To be able to use VAT register entries application, it is necessary to make once necessary configuration settings in the selected organization. In the Customizing application:

- activate the Country-specifics function and in the Settings tab, select the value Poland in the Country-specifics field

- activate the Financials – Poland function

- activate VAT register function

In this application you can:

- add a new entry to VAT registries

- update selected data of a VAT register entry

- assign entries to selected VAT register and to type of VAT subregisters

- search for and review existing VAT register entries

VAT register entries can be generated:

- manually in VAT register entries application

- automatically after:

- vouchers with transaction code of Invoices or Payments type (refers only to payments for supplier invoices with calculated cash discount) are properly posted in Posting financial accounting application

- a customer invoice (advance and final invoices) and its correction are properly generated under CEE

- a supplier invoice and its correction are properly posted under CEE

Available buttons

The application is handled with the standard buttons and with the following additional buttons:

[Select action] → [Edit entry] – this action is active if VAT register entry is confirmed and is not assigned to a blocked or closed register. It changes VAT entry status to In edition and modifies the entry data.

[Select action] → [Approve entry] – this action is active if VAT register entry’s status is In edition or In creation. It changes VAT entry status to Confirmed, which blocks the edition of entry data. Confirmation of a VAT entry can be undone via the [Edit entry] action (it changes the entry status to In edition). Only confirmed entries (with Confirmed status) are included during recalculation of JPK_V7M file.

[Select action] → [Cancel entry] – this action is active for confirmed VAT register entries. It is preceded with a warning message. A canceled VAT entry is not included in the JPK_V7M declaration. This action is irreversible.

[Select action] → [Assign amounts for bad debt] – this action is available for VAT entries with selected source voucher (in the Source voucher field) and a Tax correction category, which have Bad debt (Art 89a para. 1, Art. 89b para 1) or Bad debt settlement (Art 89a para. 4, Art. 89b para 4) value set in the Type of tax correction field. It creates individual VAT entry line items and assigns the default values to them.

