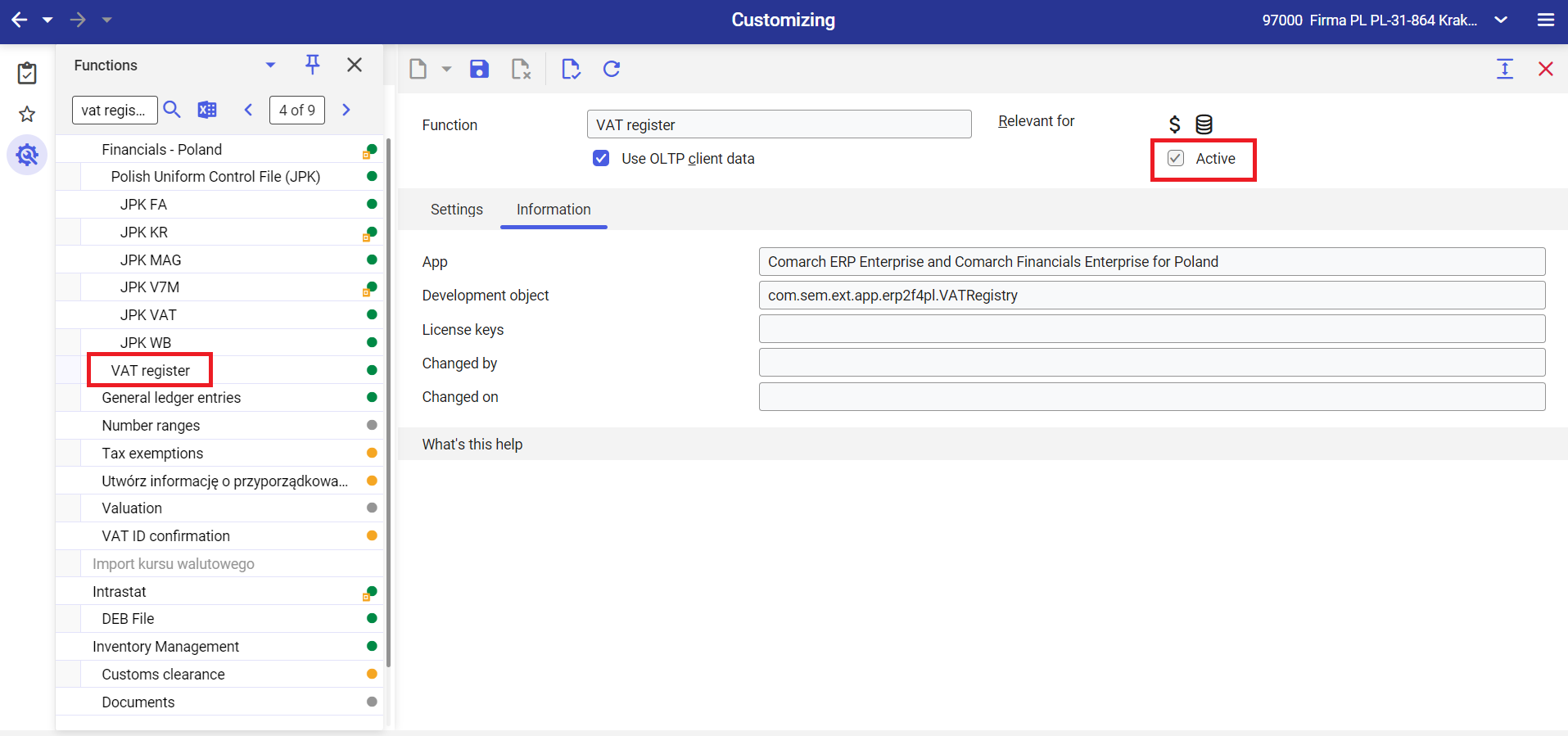

This article VAT register function, which is a secondary function of Financials − Poland function, in Customizing application. The VAT register function is available from the level of Customizing → [Functions] → VAT register.

The VAT register function allows for associating VAT register entries with appropriate object type that generates it, which is represented by a value in Category column. Defined assignments are used during the automatic generation of VAT register entries, in if in VAT register entry types assignment application, appropriate associations between the category and entry type are not created.

