In application Comarch Retail POS trade documents, it is possible to preview all trade documents deriving from the Comarch POS application (receipts, invoices, advance invoices, corrections, sales orders and quotes).

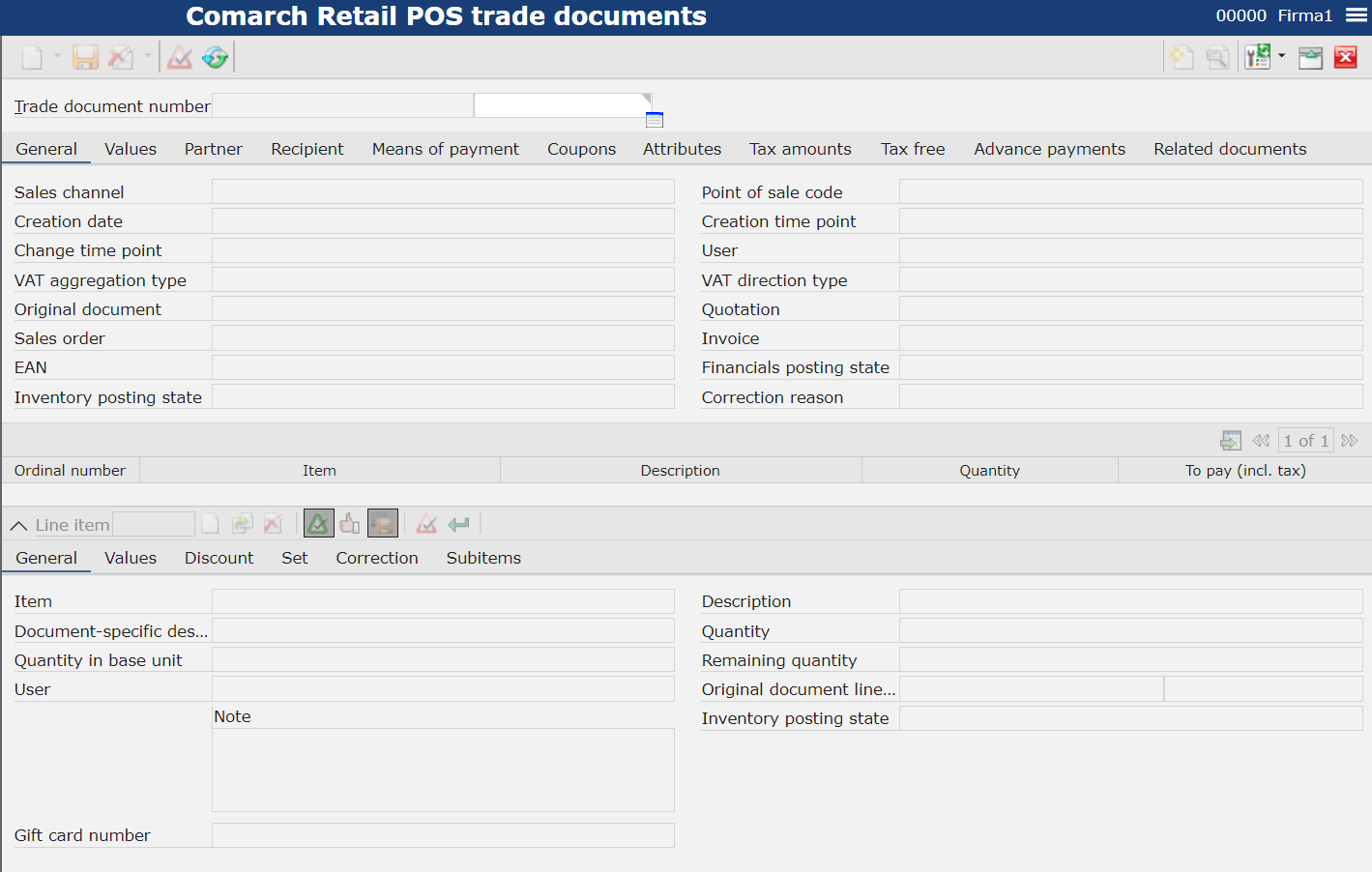

The application is composed of the header and the list of items with its details.

Application header

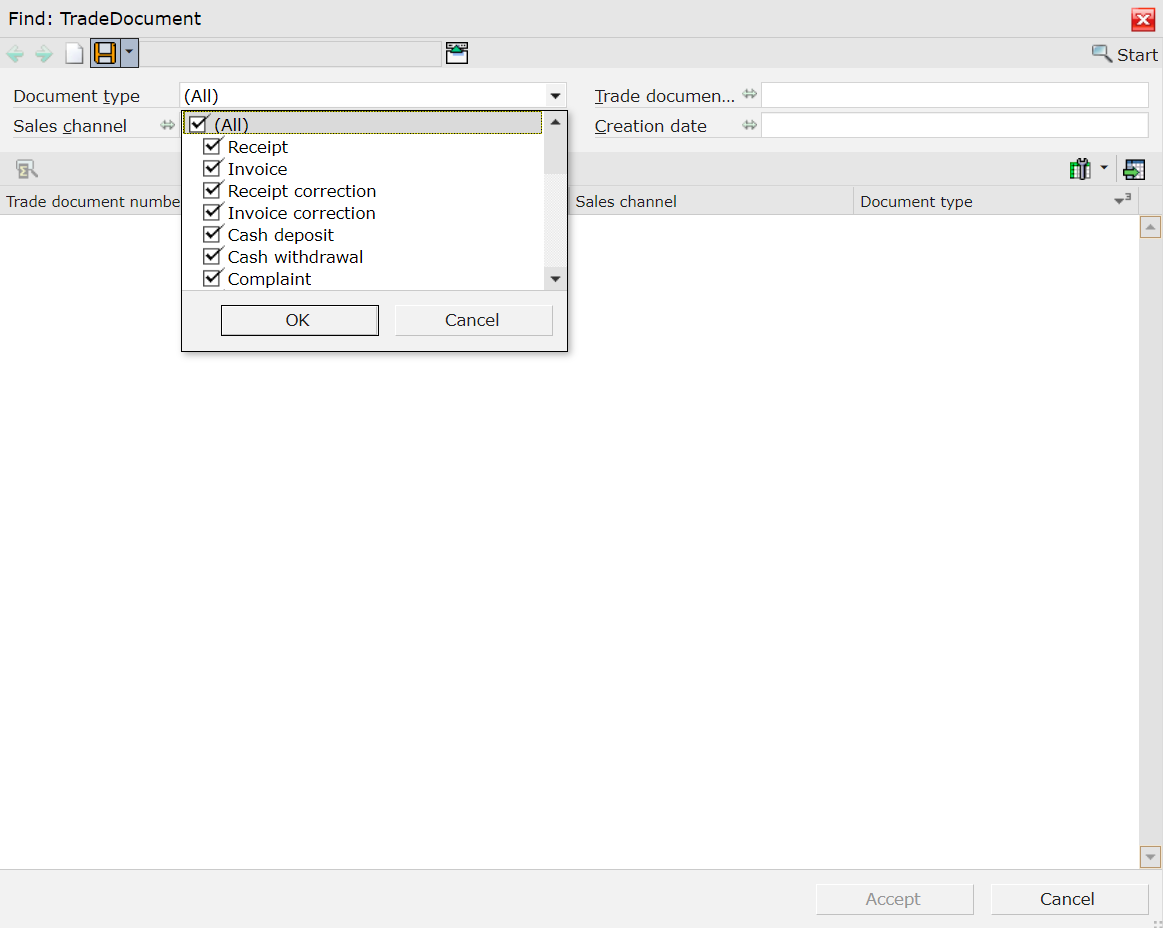

In the application header, it is possible to filter lists by indicated trade document number. To do so, it is necessary to open searching options for Trade document number value and select [Value assistant] button. After selecting the button, a window in which it is possible to find the adequate trade document number, is opened.

After selecting button [Start] the system displays the list of result with the possibility of selecting and filtering that trade document.

After selecting button [Accept], the selected trade document will be displayed in the application header.

After indicating a document number, the user can preview the list of items for that document, along with their descriptions, quantities and amount to pay.

