Rounding of cash payments for the Czech market (Comarch ERP Standard)

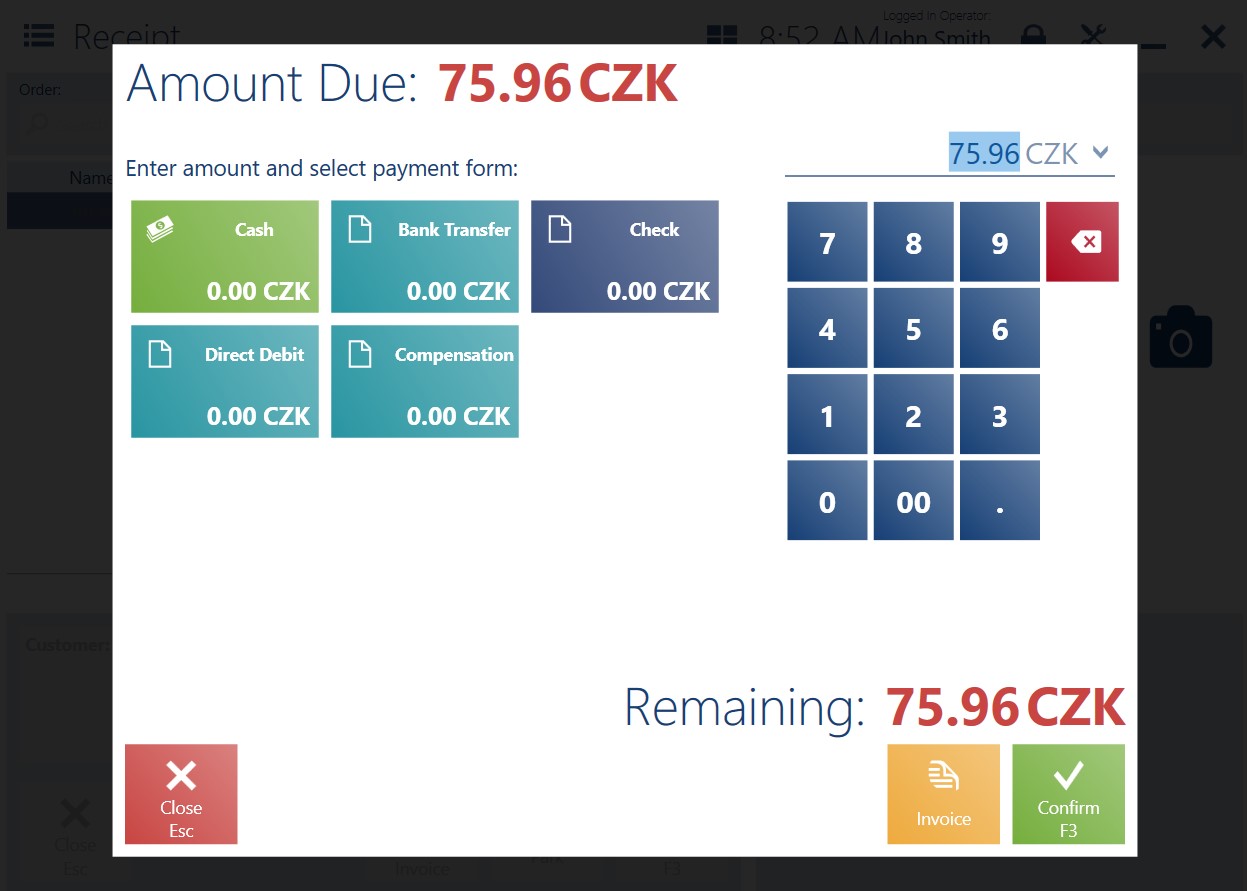

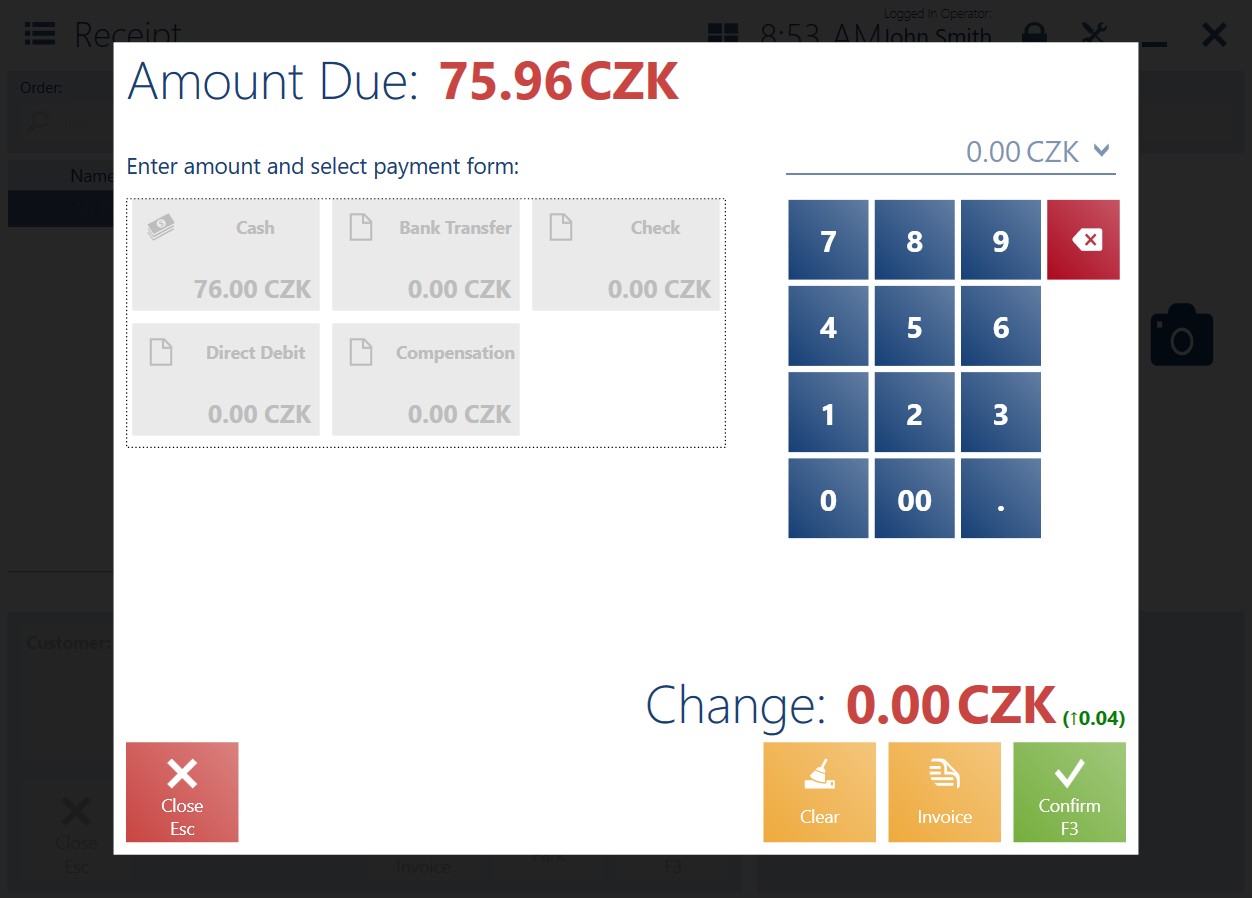

In the Czech Republic, the official currency is the Czech koruna (CZK), denoted by the symbol Kč, where 1 CZK is 100 haleru. The denominations of 10, 20 and 50 haleru coins were withdrawn from use as of September 1, 2008. As a result of these changes, total cash payments for the sale of goods and services must be rounded to the nearest whole Czech koruna. According to the requirements, if the amount to be paid in cash has a fraction of ≥50 haleru, it should be rounded up. In turn, if it has a fraction of <50 haleru, it should be rounded down. In the case of different currencies and payment forms other than cash, payments are made according to an amount displayed in the payment document, with no rounding.

