In the application, it is possible to add a correction to a sales invoice or receipt. A correction can only decrease the quantity of document items.

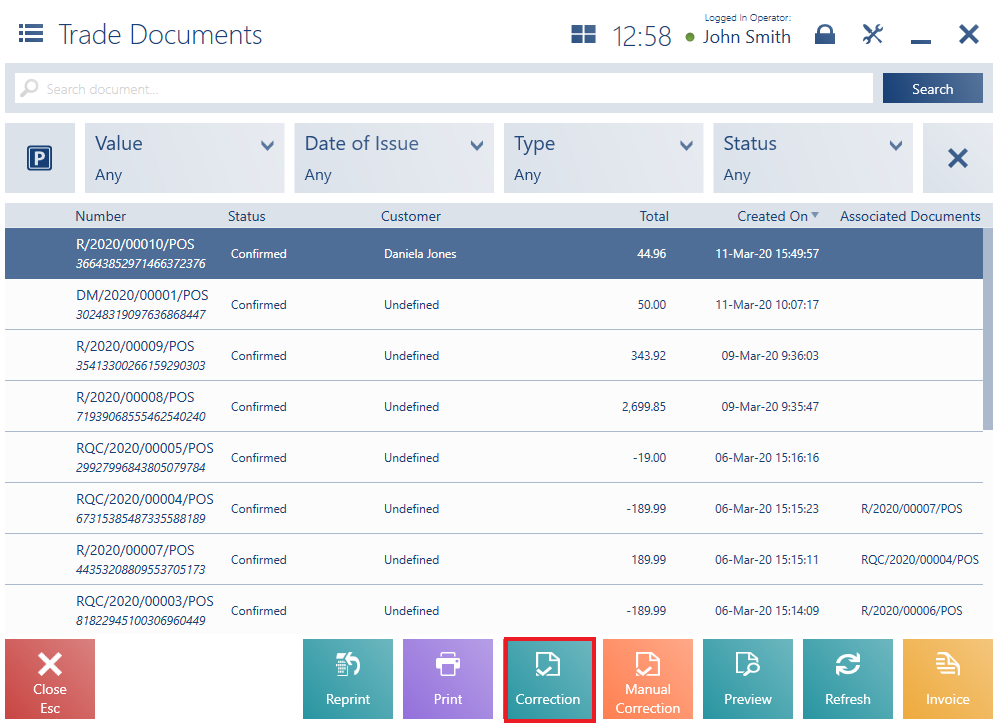

In order to create a correction, it is necessary to select a document to be corrected on the trade document list and click the button [Correction].

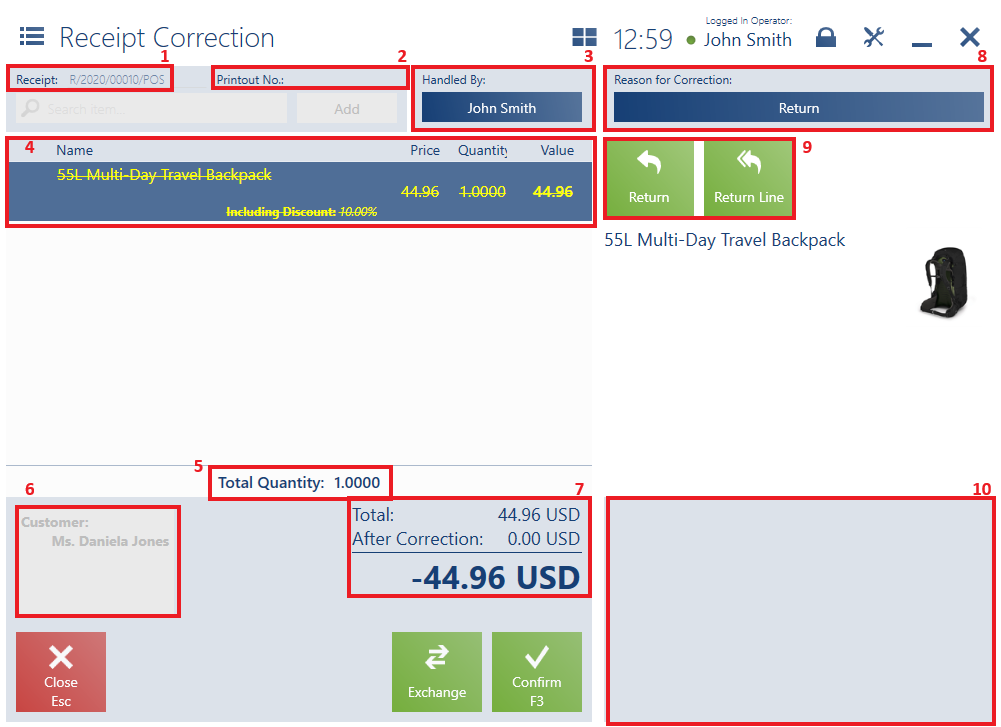

The form of a new correction document contains the following fields (particular points correspond to areas marked in the figure above):

