The Intrastat declaration propositions application is used to prepare a declaration proposition (not the final file version) from which a csv file can be generated and then uploaded to a third-party system in order to submit a declaration to the competent authority. Declarations propositions need to be verified and validated by the Comarch ERP Enterprise system user, because certain information (such as customs processes) needs to be completed/corrected manually.

In the Intrastat declaration propositions application you can:

- manually modify selected line items such as nature of transaction, statistical procedure, transport mode as well as quantities and values

- manually add own entry to a declaration

- verify individual line items

- export a declaration to a file via the [Output third-party software file] action. The Intrastat reporting process concludes with the submission of a declaration to the competent authority via third-party software.

- manually mark an Intrastat declaration as Declared; the system does not control deadlines for submission of Intrastat declarations to competent authorities. Therefore, its status needs to be updated accordingly upon submission.

Only physical goods should be included in an Intrastat declaration. Non-physical (intangible) goods should not be added.

The item in the invoice amount does not include additional costs (transport, customs expenses).

In order for the additional amount to be included in the declaration, transport costs must be properly configured in the Freight costs application: complete the required fields and indicate the billing item.

The item billing will be added to the order together with the purchased item.

If the freight costs are not configured, the billing item needs to be added manually to the declaration as a new line item.

The application consists of a query pane containing a toolbar with standard buttons and a work pane.

Query pane

In the query pane you can add a new declaration and open an existing one.

Available options next to the standard buttons are:

[New] → [Add] – creates a new declaration

[New] → [Create a correction declaration] – creates a correction to a previously created declaration

[New] → [Create new declaration for the same reporting period] – adds another declaration for the period in which such declaration was already registered

[Save] – saves a declaration. Basic validation of field formats is performed during this action.

[Delete] – deletes every declaration from the system, regardless of its status.

[Validate] – carries out the basic validation of field formats.

[Available actions] → [Run detailed validation] (not available for declarations with Archived status) – opens a Detailed validation of declaration window and comprehensively verifies the opened declaration: presents errors and warnings relating to a declaration line item in question as well as missing information/incorrectly entered data. The verification results are not displayed in a dockable window, they are displayed in the line item table in the Batch jobs application upon selecting a batch job with the left-mouse button and then the [Message logs] button available in the work pane.

The available parameter Omit status update of correct entries is used to validate a declaration without verifying correct entries. If deselected, the status is updated for all the entries.

After the verification you can filter the declaration line items in the filter window using the Verification status field. Detailed verification is also carried out during [Set status to Declared] and [Output third-party software file] actions.

In the Intrastat declaration proposition application you can search for erroneous line items using a line item filter. The line items are filtered, inter alia, by number (1 in this case) provided in the message logs (Line item field) or by verification status (Verification status field) that searches for all line items with generated errors and warnings, which makes it possible to quickly correct a given line item.

[Available actions] → [Set status to Declared] – changes a declaration status to Declared in the General status field. This action is available for an already saved declaration with Declaration generated status. Detailed validation of fields is carried out during this action.

[Available actions] → [Remove Declared status] – changes a declaration status to Declared in the General status field. This action is available for a declaration with Declared status.

[Available actions] → [Output third-party software file] – creates a .csv file that can be imported to a dedicated program used to submit a declaration to the competent authority. A third-party software is applicable for the country in which Intrastat declarations are required:

- Germany – IDEV

- Austria – RTIC

- Poland – ISTAT

- France – DEB

- Italy – DEB including items of Service type

This action opens a dialog window Output third-party software file where the following needs to be specified:

- File path and name – select a file export location in this field. The default path is the system knowledge repository. A generated file needs to have a .csv extension.

- Mode

- Create new file – generates a new file

- Overwrite existing file – overwrites the file concerning the same declaration

- Third-party software – select a software for which a .csv file is being generated. Program for which files can be generated: ISTAT, DEB, IDEV, DEB Italy, RTIC.