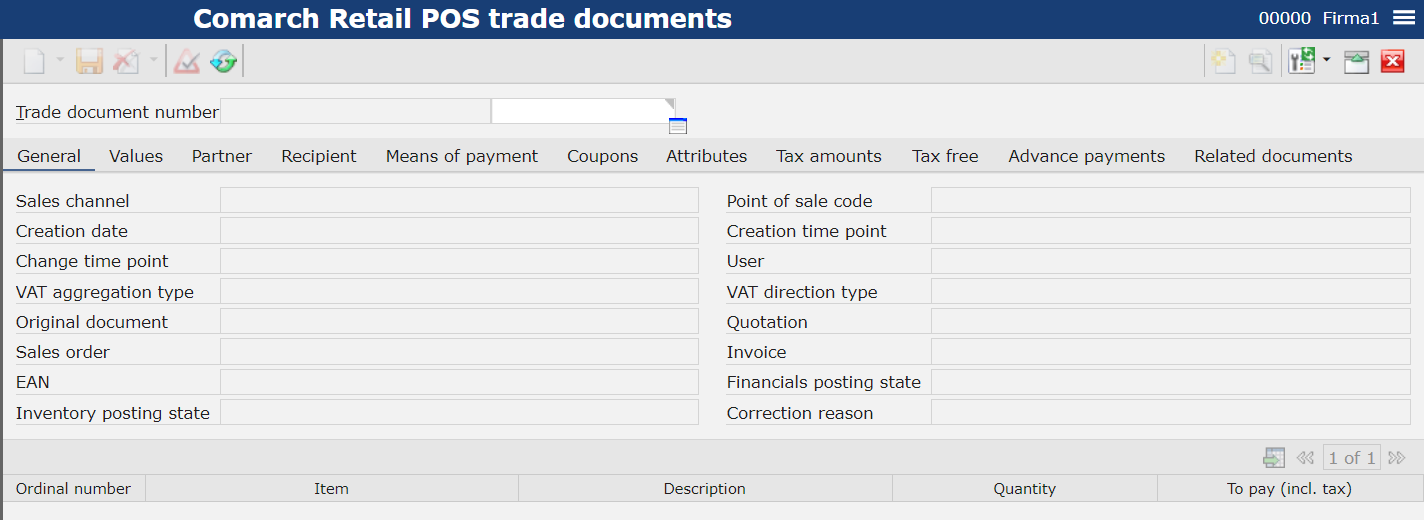

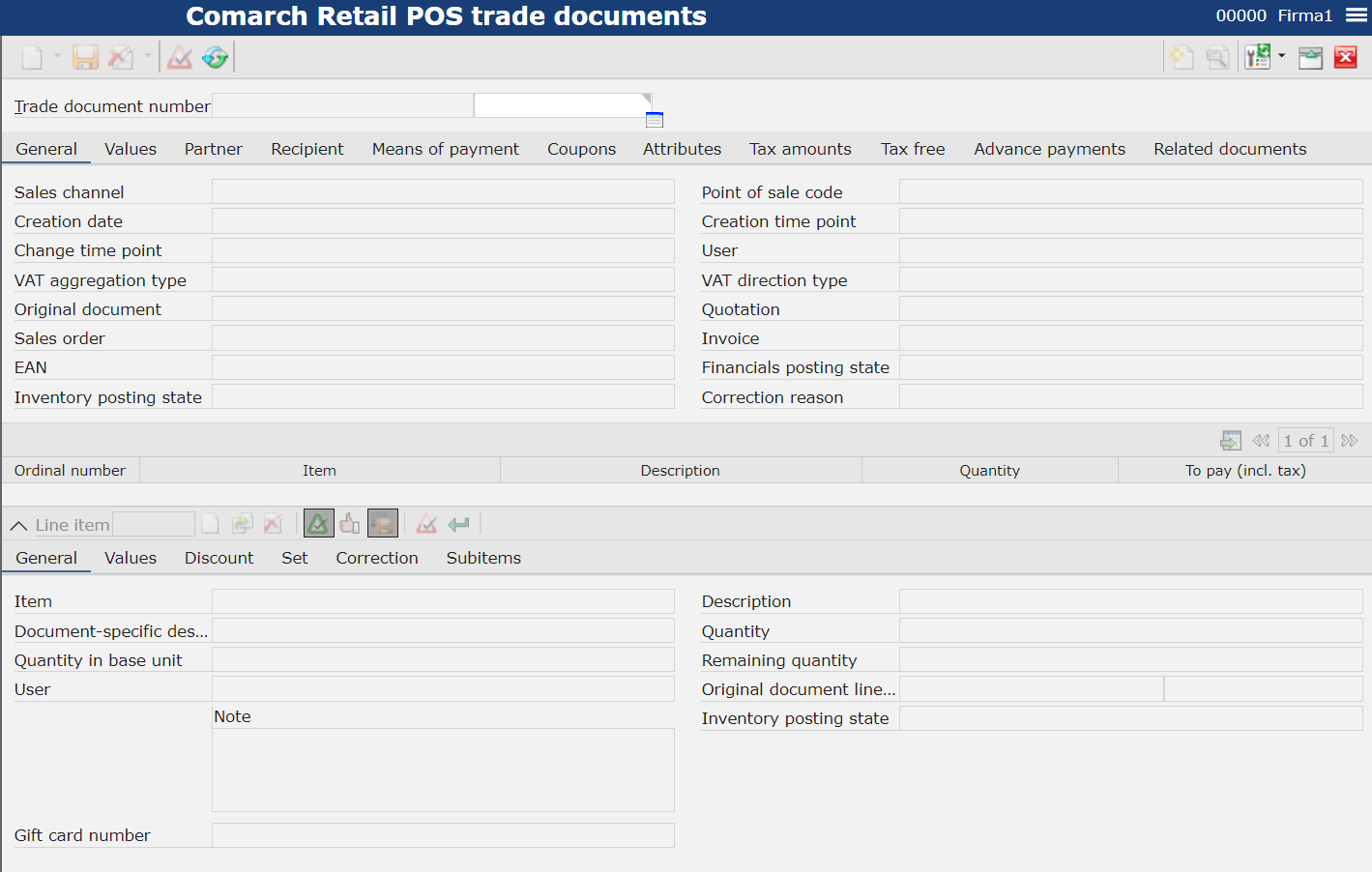

Tab General

Allows for previewing the basic information regarding a trade document.

Sales channel – contains the code of a sales channel along with assigned POS workstation on which the document was issued

- Point of sale code – information about the workstation on which the document was issued

- Creation date – date on which the document was issued on the POS workstation

- Creation time point – date on which the document was registered in the system

- Change time point – date of the las modification made to the document (e.g., in case of editing or changing document status)

- User – operator who made the last change to the document

- VAT aggregation type – information about the method of tax calculation

- VAT direction type – information about the method of tax assessment

- Original document – information regarding the document, on the basis of which a currently opened document was created. In case such document was issued manually and not generated, the filed remains empty.

- Quotation – number of associated sales quotes

- Sales order – sales order number, this field is visible only for documents of Sales order type

- Invoice – invoice number, this field is visible only for documents of Invoice type

- EAN – unique EAN code visible on the document printout on POS workstation

- Financials posting state – field provided for information purposes, completed in accordance with the posting status:

-

- Not posted in financial accounting

- Posted in financial accounting

- Inventory posting state – field provided for information purposes, completed in accordance with the posting status:

- Inventory posted

- Inventory posted with errors

- Inventory not posted

- Correction reason – reason of correction available on a correction document, allows for indicating the reason for returning item

