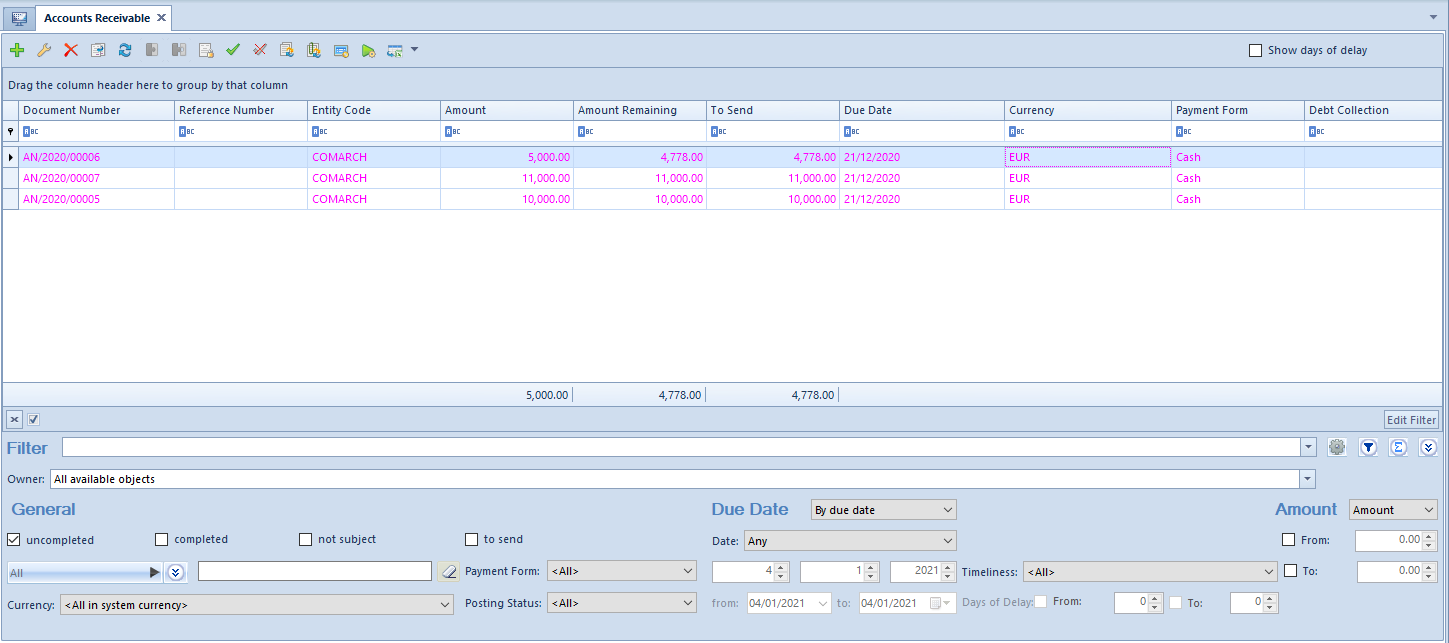

List of Receivables/Payables

Lists of Receivables/Payables is available from the level of Finances, under the [Receivables]/[Payables] button.

The visibility of data in a payment estimate depends on the center to which an operator is logged-in. The document is presented in the list, if:

- it was added by a current center (center to which an operator is logged-in)

- it was added by a center which is subordinate to the current center

- it was added by a center which makes it available (by specifiying its visibility for document types) for the current center or its child center

[Alert] All payments are displayed in a payment estimate, regardless of whether cash/bank accounts indicated on those payments are available in a current center. If an account which is not available in a given center, is indicated on a payment, such payment cannot be edited but previewed only. [/alert]

The list contains standard buttons which have been described in article <<Standard buttons>> and, additionally:

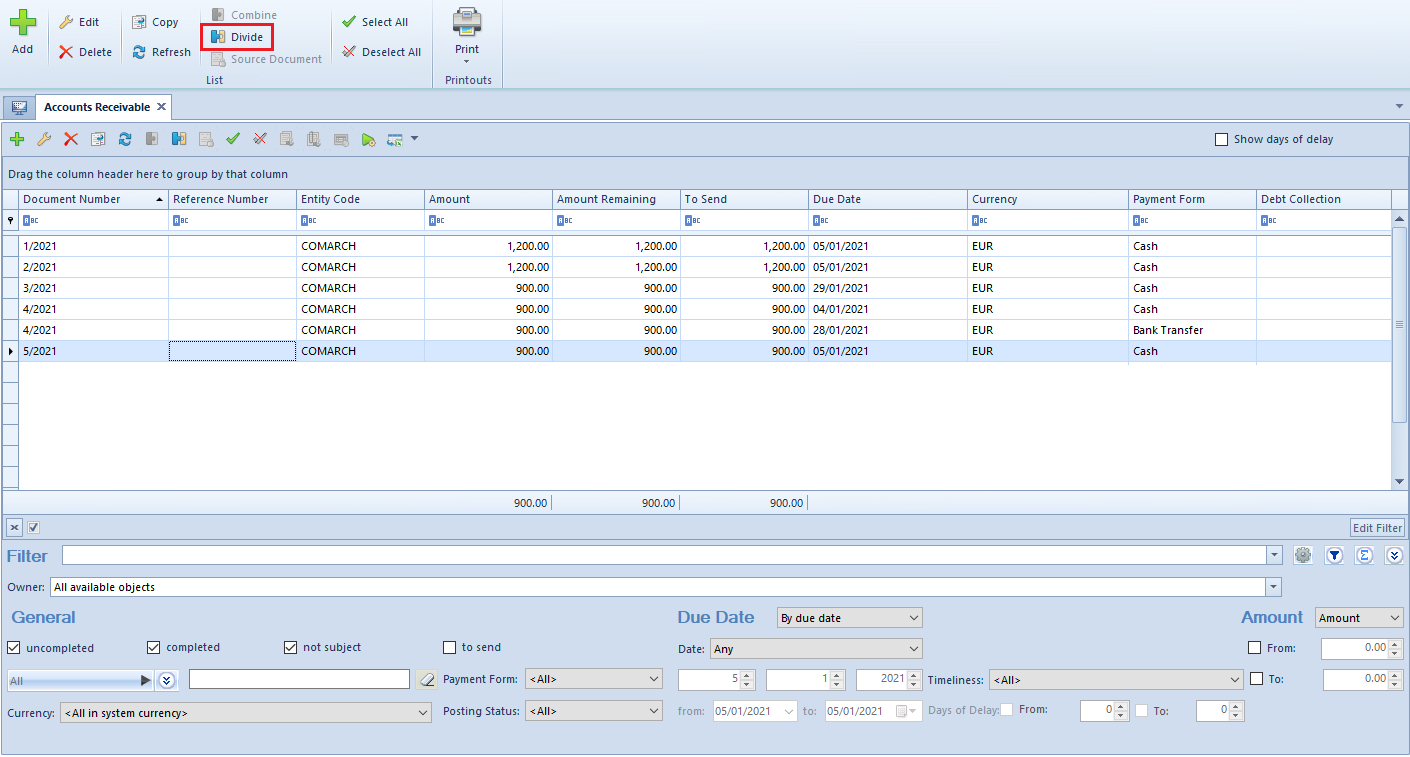

<<[Combine]>> − allows for combining several payments in one payment

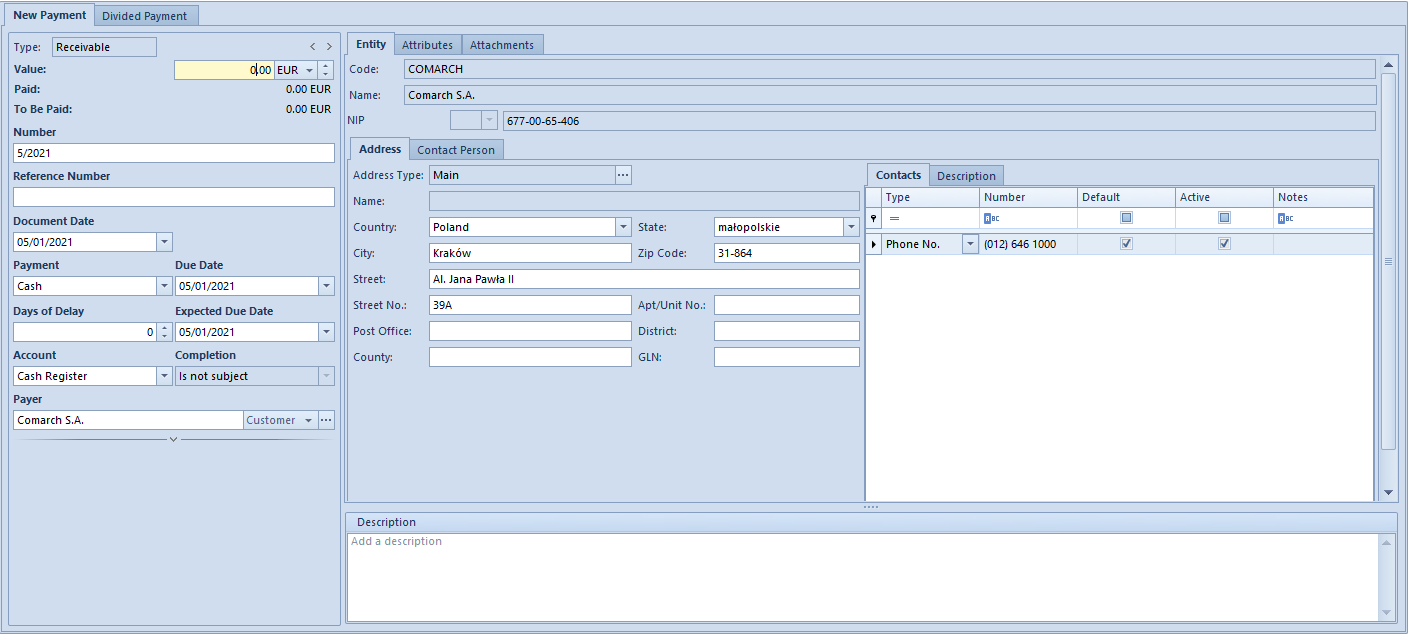

<<[Divide]>> − allows for dividing payment

[Source Document] − this button is active only form payment created automatically when adding a document. Allows for displaying the source document of a payment.

<<[Complete]>> − allows for completing a given payment

<<[Compensate]>> − allows for compensating a given payment

<<[Pay]>> − opens a form Payment Confirmation by means of which it is possible to make a payment by automatic creation of a cash/bank transaction

<<[Payment Reminders]>> − button available on the list of receivables only. Allows for generating payment reminders for selected payments.

<<[Dunning Letters]>> − button available on the list of receivables only. Allows for generating dunning letters for selected payments.

<<[Late Fees]>> − button available on the list of receivables only. Allows for generating late fees for selected payments.