Query pane

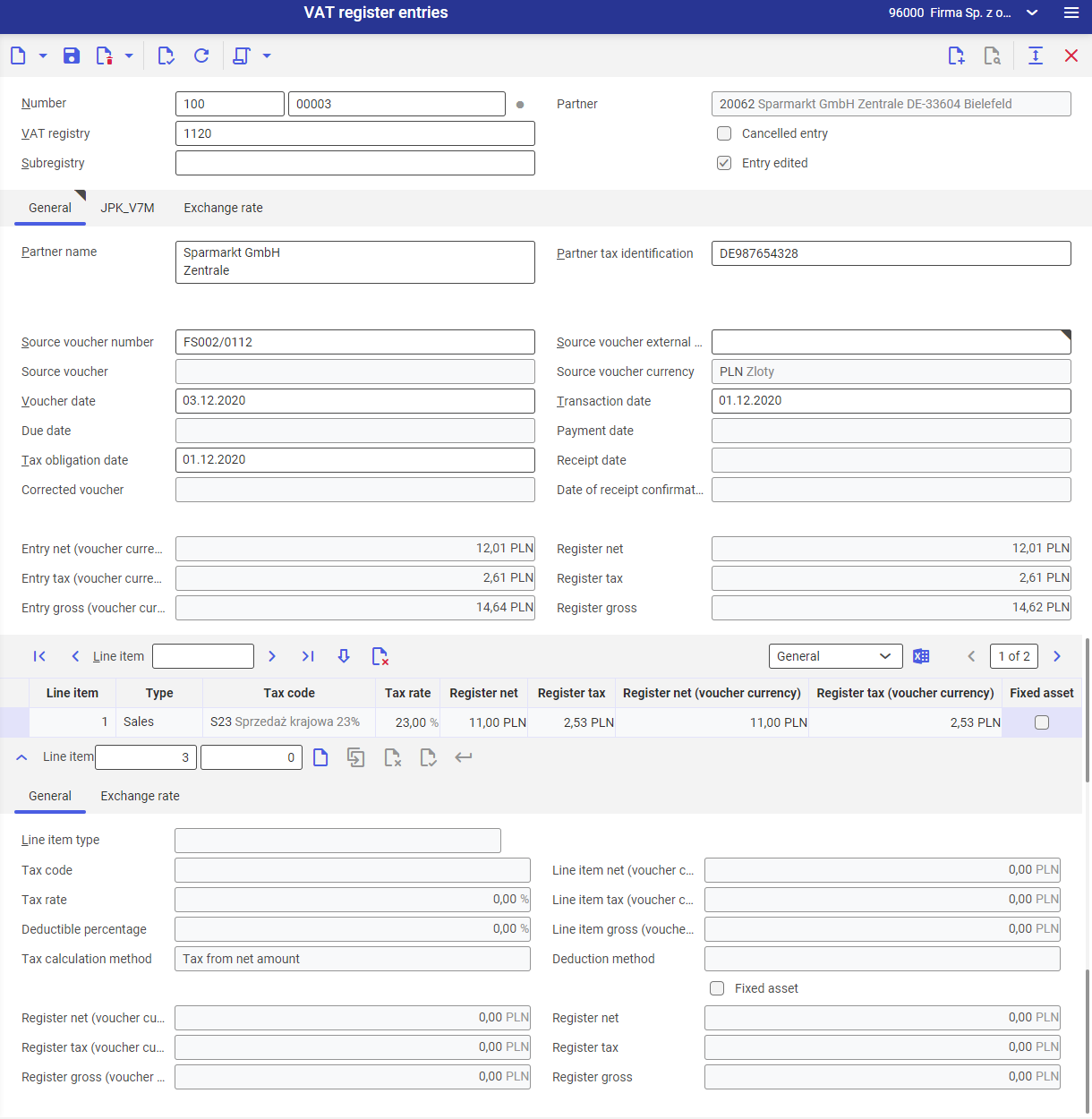

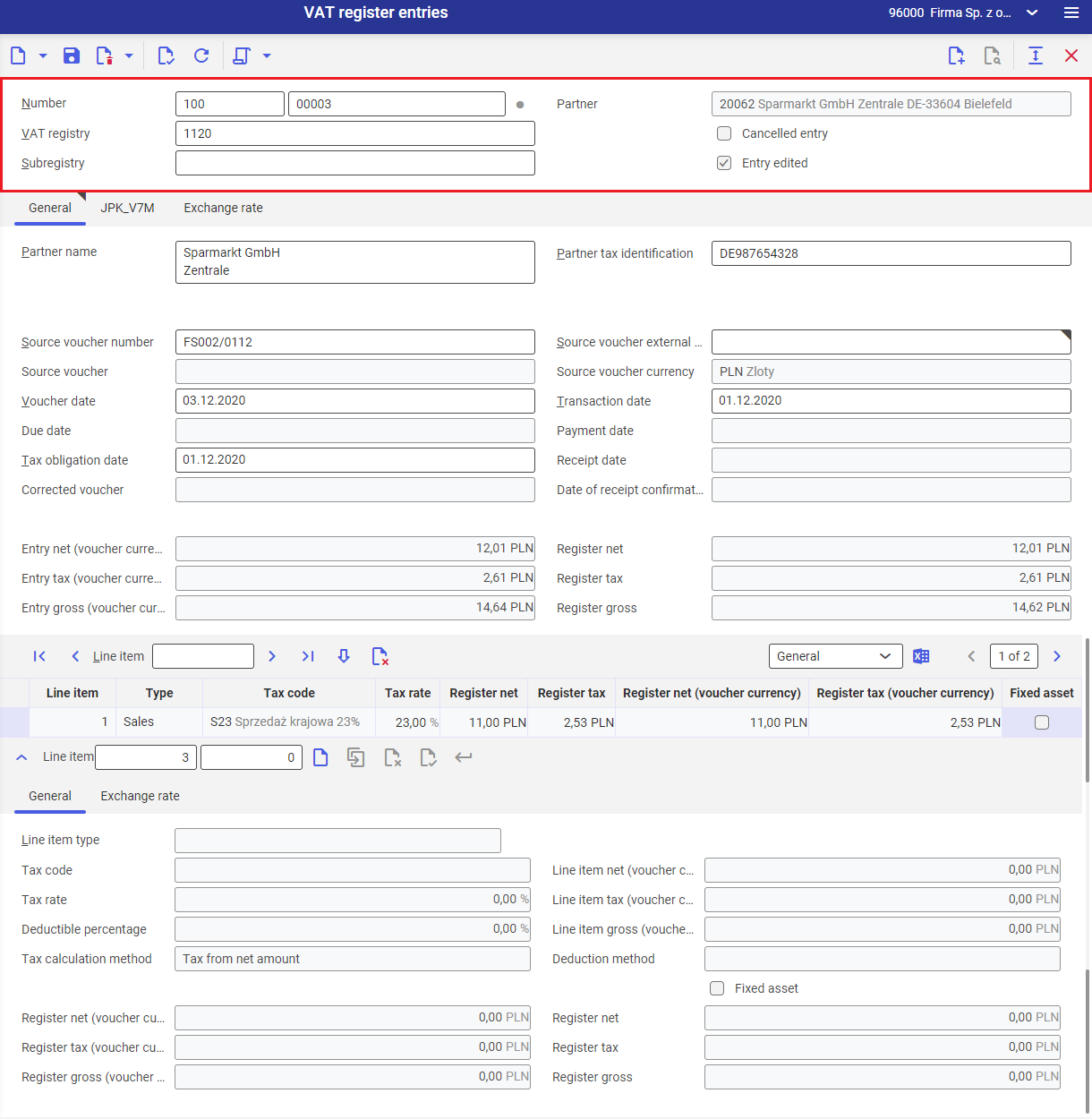

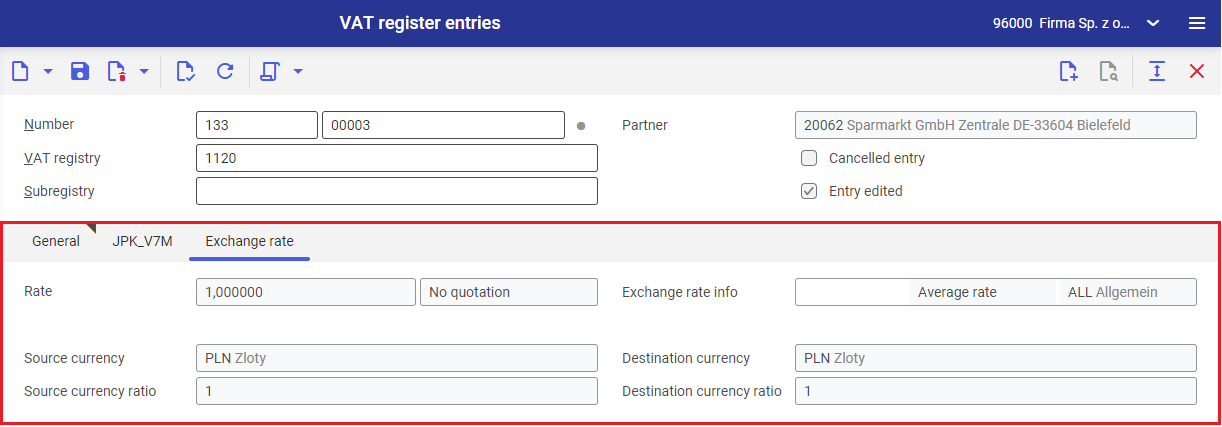

When creating a new VAT register entry, it is necessary to specify its parameters in the query pane.

