Exchange rate differences documents

An exchange rate difference document is created as a result of completing documents in foreign currency at different exchange rates on the transaction. Such document is created also automatically at the moment of clearing (including payment completion) two journal entries which were generated at different exchange rates.

Characteristics of an exchange rate difference document:

- exhange rate difference is calculated automatically when combining documents issued at different exchange rates

- exchange rate difference is calculated automatically by the system and is not editable

- the date of the later of completed documents is set as the date of issue, with a possibility to change it

- once the combination of the associated documents is removed, the exchange rate difference document is automatically deleted

Positive exchange rate differences arise if:

- the value of receivable resulting from an invoice is lower than the payment actually received from a customer

- the value of expense is higher than the payment actually made

Negative exchange rate differences arise if:

- the value of receivable resulting from an invoice is higher than the payment actually received from a customer

- the value of expense is lower than the payment actually made

[eample] A sales invoice, amounting to 100 USD, which must be paid by bank transfer, is issued. On the day the SI is issued, the valid exchange rate is 1 USD = 4 PLN A payment of receivable type amounting to 100 USD = 400 PLN is created

On the 27th of February 2019 a deposit of 100 USD is received for that invoice. On the day the deposit is received, the valid exchange rate 1 USD = 4.05 PLN. A CD document is created with the date 27.02.2019, amouting to 100 USD = 405 PLN

The receivable and the transaction of revenue type have been fully paid. The completed amount is the same and is equal to 100 100 USD, however the value in PLN is different for each document.

The system automatically creates an exchange rate difference document amounting to 5 PLN and of Positive type, with the date of issue 27th February 2019. [/example]

Part of the amount equal to 100 USD is paid. On the day the PI is received the valid exchange rate is 1 USD = 4,30 PLN.

The system automatically creates an exchange rate difference of Negative type, amounting to 10 PLN (100 x 4,30 – 100 x 4,20 = 10). [/examle]

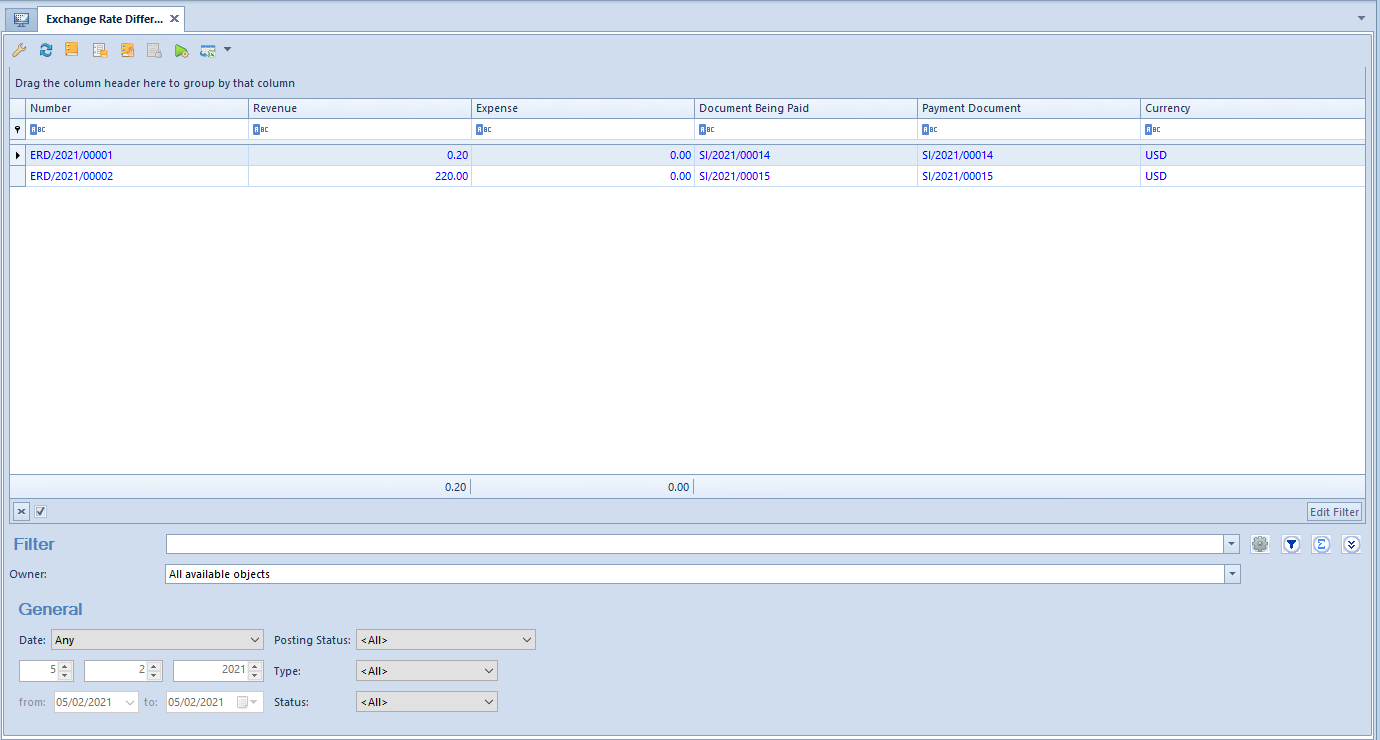

List of exchange rate documents

The list of exchange rate documents is available from the level of Finances, under the button [Compensations].

