Topic overview

This article describes the valuation procedures supported by the system. You can also find out which processes can lead to a revaluation of item stocks and what effect they have on other processes and applications. The applications used and their fields, actions and procedures are described in separate article.

This article describes the valuation process supported by the system. You will also find out what processes can lead to a revaluation of inventories of items and what effect they have on other processes and applications. The applications used for this purpose and their fields, actions and procedures are described in detail in separate articles.

Definitions of terms

Inventory valuation

Inventory valuation is an ongoing calculation of the corresponding value for item inventory available in the warehouse. The value is expressed in monetary units in the corresponding internal currencies. All inventory postings that cause changes to the quantity or value of inventoried items are documented in various valuation processes. In the course of

generating the inventory postings, the inventory and its valuation is updated on the basis of the floating average price method. The full sequence of dated inventory valuations, such as tFIFO (first in/first out) or LIFO (last in/first out), can only be identified after the posting period has been closed.

Inventory owner

The inventory owner is the legal possessor of the specified warehouse inventory. The inventory owner is used for many inventory management processes, for example, inventory counts and inventory valuation. For each business process, it may be necessary to specify the inventory owner in order to determine whose inventory is used or considered in a process.

Warehouse inventory management

Warehouse inventory management is an ongoing recording of the current warehouse inventory. The inventory management server updates these values after every inventory posting with a quantity transaction. Warehouse inventory

management is done at the lowest structural level of the warehouse and item or identifier. If the item has several parallel inventory units, then quantities are maintained for each unit. Inventory quantities can have different properties, such as subdivision into different quality statuses.

Posting periods

Posting periods are time limits or time periods within a fiscal year. All postings, such as inventory postings, must be assigned to a posting period.

Posting process

The posting process for an inventory posting may be a receipt, issue, reposting, revaluation, or correction. The posting process used controls the way the inventory posting is processed.

FIFO

The FIFO (First In—First Out) assessment process is a consumption-based process and a fiscal valuation method (according to taxation law). FIFO stands for the assumption that the first inventories acquired are also the first to be consumed. The calculation of the inventory value is therefore based on the receipts received last.

Moving average price (MAP)

The moving average price valuation method is one form of weighted average price valuation. It is in the group of valuation simplification methods and is a valuation method for inventory recognized in trade law. The moving average

price is defined as the value of inventory divided by the quantity. At every inventory posting of a receipt, it is recalculated and remains valid until the next receipt. It is used for valuation of issues.

Inventory management server

The inventory management server is responsible for ongoing recording of the current warehouse inventory quantities and for maintaining the moving average prices in the warehouses assigned to it. In warehouses subdivided into storage locations, the inventory management server has additional tasks, such as reserving storage locations and inventory, and reconciling inventory count differences. When an inventory management server is launched, a batch job is generated. If a warehouse is subdivided into storage locations, then the data relevant for storage location control is loaded into a cache, to minimize access time.

Last cost price

The last cost price is part of inventory valuation. It is the cost price of the last purchase as calculated from the purchase order and the supplier or supplementary cost invoices.

LIFO

The LIFO (Last In—First Out) assessment process is a consumption-based process and a fiscal valuation method (according to taxation law). LIFO stands for the assumption that the last inventories acquired will be consumed first. The

calculation of the inventory value is therefore based on the receipts received first.

Valuation methods

Items of various owners can be stored in one warehouse. In inventory management, the amounts are stated differentiated according to owners. The same applies in the inventory valuation; however, inventory valuation ensues exclusively for owners, who are the firms of their own corporate group.

Any changes in quantity and value of inventoried items are documented in the form of inventory postings. Inventory postings can be created by upstream processes, but they can also be recorded manually in the Inventory postings application.

The inventory postings are processed by the inventory management server responsible for the warehouse. The processing is done asynchronously in the same order as the inventory postings are generated or created. In the course

of processing, the inventory posting is completed e.g. with the posting value and the non-assignable share of the posting value. Then the inventory values are updated based on the information in the inventory posting and the posting key used. This procedure means that only after the successful processing by the inventory management server, the value changes caused by inventory postings are visible in the related query applications (e.g. Cockpit: Current inventory values or Inventory value query).

Article inventories are valued on a continuous (or moving) basis and periodized (by posting period). The continuous valuation methods include the moving average price and the last cost price. These two values are automatically updated when the material postings are processed.

The item inventories are valuated continuously (or moving) and presented as periodized (according to the accounting period). The continuous valuation methods include the moving average price and the last cost price. These two values are automatically updated in the processing of inventory postings.

In the Customizing application it is determined, according to which of the following methods a periodized valuation will be possible:

- Periodized average price, (results automatically from the periodized inventory and the periodized inventory value based on the moving average price as at the end of the period)

- FIFO

- LIFO

- Annual LIFO

Inventory postings with a posting date that lies within the posting period to be calculated serve as the basis for the periodized valuations. The average price is displayed in the Cockpit: Periodic inventory values application. To display the FIFO and LIFO prices, the Inventory value query application (Item values periodic view) is available. For the annual LIFO prices, the applications Annual LIFO query and Average annual LIFO prices are available.

Both the continuous and the periodized inventory values are maintained at the following levels:

- Firm

- Item

- Location

identifierand classification, are currently neither filled in the standard nor can be supported in analyses, etc. and used for industry solution systems and customer adaptations. It means that inventory values cannot be maintained on the identifier level and no detailed data for identifiers are available for all valuation methods.In the Customizing application, Valuation function, you specify whether the inventories are valuated either at the level of items or also at the level of item/warehouse.

The inventory values are saved in the following business objects:

- Inventory values

Business object:com.cisag.app.inventory.obj.InventoryValuationIn this business object the (timeless) moving average price (attribute:averagePriceand the last cost price (attribute:lastPrice) are saved for each firm, item and warehouse. In addition, for increasing accuracy, a common price dimension (attribute:priceDimension) is available for both prices. A change of the price dimension in the item master data affects both the current instances of the inventory values. In the case of time-dependent items, the price dimension is updated immediately when changing the active item version. However, in the case of future versions, the change can take place no sooner than in the course of the first posting or utilization of the item in the valuation logic or the period-end closing. Changes in historical item versions do not slog through (anymore).

If theConsider in FIFO, LIFO and annual LIFO function is activated in the posting key, posting can also lead to an update of the date of the last receipt (attribute:lastIncomingDate) or the last issue (attribute:lastOutgoingDate).

Further fields are the last transaction date, the last transaction number, as well as various quantity-average fields which are updated in the course of a period-end closing.NoteWith the Items valuation level set, the information for the moving average price, the last cost price and the inventory value on the Item/warehouse level is not maintained. In this configuration, the values of the Item/warehouse level are calculated according to the parent item level from the item inventory value and the item inventory as well as the item/warehouse inventory. Any rounding differences are assigned to / deducted from the greatest value. - Period inventory values

Business object:com.cisag.app.inventory.obj.InventoryOnhandPeriodSummaryIn this business object, the stock quantities and stock values are stored according to the moving average price principle per company, booking period, article and storage location. The periodized average price is calculated from the attributes beginValue, periodValue, beginQuantity and periodQuantity per summarization level and displayed in the associated query applications.

In this business object, the inventory quantities and inventory values are saved according to the principle of moving average price per firm, posting period, item and warehouse. The periodized average price is calculated on the basis of the attributesbeginValue,periodValue,beginQuantityandperiodQuantityper compression level and is displayed in the relevant query application.

