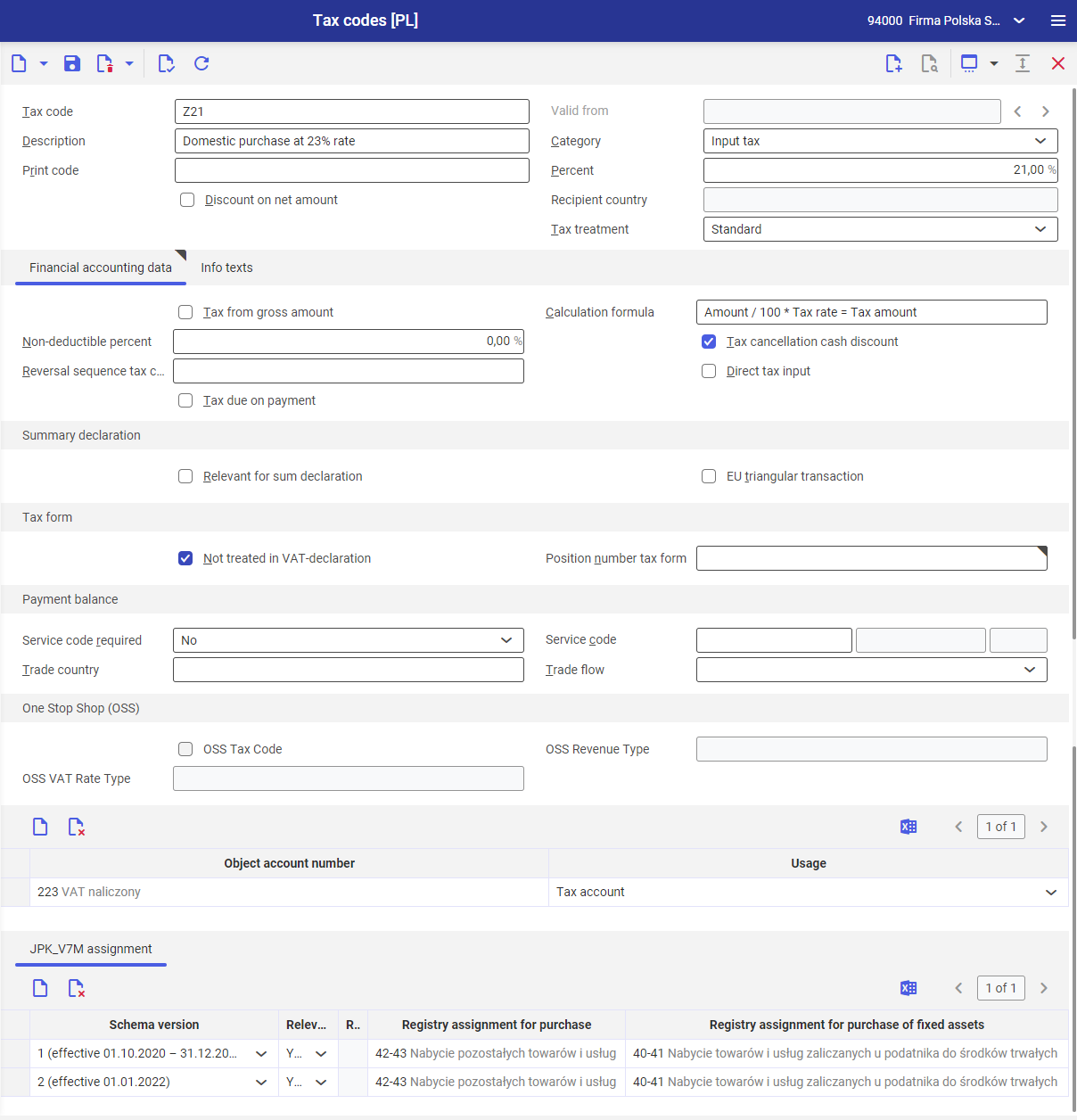

Tax codes are used in all VAT-related postings. They are specified in the Tax codes application and are applicable in the entire database, but they are presented in reference to a country specified in the address details of the logged-in organization. Organizations with the same country specified can access the same tax code list. The application is available under the Financials framework. The application is handled with the standard buttons and the [New version] button used to add a new tax code version.

Adding a tax code

To add a tax code, select the [New] button and then complete the available fields respectively.

