Contents

General information

The application makes it possible to generate advance sales invoices (ASI) from a sales order. The user can add any number of advances, but their sum cannot exceed the total value of the order.

Advance payments may be made with any payment form available to a given POS workstation and the operator. A VAT direction for advance invoices is always set on a document’s total value.

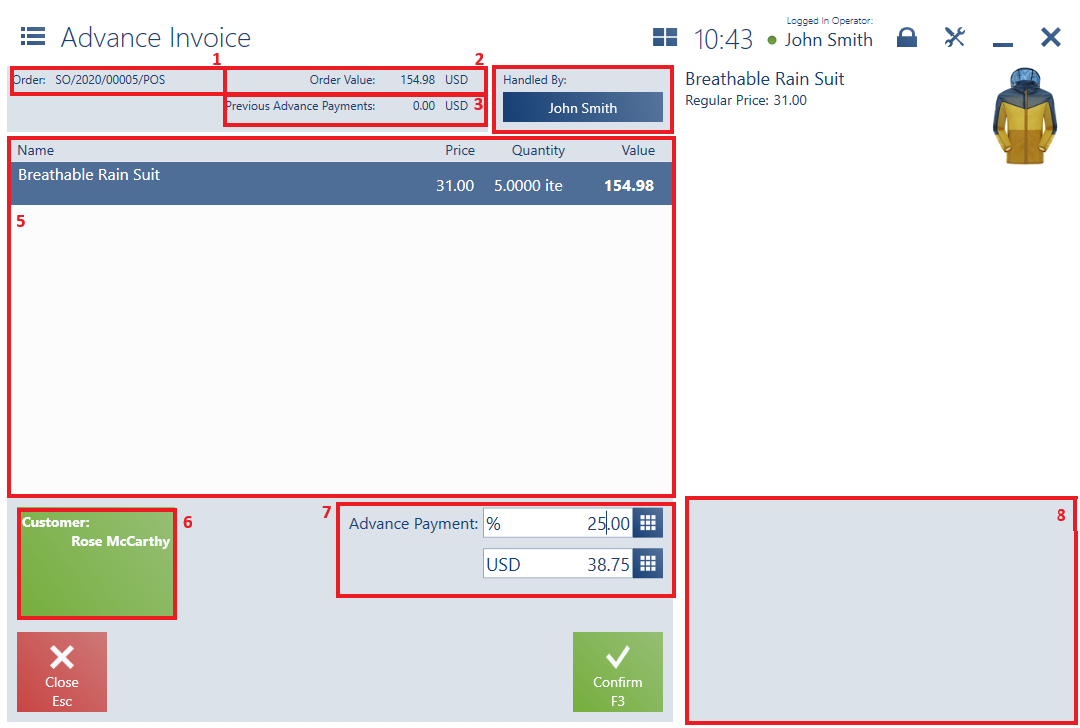

The form of a new advance invoice contains the following fields (particular points correspond to areas marked in the figure above):

1. Order – it displays the number of an order for which the advance invoice is being added. The field is not editable.

2. Order Value – it displays the value of an order for which the advance invoice is being added. The field is not editable.

3. Previous Advance Payments – it displays the sum of advance payments already added for an order for which the advance invoice is being added. The field is not editable.

4. Handled By – it displays the name of a person issuing the document

5. Document Item List, containing the following columns:

- Name

- Price

- Quantity

- Value

6. Customer – it makes it possible to select a (primary and secondary) customer of the document

7. Advance Payment – in this field, it is possible to enter the percentage value or amount of an advance payment

8. Attributes

Once the document is confirmed, the payment window is displayed.

The section Payment Form in the printout of a SO document presents information on processed advance payments (for this document).