If the Consider in FIFO, LIFO and annual LIFO function is activated in the posting key, the posting leads to the update of the receipt quantity/value (attribute:incomingQuantity/incomingValue) and the issue quantity/value (attribute:outgoingQuantity/outgoingValue) – depending on the posting procedure.NoteWith the Items valuation level set, the information for the period begin value, period inventory value, period receipts value, period issued value on the Item/warehouse level is not maintained. In this configuration, the values of the Item/warehouse level are calculated according to the parent item floor from the item period inventory value and the item period inventory as well as the item/warehouse period inventory. Any rounding differences are assigned to / deducted from the greatest value. - Valuation totals for each method and period

- Business object for FIFO and LIFO:

cisag.app.inventory.obj.InventoryValuePeriodSummary - Business objects for annual LIFO:

com.cisag.app.inventory.it.obj.InventoryYearLifo

com.cisag.app.inventory.it.obj.InventoryYearLifoPrice

com.cisag.app.inventory.it.obj.InventoryYearLifoReference

If the Consider in FIFO, LIFO and annual LIFO function is activated in the posting key used, then the inventory values are saved in the respective business object according to the valuation methods FIFO, LIFO and annual LIFO per firm, posting period, item and warehouse. In this way it is possible to indicate in the posting key, if a posting is also relevant to other valuation methods than the moving average price. The values at the end of the period are calculated from the

beginValueandperiodValueattributes for each compression level and are displayed in the Inventory value query application. - Business object for FIFO and LIFO:

With all inventory postings representing a quantity movement, the inventory quantities are updated for each period and compression level. If an inventory posting represents a value change, and the posting key provides an inventory valuation, also the inventory values are updated.

In the case of an inventory posting which represents receipts or corrections, the inventory management server updates the moving average price. If the receipt or the value correction are derived from a purchase order, then the last cost price is updated in addition. Issues, in contrast, are always valued depending on the current moving average price. Thus the issues do not lead to a change in the moving average price (except for rounding-off differences).

If the current inventory quantity in a local currency is negative, the moving average price for the local currency concerned is not updated. The difference from the posted and not updated inventory value is posted as unassignable. See Origin of unassignable amounts. However, the last cost price (if greater than zero) and a change of the price

dimension, if applicable, are saved.

The valuation takes place depending on the posting key that is used in the inventory posting. One of the following valuation price categories can be assigned to the posting key:

- Billing price 1

- Billing price 2

- Billing price 3

- Billing price 4

- Billing price 5

- Inventory count price

- Last cost price

- (Moving) average price

The billing prices 1 to 5 and the inventory count price are determined in the item master data. However, if the causative voucher fixes the price, then this price and not the valuation price from the item master data will be used.

Continuous valuation methods

The continuous valuations are calculated without taking into account the respective posting period. Continuous valuation methods include the moving average price and the last cost price. The moving average price is recalculated by the inventory management server at each inventory posting, which constitutes a receipt, and the last cost price is recalculated only for receipts from purchasing.

The continuous valuation is carried out in the order in which the inventory postings are processed by the inventory management server. This order does not necessarily coincide with the order in which the inventory postings were generated. If for example an error occurs for an automatically generated inventory posting, it persists more in the posting error log. If it is subsequently corrected, it is possible that the inventory management server will have already processed

error-free inventory postings for the same item (but at a different warehouse), but they were only generated after the erroneous inventory posting. In this case, the continuous moving average price can be different than in the case when the inventory management server processed all of the inventory postings in a strictly chronological order after their generation.

The continuous valuation methods are explained under:

Moving average price

The time of processing by the inventory management server, and not the posting date (as in the case of periodized average price), is decisive for calculating the moving average price. Backdated inventory postings may therefore lead to

discrepancies between the moving and the periodized average price.

For each inventory posting which constitutes a receipt, the inventory management server responsible for the warehouse updates the moving average price. A receipt exists if the posting key is from one of the following posting processes:

- Receipt

- Receipt transfer posting

- Receipt revaluation

- Correction

If in the case of a newly created item an issue posting is created immediately, without prior availability of the inventory, the average price is not defined. In this case the Billing price 1 from the item master data (at the level of the item) is used.

Until the next receipt is posted, the moving average price will remain valid for those inventory postings which represent issues. However, the issues are not directly valuated with the saved moving average price. Instead, the issue value

is calculated from the ratio of the current inventory value and the current inventory. Thus, possible rounding-off errors that result from small moving average prices and large inventory quantities are minimized. If the current inventory is zero, the issues are valuated with the last saved moving average price, if this price is larger than zero.

The following example for calculating the moving average price (MAP) comes from a newly created item. The initial values of the item are therefore zero. The posting date is the date of creation.

| Posting date |

Process | Quantity | Price | Inventory quantity | Inventory value | MAP |

| Feb 02 | Receipt | 100.00 | 10.00 | 100.00 | 1000.00 | 10.00 |

| Feb 03 | Issue | 80.00 | 20.00 | 200.00 | 10.00 | |

| Feb 04 | Receipt | 30.00 | 20.00 | 50.00 | 800.00 | 16.00 |

| Feb 05 | Issue | 20.00 | 30.00 | 480.00 | 16.00 | |

| Feb 06 | Issue | 20.00 | 10.00 | 160.00 | 16.00 |

On 7 February, a backdated inventory posting is created with a posting date of 30 January. The backdated inventory posting is presented below in italics.

| Posting date | Process | Quantity | Price | Inventory quantity | Inventory value | MAP |

| Feb 02 | Receipt | 100.00 | 10.00 | 100.00 | 1000.00 | 10.00 |

| Feb 03 | Issue | 80.00 | 20.00 | 200.00 | 10.00 | |

| Feb 04 | Receipt | 30.00 | 20.00 | 50.00 | 800.00 | 16.00 |

| Feb 05 | Issue | 20.00 | 30.00 | 480.00 | 16.00 | |

| Feb 06 | Issue | 20.00 | 10.00 | 160.00 | 16.00 | |

| 30 Jan | Receipt | 20.00 | 5.00 | 30.00 | 260.00 | 8.67 |

The inventory management server responsible for the warehouse processes the inventory postings in the order, in which they were created. The backdated inventory posting is thus considered for the update of the moving average price only after the last issue on 6 February. If the inventory positing was created on 30 January, the moving average price would amount to the value of EUR 13.81 instead of EUR 8.67 after the processing of the material inventory postings. See also the example under Periodized average price.

The calculation of the moving average price is affected by the valuation level set:

- Item valuation level:

The context for the calculation is item instance oriented. The average price is persisted only on this level. - Item/warehouse valuation level:

The context for the calculation is oriented on the inventory or the inventory value of the item/warehouse instance. In addition, the average price is updated in the parent level (item instance) (quotient of the item inventory value and item inventory, if greater than zero).

The (timeless) moving average price can be comfortably queried in the respective query applications. Both prices can

differ due to various influences, e.g., due to back-dated and inventory/inventory value changing inventory postings.

Last cost price

For the calculation, the pro rata amount of the invoiced supplier invoices and supplementary costs invoices for the delivered amount of a purchase or distribution order line item are considered. If the invoiced quantity is smaller than the delivered quantity, the value for the non-invoiced portion of the delivered quantity is determined and accounted for

based on the order.

