Correcting documents

Correcting documents – introduction

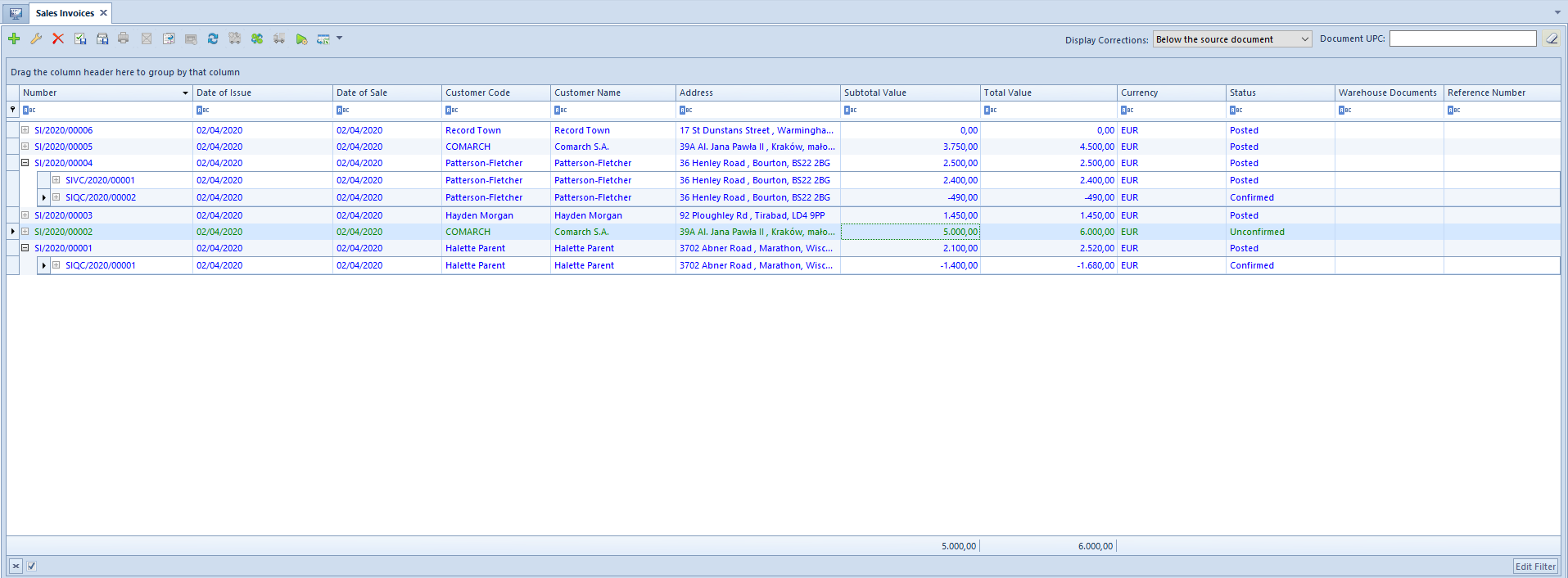

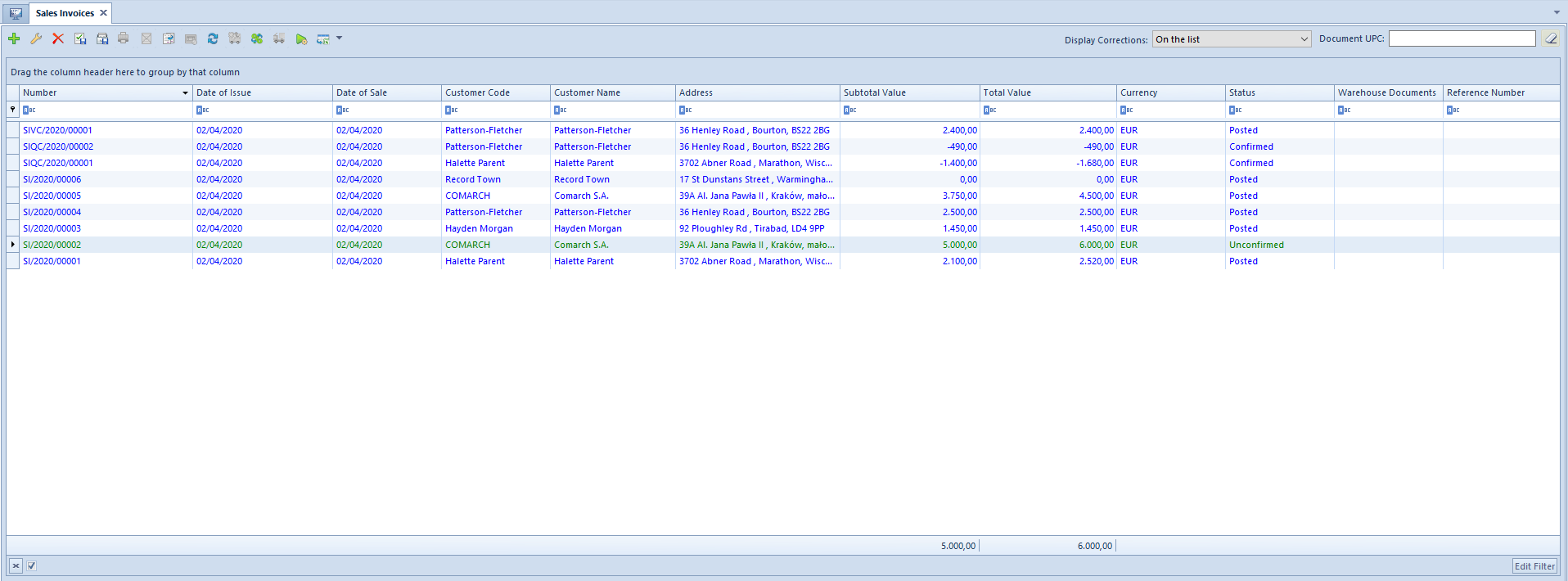

Among correcting documents, two types can be distinguished:

- corrections generated to documents existing in the system (“automatic” corrections)

- manual corrections, issued to documents from outside the system

In terms of type of corrected data, it is possible to distinguish documents correcting:

- quantity

- value

- additional costs

- VAT rate

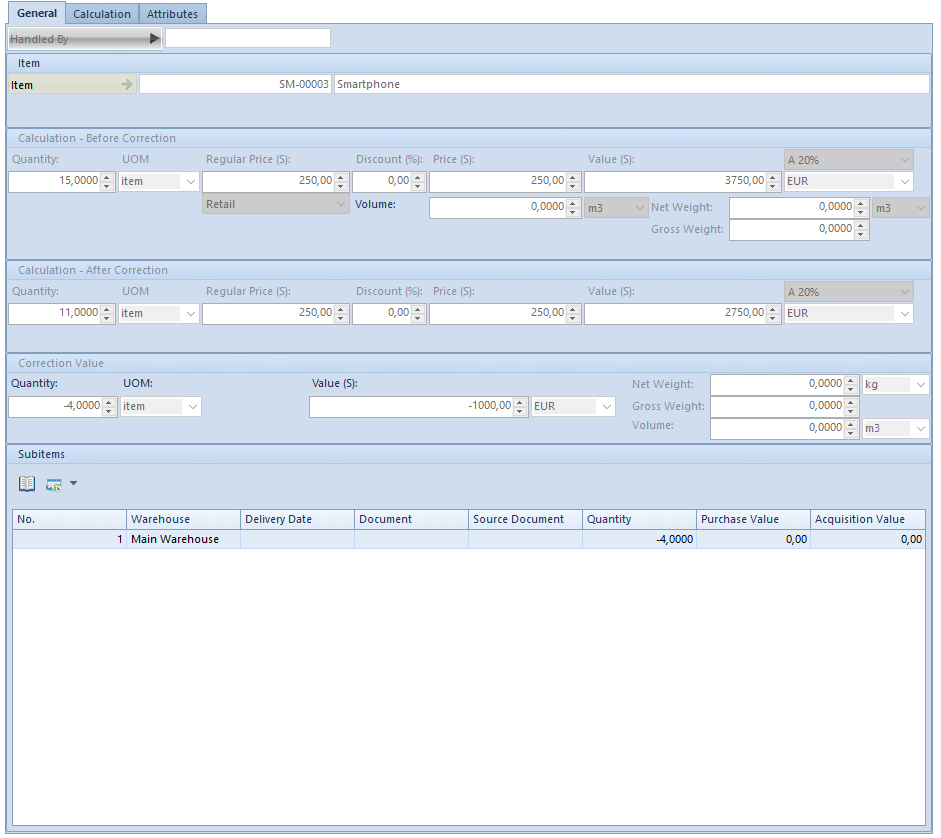

A quantity correction issued to a document can be both positive and negative. It means that it is possible to increase or decrease the quantity in the correction in reference to the initial quantity.

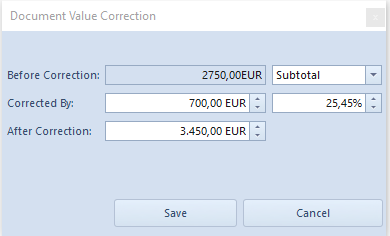

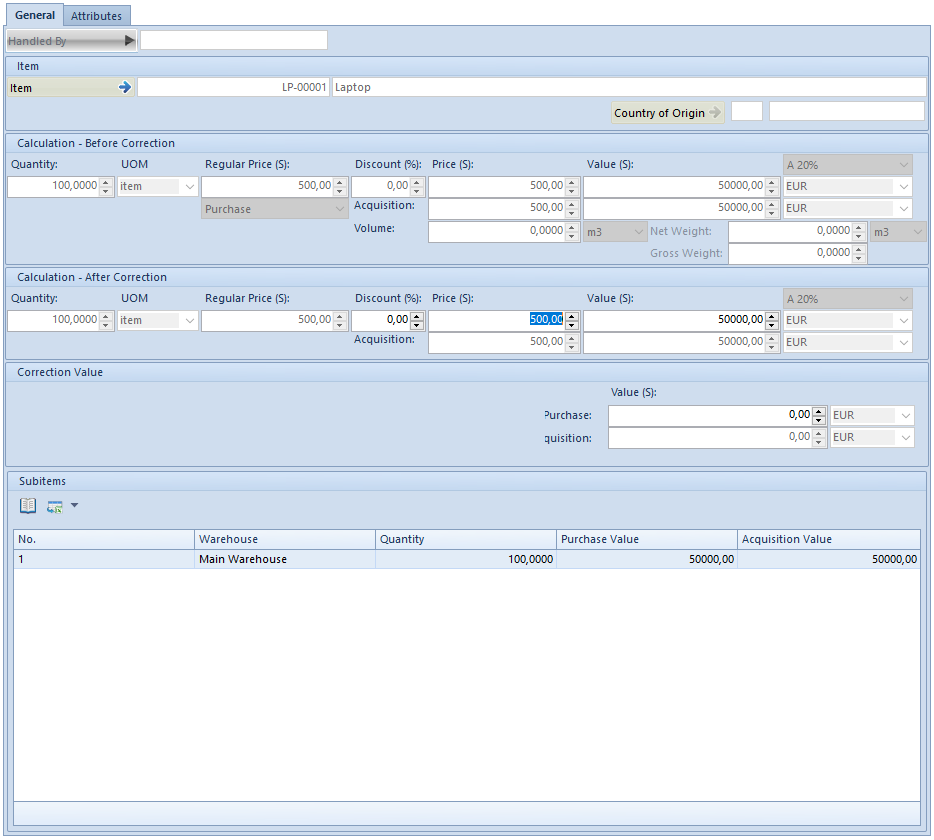

In a value correction it is possible both to increase and decrease purchase price/value of items in the source document. Exception includes corrections of advance invoices which can be negative only.

