VAT registries application is available if Financials – Poland function is activated and Country-specifics function is set to Poland under the Customizing application.

In VAT registries application, it is possible to create and manage VAT registries in which tax information is collected. Collected information is used to generate JPK_V7M declarations and the related export files. VAT registries closely interact with tax periods – they are generated for specific tax periods defined in Tax years and periods application.

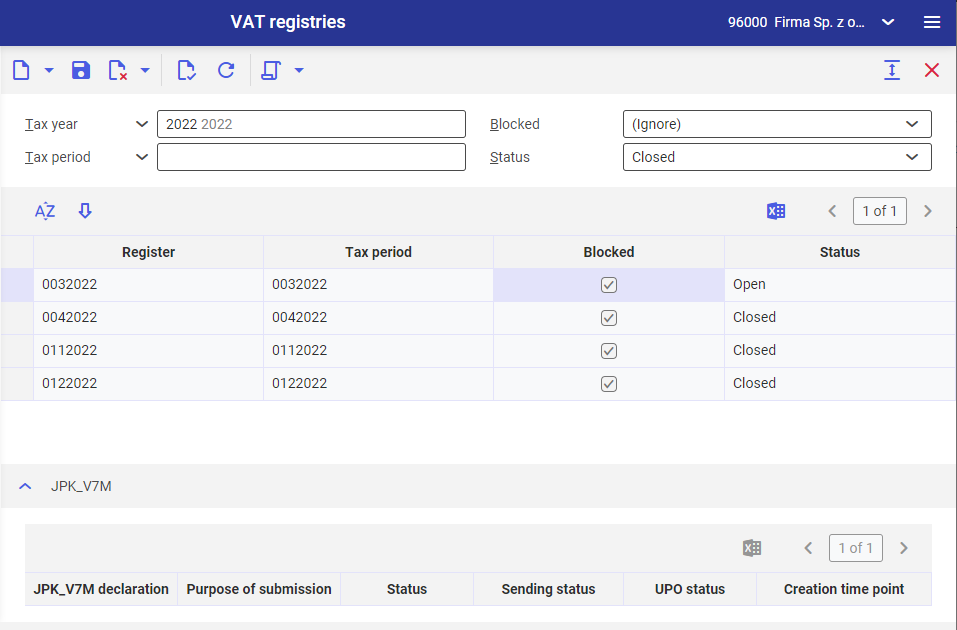

Query pane

In the query pane of the VAT registries application, you can filter the created registries.

Tax year – in this field, specify a tax year defined in the Tax years and periods application

Tax period – in this field, select a tax period defined in the Tax years and periods application

Blocked – in this field, specify if the VAT register is blocked. Selectable options are:

- Yes

- No

- Ignore – parameter is not taken into account when filtering the search results after selecting the [Refresh] action

Status – specify VAT register status in this field. Selectable options are:

- All

- Open

- Closed

Available buttons

The application is handled with the standard buttons as well as the following additional buttons:

[Add] – creates a new VAT register. Opens a window to select a proper tax year applicable for the created register. The code assigned to the created register corresponds to a description of the selected tax period. It is possible to create several registries simultaneously by selecting several tax periods.

[Select action] -> [Close VAT register] – changes the status of a selected VAT register to Closed. No new entries can be assigned to a closed VAT register and the already assigned entries are not editable, but it is possible to generate a JPK_V7M declaration to such register.

[Select action] -> [Open VAT register] – changes the status of a selected VAT register to Open, which makes possible to execute the [Unblock] action.

[Select action] -> [Block/Unblock] – changes the status of a selected VAT register to Blocked or Unblocked, depending on the current status. Selecting the [Close VAT register] action blocks the register automatically. Only open registries can be unblocked. No new entries can be assigned to a blocked VAT register and the already assigned entries are not editable in such register.

[Select action] -> [Generate JPK_V7M declaration] – generates a JPK_V7M declaration. This action can be executed for one, selected VAT register only.

It is advisable to execute it for a closed VAT register. If executed for an open register, the generated declaration will be a simulated document and it will not be possible to confirm it.

Only one declaration can be generated to one VAT register, but it is possible to generate numerous corrections.

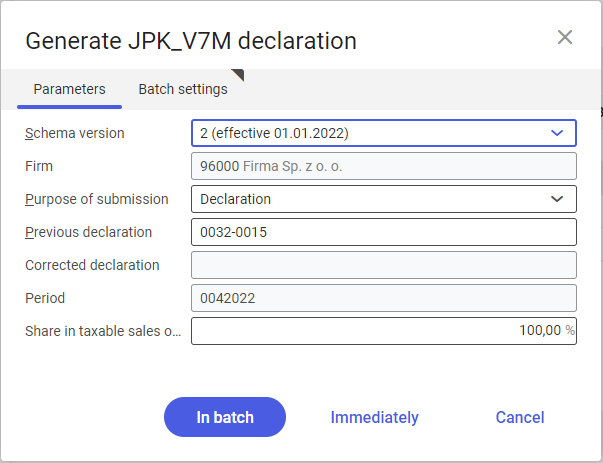

The button opens a dialog window composed of the following tabs: Parameters and Batch settings.