For the Last cost price value from purchasing, the imputed procurement costs are taken into account for this calculation only as long as a supplementary cost invoice is posted for the line item.

Next, the resulting amount is divided by the delivered quantity (according to the order line item), producing the last cost price.

Purchase order line items

The update of the last cost price is conducted for priced purchase order line items under the following conditions:

- Either the used posting key uses the process Receipt

- and the delivered quantity of the inventory posting is larger than zero

- and the inventory posting has been assigned a purchase order line item or a receipt of goods line item (and thus indirectly in a purchase order line item)

- Or the used posting key uses the process Correction and the current inventory posting has been assigned the one purchase order line item based on which the last cost price had been determined, in the course of a receipt posting. This means, that if the last receipt is followed by an appropriate correction (and only then), the saved last cost price can be corrected in the inventory valuation with the help of a supplier invoice line item or a supplementary cost invoice line item.

On the other hand, an update on the last cost price for non-priced purchase order line items is possible under the following conditions:

- for the related purchase order line item, the value of goods is zero at time of posting

- the receipt of goods was posted with a value of zero

- the correction posting of the supplier invoice was carried out with a posting key for which the Roll-up valuation category was selected.

If the above conditions are met and a material correction posting is carried out in the course of a supplier invoice posting, then the last cost price can be updated.

Distribution order line items

The last cost price is updated for distribution order line items from the Delivery category under the following conditions:

- Either the posting key used is of the Receipt transfer posting process

- and the delivered quantity of the inventory posting is greater than zero

- and the inventory posting has a receipt of goods line item (and thus, indirectly, a distribution order line item) assigned

- Or the posting key used is of the Correction process and the current inventory posting has the distribution order line item assigned with which the last cost price was created in the course of a receipt transfer posting. It means that if a corresponding correction follows the last receipt, the last cost price saved can be corrected with the use of a receipt or supplementary costs invoice line item in the inventory valuation

Manual receipt posting

The last cost price is not updated with manual receipt postings without reference to receipt of goods line items or purchase order line items. In the case of production order receipts and distribution orders of the Value correction category, the last cost price is not updated, either.

Calculation

The calculation of the last cost price is affected by the valuation level set:

- Item level – the context for the calculation is item instance oriented. The last cost price is persisted only on this level.

- Item/warehouse level – the context for the calculation is item warehouse instance oriented. In addition, the parent level (item instance) is updated as well.

The last cost price can be queried in the respective query applications. Another possibility to view the last cost price of an item is to either use a report or, for example, create an inventory posting from the Receipt posting process in the desired warehouse without saving. If the Last cost price valuation price was saved for the posting key, the last cost

price of the item is quoted in the Price field.

Periodized valuation methods

A periodized valuation considers all relevant inventory postings of a given posting period. Backdated inventory postings are assigned to the posting period in which falls the date of entry. The periodized valuation methods include the periodized average price and valuations based on the FIFO and LIFO principle. Which periodized valuation methods are available, depends on the settings in the Customizing application, Valuation function and the settings in the respective item master data. The periodized average price – just like the moving average price – is indirectly recalculated by the inventory management server for in every inventory posting that represents a receipt or a correction. Therefore, you can query the inventory values based on the principle of moving average price per posting period, without having them previously calculated. The valuation methods FIFO and LIFO are mainly used for subsequent valuation of inventories and are typically calculated only after the completion of the posting period. The inventory values for these so-called revaluation methods need to be calculated before you can query them.

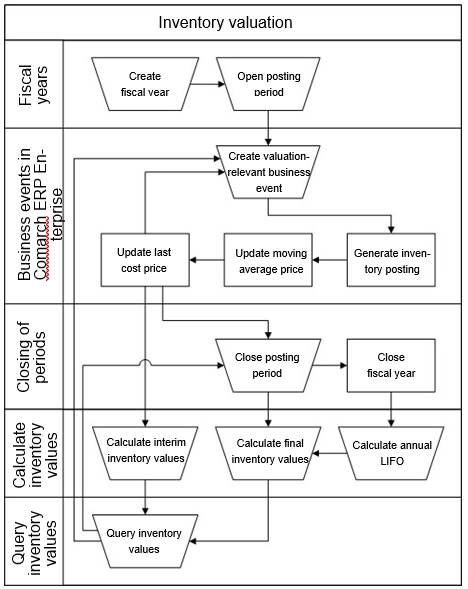

The following figure shows schematically the process of calculating the inventory values.

The calculation of periodized inventory values according to the FIFO and LIFO principle takes place in the Calculate inventory values application for a particular posting period. The inventory values are calculated completely. This means that calculation is done for all previous posting periods that are either open or for which a final calculation of inventory values has not yet been performed. In order to be able to calculate the inventory value for a posting period, make sure all posting periods of the previous fiscal year are closed. If the posting period is already closed, no further inventory postings can be assigned. In closed posting periods, the calculation is final and the inventory values cannot be recalculated. If the posting period is open, the calculation can be repeated as often as required. In this case, the valuations are preliminary. After the fiscal year is closed, also the FIFO and LIFO valuations for this closed year have to be carried out before either a preliminary or final valuation will be possible in the new fiscal year. It is sufficient to perform subsequent valuations for the last period of the closed fiscal year.

In the calculation of periodized inventory values, the inventory values as of the end of the previous posting period are applied as the initial values of the posting period which is to be calculated. This value represents the inventory valuation at the end of the posting period, plus the valuation of all receipts and minus the valuation of all issues on the basis of the inventory postings saved in the system.

To be able to retrieve the periodized average price on a certain compression level, a data record must be available. A record is generated in the following cases:

- The first valuation-relevant inventory posting for the compression level is processed by the inventory management server.

- A valuation-relevant inventory posting, backdated to the previous period, is processed by the inventory management server. In this case, the period end value is transferred to the period beginning value of the same compression level of the subsequent posting period.

- The previous period is closed. In this case, the period end values are transferred to the period beginning values of the subsequent posting period.

This means, among other things, that the inventory values of a newly created item cannot be queried for the previous posting periods (no periodized data is available).

The results of the calculation can be displayed in the Inventory value query application per accounting period.

have already been generated, to a new inventory account, you may have to close out the item manually before you change the inventory account.

The periodized valuation methods are explained under:

Periodized average price

The valuation process of the moving average price is a special form of the weighted average price method. It belongs to the methods of valuation simplification and is a method of commercial inventory valuation.

The posting period, and not the time point of processing by the inventory management server (as in the case of moving average price), is decisive for calculating the periodized average price. However, the quantity and the value are derived from the underlying inventory posting, under consideration of any possible existing unassignable portions that are oriented according to the current inventory values. Thus, back-dated inventory postings can lead to deviations up to serious differences (positive periodized inventory, negative periodized inventory value) between the (timeless) moving average price and the periodized average price.