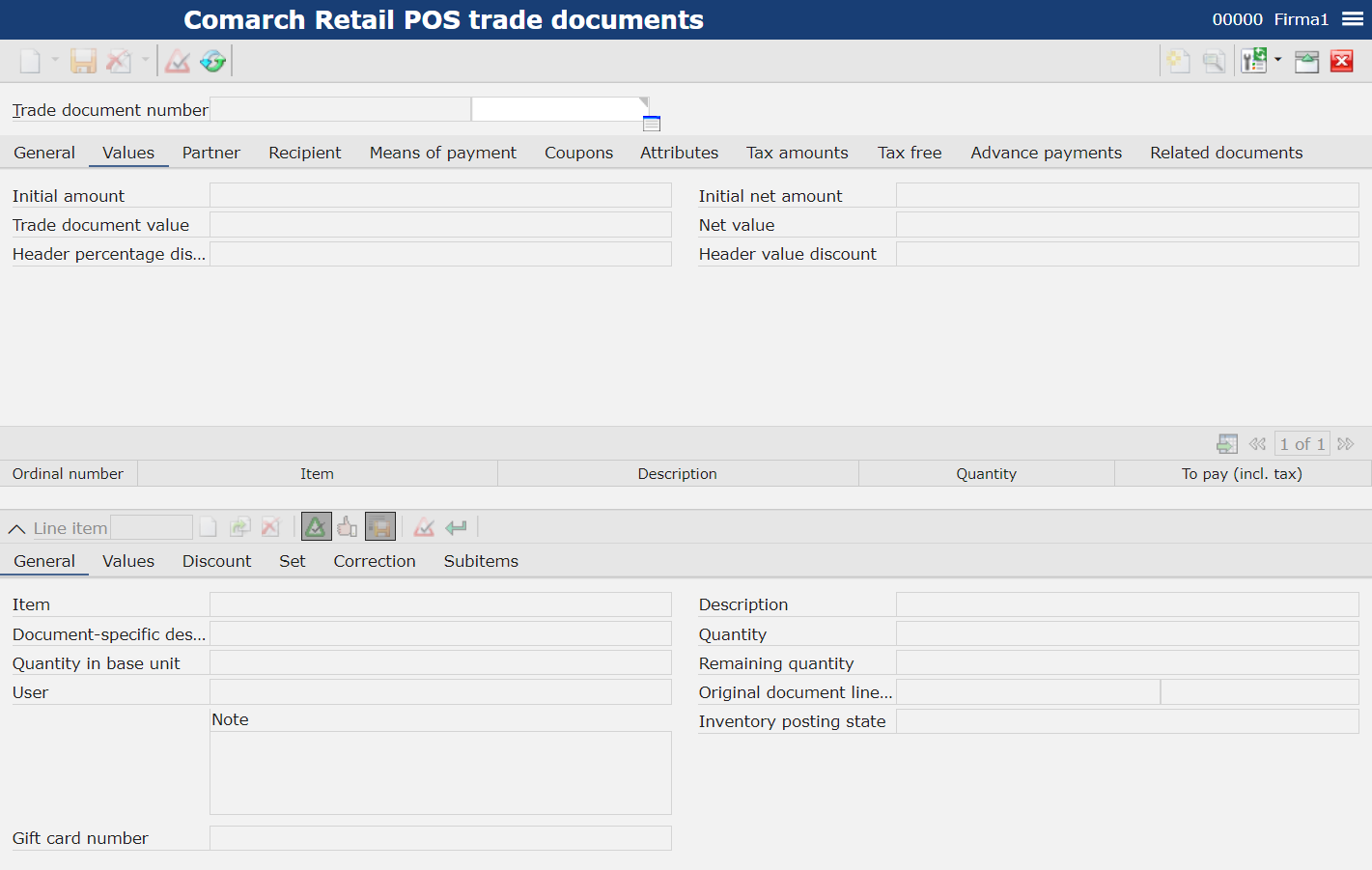

Tab Values

Allows for previewing information regarding the values on documents and granted discounts.

- Initial amount – field available only for documents of Sales order type, allows for displaying the initial amount

Initial net amount – field available only for documents of Sales order type, allows for displaying the initial net amount - Trade document value – total value for which the document was issued with the information about currency

- Net value – net value for which the document was issued with the information about currency

- Header percentage discount – header percentage discount granted by the operator directly in the header of an issued document

- Header value discount – header value discount granted by the operator directly in the header of an issued document

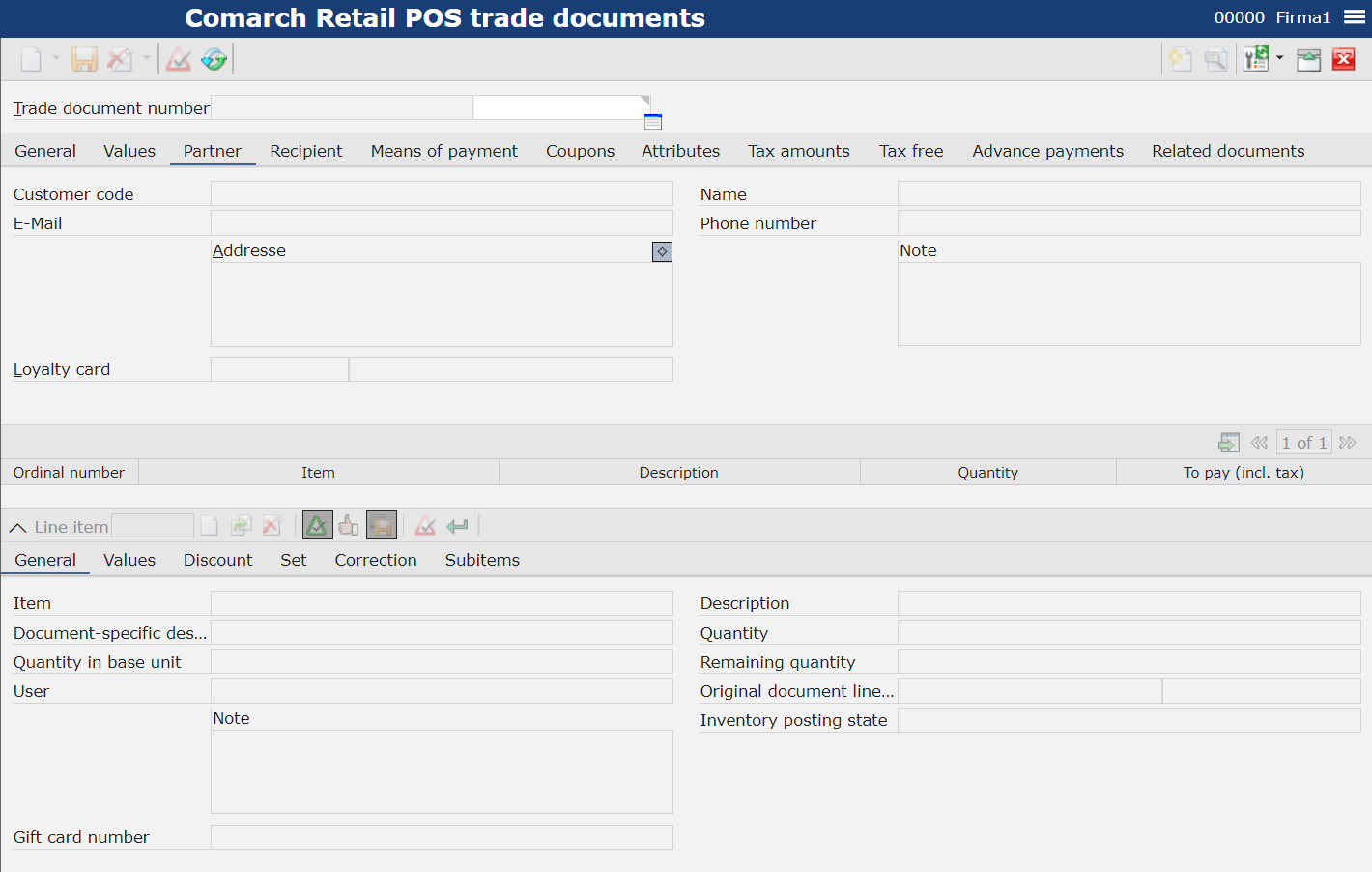

Tab Partner

Allows for previewing information regarding partner associated with a given trade document. It is possible to verify particular information regarding partner: code and his/her name, mailing address, e-mail address, phone number and the number of associated loyalty card.

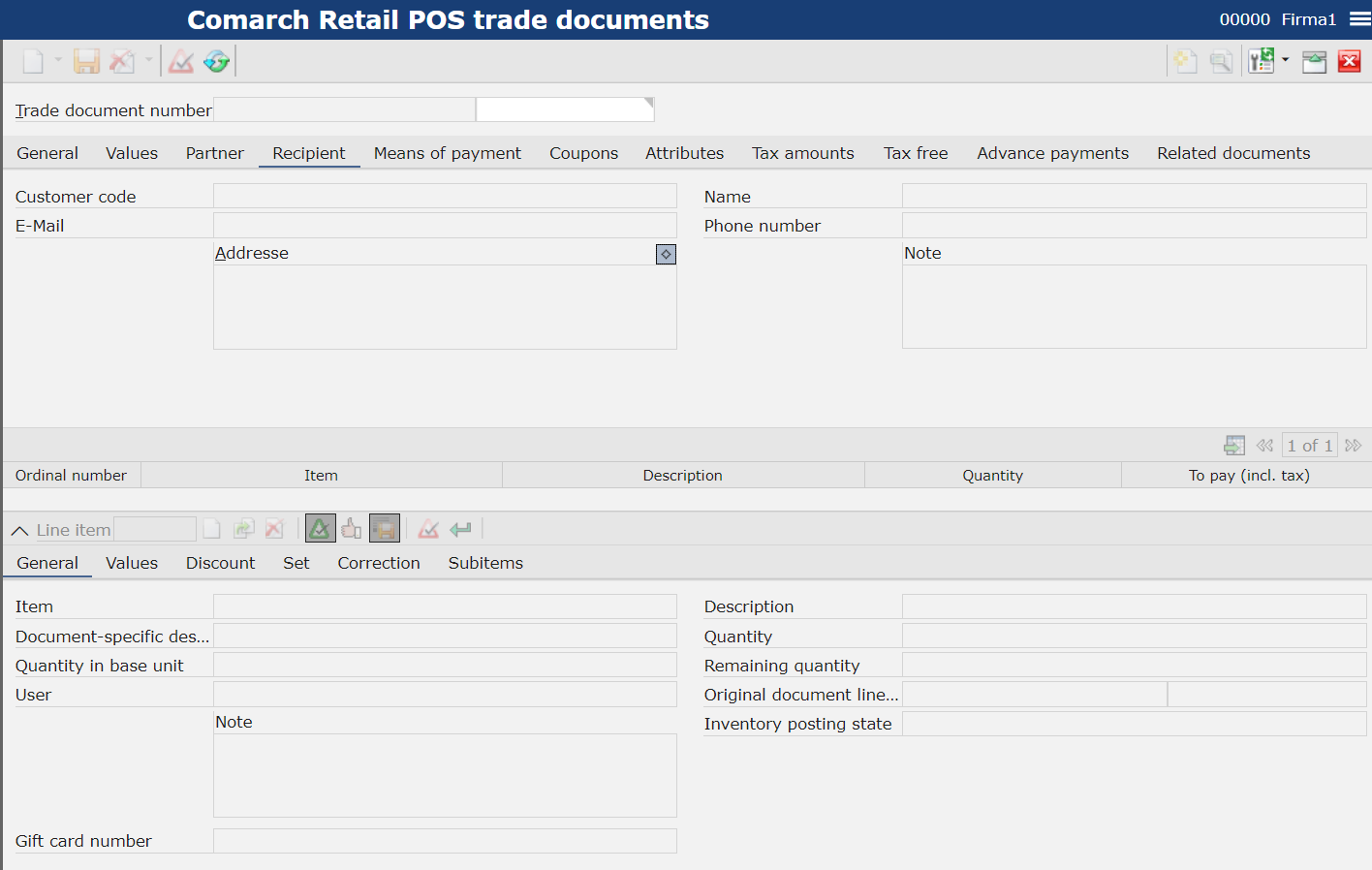

Tab Recipient

Allows for displaying information about the document recipient: customer code and address data.