The following needs to be specified in the Third-party software settings section:

- Separator – a character selected in this field separates information included in a file. Available options are: comma and semicolon. This option is available for a DEB Italy file. A comma separator cannot be selected if Disable rounding parameter is activated in the Customizing application → Intrastat function.

- Character recognition flag – available for third-party software IDEV, RTIC. If you use a recognition flag, attributes will be searched in the csv file and marked with that flag.

- Language – language by which data (item description for instance) will be retrieved into a file.

- ID of the party obliged to submit declaration – this value is editable and available for third-party software IDEV and is retrieved from the declaration from the VAT identification field.

Selected Confirm warnings parameter automatically confirms possible warnings, thus they are not displayed.

During generation of a third-party software file, detailed validation of declaration fields is carried out in the background.

Description of the other batch application fields can be found in article Export items.

[Available actions] → [Process free of charge declarations] – option available for declarations with Declaration generated status. It opens a dialog window Process free of charge declarations where you need to select a nature of transaction. This action retrieves a value to the Statistical value field Items application → Financials view → Price field. This way a statistical value can be specified for the line items that have neither an invoice value nor a statistical value specified. If this value is provided in an invoice, the Statistical value field is completed on the basis of that value. Basic validation of fields is carried out during this action.

[Available actions] → [Recalculate declaration proposition based on item attributes] – option available for declarations with Declaration generated status. It opens a dialog window Recalculate intrastat declaration proposition based on item attributes. If attributes in a declaration are different than those specified on the item chart, then this action overwrites the declaration data with the date from the Items application. Detailed validation of fields is carried out during this action.

