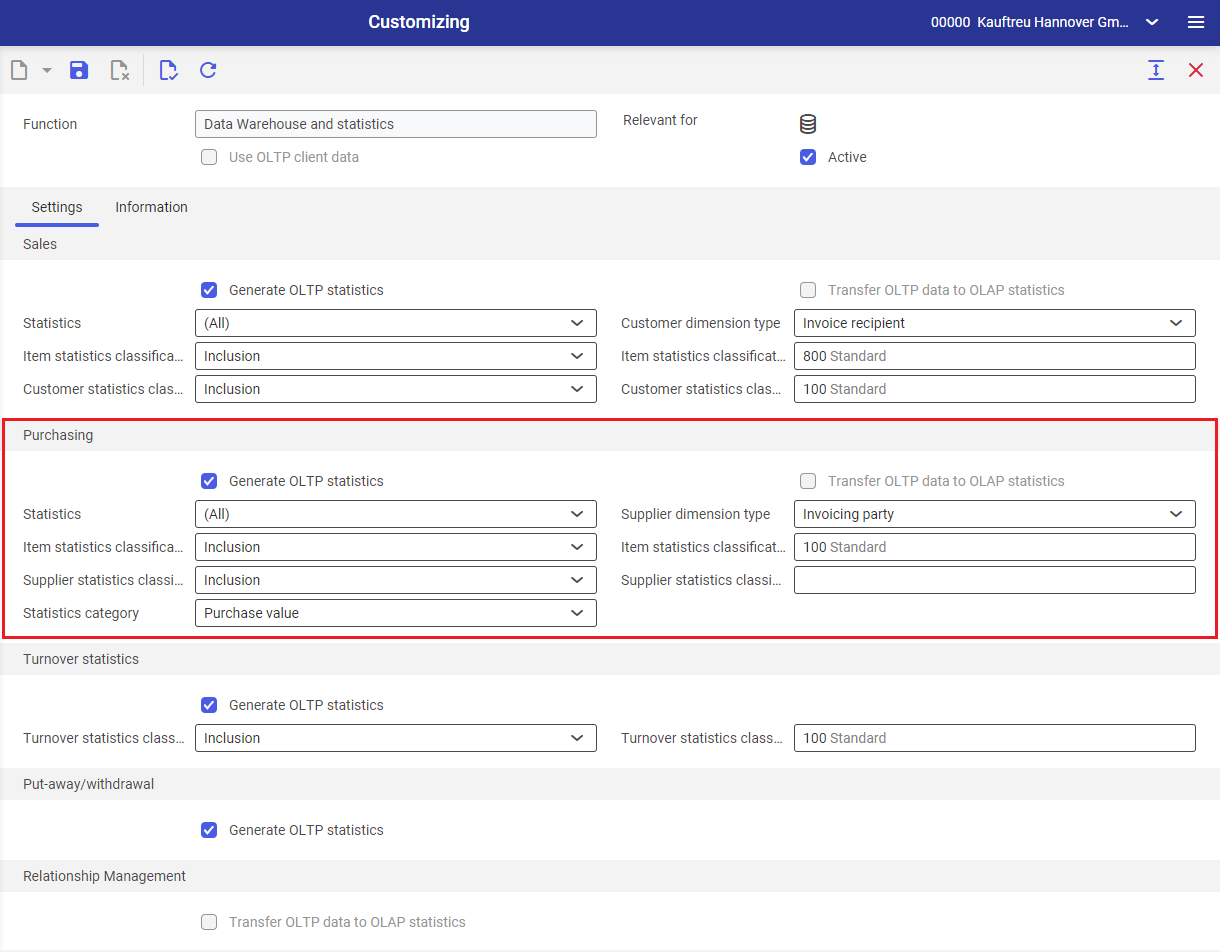

Customizing

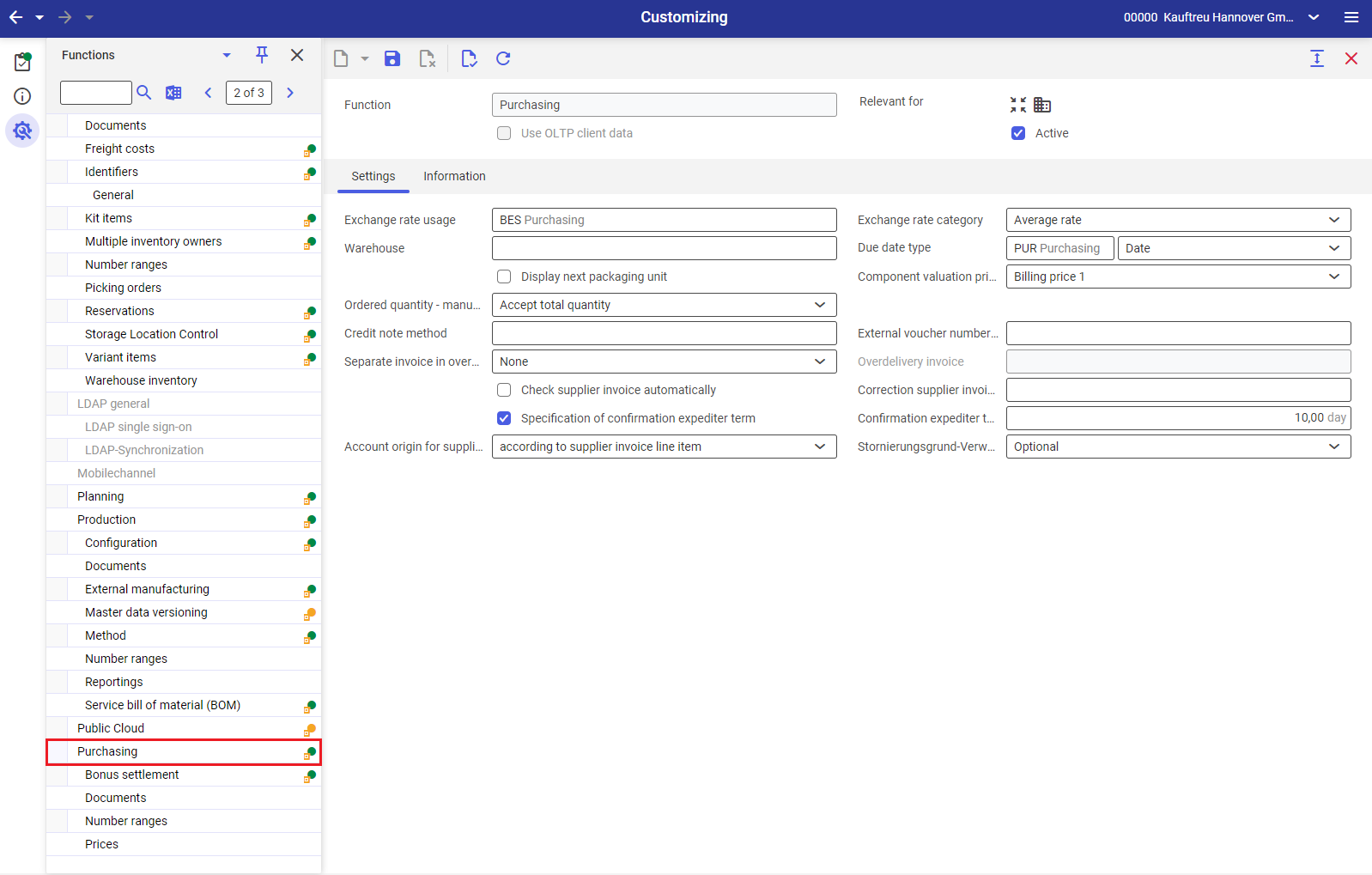

The following settings in the Purchasing function of the Customizing application are relevant to the Supplier invoices application:

Field/Parameter | Full description |

|---|---|

| Based on entries in these fields, different currencies are converted for purchasing vouchers into your company’s primary currency. For more information, refer to the article Exchange rate usages. |

|

| If required, assign a supplier invoice type for the credit note method in this field. This supplier invoice type serves as default value for the corresponding field Supplier invoice type for the credit note method in the supplier data of the Partners application. | |

| If required, assign a number range for the credit note method in this field. This number range serves as default value for the corresponding field External voucher number range in the supplier data of the Partners application. | |

| This parameter is used to specify whether the quantities, prices, and supplementary costs of a supplier invoice are to be validated automatically before posting. The actual values are then compared with the specified values from purchase orders and any discrepancies are displayed. | |

| In this field, you can specify a supplier invoice type that is to be used for generating correction supplier invoices. |