1. Receipt/Invoice – it presents the number of a document to be corrected

2. Printout No. – it makes it possible to enter the printout number of a document to be corrected

3. Handled By – a person responsible for the document

4. Document Items containing the following columns:

- Name

- Price

- Quantity

- Value

- Regular Price (hidden by default)

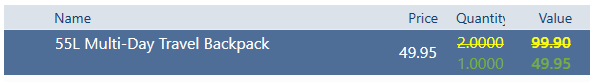

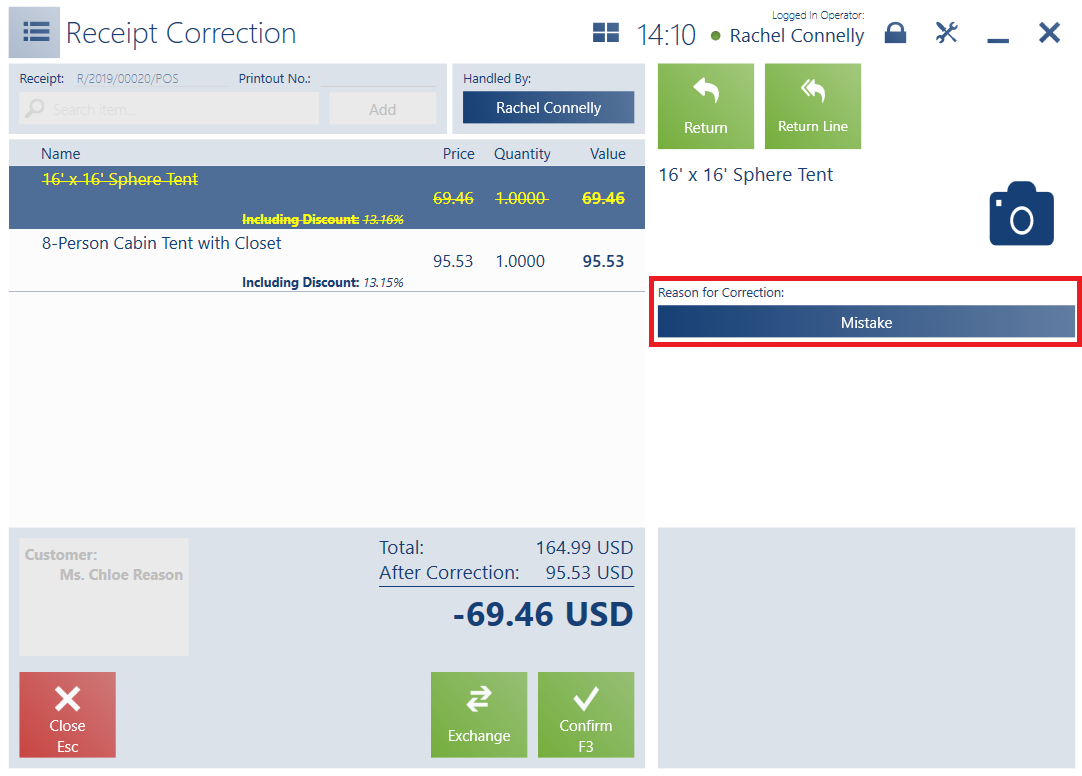

If a document item:

- Is not corrected entirely, its base price and quantity are crossed out and the corrected data is displayed below

- Is corrected entirely in terms of its quantity, all the item details on the list are crossed out

5. Total Quantity – it presents the sum of quantities of corrected/returned document items

6. Customer – it presents a (primary and secondary) customer retrieved from the source document

7. Summary – it presents the total value of all document items:

- Total – displayed for documents with the VAT direction specified as On Total

- Subtotal – displayed for documents with the VAT direction specified as On Subtotal

- Discount

- Mark-Up

- Prepayments

- VAT – displayed for documents with the VAT direction specified as On Subtotal

- The overall sales value after considering a discount/mark-up/VAT

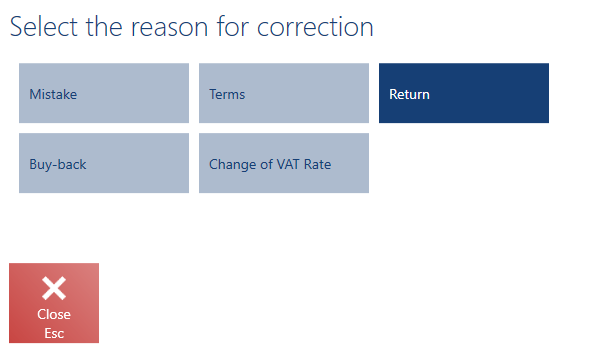

8. Reason for Correction – in this field, the user needs to specify a reason for a new correction; otherwise, it is not possible to confirm the document. Selecting the button displays a window where the user can choose one of the values defined in the ERP system.

