General information

In the Comarch ERP Enterprise system, a fiscal year does not have to overlap with the calendar year, however it cannot be longer than 12 months. Each fiscal year can be divided into periods (months or quarters). Creation/deletion/modification of periods from the level of Sample periods tab allows for creating/deleting/modifying periods on the rest of tabs. It is also possible to create/delete periods from the level of individual tabs.

Fiscal years are defined separately for each company, in Fiscal years application. The application is available in Base module.

Available buttons

In the application Fiscal years, standard buttons are available, and, additionally:

- [Add posting period] – addition of fiscal period

- [Add multiple posting periods] – after selecting this button, a dialog window is opened, where the user specifies the following parameters:

- Time period – first possible date within the al period is displayed as the start date and last possible date within the fiscal period

- Period duration – period length expressed in days or months

After defining the parameters, it is necessary to click on [OK] button in order to add posting periods in edit mode. Clicking on [Cancel] button cancels the process of adding posting periods.

- [Set/remove deletion marker] – detailed information regarding this button can be found in article Standard buttons.

- [Previous status] – changing period status to previous one, in accordance with a list defined in Fiscal year status application. After selecting the button, a dialog window is opened, where it is necessary to specify the following parameters:

- Automatically confirm warnings – if the parameter is checked, the status will be changed in case of warnings. If the parameter is unchecked, the status will not be changed in case of warnings.

- Also change status of all posting periods – if the parameter is active, the status of all posting periods will be changed.

- [Next status] – changing period status to the next one, in accordance with a list defined in Fiscal year status application. After selecting the button, a dialog window is opened, where it is necessary to specify the following parameters:

- Automatically confirm warnings – if the parameter is checked, the status will be changed in case of warnings. If the parameter is unchecked, the status will not be changed in case of warnings.

- Also change status of all posting periods – if the parameter is active, the status of all posting periods will be changed.

- [Use sample periods] – this button can be activated for Created period status.

- If the button is selected, periods in the tab reflect sample periods. To already existing periods, deletion mark is assigned. Changes entered in the tab Sample periods are automatically transferred to the tab.

- If the button is selected, periods in the tab reflect sample periods. Unchecking the button makes available the following buttons:

- [Add posting period]

- [Add multiple posting periods]

- [Set/remove deletion marker]

Button available in tabs ERP, Financials, Asset accounting, Controlling, Time recording.

- [Set current] – setting a fiscal year/period as current. Setting a fiscal year as current is relevant for printouts and reports. Button available in tabs Financials, Asset accounting, Controlling, Time recording.

- [Carried forward balances] – automatic transfer of the opening balance Button available in tabs Financials, Asset accounting, Controlling.

- [Change reorganization state] – marking of time for reorganization, on condition that:

- Fiscal year has Closed status

- Previous fiscal year has at least Reorganizable status

Button available in tabs Financials, Asset accounting, Controlling.

- [Ad carry-forward period] – adding of carry forward-period which includes opening balance. Only one carry-forward period can be added within a fiscal year. Button available in tabs Sample periods, Financials, Asset accounting, Controlling.

- [Add closing period] – adding of closing period which can be used for transfer posting (e.g., to a financial result). The number of closing periods which can be added is unlimited. Button available in tabs Sample periods, Financials, Asset accounting, Controlling.

Adding fiscal year

To add a fiscal year, it is necessary to click on [New] button and fill-in fields available in the identification pane and in the tabs.