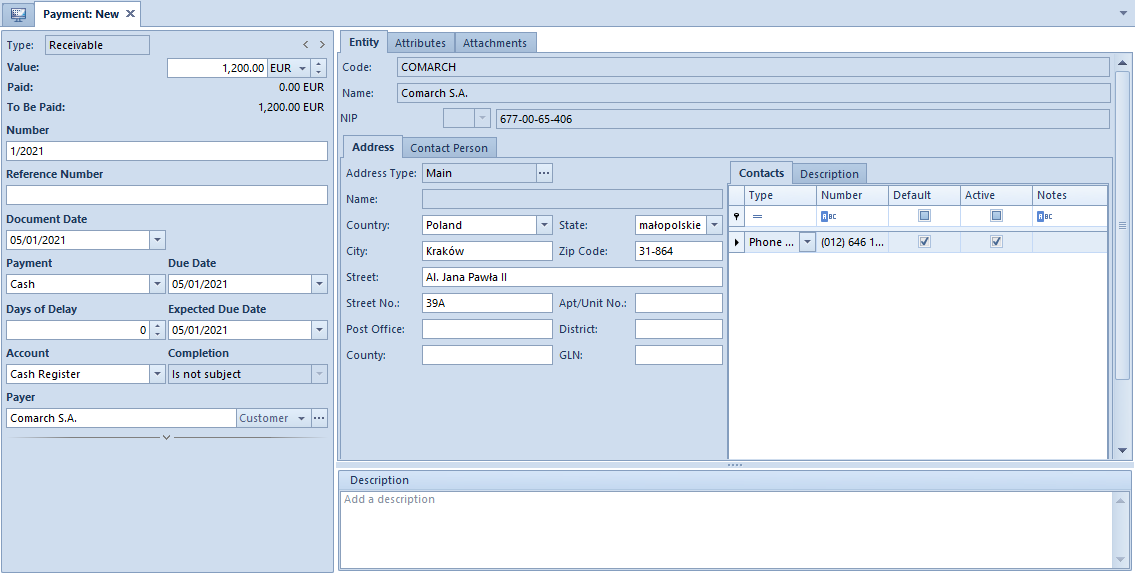

The list Receivables/Payables is composed of the following columns:

- Reference Number − number entered by a user for providing an additional identification

- Entity Code − payer’s code indicated on payment

- Value − payment value

- Amount Remaining − amount remaining to be cleared

- To Send − transfer amount remaining to be sent

- Date − date of payment

- Currency − document currency, depends on the settings in the filter

- Payment Form

- Debt Collection − column available on the list of receivables only. It displays the number of a debt collection document containing a given payment.

and columns hidden by default:

- Document Date – date of the document from the form of registered payment

- Date of Receipt − date of receipt from the source document and if case there is no source document, document date from the payments

- Cash Register/Bank – name of account selected on payment

- VAT Amount – displayed only for payments with checked parameter Split Payment

- Entity Code − payer’s code indicated on payment

- Voucher Number – number of voucher indicated on payment

- Description – description entered in payment

- Document Description – description of payment source document

- Voucher Sort – sort of voucher indicated on payment

- Applied − amount cleared by now

- <<Split Payment>> − informs whether the parameter Split Payment has been checked on a given payment

- Expected Date − expected payment date

- Status

- C − Completed

- U − Uncompleted

- NS − Not Subject

- Currency − system currency of a company in which the document has been issued

- Owner − center of the company structure which is the issuer of a document

- Affects Balance − indicates whether a given payment affects the balance of the account

[Alert] The status of partially completed receivables/payables is U − Uncompleted. [/alert]

In the upper right corner of the list, parameter Show days of delay is available. Checking this parameter displays an additional column Days of Delay which presents a number of days of delay after the due date.

The list of Receivables/Payables contains the following filtering areas:

- General − allows filtering by:

- Payment status − uncompleted, completed, not subject to completion, to send

- Entity indicated on payment − All, Customer, All customers, Employee, All employees, Institution, All institutions, Bank, All banks

- Currencies − <All>, <All in system currency> and active currencies defined from the level of <<Configuration →Currencies>>.

- Payment forms – <All> and acrive payment forms defined from the level of Configuration →Finances →Payment Forms

- Document status − <All>, Posted, Unposted

- Due Date − allows for filtering by the following values:

- By due date − payment date. Available options: Any, Day, Month, Range of Dates, Previous Month, Current Month. The range of dates allows for selecting a specific time interval.

- By expected due date − expected payment date. Available options: Any, Day, Month, Range of Dates, Previous Month, Current Month. The range of dates allows for selecting a specific time interval.

- Timeliness − <All>, Not overdue, Overdue, Today’s

- Days of Delay − available upon checking the parameter Show days of delay. The range of days allows for selecting a specific time interval.

- Amount − the following options are available within this filter:

- Amount – total payment amount. Range of amounts allows for selecting a specific amount interval.

- Amount Remaining − amount remaining to be cleared. Range of amounts allows for selecting a specific amount interval.

[Alert] Totaling on the list Receivables/Payables is possible only after selecting a specific amount in the filter or the option All in system currency. If system currency of displayed payments, value 0 is displayed in the summary. [/alert]

Detailed description of functioning of the filters can be found in category <<Searching and filtering data>>>