Contents

General information

The handling of tax free documents (TF) enables the refund of VAT paid by travelers from outside the European Union directly on POS workstations. Owing to that, customers may avoid double taxation: in the country of purchase and country of residence. Comarch POS supports communication with the dedicated Tax and Customs Electronic Services Portal (PUESC). Using the portal, it is possible to issue an electronic tax free document and verify its status when the traveler arrives at the store for a VAT refund.

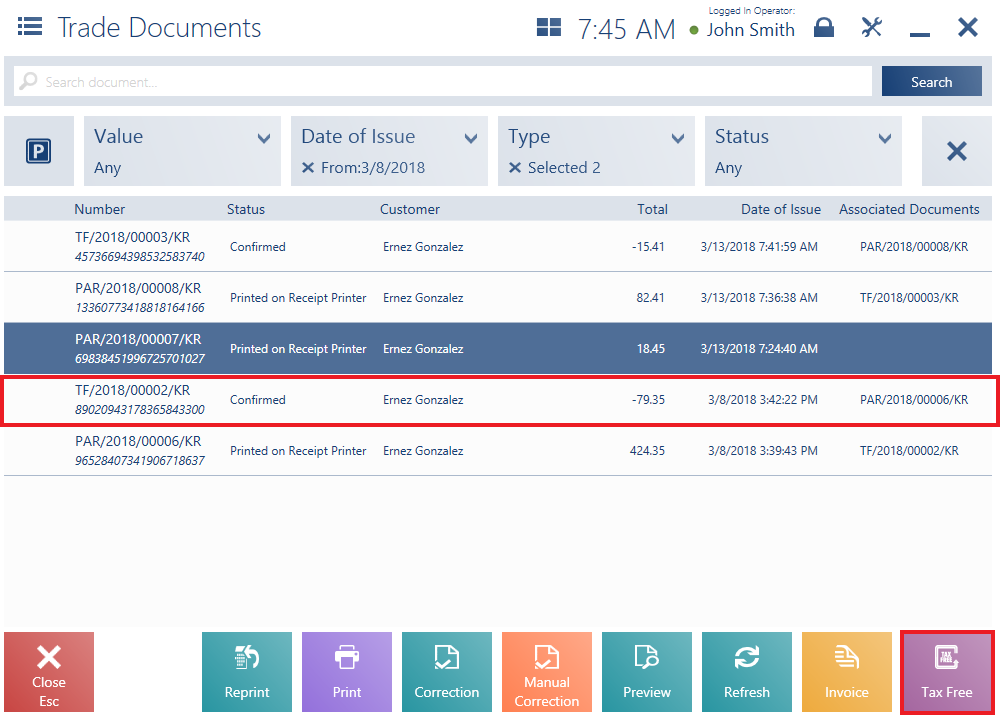

- Has not been printed on a receipt printer

- Has no corrections (or all the corrections have been canceled)

- Has no associated sales invoice

- Has no other tax free document generated (or the generated tax free document has been canceled)

In the ERP system, it is also possible to activate the functionality of generating TF documents from confirmed documents. If the functionality has been activated and no numbering scheme has been defined for the TF document type in the ERP system, an attempt to generate a TF document from a confirmed receipt on the POS workstation is blocked with the notification: “Unable to issue a tax free document. There is no document definition”.

As in the case of other documents, it is not possible to generate a collective tax free document from several receipts.

Using Comarch POS, you can:

- Issue an electronic TF document on the PUESC portal

- Help a traveler settle documents that have the status Export Confirmed or Export Partially Confirmed

Tax free documents can only be issued in the online mode. If the connection to the PUESC portal is obtained and the verification of the employee as well as the data required in the message for the document is successful, the TF document in Comarch POS will be confirmed, and the traveler will be able to collect the printout necessary to obtain a tax refund.

In addition, when confirming a tax free document, the date of birth of the customer selected in the document is verified. If the customer’s date of birth is:

- Filled in – the document will be confirmed and the electronic TF document will start to be processed on the PUESC portal

- Not filled in – the document will not be confirmed and the application will display an appropriate notification