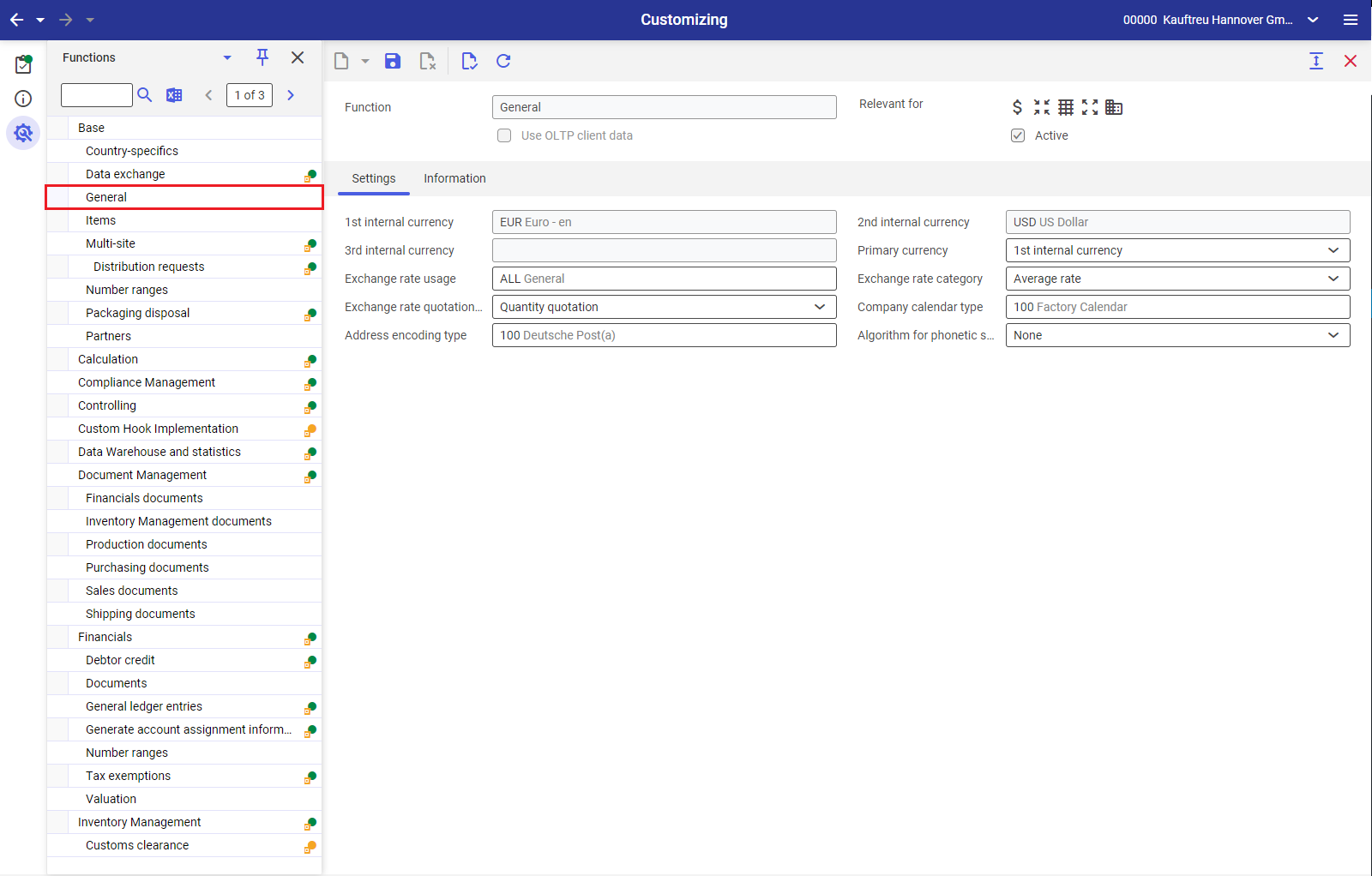

The following settings in the General function under Base of the Customizing application are relevant to the Supplier invoices application:

Field | Full description |

|---|---|

| One of the up to three internal currencies of the own company is marked as primary currency. The supplier invoice is created in the currency that has been specified in the master data of the supplier. The currency can be changed in the Gross amount field if no line items have been created so far. It must be possible to convert it into any of the internal currencies. For this purpose, corresponding conversion factors need to be provided in the Exchange rates application. |

The following settings in the Country-specifics function under Base of the Customizing application are relevant to the Supplier invoices application:

Field | Full description |

|---|---|

| In the Country-specifics field, you can select a country (Poland, Italy, Switzerland, France, Czech Republic among others) to which special criteria apply. Example In case of Italy, for example, an additional field for creating a tax register is shown under the General tab. There are commercial roundings applied for Switzerland. If you have selected Switzerland, you can create a payment method that is suggested after an invalid payment slip reference number has been entered. |

