For the purpose of the correct handling of VAT, support for international transactions has been introduced. In order to distinguish types of tax classifications in Comarch Mobile, tax classifications are downloaded from Comarch ERP Enterprise to the mobile application instead of specific customer types. Which tax code, and thus which VAT value is to be calculated in a document depends on the tax classification of a given customer and item.

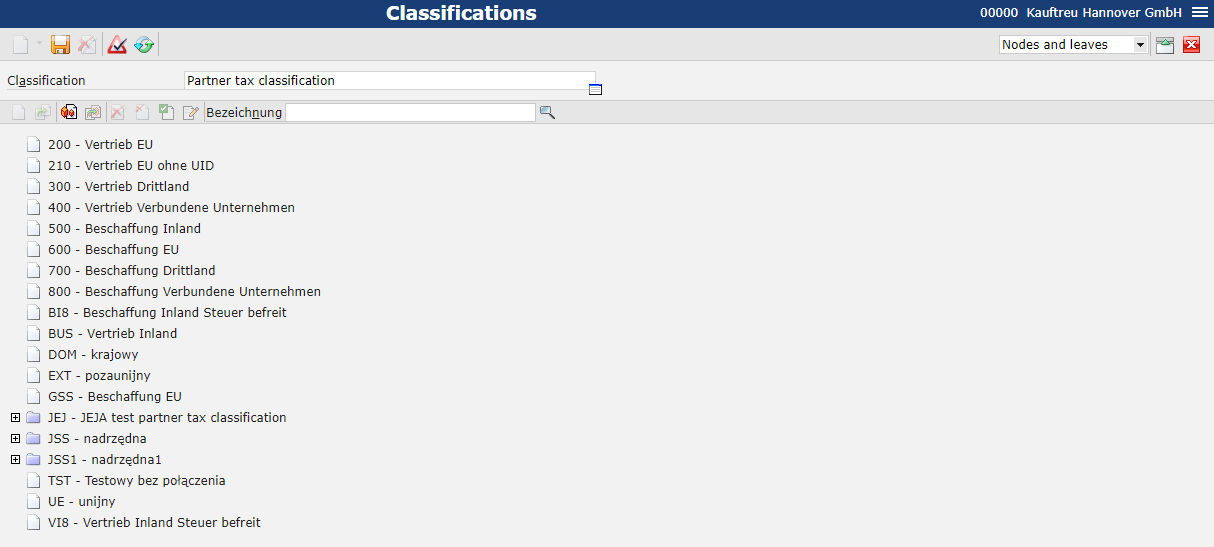

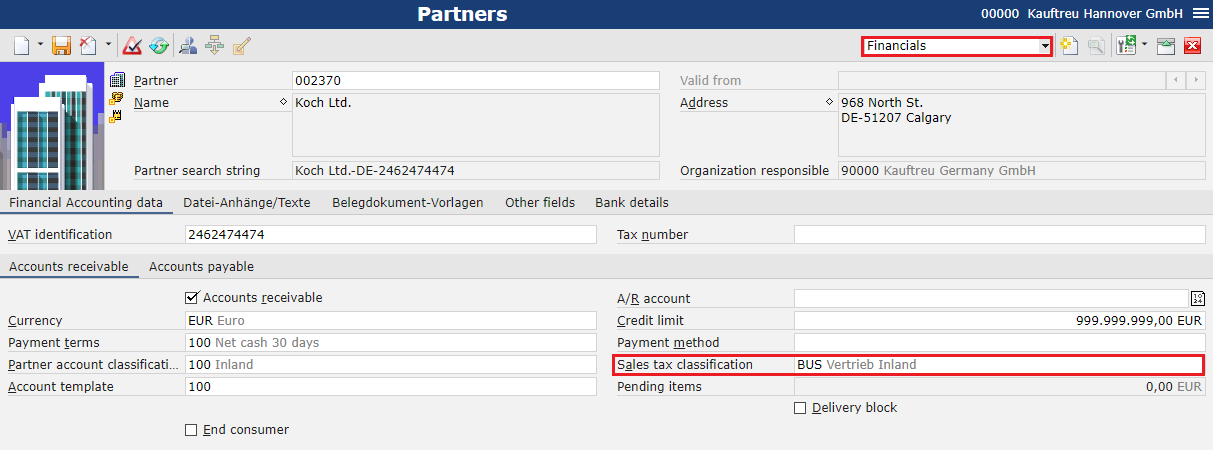

Partner tax classifications

Each customer must have an assigned tax classification.