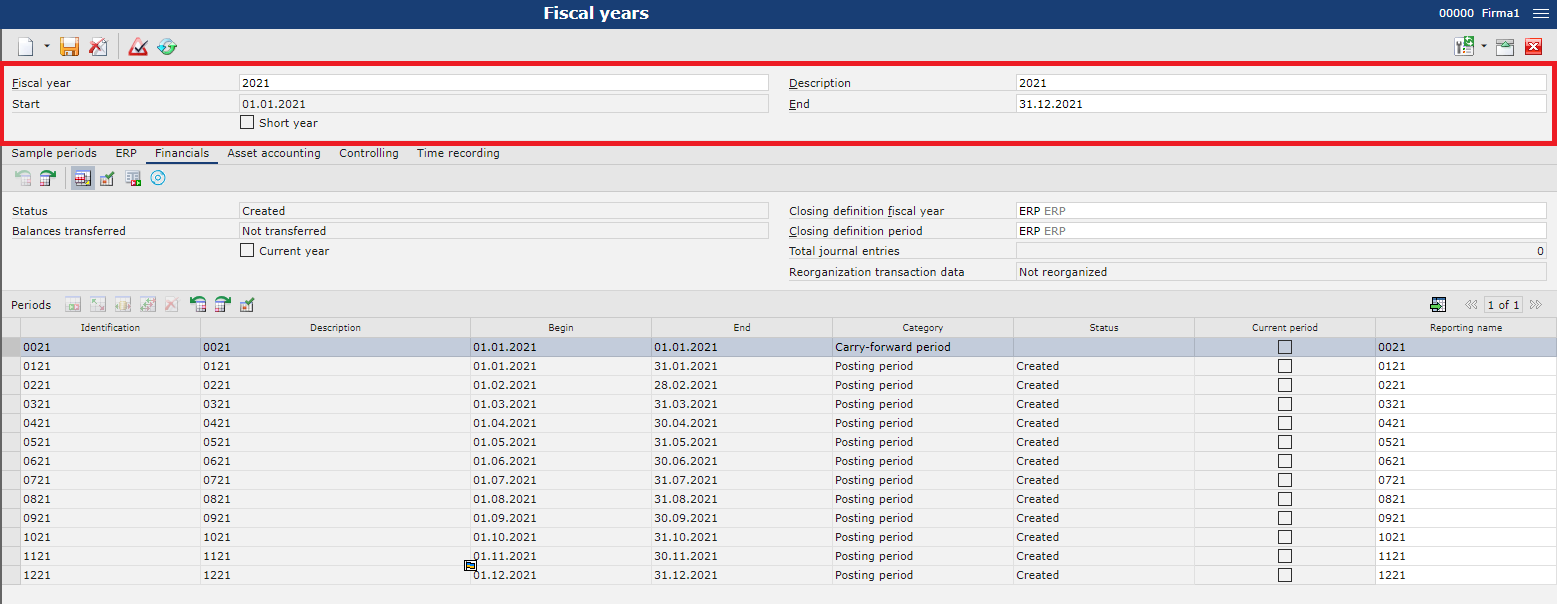

Identification pane

- Fiscal year – unique name for each fiscal year. Mandatory field.

- Description – additional data identifying fiscal year. Mandatory field.

- Start – fiscal year start date. This field is editable when adding first fiscal year to the system. For subsequent fiscal years, this date is completed automatically end set to the first day after the end date of the previous fiscal year.

- End – fiscal year end date, filled-in automatically. A fiscal year does not have to overlap with the calendar year; however, it cannot be longer than 12 months. Mandatory field, editable.

- Short year – non-editable parameter, provided for information purposes. It is checked automatically, if a fiscal period calculated on the basis of the dates in Start and End is shorter than 12 months.

Available fields

The following fields are available in particular tabs:

- Status – fiscal year status. The number of available statuses is defined in the application Fiscal year status. Field available in tabs ERP, Financials, Asset accounting, Controlling, Time recording.

- Documents can be generated for open fiscal years only

- It is possible to close a fiscal year temporarily or definitively

- If fiscal year has temporarily closed status, validations are executed as for a closed fiscal year.

- Closing is irreversible.

- Status – list of available statuses which can be assumed by a fiscal year, defined in the application Fiscal year status. Field available in tabs ERP, Financials, Asset accounting, Controlling, Time recording.

- Status – list of available statuses which can be assumed by a period, defined in the application Fiscal year status. Field available in tabs ERP, Financials, Asset accounting, Controlling, Time recording.

- Balances transferred – information whether an automatic opening balance was created for a given fiscal year. Field available in tabs Financials, Asset accounting, Controlling.