To enable this feature, select the CZK value for the Round Off Cash Payments To field on the POS Workstations tab of the POS center definition. For the field to be active, the CZ option must first be selected in the VAT Rate Group field on the company form.

Cash payment rounding is supported for the following document types:

- Receipt

- Invoice

- Advance sales invoice

- Receipt correction

- Invoice correction

- Advance sales invoice correction

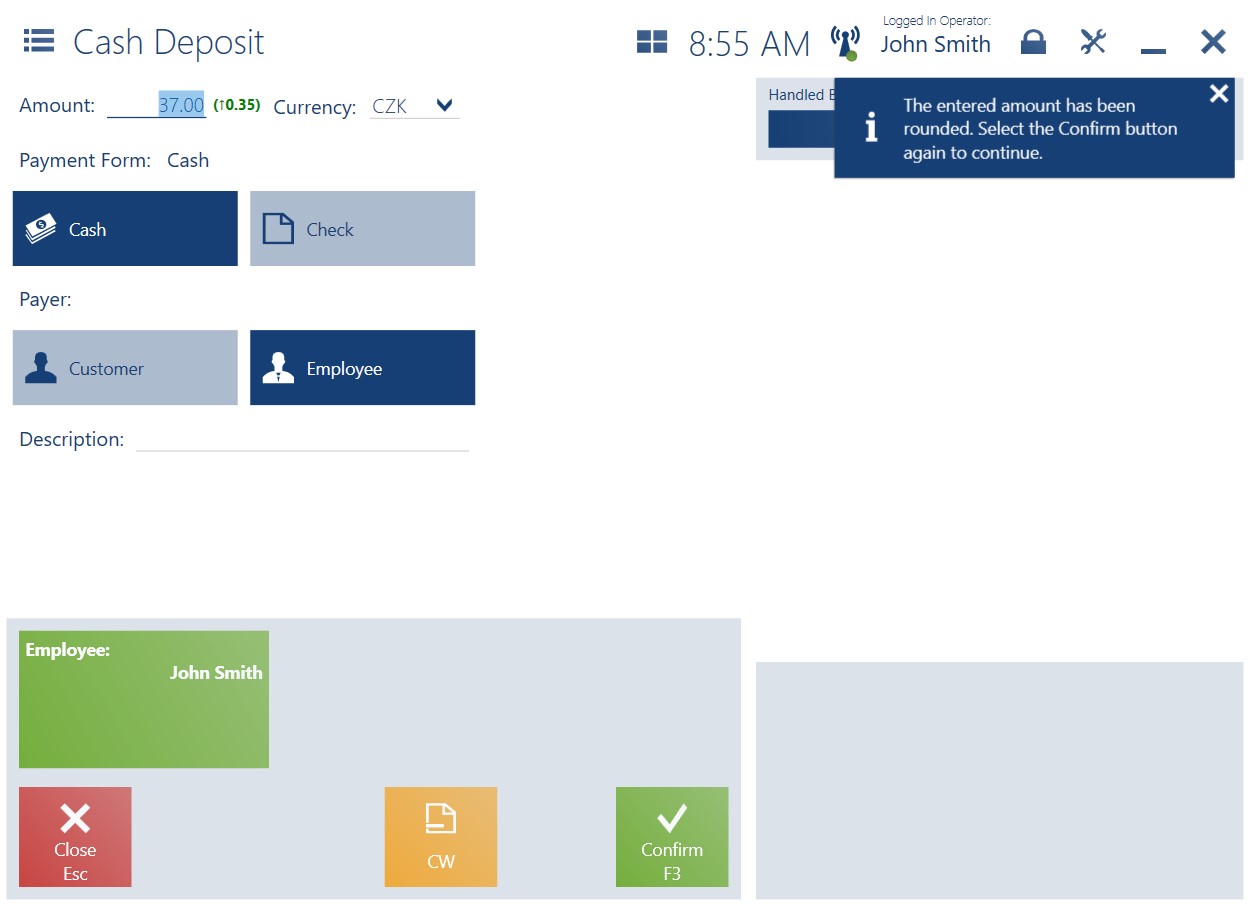

- Cash deposit

- Cash withdrawal

Payment limits (Comarch ERP Standard)

Comarch POS now allows you to apply payment limits. This function is especially useful in EU countries where there are certain restrictions regarding the maximum or minimum transaction amount. Payment limits are set individually for each country. In the Czech Republic, the official currency is the Czech koruna (CZK), and the daily cash payment limit is 270,000 CZK (about 10,500 EUR). Some countries also have legal requirements concerning a minimum amount that can be used for payment methods (e.g. 0.1 EUR as a minimum amount for card payments).

In some cases (for instance, in Poland), payment limits are set based on the type of customer (either a retail customer or a business entity). In Poland, the maximum cash limit for a business entity is PLN 15,000. There is no limit for a retail customer.

In Comarch ERP Standard, you can define the following parameters on the POS Workstations tab of the company form (Configuration → [Company Structure] → [Rights Structure] → Company center):

- Minimum Payment Value

- Maximum Payment Value

The values can be determined in the Payment Limits By Customer Status and Payment Form section on the POS Workstations tab. They can be set individually depending on the type of customer: Business Entity or Comarch POS Customer.

If the amount in a sales document is greater than or equal to the set minimum limit, the entire payment process proceeds without any warning messages – it does not matter whether the customer was specified or unspecified.

The payment limit feature also applies to own and external vouchers, as well as CD/CW documents created for a customer.

In the case of cash documents with an entered employee, payment limits do not apply.

Making deposits and withdrawals only results in a warning message allowing the seller to decide whether or not to proceed with the transaction.

The minimum and maximum payment limits for foreign currencies are calculated based on the exchange rates defined in Comarch ERP Standard.

