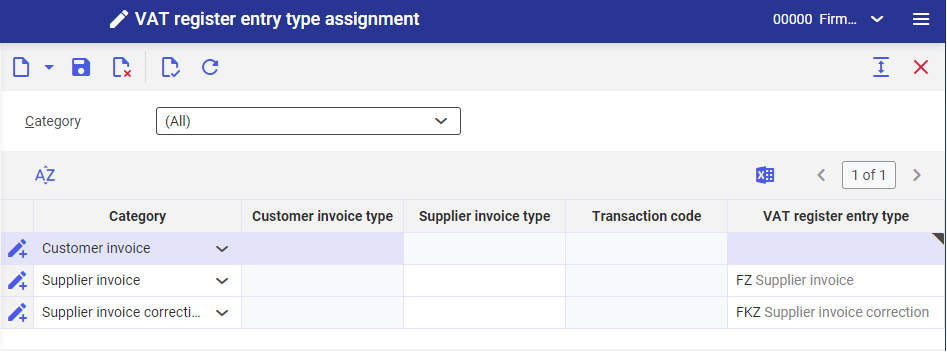

In VAT register entry type assignment application you can assign VAT register entry types to voucher and transaction categories. Creating and/or posting a voucher and a transaction initiates the process of generating VAT register entries. A type of generated entry is specified on the basis of the assignments created in the VAT register entry type assignment application. Assignments created in this application take precedence over the assignments defined in Customizing: VAT register (function under Financials -> Financials – Poland) application.

Only one assignment can be defined for a category with a specified invoice/transaction category. VAT register entry type receives the category defined in the assignment.

Query pane

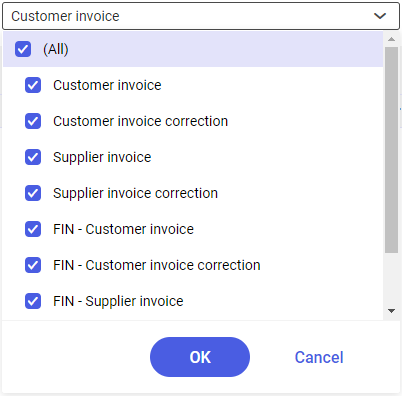

Category – in this field you can filter the specified object types, which generate VAT register entries. Available categories:

- All

- Customer invoice

- Customer invoice correction

- Supplier invoice

- Supplier invoice correction

- FIN – Customer invoice

- FIN – Customer invoice correction

- FIN – Supplier invoice

- FIN – Supplier invoice correction

- FIN – Other

Work pane

Following fields are available in the work pane:

Category – select a category to which a VAT register entry type is to be assigned. The available list of categories is predefined and not editable. The selected category with specified parameters can be used only once.

Customer invoice type – if you selected Customer invoice or Customer invoice correction as category, then you can specify a customer invoice type in this field, for which the assignment will be applicable. Customer invoice types are defined in the Customer invoice types application.

Supplier invoice type – if you selected Supplier invoice or Supplier invoice correction as category, then you can specify in this field a supplier invoice type defined in the Supplier invoice types application.

Transaction code – transaction code is specified for postings made directly in the Financials framework. Transaction codes are created in Transaction codes financial accounting application. The same transaction code cannot be assigned to these categories:

- FIN – Customer invoice and FIN – Customer invoice correction

- FIN – Supplier invoice and FIN – Supplier invoice correction

VAT register entry type – select a VAT register entry type in this field. Defined assignment associated a specified category with a corresponding entry type. Entry types are defined in VAT register entry types application.