Query pane

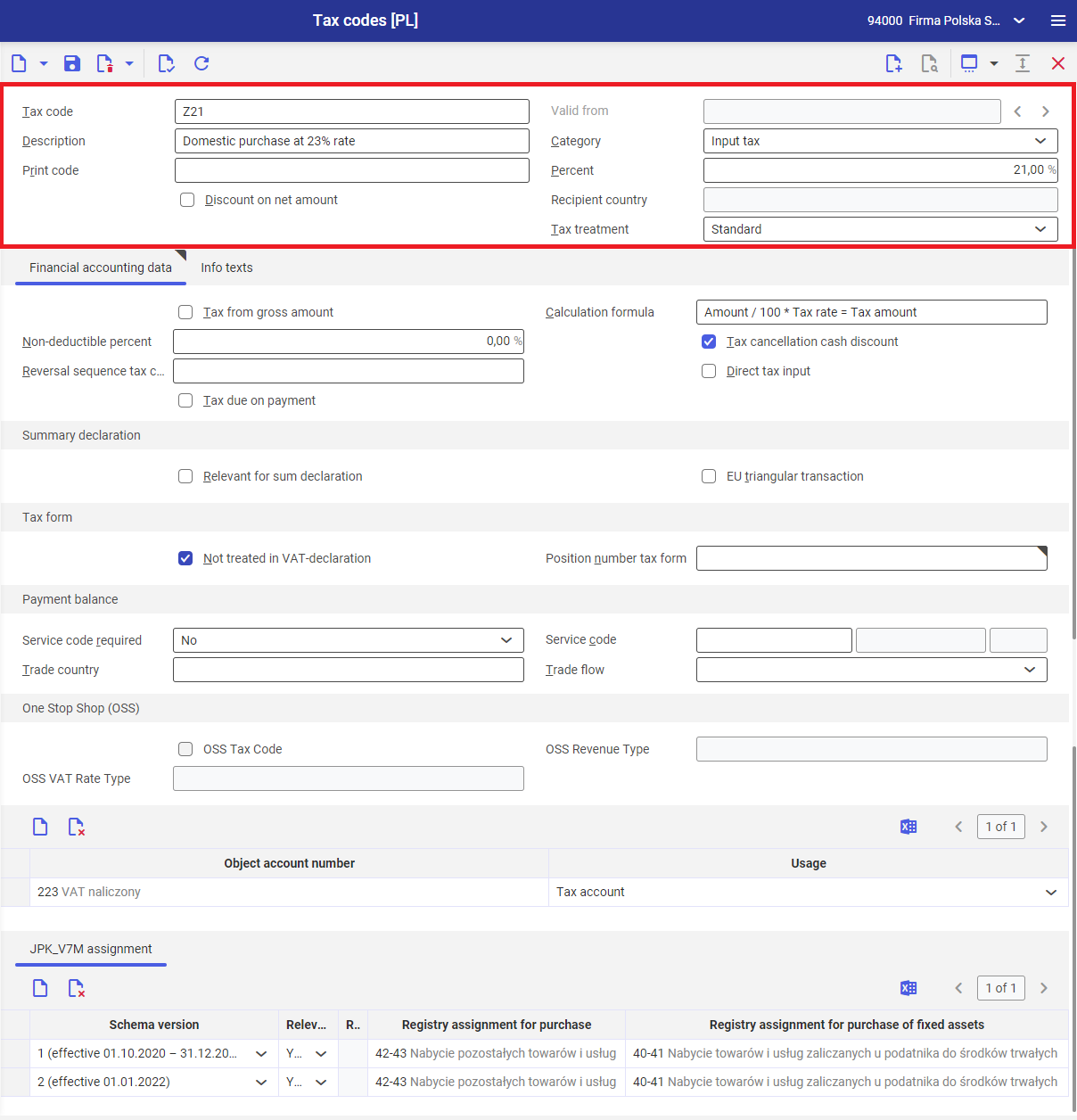

Tax code – identification of the tax code. This field is mandatory and can comprise a maximum of 3 characters. It must be unique for each code. Upon saving, it is no longer editable.

Description – additional name used to identify the tax code. This field is mandatory.

Print code – code displayed in voucher printouts for a specific tax code.

Valid from – this field is active when creating a new tax code version. If there is more than one version of the tax code, the field will display the valid-from date of the displayed tax code version.

Category – category of the tax code. It determines the types of vouchers in which the tax code can be used:

- Value added tax – assigned automatically when adding a new tax code

- Input tax

- Intra-community delivery

- Intra-community purchase

- EU service with transferred tax liability

- Purchase with tax liability of the service recipient

- EU end consumer delivery

Percent – tax rate in percentage terms.