The periodized average price (PAP) for the example under Moving average price for the posting period of January is as follows:

| Posting date |

Process | Quantity | Price | Inventory quantity | Inventory value | PAP |

| Beginning of period | 0.00 | 0.00 | 0.00 | |||

| 30 Jan | Receipt | 20.00 | 5.00 | 20.00 | 100.00 | |

| End of period | 20.00 | 100.00 | 5.00 | |||

The following values are generated for the accounting period in February:

| Posting date |

Process | Quantity | Price | Inventory quantity | Inventory value | PAP |

| Beginning of period | 20.00 | 100.00 | 0.00 | |||

| Feb 02 | Receipt | 100.00 | 10.00 | 100.00 | 1000.00 | |

| Feb 03 | Issue | 80.00 | 20.00 | 200.00 | ||

| Feb 04 | Receipt | 30.00 | 20.00 | 50.00 | 800.00 | |

| Feb 05 | Issue | 20.00 | 30.00 | 480.00 | ||

| Feb 06 | Issue | 20.00 | 10.00 | 160.00 | ||

| End of period | 30.00 | 260.00 | 8.67 | |||

All inventory postings with a posting date that lies within the posting period that is to be calculated are used to calculate the periodized average price. Please note that the periodized average price has a different value (8.67 €) than if the inventory postings were created strictly chronologically according to the posting date (13.81 €). Also in the case of the periodized average price no actual roll-up of the backdated inventory postings takes place.

At the start-up of a system, begin both with inventories and with suitable values (e.g., from the old system, or valuate the inventories at least with calculative billing prices).

The periodized average price is calculated on the basis of the business object com.cisag.app.inventory.obj.InventoryOnhandPeriodSummary from the quotient of the period-end inventory value and the period-end inventory . The periodized average price results from the sum me of the inventory value at the beginning of the posting period and the period value, divided by the sum of the inventory quantity at the beginning of the posting period and the period quantity.

The periodized average price is calculated based on the business object com.cisag.app.inventory.obj.InventoryOnhandPeriodSummary from the quotient of the period-end inventory value and the period-end inventory. The periodized average price is determined by the total of the inventory value at the beginning of the posting period and the period value, divided by the total of the inventory quantity at the beginning of the posting period and the period amount.

(beginValue + periodValue) / (beginQuantity+ periodQuantity)

The calculation of the periodized average price depends on the valuation level set and its data:

- Item valuation level

The periodized average price is calculated from the item instance and the formula for the periodized average price. The item warehouse values in open periods are temporarily zero and are calculated for the display according to the periodized storage end inventory and the periodized item average price. The periodized item warehouse period values are calculated and aliquoted based on the available item period values no sooner than in the course of the period-end closing.

- Item/warehouse valuation level

The periodized average price is calculated separately for each item/warehouse instance from the formula for the periodized average price. The item instance is used as the total of all item/warehouse instances.

FIFO

The FIFO (first in—first out) valuation method sets the sequence of inventory removal and is also a method of inventory valuation for fiscal (taxation) purposes. In FIFO, inventory that was put away first will also be withdrawn first. The inventory value is calculated on the last inventory received. With increasing inventories, the increases are valuated with the acquisition costs of the last receipts in the period.

The inventory values are calculated at the end of the respective posting periods. Due to the different considered periods, these values can deviate significantly from those at the end of a fiscal year. Depending on the level of valuation selected in the Customizing application, Valuation function, the calculation takes place at the level of the item (across all the warehouses) or at the level of item/warehouse.

The following table describes the calculation for an item with an inventory of 100 pieces at the beginning of the period, at a price of 10.00 €. In the posting period to be calculated, the following inventory postings were created

| Posting date | Process | Quantity | Price | Inventory quantity | Inventory value | FIFO price |

| Beginning of period | 100.00 | 1000.00 | 10.00 | |||

| Feb 10 | Issue | 60.00 | 40.00 | |||

| Feb 11 | Receipt | 10.00 | 15.00 | 50.00 | ||

| Feb 12 | Issue | 30.00 | 20.00 | |||

| Feb 13 | Receipt | 20.00 | 20.00 | 40.00 | ||

| End of period | 40.00 | 650.00 | 16.25 | |||

At the end of the accounting period, the inventory amounts to 40 pieces. Since this inventory is composed of the last receipts of the posting period, it is valued at the prices of these receipts. The valuation at the end of the posting period is

therefore € 650.00. This valuation consists of 20 pieces of the last receipt for € 20.00, 10 pieces of the second to last receipt for € 15.00 each, and 10 pieces of the inventory at the beginning of the period for € 10.00 each.

The valuation following the FIFO principle is saved in the business object com.cisag.app.inventory.obj.InventoryValuePeriodSummary. If the attribute valuationMethod has the value of FIFO, then the attributes beginValue and the periodValue include the FIFO values. The saving takes place per firm, both for multiple warehouses and for each warehouse. The valuation according to the FIFO principle arises from the periodic initial value plus the receipts that are relevant for FIFO and minus the issues that are relevant for FIFO, based on the inventory postings that are saved in the system.

In the case of the FIFO method only end-of-period totals, and not individual movements, are displayed in the Inventory valuation query application.

LIFO

The LIFO (Last In, First Out) valuation method is a consumption-based method and a fiscal valuation method (according to taxation law). In LIFO, the last inventories acquired will be consumed first. The inventory value is therefore calculated on the receipts received first.

The inventory values are calculated at the end of the considered posting periods, retrospectively. Due to the different considered periods, these values can deviate significantly from those at the end of a fiscal year. Depending on the

level of valuation selected in the Customizing application, Valuation function, the calculation takes place at the level of the item (across all the warehouses) or at the level of item/warehouse.

The following table describes the calculation of the LIFO value for an inventory item with an inventory of 20 pieces at the beginning of the period, at 10.00 € each. In the posting period to be calculated the following inventory postings were created:

| Posting date | Process | Quantity | Price | Inventory quantity | Inventory value | LIFO Prize |

| Beginning of period | 20.00 | 200.00 | 10.00 | |||

| Feb 10 | Departure | 10.00 | 10.00 | |||

| Feb 11 | Access | 40.00 | 15.00 | 50.00 | ||

| Feb 12 | Departure | 30.00 | 20.00 | |||

| Feb 13 | Access | 20.00 | 20.00 | 40.00 | ||

| End of period | 40.00 | 500.00 | 12.50 | |||

At the end of the posting period, the inventory amounts to 40 pieces. Since this inventory is composed of the initial inventory and the first receipts of the posting period, it is valued at the prices of these receipts. The valuation at the end

of the posting period is therefore € 500.00. This valuation consists of the initial inventory of 20 pieces for 10.00 € each and the first receipt of 20 pieces for 15.00 € each.

The valuation following the LIFO principle is saved in the business object com.cisag.app.inventory.obj.InventoryValuePeriodSummary. If the attribute valuationMethod has the value of LIFO, then the attributes beginValue and periodValuehave the LIFO values. The saving takes place per firm, both for multiple warehouses and for each warehouse. The valuation according to the LIFO principle arises from the value at the beginning of the period plus the receipts that are relevant for LIFO and minus the issues that are relevant for LIFO, based on the inventory postings that are saved in the system.

In the case of the LIFO method, only period-end totals, and not the individual movements, are displayed in the Inventory valuation query application.

Annual LIFO

The annual LIFO valuation method is available in the country version for Italy. Please read the article Annual LIFO for a detailed description of the annual LIFO valuation method.

Valuation categories

The following valuation categories can be selected in the posting key:

- Interim

- Final

- Roll-up

- Roll-up of additional costs

The valuation categories Interim, Roll-up and Roll-up of additional costs are, inter alia, relevant to the processes of receipt of goods, supplier invoices and supplementary cost invoices.

In addition, the inventory valuation setting in the posting key is to be considered. With inventory postings using a posting key with inventory valuation, all relevant inventory values are updated. If, on the other hand, a posting without inventory valuation takes place, the inventory values such as item account, average price, inventory accounts and item/warehouse values are not updated.