The list contains standard buttons which have been described in article <<Standard buttons>>.

The list is composed of the following columns:

- Number – system number of an exchange rate document, assigned by the system according to the numerator

- Revenue – value of an exchange rate of the Positive type

- Expense – value of an exchange rate of the Negative type

- Document Being Paid – system number of the document being paid

- Payment Document – system number of the payment document

- Currency – system currency of a company in which the document has been issued

and columns hidden by default:

- Date of Issue

- Status – status of exchange rate difference, possible values are: Revenues, Costs, Compensations, Other

- Status – status of exchange rate difference, possible values are: Negative, Positive

- Owner – center of the company structure which is the issuer of a document

Detailed description of functioning of the filters can be found in category <<Searching and filtering data>>>

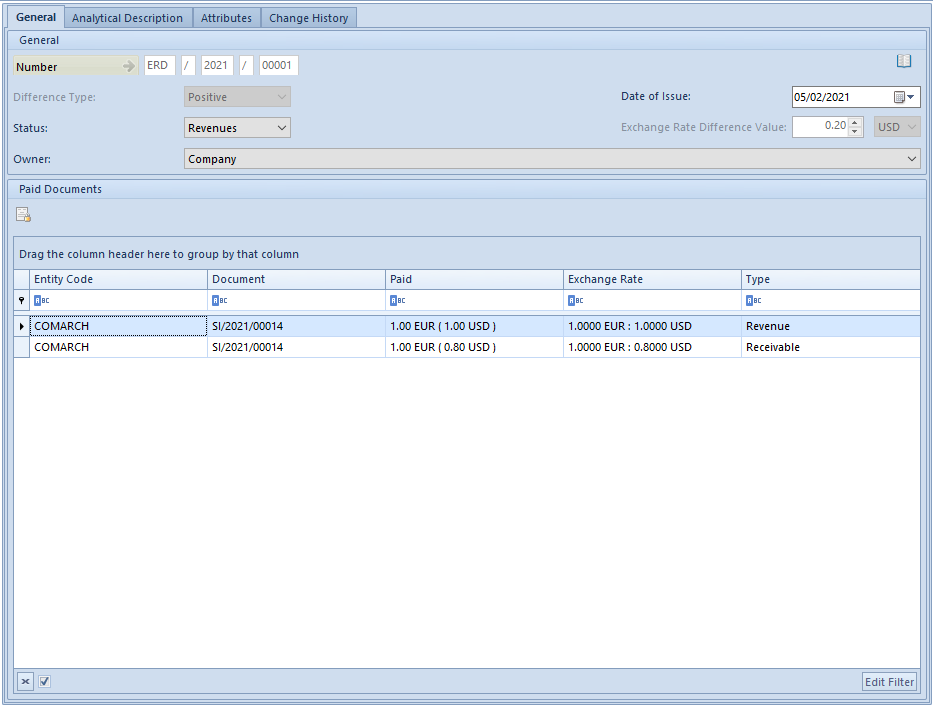

Exchange rate difference document form

To modify or view the details of a document, mark one of the documents on the list and then click [Edit].

Modification of an exchange rate document is possible only for documents issued in the same company. Documents issued in different companies can be previewed only.

The form of exchange rate document is composed of the following elements:

Tab General

Section General

- Number – system number of an exchange rate document, assigned by the system according to the numerator

- Difference Type – type of exchange rate difference: Positive, Negative. The field cannot by edited.

- Status – status of exchange rate difference, possible values are:

- Revenues (association type: receivable and transaction)

- Costs (association type: payable and transactions)

- Compensations (association type: receivable and payable or deposit and withdrawal transactions)

- Other

A user can add own values from the level of Configuration → Generic Dictionaries → General → Exchange Rate Difference Status.

- Date of Issue – document date of issue retrieved from the most recently generated paid document. It can be changed.

- Exchange Rate Difference Value – value of the created exchange rate difference

- Owner – center of the company structure which is the issuer of a document. Owner can be changed in an exchange rate difference document only if the document is not posted.

Section Paid Documents:

- Entity Code – entity’s code indicated on payment/tranaction

- Document – system document number

- Paid – payment amount in the system currency and in the foreign currency

- Exchange Rate – exchange rate of the source document

- Type – type of transaction (Revenue/Expense) or payment (Receivable/Payable)

Tab Analytical Description, Attributes, Change History

Detailed description of the tabs can be found in <<Article>>. Change History