VAT registers are defined for a given company on the basis of its tax periods.

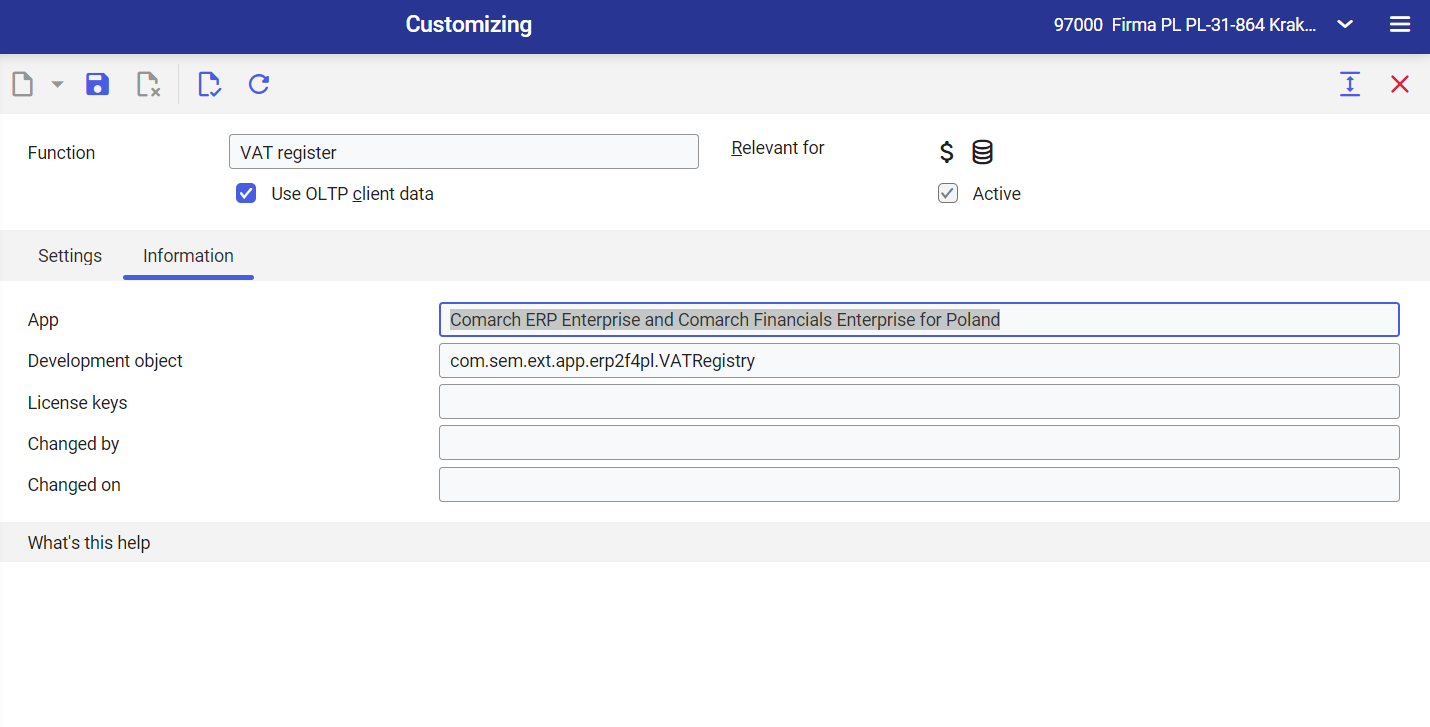

The identification pane of the application contains:

- Function name

- Information about the areas affected by the described function

- Use OLTP client data parameter

- Active parameter

Tab Settings

In the tab Settings, a table with the following columns is available:

- Category – this column presents categories of objects that generate VAT register entries. The rows of the column are not subject to edition.

- VAT register entry type – column used for assigning VAT register entry type to a category. Its rows can be edited. Types can be selected from among types defined in VAT register entry types application

Tab Information

Tab Information contains data regarding:

- Application name

- Development object

- License key

- User who made the last modification

- Date of the last modification