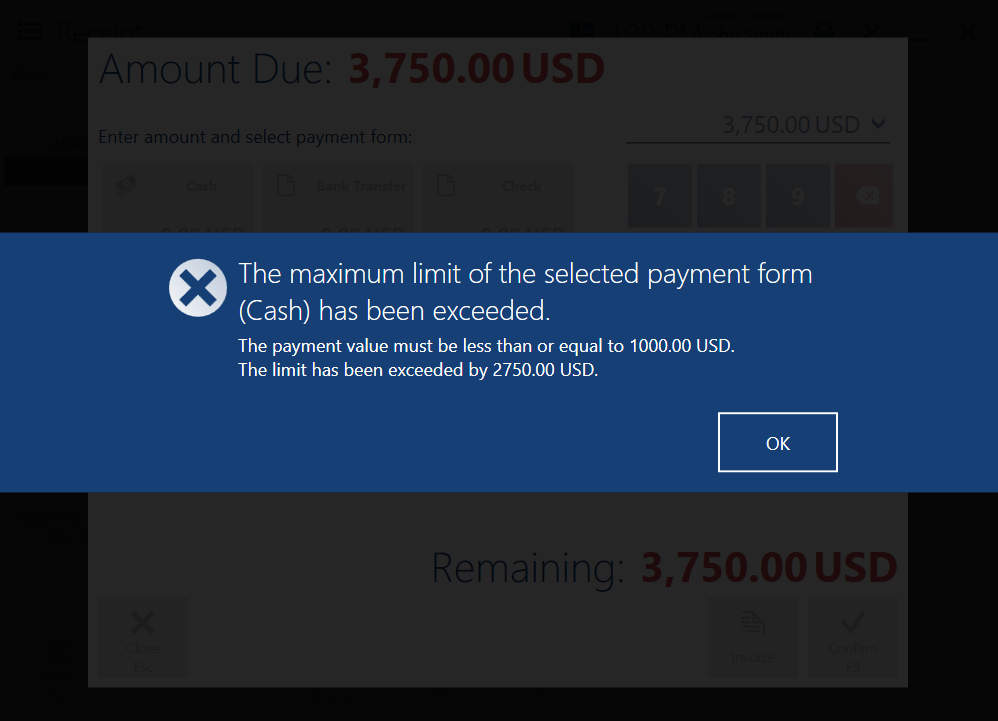

When the total payment amount exceeds a defined maximum payment limit, the following blocking message appears:

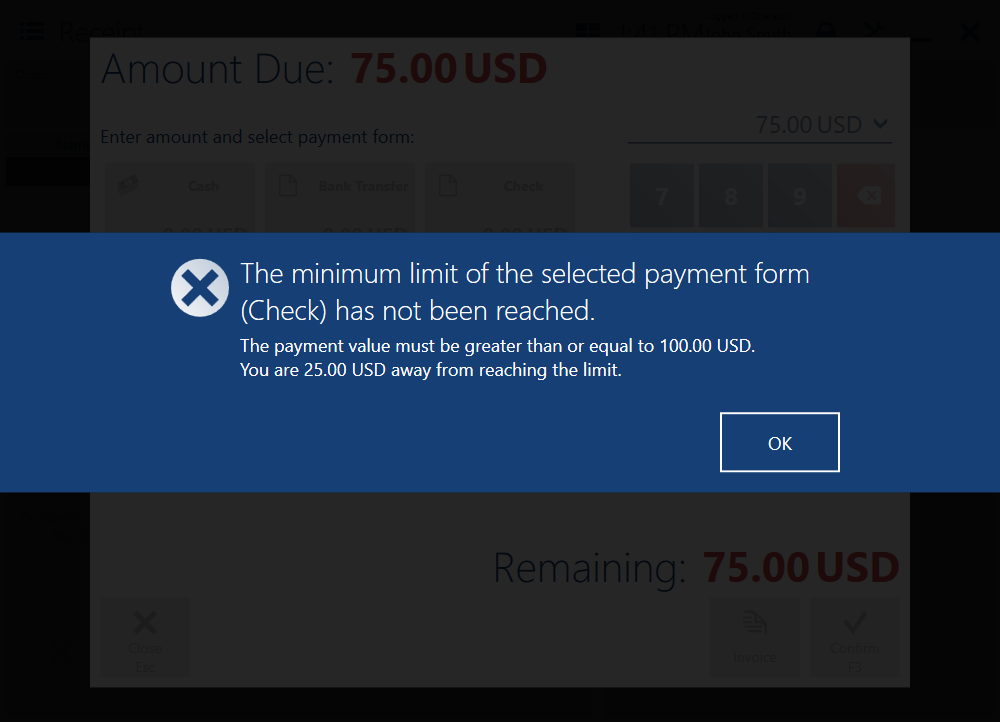

When the total payment amount is less than a defined minimum payment limit, the following blocking message appears:

The system currency is € and the payment limits are defined as follows:

- Cash – maximum 1000 EUR

- Card – maximum 50000 EUR

- Voucher – minimum 1 EUR

A customer wants to pay:

- 1100 EUR in cash

- 51000 EUR by card

- 1 EUR with a voucher

Cash payment:

The maximum cash payment limit has been exceeded.

The payment value must be less than: 1000 EUR. The limit has been exceeded by 100 EUR.

Card payment:

The maximum card payment limit has been exceeded.

The payment value must be less than: 50000 EUR. The limit has been exceeded by 1000 EUR.