- Current year – setting fiscal year as current has impact for printouts and reports. Field available in tabs Financials, Asset accounting, Controlling.

- Journal type – parameter included on printouts, available in the tab Financials. Indicates whether a journal is divided into particular months or it is common for the whole year.

- Daily journal – numeration within year, journal number on printouts is 1

- Period journal – numeration within months, numbers of journals on printouts are assigned in increasing order, according to months (January – 1, February – 2,…)

- Journal GL – field provided for information purposes, regards the numeration of the journal in the general ledger. Available in the tab Financials

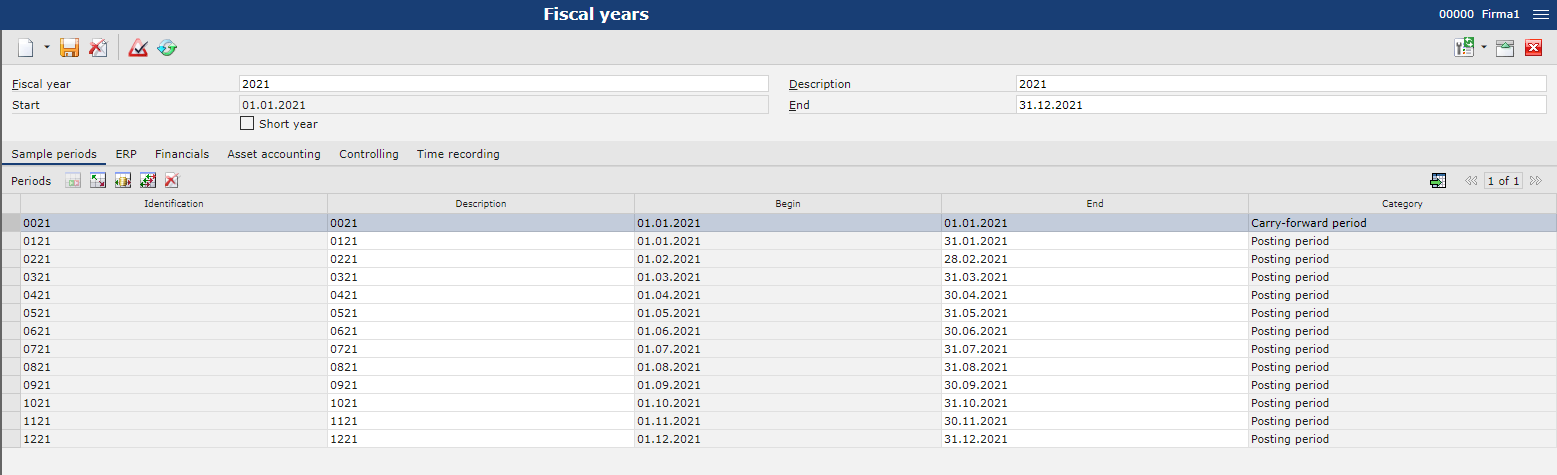

Available columns

Columns with tables are available in each tab:

- Identification – unique name for each period, filled-in automatically in accordance with the field Fiscal year. Mandatory field, editable.

- Description – additional data identifying period, filled-in automatically in accordance with the field Fiscal year in the identification pane. Mandatory field, editable.

- Begin – period start date, filled-in automatically. For the first period, this date is equal to the date from the field Start in the identification pane. For subsequent periods, this date is completed automatically end set to the first day after the end date of the previous period. The field cannot by edited.

- End – period end date, filled-in automatically.

- Category – non-editable field, provides information regarding period type (posting period/carry forward period/closing period). Field available in tabs Sample periods, Financials, Asset accounting, Controlling.

- Status – period status. The number of available statuses is defined in the application Fiscal year status. Field available in tabs ERP, Financials, Asset accounting, Controlling, Time recording.

- Documents can be generated for open fiscal years only

- It is possible to close a fiscal year temporarily or definitively

- If fiscal year has temporarily closed status, validations are executed as for a closed fiscal year.

- Closing is irreversible.

