The handling of tax free documents (TF) enables the refund of VAT paid by travelers from outside the European Union directly on POS workstations. Owing to that, customers may avoid double taxation: in the country of purchase and country of residence.

- Has not been printed on a receipt printer

- Has no corrections (or all the corrections have been canceled)

- Has no associated sales invoice

- Has no generated tax free document (or the generated tax free document has been canceled)

As in the case of other documents, it is not possible to generate a collective tax free document from several receipts.

In the ERP system, it is also possible to activate the functionality of generating TF documents from confirmed documents. If the functionality has been activated and no numbering scheme has been defined for the TF document type in the ERP system, an attempt to generate a TF document from a confirmed receipt on the POS workstation is blocked with the notification: “Unable to issue a tax free document. There is no document definition”.

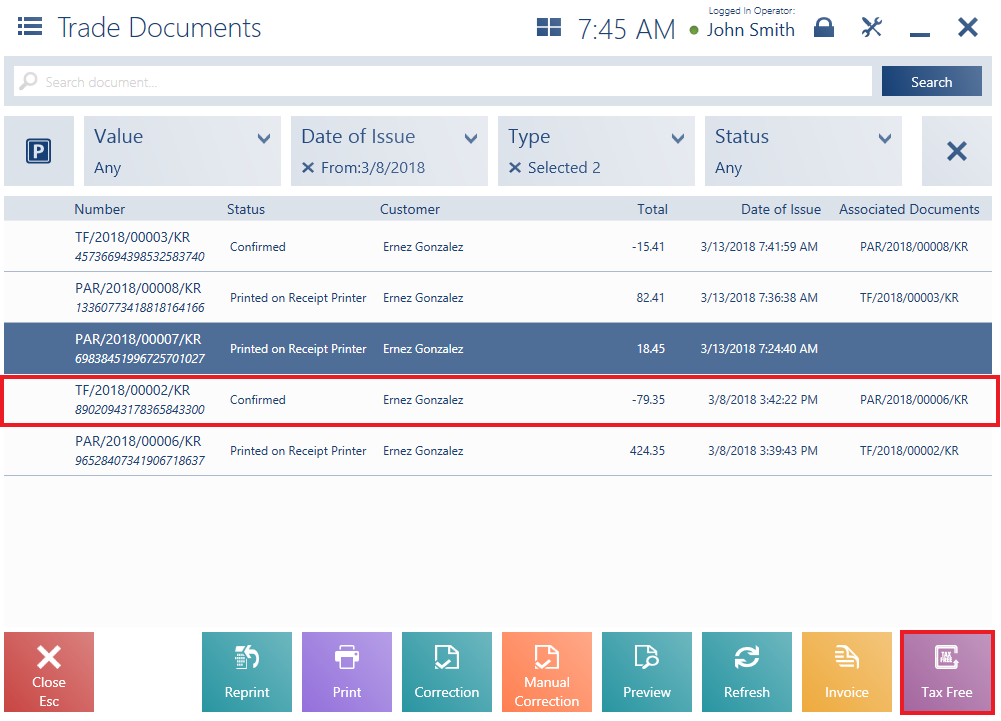

A tax free document can have one of the two statuses:

- Confirmed

- Paid – it is assigned to a TF document with confirmed export

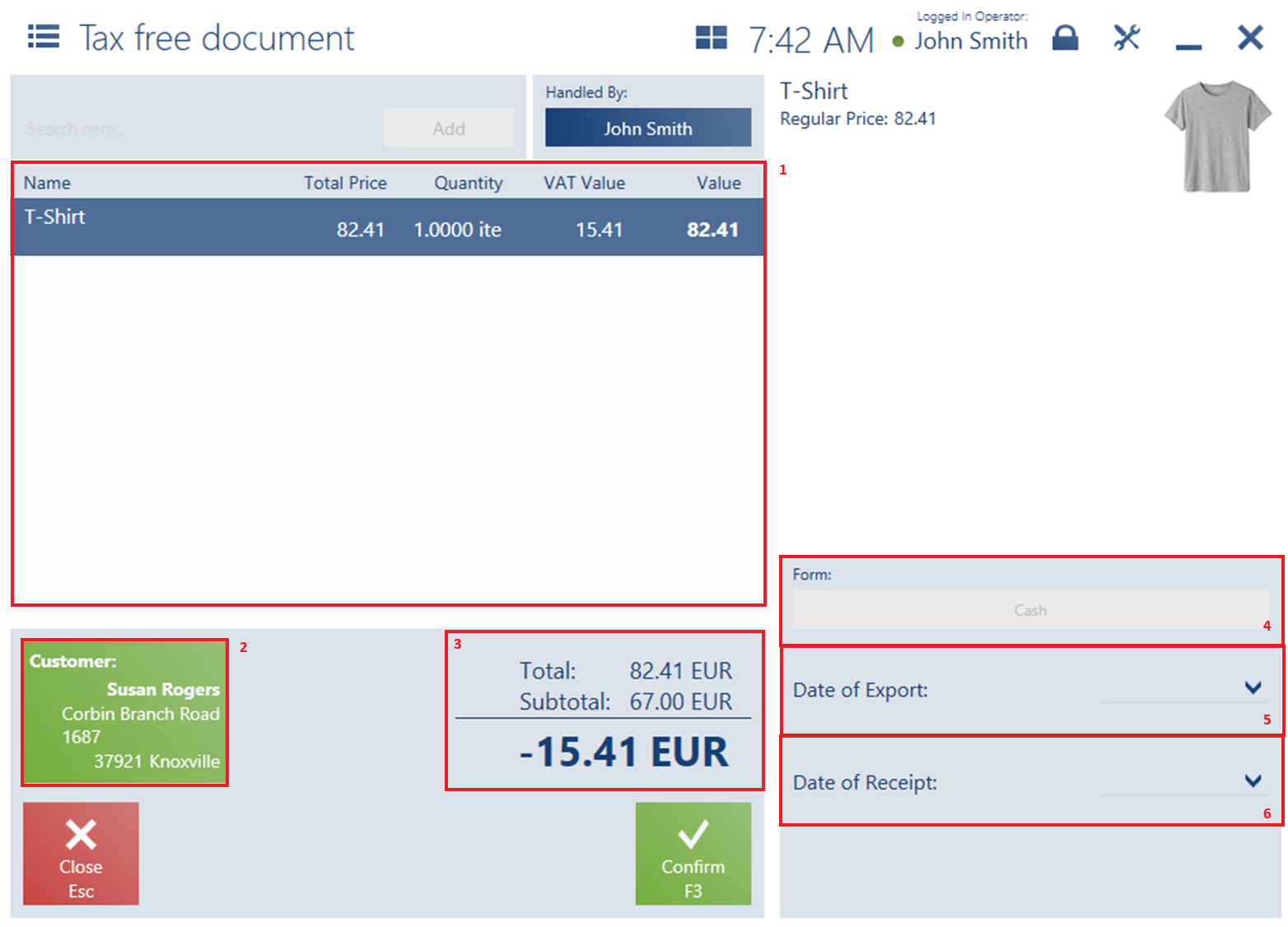

The form of a TF document contains the following fields (particular points correspond to areas marked in the figure above):

1. The list of document items presents the following columns:

- Name

- Total Price

- Quantity

- VAT Value

- Total Value

- VAT Rate (hidden by default)

2. The [Customer] tile presents:

- Customer name

- Address

- Number of an identity document – it is required for the confirmation of a TF document

- Address country – it is required for the confirmation of a TF document

3. The document summary contains the following fields:

- Total

- Subtotal

- Amount to refund

4. Form – it is a customer’s default payment form; it can be changed to a different payment form available on the POS workstation. In the case where a payment form selected for a customer is not available on the POS workstation, the application sets a payment form of the Cash type assigned to the workstation.

5. Date of Export – it displays the date of export outside the EU territory

6. Date of Receipt

7. Attributes – it presents attributes assigned to the document type

- Date of Export – by default, it is set as the current date, with a possibility to edit it

- Date of Receipt – this field is required, since receiving a tax refund is only possible if the export of goods outside the EU takes place no later than on the last day of the third month following the month of purchase

It is not possible to generate a sales invoice or a correction (it also refers to corrections related to the exchange process) from receipts associated with TF documents.