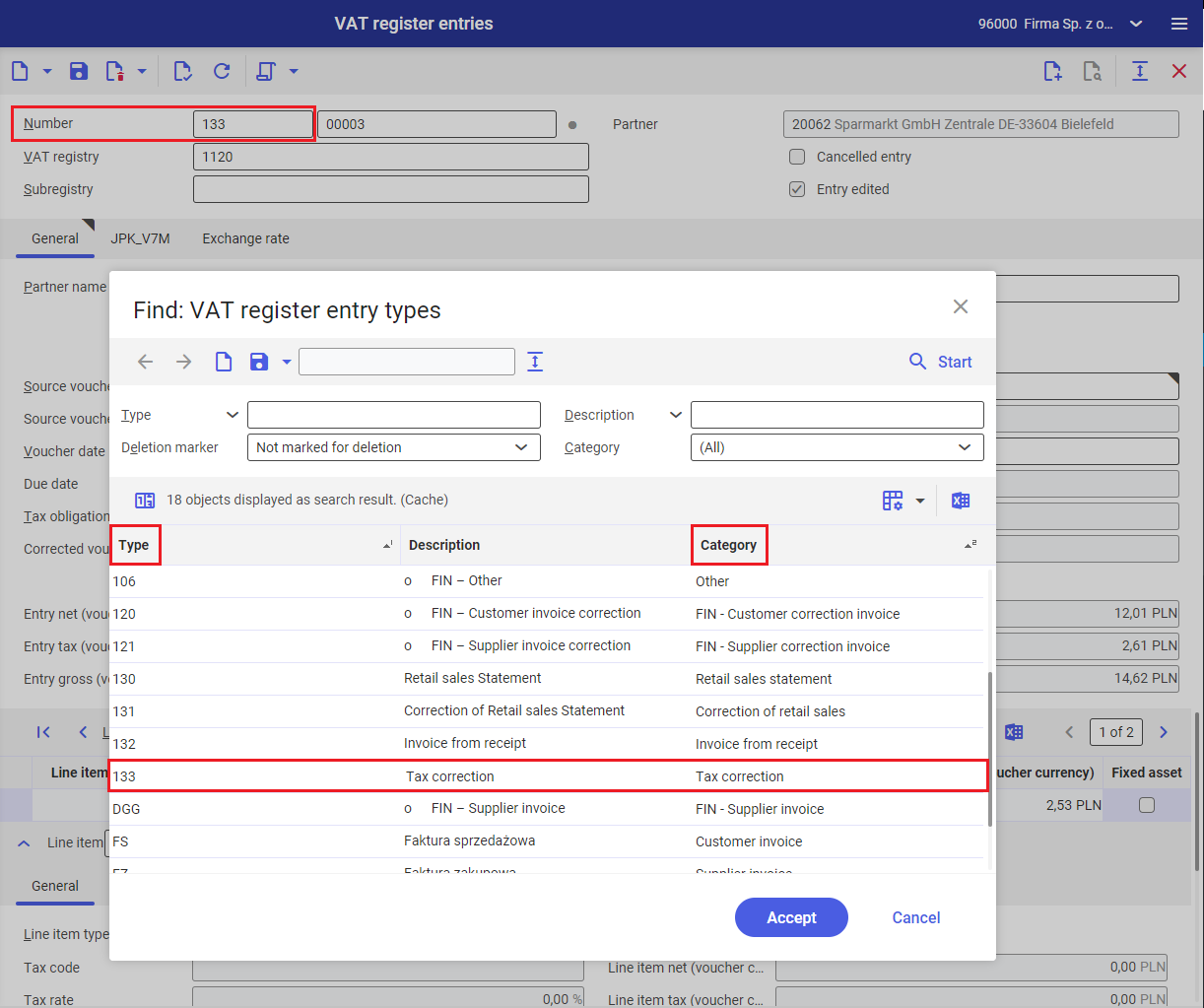

Number – entry number, it is composed of two segments. The first one is a voucher type defined in VAT register entry types application and the second one is a number automatically assigned to the entry.