VAT table edition

For unconfirmed corrections of PI/API (both “automatic” and manual) it is possible to edit values in VAT table, which results in changing document value and payments. Such a change does not affect values of document items.

In the case of purchase invoice quantity corrections and advance purchase invoice quantity corrections, it is not possible to enter a value higher than zero and for document with VAT direction on total, additionally, VAT value cannot be lower than total value. This is due to the type of document.

Purchase invoice quantity corrections have no such limits. An operator can enter both negative and positive values.

Receipt printout numbers on corrections

On forms of corrections issued to receipts (value and quantity corrections, both automatic and manual), there is a need to enter printout number assigned to a source receipt by a receipt printer. Such an information is entered in field Printout No. placed in document header, immediately below correction document number.

Reason for correction

For all types of corrections, both automatic and manual, it is possible to specify whether a document is being issued in the result of a return from customer or a mistake made in a source document to which a correction is being issued. Such information is essential for registering returns, complaints and mistakes. The reason for correction is determined in field Reason for Correction, located in document header immediately below the field with document status. The field Reason for Correction contains a drop-down list from which an operator selects an appropriate option. A list of options is retrieved from generic directory (Configuration (General) → Generic Directories → General → Reasons for Corrections). By default, the dictionary contains the following options:

- Mistake

- Terms

- Return

- Buy-back

- Change of VAT rate

It is not possible to modify, deactivate or delete predefinted options. New values can be added to the generic directory Reasons for Corrections, upon adding new values and selecting one of the available options: Mistake, Return, other in field Type.

Field Reason for Correction assumes the following default values:

- for RQC – Return

- for RVC – Mistake

- for the other correction documents the field is not filled in automatically.

An operator can freely modify value in this field, until a document is confirmed.

Generating corrections and reason for correction

On correction documents generated as the result of other corrections, the field Reason for Correction assumes the same value as the field Reason for Correction on the source correction, regardless of whether correction generation has been activated by the system or by the user.

In the system, there is also a possibility to perform the following business situations which result in automatic generation of not editable correction documents, without operator’s input. On such documents, an operator cannot indicate or change reason for correction.

The first two situations regard generations of a SI to R, the last one refers to a terms defined on a SI.

Scenario I: A SI is generated to a receipt, and next the operator issues SIQC/SIVC for this SI. In the result of confirming the SIQC/SIVC, the system automatically generates RQC/RVC corresponding to these corrections and associated with the source receipt. If a reason for correction has been specified in corrections issued to the SI, value in field Reason for Correction is copied to RQC/RVC from corresponding SIQC/SIVC. If field Reason for Correction on the SIQC/SIVC has been left undefined, then on the corresponding RQC/RVC the option set in field Reason for Correction is the same as when RQC/RVC are issued manually – Return for RQC and Mistake for RVC.

Scenario II: The operator issued a RQC/RVC to a receipt and then generated a SI for the receipt. When confirming the SI, the system automatically generates appropriate corrections to the SI. In corrections generated this way, field Reason for Correction has the same value as it was specified on the corresponding correction to the receipt.

Generating warehouse document to SIVC and PIVC on account of terms

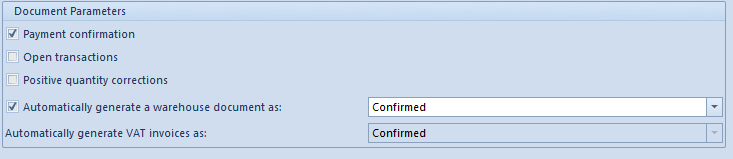

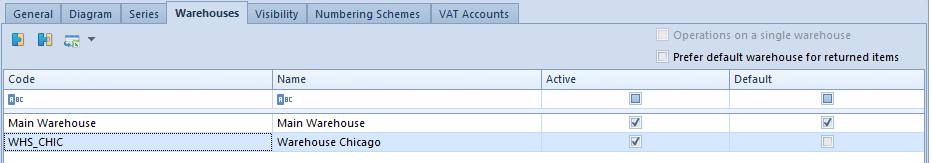

If terms is defined on a SI/PI document and payer has fulfilled its conditions, then, depending on setting of parameter Generate a warehouse document on account of terms on definition of SIVC/PIVC document type:

- the system generates a warehouse to SIVC/PIVC on account of Terms – if the parameter is checked

- the system does not generate any warehouse document to SIVC/PIVC on account of Terms – if the parameter is unchecked

Scenario I: (parameter Generate a warehouse document on account of terms is checked): On SI/PI document, terms was defined and the payer fulfilled the terms conditions. SOR/POR document was generated to SI/PI. When paying for the SI/PI, the system automatically generates a SIVC/PIVC and SORVC/PORVC. In both corrections option Terms is set as a reason for correction.

Scenario II (parameter Generate a warehouse document on account of terms is unchecked): On SI/PI document a terms was defined and the payer fulfilled the terms conditions. SOR/POR document was generated to SI/PI. When paying for the SI/PI, the system automatically generates a SIVC/PIVC. SORVC/PORVC document is not generated.

Scenario III (parameter Generate a warehouse document on account of terms is unchecked): On SI/PI document a terms was defined and the payer fulfilled the terms conditions. SOR/POR document was not generated to SI/PI. When paying for the SI/PI, the system automatically generates a SIVC/PIVC. During manual generation of warehouse document, SIVC/PIVC is not taken into account, so the value is uploaded from the trade document.

When generating subsequent corrections to the warehouse document, only those quantity and value corrections of trade documents are taken into account, which were not generated in result of calculating terms.

Scenario IV (parameter Generate a warehouse document on account of terms is unchecked): On SI/PI document a terms was defined and the payer fulfilled the terms conditions. SI/PI document was issued to which a warehouse document was generated. When paying for the SI/PI, the system automatically generates a SIVC/PIVC. Correction to the warehouse document is not generated. Another value correction resulting from Mistake is issued and confirmed. A warehouse document is generated to the second value correction.

During conversion of a databases, the parameter is checked, by default. In case of creating a new database:

Receipt confirmation

In Polish version of the system, it is possible to check confirmation of receipt of a correction by a customer on all types of corrections, both automatic and manual, issued to a sales invoice document. The fields are editable regardless of a correction document status. However, in case of SIQC/SIVC with Posted status possibility to edit such a document depends on setting of parameter Change of parameters in a posted VAT invoice. This permission is available in Configuration → Company Structure → Operator Groups → group edit → tab Other Permissions. Value of fields referring to receipt confirmation is transferred onto automatically generated VAT invoices and may affect the date of inclusion of a correction in VAT-7 declaration. Completing information regarding receipt confirmation on VAT invoice results in transferring this information onto SIQC/SIVC correction.

The parameter Receipt Confirmed On is unchecked by default; its checking activates fields:

- date – system date is set automatically but it can be freely modified by a user

- By – list with contact persons assigned to a customer; the field is not mandatory and can remain empty

Regardless if parameters referring to receipt confirmation are changed from the level of SIQC/SIVC or from the level of a generated VSIC, relevant data is automatically updated on the associated document.

Printout

From the level of the list of receipts, under button [Print Document] and from the level of RQC form under button [Print], there is a printout called Return/Complaint receipt report available for RQC. Data for this printout is retrieved from the form of document for which the printout has been started. Date of return in the printout refers to correction date from the RQC form. Field For Receipt on the printout contains number of a receipt associated with a given correction, which was assigned to the receipt by Comarch ERP Standard system; whereas receipt printout number (assigned by a receipt printer), which was entered in field Printout No. in the RQC form, is displayed by this number in brackets.

From the level of the list of receipts for correction documents, there are also collective printouts available which refer to registration of mistakes and returns – Statement of Mistakes and Statement of Returns/Complaints. Both of them are located under button [Print List]. The first one presents a statement of corrections for receipts having option Mistake set as their type in the Reason for Corrections generic directory. The other includes corrections for receipts whose type is set as Return. When starting a given printout, it is necessary to specify a range of dates for which a statement of mistakes or returns must be generated. When preparing a statement, a correction date from correction document form is verified.