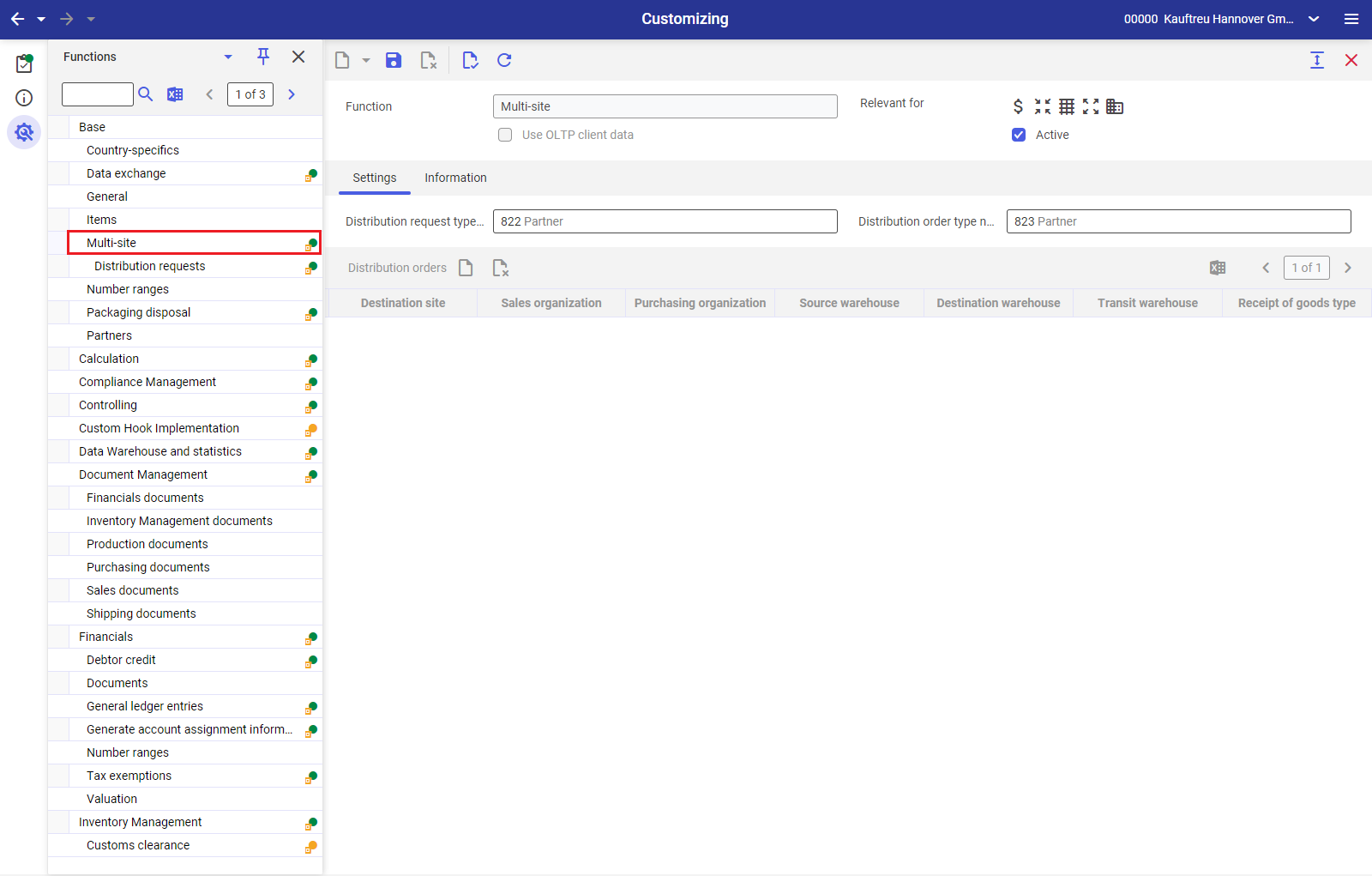

The following settings in the Multi-site function under Base of the Customizing application are relevant to the Supplier invoices application. The Distribution orders table in the Multi-site function is used for the inter-company billing of distribution orders:

Business entities

The following business entity is relevant to the Supplier invoices application, which you use to

- assign authorizations,

- provide activity definitions, or

- import or export data.

Supplier invoice

com.cisag.app.purchasing.obj.SupplierInvoice

The business entity is part of the following business entity group:

