In the application Countries, the user can define countries used, for example, in the following areas: Multi-channel sales and Partner relationships. Defined country can be selected, i.e., in the following applications:

- Country encodings, field Country

- Cockpit: Suppliers, field Country

- Output: Countries, field Country

Additionally, the application allows for defining format templates for addresses, bank data and tax numbers.

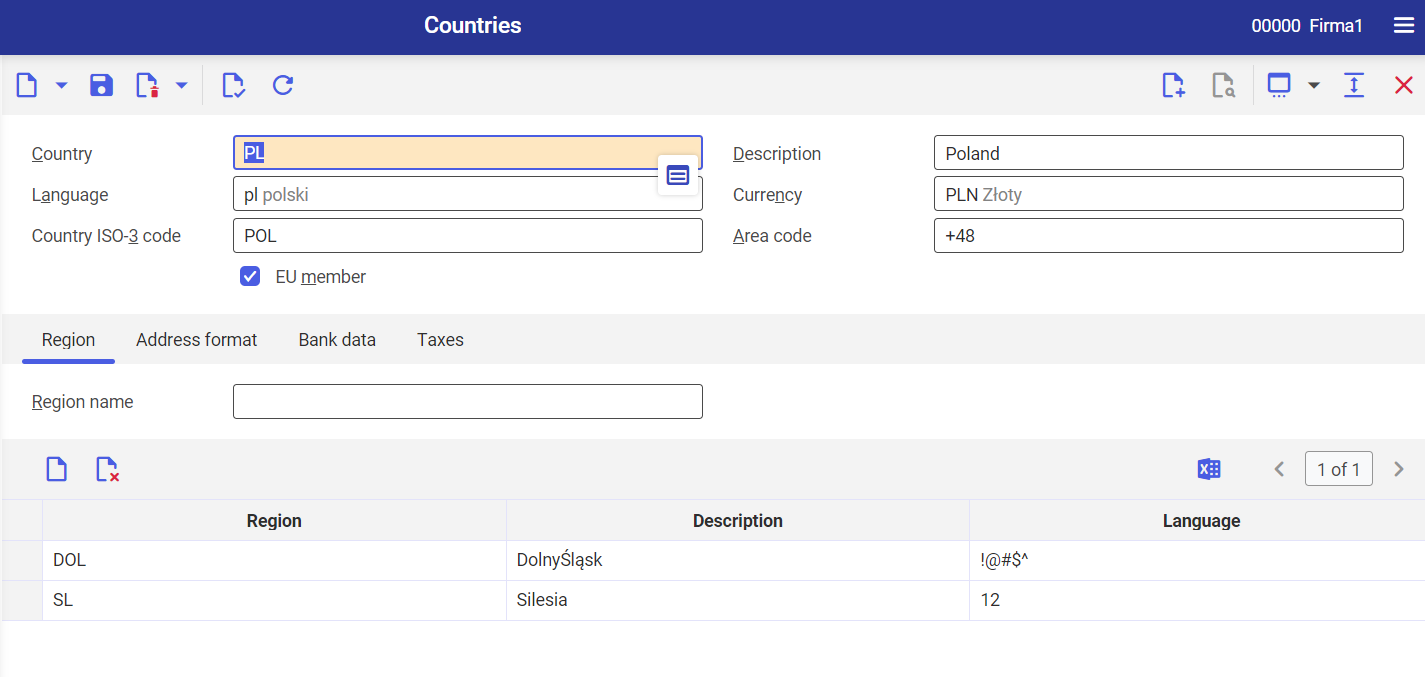

Identification pane

In the application header, it is possible to search an existing country. Available fields:

- Country (mandatory field) – in this field, it is necessary to enter country identifier composed of up to two characters (letters or digits)

- Description (mandatory field) – description of field, additional search criterion

- Language – with the use of the [Value assistant] button it is necessary to enter the language specific for a given country. The values for this field are retrieved from the Languages application.

- Currency (mandatory field) – in this field, it is necessary to enter the currency specific for a given country. The values for this field are retrieved from the Sales channels application and are available under the [Value assistant].