Voucher payment (with the exchange rate of 1 EUR = 4.32 PLN):

The minimum voucher payment limit has not been reached.

The payment value must be greater than: 1 EUR. The customer is 3.32 PLN away from reaching the limit.

Customer identification

According to the current legal requirements in the Czech market, when issuing trade documents whose value exceeds a specified amount, it is necessary to identify the customer, e.g. by specifying the person for whom the service is being provided or by entering the customer’s tax identification number.

The parameter responsible for customer identification is sent to Comarch POS from the ERP system. The threshold value for identification can be set on the company form (Configuration → Company Structure → Rights Structure) and is inherited by all the POS centers within the structure.

If the value is exceeded in a trade document, it will be necessary to enter required customer data. When it has a value less than 0, the feature is disabled. There is no limit specified for this parameter.

For payments in a currency different than the system currency, the amount is converted based on an exchange rate from the ERP system.

If the amount in a sales document is greater than or equal to the set minimum limit, the entire payment process proceeds without any warning messages – it does not matter whether the customer was specified or unspecified.

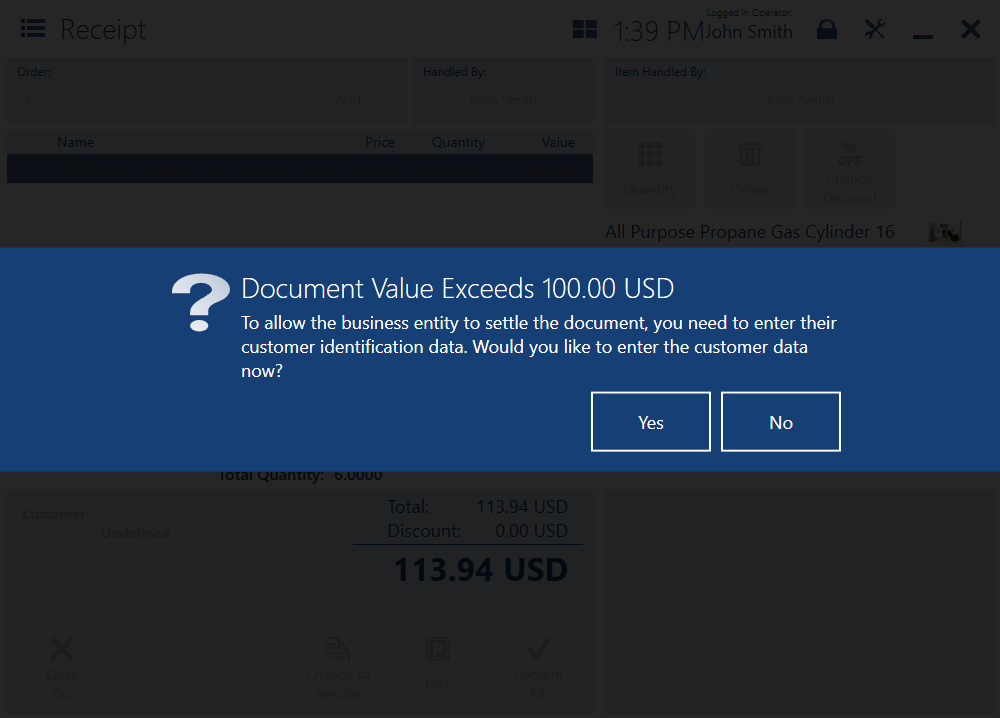

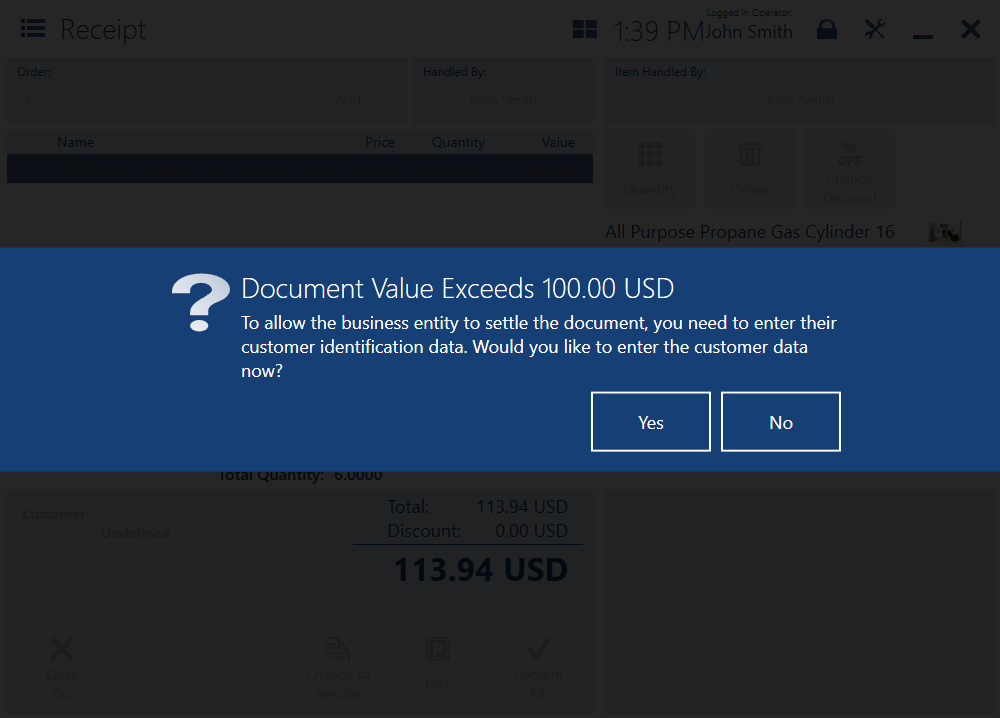

A warning message is displayed by the application if:

- The total transaction amount is greater than the limit defined in the ERP system

- The customer is unspecified

- The sales document is a receipt or an invoice with a default customer selected

To respond to the message, you can select:

- Yes – after selecting the button, you will need to select the customer from the customer list or scan their loyalty card and confirm the document again