Purchasing voucher data

com.cisag.app.purchasing.OrderData

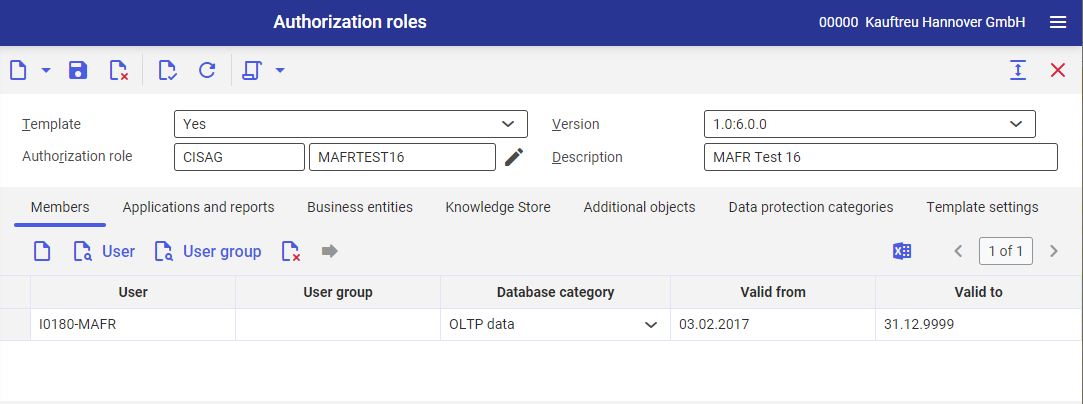

Authorizations

Authorizations can be assigned by means of authorization roles as well as by assigning an organization. The authorization concept is described in the article Authorizations.

Special capabilities

The following special capability, dependent on actions, is available for the Supplier invoices application. You can assign authorizations for this capability in the Authorization roles application.

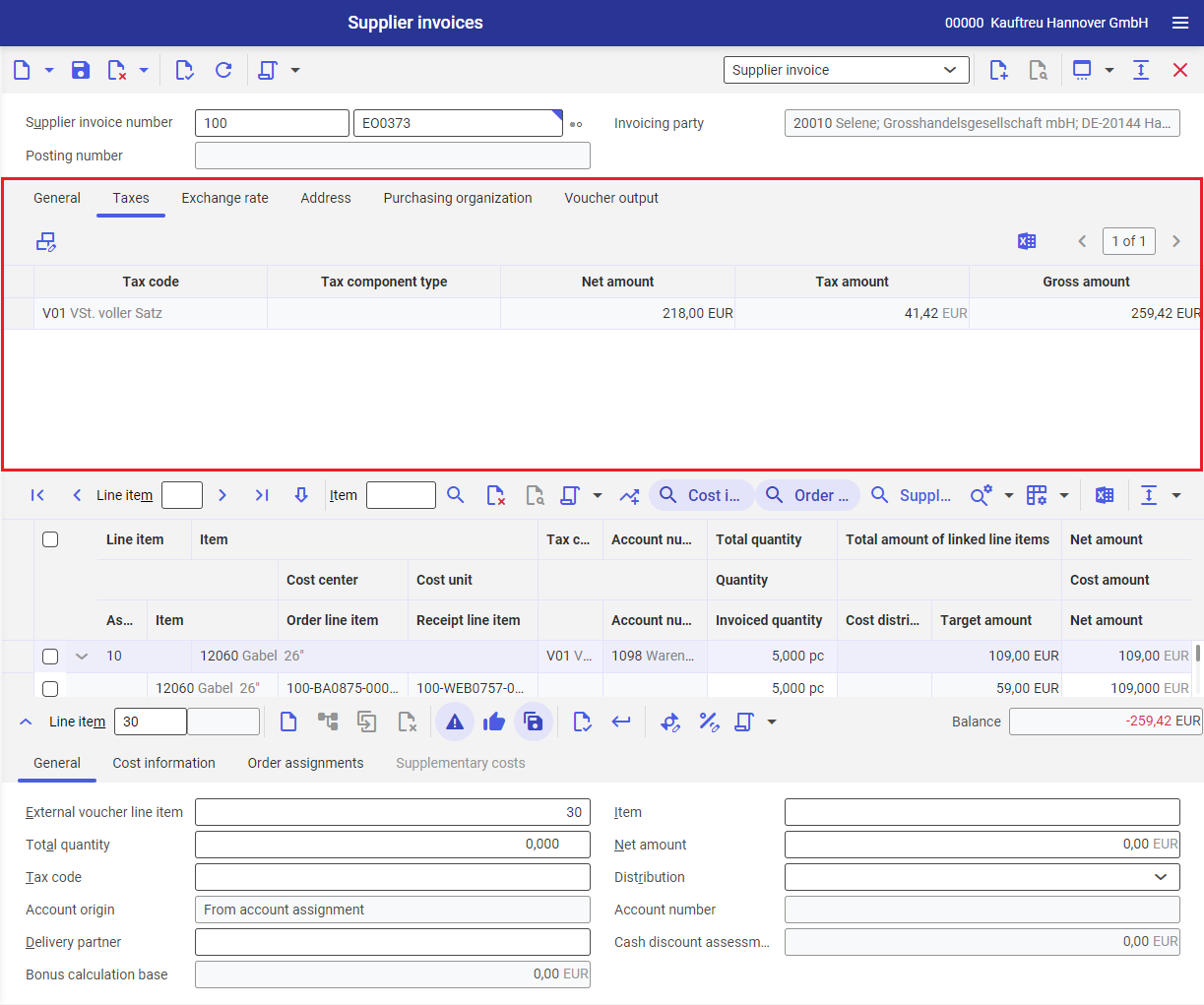

Edit tax data

com.cisag.app.purchasing.invoice.ui.EditTaxData

You can edit the tax amounts in the tax table in the Taxes tab of the Supplier invoices application with this capability. This is necessary, for instance, when the tax amount calculated according to the tax code is different from the amount appearing in the invoice.