VAT registry – specifies a VAT register code. Entries are recognized in relevant JPK_V7M declarations based on a VAT register.

Subregister – code of VAT subregister type, created in VAT subregistry types application, can be specified in this field. A VAT entry can be assigned to a subregistry only manually in this very field.

Partner – partner with data completed in the Financials view can be selected in this field.

Cancelled entry – specifies whether a VAT entry is canceled.

Entry edited – specifies whether a VAT entry has been edited.

In the query pane, you can also search for relevant VAT register entries. Using the [Value assistant] button, you can proceed to a window where entries created in the system will be displayed.

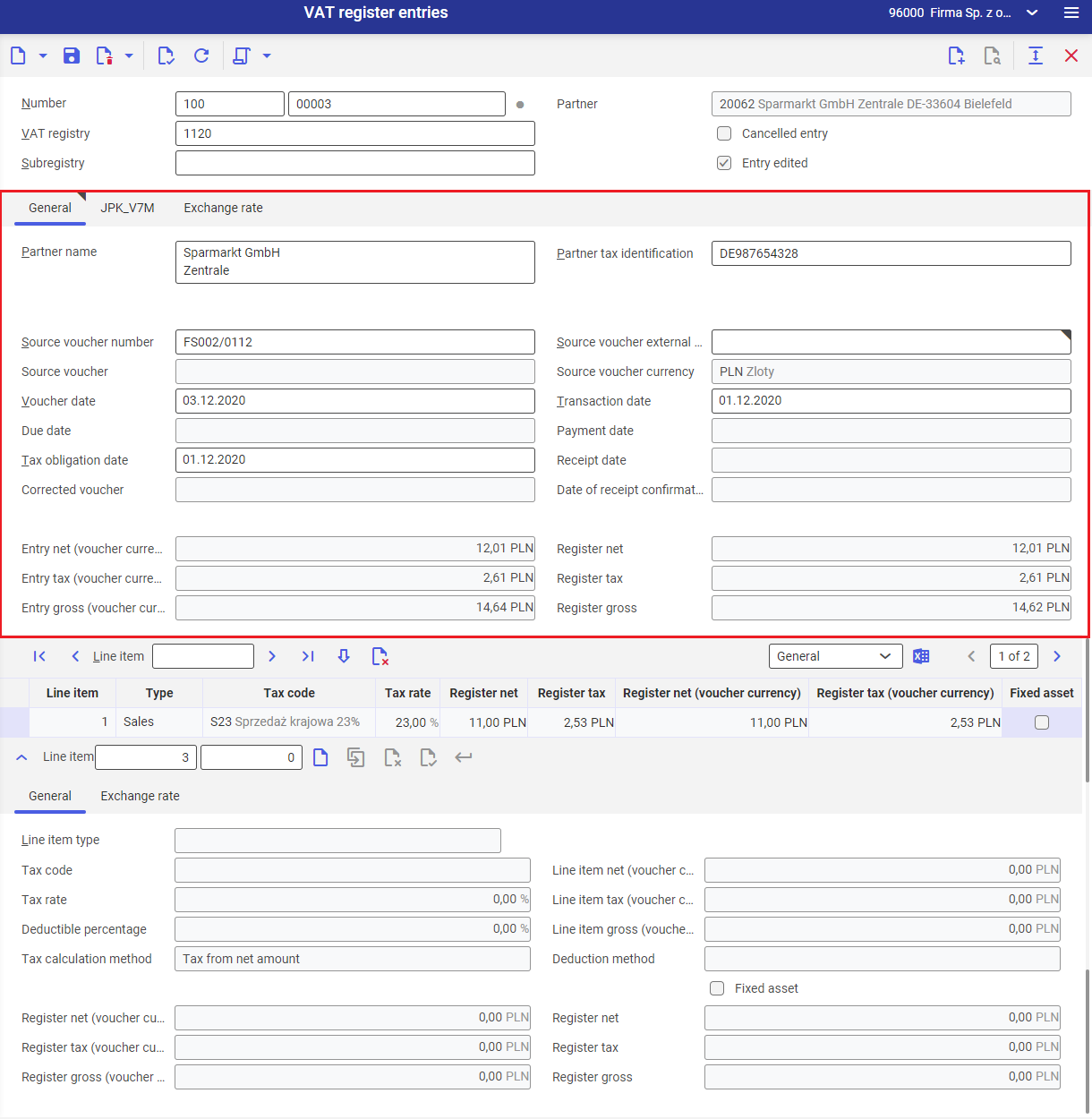

General tab

This tab provides basic information regarding a VAT register entry.

Partner name – partner name specified in the query pane parameters.

Partner tax identification – partner tax identification (TIN), it is retrieved from the partner chart. It can be edited in the VAT entry.

Source voucher number – number and type identifying the source voucher in the system.

Source voucher external number – a reference number provided in the source voucher can be entered in this field.

Source voucher – refers to the source voucher on the basis of which a VAT entry was generated. This field is active for entries of Tax correction category. By holding the [Ctrl] key and clicking the completed value, you can proceed to the source voucher.

Source voucher currency – currency of the source voucher can be specified in this field; normally, it is the company’s default currency.

Voucher date – voucher date of issue; it is completed when adding a new voucher with a current date.

Transaction date – you can specify a sales/purchase date in this field.

Due date – this field is active for vouchers of Tax correction and Other categories, it is mandatory for vouchers with Bad debt (Art 89a para. 1, Art. 89b para 1) value selected in the Type of tax correction field in JPK_V7M tab. This field is editable for unconfirmed vouchers of Tax correction and Other categories.