Posting keys without inventory valuation can be used for a pure quantitative inventory management, where inventory values are generally not important. If, however, an item/warehouse has been valuated at least once, the use of a posting key without inventory valuation is no longer recommended, since the inventory values are not updated after such posting (without inventory valuation) which may result in inconsistencies in the subsequent processes.

The valuation categories are described in under:

Interim

The Interim valuation category allows that an inventory posting representing a receipt has a preliminary valuation and that it can be re-valuated (rolled-up) in the course of a further inventory posting. Normally, receipts of goods are posted with a posting key of the Interim valuation category so they can be valuated again when creating a supplier invoice or a supplementary costs invoice. A roll-up of a receipt of goods takes place e.g. when there are deviations from the originally planned values or the cost price of the purchase order line item. The reasons for it can be price deviations detected in the supplier invoice or supplementary costs for e.g. freight forwarding, transport charges, express service charges, customs, etc.

If a posting key of the Interim valuation category is used for posting a receipt of goods, it is necessary to consider the settings of the posting key used for the supplier invoice. For supplier invoices, the posting key should then be of the Roll-up valuation category and for supplementary cost invoices it should be of the Roll-up of additional costs category. Both posting keys should have activated the Inventory valuation check box.

In the case of receipts of goods from purchasing, the received quantity is always valued at the price as per purchase order line item. In the case of receipts of goods from production the valuation takes place at the valuation price provided in the used posting key.

Final

Inventory postings of the Final valuation category, e.g. posting of receipts of goods, cannot be re-valuated (rolled-up) through a later inventory posting (correction posting from the supplier invoice or supplementary costs invoice). The inventory valuation is therefore considered as final.

Roll-up and roll-up supplementary costs

The inventory postings which result from the posting of supplier invoices and supplementary cost invoices can have a posting key of the Roll-up or Roll-up of supplementary costs valuation category, which leads to a correction of the inventories posted in the receipt of goods to the calculative cost prices from the purchase order. If the receipt of goods is posted after the supplier invoice, then the receipt of goods is valuated with the value from the supplier invoice.

A roll-up is possible only in open posting periods, provided that the item still remains on stock. Any issues that took place in the meantime are not rolled up again and valuated again.

valuation. This applies to the purchasing process, as well as to any claims for the return of goods. Correct handling is to be ensured from the organizational point of view.

The following example describes an interim valuation of a receipt of goods and the subsequent roll-up when posting the supplier invoice:

A roll-up can be done only as far as the delivered item is still at the warehouse. In the case of a roll-up the current inventory of the item is compared with the quantity of the purchase order line item. If the current inventory is smaller than the quantity in the purchase order line item, the roll-up takes place as regards the proportion of the available inventory. The amount not distributed to an item is marked as unassignable and is not considered in the inventory valuation.

The following example describes the same receipt of goods with roll-up as the last example, under the assumption that the current inventory is 5 pcs at roll-up:

If in the example above on 19 December the whole inventory had been withdrawn, then there would have been no inventory of this item available when posting the supplier invoice. In this case the whole discount of € 50.00 would have to be marked as unassignable.

In the calculation of the inventory that is available at the time of roll-up, the inventory with identifiers are by no means taken into account. If a roll-up of an item that is managed by identifiers takes place, it is irrelevant which identifiers are withdrawn and which of them are still available in the warehouse.

Origin of unassignable amounts

Unassignable movements are value-neutral, with no further impact on the inventory valuation and are used only for documentation. They can, inter alia, arise as follows:

- Rounding differences

To avoid the warehouse inventories with zero quantities produce a values due to rounding-off errors, possible rounding-off differences are marked as unassignable. - Roll-up for a closed posting period

If the inventory posting which is to be rolled-up is located in a closed posting period, roll-up is not possible. The value in the inventory posting is marked as unassignable. - Roll-up at zero inventories

If the received quantity is no longer available in the warehouse when the roll-up due to a supplier invoice or supplementary costs invoice takes place, because the item was sold to customers or consumed, roll-up is not possible. - Negative receipts with zero passage of the inventory value in the case of positive inventory

In the event that in a negative receipt posting, the inventory remains positive, but the inventory value would become zero or negative, such inventory postings will be posted at the current average price. The zero line is used as the threshold; in an extreme case where the resulting inventory value is less than zero or equal to zero, the negative receipt posting is valuated forcibly with the available average price. The resulting difference from the stated posting value is marked as unassignable. - Negative value adjustments with zero passage of the inventory of value at current positive inventory

In the case of posting negative value adjustments and forced fall under the zero line, the resulting negative proportion is marked as unassignable. - Receipts in the case of negative quantities

When posting receipts of items with a negative inventory quantity, as many receipts are posted as unassignable as are necessary to bring the item to a zero inventory.

The following describes by way of examples, how unassignable amounts may result in the case of negative inventory quantities. The first example shows a receipt with a negative inventory quantity, while the new inventory quantity remains negative:

The next example shows a receipt with a negative inventory quantity, leading to a zero inventory:

If the receipt leads to a positive quantity, the new moving average price is composed of the valuation price of the receipt and the new inventory quantity, as shown by the following example:

If the posting in the last example led to a negative inventory value, the unassignable amount would be negative, as shown by the following example:

Valuation-relevant processes

Basically inventory postings, which represent the receipts, are valuated using the valuation price specified in the applied posting key. When creating inventory postings manually, this valuation price is used as a default. Some business processes differ from this scheme, however, because fix a valuation of price, for example, from a preceding voucher. In this case, the specified price, and not the price of the posting key, is used for the valuation.

This section explains the processes that generate an inventory posting, and thus lead to an update of the inventory valuation.

- Receipt of goods from purchasing

- Receipt of goods from purchasing as part of supplier consignment

- Receipt of goods from production

- Receipt of goods from distribution orders

- Receipt of goods from customer returns

- Supplier invoice

- Supplementary costs invoices

- Cancellation of a supplier invoice or a supplementary costs invoice

- Completion of an inventory count

- Relocation

Receipt of goods from purchasing

A receipt of goods from purchasing is valuated at the price that was specified in the related purchase order. When posting the receipt of goods, an inventory posting is generated, which automatically updates the moving average price

and the last cost price of the item. If the supplier invoice associated with the purchase order is already posted, then the more exact valuation price from the supplier invoice is used. If the invoiced quantity is smaller than the ordered quantity in the purchase order, then the difference will be valuated at the price from the purchase order. Even if the quantity posted in the receipt of goods is larger than the ordered quantity in the purchase order (over-delivery), the difference is valuated at the price from the purchase order.

If only a partial quantity was delivered and this under-delivery was accepted as the final delivery by completing the delivery manually, any additional costs that have not yet been charged are corrected. This may result in unassignable amounts.

For receipts of goods from purchasing, please note the special features described under:

- Surcharge distribution for the first partial delivery

- Calculation basis for receipt of goods valuation

Surcharge distribution for the first partial delivery

Absolute surcharges in a purchase order line item can be allocated not only proportionally to the received quantities in the case of partial deliveries (Distribute by partial deliveries), but, if the Assign completely to the first partial

delivery parameter is activated, they are immediately allocated to the inventory account in the course of the first receipt of goods.

