Contents

General information

In order to add a new receipt (R) or sales invoice (SI), the user needs to select the button [New Document] in the main menu.

By default, the application displays a new receipt form. To change the document type, it is necessary to select the button [Change to Invoice]/[Change to Receipt].

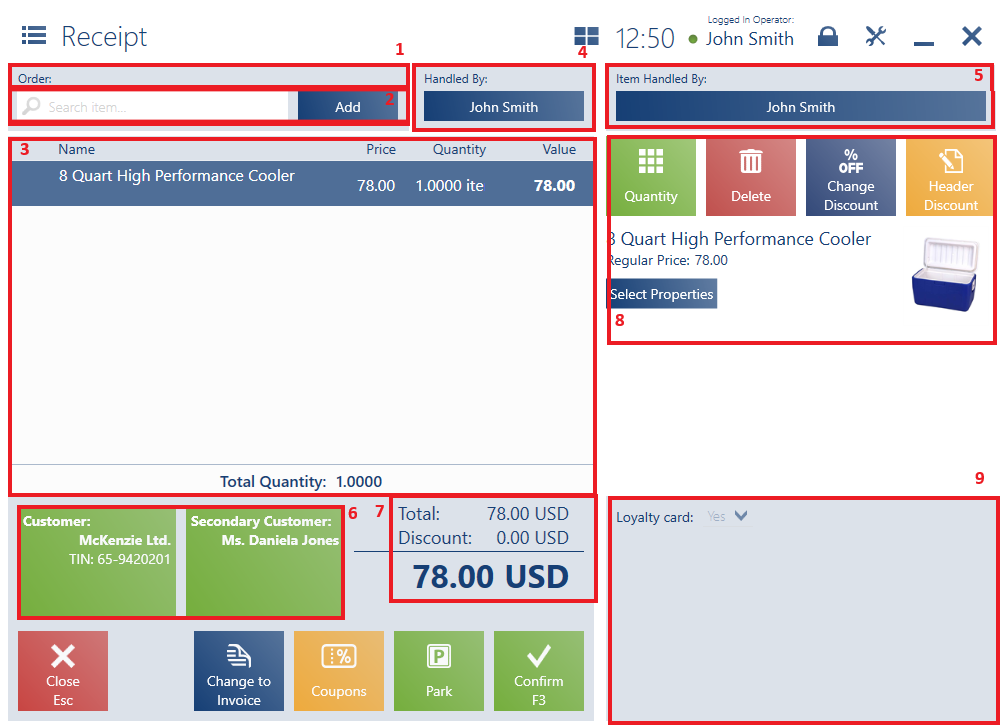

A new R/SI document form contains the following fields (particular points correspond to areas marked in the figure above):

1. Order – the field is editable

2. Search Item – it enables the user to search and add a document item

3. Document Item List, containing the following columns:

- Name

- Price

- Quantity

- Value

Hidden by default:

- Base Price

- Regular Price

- Code

- VAT

- Total Price

- Subtotal Price

4. Handled By – it presents an employee issuing the document

6. Customer – it makes it possible to select a (primary and secondary) customer in the document. In SI documents, selecting a customer other than Undefined is required.

7. Summary – it presents the total value of all entered document items:

-

- Total – displayed for documents with the VAT direction specified as On Total

- Subtotal – displayed for documents with the VAT direction specified as On Subtotal

- Base Total – the sum of all document items at a base price, including the quantity of each item

- Price Difference – a difference between the value of items at a base price and at a regular price

- Discount

- Mark-Up

- Prepayments

- VAT – displayed for documents with the VAT direction specified as On Subtotal

- Credit Limit – depending on configuration in the ERP system, this field presents the value of a credit limit granted to a given customer which either is or is not reduced by the document’s value

- The overall sales value after considering a discount/mark-up/VAT

8. Document Item Details – it presents detailed information on a document item and enables the user to change the item’s quantity, regular price, etc.

9. Attributes – it presents attributes assigned to a given document type

The form of a new receipt or sales invoice contains the following buttons:

- [Park] – it saves the document as unconfirmed to enable its completion later or on another workstation

- [Confirm] – it confirms the document

- [Print] – it prints the document (hidden by default)

- [Coupons] – it displays discount coupons

- [Calculate Promotions]/[Promotions] – it calculates/deletes bundle promotions

- [Advance Invoices] – it opens the list of existing advance invoices issued for the selected customer

In the ERP system, it is possible to specify whether a trade document which contains at least one document item with a zero price can be confirmed on the POS workstation.

The application makes it possible to confirm SI, SIQC, ASI, and ASIQC documents for an undefined customer. The functionality may be activated on the ERP system’s side.

Simplified invoices (Polish legal regulations)

According to changes in Polish legal regulations, Comarch POS should verify the process of invoice generation. As of 1 October 2020, receipts up to 450 PLN total with a customer holding a TIN number should be treated as simplified invoices. Therefore, generating invoices to such receipts is blocked when an appropriate parameter is activated in the ERP system.

Printing invoices on a receipt printer

When verifying conditions that need to be met to print invoices and advance invoices on a receipt printer, the application takes into account the customer type:

- An advance invoice may be printed on a receipt printer if a retail customer has been selected and the VAT direction On Total has been set in the source sales order

- A sales invoice may be printed on a receipt printer if a retail customer has been selected and the VAT direction On Total has been set in that invoice