Payment date – this field is active for vouchers of Tax correction and Other categories, it is mandatory for vouchers with Bad debt settlement (Art 89a para. 4, Art. 89b para 4) value selected in the Type of tax correction field under JPK_V7M tab. This field is editable for unconfirmed vouchers of Tax correction and Other categories.

Tax obligation date – enter a tax point date in this field.

Receipt date – date of receipt for purchase vouchers, this field is active for vouchers of Tax correction, Other, SAD, Supplier invoice categories as well as for supplier correction invoices.

Corrected voucher – voucher for which a correction is created. This field is not editable, it is completed automatically for supplier correction invoices or customer invoices.

Date of receipt confirmation – enter a receipt confirmation date in this field for a customer correction invoice.

Entry net (voucher currency) – net amount of the source voucher. Currency in this field depends on the Source voucher currency field.

Entry tax (voucher currency) – tax amount of the source voucher. Currency in this field depends on the Source voucher currency field.

Entry gross (voucher currency) – gross amount of the source voucher. Currency in this field depends on the Source voucher currency field.

Register net – net amount specified in a VAT register in system currency.

Register tax – tax amount specified in a VAT register in system currency.

Register gross – gross amount specified in a VAT register in system currency.

JPK_V7M tab

JPK_V7M tab contains the parameters which information is used when creating a JPK_V7M declaration. It is composed of subtabs: Characteristics and Goods and services groups.

Characteristics subtab

Following fields are available in this subtab:

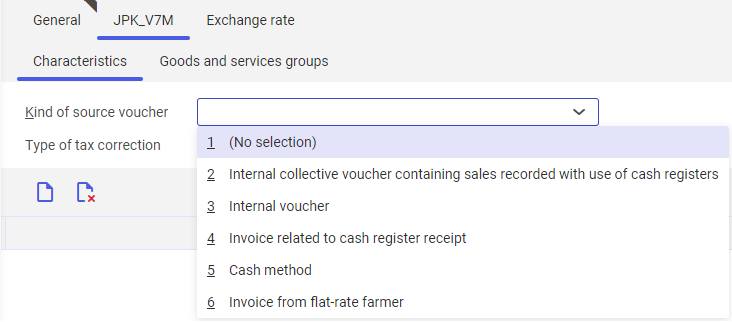

Kind of source voucher – you can specify a kind of source voucher in this field. Information in this field refers to Voucher type schema element which specifies sales or purchase.