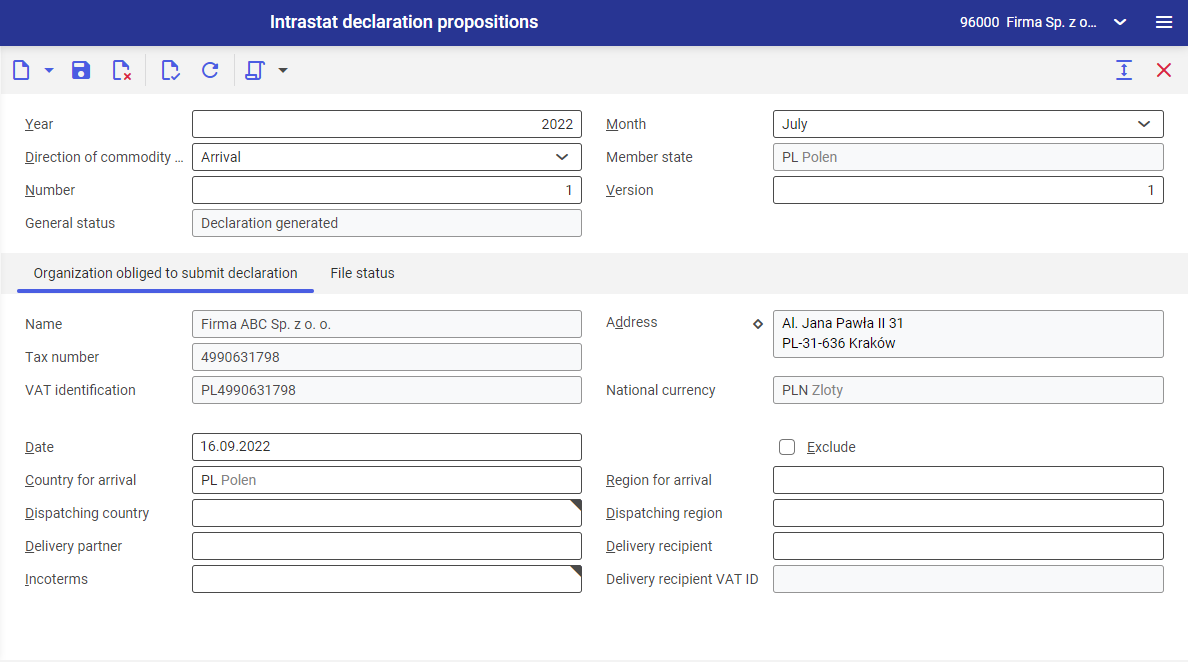

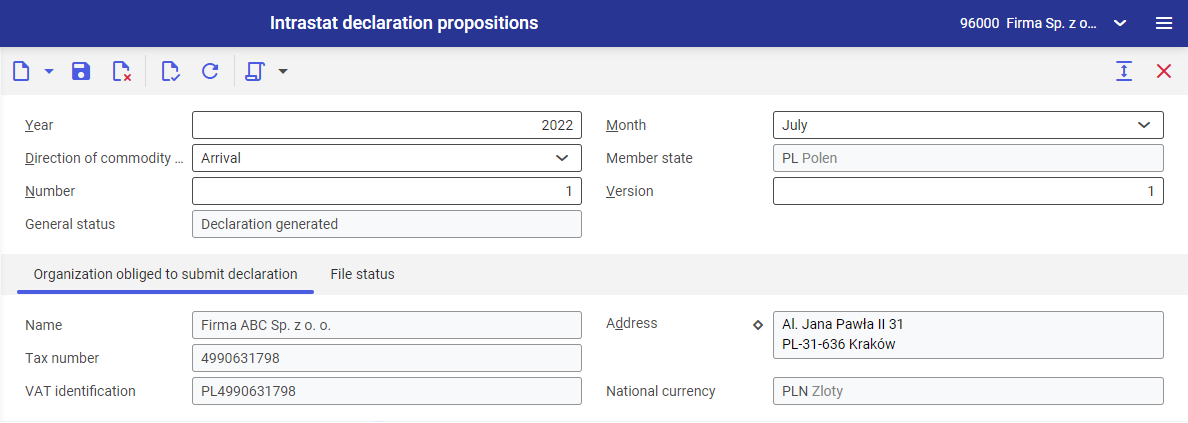

In the query pane, you can define the basic information about a created declaration. Available fields:

- Year (mandatory field) – specify a year in this field, for which a declaration is created. The default value is the current year. In this field, you can be enter a value manually (when adding a new declaration for instance) or open a previously created declaration using the [Value assistant] button.

- Month – month for which a declaration is created. The default value is the current month. You can select a different month from a drop-down list.

- Direction of commodity trade (mandatory field) – in this field you can specify a declaration for dispatch (export)/arrival (import)

- Member state – the default value is the country assigned to the organization to which a user is currently logged in. This field is completed automatically and it not editable.

- Number – number of submitted declaration. When several declarations are added for the same period, then you need to assign a consecutive number for Intrastat declaration propositions.

- Version – version of submitted declaration.

- General status – current declaration status.

- Declaration generated – new declaration

- Declaration sent to officials – this status is assigned upon selecting the action [Available actions] → [Set status to “Declared”]

- Declaration modified by used – declaration line items were edited after a declaration proposition was generated

- Declaration archived – a declaration was archived (this status is assigned automatically after switching to a new Intrastat version)

- Corrected declaration – this field is only available when the currently edited declaration is a correction. It presents the declaration number, to which the correction refers.

The query pane is divided into following tabs:

Organization obliged to sumbit declaration tab

This tab presents the basic information about the reporting entity:

- Name – partner name; this field is completed automatically and is not editable. Data is retrieved from the partner master data.

- Address – address details of the partner submitting a declaration; this field is completed automatically and is not editable. Data is retrieved from the partner master data.

- Tax number – partner’s tax number; this field is completed automatically and is not editable. Data is retrieved from the partner’s financials data.

- VAT identification – partner’s VAT identification; this field is completed automatically and is not editable. Data is retrieved from the partner’s financials data.

- National currency – field completed automatically, not editable. Data is retrieved from the Customizing application → Base/General function → Primary currency field (the currently used currency is presented in this field).