Tax treatment – determines if the VAT registry entry with a specified tax code will be included in the VAT registry

- Standard – includes an entry in the VAT registry, this value is assigned automatically when adding a new tax code

- Non-taxable

- Tax exempt

- Not reportable – does not include an entry in the VAT registry

Discount on net amount – parameter deselected, by default. If:

- deselected – the discount will be calculated on gross amount

- selected – the discount will be calculated on net amount

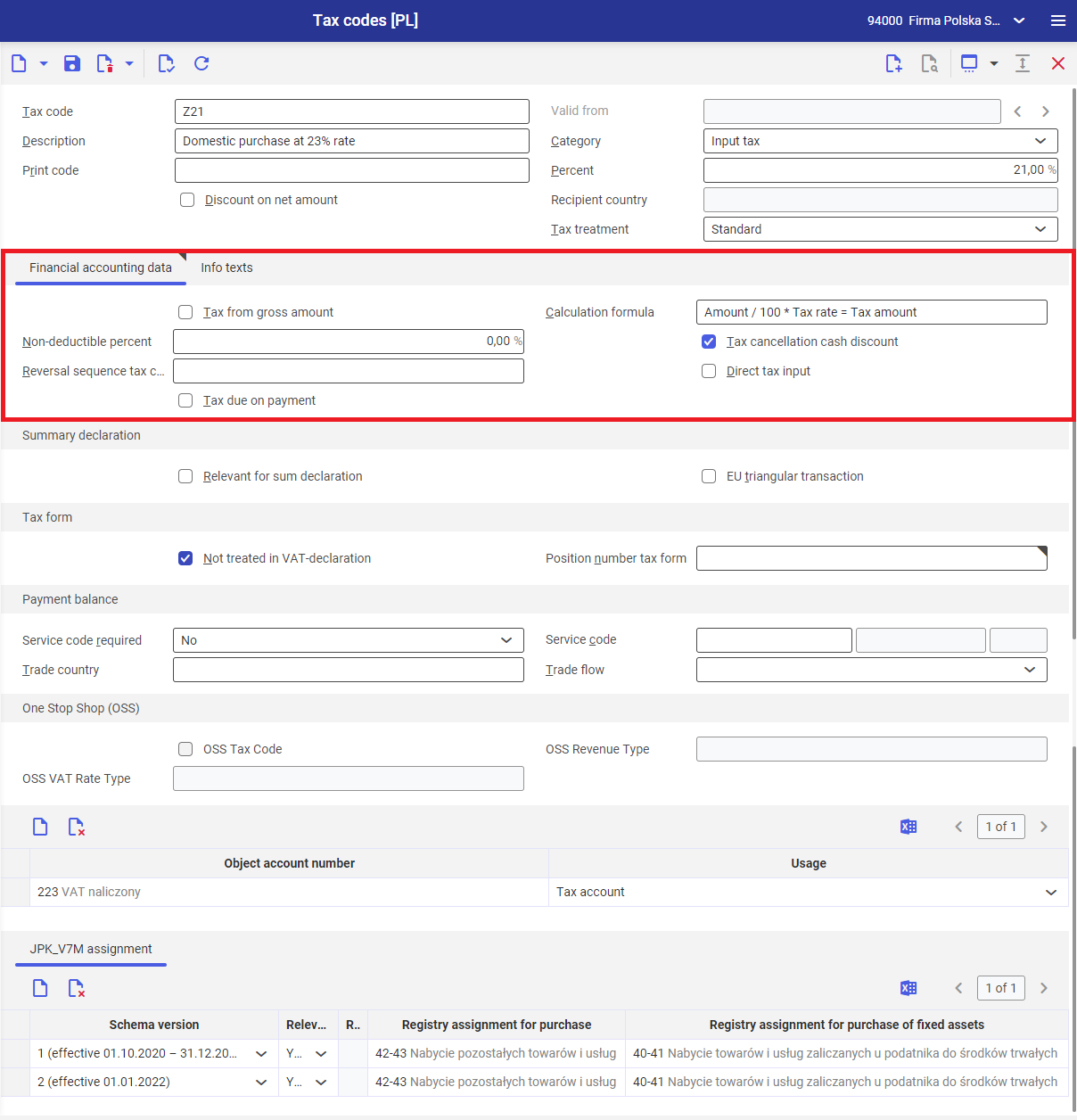

Financial accounting data tab

Tax from gross amount – if:

- selected – the discount will be calculated in CFE on gross amount

- deselected – the discount will be calculated in CFE on net amount

Select the parameter for the following tax code categories:

- Value added tax

- Intra-community delivery

- EU service with transferred tax liability

Deselect the parameter for the following tax code categories:

- Intra-community purchase

- Purchase with tax liability of the service recipient

Calculation formula – tax calculation formula. It is the Tax from gross amount parameter-dependent. The formula is not editable.

Tax cancellation cash discount

- If selected, the discount will be posted at the tax rate specified in the query pane.

- If deselected, enter the tax code in the Reversal sequence tax code field, according to which the discount will be posted. The required tax code is 0.00% and the required category is the same as that of the created tax code.

Non-deductible percent – if part of the VAT amount is, under the legal regulations, deductible up to the specified amount only, enter the percent of the VAT amount in this which, which is to be posted as costs. During posting, the system will calculate and post as costs the tax amount resulting from the specified tax rate.

Reversal sequence tax code – if Tax cancellation cash discount parameter is deselected, you can enter the tax code according to which the discount will be posted. The required tax code is 0.00% and the required category is the same as that of the created tax code.