- Country ISO-3 code – in this field, it is necessary to enter manually a three-digit ISO code corresponding to the IO 3166–1 ALPHA 3 code

- Area code – this field should be filled-in manually with the area code of a given country

- EU member – parameter indicating whether the country is an EU member

This information affects:

- Intrastat declaration

- invoices incoming to the payables department

- outgoing invoices in accounts receivable

- assigning tax key to the partner

Work pane

The work pane allows for defining the settings regarding a given country. It is divided into the following tabs:

- Region

- Address format

- Bank data

- Taxes

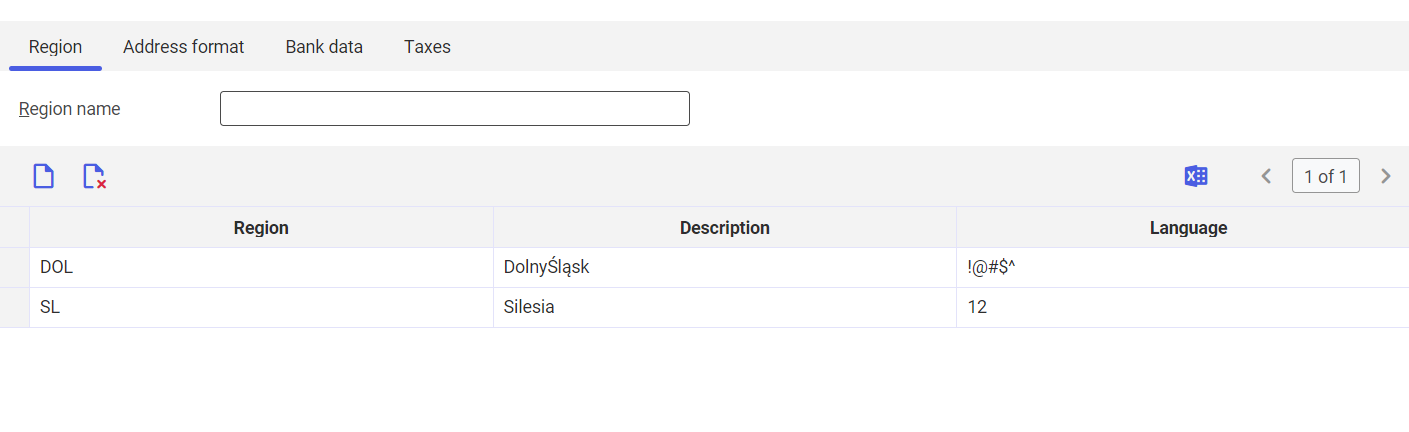

Tab Region

Each country has its specific regions which can be defined in this tab. For example, for Poland, it is possible to define voivodeships.

In Description field, it is possible to enter additional name for a given region.

In the table header, there is [Add] button, which allows for adding new region and [Set/remove deletion marker] button. The table displays regions and allows for entering new regions for a given country.

Available columns:

- Region (mandatory field) – in this field, it is necessary to enter the ID for a given region, composed of up to 3 letters (without diacritical signs)

- Description (mandatory field) – full name for a given region

- Language – in this field, it is necessary to define the language used on the territory of the whole region. The language can be entered manually with the use of the [Value assistant] button. The values for this field are retrieved from the Languages application.