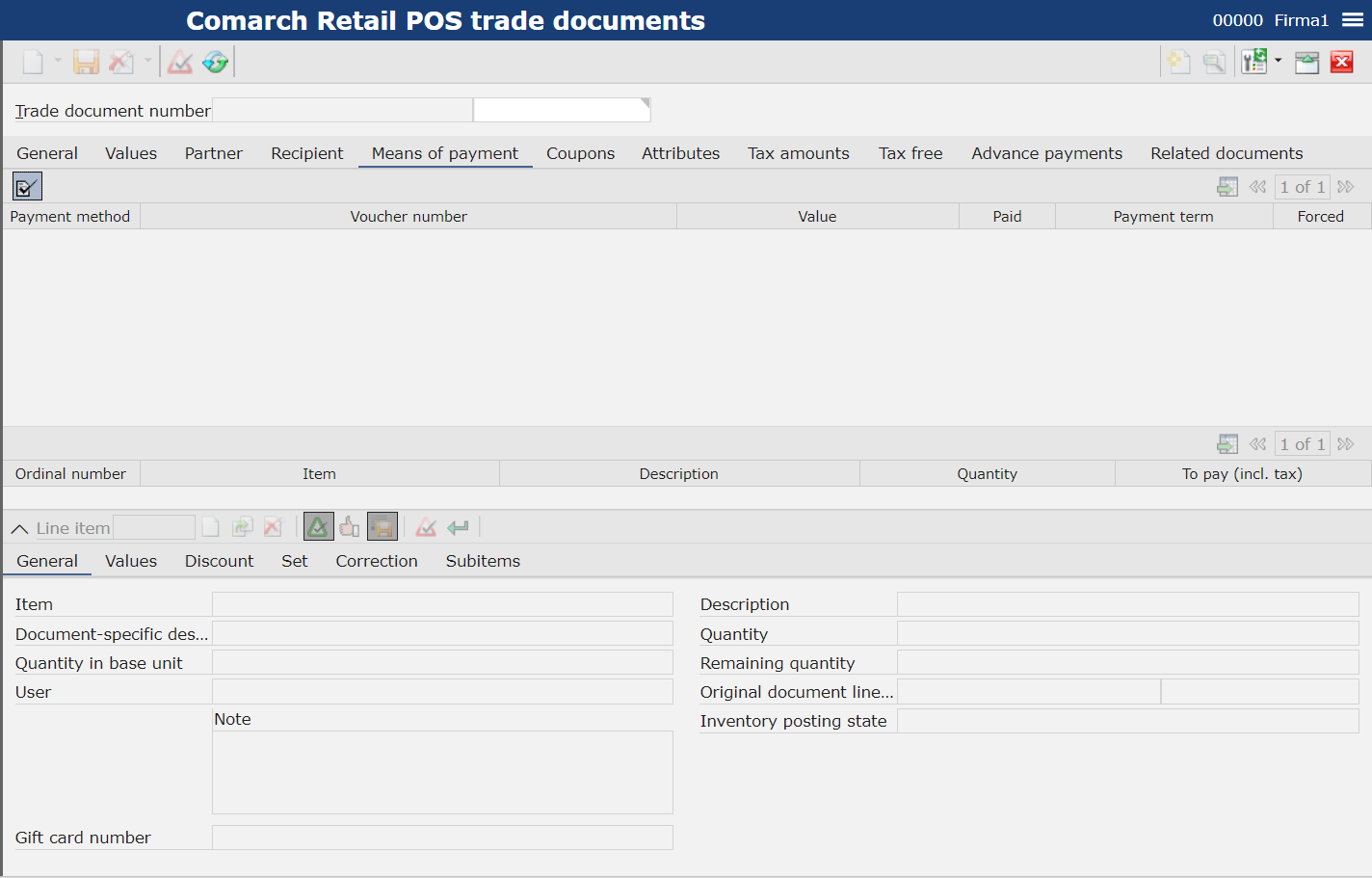

Tab Means of payment

Allows for previewing details of payment for a given trade document.

Available fields:

- Payment method – information about the payment method selected on a document, e.g., cash, card

- Voucher number – in the case of voucher payment, the user obtains information about voucher number. For the rest of payment methods, the field remains empty.

- Value – amount paid with a given payment method

- Paid – parameter checked automatically once the payment is made

- Payment term – date and hour of payment

- Forced – parameter checked automatically once the payment is confirmed manually

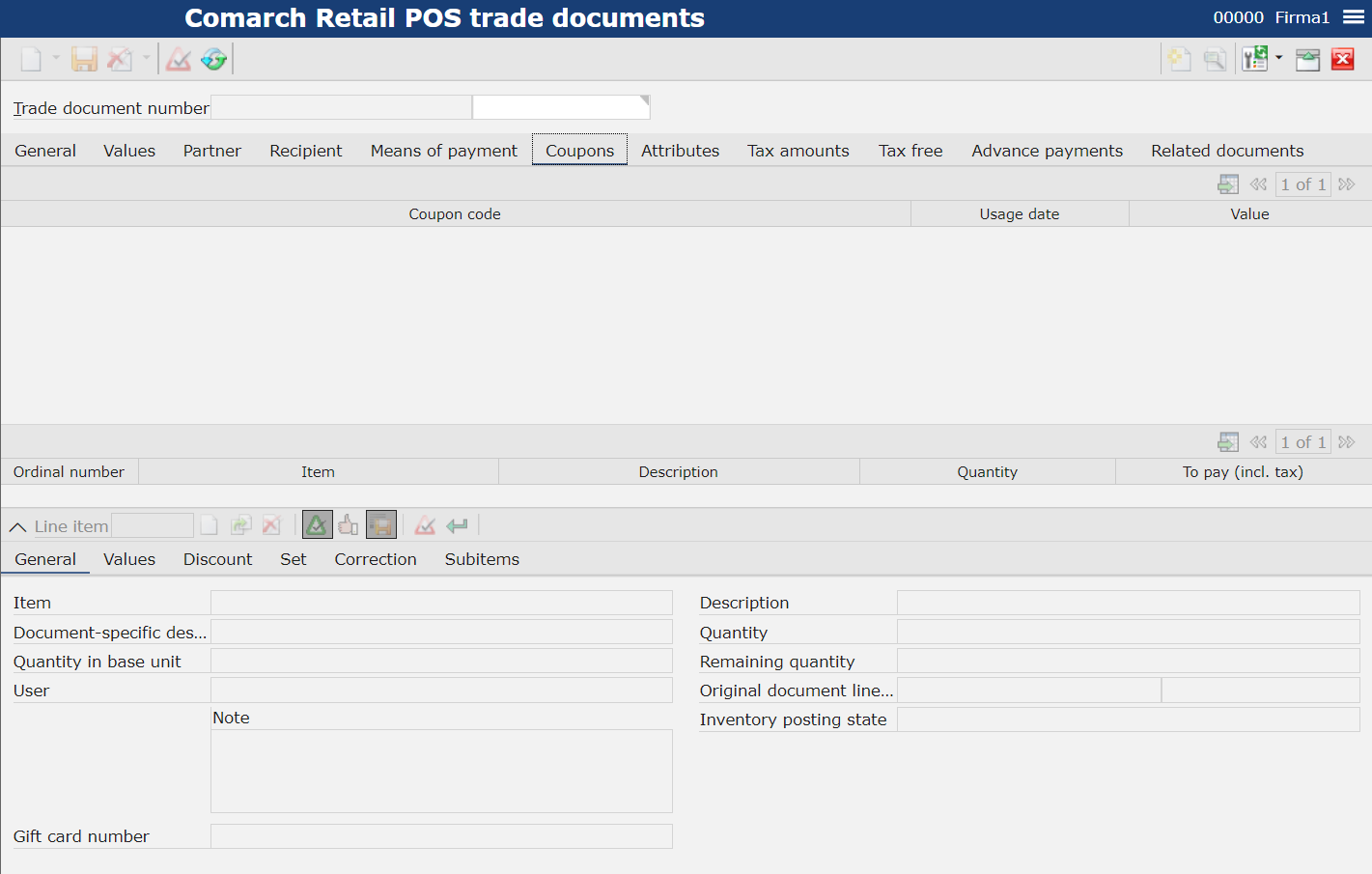

Tab Coupons

Allows for previewing coupons used on document.