- No – after selecting the button, you will be redirected to the payment window

If the payment is made in the Czech Republic and the rounding parameter is activated, amounts between 10000.01 and 10000.49 CZK should be rounded down to 10000 CZK, and then the customer identification parameter is not activated (the amount must be higher than the set limit).

When the buy-back option is used in a document, it is not included in the customer identification limit, since the receipt shows the total amount for the items and a manual receipt correction is made for the buy-back amount.

Example: A document contains the following items (while the customer identification limit is 10000 CZK)

Item A1: 5000 CZK

Item A2: 6000 CZK

Item A3 to be bought back: -2000 CZK

The customer must pay 9000 CZK. However, two documents are issued as part of the transaction:

Receipt: 11000 CZK

Manual receipt correction: -2000 CZK

If the limit was exceeded, information about the required customer identification would be displayed.

If a voucher is sold as a debit memo, its amount is not considered when calculating the amount for customer identification. During a transaction where such a voucher is used, two documents are issued – a receipt and a debit memo.

Example: A document contains the following items (while the customer identification limit is 10000 CZK)

Item A1: 4000 CZK

Item A2: 5000 CZK

Voucher B3 (sold as a debit memo): 2000 CZK

The customer must pay 11000 CZK. However, two documents are issued as part of the transaction:

Receipt: 9000 CZK

Debit memo: 2000 CZK

In this case, customer identification is not required.

In the case of an exchange process, the refund amount is not considered when calculating the amount for customer identification. If a document records a return of items, two documents are issued: a receipt and a receipt correction. Only the receipt amount is verified to check whether customer identification is required.