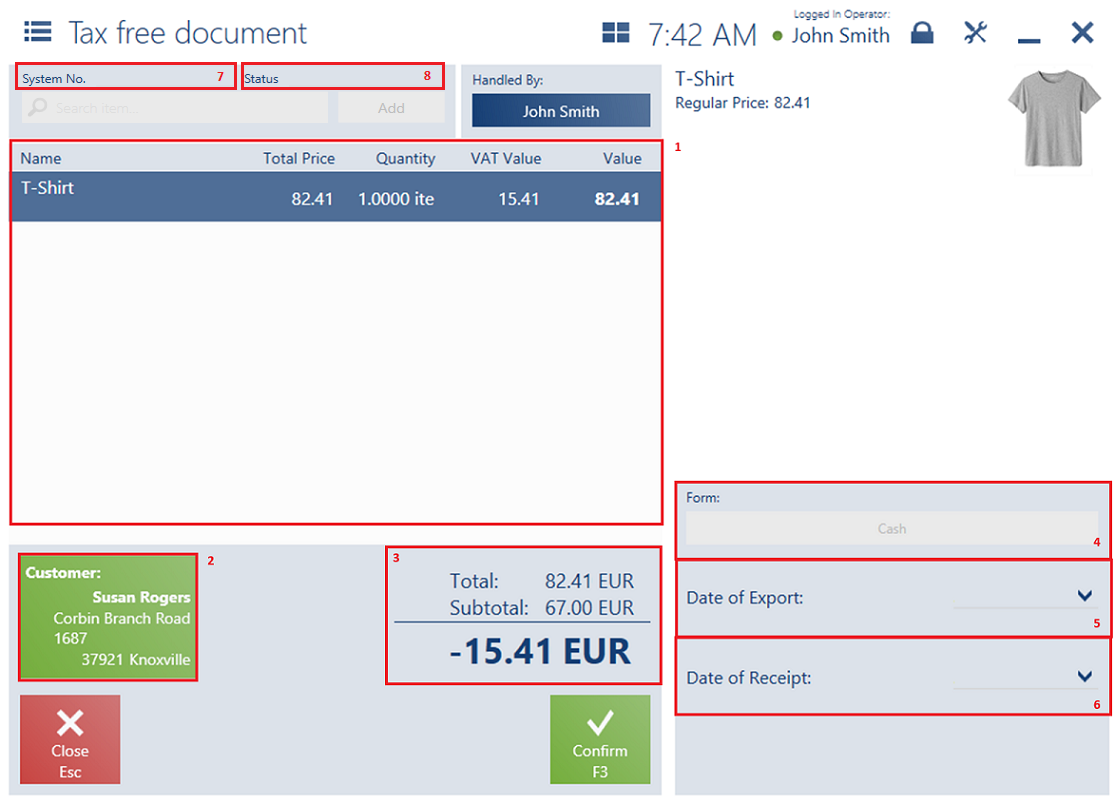

The form of a TF document contains the following fields (particular points correspond to areas marked in the figure above):

1. The list of document items presents the following columns:

- Name

- Total Price

- Quantity

- VAT Value

- Total Value

- VAT Rate (hidden by default)

2. The [Customer] tile displays:

- Customer name

- Address

- Number of an identity document – it is required for the confirmation of the TF document

- Address country – it is required for the confirmation of the TF document

3. The document summary contains the following fields:

- Total

- Subtotal

- Amount to refund

4. Form – available payment forms include Cash, Charge Card, and Bank Transfer. The payment forms are available if they have been correctly configured and shared with the POS workstation in the ERP system.

5. Date of Export – date of export outside the EU territory

6. Date of Receipt

7. System Number – a unique system number received in response to the entered TF document on the PUESC portal

8. Status – information about the status of the entered TF document on the PUESC portal

In the bottom right corner, you can also find attributes assigned to the document type, such as Document notes.

A document R/2018/04/POS1 is visible on both the workstations. The operator of the POS1 workstation generates a tax free document from the R/2018/04/POS1 document. At this moment, the R document is blocked for other workstations; therefore, the operator of the POS2 workstation, attempting to generate a TF or SI document from the same receipt document, will receive a blocking notification: “Cannot generate a tax free document because the document R/2018/04/POS1 has already been blocked on another workstation”.

A document TF/2018/03/POS1 is visible on both the workstations. The operator of the POS1 workstation confirms the export for the TF/2018/03/POS1 document. At this moment, the TF document is blocked for other workstations; therefore, the operator of the POS2 workstation, attempting to confirm the export for the TF/2018/03/POS1 document, will receive a blocking notification: “Cannot confirm the export because the document TF/2018/03/POS1 has already been blocked on another workstation”.

It is not possible to generate a sales invoice or a correction (it also refers to corrections related to the exchange process) from receipts associated with TF documents.