- Current period – activated parameter means that selected period is a current period. To activate the parameter, it is necessary to select a row with period and click on the button [Set current] which is available in the Periods section. Field available in tabs Financials, Asset accounting, Controlling.

- Reporting name – value representing periods in reports, it is automatically equal to the value from the Identification field. Field available in tabs Financials, Controlling.

Tab Sample periods

In Sample periods tab, it is possible to create periods within a fiscal year that can be inherited to the other tabs. Periods can be added as: Posting period, Carry forward period or Closing period.

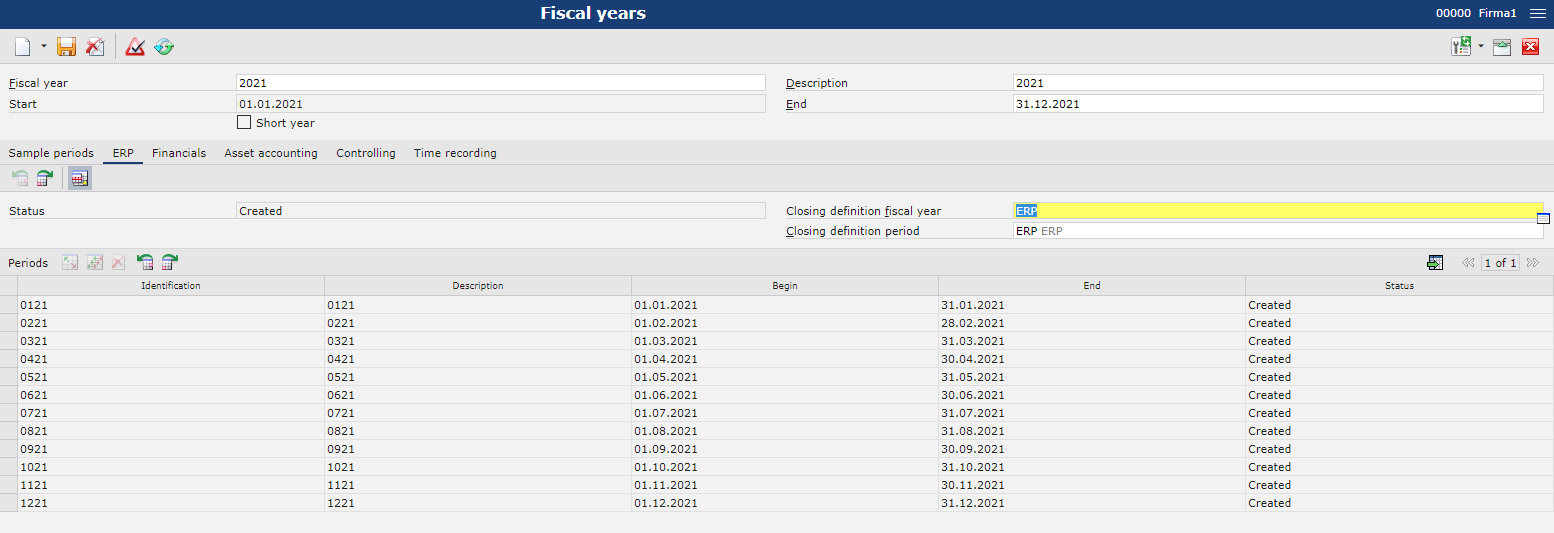

Tab ERP

In the tab ERP, it is possible to create period for the Comarch ERP Enterprise part. To do so, the following actions must be taken:

- In the field Status, select fiscal year status from among statuses defined in the Fiscal year status application.

- In the field Status, select period status from among statuses defined in the Fiscal year status application.

- Select [Save] button. Fiscal years defined in the tab Sample periods will be transferred to the ERP tab, however Closing periods and Carry forward periods will not be transferred to it.