Organizational assignments

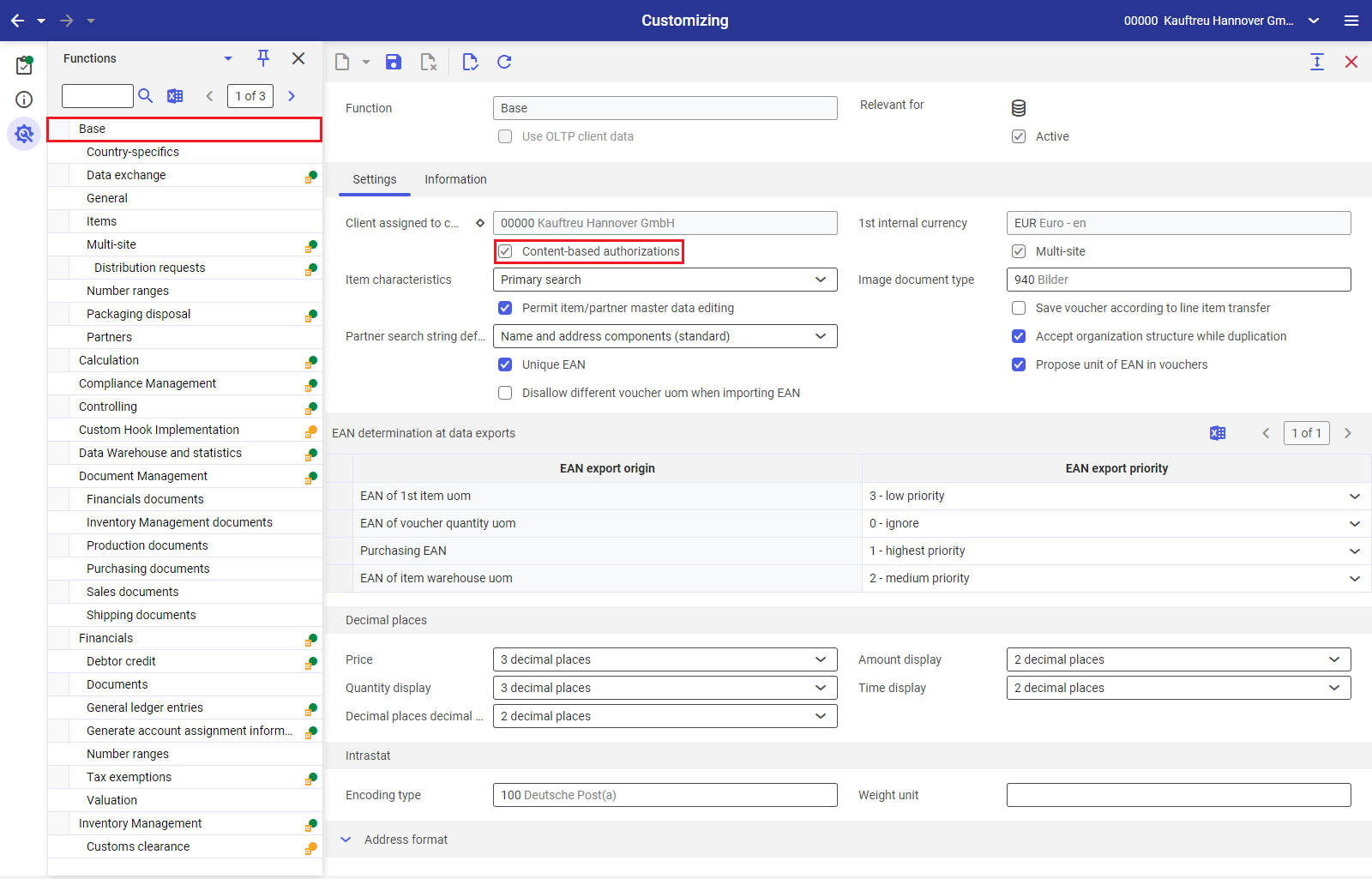

Organizational structures are used to control which data can be viewed, used, or edited. The Content-based authorizations function must be activated in the Customizing application for this purpose.