File status tab

This tab contains detailed information concerning a generated Intrastat declaration file.

- File status – a relevant message is presented in this field:

- Third-party software file generated – if .csv file was generated to a declaration

- Third-party software file not generated – if .csv file was not generated to a declaration

- Output by – ID and description of the user who has generated a file

- File generation date – file generation date and time

Work pane

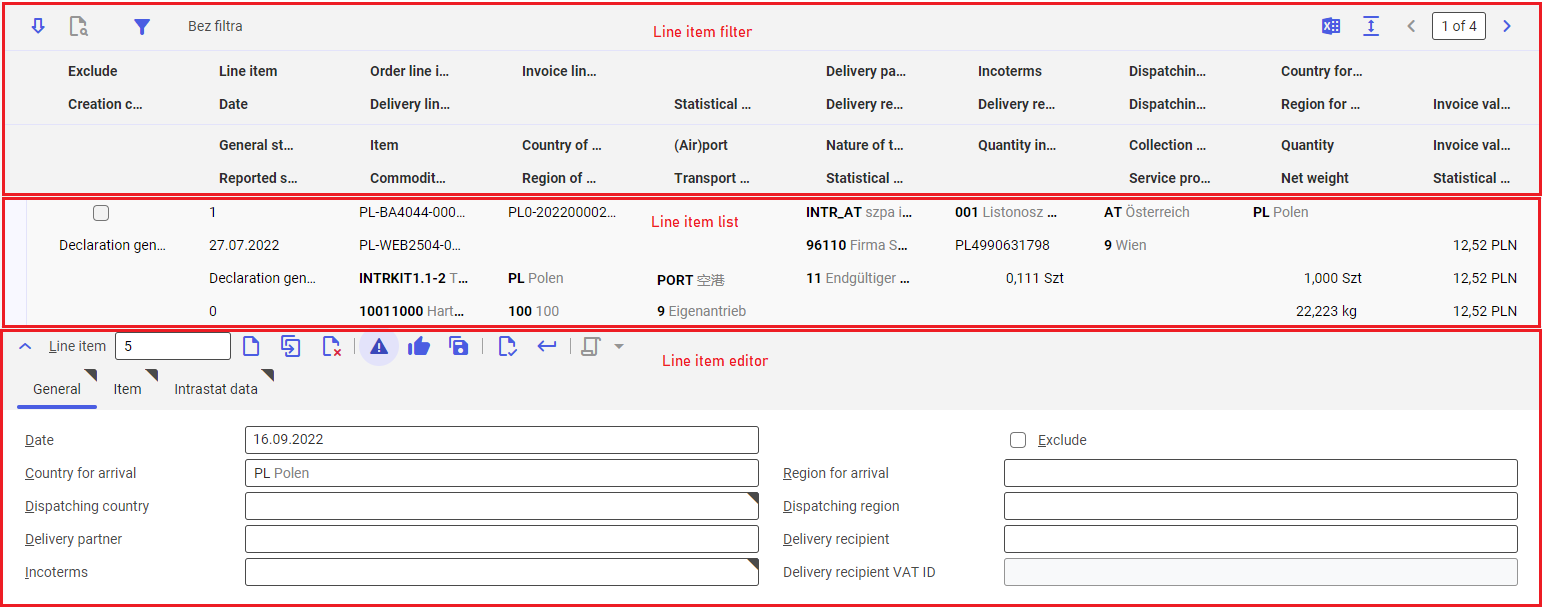

The work pane of the Intrastat declaration propositions application is composed of:

- line item filter – searches for a declaration according to specified criteria

- line item list – presents the line items added to a declaration

- line item editor – presents the information regarding a currently open or edited line item of the Intrastat declaration proposition

Declaration line item filter

The line item filter is used to search for declarations according to the criteria available in a dialog window under the [Set and execute filter] button. It also edits and searches for specific line items as well as export line items to an Excel file.

