When mapping business processes in a multi-site organization, business organizations related to different companies require an inter-company billing.

This article descrives the preconditions and processes of inter-company billings.

Process and voucher references chain

Business transactions between organizations, which are assigned to different companies in Financials organization structure, require an inter-company billing within the corporation. The following vouchers are the source for a possibly required inter-company billing:

- sales orders

- purchase orders

- distribution orders

- manual inventory postings with the posting process Revaluation

- manual inventory postings with the posting process Transfer posting

The data for inter-company billing concerning these source vouchers, except for distribution orders, is generated automatically. Data for inter-company billing concerning distribution orders is created manually in the distribution orders.

The data for inter-company billing is based on either inventory postings or sales, purchase, or distribution order data. Since items not maintained in the inventory do not result in inventory postings, the data for the inter-company billing of such items will be generated from sales, purchase, or distribution orders.

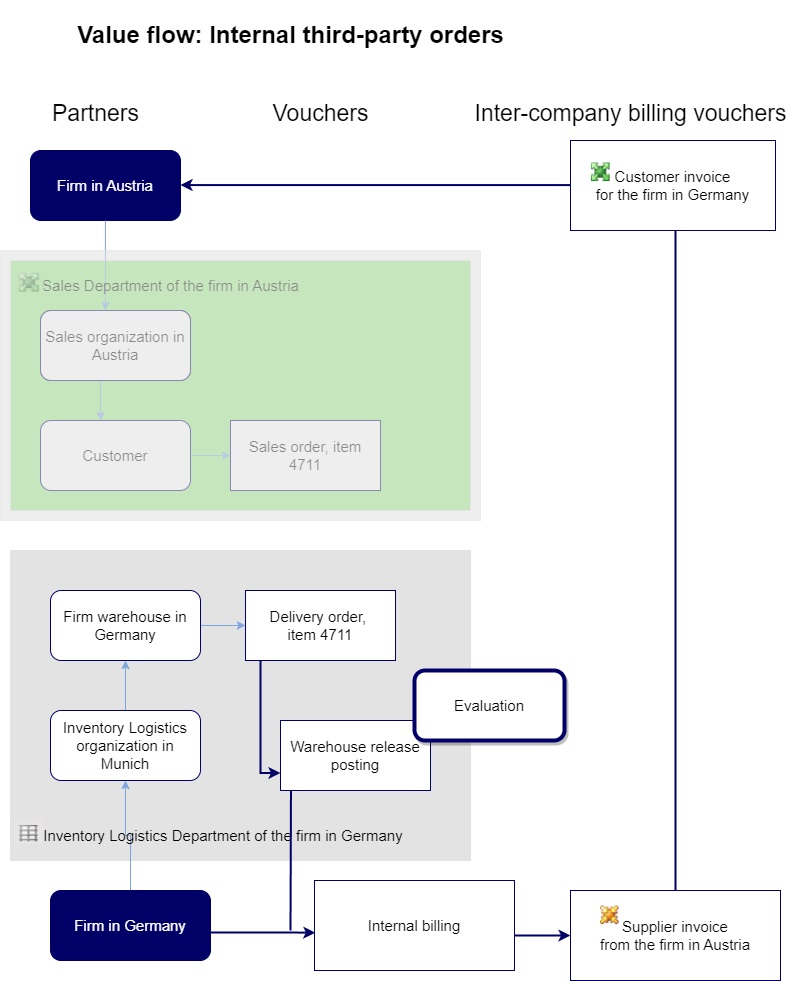

Sales – Internal third party orders

Internal third-party orders include the following conditions for selling an item: An item is distributed by a firm to one of their customers. This firm, however, is not the owner of the item. Due to the organizational structure, another firm is the owner and used as delivery partner. Consequently, the owner supplies the customer directly.

A customer engages the sales organization in Austria to deliver item 4711. The item is not in the inventory of the affiliated company in Austria so that a warehouse of an inventory management organization of the firm in Germany is specified when creating the sales order. This organization has the requested item in the inventory and can deliver it directly to the customer.

For such delivery, the firm in Germany issues a customer invoice to the firm in Austria. This is automatically a supplier invoice for the firm in Austria. The customer invoice to the customer is created by the sales organization in Austria because it is the contractor.