Direct tax input – if selected, the tax amount will be calculated automatically by the system, but it needs to be entered manually in the journal entry. For this purpose, in the Posting financial accounting application in the Mirror fields tab:

- enter the tax amount into the Posting amount field

- select Direct tax input value in the Tax record info input field

- enter a general ledger account of Tax type

The Direct tax input parameter can be selected, if:

- the Percent field value in the query pane is set to 0.00%

- tax code is of Value added tax or Input tax category

If selected, specify an account to which the tax can be input directly. For this purpose, in the object accounts-related section:

- select the [New] button

- in the Object account number field, select an account of Tax type

- in the Usage field, select Tax account

Summary declaration section

Relevant for sum declaration – if selected, postings will be included automatically in the summary declaration

EU triangular transaction – if selected, postings will be treated as EU trilateral transactions in the summary declaration

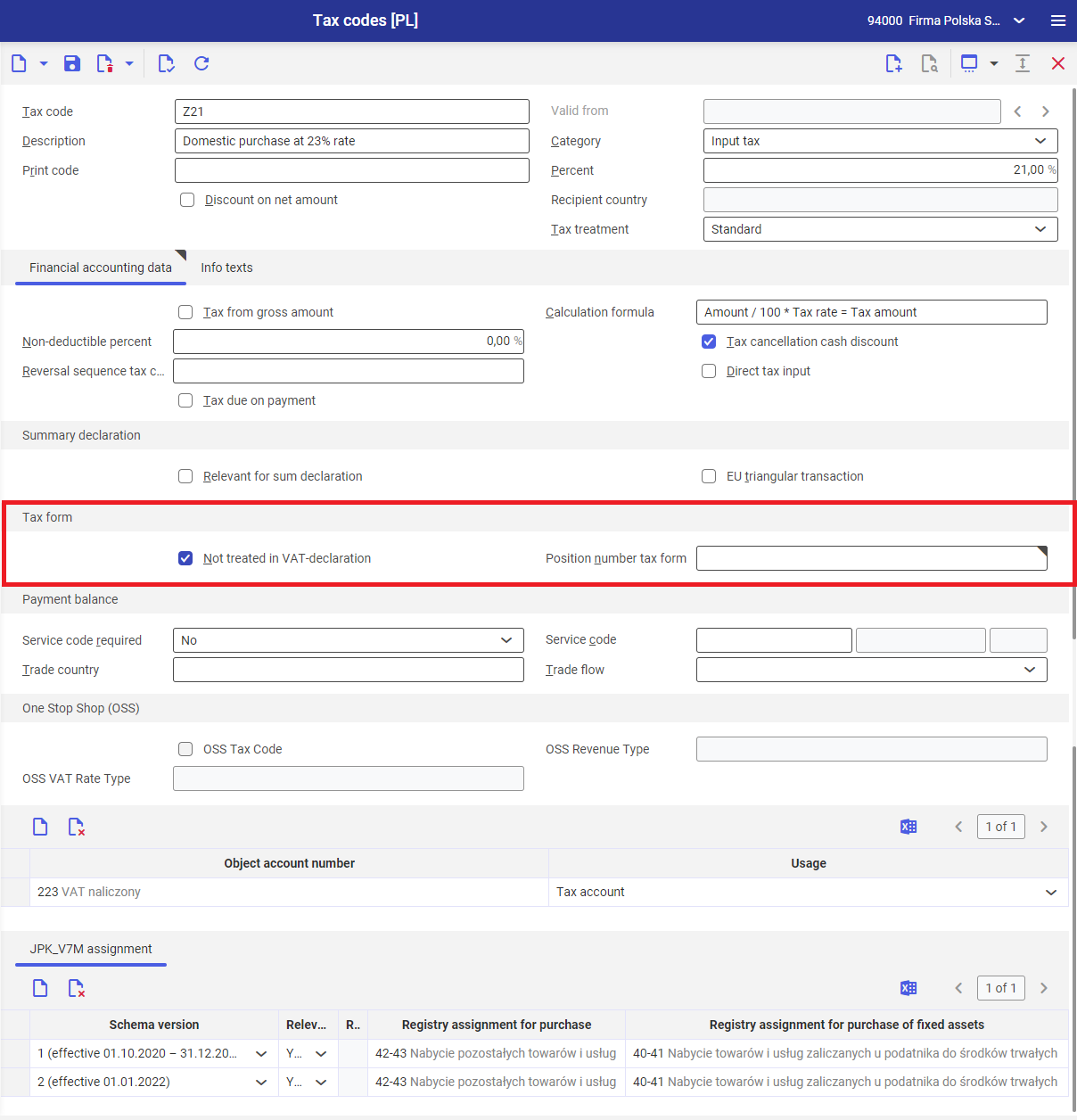

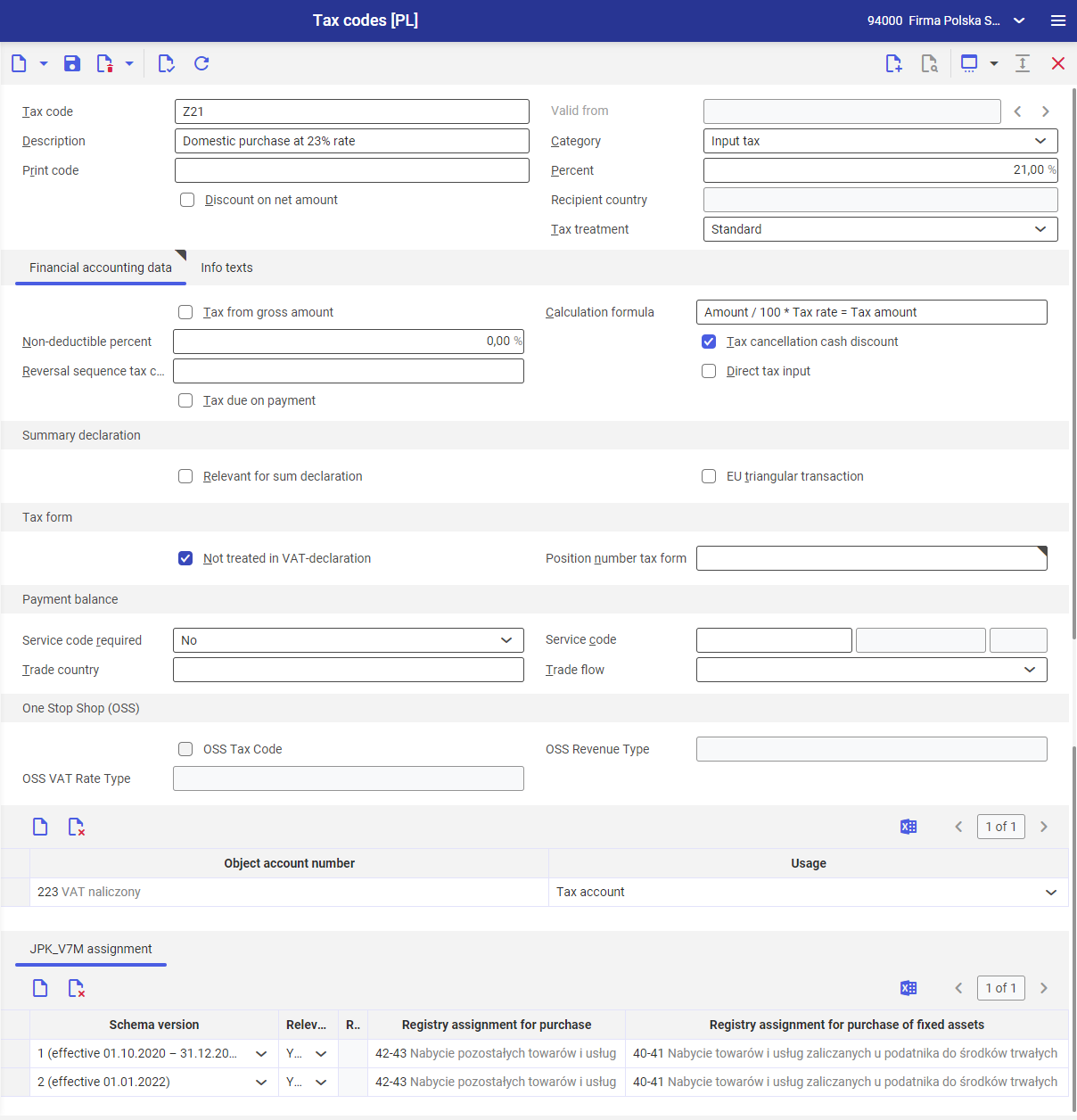

Tax form section

Not treated in VAT-declaration – for the Polish market, it is recommended to:

- select the parameter – if value other then Intra-community delivery is selected in the Category field

- deselect the parameter – if Intra-community delivery is selected in the Category field

Position number tax form – enter the number specified in the Position number tax form application, if Not treated in VAT-declaration parameter is deselected. The tax category of the entered number must be the same as that of the created tax code.