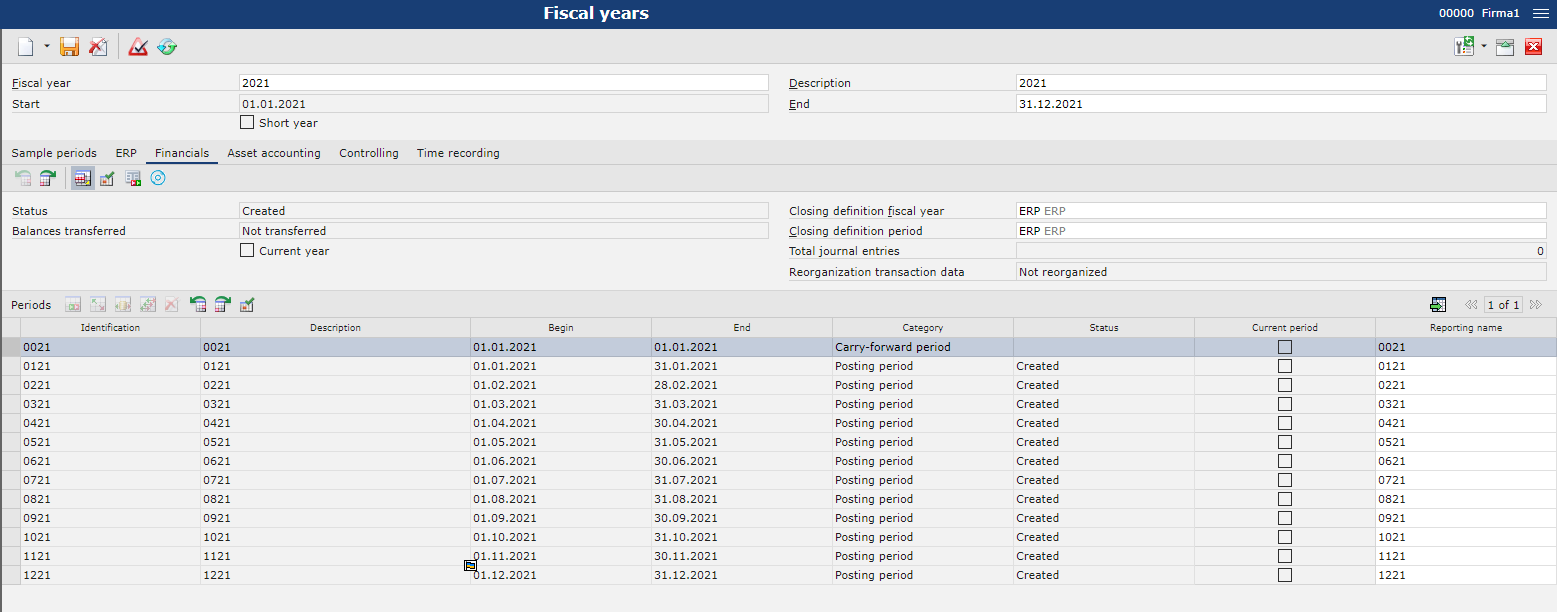

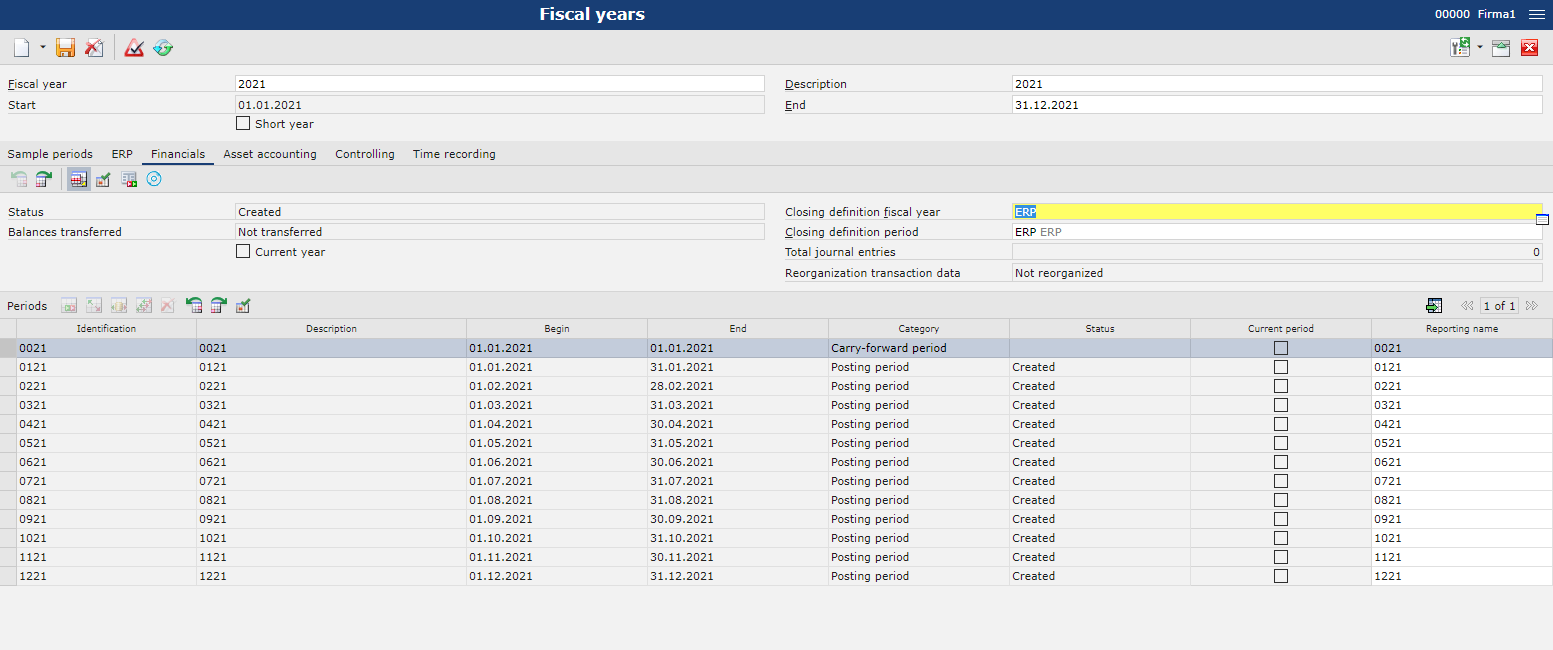

Tab Financials

In order to add a fiscal year used in the financial accounting, it is necessary to take the following actions:

- In the field Status, select fiscal year status from among statuses defined in the Fiscal year status application.

- In the field Status, select period status from among statuses defined in the Fiscal year status application.

- Select [Save] button. Periods defined in the tab Sample periods will be transferred to the Financials tab. To the fields Status, the status corresponding to the values of the fields Status (for fiscal year and for period) will be transferred.