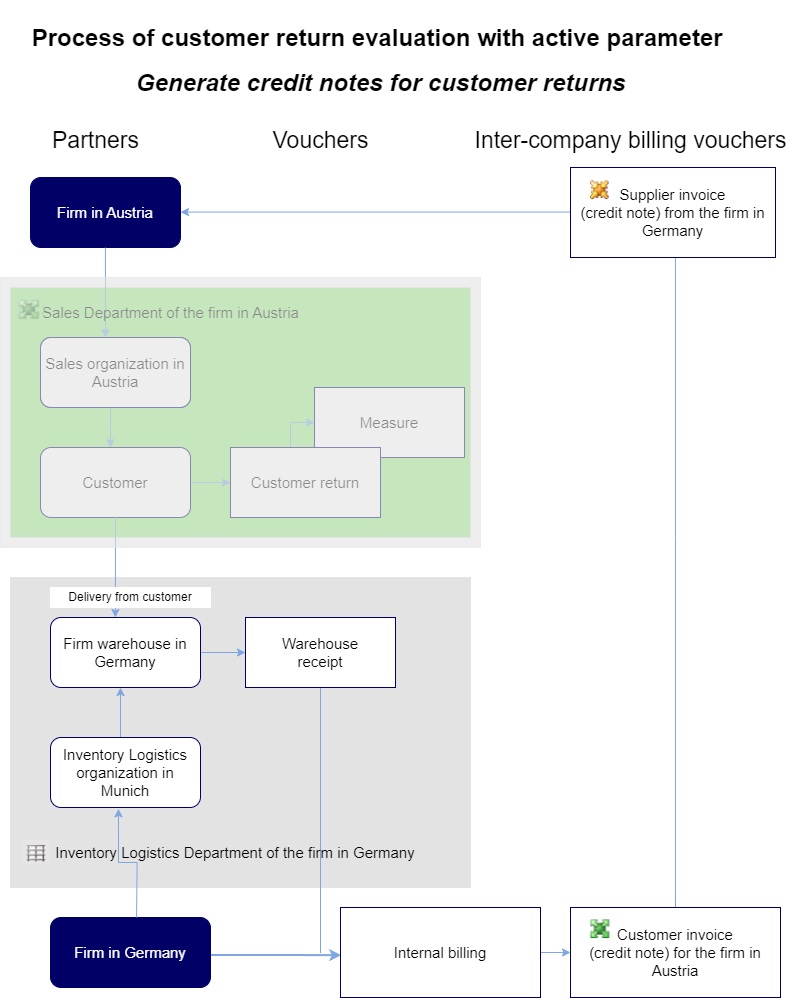

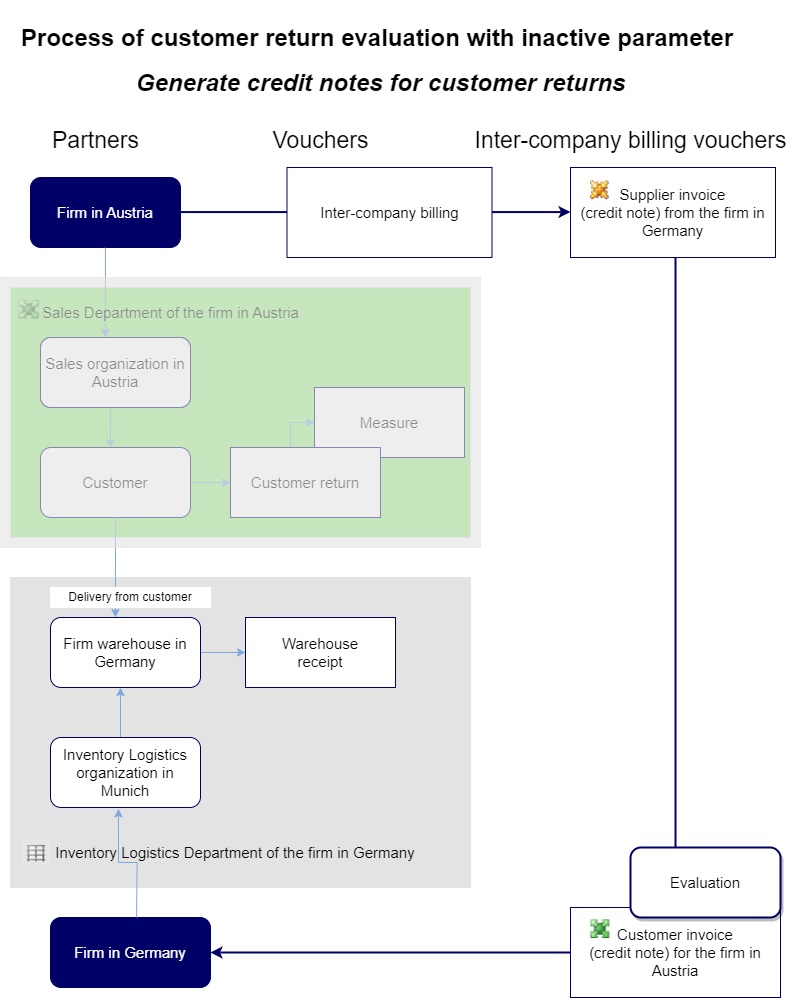

Sales – Customer returns

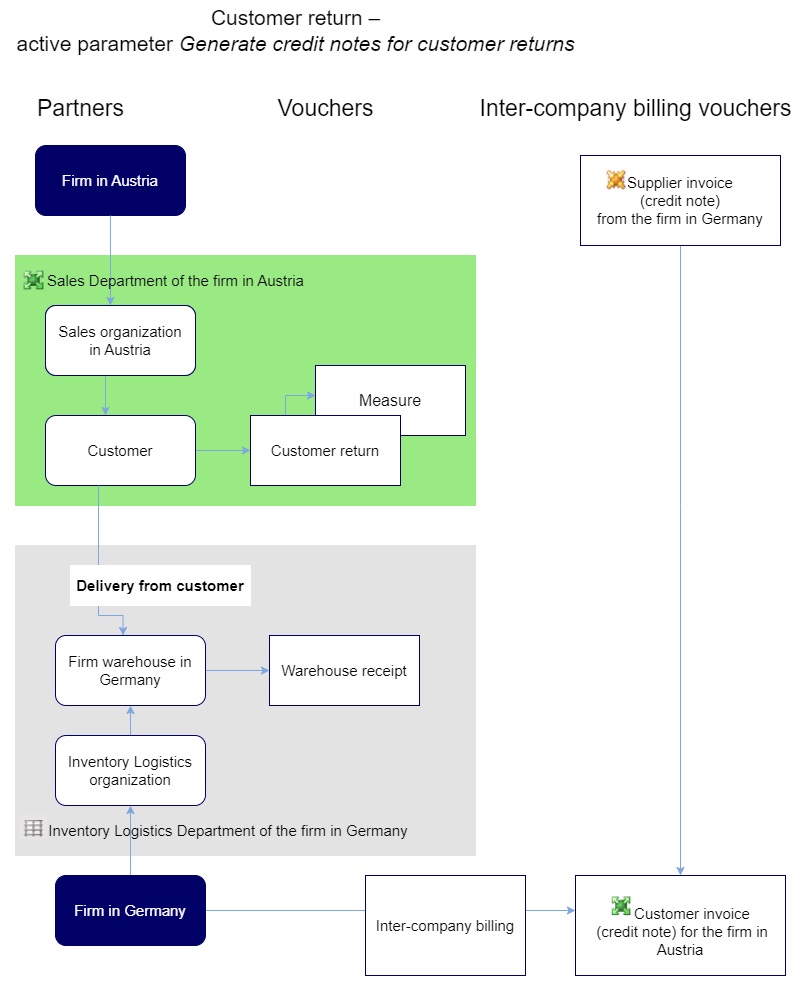

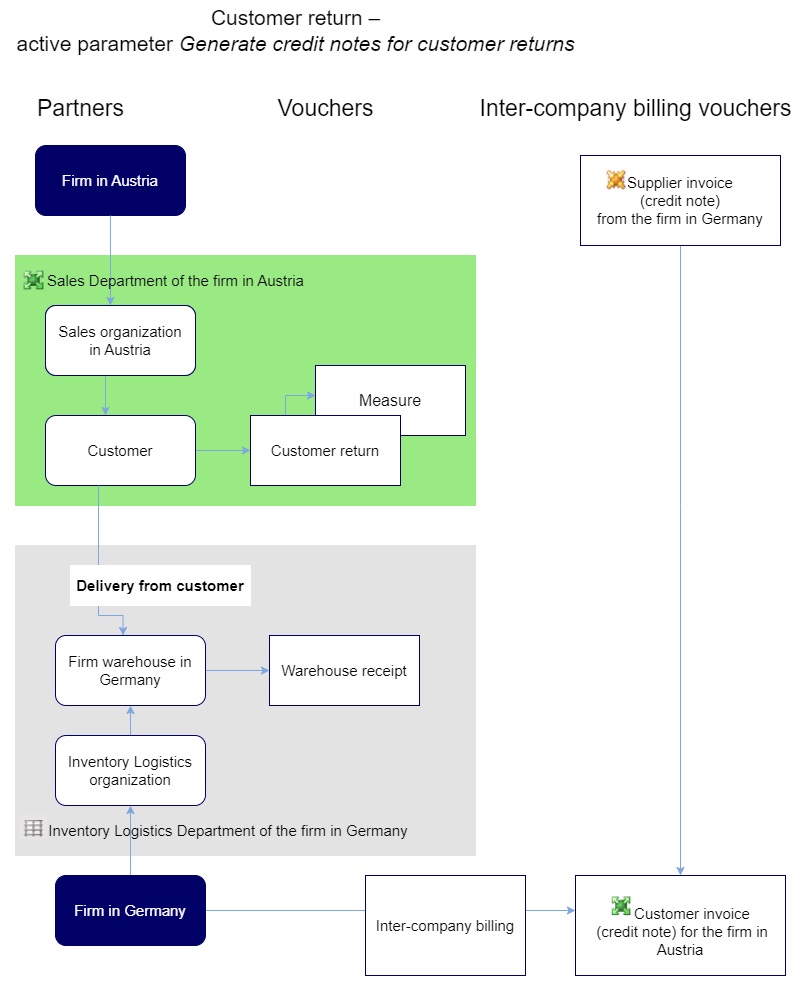

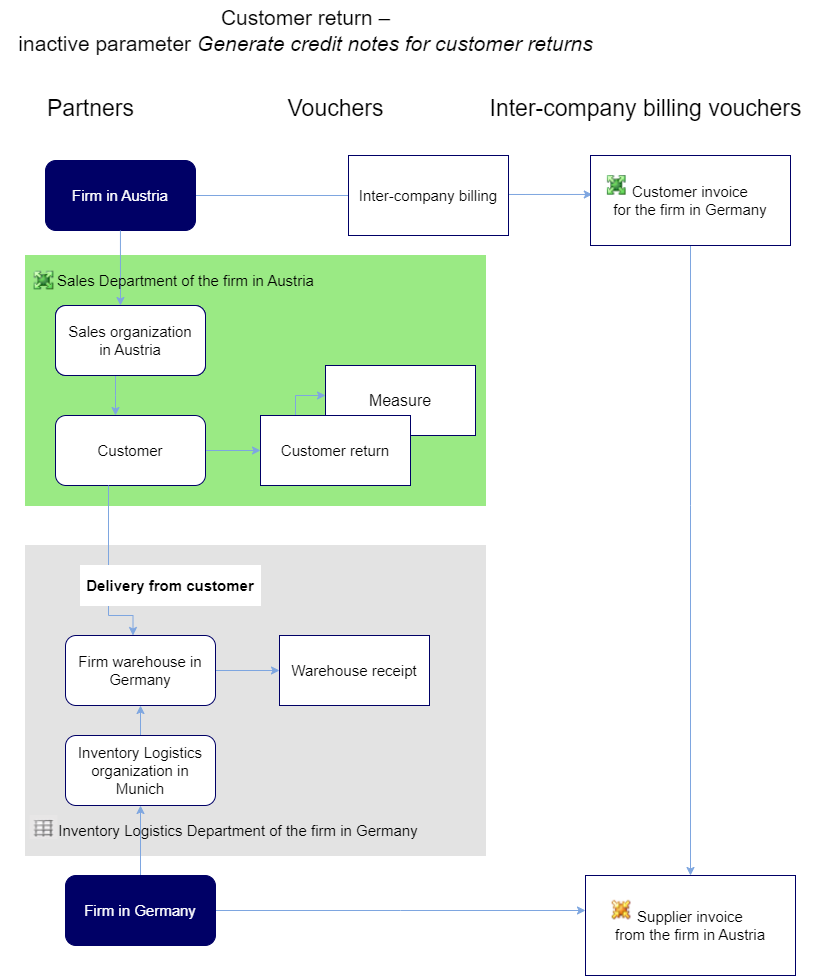

The process of inter-company billing for a customer return to a warehouse different than the warehouse of the sales organization, depends on the setting of the parameter Generate credit notes for customer returns.

In this example, the Generate credit notes for customer returns function is activated for inter-company billing. Therefore, the source inventory owner and the destination inventory owner are exchanged when generating the customer and supplier invoices. The firm in Germany, into whose inventory the item passes, issues a customer invoice with a negative sign, i.e., a credit note, to the firm in Austria. This is automatically a supplier invoice for the firm in Austria.

If the Generate credit notes for customer returns function is deactivated, a customer invoice will be generated by the firm in Austria for the firm in Germany