Available buttons:

[Edit] – transfers line item data to the line item editor

[Find and add declaration line items] (selectable for declaration corrections) – opens a dialog window Find: Intrastat declaration proposition detail, where you can search for and select line items from the source declaration that will be added to the declaration correction line item list. You can correct a line item by transferring it to the line item editor with the [Edit] button.

[Set and execute filter] – opens the Set and execute filter window where you can define the search criteria of declaration line items (a declaration with a specific date for instance)

[Output pages already displayed into a file] – exports a line item list to a file

[Show/hide title bar] – hides column names on the line item list

Declaration line item list

The line item list is composed of a table with columns presenting data of the line items, which was completed in the line item editor and transferred to the list with the [Accept] button. Following additional columns are also available:

- Creation category – presents information about declaration creation category. Available values:

- Declaration generated automatically – declaration line item was generated automatically by the system

- Declaration generated by user – declaration line item was added manually

- Line item – internal declaration line item number assigned sequentially for each new entry

- General status – presents declaration status. Available values:

- Declaration generated – line item was generated

- Declaration modified by used – line item was edited

- Declaration sent to officials – declaration status was set to Declared

- Reported sequence – numbering of reported line items

- Order line item – number of the voucher on the basis of which a declaration proposition was generated (purchase or sales order for instance)

- Delivery line item – number of the inventory document on the basis of which a declaration proposition was generated (receipt of goods for instance)

- Invoice line item – number of the invoice associated with the voucher on the basis of which a declaration proposition was generated (supplier or customer invoice for instance)

By each line item, its status is displayed as well as possible icon-like warnings/errors.

Declaration line item editor

Columns on the line item list are completed based on the line item editor. More information can be found under Line item editor for Arrival declaration and Line item editor for Dispatch declaration.

Buttons available in the line item editor:

[Add] – adds a new declaration line item and its consecutive number assigned is presented in the Line item field above the line item editor

[Duplicate] – copies a selected declaration line item with all its data and its consecutive number assigned is presented in the Line item field above the line item editor

[Set/remove deletion marker] – adds or removes a deletion marker, respectively. The marker is presented on the line item list.

[Validate when accepting]/[Don’t validate when accepting] – specifies whether line items should be validated when being transferred from the line item editor to the line item list upon selecting the [Accept] button. The button name differs depending on its activity status.

[Discard changes when switching line items]/[Accept changes when switching line items] – specifies whether changes are to be saved automatically after switching to another line item. The button name differs depending on its activity status.

[Save automatically after accepting if the limit of the changeable line items is reached without saving] – standard button that saves automatically a declaration after the liming of the edited line items is reached

[Validate] – checks the correctness of entered data. Fields with erroneous data or uncompleted mandatory fields are framed in red.

[Accept] – transfers edited line item to the line item list

[Select action] → [Mark as “Verified”] – marks a line item as verified in case of warnings. The line item is at the same time considered correct.

[Select action] → [Remove “Verified” marking] – undoes the [Mark as “Verified”] action.

Line item editor for Dispatch declaration

General tab

General settings of declaration line item are available in this tab:

- Date – the default value is the current date. The date should include in the period for which a declaration is created.

- Exclude – specifies if a line item is to be taken into account when calculating a declaration and whether it will be exported to a .csv file.

- Country for arrival (mandatory field) – the country goods are shipped to based on the delivery address. The values are retrieved from the Countries application.

- Region for arrival – this field is completed automatically based on the address of the region goods/services are delivered to. The values are retrieved from the Countries application, indicating, by default, the region assigned to the country selected in the Country for arrival field.

- Dispatching country – this field is completed automatically based on order data. The values are retrieved from the Countries application.

- Region for arrival – this field is completed manually, values are retrieved from the Countries application, indicating, by default, the region assigned to the country selected in the Country for arrival field.

- Delivery partner – the supplier partner of the goods

- Delivery recipient – the recipient partner of the goods

- Incoterms (mandatory field) – specifies the method of delivery in this field. The values are retrieved from the Delivery terms application.