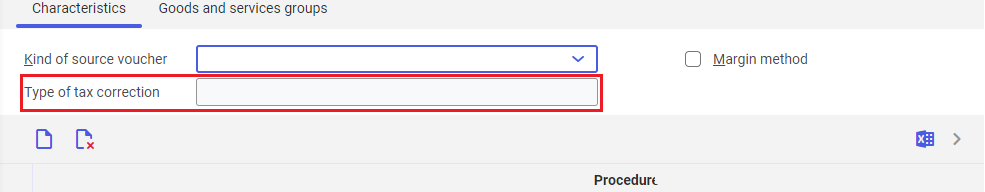

Type of tax correction – specify a tax correction in this field, the field is editable.

Margin method – specifies if the margin method was used for the source voucher (supplier/customer invoice).

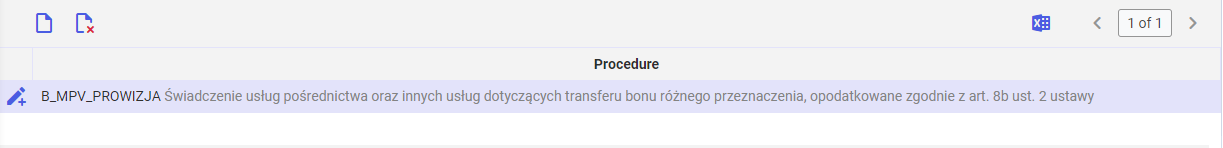

This subtab contains the Procedure section. It presents SAF-T procedures for a VAT register entry.

This section is handled with the following buttons:

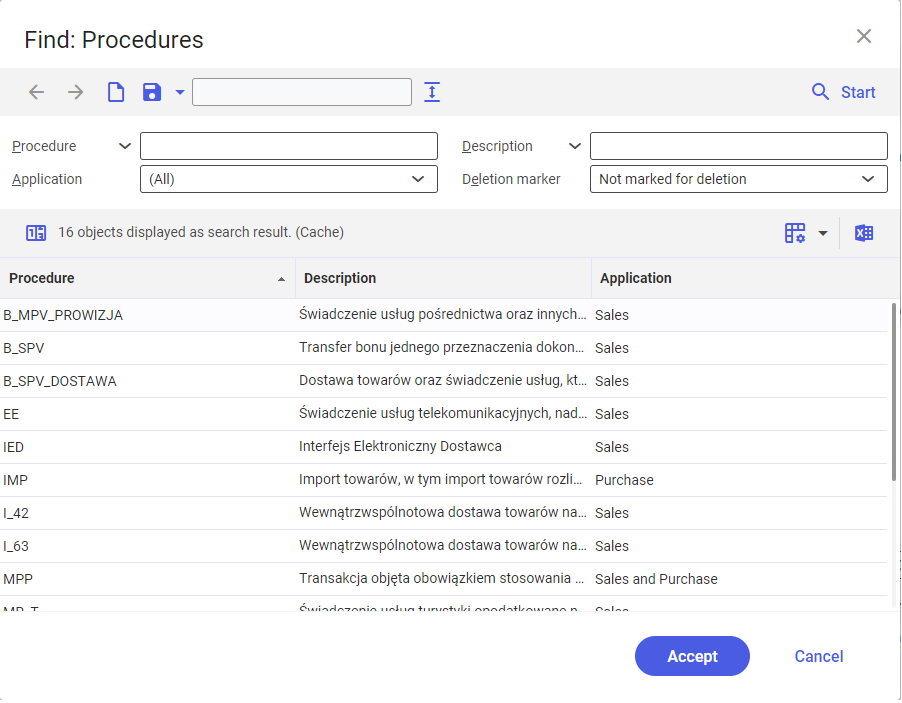

[Assign procedure] – assigns a procedure. It adds a line in the work pane for specifying the procedure. The procedure can be assigned manually: by entering the name of an existing procedure/via a dialog window.