- Coupon code – information regarding the code of a used coupon

- Usage date – date on which a coupon was used on the POS workstation

- Value – value of granted discount

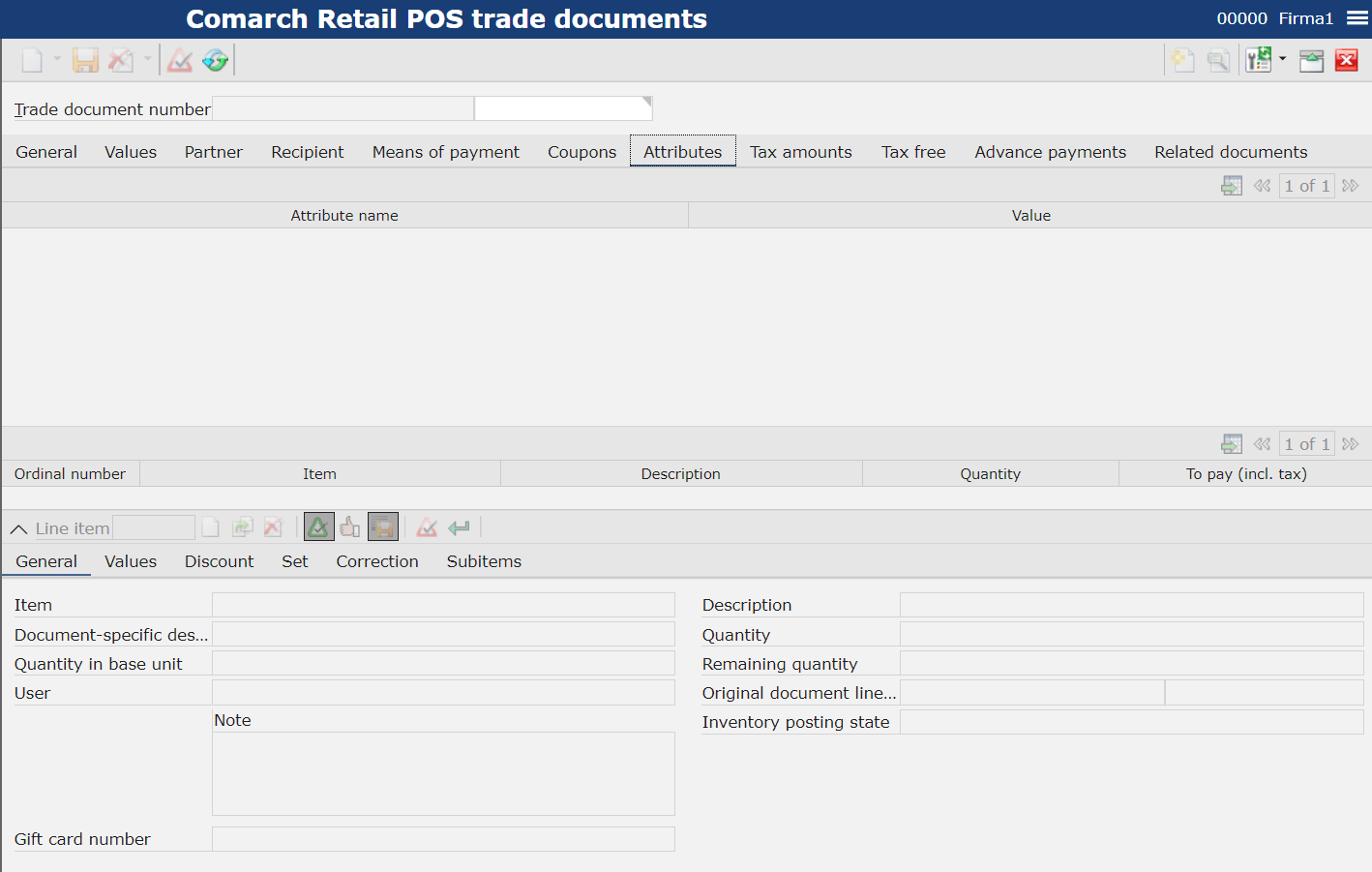

Tab Attributes

Allows for displaying attributes (names and values), if there are any associated with a given document.

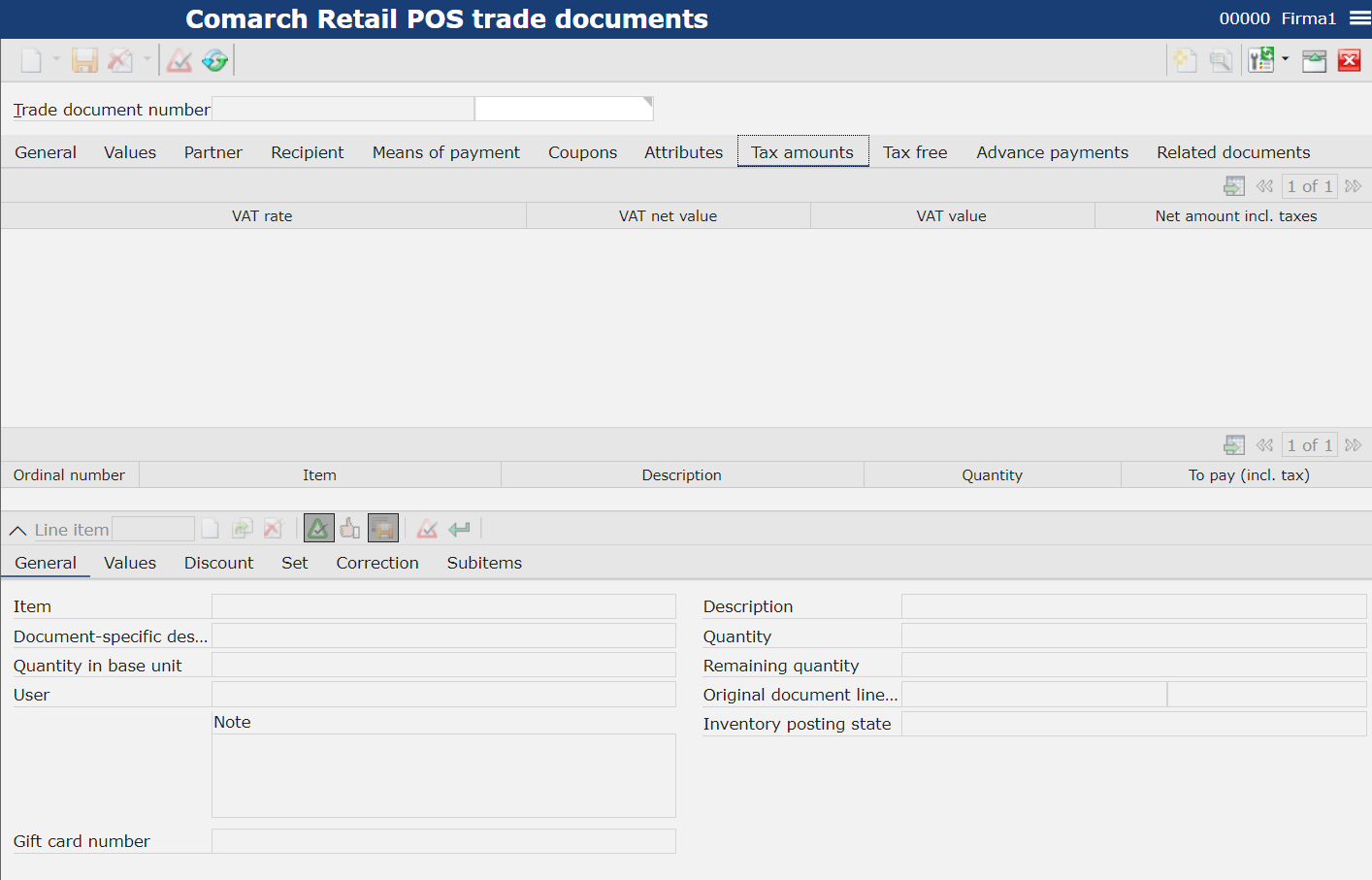

Tab Tax amounts

Allows for displaying information about: VAT rate, VAT net value, VAT amount net value.

