Block the operation of generating invoices from receipts without TIN

According to the amendment to the Polish VAT Act and other acts, regulations on the issuing of invoices based on receipts changed as of 1 January 2020. In consequence, it is only possible for entrepreneurs to issue an invoice to a receipt if the seller includes the customer’s TIN in the receipt. A new parameter Verify customer’s TIN in the invoice to a receipt has been added on the company configuration form in the ERP system. If the parameter is selected, the application verifies whether a sales invoice generated to a receipt contains a TIN number compatible with a number in the receipt. The verification is performed upon an attempt to save or confirm the invoice.

If the condition is not fulfilled, the application displays the following notification: “The customer’s TIN number in the invoice is incompatible with the TIN number in the receipt or there is no TIN number specified in the receipt. Unable to confirm the document”.

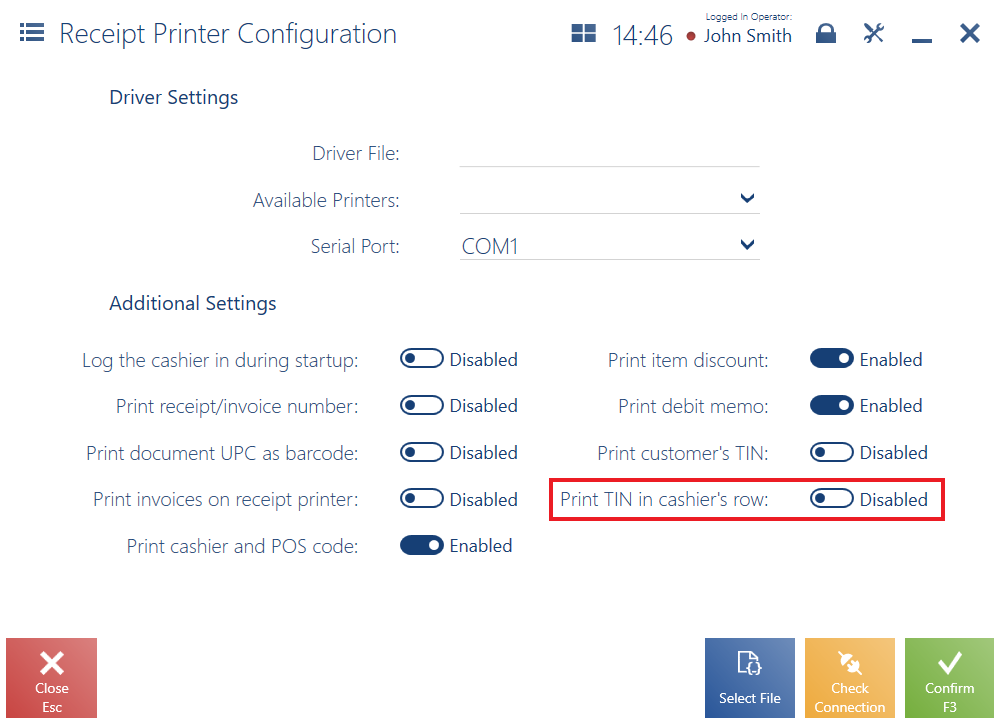

Print a customer’s TIN in a cashier’s row

Some older models of receipt printers do not enable printing a customer’s TIN. Because of that, according to the Minister of Finance Regulation of 29 April 2019 on cash registers, par. 25 sec. 2, it is now possible to print a TIN number in the cashier’s row of a receipt, after a cash register’s number and cashier’s code. The parameter may be enabled in Configuration → Receipt Printer.

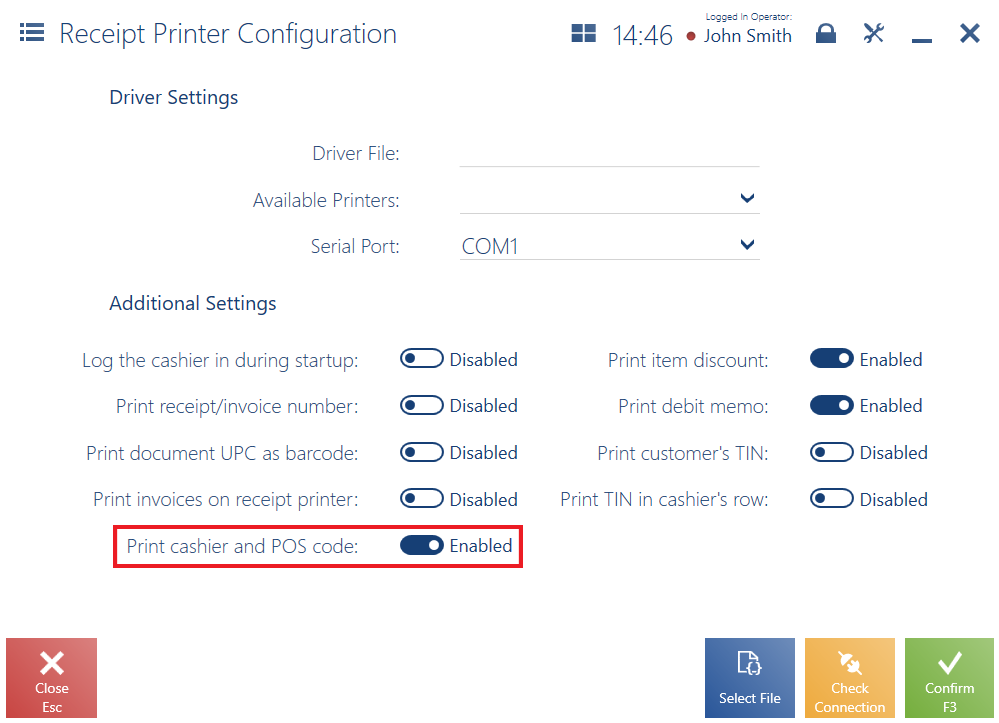

Print a cashier and POS code

A new parameter Print cashier and POS code is now available in the application. A cashier code is retrieved from the ERP system. The parameter may be activated in Configuration → Receipt Printer.

Synchronize processed SO documents from Comarch ERP Standard

Following the need to enable displaying sales orders deriving from an e-shop on POS workstations in order to release ordered items to be collected personally, it is now possible to synchronize processed sales orders which have not been sent to Comarch POS before.

In Comarch ERP Standard, there is a new parameter Synchronize Sales Orders from the Last (x days), available in System → Configuration → Data Exchange.

The parameter is only applied during the first POS synchronization or the first synchronization of the SO object in version 2019.5.2. By default, the parameter is set as 60 days.

[Recalculate Discounts] button

In case of an exception occurring while discounts are being calculated, it may be necessary to verify again whether discount conditions are fulfilled. For that purpose, there is a new button [Recalculate Discounts] available in receipt, sales invoice, order, and quote documents (the button is hidden by default). Selecting the button recalculates discount amounts (including manual discounts) if an item quantity has been changed in a given document.