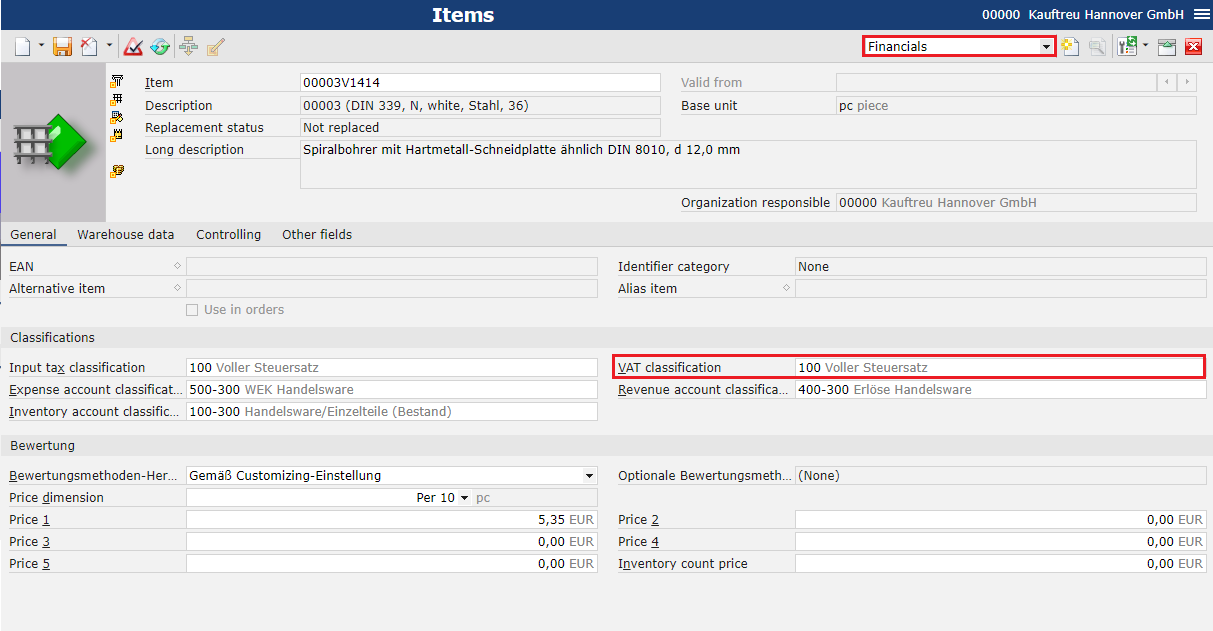

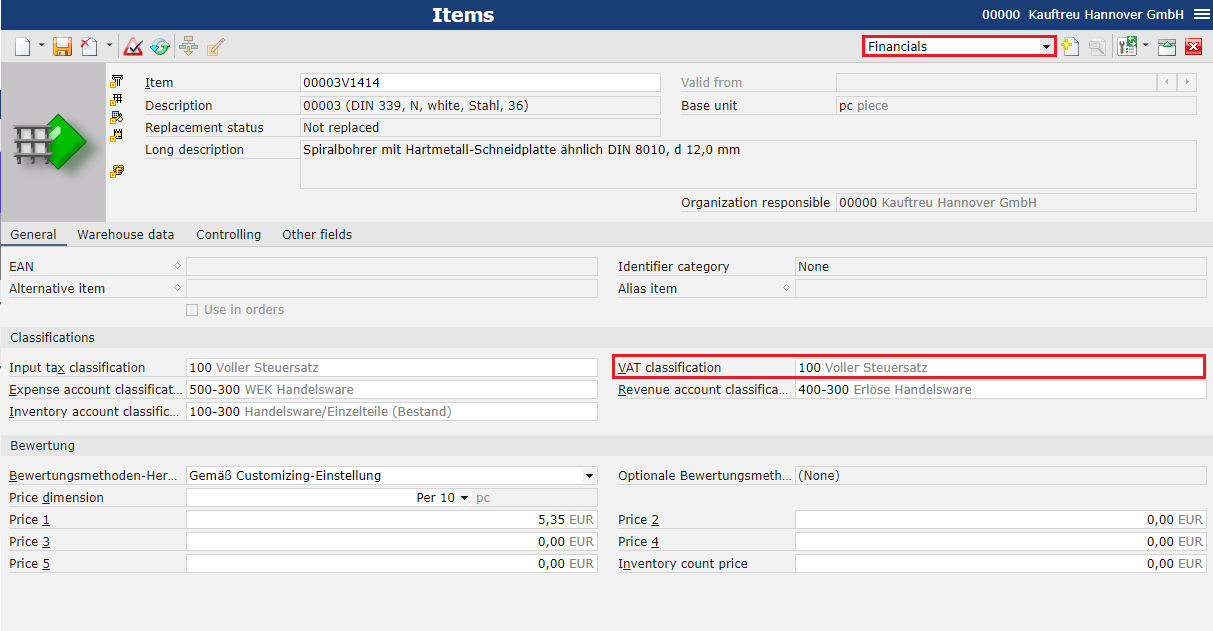

Item tax classification

Each item must have an assigned VAT classification.