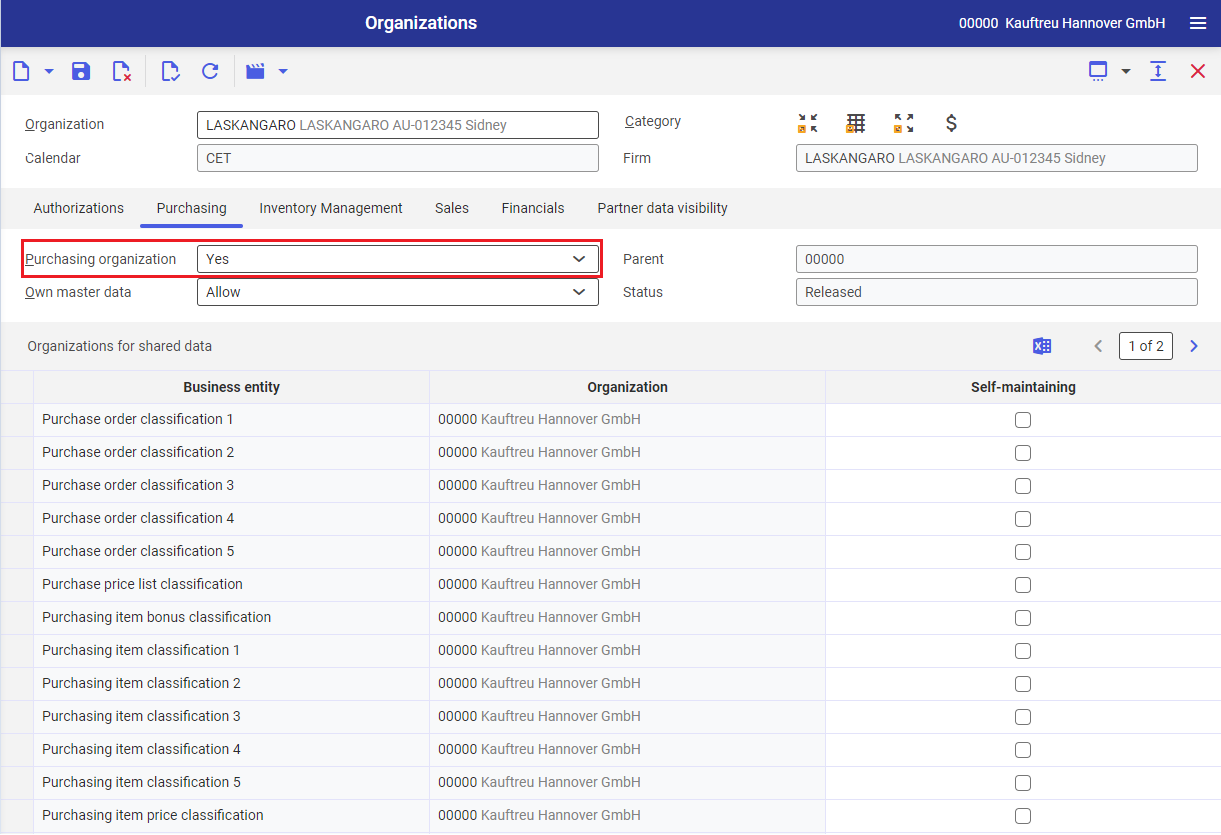

To ensure that a person can see the Supplier invoices application in the user menu and can open it, the user must be assigned to an organization of Purchasing type. First, the selected organization must be assigned to the Purchasing organization structure in the Organizations application.