In Parameters tab, specify the following JPK_V7M declaration-related settings:

- Schema version – a schema version effective for a given period and defined under the customizing function JPK_V7M is assigned automatically in this field (schema version 2 is effective from 01.01.2022). Schema version 1 is suggested automatically for the period of 01.01.2022, it is not possible to generate a JPK_V7M declaration using the schema version 2 – if attempted, a relevant message informing that the selected schema is incorrect will then be displayed.

- Firm – a company for which a declaration is generated. This is an informative field. It is not editable.

- Purpose of submission – specify the purpose for submitting the JPK_V7M declaration: Declaration and Correction. It is possible to generate one declaration and multiple corrections for one register.

- Previous declaration – recent declaration number with the Sent status. This field is active if the previously registered declaration is Sent or Confirmed.

- Corrected declaration – corrected declaration number in case of generating a correction. This field is editable if Correction is selected as the purpose of submission. Only Sent or Confirmed JPK_V7M declaration can be selected.

- Period – tax period to which the VAT register applies. This is an informative field. It is not editable.

- Share in taxable sales of goods and services – in this field, specify what percentage of VAT related to purchases for mixed sales purposes can be accounted for. The default value is 100% and it is editable.

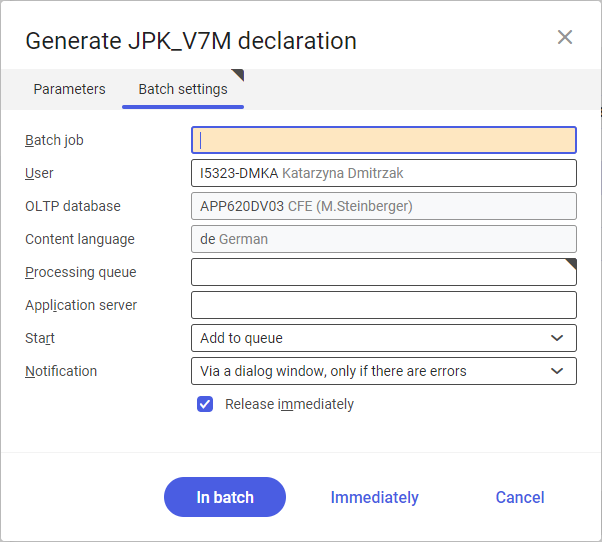

In Batch settings tab, the settings relating to JPK_V7M declaration generation process are specified.

JPK_V7M declaration can be generated in the background ([In batch] button). Selecting the [Cancel] button cancels the generation of JPK_V7M declaration.

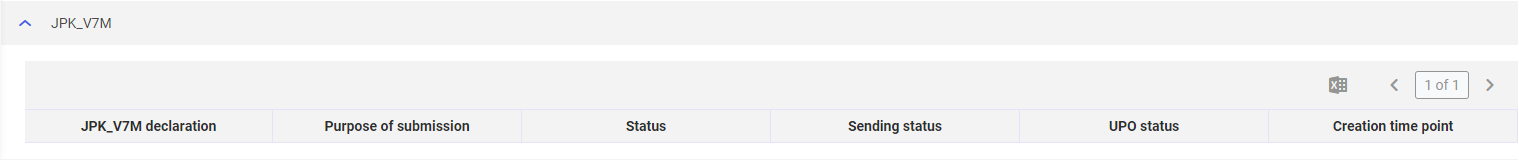

Generated declaration is available in JPK_V7M section upon clicking twice the record with the selected VAT register.

Work pane

The work pane contains a table with registries that meet the conditions specified in the query pane. The table consists of the following columns:

Register – code of a specific VAT register

Tax period – tax period assigned to the VAT register

Blocked – attribute determining if the VAT register is blocked

Status – status of a specific VAT register

JPK_V7M section

Clicking twice the selected VAT register presents information regarding JPK_V7M declarations generated for a given VAT register. The table consists of the following columns:

JPK_V7M declaration – JPK_V7M declaration number assigned as per settings defined in the customizing function JPK_V7M

Purpose of submission – the purpose for submitting the JPK_V7M declaration: Declaration or Correction

Status – JPK_V7M declaration status such as Created, Sent, Confirmed

Sending status – specifies whether the declaration was/was not sent

UPO status – specifies whether the JPK_V7M declaration was verified by a tax office

Creation time point – date and time the declaration was added

By selecting the combination of the left hot key <Ctrl> and the left mouse button on the JPK_V7M declaration record you can proceed to JPK_V7M declaration data application.