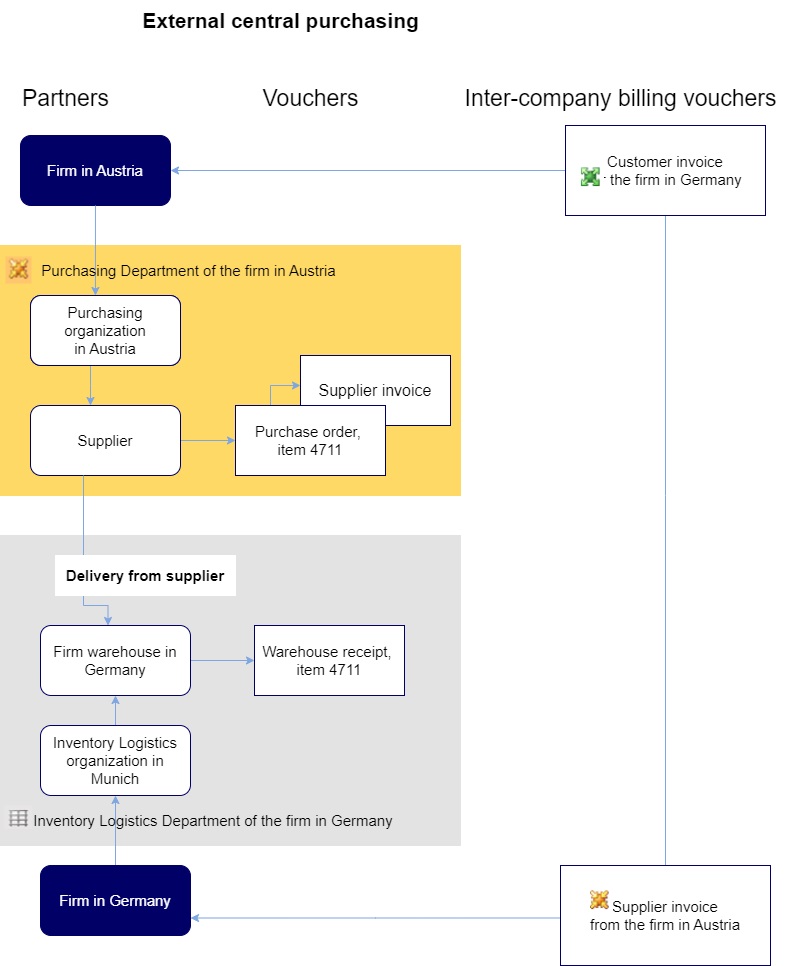

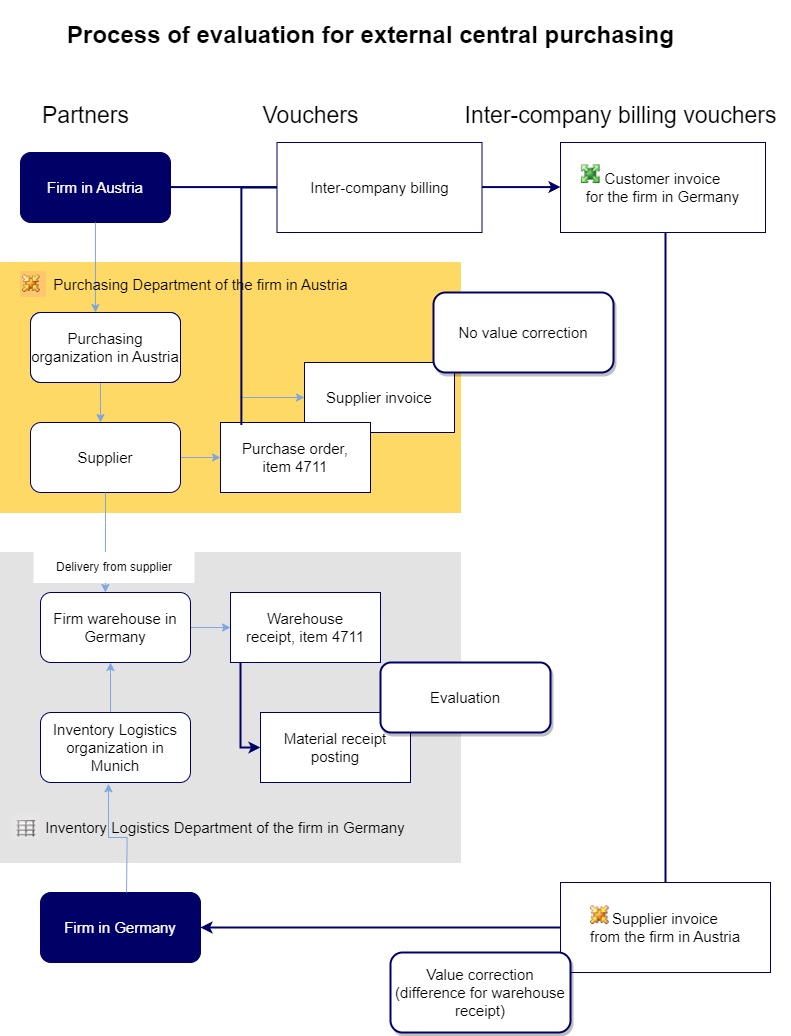

External central purchasing

When it comes to the external central purchasing of items, the purchasing process involves two firms. One firm orders item for another firm from the supplier. The ordering firm receives the invoice from the supplier and the internal billing is generated for the firm that orders the items.

The inventory owner of the delivered items is the firm in Germany. The firm accepts the item as their own through the receipt of goods. Therefore, the firm in Austria issues a customer invoice to the firm in Germany. This is automatically a supplier invoice for the firm in Germany.

