Receipt is a trade document which documents retail sales. A receipt is the confirmation of a purchase and is issued by vendors, who have fiscal cash registers or receipt printers, in the form of a printout. It contains basic information on the price of an item, calculated taxes as well as data relating to the vendor. An issued receipt generates a payment but the related record is not registered in VAT accounts

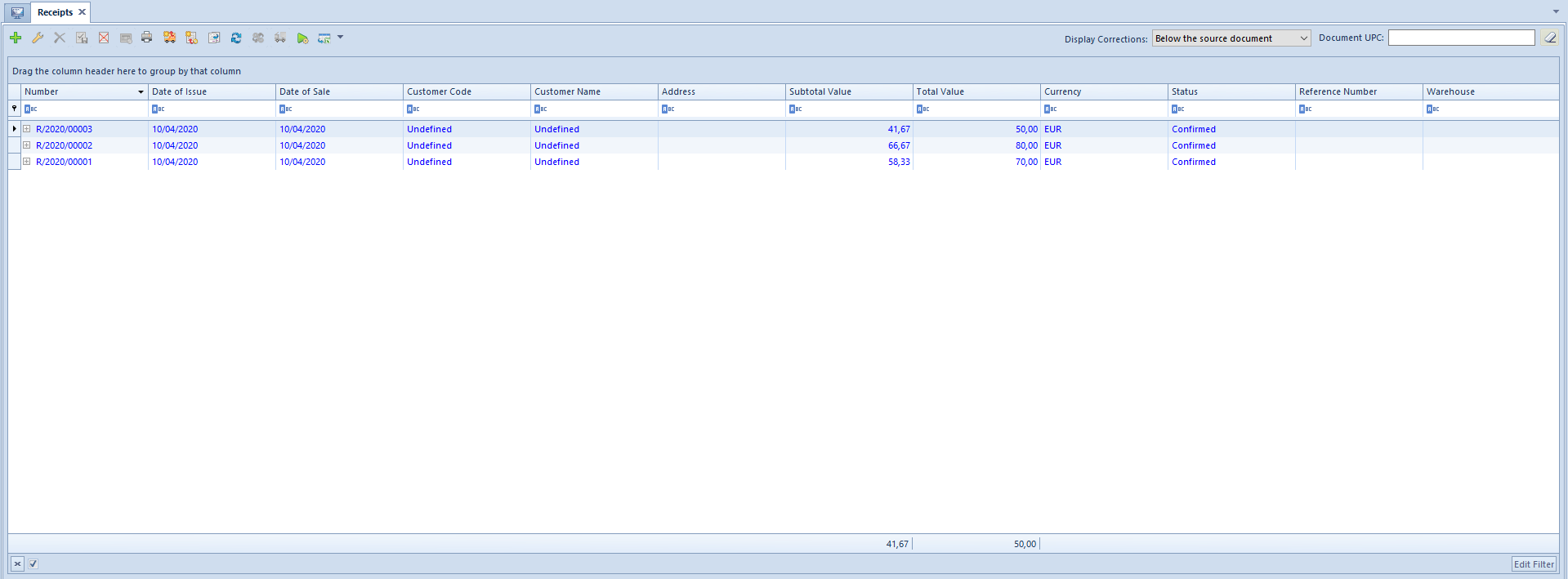

List of documents has been described in article List of documents.