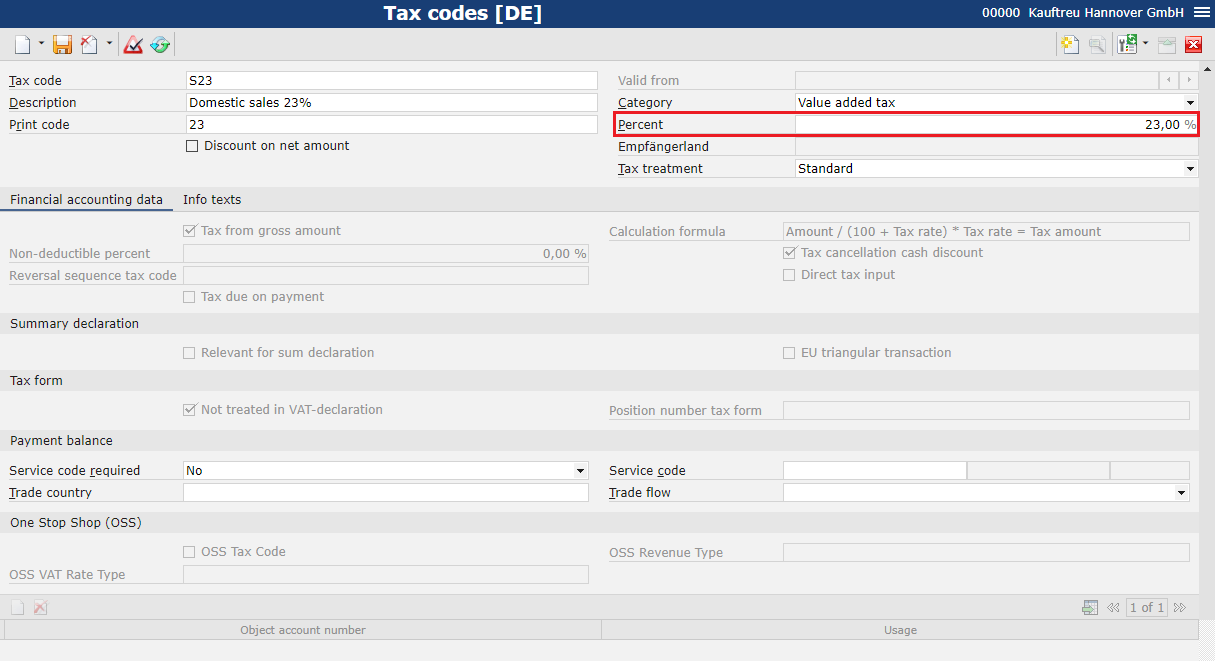

Defining a tax code

Appropriate tax codes can be defined in the Tax codes application. More information may be found in the article Tax codes in Comarch ERP Enterprise Knowledge Base.

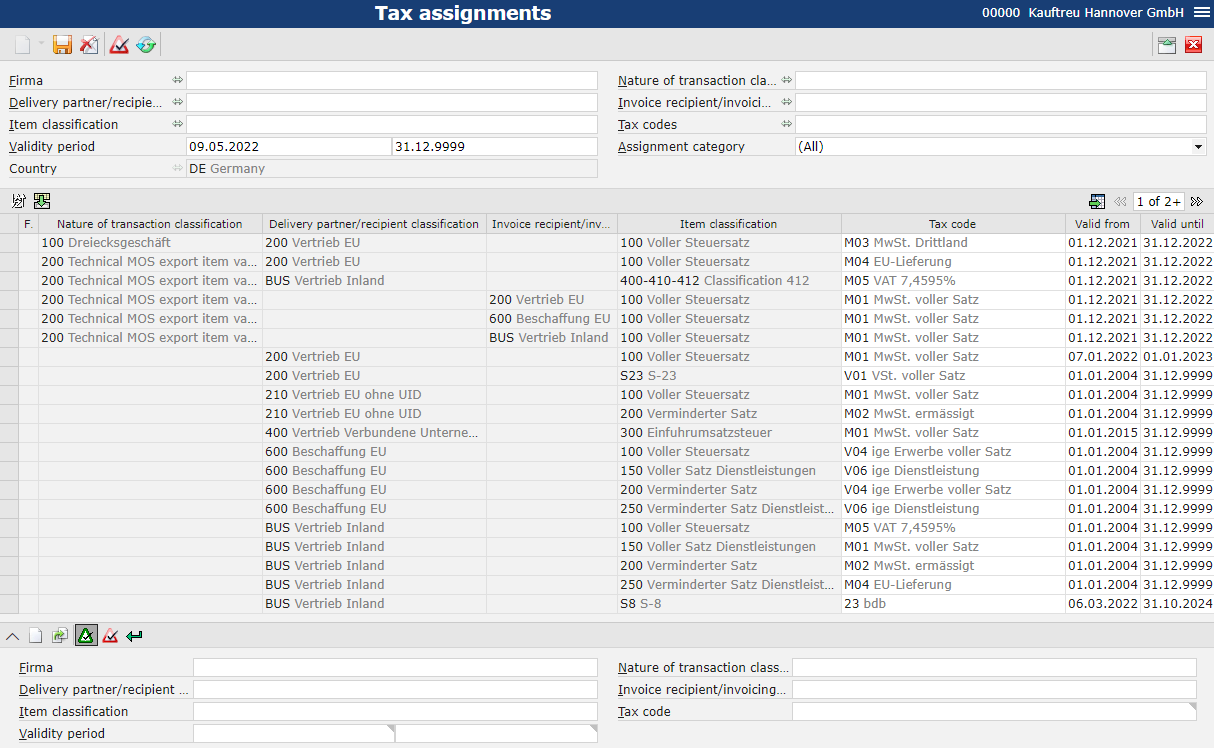

Tax assignment

A relevant assignment between a partner and tax code should be created in the Tax assignments application. Such an assignment allows entering an appropriate VAT rate in a document issued for a given customer and item. More information may be found in the article Tax assignments in Comarch ERP Enterprise Knowledge Base.