GDPdU Export

According to German regulations, during a tax audit, companies are obliged to provide tax-relevant data in electronic form upon request. The requirements that the provided data must meet are included in the document “Principles on Data Access and Verifiability of Digital Documents” (Grundsätze zum Datenzugriff und zur Prüfbarkeit digitaler Unterlagen”, or GDPdU). The tax administration does not determine the particular fields and specifications of the provided data, because, depending on the computer system, structure, and size of the company, different data may be tax-relevant.

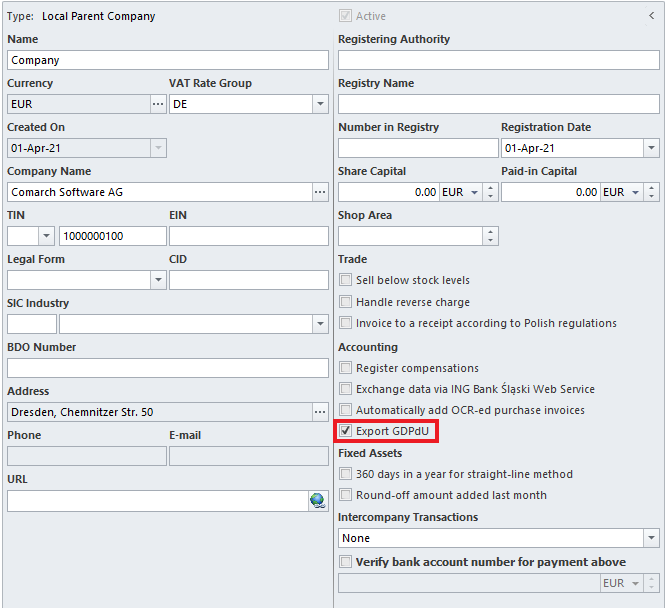

System data considered by the software manufacturer as tax-relevant may be exported in the menu [Main] → [Export GDPdU] if the Export GDPdU parameter has been activated on the company form, in the Accounting section.

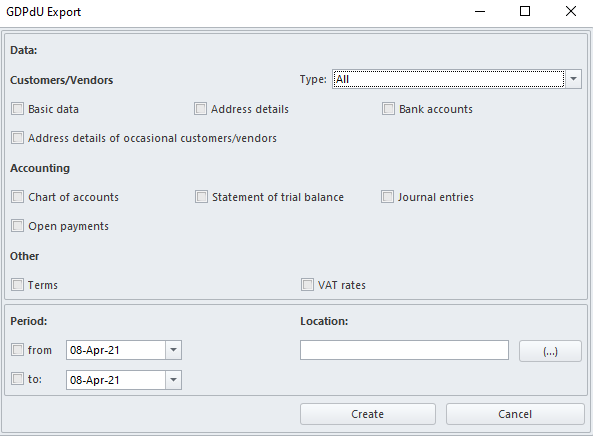

After selecting the [Export GDPdU] button, a window will open, in which it is necessary to enter the following details:

- The range of data to be exported

- The period for which the data will be exported – required if data from the Accounting section has been selected. The date indicated cannot be earlier than 01.01.1900 and later than 31.12.2079.

- The location where the exported files will be saved

Range of exported data:

- Customers/Vendors

- Type – this parameter determines if data will be exported for all customers and vendors, customers only, or vendors only

- Basic data – code, name, TIN, interest, accounting accounts, payment forms, etc. Bookkeeping accounts are exported for the period designated by the date range indicated.

- Address details – street, number, city, zip code, etc.

- Bank accounts – data concerning bank accounts assigned to particular customers/vendors

- Address details of occasional customers/vendors – street, number, city, zip code, etc.

- Accounting

- Chart of accounts:

- A chart of accounts for the accounting period designated by the date range entered. If the date range covers movere than one accounting period, data will be exported for the later period.

- Account types

- Statement of trial balance – the trial balance of particular bookkeeping accounts within the selected period

- Journal entries

- Data on journal entries for the selected period: number in general ledger, posting date, amount, etc.

- Data on company structure centers and subsidiaries

- Information on the possible states of a given document type

- Data on ledgers for the selected period

- Open payments

- Payment forms

- Payments whose due dates fall within the date range entered and are open at the time of export (document number, reference number, entity code, currency, amount to be paid, etc.)

- Other

- Terms – data on types of terms defined in the system

- VAT rates – data on VAT rates defined in the system

- Chart of accounts:

After selecting the appropriate parameters, it is necessary to select the [Create] button to perform the export. The following files will be created in the selected location:

- .csv files containing exported data

- an index file describing the data structure

- a fixed file gdpdu-01-09-2004.dtd

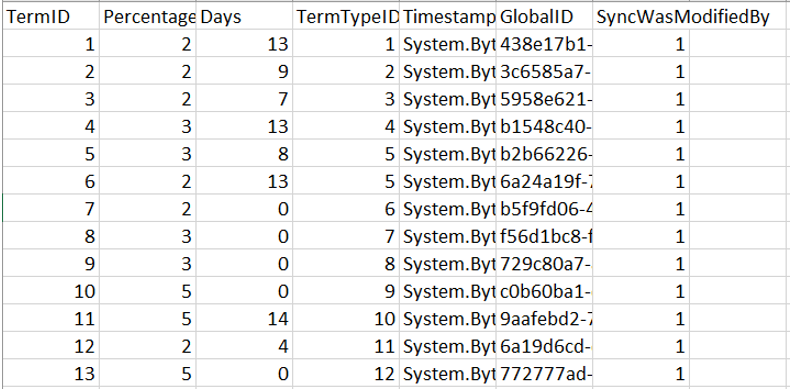

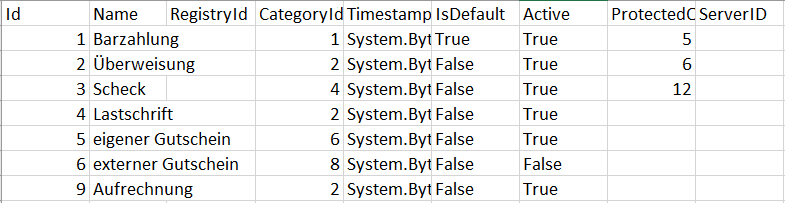

The following table presents from which tables/procedures/views particular data is retrieved during the export:

| Section | Data | Table/Procedure/View |

| Customers/Vendors | Basic data

|

Dictionaries.CustomerInterestValues dbo.Dic_CustomerData

dbo.Dic_Customers SecDictionaries.Dic_PaymentForms |

| Address details | Address.Addresses

Address.AddressData |

|

| Bank accounts | Dictionaries.BankAccounts | |

| Address details of occasional customers/vendors | Address.Addresses

Address.AddressData |

|

| Accounting | Chart of accounts | SecAccountingStructure.Accounts AccountingStructure.AccountTypesTable |

| Statement of trial balance | AccountingStructure.CalculateSAB | |

| Journal entries | AccountingDocuments.AccountingAdviceDocuments

AccountingDocuments.Decrees SecAccountingStructure.PartialJournals CompanyStructure.CompanyUnits DT.States |

|

| Open payments | BanksRegisters.vPaymentPlanEntities

SecDictionaries.Dic_PaymentForms

|

|

| Other | Terms | Dictionaries.Terms |

| VAT rates | Dic_VatRates |