Object account numbers

If value other than 0% is entered in the Percent field, an account to which tax is to be posted needs to be specified. For this purpose:

- select the [New] button

- in the Object account number field, select an account of Tax type

- in the Usage field, select Tax account

If Intra-community purchase is selected in the Category field, a contra account is additionally required. For this purpose:

- select the [New] button

- in the Object account number field, select an account of Tax type

- In the Usage field, select Contra account purchase tax

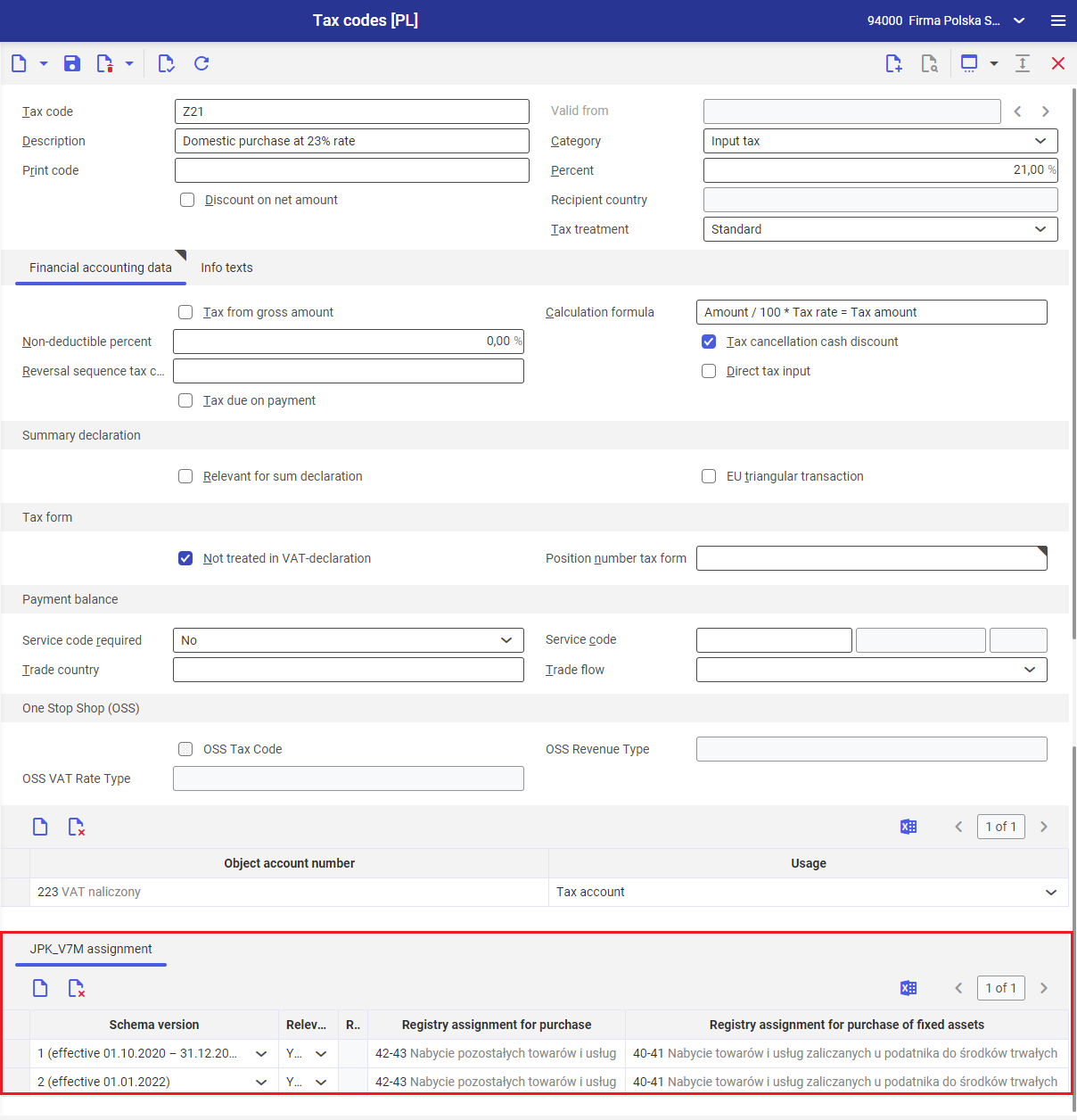

JPK_V7M assignment section

The settings in the JPK_V7M assignment section determine how a VAT registry entry with a specific tax code will be treated in a JPK_V7M file.

Schema version – specifies the scheme version of JPK-V7M file by which the mapping of VAT registry entry to declaration line items and a JPK_V7M file is prepared. The currently applicable schema version is assigned automatically.

Relevant for schema – set, by default, to Yes. By changing the value to No, the entry will not be included during generation of tax return-related section and data records section as well as aJPK_V7M file for the specified schema version.