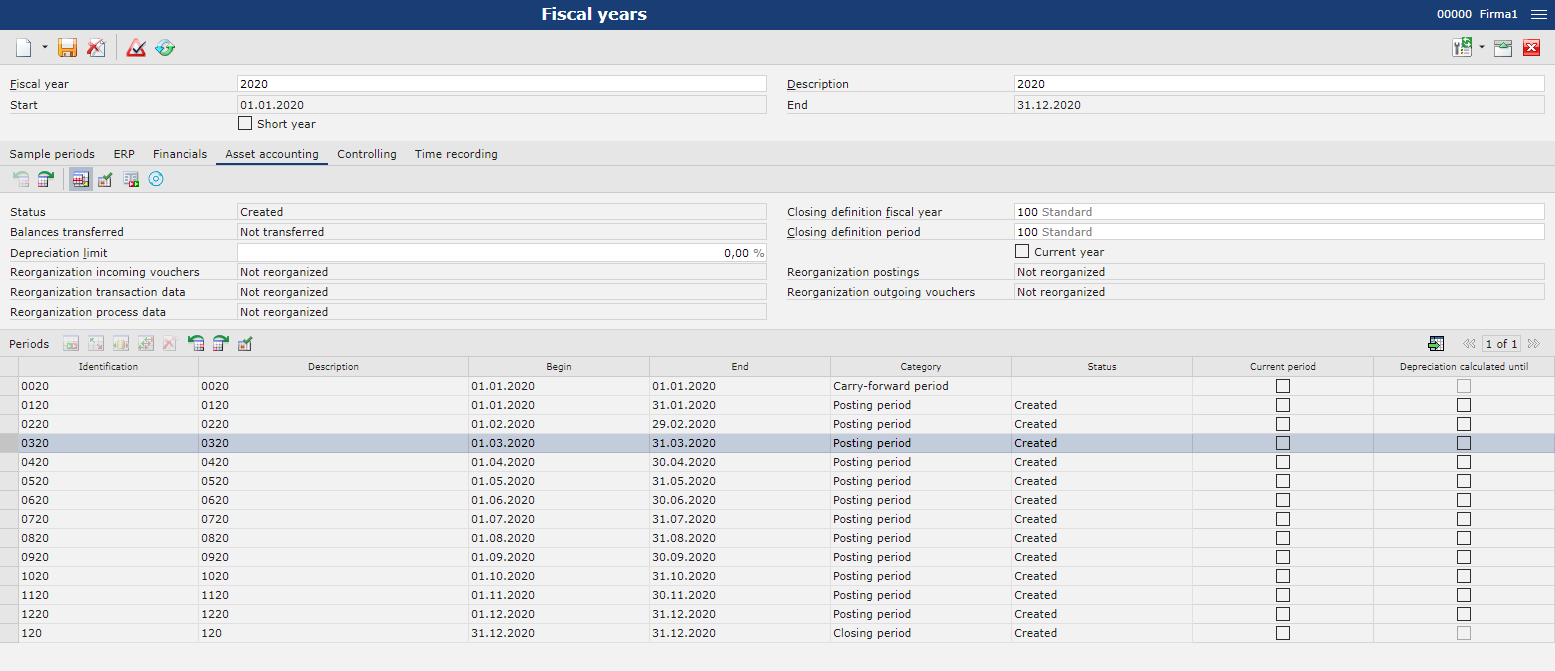

Tab Asset accounting

In order to add a fiscal year used in the asset accounting, it is necessary to take the following actions:

- In the field Status, select fiscal year status from among statuses defined in the Fiscal year status application.

- In the field Status, select period status from among statuses defined in the Fiscal year status application.

- Select [Save] button. Periods defined in the tab Sample periods will be transferred to the Fixed asset accounting tab. To the fields Status, the status corresponding to the values of the fields Status (for fiscal year and for period) will be transferred.