The purpose of this parameter is to avoid a too-low valuation of partially delivered quantities – until arrival of a supplier invoice – and, in return, a too-high valuation in the case of any over deliveries (through proportional surcharges).

A simple example for visualization:

PO = purchase order

RG = receipt of goods

SI = supplier invoice

AP = average price

AP[with] = AP with activated Assign complete to the first partial delivery parameter

AP[without] = AP without complete assignment at the first partial delivery, the Distribute by partial deliveries parameter is activated.

Here, we have an order of 10 pieces, at a price of € 10.00 and a surcharge of € 5.00. The receipts of goods are distributed to 3 partial deliveries, the first receipt of goods reposts, in addition to the value of goods, the surcharge of € 5.00 to the inventory account, no procurement costs available.

| Voucher | Quantity | Price | Surcharge | Amount/ value | AP [with] |

AP [without] |

| PO | 10 pcs | 10.00 | 5.00 | 105.00 | – | – |

| RG 1 | 5 pcs | 5.00 | 55.00 | 11.00 | 10.50 | |

| RG 2 | 3 pcs | – | 30.00 | 10.625 | 10.50 | |

| RG 3 | 2 pcs | – | 20.00 | 10.50 | 10.50 | |

| SI | 10 pcs | 105.00 | 10.50 | 10.50 |

In the example below, small quantities are reposted to the partial deliveries first. It shows the relatively strong increase of the average price after the first partial delivery.

| Voucher | Quantity | Price | Surcharge | Amount/ Value | AP [with] |

AP [without] |

| PO | 10 pcs | 10.00 | 5.00 | 105.00 | – | – |

| RG 1 | 1 pc | 5.00 | 15.00 | 15.00 | 10.50 | |

| RG 2 | 1 pc | – | 10.00 | 12.50 | 10.50 | |

| RG 3 | 8 pcs | – | 80.00 | 10.50 | 10.50 | |

| SI | 10 pcs | 105.00 | 10.50 | 10.50 |

Calculation basis for receipt of goods valuation

The following calculation basis – presented in simplified form – is used for determination of the goods values, non-recurring surcharges and procurement costs:

| Attribute | Explanation |

valueInvoicedGoods |

The total of the supplier invoice values without supplementary costs, which refers to the already invoiced amount in attribute invoicedQty. This value is important if supplier invoices for the delivered purchase order line item have already been posted before the receipt of goods. |

valueInvoicedGoodsPosted |

An amount saved in the purchase order line item. It is the proportion of the attribute valueInvoicedGoods, which was posted in the inventory account so far and is therefore covered by appropriate receipts of goods. |

iValue |

Temporary variable for the already invoiced value. The variable is needed for the calculation (see Calculation at the end of the attribute explanations). This value increases or decreases the value of the attribute valueInvoicedGoodsPosted in the case of credit notes and is a summand for the calculation of the inventory posting value in the attribute goodsValueResult. |

valueGoods |

An amount saved in the purchase order line item. The total net value of goods excluding procurement costs, based on the total quantity of the purchase order line item in the attribute totalQty. |

valueGoodsPosted |

An amount saved in the purchase order line item. It is the proportionate amount of the attribute valueGoods, which was posted to the inventory account so far but has not been billed yet. |

niValue |

Temporary variable for the not yet invoiced value. The variable is needed in the calculation (see Calculation at the end of the attribute explanations). This value increases or decreases the value of the attribute valueGoodsPosted in the case of credit notes and is a summand for the calculation of the inventory posting value in the attribute goodsValueResult. |

surchargeGoods |

An absolute surcharge amount, maintained in the purchase order line item. The surcharge results from the line item discount total of those purchase price component types in which the Assign completely to the first partial delivery parameter is activated. This surcharge applies to the total quantity of the purchase order line item. |

surchargeGoodsPosted |

An amount saved in the purchase order line item. The proportional amount of the surchargeGoods attribute that has been posted to the inventory account but has not been cleared yet. |

niSurchage |

Temporary variable for the yet non-invoiced surcharge of the first delivery. The variable is necessary for the calculation (see Calculation at the end of the attribute explanations). This value increases or decreases the value of the surchargeGoodsPosted attribute in the case of credit notes and is a summand for the calculation of the inventory posting value in the goodsValueResult attribute. |

additionalCosts |

An amount saved in the purchase order line item, which says which supplementary costs were posted so far with supplier invoices and supplementary costs invoices for this purchase order line item. |

additionalCostsPosted |

An amount saved in the purchase order line item. It is the proportion of additionalCosts attribute which has been posted to the inventory account so far. |

iCosts |

Temporary variable that is is necessary for the calculation (see Calculation at the end of the attribute explanations). The variable increases or decreases the value of the attribute additionalCostsPosted and is a summand for the calculation of the inventory posting value in the attribute costsValueResult. |

calculatedCosts |

An amount saved in the purchase order line item. The value represents the procurement costs (supplementary costs known in advance) related to the total quantity of the purchase order line item in the attribute totalQty. |

calculatedCostsPosted |

Amount amount saved in the purchase order line item. It is the proportion of the calculatedCosts attribute which has been posted to the inventory account so far. |

niCosts |

Temporary variable for the amount not yet invoiced. The variable is necessary for the calculation (see Calculation at the end of the attribute explanations). This value increases or decreases the value of the attribute calculatedCostsPosted and is a summand for the calculation of the inventory posting value costsValueResult. |

totalQty |

Total quantity of the purchase order line item. |

transQty |

Total quantity of the receipt of goods line item or the posted quantity of the considered receipt of goods. |

iQty |

Partial quantity of the posted quantity of the considered receipt of goods in the attribute transQty, for which received supplier invoices have alreadybeen posted. |

niQty |

Partial quantity of the posted quantity of the considered receipt of goods in the attribute transQty, for which no supplier invoices have been posted yet. |

invoicedQty |

Currently invoiced quantity, i.e. partial quantity of the procurement order item for which received supplier invoices have already been posted. |

receivedQty |

Currently received quantity, i.e. portion of the purchase order line item, for which receipts of goods have already been posted. |

valuationValues[] |

Total result value of the calculation of the available algorithm that consists of the partial results goodsValueResult (value of goods) and costsValueResult (procurement costs). The share of goods value share and the available share of procurement costs are posted – due to the nominal ledger posting situation – as separate inventory posting. |

goodsValueResult |

Result of the value of goods from the calculation. With this value the receipt inventory posting will be provided. |

costsValueResult |

Result of the procurement cost or expenses from the calculation. This value proportion is posted as a separate correction movement in the course of the receipt of goods. |

Calculation

Preparation of the anciliary variables:

niQty = transQty - iQty

iCosts = (additionalCosts * transQty) / totalQty

niCosts = (calculatedCosts * transQty) totalQty

The delivered quantity in the receivedQty attribute updates:

receivedQty += transQty

The values determined for this posting of goods are calculated according to the following formulas:

iValue = (iQty * (valueInvoicedGoods - valueInvoicedGoodsPosted)) / invoicedQty

niValue = (niQty * valueGoods) / totalQty

niSurcharge = surchargeGoods (for the first receipt of goods, i.e., delivered and cleared quantity, equal zero. In the case of a receipt of goods cancellation resulting in an empty inventory account, the surcharge amount is negated).