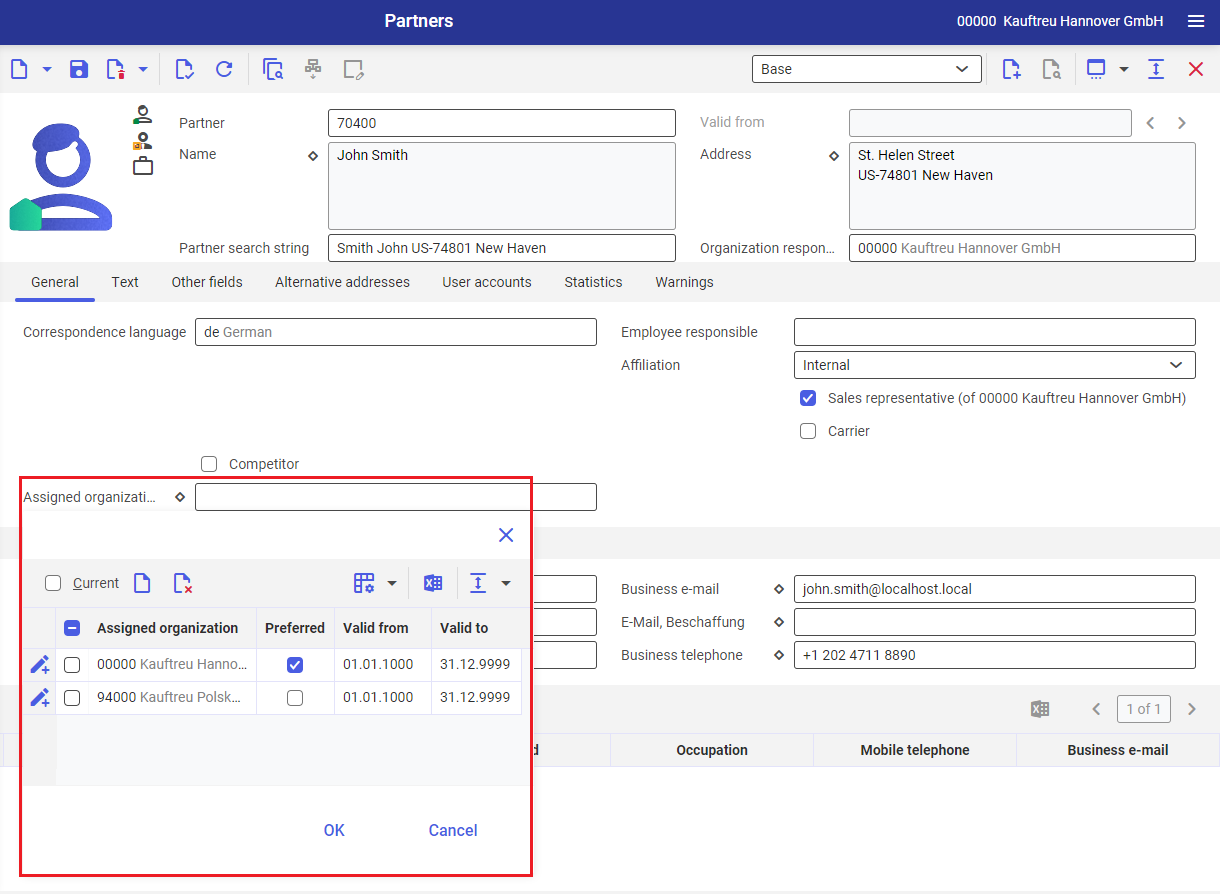

Then, the user must be assigned directly to the organization in the Partners application.

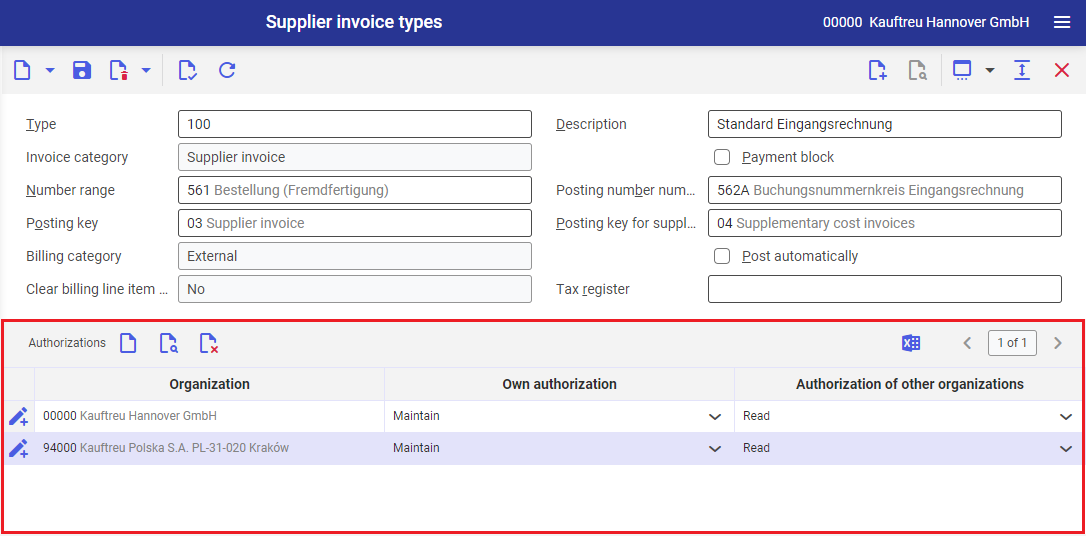

To ensure that a person is able to open a supplier invoice and edit the data in it, one of the organizations assigned to the user must be entered in the Supplier invoice types application in the Authorizations table.

For more information on the Authorizations table and a comprehensive overview of content-based authorizations, refer to the article Content-based authorizations.

Special features

There are no features for the Supplier invoices application.

Authorizations for business partners

The Supplier invoices application is not released for the business partners.