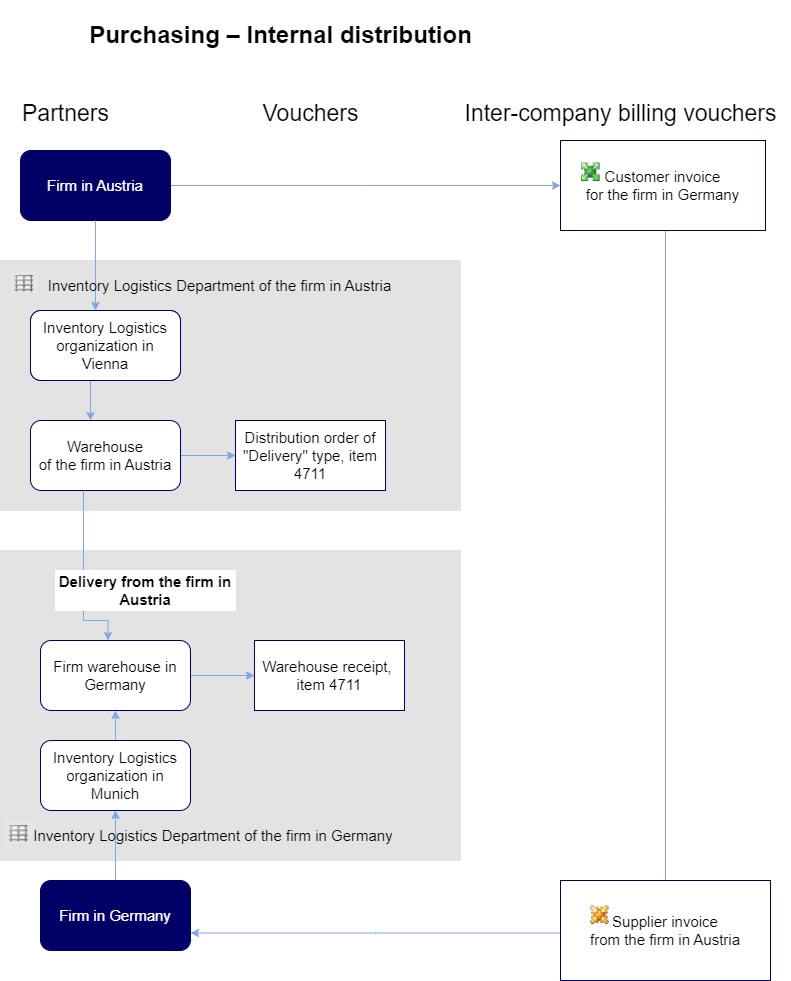

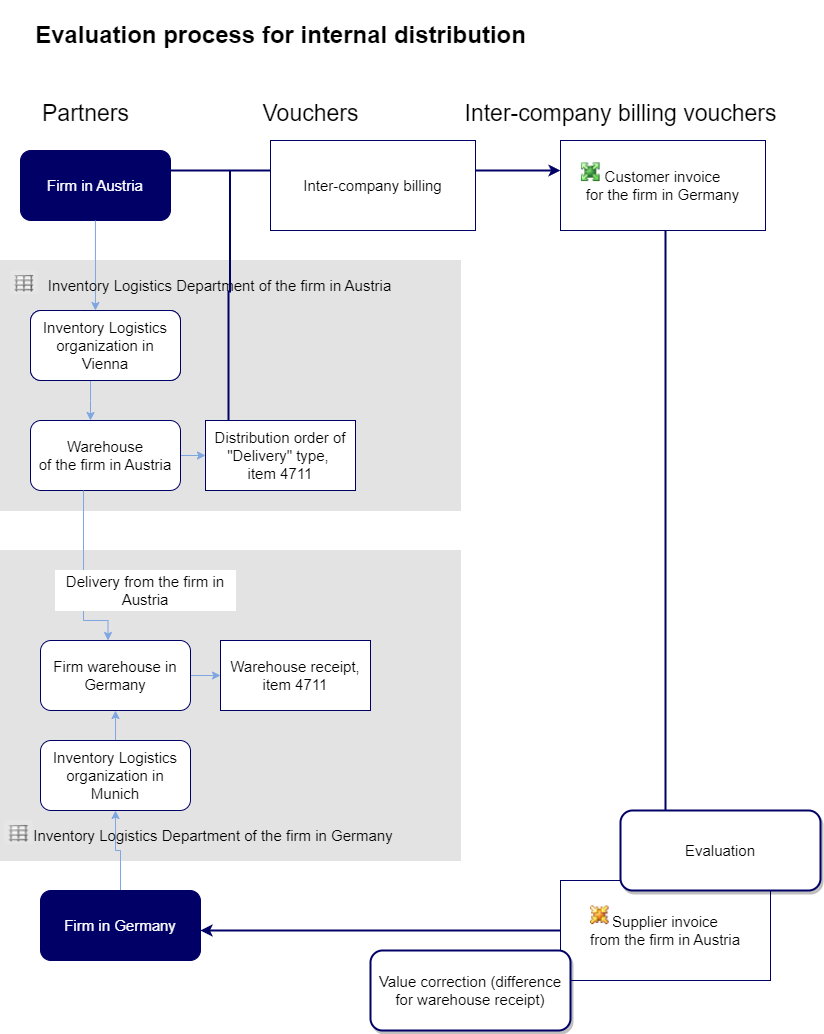

Purchasing – Internal distribution

When items are purchased through internal distribution, the purchasing process involves two firms: One firm orders the required items from another firm, using a distribution order.

The internal distribution of item 4711 is realized by the inventory management organization in Vienna delivering to the inventory management organization in Munich based on a distribution order.

The inventory owner of the delivered items is the firm in Germany. The firm accepts the item as their own through the receipt of goods. Therefore, the firm in Austria issues a customer invoice to the firm in Germany. This is automatically a supplier invoice for the firm in Germany.

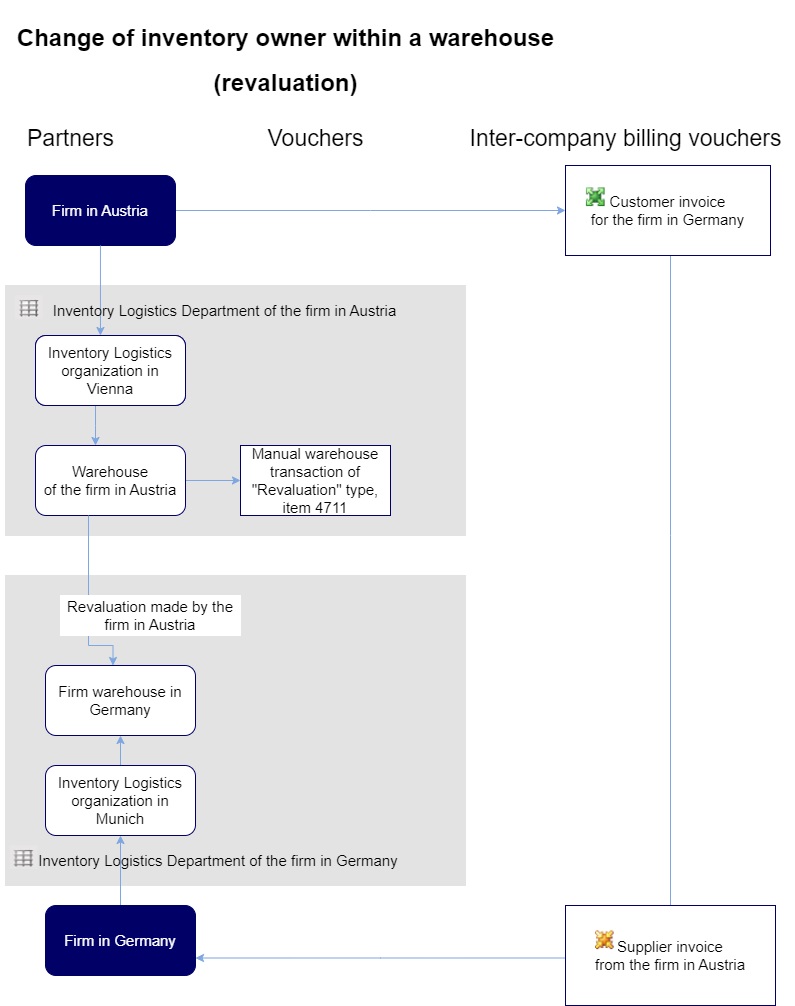

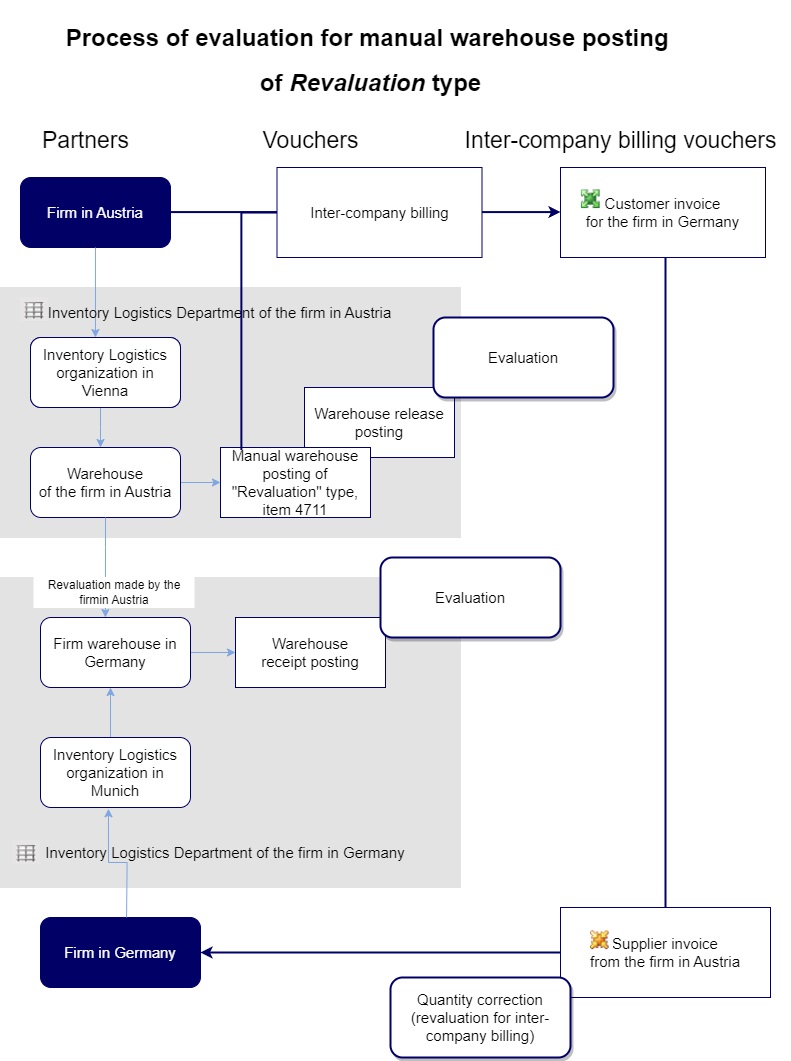

Manual inventory posting – Change of inventory owner within a warehouse

As long as there are no vouchers for the distribution of items in the system, it is possible to change the owner of the inventory through a manual inventory posting in the Inventory postings application, with the use of a posting key of Revaluation type. In such case, no quantity postings are created, only the owner of the inventory changes.