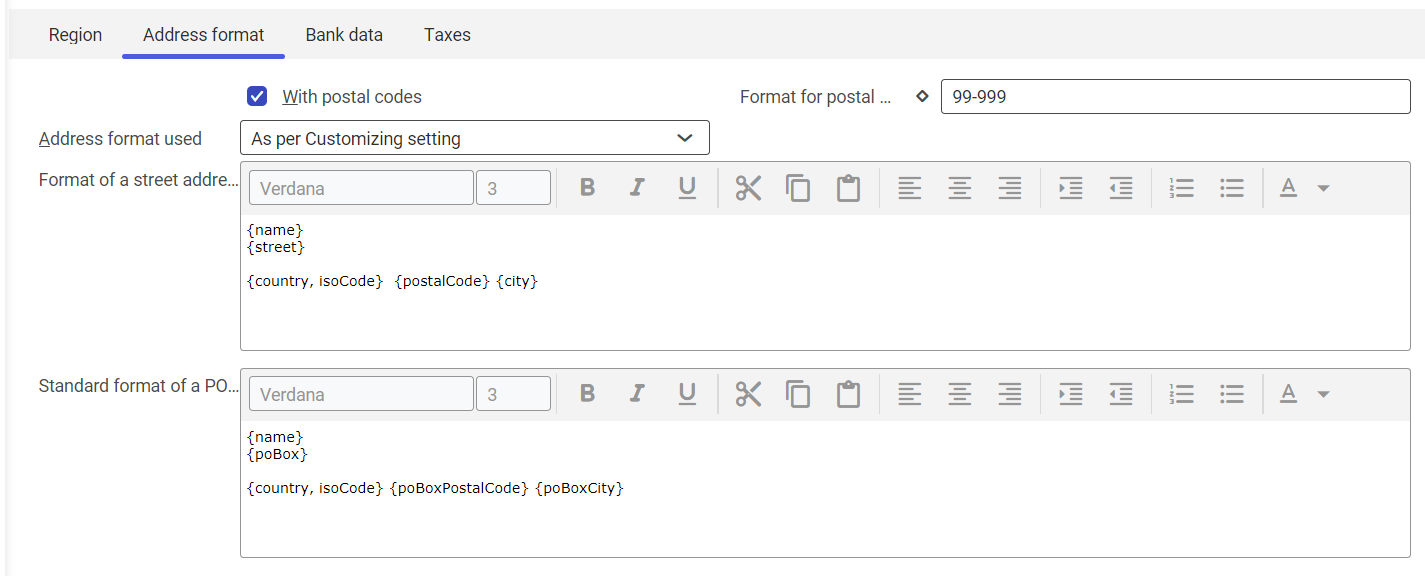

Tab Address format

This tab allows for assigning street or postal box address formatting to each country.

The following fields/parameters are available:

- With postal codes – this parameter specifies whether in the national address postal codes should be used. If the parameter is checked, the system verifies postal codes when entering new addresses.

- Format for postal code validation – entered format checks the correctness of added postal codes. It is possible to enter more than one format.

- Address format used – in this field, it is necessary to specify whether during the control, address format specific for a given country should be used or a format defined by the user individually. The following options are available on the drop-down list:

- As per Customizing settings – for a given country, address format entered in the application Customizing → function Base → section Address format, is used

- Country-specific – settings entered for a given country in the application Countries → Address format tab, are used

- Format of a street address – address format defined in this field is used as a default value

- Standard format of a PO box address – format specified in this text editor for a PO box address is used as a default value

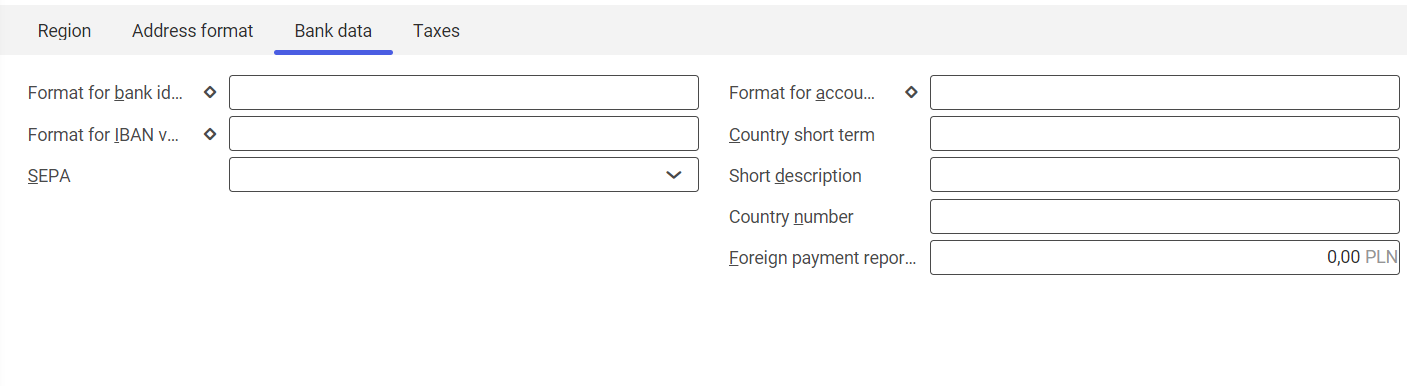

Bank data tab

This tab allows for defining formats for bank identifiers, account numbers and IBAN numbers for each country.

Fields available in the tab:

- Format for bank identification validation – in this field, it is necessary to insert ore on more bank identifier formats. In accordance with this data, entered bank identifiers are verified.