It is also possible to define a reason for correction for each document item, and not for the entire document. Such a functionality enables further statistical analysis. Reasons for item corrections may be specified for:

Upon an attempt to correct an element of a set with the option Retrieve elements onto document selected and a modification blockade active, the application displays the notification: “This set is not subject to decomposition. Would you like to correct all its elements?”. Selecting Yes opens the window with reasons for correction. The selected reason is set for all set elements. The application’s behavior is similar in the case of bundle promotion elements with the blockade of element correction active.

In the correction preview window, the reasons for correction of separate document items are presented with no possibility to edit them.

It is not possible to change a reason for correction for document items of the Buy-back type – the application automatically sets the reason Buy-back.

9. Document Item Details – it presents basic information on a given document item and contains the following buttons:

- [Return] – it corrects a specified quantity of a given document item. This action is also possible directly in the line of a given document item after selecting the value of the column Quantity.

- [Return Line] – it corrects the entire quantity of a selected document item

- [Return All] – it returns all document items

10. Attributes – it presents attributes assigned to the document type

The form of a new correction contains the following buttons:

- [Confirm]

- [Exchange] – it initiates an exchange process for an item to be corrected

Once a correction is confirmed, the application displays the payment window To Refund, which is arranged in the same way as the window for accepting payments; however, after confirming the To Refund window, an appropriate amount is refunded, not received.

A customer wants to buy a sports T-shirt as a gift for her husband. However, she is not sure which size to select. She decides to buy two shirts sized L and M.

After a week, the customer comes back to the XYZ shop to return a not fitting shirt sized L. The attendant searches the receipt submitted by the customer on the trade document list. After selecting it, he clicks [Correction]. Next, he selects the item to be returned (Sports T-shirt size L) on the list of document items and clicks [Return Line]. After confirming the document, the operator selects a payment form in which money is to be returned in the payment window.

In the case of sets not retrieving elements onto a trade document, it is not possible to correct a set element in the document of an automatic correction. In turn, in the case of sets retrieving elements onto a trade document, automatic corrections present set elements as regular items.

Generating a voucher number when issuing a correction (Comarch ERP Enterprise)

Many retail chains choose to issue an internal voucher instead of a cash refund when a customer returns a purchased item. This makes marketing sense, as the company is assured that the customer will return to use the voucher.

