Defining cash and bank accounts

Cash/bank accounts are accounting tools used to register transactions related to cash flow, that is cash inflows and outflows within a cash register or bank account. Each cash account corresponds to one checkout, and each bank account corresponds to one account in a bank.

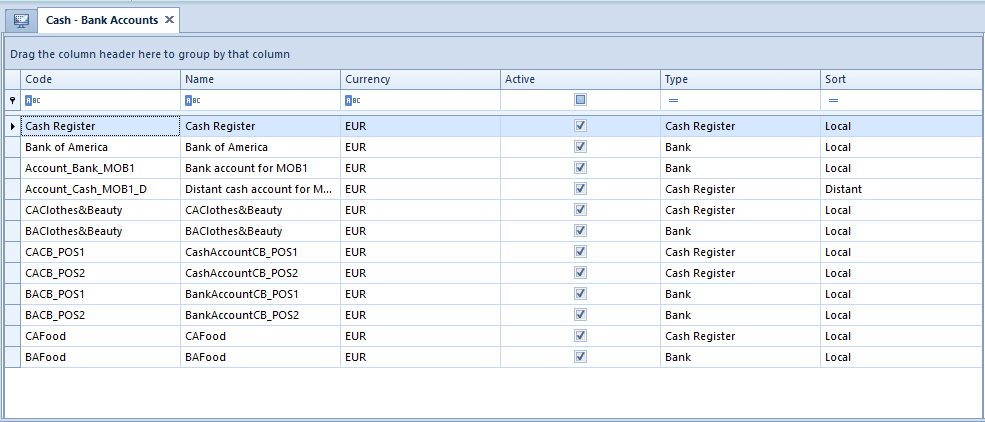

The list of cash/bank accounts can be accessed in the menu Finances after selecting the button [Cash/Bank Accounts].

The list displays all cash/bank accounts available at a given company.

Defining a new cash/bank account

In order to define a new account, it is necessary to select the button [Add] in the button group List.

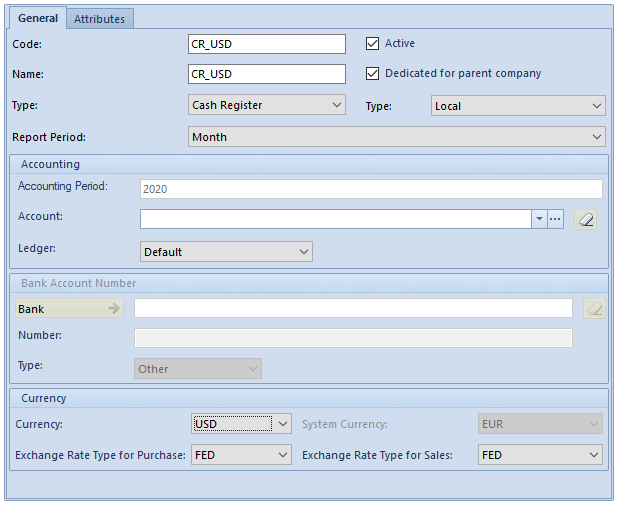

The account form contains the following elements:

General tab

General section

Required fields:

- Code – it presents a shortened account name. It can be composed of up to 50 characters (letters and/or digits) and must be unique.

- Name – it can be composed of up to 50 characters (letters and/or digits)

Remaining fields:

- Type – it defines an account type selected from a drop-down list. The available types are Cash Register and Bank.

- Type (2) – it defines an account type selected from a drop-down list. The available values are Local and Distant.

- Report Period – it defines a default report expiration period for a given account. The available values are Month, Week, Day, and Freely Defined. A period selected for an account is later suggested in newly created reports, with a possibility to change it by the user.

- Active – this parameter is selected by default and specifies whether an account is active. Deselecting the parameter deactivates a given account and makes it impossible to further use it in the system.

- Dedicated for parent company – this parameter decides whether an account is dedicated to be used in the parent company. It is inactive if a given account is attached to any center of the Company By default, the parameter is set as follows:

- When adding a new cash/bank account on the list by a user logged in to the parent company or a center located directly below the parent company – the parameter is selected, with a possibility to deselect it

- When adding a new cash/bank account on the list by a user logged in to a center of the Company type or a center subordinate to a center of the Company type – the parameter is deselected, with no possibility to select it

- When adding a new cash/bank account on the rights structure list at the parent company – the parameter is selected, with a possibility to deselect it

- When adding a new cash/bank account on the rights structure list in a center of the Company type – the parameter is deselected, with no possibility to select it

Accounting section

- Accounting Period – it presents a current accounting period; the field is non-editable

- Account – it enables the user to select an account from the chart of accounts. Selecting the button

removes the selected account from the field.

removes the selected account from the field. - Ledger – it enables the user to select a ledger from the list of ledgers

Bank Account Number section

- Bank – it presents the name of a bank keeping a given bank account. Selecting the button

opens the list of banks defined in the system.

opens the list of banks defined in the system. - Number – it presents a bank account number

- Type – it presents a numbering type used by a bank. The available types include IBAN, NRB_PL, and Other. IBAN stands for the International Bank Account Number, which is used by banks to identify bank accounts across national borders; NRB_PL is used to identify national bank accounts in Poland.

Currency section

- Currency – it presents the symbol of a currency in which the new account is to be kept. A relevant currency can be selected from the list.

If the user selects a currency different than the system currency, the Currency section displays additional fields:

- System Currency – it presents the system currency of a given company; the field is non-editable

- Exchange Rate Type for Purchase – it enables the user to select an exchange rate for purchase documents. More information on this subject may be found in the article Currency accounts.

- Exchange Rate Type for Sales – it enables the user to select an exchange rate for sales documents. More information on this subject may be found in the article Currency accounts.

While adding a new cash/bank account or editing an existing one, it is possible to define a new currency or exchange rate type by selecting either the button [Add] or [Add Exchange Rate Type].

Change History and Attributes tabs

A detailed description of these tabs may be found in the article Tabs Discount Codes, Analytical Description, Attributes, Attachments, and Change History.