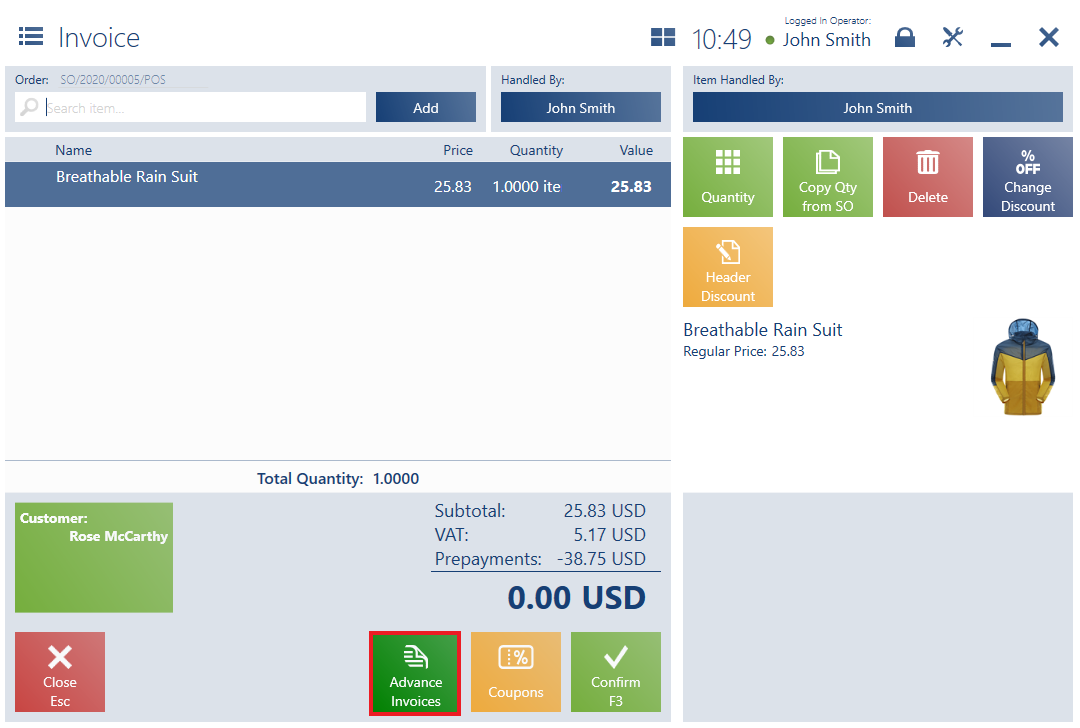

In the ERP system, it is possible to specify a settlement method for advance payments with the use of the parameter Deduct advance payments in full:

- If the parameter is selected – a sales invoice generated from a SO document associated with ASI presents relevant advance payments’ amount below the overall value of all document items, in the field Prepayments. In the case where different customers are set in SO and its associated ASI, an attempt to generate a sales invoice displays the notification: “There are uncompleted advance payments associated with the order. Check consistency of customer data in the issued advance invoices and the final invoice”.

- If the parameter is deselected – the user may manually deduct advance payments in the generated sales invoice, provided that there is at least one advance invoice generated for an associated sales order and that the advance invoice has the same customer defined as in the sales invoice.