- Delivery recipient VAT ID (mandatory field) – recipient’s tax identification used in the EU. The value is retrieved from the Financials view of the Partners application on partner chart.

Item tab

In this tab, you can enter item data. Available fields:

- Item (mandatory field) – presents a voucher line item or a line item can be selected in this field for declaration proposition

- Commodity code (mandatory field) – code of the Intrastat Classification Nomenclature assigned to an item (Items application → [Select and organize view] → Intrastat → Commodity code field). A manually entered commodity code should be consistent with the ICN code assigned to an item.

If commodity code is not completed on item chart under the Base view when running the Determine source data for Intrastat declaration propositions application, then the item from a (sales, purchase, distribution) order will not be included in the declaration also when the commodity code is provided later. If this being the case, a new order with this item needs to be created.

- Description (mandatory field) – field completed automatically on the basis of the Description field from Items application for the item selected in the Item field

- Quantity (mandatory field) – item quantity in the selected unit of measure. A unit of measure is selectable from a drop-down list.

- Quantity in supplementary unit – item quantity in an additional unit of measure (Items application → [Select and organize views] button → Intrastat section → Special measure field)

- Net weight – net weight unit retrieved from the Customizing application → Intrastat function. It is changeable. This field is completed manually.

- Invoice value in national currency (mandatory field) – tax base in the currency of the voucher processing a transaction

- Statistical value – on imports, it is the value of goods at the place and time of entry into the statistical area. It is calculated according to the formula Price 1 (Items application → Financials view) * quantity

- Country of origin – completed automatically on the basis of the country assigned to the selected item (Items application → [Select and organize views] button → Intrastat section → Country of origin field). If no value is specified in this field, the code of the last shipping country is retrieved.

- Region of origin – completed automatically on the basis of the region assigned to the selected item (Items application → [Select and organize views] button → Intrastat section → Region of origin field).

Intrastat data tab

This tab contains the Intrastat data-related settings:

- (Air)port – value retrieved from the voucher on the basis of which a declaration was created

- Nature of transaction (mandatory field) – value retrieved from the voucher on the basis of which a declaration was created. A nature of transaction can also be added manually from the Intrastat natures of transaction application upon selecting the [Value assistant] button

- Transport mode (mandatory field) – value retrieved from the voucher on the basis of which a declaration was created. A transport mode can also be added manually from the Intrastat transport modes application upon selecting the [Value assistant] button

- Statistical method – value retrieved from the voucher on the basis of which a declaration was created. A statistical method category needs to agree with the direction of commodity trade.

- Statistical procedure – value retrieved from the voucher on the basis of which a declaration was created. A statistical procedure can also be added manually from the Intrastat statistical procedures application upon selecting the [Value assistant] button

Service Intrastat data section

- Collection term – value retrieved from the voucher on the basis of which a declaration was created. A collection term can also be added manually from the Intrastat collection terms application upon selecting the [Value assistant] button.

- Service providing terms – value retrieved from the voucher on the basis of which a declaration was created.

Line item editor for Arrival declaration

General tab

General settings of declaration line item are available in this tab:

- Date (mandatory field) – the default value is the current date. The date should include in the period for which a declaration is created.

- Exclude – specifies if a line item is to be taken into account when calculating a declaration and whether it will be exported to a .csv file.

- Country for arrival (mandatory field) – field completed automatically on the basis of the country or the organization for which a declaration proposition is created. The values are retrieved from the Countries application.

- Region for arrival – manually completed field, values are selected from the Countries application, indicating, by default, the region assigned to the country selected in the Country for arrival field.

- Dispatching country (mandatory field) – the country the goods are shipped to. Values are retrieved from the Countries application on the basis of the voucher (delivery partner address for instance).

- Dispatching region – manually completed field, values are selected from the Countries application, indicating, by default, the region assigned to the country selected in the Dispatching country field.