[Set/remove deletion marker] – adds/removes a deletion marker.

Goods and services groups subtab

This subtab contains the Goods and services group section. It presents the goods and services groups assigned to a VAT register entry. This section is handled with the following buttons:

[Assign goods and services group] – assigns a goods and service group. It adds a line in the work pane for specifying a goods and services group.

[Set/remove deletion marker] – adds/removes a deletion marker. This action is available for In edition or In creation VAT entries.

Exchange rate tab

The Exchange rate tab contains information regarding a currency exchange rate accepted for VAT register entry. For manually entered VAT entries, the exchange rate is set on the basis of the Transaction date field under General tab. For VAT entries generated from source vouchers, the exchange rate is retrieved from the source voucher.

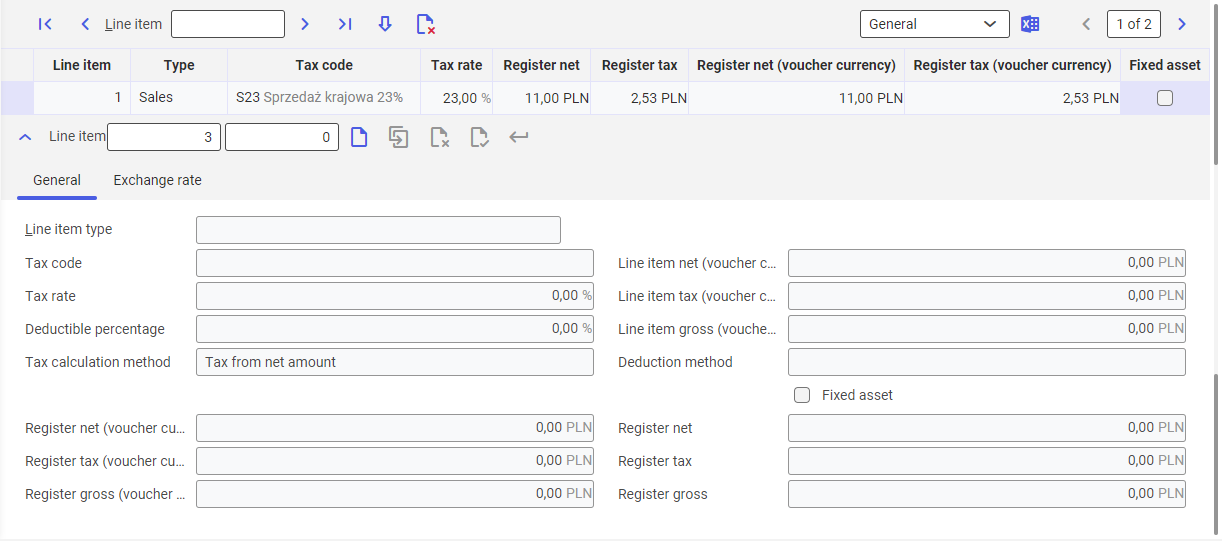

Line item section

This section contains a table with basic information about line items on VAT register entries. For automatically generated VAT entries, data presented in these fields is based on source vouchers aggregated by a common tax code.

Clicking twice on a record with selected line item presents its related detailed information in the line item table under General and Exchange rate tabs.

After adding a new voucher line item, a tax code must be completed under General tab. Following fields can additionally be completed or modified: Deductible percentage and Line item net (voucher currency). The other fields are completed automatically based on the entered data. Data in the Exchange rate tab is completed on the basis of the information provided in the Exchange rate tab above.