After the above calculations, the total fields in the purchase order line item are updated:

valueInvoicedGoodsPosted += iValue

valueGoodsPosted += niValue

surchargeGoodsPosted += niSurcharge

additionalCostsPosted += iCosts

calculatedCostsPosted += niCosts

The results for the posting of goods and, if applicable, the posting of procurement costs:

goodsValueResult = iValue + niValue + niSurcharge

costsValueResult = iCosts + niCosts

valuationValues[GOODS_VALUE] = goodsValueResult

valuationValues[COSTS_VALUE] = costsValueResult

Receipt of goods from purchasing as part of supplier consignment

A receipt of goods from purchasing as part of supplier consignment is not valuated at receipt of goods. When the item is received, only the incoming quantity is posted. The inventory of the item is regarded as external inventory until it is withdrawn. Valuation is only carried out with a revaluation posting when the consignment is withdrawn. In the case of supplier consignment withdrawals, this revaluation posting immediately precedes the issue posting.

The revaluation posting is valued at the price determined in a valid supplier contract of the category Consignment. This contract was agreed with the owner of the external inventory, i.e. the consignment supplier. If no valid contract can be determined, the price from an expired contract is used. Such a contract exists in any case, as no purchase order line item for consignment supplier can be entered without a relationship to a supplier contract of the category Consignment. Consequently, a price can always be determined.

The valuation for the above revaluation posting is the same as for receipts of goord from purchasing (see also Receipt of goods from purchasing), except that the prices are determined from a contract. The moving average price and the last cost price of the item are updated automatically.

The consignment withdrawals and the resulting withdrawal notifications are followed by supplier invoices with relationships to the withdrawal notifications. The incoming supplier can trigger correction postings if deviations occur and corresponding settings are defined in the posting key (see Supplier invoice).

Receipt of goods from production

A receipt of goods from production is valued at the valuation price specified in the posting key. When the receipt of goods is posted, an inventory posting is created that automatically updates the moving average price. The last cost price of the item remains unchanged by this process.

Receipt of goods from distribution orders

Distribution orders serve the internal purchasing and distribution of items. It can be determined in the distribution order whether the items should be taken from the property of the firm of the sales organization (invoicing party) or from the property of the delivery partner (source warehouse).

Items can be distributed over various warehouses of the same firm. In these cases, the source and target owners of inventory are the same, namely the firm of the sales organization. In this case, distribution orders map the same business event as branch orders in a single-site environment. A receipt from such a distribution order is valuated at the price used for the issue. This is the moving average price at the issue warehouse. Thus, material movements on the basis of distribution orders are always neutral to valuation.

You can also specify when freight costs are to be posted for inventory valuation: Expected freight costs can already be generated at receipt of goods. Alternatively, the posting is made with the supplier invoice when the actual freight costs have been determined. You make the settings in the distribution order types and in the distribution order. Please refer to the relevant article and the description of the Freight cost posting for inventory valuation function. You can also specify in the distribution order how freight costs are to be distributed for inventory valuation (by quantity, value, weight, volume). See the articles Distribution order types and Distribution orders.

Background:

Early posting of expected freight costs may be desirable for longer delivery processes. With the appropriate setting, the expected freight costs are distributed in the same way as in purchasing. Further information on this can be found under Receipt of goods from purchasing and Supplier invoice.

If only a partial quantity was delivered and this under-delivery was accepted as the final delivery by manually completing the delivery for the destination, any supplementary costs that have not yet been charged are corrected. This may result in unassignable amounts.

If items are distributed between warehouses of different firms, an internal assignment is required. In this case, the source inventory owner is the firm of the delivery partner (source site) and the target inventory owner is the firm of the delivery recipient (target site). Further information on internal invoicing can be found in the article Introduction: Inter-company billing.

Receipt of goods from customer returns

When posting a return of goods from a customer, the returned goods are valuated at the valuation price specified in the posting key that is used in the receipt of goods type:

- Billing price 1 to 5

- Inventory count price

- Last cost price

- Average price

Analogous to it is the determination of item prices. Should the billing prices 1 to 5, or the inventory count price at the item/warehouse level equal to zero, the price of the item level is used.

Supplier invoice

The posting of a supplier invoice leads to a value correction of valuation that has taken place at the receipt of goods. The following criteria, among others, need to be fulfilled in order for the correction to be possible:

- In the supplier invoice, a posting key of the Roll-up valuation category was specified. This posting key has to have the Inventory valuation paramater activated

- The receipt of goods was posted with a posting key of the Interim valuation category

- The already delivered quantity is larger than zero

On the other hand, if no correction shall be performed on the inventory values in the course of the supplier invoice, i.e. with the receipt of goods, a final valuation is undertaken, then the following settings are required:

- The posting key for the receipt of goods is of the Final valuation category

- The Inventory valuation parameter is not activated in the posting key of the supplier invoice

If the supplier invoice is posted before the receipt of goods, the posting of the supplier invoice does not lead to an immediate revaluation of the moving average price or the last cost price. During the subsequent posting of the outstanding receipt of goods, however, also such amounts of the supplier invoice will be taken into account, which may deviate from the purchase order in the valuation.

The following calculation basis is used to determine the value when posting a supplier invoice. Which inventory posting is generated or whether it is generated at all depends on the category of the used posting key. This is described under Valuation categories.

In contrast to the goods receipt, a material posting is not always generated for the incoming invoice. A material posting is only generated if stock valuation is activated in the posting key used and only if a value correction is required on the stock account. A correction is always made if the value determined in the correctionValue attribute described below is not equal to zero.

In contrast to the receipt of goods, an inventory posting is not always generated for a supplier invoice. An inventory posting is only generated as far as the inventory valuation is activated in the used posting key but also only if a value correction in the inventory account is required. A correction takes place if the below described determined value in attribute correctionValue is not equal to zero.

Basis for calculating a value adjustment

The following – simplified – calculation bases are used to determine the correction value of incoming invoices:

| Attribute | Explanation |

valueInvoicedGoods |

The total of the supplier invoice values without supplementary costs, which refers to the already invoiced amount in the attribute invoicedQty. This value is important if supplier invoices for the delivered purchase order line item have already been posted before the receipt of goods. |

valueInvoicedGoodsPosted |

An amount saved in the purchase order line item. It is the proportion of the attribute valueInvoicedGoods, which was posted in the inventory account so far and is therefore covered by appropriate receipts of goods. |

iValue |

Temporary variable for the already invoiced value. The variable is needed for the calculation (see Calculation at the end of the attribute explanations). This value increases or decreases the value of the attribute valueInvoicedGoodsPosted in the case of credit notes and is a summand for the calculation of the inventory posting value in the attribute correctionValue. |

valueGoods |

An amount saved in the purchase order line item. The total net value of goods excluding procurement costs, based on the total quantity of the purchase order line item in the attribute totalQty. |

valueGoodsPosted |

An amount saved in the purchase order line item. It is the proportionate amount of the attribute valueGoods, which was posted to the inventory account so far but has not been billed yet. |

niValue |

Temporary variable for the not yet invoiced value. The variable is needed in the calculation (see Calculation at the end of the attribute explanations). This value increases or decreases the value of the attribute valueGoodsPosted in the case of credit notes and is a summand for the calculation of the inventory posting value in the attribute correctionValue. |

surchargeGoods |

An absolute surcharge amount, maintained in the purchase order line item. The surcharge results from the line item discount total of those purchase price component types in which the Assign completely to the first partial delivery parameter is activated. This surcharge applies to the total quantity of the purchase order line item. |