- VAT rate – information about VAT rate used on document

- Net value – document net value

- VAT value – information about VAT value for a document

- Net amount incl. taxes – document value after including VAT

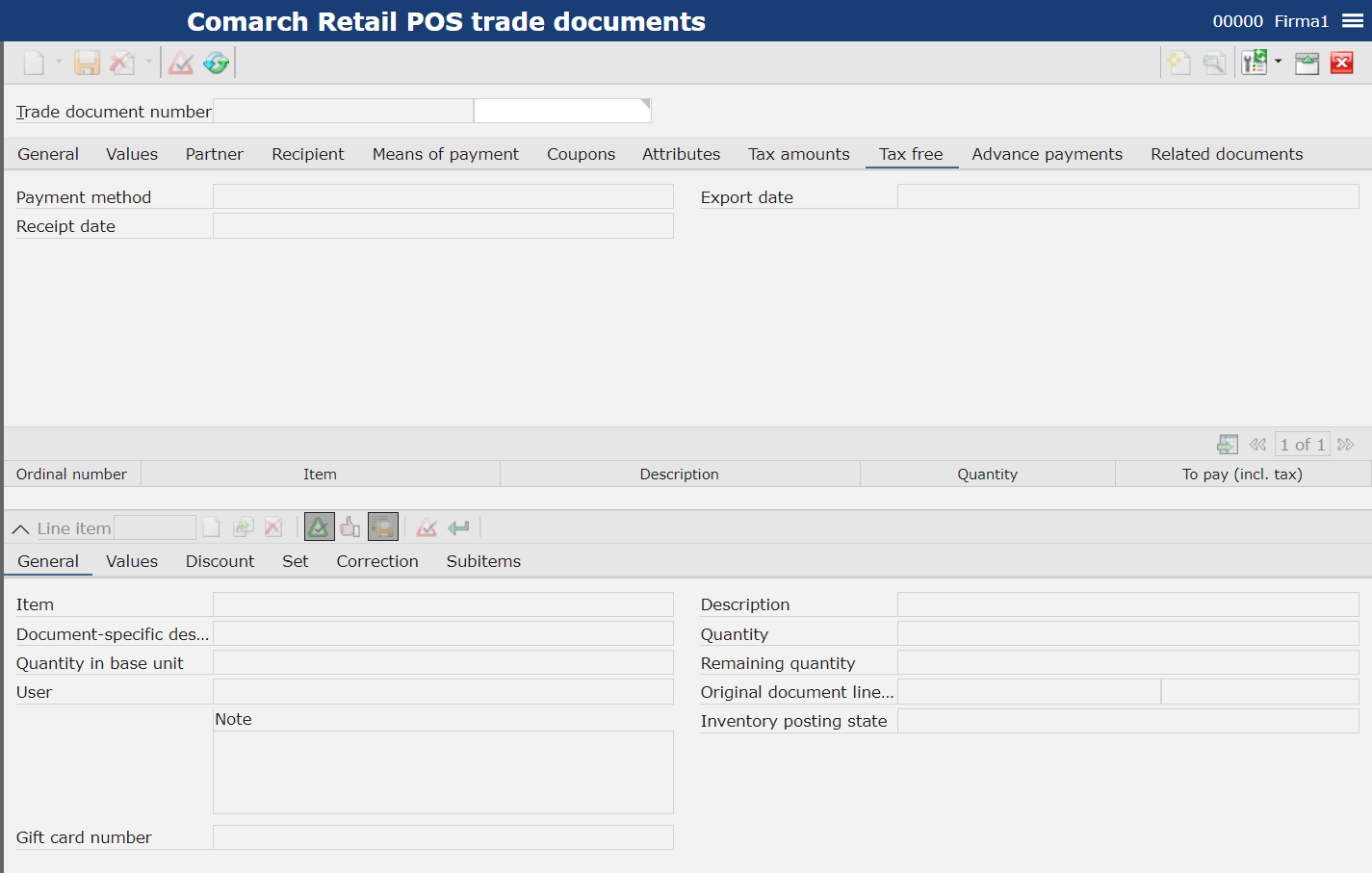

Tab Tax free

Handling of TAX FREE (TF) documents allows for refunding VAT paid by travelers from outside the European Union directly on retail sales workstations. Thanks to that, a customer can avoid double taxation in the country of purchase and in the country of residence.

- Payment method – document payment method

- Export date – date of registering of the document in the system

- Receipt date – date on which the receipt was issued on the POS workstation

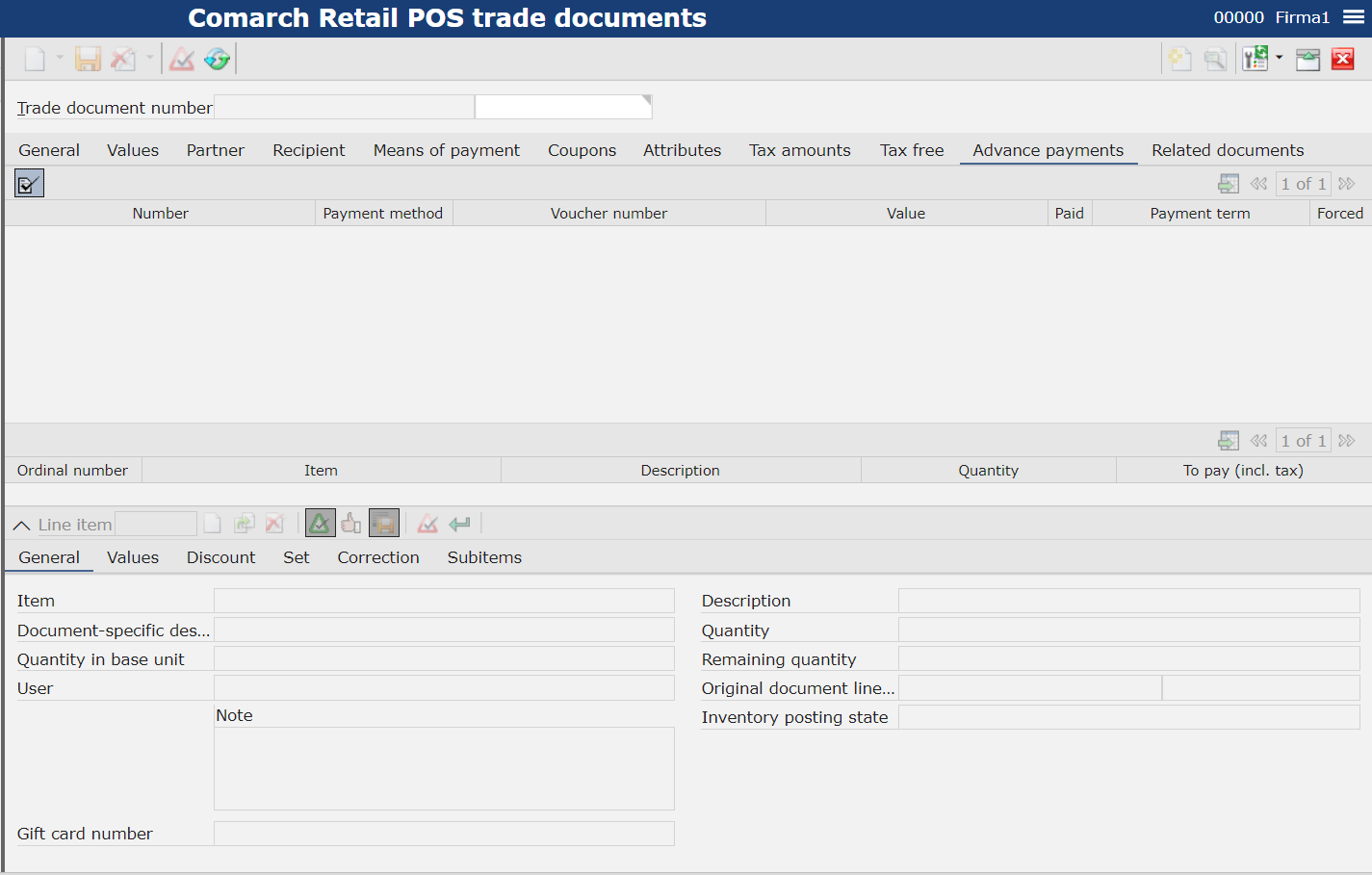

Tab Advance payments

Allows for displaying details of advance payments associated with a given document.

- Number – number of the advance payment invoice

- Payment method – advance payment invoice payment method

- Voucher Number – number of vouchers used on the advance payment invoice

- Value – value of sales order from which the advance payment invoice was created on the POS workstation

- Paid – advance payment invoice value

- Payment term – date and hour of payment

- Forced – parameter checked automatically in the system if the advance payment was accepted manually (in case there is no confirmation on payment terminal, it is possible to force it and accept manually a given voucher or check)