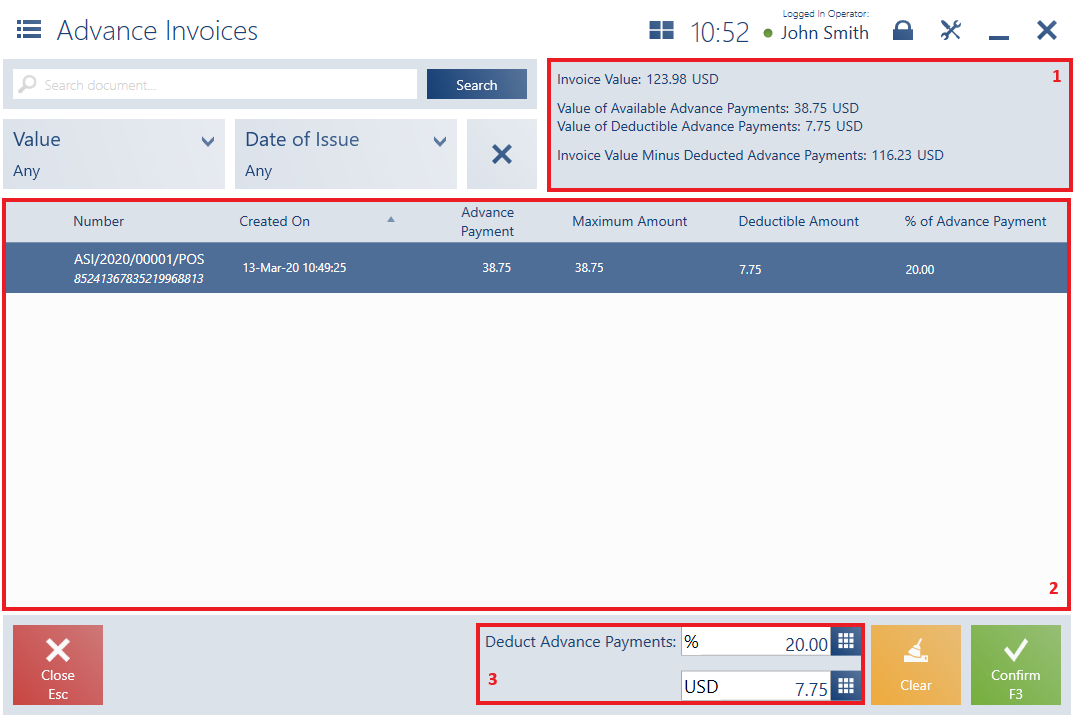

The list of advance invoices presents the following fields (particular points correspond to areas marked in the figure above):

1. Information on the values of:

- The invoice

- Available advance payments

- Deductible advance payments

- The invoice after deducting advance payments

2. Document list, containing the following columns:

- Number

- Created On

- Advance Payment

- Maximum Amount

- Deductible Amount

- % of Advance Payment

3. Deduct Advance Payments – it enables the user to enter the percentage value or amount of an advance payment to be deducted

The upper part of the window contains the text filter field enabling the user to search through the ASI document list on the basis of a document’s system number.

It is also possible to narrow down displayed results with the use of drop-down filters:

- Value

- Date of Issue

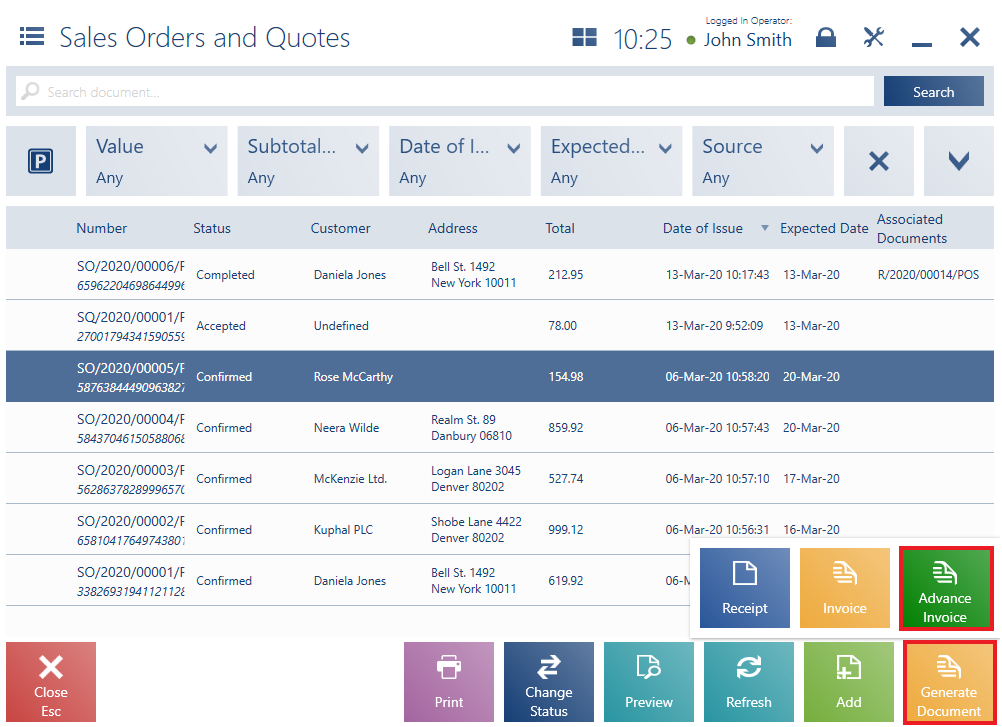

According to the company’s policy, within two weeks after the order is made, the customer is required to make a 15% advance payment.