Registry assignment for sale – selectable values refer to fields available in JPK_V7M declaration under Value added tax reimbursement section. The column is editable if value True is selected in the Relevant for schema column and if one of the values below is selected in the Category field in the query pane:

- Value added tax

- Intra-community delivery

- Intra-community purchase

- EU service with transferred tax liability

- Purchase with tax liability of the service recipient

Registry assignment for purchase – selectable values refer to fields available in JPK_V7M declaration under Input tax reimbursement section. The column is editable if value True is selected in the Relevant for schema column and if one of the values below is selected in the Category field in the query pane:

- Input tax

- Intra-community purchase

- Purchase with tax liability of the service recipient

Registry assignment for purchase of fixed assets – selectable values refer to fields available in JPK_V7M declaration under Input tax reimbursement section. The column is editable if value True is selected in the Relevant for schema column and if one of the values below is selected in the Category field in the query pane:

- Input tax

- Intra-community purchase

- Purchase with tax liability of the service recipient

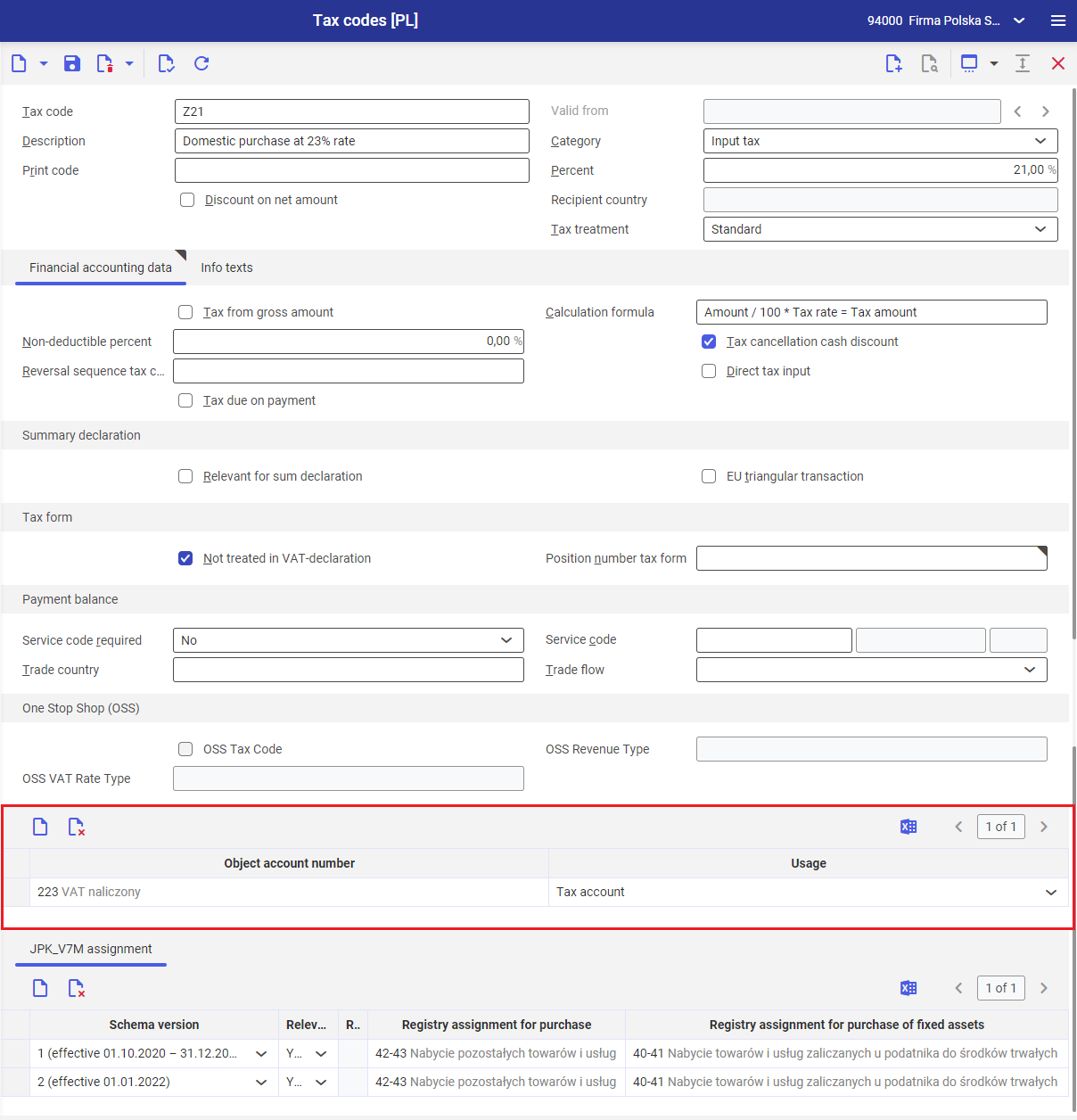

- Tax code – Z21

- Description – Domestic purchase taxed at 21%

- Category – Input tax

- Percent – 21%

- Tax treatment – Standard