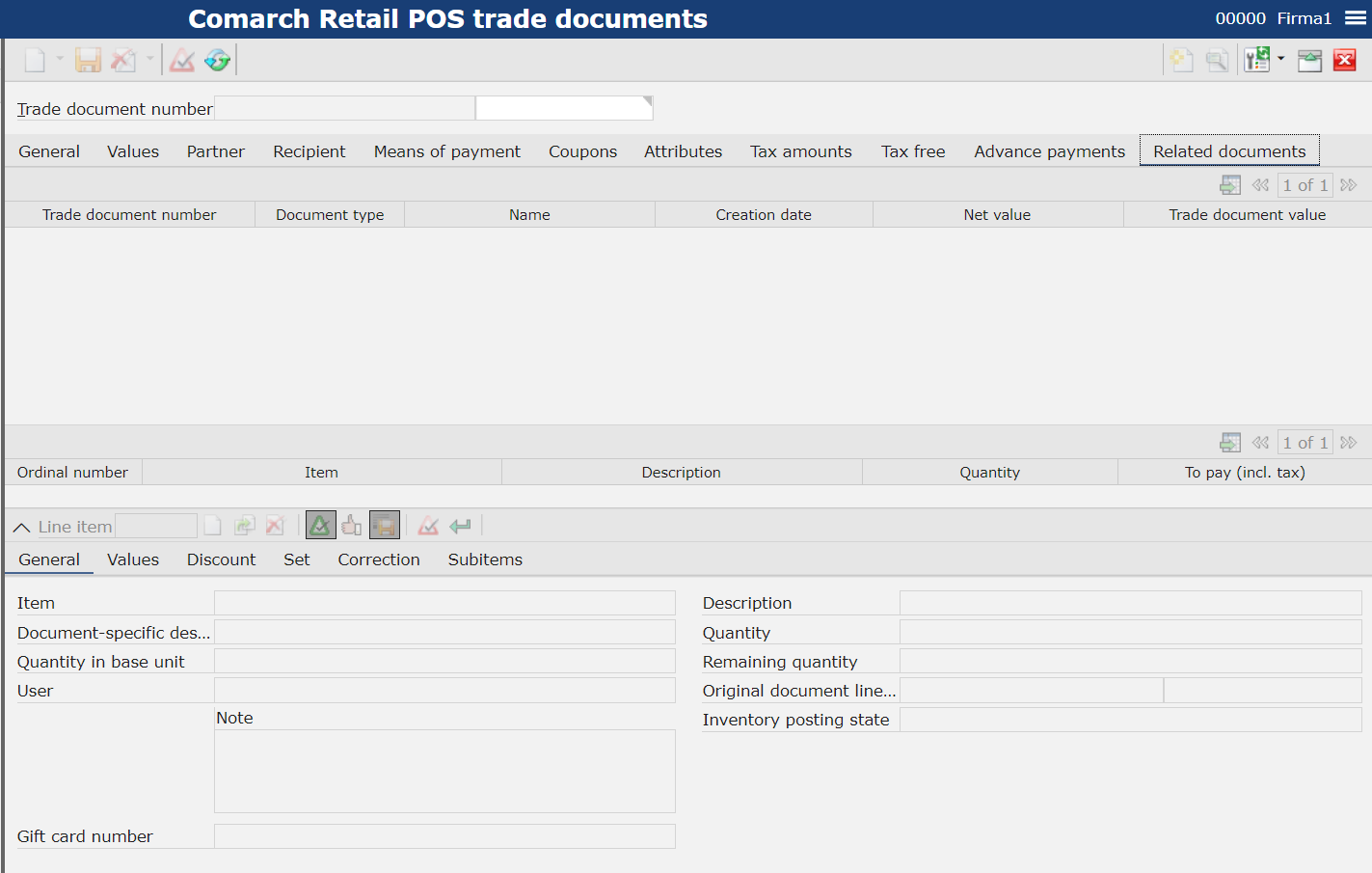

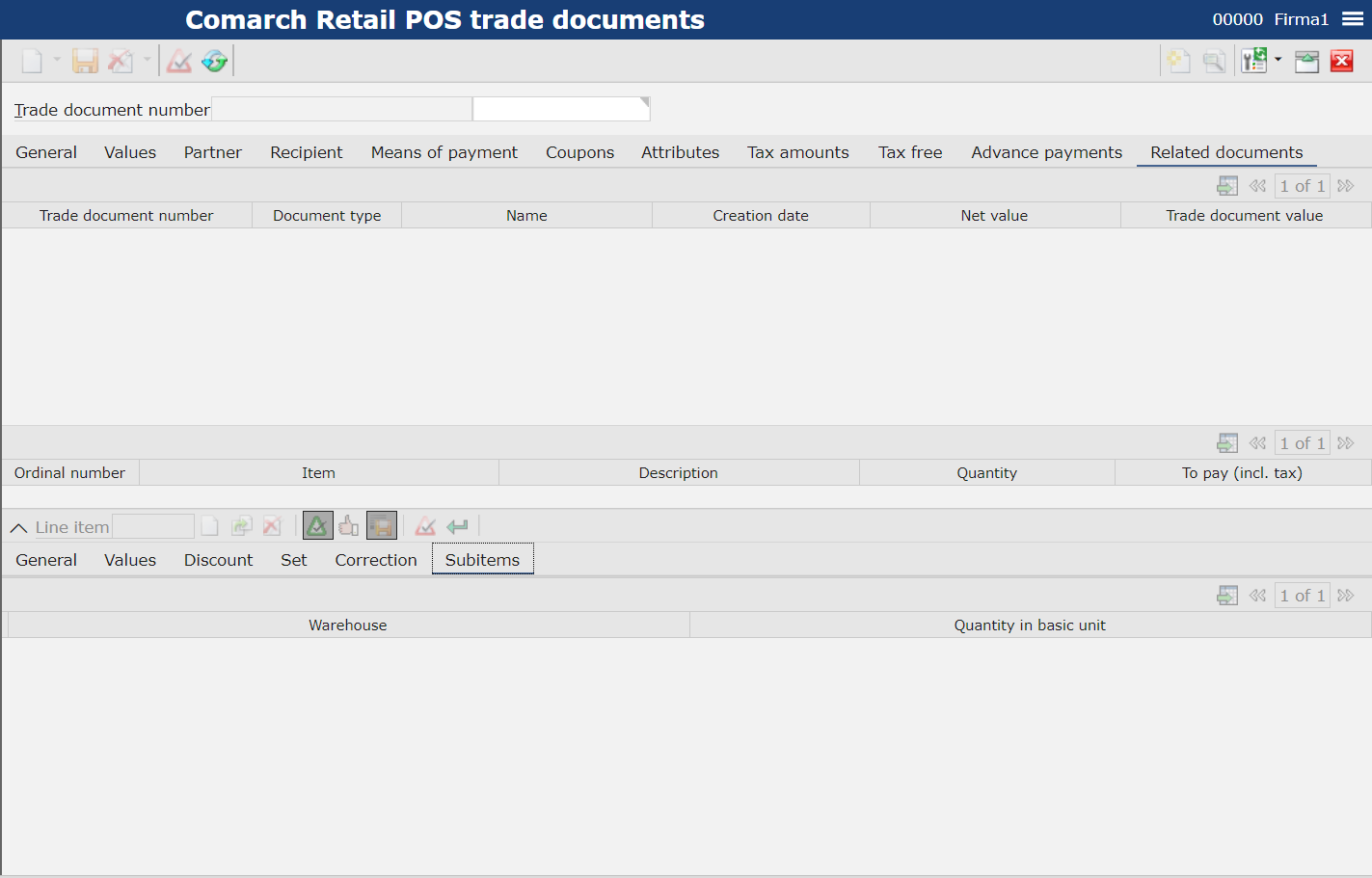

Tab Related documents

Allows for displaying the numbers of related documents and details regarding, among others, their creation dates, net values.

Workspace

The workspace of the application Comarch Retail POS trade documents allows for verifying:

- lists of document items

- item details

Section Item list

Contains information about all items included in a document:

- ordinal number

- item code and its description

- quantity

- value including taxes

Section Line item

Contains information regarding details of items selected on the item list.

Tab General

Allows for displaying details regarding items.

- Item – item code

- Document-specific description – additional document description

- Quantity in basic unit – quantity in basic measure unit defined in the system for a given item

- User – operator who is making the change to the document

- Gift card number – number for a gift card, if there is a gift card associated with the item (in case a voucher is being sold, the field remains empty)

- Descriptions – item description in the ERP system which is synchronized to the POS workstation and is available in the preview of a given item

- Quantity – quantity on the document in a specific measure unit

- Remaining quantity – quantity in the basic unit, available in the warehouse for a given item

- Original document line item – number from the original document and number of the line item on the trade document

- Inventory posting state – field provided for information purposes, completed automatically in accordance with the posting status:

-

- Inventory posted

- Inventory posted with errors

- Inventory not posted

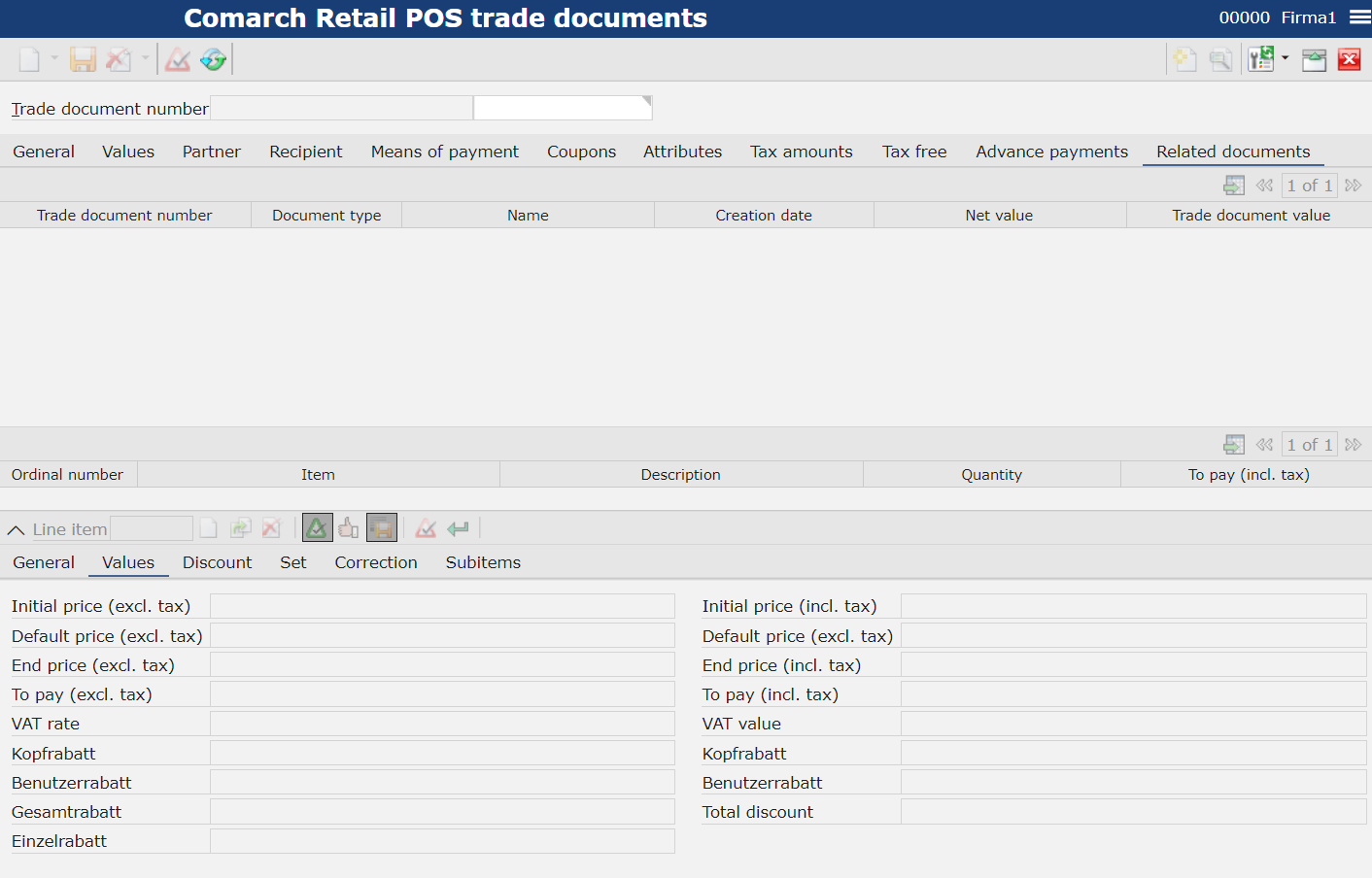

Tab Values

Allows for displaying details regarding item prices and discounts.

- Initial price (excl. tax) – initial net price on the POS workstation (retrieved from the price list or assigned by the user in case he/she possesses permissions to change the initial price)

- Default price (excl. tax) – net price of a given item retrieved from the price list

If the cashier changes that price on the receipt, the initial price changes.

- End price (excl. tax) – price after including all discounts

- To pay (excl. tax) – document net value

- VAT rate – rate assigned to the item (%)

- Header discount – document percentage header discount

- User discount – document user discount (%)

- Total discount – total document percentage discount

- Item line discount – discount for a selected item

- Initial price (incl. tax) – initial total price on the POS workstation (retrieved from the price list or assigned by the user in case he/she possesses permissions to change the initial price)

- Default price (incl. tax) – total price of a given item retrieved from the price list

If the cashier changes that price on the receipt, the initial price changes.

- End price (incl. tax) – total price after including all discounts

- To pay (incl. tax) – total document value

- VAT value – VAT value for an item

- Header discount – item header discount value

- User discount – amount of total of discounts granted by the user

- Total discount – amount of total of discount for the item

Tab Discounts

Allows for displaying details regarding discounts. Contains information regarding calculated discount, promotion on the basis of which a discount was calculated, type and values.

- Discount order number – displays information about the display order number

- Discount type – displays information regarding discount type

- Discount name – displays information regarding discount name

- Discount value – discount value

- Total discount – total discount value

- Total discount % – total discount with specific percentage value

- Discount header – discount applied to all document items

- Discount as amount – parameter checked automatically if a discount was calculated as amount

- Discount in % – parameter checked automatically if a discount was calculated as percentage

- Additive – parameter checked automatically if the discount was calculated additively (as a total of discount granted for the customer and a given item)

- Next allowed – parameter checked automatically, determines whether a subsequent discount can be calculated for the item

- Sales promotion – associated sales promotion

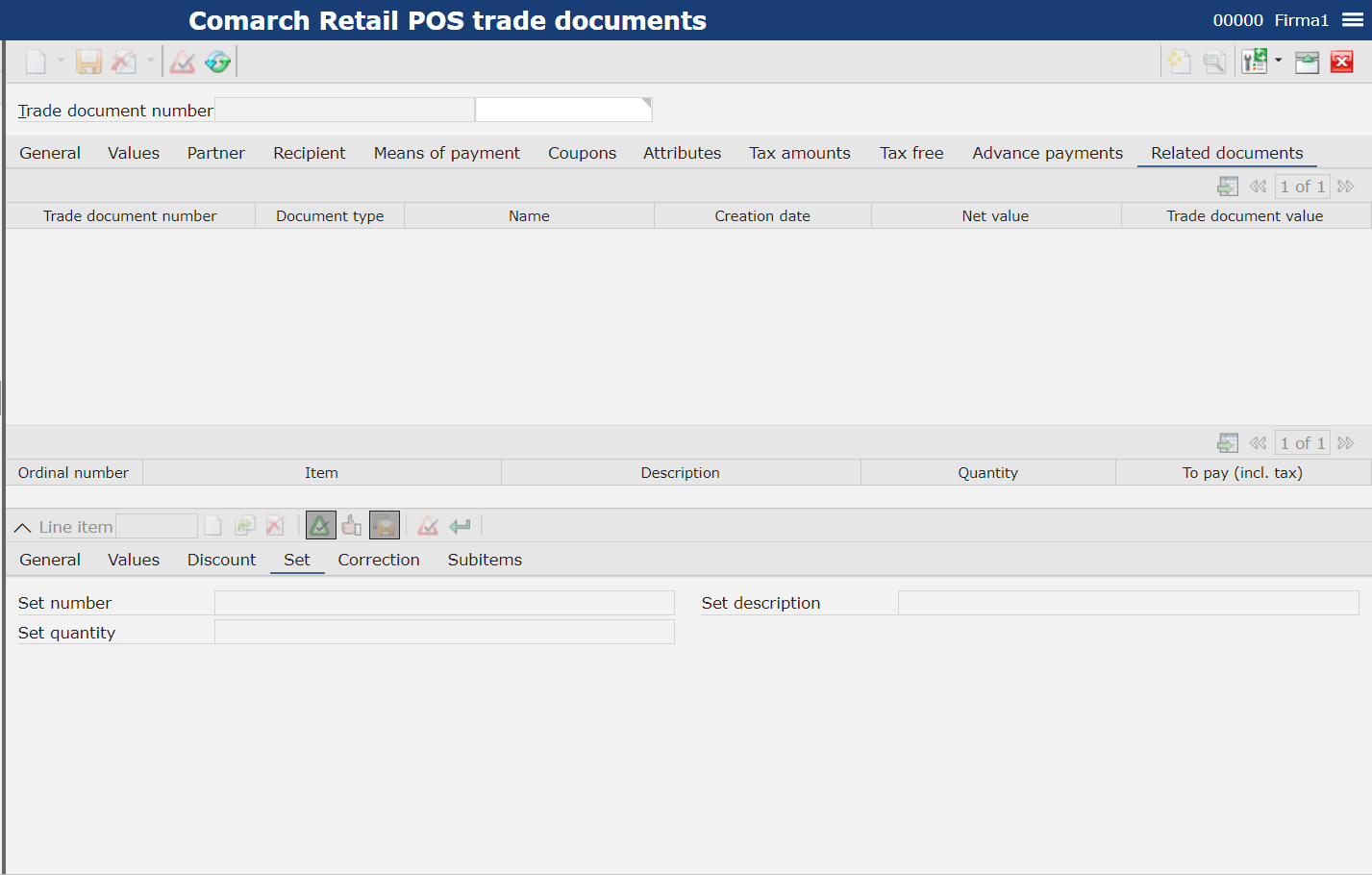

Tab Set

Allows for displaying details regarding sets. In the system, a set is considered as an item of set type where singular items are specified, which are retrieved onto the document after entering the set code to the trade document. After entering a set code to the document, its elements are added to it.

- Set number – code of an item of set type

- Set quantity – number of set items

- Set description

Tab Subitems

Allows for displaying information regarding warehouses assigned to subitems on trade documents

- Warehouse – warehouse from which resources were reserved/retrieved

- Quantity in basic unit – quantity in basic measure unit defined in the system for the item