After a week, the customer comes to the store to make the prepayment. To process the transaction, the operator searches the document submitted by the customer on the list of sales orders and quotes, and clicks [Generate Document] → [Advance Invoice]. The generated form correctly copies customer data from the SO document. The operator enters the value 15% in the field Advance Payment. After confirming the document, the operator accepts the payment from the customer.

In the case where there is no connection established with the data synchronization service (offline work mode), upon an attempt to generate a trade document from SO, the application displays the notification: “Connection with data service is not established. The document will not be associated with the order and advance payments will not be deducted. Would you like to continue?”. The operator may then issue a trade document, but it will not be associated with a given SO document, and advance invoices will not be included in it. A trade document generated in this way displays an entered order number in the field Reference Number.

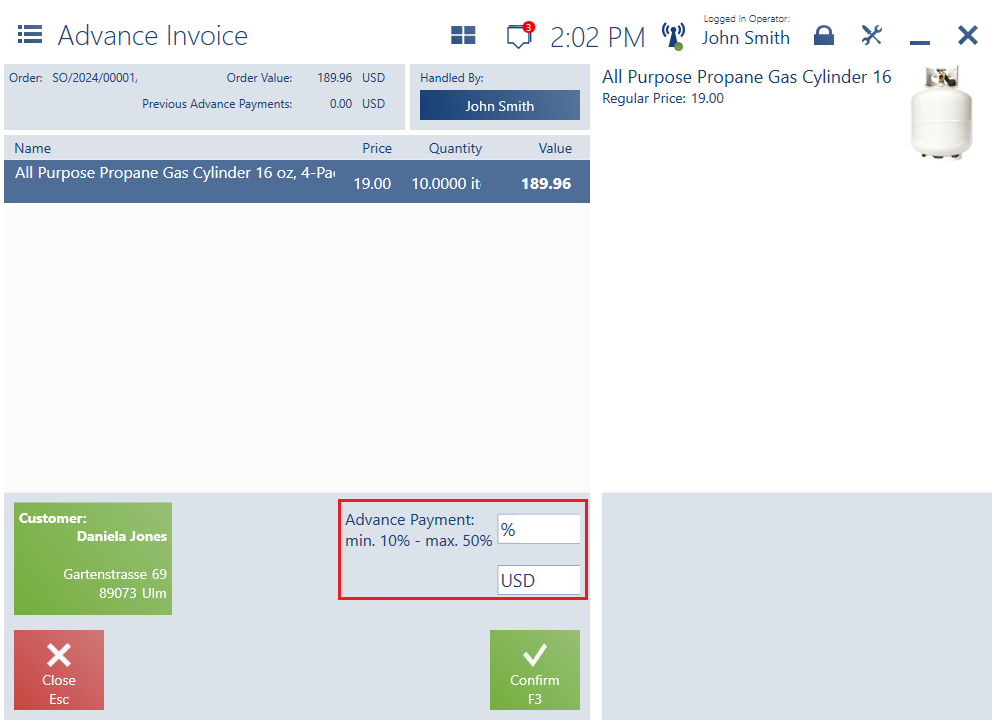

Configuring the advance payment amount (Comarch ERP Enterprise)

When a sales order is created in Comarch POS and a delivery is made to the customer’s home or to an external pickup point, the items are physically taken from the warehouse, so it is not just a reservation of goods, but an actual order. In this situation, the customer is asked to pay the entire amount of the sales order when it is created in Comarch POS. In order to make sure that the entire amount has been paid in advance, it is possible to set a percentage of the advance and prevent its modification by POS users.

The feature requires predefining the percentage of the first advance in the range from 0.01% to 100% in Comarch ERP Enterprise.

To do so, first activate the parameter Advance payment percentage required in the Sales channels application → Comarch Retail POS tab → Advance payment percentage section. After activating the parameter, you can enter the percentage range for advance payments.