Tab Data Exchange, available in the menu System → Configuration, allows for specifying parameters necessary for sending information from Comarch ERP Standard to other platforms. Its area is divided into the following sections:

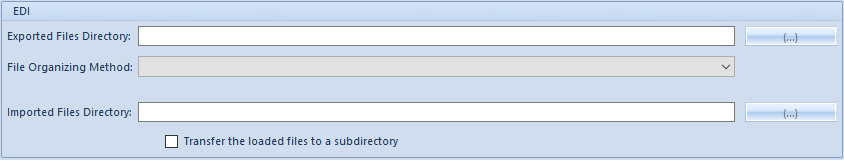

EDI

The section contains a mechanism for importing and exporting data to EDI platform.

The following fields are available in the section:

- Exported Files Directory − in this field, it is necessary to select a location in which files exported from the system will be saved

- File Organizing Method − in this field, it is necessary to select a structure of directories within which files will be saved. The following options are available:

- DocumentType − organizes files by document types, by creating subfolders Orders and Invoices

- CustomerCode − organizes files by customer/vendor codes, by creating subfolders dedicated to particular customers/vendors

- DoicumentType_CustomerCode − creates subdirectories divided into document types and with the created name of directory assigned according to the key document type_customer code

- DoicumentType_CustomerCode − creates subdirectories divided into customer code and with the created name of directory assigned according to the key customer code_document type

- DocumentType\CustomerCode − creates subdirectories in a two-level structure, where parent directories group files by document types and then subdirectories divide grouped files by customer codes

- CustomerCode\DocumentType − creates subdirectories in a two-level structure, where parent directories group files by customer codes and then subdirectories divide grouped files by document types

- Imported Files Directory − in this field, it is necessary to indicate location of the folder of files imported to the system

- Transger the loaded files to a subdirectory − if this option is checked, a subfolder Done is created in a given path to which EDI files imported by the user are automatically transferred.

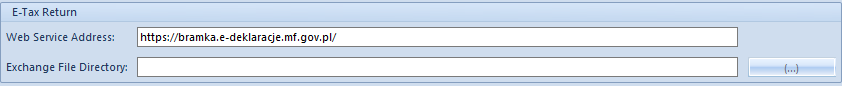

E-Tax Return

The following fields are available in the section:

- Web Service Address − address to which e-tax returns are sent, the address set by default is https://bramka.e-deklaracje.mf.gov.pl/

- Exchange File Directory – field allowing for specyifying a directory in which exported e-tax returns will be saved

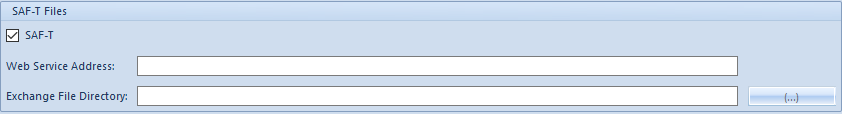

SAF-T Files

Detailed description of fields presented in the section can be found in article <<Configuration of SAF-T file>>.

Transfers

The section Transfers enables the user to select an exchange file directory for the documents Statement of Remittance Orders and Statement of Payment Orders. In the field Exchange Data Directory, the user can choose a directory in which relevant files will be saved. Thanks to that, it is not necessary to enter a specific path for file export on each SRO or SPO document form.

POS

The following field is available in the section:

-

- Synchronize sales orders from the last – in the field, it is possible to specify the number of days from which SO documents with Executed status, which have never been sent to Comarch Retails POS, should be synchronized.

The setting is useful only during the first synchronization from Comarch Retail POS or during the first synchronization of a SO object. Default value is set to 60 days and it can be changed until the first object synchronization is performed.

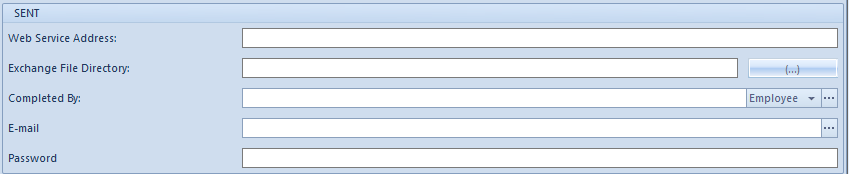

Sent

The SENT section allows the user to configure Web Service for the needs of registering .xml carriage notifications performed via Electronic Services Portal of the Customs Service (PUESC). Such notifications are compliant with technical specifications shared on the portal.

Fields from this section are described in article <<>>