- Tax cancellation cash discount parameter was selected

- An object account number 223 with Tax account usage was assigned

- JPK_V7M assignment section was completed

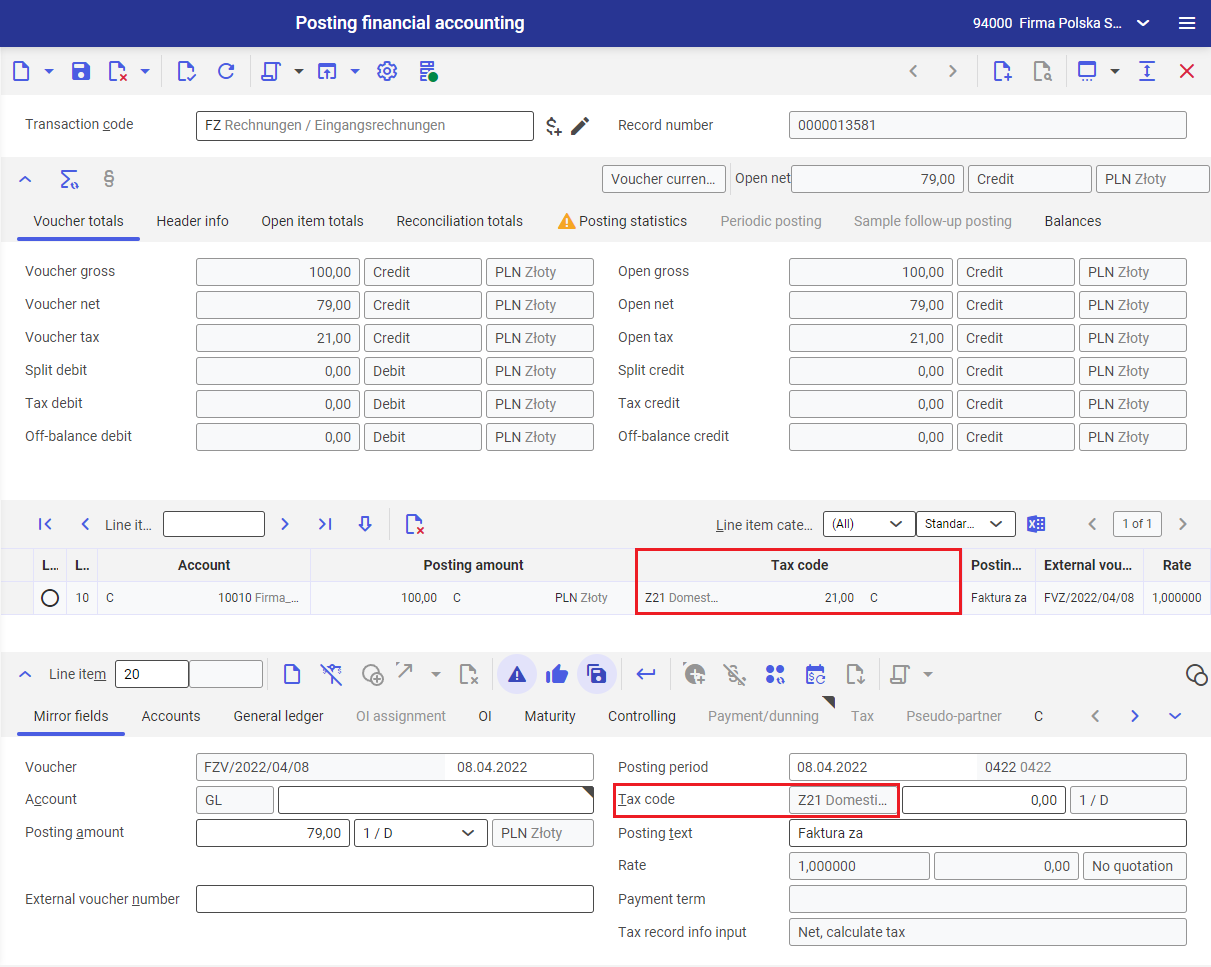

When adding a supplier invoice line item in the amount of 100 pln taxed at 21% in the Posting financial accounting application, Z21 tax code was selected in the Tax code column. After selecting the [Apply] button, the line item was transferred from the editor to the Line item section. The system calculated automatically the VAT amount based on the Z21 tax code – 21.00 PLN.

Info texts tab

Detailed description of the Info texts tab can be found in the article Info texts tab.

Adding a new tax code version

In case changes are made to a specific tax code, for instance, due to a changed tax rate, a new version of tax code can be added. For this purpose:

- select the [New Version] button

- in the Valid from field, enter the valid-from date of the new tax code version

- Make changes into the corresponding fields

- Select the [Save] button

The Valid from field presents the start-from date of the new tax code version.

- 01.01.2011 was selected in the Valid from field

- Domestic purchase taxed at 22% was changed to Domestic purchase taxed at 23% in the Description field

- Value in the Percent field was changed from 22% to 23%

When posting the supplier invoice taxed at 23%, the new version of the tax code Z22 was used to post the VAT amount.