The inventory owner of item 4711 can be changed from the firm in Austria to the firm in Germany by means of a manual inventory posting in the Revaluation posting process.

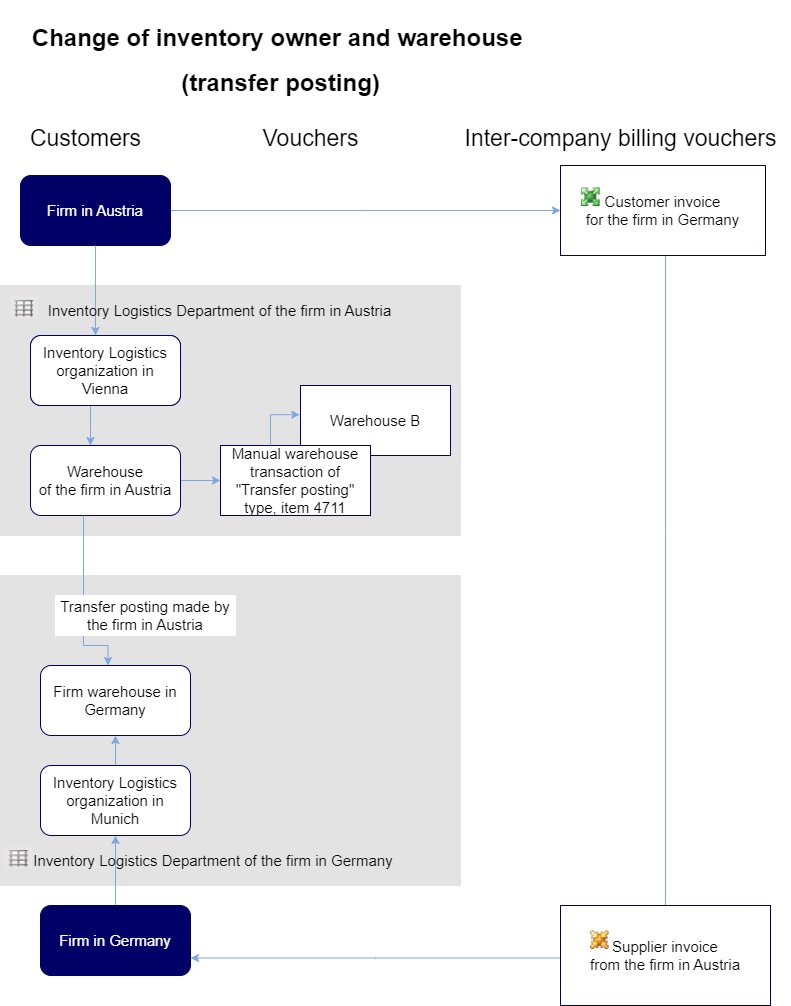

Manual inventory posting – Inventory owner and warehouse change

An item quantity can be cleared by means of the Inventory postings pplication, with the use of the Transfer posting posting key. This results in the change of the inventory owner and, as needed, the warehouse.

Voucher references chain

For customer and supplier invoices generated in the course of inter-company billing, voucher references are created in the voucher references chain of the destination voucher:

| Source voucher | Reference in the voucher references chain of the destination voucher |

| Purchase order

Sales order Distribution order |

The customer invoice is assigned a voucher reference to the source voucher for the header and line items |

| Customer invoice | The supplier invoice is assigned a voucher reference to the customer invoice for the header. |

| Purchase order

Sales order Distribution order |

The supplier invoice is assigned a voucher reference to the source voucher for the header and line items. |

The voucher references chain of the following source vouchers always includes a voucher reference to the destination voucher:

- Purchase order

- Sales order

- Distribution order

In case of a revaluation, a voucher reference is only included in the delivery order.

Source vouchers for the inter-company billing

The starting basis for inter-company billing can be different vouchers. Depending on the voucher, inter-company billing is triggered:

- Manually – inter-company billing is generated manually for a distribution order from the level of the application Distribution orders or Cockpit: Distribution oders, with the use of the button [Select action] -> [Generate inter-company billing].

- Semiautomatically – inter-company billing is generated at the same time in the Inter-company billings application for purchase orders, sales orders and manual inventory postings. Inter-company billings generated on the basis of selected vouchers can be managed in the Inter-company billings application.

The voucher becomes a suitable source voucher for inter-company billings, if the following requirements are fulfilled:

- Where a purchase order line item is concerned, the firm of the purchasing organization and and the firm of the delivery recipient are not identical (central purchasing).

- Where a sales order line item is concerned, the firm of the sales organization and the firm of the delivery partner are not identical (internal thirdparty orders or customer return).

- Where manually created inventory postings are concerned, the source inventory owner and the destination inventory owner are not identical (transfer postings and revaluations).

All vouchers that concern inter-company billing are complemented with data to generate customer and supplier invoices in the Inter-company billing application. The actual inter-company billing consists of generating customer and supplier invoices for the source and destination firms involved. It can be performed and timed directly from the Inter-company billing application or via batch jobs with serial pattern based on different query templates.

Status and error correction

The generated vouchers contain status information showing the billing state. Failed inter-company billing results in an Invalid status. Errors can be partly corrected in the application Inter-company billing via the existing line item editor. Erroneous master data can be localized through the voucher references chain which is also available. Subsequently, inter-company billing can be repeated.

Source vouchers (purchase order, sales order, distribution order), depending on the inter-company billing process flow, have the following statuses:

- Not cleared intrnally – no order line item has been cleared internally

- Cleared internally in full – all order line items have been cleared in full

- Cleared internally in part – part of order line items has been cleared in full. To verify which line items are cleared, it is necessary to check their statuses.

Clearing inventoried items

With regard to inventoried items, the inventory postings for the corresponding source vouchers are decisive when it comes to generating customer and supplier invoices for inter-company billing. Each inventory posting is related to the relevant inventory owners that are involved in the changing ownership of inventoried items. The billing is carried out for inventory items, storage units, variant and kit items.