Example of bank identifier format: 999 999 99. Compliant identifier 123 456 78.

- Format for account number validation – in this field, it is possible to enter one or more formats according to which it will be possible to create account numbers. After adding new account, the system verifies whether it corresponds to any format entered in this field.

- Format for IBAN validation – in this field, it is necessary to insert ore on more formats for IBAN number validation. In accordance with this format, the system verifies whether IBAN numbers are correct.

- Country short term – in this field, it is necessary to specify the abbreviation used for marking the country. The value can be composed of up to seven characters.

- SEPA – settings regarding SEPA (Single Euro Payments Area), that is common area of non-cash settlements in euro according to unified rules:

- (No selection)

- Not SEPA capable – does not belong to SEPA

- SEPA payments – for a given country, it is possible to make SEPA payments

- SEPA payments and debit notes – for a given country, SEPA payments and debit notes are available

- Short description – in this field, it is possible to enter the abbreviation of balance of payments number. It can be composed of up to 7 characters.

- Country number – in this field, it is possible to enter the country number composed of up to 3 characters

- Foreign payment reporting limit – in this field, it is possible to define amount limit for SEPA payments in the currency of a given country. In the first part of the field, it is necessary to enter a numerical value and in the second – the currency.

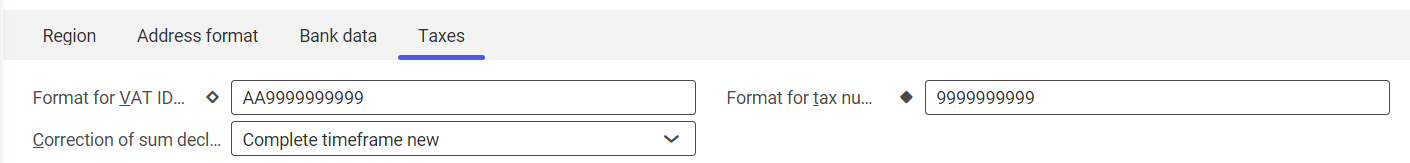

Tab Taxes

In the tab Taxes, it is possible to define tax settings for a given country.

Available fields:

- Format for VAT ID validation – in this field, it is necessary to insert ore on more formats for VAT ID number validation. Basing on the format entered in this field, the system verifies whether the entered VAT ID number is correct.

- Format for tax number validation – in this field, it is necessary to insert ore on more formats for tax number validation. On the basis of this data, the system verifies whether the entered tax number is correct.

For example, tax number format valid for Poland is: 999,999,999 9. So, the number 000,111,222 3 will be compliant with that format.

- Correction of sum declaration – this field allows for specifying the method of making corrections for declared period of sum declarations for a currently open country:

- (No selection)

- Complete timeframe new (mandatory value for Austria)

- Only changes, cancel with zero (mandatory value for Germany)

- Only changes, cancel with value

Allowed address formats

The following markers can be used for defining address format:

- {name} Full name

- {street} Street, address

- { city } City

- { postalCode } Postal code

- { district } District

- {country, isoCode} Country ISO code

- { country, description } Country name

- { country } Abbreviated form of { country, description }, it can be used as a synonym of { country, isoCode }

- { region, code} Region code

- { region, description } Region description

- { region } Abbreviated form of { region, description }, forms can be used as synonyms

- { poBox } Postal box

- { poBoxCity } Postal box city

- { poBoxPostalCode } Postal code of the postal box city

Allowed formats for number validation

For creating format definitions in fields: Format for postal code validation, Format for bank identification validation, Format for account number validation, Format for VAT ID validation and Format for tax number validation, the following characters are available:

- A for any letter

- A for each uppercase

- 9 for a digit

- X for digit or any letter

- X for digit or uppercase

The following separators can be added to the format:

- – minus

- / backslash

- . dot

Business entities

For the application Countries, the following business entity is relevant: cisag.app.general.obj.Country, which belongs to the group of business entities: cisag.app.general.MasterData.

Authorizations

Authorizations can be assigned both through authorization roles and by assigning organizations.

Technical documentation Authorizations contains rules regarding authorization handling.

Special capabilities

There are no special capabilities for the application Countries.

Organizational assignments

The application Countries is not associated with the organizational structure.

Special features

There are no special features for the application Countries.

Authorizations for Business Partners

The application Countries is not released for business partners.