- Delivery partner – the supplier partner of the goods

- Delivery recipient – the recipient partner of the goods

- Incoterms (mandatory field) – you can specify the method of delivery in this field. The values are retrieved from the Delivery terms application.

- Delivery recipient VAT ID (insensitive for Arrival direction of commodity trade) – recipient’s tax identification used in the EU.

Item tab

In this tab, you can enter item data. Available fields:

- Item (mandatory field) – presents a voucher line item or a line item can be selected in this field for declaration proposition

- Commodity code (mandatory field) – code of the Intrastat Classification Nomenclature assigned to an item (Items application → [Select and organize views] → Intrastat → Commodity code field). A manually entered commodity code should be consistent with the ICN code assigned to an item.

If commodity code is not completed on item chart under the Base view when running the Determine source data for Intrastat declaration propositions application, then the item from a (sales, purchase, distribution) order will not be included in the declaration also when the commodity code is provided later. If this being the case, a new order with this item needs to be created.

- Description (mandatory field) – field completed automatically on the basis of the Description field from Items application for the item selected in the Item field

- Quantity (mandatory field) – item quantity in the selected unit of measure. A unit of measure is selectable from a drop-down list.

- Quantity in supplementary unit – item quantity in an additional unit of measure (Items application → [Select and organize views] button → Intrastat section → Special measure field)

- Net weight – net weight unit retrieved from the Customizing application → Intrastat function. It is changeable. This field is completed manually.

- Invoice value in national currency (mandatory field) – tax base in the currency of the voucher processing a transaction

- Statistical value – on imports, it is the value of goods at the place and time of entry into the statistical area. It is calculated according to the formula Price 1 (Items application → Financials view) * quantity

- Country of origin (mandatory field) – completed automatically on the basis of the country assigned to the selected item (Items application → [Select and organize views] button → Intrastat section → Country of origin field). If no value is specified in this field, the code of the last shipping country is retrieved.

- Region of origin – completed automatically on the basis of the region assigned to the selected item (Items application → [Select and organize views] button → Intrastat section → Region of origin field).

Intrastat data tab

This tab contains the Intrastat data-related settings:

- (Air)port – value retrieved from the voucher on the basis of which a declaration was created

- Nature of transaction (mandatory field) – value retrieved from the voucher on the basis of which a declaration was created. A nature of transaction can also be added manually from the Intrastat natures of transaction application upon selecting the [Value assistant] button

- Transport mode (mandatory field) – value retrieved from the voucher on the basis of which a declaration was created. A transport mode can also be added manually from the Intrastat transport modes application upon selecting the [Value assistant] button

- Statistical method – value retrieved from the voucher on the basis of which a declaration was created. A statistical method category needs to agree with the direction of commodity trade.

- Statistical procedure – value retrieved from the voucher on the basis of which a declaration was created. A statistical procedure can also be added manually from the Intrastat statistical procedures application upon selecting the [Value assistant] button

Service Intrastat data section

- Collection term – value retrieved from the voucher on the basis of which a declaration was created. A collection term can also be added manually from the Intrastat collection terms application upon selecting the [Value assistant] button.

- Service providing terms – value retrieved from the voucher on the basis of which a declaration was created.

Business entities

The following business entity is relevant to the Intrastat declaration propositions application: com.sem.ext.app.intrast.obj.IntrastatDeclarationProposition. It is used, for example, to perform one of the following:

- grant authorizations

- set activity definition

- import or export data

Authorizations

Authorizations can be assigned by means of authorization roles as well as by assignment of organizations. The authorization concept is described in the article Authorizations.

Special capabilities

There are no special capabilities for the Intrastat declaration propositions application.

Organizational assignments

To ensure that a person can see the Intrastat declaration propositions application in the user menu and can open it, it is necessary to assign an organization to the user in the partner’s master data. The organization must be assigned to at least one of the following organizational structures:

- Financials

Special capabilities

There are no special features for the Intrastat declaration propositions application.

Authorizations for business partners

Application The Intrastat declaration propositions application is not released for business partners.