Transfer postings and revaluations

Transfer postings and revaluations necessarily require a source and a destination inventory owner. Therefore, both source and destination inventory owner have to be firms of one corporation in each case.

Receipt posting

A receipt posting documents to which firm the property in the posted item is passed, i.e., which firm is the new inventory owner.

In case of an external central purchasing the items at first pass into the ownership of such firm that pays the supplier invoice. This is such a firm to which the respective purchasing organization belongs and that therefore acts the role of the payment partner. For each purchase order category, it can be determined whether this firm should stay the definite owner or whether the property in the item passes to the firm of the respective delivery recipient, which results in a required further billing within the corporation (inter-company billing).

The inter-company billing is necessary if an external central purchasing is executed for one or several items for different firms within the own corporation. The subsequent inter-company billing will only then have effect if the firm of the purchasing organization and the firm of the delivery recipient differ from each other. The delivery recipient can be determined for each purchasing line item, which results in an inter-company billing per line item.

In case of a customer return, the destination inventory owner of the items to be returned can be defined in the customer return voucher. If various firms are affected, inter-company billing will be required. Additionally, the user can specify whether a customer or supplier invoice or, alternatively, a credit note should be generated for them.

Issue posting

An issue posting documents which items were taken from the property of which firm.

In case of a sales or distribution order the items principally always are taken from the property of such a firm to which the sales organization belongs. This is such a firm which receives the payment of the customer invoice and therefore acts the role of the payment partner.

Sales order

If the delivered items in a sales order do not belong to such firm that receives the payment, then an inter-company billing has to be executed (internal thirdparty orders).

The firm of the delivery partner acts as original owner. The delivery partner is such organization that is responsible for the fulfillment of the order. The delivery partner can vary per line item.

Depending on the settings in the sales order category, the original inventory owner is supposed to be the firm of the delivery partner or the firm of the sales organization. An inter-company billing of the delivery partner’s firm to the firm of the sales organization is solely executed per line item if both firms are different.

In case of external third-party orders, the delivery partner is an external supplier. Independent of the settings in the sales order category, the firm of the sales organization is always regarded as inventory owner in this case. A delivery order is used to document which supplier delivers to the customer. There is no issue posting in such case.

Customer returns

In case of a customer return, the destination inventory owner of the items to be returned is defined in the customer return voucher. Depending on further settings for destination and source inventory owners, inter-company billing is performed accordingly. There is no issue posting in such case.

Distribution order

Distribution orders are provided for the internal purchasing and distribution of items. In the distribution order it can be determined whether the items are to be taken from the property of the sales organization’s firm (the invoicing party) or from the property of the delivery partner’s firm (source site). The sales organization and the delivery partner are determined for each order and not for each line item.

If items are distributed between sites of different firms, an inter-company billing is required. The source inventory owner is the firm of the delivery partner (source site) and the destination inventory owner is the firm of the delivery recipient (destination site). An inter-company billing is only then carried out if both firms are different ones.

To post an issue to the production, the issue warehouse is relevant. It discloses the owner of the material taken: the firm of the site to which the issue warehouse belongs.

Clearing not-inventoried items

With regard to non-inventoried items, e.g., service items, the corresponding source vouchers are decisive when it comes to generating supplier and customer invoices for inter-company billing. Within this scope, non-inventoried items are considered like inventoried items since these items are delivered, as well, so that necessary data is generated for inter-company billing.

In addition, it is possible to define in a customer invoice category whether and how those billing items are to be cleared.

Clearing internally

To clear items internally, some requirements have to be met. This chapter describes the preconditions, triggers of inter-company billing, and their effects.

Preconditions

- Settings for inter-company billings

The application Inter-company billing settings is used for defining the settings for the clearings between two firms of a corporation. It allows for defining the settings for ivoicing and pricing. The source firm is the one selected in the toolbar.

Detailed information is available in article Inter-company billing settings.

- Category of supplier/customer invoice

The supplier and customer invoice categories used to generate invoices are defined in the application Supplier invoice type and Customer invoice type. Invoice type is assigned to the inter-company billing in the Inter-company billing settings application.

- Inventory management server

To generate data for inter-company billing based on source vouchers, as well, it is required that the corresponding inventory management server is running.

The following needs to be defined for organizations involved in inter-company billing:

- Partners application

-

- The destination firm is to be Customer and Invoice recipient (accounts receivable) in the sales organization of the source firm.

- The source firm is to be Supplier and Invoicing party (accounts payable) in the purchasing organization of the destination firm.

- Organizations application

- The source firm must be assigned as firm to the sales organization.

- The destination firm must be assigned as firm to the purchasing organization.

Furthermore, the following applies to distribution orders:

- The destination purchasing organization of the destination firm must be recorded as Customer and Delivery recipient with the sales organization of the source firm. The destination firm must be assigned as Invoice recipient.

- The source purchasing organization of the source firm must be recorded as Supplier and Delivery partner with the purchasing organization of the destination firm. The source firm must be assigned as Invoicing party.

Triggers

Using the [Generate inter-company billing document…] action in the Intercompany billing application, inter-company billing can be triggered for selected available data from Purchase order, Sales order, and manual Inventory posting source vouchers.

The inter-company billing of distribution orders is performed via the [Generate inter-company billing document…] action in the Distribution orders application.

Effects

Customer and supplier invoices are generated in pairs for relevant inventory postings with different inventory owners. First, the customer invoice is generated and then the supplier invoice. Both vouchers cannot be edited and are posted immediately. All vouchers affected are linked through the voucher references chain. A corresponding billing status is automatically recorded for the original orders.

The customer invoice and the supplier invoice are assigned the same values (including tax and excluding tax) as well as the same tax amounts. The tax code categories are determined according to the country assignment of the billing partners. In case of doubt the tax amounts determined for the generated customer invoice are accepted in the supplier invoice, even though different tax rates will be calculated by mistake due to the tax codes.

Evaluation

The evaluation for the inter-company billing is always carried out with reference to the customer invoice. The same values are transferred onto the related supplier invoice. This means that the entire pricing is performed in the sales area of the source organization.

Materiasls subject to inter-company billing are priced in the following way:

- For an internal clearing of distribution orders, the price defined for its line items is used.

- If an inter-company billing is due to an inventory posting with different inventory owners from purchasing or sales orders or a manual inventory posting, price and discount will be determined in the course of the intercompany billing as defined for the source and destination firms in the Inter-company billing settings application.

Value corrections

Distribution orders of the Value correction category are available so that values can be corrected within the scope of inter-company billing. Line items cannot be created via the line item editor, but can only be accepted from customer invoices via the find and add function. Just as in sales orders, prices can be defined in distribution orders to use them for inter-company billing.