Printing a tax free document

There are two methods for printing a tax free document in Comarch POS:

- Physical printout – using the [Print] button

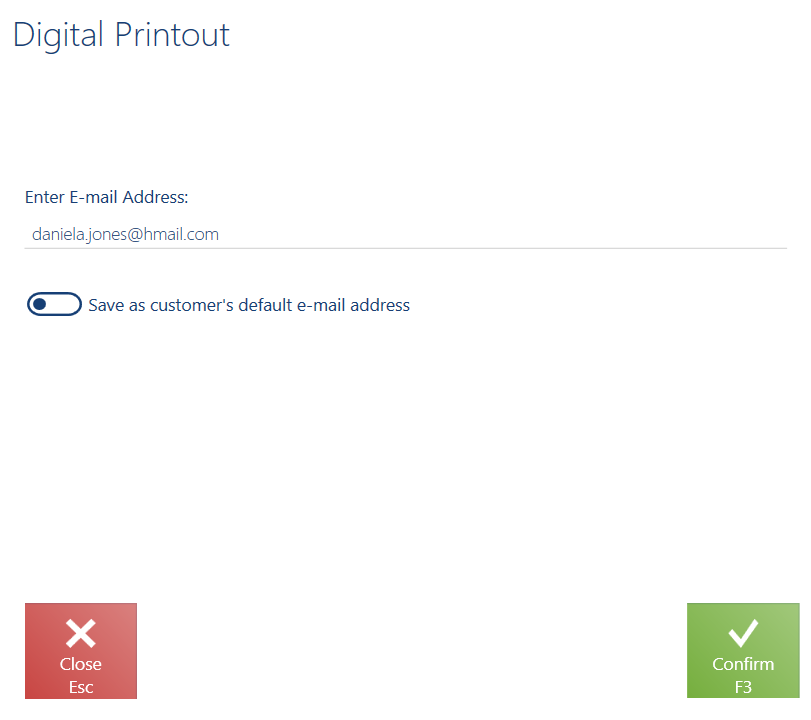

- Electronic printout sent to the traveler’s e-mail address as a pdf file – using the [Print] → [Send] buttons

If you select the option to send a printout, an additional window is presented where you need to enter an e-mail address:

Updating a tax free document status

Selecting the [Update Status] button for a tax free document in the list of trade documents receives a message from the PUESC portal and further processes the document, usually when settling the VAT with the traveler.

Settling a tax free document with a traveler

Tax free documents can only be settled in the online mode. For a tax free document to be settled, it must meet the following conditions:

- Status: Export Confirmed or Export Partially Confirmed

- Status: Confirmed

- Issued within the same center

- Form of refund payment set as Cash

To settle a document, press the [Settle Document] in the list of trade documents or in the tax free document preview.

Tax free – Integration with Global Blue (Comarch ERP Standard)

The tax free feature in integration with Global Blue is mostly used in the Czech market. If Global Blue’s services are to be used in Poland, prior integration with PUESC is necessary.

If the global e-Tax Free parameter is selected, you can select the parameter Upload documents via Global Blue platform to activate the Global Blue feature. This parameter is available on the center form → POS Workstations tab → Tax Free integration with Global Blue platform section.

After selecting both the parameters, the following fields must be filled in on the Tax Free tab of the company form (the fields are located in the Tax Free integration with Global Blue platform section):

- Payment amount must be greater than – enter the minimum transaction amount in the system currency. If the value on a receipt exceeds this amount, the seller will have the option to issue a tax free document.

- Document must be issued on/in – specify until when it should be possible to issue tax free documents; available options include:

- the same day

- month of purchase + defined number of months

- date of purchase + defined number of days

- date of purchase + defined number of months

Additionally, you need to fill in the following configuration parameters on the POS Workstations tab:

- Shop ID

- User

- Password

- Print Type

Generating a tax free document with Global Blue

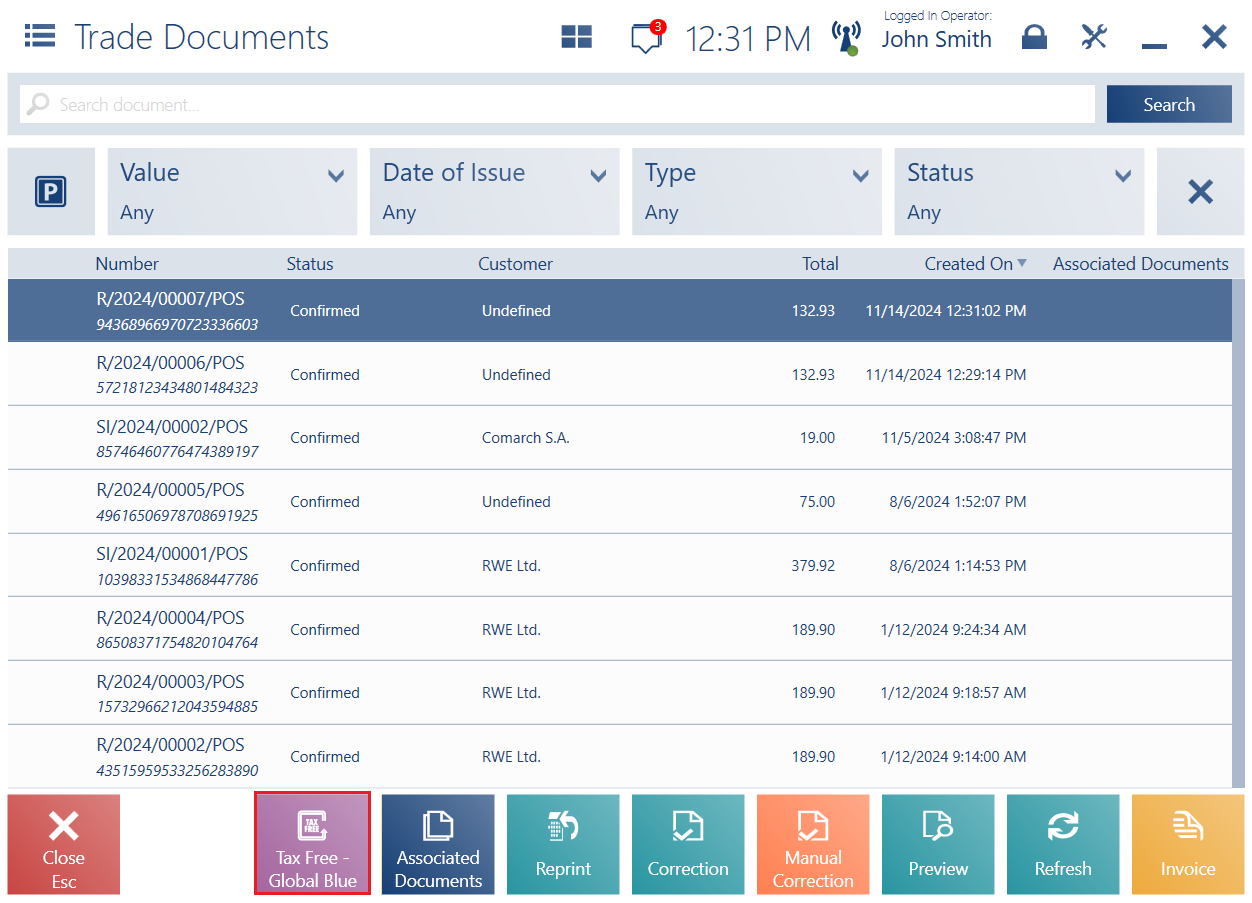

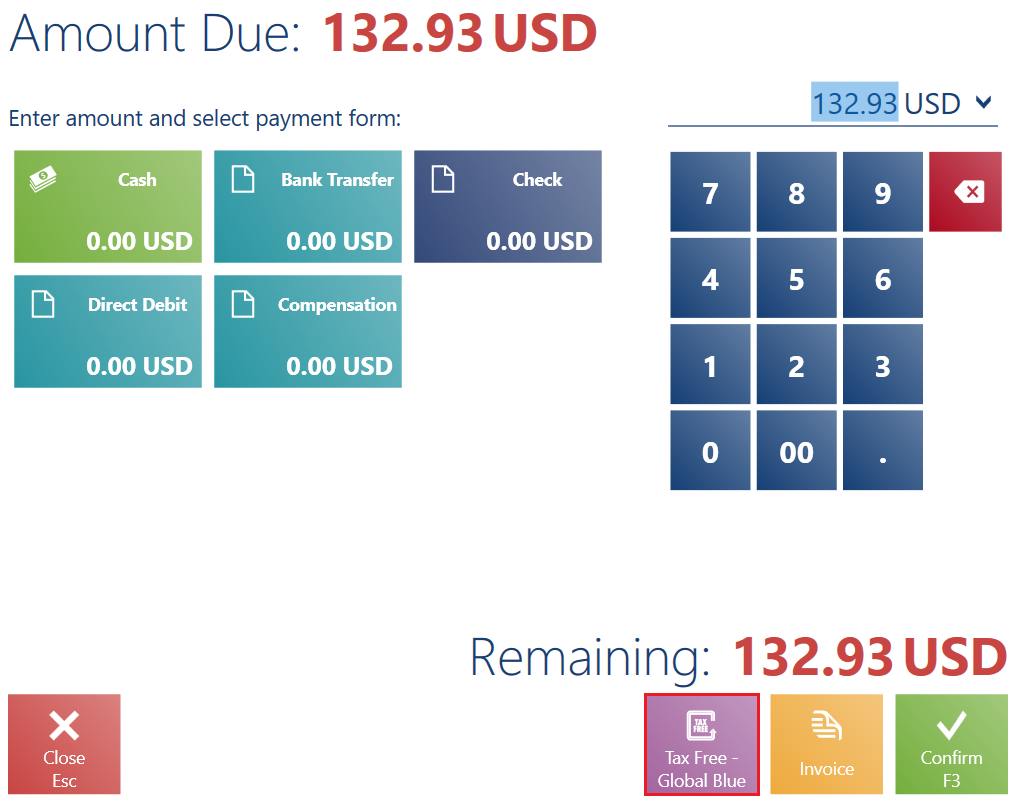

Once the integration of the tax free feature with Global Blue is activated, the [Tax Free – Global Blue] button becomes available in the following areas in Comarch POS:

- List of trade documents

- Receipt payment window

- The TF document cannot be printed on a receipt printer nor corrected

- The TF document can only be issued based on a receipt

- After the TF document has been issued, its source receipt cannot be corrected or converted into an invoice

- The TF document can only be issued if no invoice or other TF document has been generated from the associated receipt

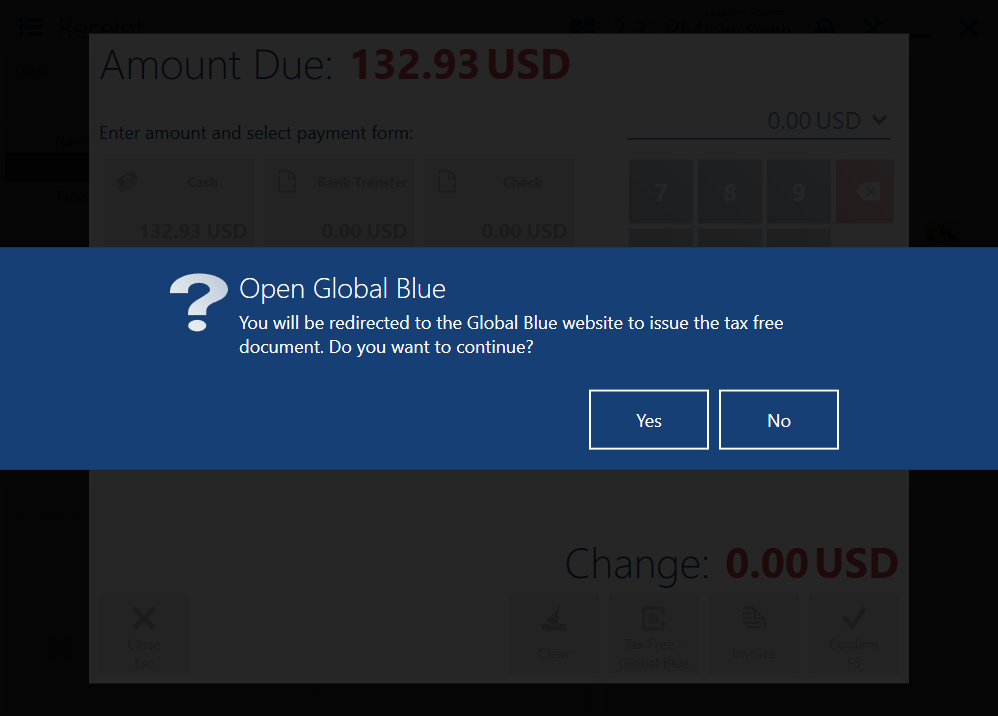

In Comarch POS, you can issue a tax free document for a receipt for which no other tax free document or other associated documents (e.g. corrections) have been issued. Selecting the [Tax Free – Global Blue] button opens the Global Blue website. On the website, you will find a filled-in tax free document that you can print immediately.

Messages

Comarch POS displays blocking messages if:

- The document amount is less than or equal to a specified limit

- The receipt is already associated with other documents

- The time of issue of the tax free document exceeds the limit set in a given country, e.g. 3 months from the creation of the receipt

- There is no online connection

- There are external errors on the part of Global Blue and the platform cannot be opened