surchargeGoodsPosted |

An amount saved in the purchase order line item. The proportional amount of the surchargeGoods attribute that has been posted to the inventory account but has not been cleared yet. |

niSurchage |

Temporary variable for the yet non-invoiced surcharge of the first delivery. The variable is necessary for the calculation (see Calculation at the end of the attribute explanations). This value increases or decreases the value of the surchargeGoodsPosted attribute in the case of credit notes and is a summand for the calculation of the inventory posting value in the correctionValue attribute. |

totalQty |

Total quantity of the purchase order line item. |

transQty |

Total quantity of the supplier invoice line item or the posted quantity of the considered supplier invoice line item. |

invoicedQty |

Currently invoiced quantity, i.e. partial quantity of the purchase order line item for which supplier invoices have already been posted. |

iQty |

Proportionate quantity of the attribute transQty for which a receipt of goods has already been posted. |

newInvoicedQty |

The new invoiced quantity according to this supplier invoice. It results from the sum of the attributes invoicedQty and transQty attributes. |

bookQty |

Posting quantity for the inventory posting.

This value corresponds to the value of the attribute |

transValue |

Total amount of the supplier invoice line item or the posted amount of the considered supplier invoice line item. |

uninvoicedQty |

The determined quantity of the received and not yet invoiced quantity. The value is derived from the attribute receivedQty minus the attribute invoicedQty . |

correctionValue |

Resulting value from the calculation. This value will be transferred to the correction inventory posting and a posting is carried out if it does not equal zero. |

remainingQty |

The open quantity calculated as follows: remainingQty = max(totalQty, receivedQty) – invoicedQty |

Here, the temporary variable niSurcharge is determined as follows:

- Case 1

Invoice, the cleared quantity is zero and the quantity to be cleared does not equal zero:

niSurcharge = surchargeGoodsPosted * (-1)

- Case 2

Cancellation invoice, the new cleared quantity is zero, the quantity to be cleared does not equal to zero and the delivered quantity is zero:

niSurcharge = surchargeGoodsPosted

In this case determining the values of the attributes niSurcharge, iValue and niValue is performed as follows:

- Case 1

The attribute

transQty is zero. The following applies in this case:

iValue = (transValue * bookQty) / invoicedQty

niValue = 0

- Case 2

The value in the receivedQty attribute is equal to the value in the newInvoicedQty attribute and the sign of invoicedQty is negative (i.e. more credit notes than invoices have been posted so far) and no credit note is currently being considered. In this case, the following applies:

iValue = (transValue * iQty) / transQty

niValue = valueGoodsPosted * (-1)

- Case 3

The value in the

receivedQty attribute equals to the value in the newInvoicedQty attribute. The following applies in this case:

iValue = transValue

niValue = valueGoodsPosted * (-1)

- Case 4

It concerns a credit note since the key of the value in attributetransQtyis not equal to the key of the value in attributetotalQty. The following applies in this case:

iValue = (transValue * iQty) / transQty

niValue = -(valueGoods * iQty) / totalQty

- Case 5

For normal invoices, the following applies:

iValue = (transValue * iQty) / transQtyniValue = -(valueGoodsPosted * iQty) / uninvoicedQtyWherebyvalueGoodsPostedare only aliquoted for the calculation ofniValueif the open quantity is not equal to the quantity to be billed (iQty). The open quantity is determined fromremainingQty = max(totalQty, receivedQty) - invoicedQty

Subsequently to the above calculations, the total fields of the purchase order line item that are listed below are updated:

valueInvoicedGoodsPosted += iValue

valueGoodsPosted += niValue

valueInvoicedGoods += transValue

surchargeGoodsPosted += niSurcharge

Update of the cleared quantity:

invoicedQty += transQty

The correctionValue value determined for the corrective posting is calculated according to the following formula:

correctionValue = iValue + niValue + niSurcharge

Supplementary costs invoices

The posting of a supplementary costs invoice leads to a correction in value of the valuation already registered at the receipt of goods, i.e. the moving average price and possibly the last cost price. Thus the posting of a supplementary

costs invoice results in a corrective inventory posting related to the delivered goods and taking into account the currently posted calculative procurement costs. For the corrective inventory posting, the difference between the pro rata posted calculative procurement costs and pro rata posted supplementary costs is used for the correction of the current inventory value.

Both for the calculative procurement costs and the actual supplementary costs, the maximum of the delivered quantity and the total quantity, according to the purchase order line item, are used as reference. In the course of the first supplementary costs invoice for an associated purchase order line item, the actually posted supplementary costs will be juxtaposed with the pro rata calculative procurement costs and the difference is used for the corrective inventory posting. A difference of zero does not lead to a corrective inventory posting, the calculative procurement costs are nevertheless replaced by the actual supplementary costs.

The following criteria, inter alia, need to be fulfilled so that a correction could be possible:

- A posting key of the Roll-up of supplementary costs valuation category is used in the supplementary costs invoice type. This posting key must also have the Inventory valuation parameter activated.

- The receipt of goods has been posted with a posting key of the Interim valuation category.

- The already delivered quantity is larger than zero.

If no correction shall be performed on the inventory values through the supplementary costs invoice i.e. with the receipt of goods, a final valuation is undertaken, then the following settings are required:

- The posting key for the receipt of goods is of the Final valuation category.

- The Inventory valuation parameter is not activated in the posting key of for supplementary costs invoice.

If the supplementary costs invoice is posted before the receipt of goods, the posting of the supplementary costs invoice does not lead to an immediate revaluation of the moving average price or the last cost price (no value correction for the item account is generated). During the subsequent posting of the receipt of goods, however, also such amounts will be taken into account, which in the valuation may deviate from the purchase order.

If only a partial quantity was delivered from a purchase or distribution order and this underdelivery was accepted as the final delivery by completing the delivery manually, then any supplementary costs that have not yet been assigned are corrected. This results in unassignable amounts if required.

In these cases, an correction entry is now made and the supplementary costs that have not yet been charged are posted according to the usual rules (not assignable…).

A supplementary costs invoice can also be created and posted without reference to a purchase order. If this is the case, the posting does not lead to a corrective inventory posting. Thus, no new valuation of the moving average price and the last cost price is performed.

Cancellation of a supplier invoice or a supplementary costs invoice

If a supplier invoice or supplementary costs invoice is cancelled, which would have led to a correction of a receipt of goods, then a new value corrective posting is generated upon cancelling that reverses the original correction based on the available total field data.

Completion of an inventory count

The differences between the actual and the target inventory reported in an inventory count result in inventory postings of the Correction process. These inventory postings are valuated at the valuation price provided in the inventory count at the completion of inventory.

In the case of a key date inventory, issue and receipt postings for the quantity differences can be generated when an inventory count list is closed. These inventory postings are valuated at the moving average price. When the inventory count is closed, value correction postings are generated that correct the value difference to the valuation price stored in the inventory count.

Further information on inventory valuations, such as how differences from inventory count lists are valued or differences from perpetual inventories, can be found in the article Introduction: Inventory counts.

Relocation

Relocations between two warehouses of the same firm are always valuated with the moving average price at the issue warehouse. Thus, the relocations over multiple warehouses at the level of the firm are neutral to the valuation.

Relocations within one warehouse are not re-valuated, since the item inventories are not valuated at the levels of storage zones and storage locations.