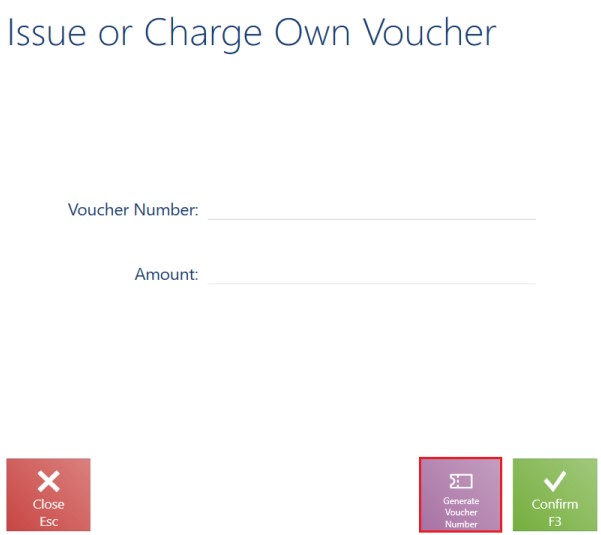

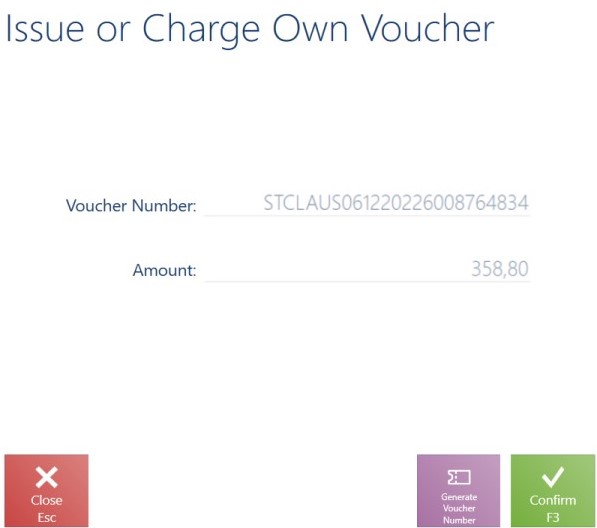

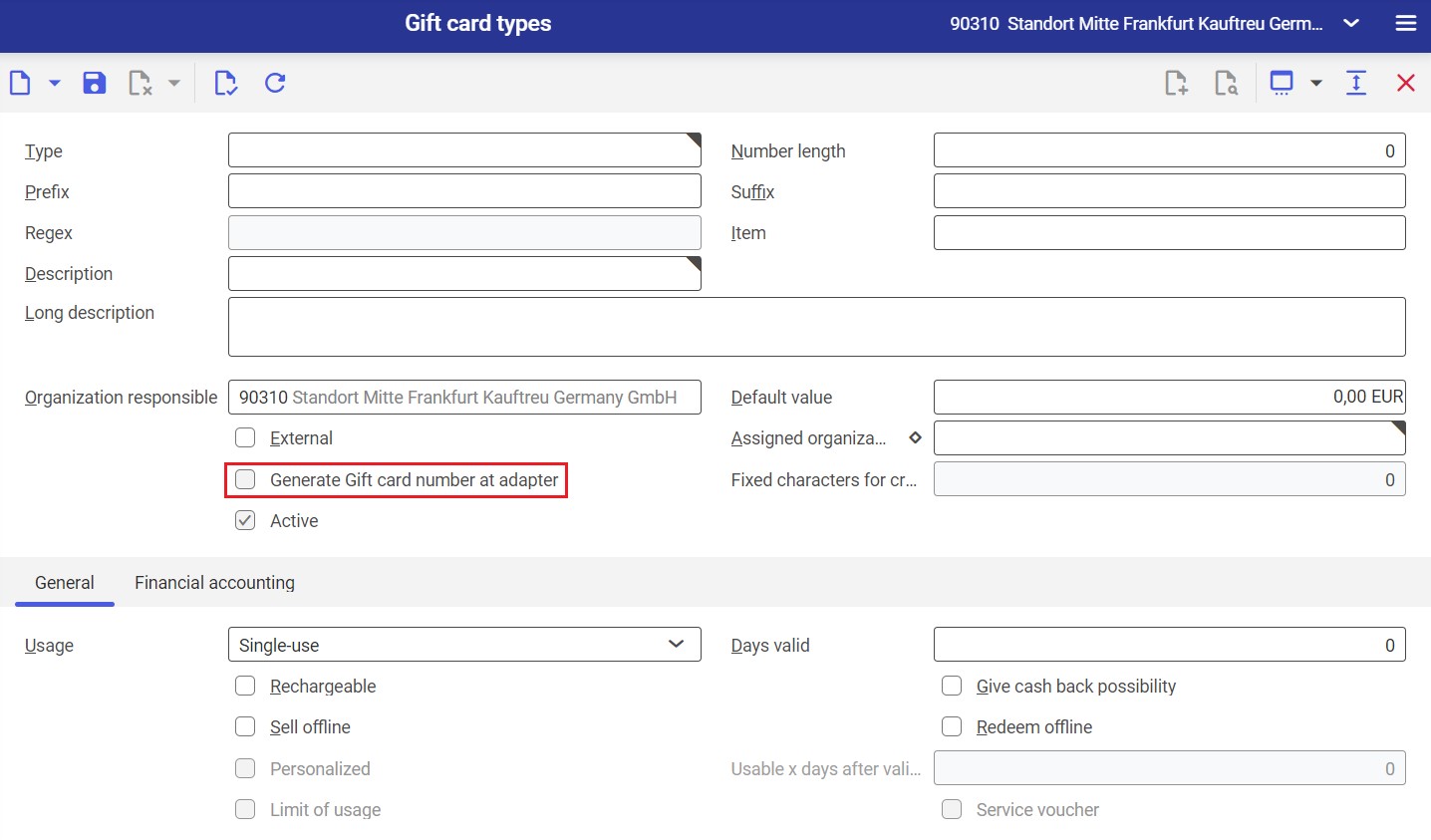

A voucher number can be issued directly on the POS workstation, even if the connection to the ERP system is not available. The solution avoids the situation where physical cards in the store have run out and the company is unable to issue a correction because the number of vouchers/cards in the store has been limited to a certain number.

When correcting a trade document by X amount, the user can still select the refund form Own Voucher in the payment window. Afterwards, it is still possible to scan/enter the number of an existing voucher (e.g. when issuing a physical gift card) but the user can also select the new button [Generate Voucher Number]. Once the button is selected, the POS workstation generates a unique voucher number (also in the offline mode). The refund amount is assigned to a given voucher, while the voucher is created and activated in the ERP system following synchronization.