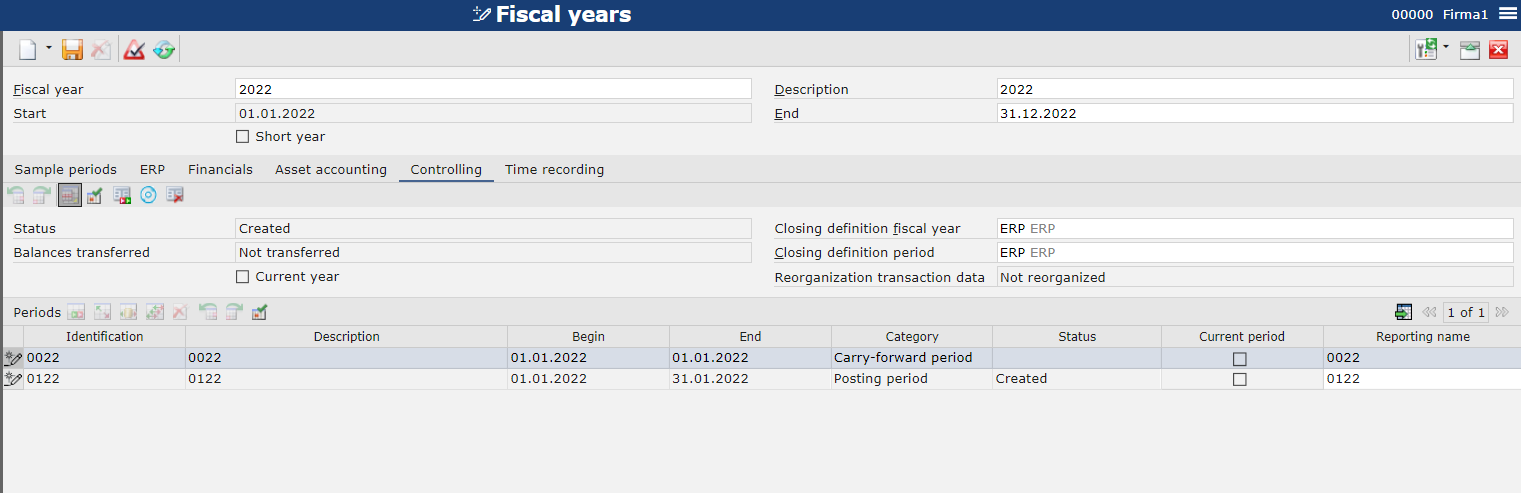

Tab Controlling

In order to add a fiscal year used in the controlling, it is necessary to take the following actions:

- In the field Status, select fiscal year status from among statuses defined in the Fiscal year status application.

- In the field Status, select period status from among statuses defined in the Fiscal year status application.

- Select [Save] button. Periods defined in the tab Sample periods will be transferred to the Controlling tab. To the fields Status, the status corresponding to the values of the fields Status (for fiscal year and for period) will be transferred.

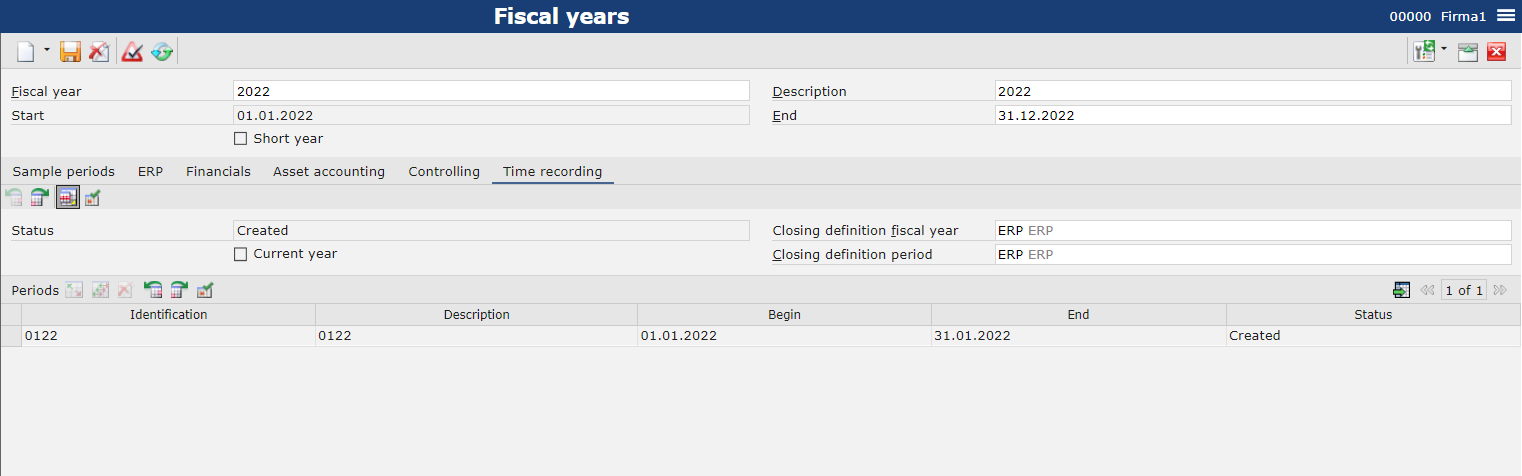

Tab Time recording

In order to add a fiscal year used in Time recording application, it is necessary to take the following actions:

- Select Time recording view

- In the field Status, select fiscal year status from among statuses defined in the Fiscal year status application.

- In the field Status, select period status from among statuses defined in the Fiscal year status application.

- Select [Save] button. Periods defined in the tab Sample periods will be transferred to the Time recording tab. To the fields Status, the status corresponding to the values of the fields Status (for fiscal year and for period) will be transferred.