Example: A document contains the following items (while the customer identification limit is 10000 CZK)

Returned item: -2000 CZK (exchange mode)

New item: 5000 CZK

New item: 6000 CZK

The customer must pay 9000 CZK. However, two documents are issued as part of the transaction:

Receipt correction: -2000 CZK

New receipt: 11000 CZK

In this case, customer identification is required.

Rounding of cash payments for the Czech market (Comarch ERP Enterprise)

In the Czech Republic, the official currency is the Czech koruna (CZK), denoted by the symbol Kč, where 1 CZK is 100 haleru. The denominations of 10, 20 and 50 haleru coins were withdrawn from use as of September 1, 2008. As a result of these changes, total cash payments for the sale of goods and services must be rounded to the nearest whole Czech koruna. According to the requirements, if the amount to be paid in cash has a fraction of ≥50 haleru, it should be rounded up. In turn, if it has a fraction of <50 haleru, it should be rounded down. In the case of different currencies and payment forms other than cash, payments are made according to an amount displayed in the payment document, with no rounding.

To enable this feature, go to the Customizing application → Multi-channel sales function → Comarch Retail POS sub-function → Finances, accounting tab and select the Czech payment rounding option in the Rounding Rules field.

Cash payment rounding is supported for the following document types:

- Receipt

- Invoice

- Advance sales invoice

- Receipt correction

- Invoice correction

- Advance sales invoice correction

- Cash deposit

- Cash withdrawal

Customer identification

According to the current legal requirements in the Czech market, when issuing trade documents whose value exceeds a specified amount, it is necessary to identify the customer, e.g. by specifying the person for whom the service is being provided or by entering the customer’s tax identification number.

The parameter responsible for customer identification is sent to Comarch POS from the ERP system. The threshold value can be set in the field Customer identification required from value in the Comarch Retail POS terminals application → General tab → Document processing section.

If the value is exceeded in a trade document, it will be necessary to enter required customer data. When it has a value less than 0, the feature is disabled. There is no limit specified for this parameter.

For payments in a currency different than the system currency, the amount is converted based on an exchange rate from the ERP system.

If the amount in a sales document is greater than or equal to the set minimum limit, the entire payment process proceeds without any warning messages – it does not matter whether the customer was specified or unspecified.

A warning message is displayed by the application if:

- The total transaction amount is greater than the limit defined in the ERP system

- The customer is unspecified

- The sales document is a receipt or an invoice with a default customer selected

To respond to the message, you can select:

- Yes – after selecting the button, you will need to select the customer from the customer list or scan their loyalty card and confirm the document again

- No – after selecting the button, you will be redirected to the payment window

If the payment is made in the Czech Republic and the rounding parameter is activated, amounts between 10000.01 and 10000.49 CZK should be rounded down to 10000 CZK, and then the customer identification parameter is not activated (the amount must be higher than the set limit).

When the buy-back option is used in a document, it is not included in the customer identification limit, since the receipt shows the total amount for the items and a manual receipt correction is made for the buy-back amount.

Example: A document contains the following items (while the customer identification limit is 10000 CZK)

Item A1: 5000 CZK

Item A2: 6000 CZK

Item A3 to be bought back: -2000 CZK

The customer must pay 9000 CZK. However, two documents are issued as part of the transaction:

Receipt: 11000 CZK

Manual receipt correction: -2000 CZK

If the limit was exceeded, information about the required customer identification would be displayed.

In the case of an exchange process, the refund amount is not considered when calculating the amount for customer identification. If a document records a return of items, two documents are issued: a receipt and a receipt correction. Only the receipt amount is verified to check whether customer identification is required.

Example: A document contains the following items (while the customer identification limit is 10000 CZK)

Returned item: -2000 CZK (exchange mode)

New item: 5000 CZK

New item: 6000 CZK

The customer must pay 9000 CZK. However, two documents are issued as part of the transaction:

Receipt correction: -2000 CZK

New receipt: 11000 CZK

In this case, customer identification is required.