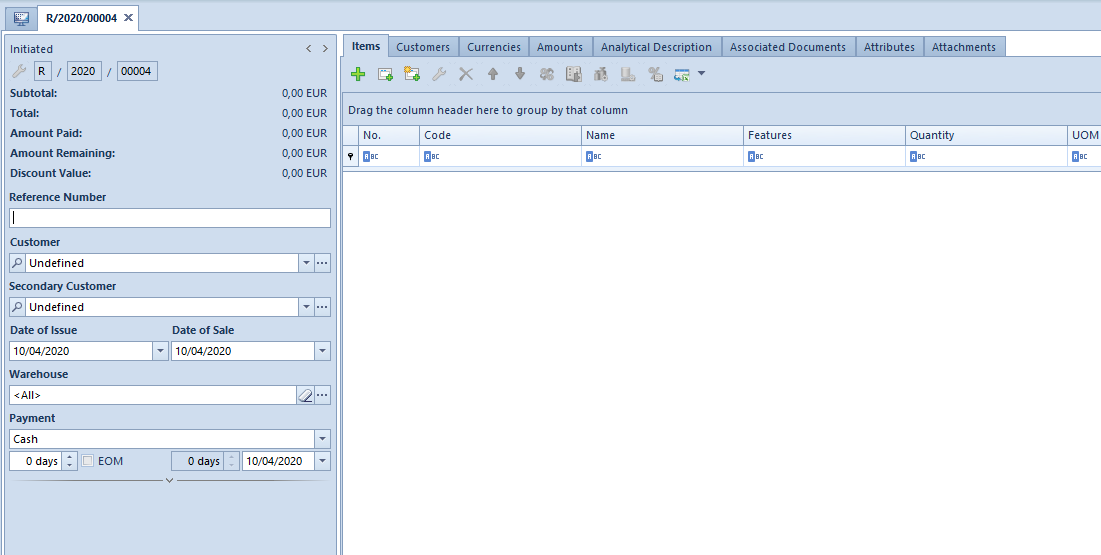

Detailed description of the document form and its tabs can be found in subcategory Document Forms.

Characteristic features of a receipt

- it can be confirmed without selecting a customer (it remains Undefined)

- a confirmed receipt can be converted into a sales invoice

- a receipt is not included in VAT account

- a receipt is issued solely and exclusively in the system currency. However, payments can be made in foreign currencies.

- parameter VAT Direction takes on the value On Total and it is not possible to change it

- while issuing a receipt it is possible to use the option Confirm and Print which confirms and, at the same time, prints a receipt

- a confirmed receipt can be printed many times

Generating trade and warehouse documents from a receipt

- it is possible to generate SI (if customer’s TIN number on the receipt is the same as the TIN number on generated invoice) or SOR from a confirmed receipt

An invoice generated from a receipt without customer’s/vendor’s TIN number defined, can be saved/confirmed only, if:

- the documets have been issued for a natural person

- the receipt has been issued before 01/01/2020

- it is not possible to generate a SI from several receipts

- it is not possible to generate SI or SOR from an unconfirmed or cancelled receipt

- a receipt can be converted to invoice only one time

- it is not possible to generate an invoice from a receipt only for a part of items

- converting a receipt to invoice can result in creating an entry in VAT account

- it is not possible to generate SOR from an invoice from which a SI has been previously generated. An opposite situation is possible, that is it is possible to generate SI from a R to which a SOR has been previously generated.

- of on the basis of a receipt another document has been generated – first, it is necessary to cancel the generated document, and then the receipt

Generating VAT invoices to invoices generated from receipt

For a receipt to be included in VAT accounts and in tax return, it must be contained in SRS or CRS document. Additionally, in Polish version of database, it is possible to generate entries in a VAT account to invoices issued to receipts. To enable such possibility, check parameter Generate VAT invoices in VAT account to invoices issued from receipts in System → Configuration → Accounting – by default, the parameter is unchecked. Upon checking it, VAT invoice or VAT invoice correction will be created while generating a sales invoice to a receipt.

After checking parameter Generate VAT invoices in VAT account to invoices issued from receipts, in definitions of SI/SIQC/SIVC document types it is possible to specify in which VAT account such invoice should be registered.

Blocking retail sales

To activate the option of blocking retail sales, it is necessary to select on the form of company a VAT rate group: VAT FR as well as the Compliance with French VAT Law parameter. After these conditions are fulfilled, it will not be possible to do the following:

perform any operations in receipts and their corrections (such as addition, deletion, confirmation, confirmation and posting, printing documents)

- generate receipts from orders and warehouse documents

- issue receipt corrections following complaint actions

- print invoices on a receipt printer

perform operations (such as confirmation, correction generation, cancellation) in a sales invoices, advance invoices and their corrections (corrections issued to a document and manual corrections) if customer’s TIN was not specified in the document

Operations that can be performed with blocked retail sales option:

- posting addition of SRS to CRS

- generation of a warehouse document SOR