Cancellations

Supplier and customer invoices resulting from inter-company billing can only be canceled in pairs if they are based on a distribution order. The cancelation of a supplier or customer invoice automatically includes the counter voucher in each case. However, if the inter-company billing is based on another voucher, canceling is not directly possible. In this case, the inter-company billing document can be corrected only via distribution orders of the Value correction category.

For more information, refer to Distribution orders article.

Inventory evaluation

It is possible to store items of different inventory owners in one warehouse. Thus, the inventory management shows inventories in a differentiated way as to the inventory owner. It has an important impact on inventory values.

This chapter describes in examples for various processes how an inventory valuation is carried out for the purpose of the supplier invoice and the receipt of goods.

The following applies to these examples:

The correct valuation price for the billing from the firm in Germany to the firm in Austria s recorded in an internal price list, which is used when generating the invoice pair. The subsequent examples always assume that an internal price list exists for billings from the firm in Germany to the firm in Austria for the mentioned item 4711 with a price of EUR8 per item.

Evaluation for internal third-party orders

The firm in Austria sells items owned by the firm in Germany. The delivery within the scope of these internal third-party orders is carried out by the firm in Germany.

Based on the inter-company billing, a customer invoice is generated for the firm in Germany and a supplier invoice for the firm in Austria. The supplier invoice for the firm in Austria refers to the basic sales order. As the firm in Austria does not accept any items, no inventory posting is generated, which changes the inventory value when posting the supplier invoice.

Customer returns

A customer return can result in a credit note being issued within the scope of inter-company billing. To do so, the Generate credit notes for customer returns function is provided in the inter-company billing settings.

If the function is activated, the source inventory owner and the destination inventory owner will be exchanged for the billing process. A credit note is produced since the firm into whose inventory the item is to pass (i.e., the destination inventory owner) generates a customer invoice which is usually created by the source inventory owner. The floating average price will not be re-evaluated with the credit note.

If the function is deactivated, the source inventory owner taking back the customer’s items will create a customer invoice addressed to the destination inventory owner so that the items pass into the inventory of the destination inventory owner.

Below, evaluation schemes depending on the settings of the Generate credit notes for customer returns, are presented.

Manual inventory posting – Change of inventory owner within a warehouse (Revaluation)

Revaluation is done through a manual inventory posting.

Through the receipt posting for the firm in Germany, the item is evaluated with this price that is a sales price of the firm in Austria. In the course of posting the supplier invoice for the firm in Germany, there must be a value correction that sets the inventory value of the item to the internal price (difference between supplier invoice price and internal price).

Revaluation of 10 exemplars of item 4711 from the inventory management organization in Vienna to the inventory management organization in Munich with a price of EUR10 per exemplar.

The inter-company billing (customer invoice and supplier invoice) is affected at EUR8. In the course of the supplier invoice posting, a value correction is generated with the single unit price of -EUR2. The result is the value of goods amounting to EUR80.

Central purchasing

In central purchasing, a firm orders items for another firm from the supplier. The supplier does not deliver to the ordering firm but directly to the actual recipient of items. The recipient receives the items and enters them for the orderer in their inventory. Only after inter-company billing, the inventory passes into the ownership of the recipient.

Due to the receipt of goods posting, data is saved for inter-company billing. If the billing is triggered and thus customer and supplier invoices are generated, the supplier invoice will accept the correction of the value for the recipient firm according to the internal price list The supplier invoice for the ordering firm does not involve any value correction since this organization does not accept any goods.

The firm in Austria orders 10 exemplars of item 4711 at a price of EUR10 per exemplar for the firm in Germany.

The firm in Germany enters a receipt of goods for item 4711. The receipt posting is priced at EUR10. This price results from the purchase order line item which was assigned to the receipt of goods line item before posting.

The inter-company billing (customer and supplier invoices) is based on the price of EUR8. In the course of the supplier invoice posting, a value correction is generated with the single unit price of -EUR2. The result is the value of goods amounting to EUR80.

Please consider that the quantities in the receipt of goods and the supplier invoice can differ from each other. In such case the standard valuations are applied.

The price which is entered for the firm in Austria based on the supplier invoice does not have any effects on the valuation.

Internal distribution

The internal distribution is based upon distribution orders. Distribution orders are to be distinguished in the Delivery and Value correction categories.

Distribution orders of Delivery type

The transfer posting from the source warehouse to a transit warehouse is made upon delivery of the delivery order based on the distribution order. At the same time a receipt of goods is created for the destination organization with which the transfer posting can be carried out from the transit warehouse to the destination warehouse. This transfer posting (receipt) is valuated with the price of the distribution order.

The inter-company billing is affected on the basis of the delivery and so the inventory posting of the “Issue transfer posting” posting process. If customer and supplier invoices are created, they will contain prices according to the internal price list.

In the course of posting the supplier invoice for the firm in Germany, there must be a value correction that sets the inventory value of the item to the internal price (difference between the price in the internal price list and the evaluation of the warehouse receipt in accordance to the assigned distribution order line item).

The delivery order is generated on the basis of the distribution order. During the delivery a warehouse transfer from the source warehouse to the destination warehouse, amounting to 10 EUR, is generated.

At the same time, the warehouse receipt for the 4711 item is generated for the firm in Germany in reference to the distribution order. Received item is reduced from 10 to 9 pieces. One item piece remains in the destination warehouse and must be transferred manually later.

The receipt posting is priced at EUR10. This price results from the distribution order line item which was assigned to the receipt of goods line item before posting. That’s why received goods are evaluated to 9 EUR.

The inter-company billing (customer and supplier invoices) is performed with the price 8 EUR for 10 pieces.

In the course of the supplier invoice posting, a value correction is generated with the single unit price of -EUR 2 and for reduced quantity of 9 pieces. So, the value of the goods is 72 EUR.

In order to obtain a correct value, through a manual warehouse posting of Transfer type, it is necessary to determine the correct price of the lacking piece, which is 8 EUR.

Distribution orders of Value correction type

With the use of distribution orders of Value correction type, it is possible to make necessary corrections of inter-company billings.

A distribution order line item entered during the value correction, is associated with the customer invoice generated within the inter-company billing. The reason of such customer invoice can be, for example, an error regarding the amount of the invoice.

The value credit note does not contain any warehouse and the quantity is always equal to 0. On the basis of value credit notes, new pair of invoices is directly generated (customer and supplier invoice) for inter-company billing purposes.

When posting the new supplier invoice, the value of the original supplier invoice is also corrected. The reference to the original supplier invoice is determined on the basis of assigned value credit note and customer invoice on which the value credit note is based and on the basis of the supplier invoice associated with the customer invoice.

The system searches for the original supplier invoice during the posting process. This represents a reference to the relevant original warehouse receipt which can be used in the standard evaluation for determining new correct price (again, only for the 9 received pieces).