General information

The system makes it possible to add a cash/bank transaction with the use of one of the following buttons:

- [Add Deposit]/[Add Withdrawal] – after using one of these buttons, a transaction type (Revenue/Expense) is automatically assigned, with no possibility to change it

- [Add] – after using this button, a transaction type is set as Revenue, with a possibility to change it

Adding a transaction with the buttons [Add Deposit]/[Add Withdrawal]

Both revenue and expense transaction forms are filled in in a similar way.

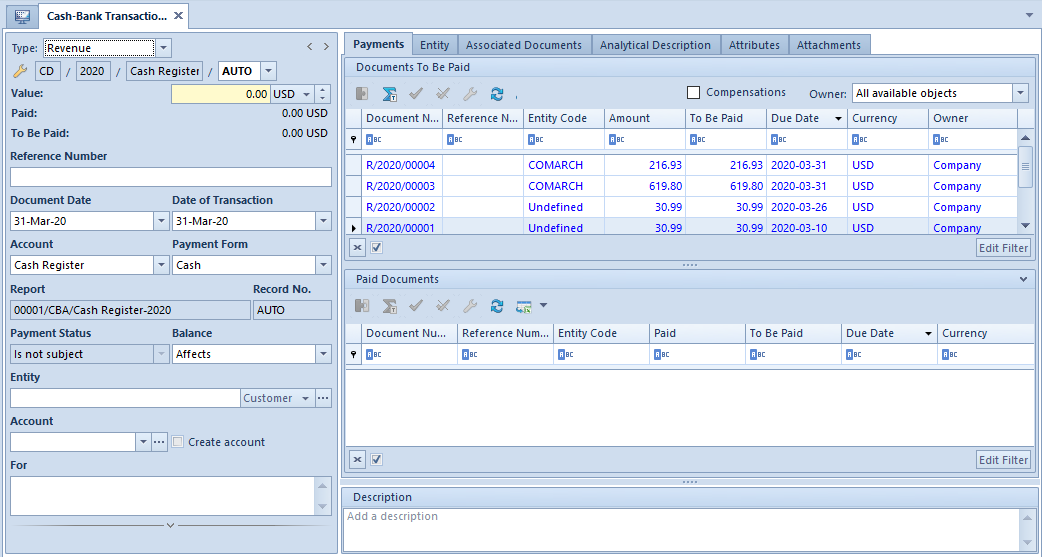

In order to add a deposit transaction, it is necessary to select Finances → C/B Transactions and click the button [Add Deposit] in the button group List.

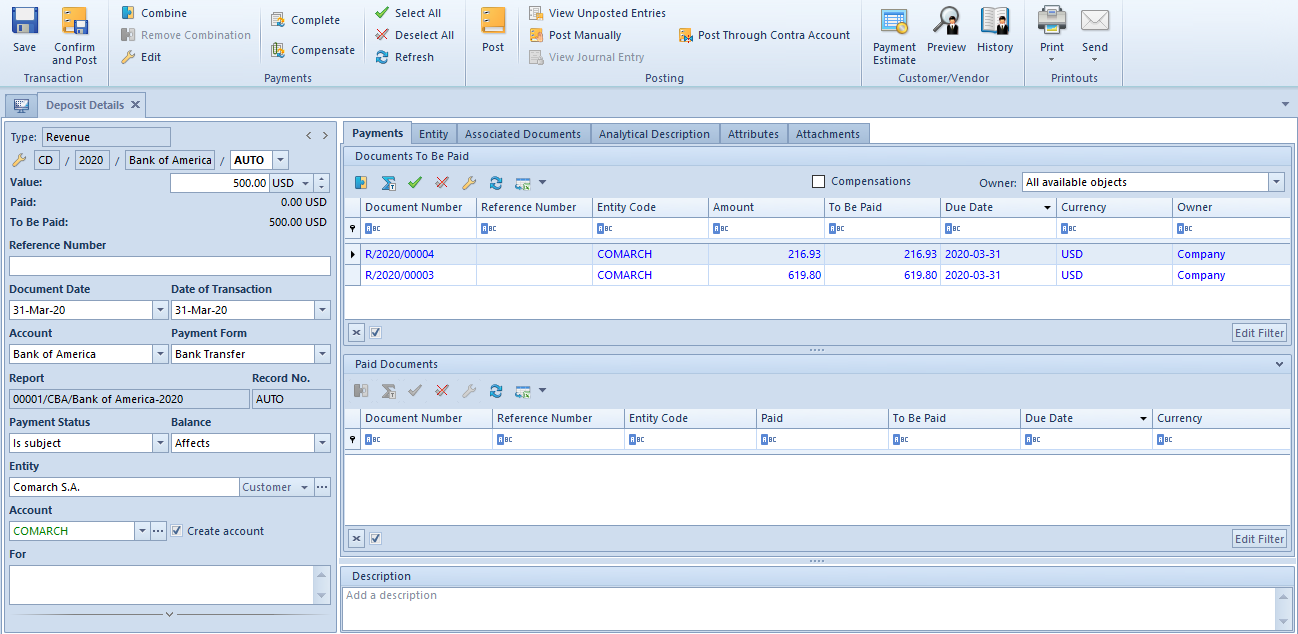

- [Combine] – it settles the transaction with a payment selected on the list Documents To Be Paid

- [Remove Combination] – it deletes the association between the transaction and a payment selected on the list Paid Documents

- [Complete] – it allows the user to settle the transaction and register a deduction

- [Post Through Contra Account] – it can be used to automatically post the transaction with the use of an account, ledger, and a contra account selected for the transaction

- [Payment Estimate] – selecting this button opens the payment estimate window related to a given customer/vendor, where it is possible to complete/compensate a payment

- [Preview] – it displays the form of a customer/vendor selected for the transaction in the read-only mode

- [History] – it displays the history of all transactions related to a customer/vendor selected for the transaction

The transaction form is composed of the following elements:

Header

Type – it specifies whether a given transaction is of the Revenue or Expense type. The field is for information purposes only and is non-editable.

Below the Type field, the system displays the number of a transaction being entered, automatically assigned by the system.

Value – it displays the transaction’s value and currency. The field is required. The system automatically sets a currency assigned to a selected cash/bank account. In the case of accounts defined in the system currency, the user may change it to a foreign currency for the needs of a given transaction. It is not possible to change a currency in the case of currency accounts.

Paid – it displays the transaction amount which has already been paid. The field is non-editable.

To Be Paid – it displays an amount calculated as the difference between the transaction value and an amount paid. The field is non-editable.

Reference Number – a number displayed in this field depends on the setting of the parameter Default automatic numeration in the system configuration. If the parameter is:

- Selected – for transactions added automatically, the reference number is set as the number of a document associated with a given transaction; for manual transactions, the reference number is any number entered by the user

- Deselected – the reference number is any number entered by the user

Document Date – this date affects the calculation of report balance and a document completion date

Date of Transaction – it allows the user to register the date of a business event related to a given deposit or withdrawal, e.g. the date of issue of a source document (cash invoice, receipt), or the date of a remittance order

Account (1) – it presents a cash/bank account to which a given transaction will be added

Payment Form – it presents the transaction’s payment form. It can be selected from the list of payment forms.

Report – this field is automatically filled in with the number of a report assigned to a selected cash/bank account and corresponding to a document date given. If such a report is missing, the field remains empty and the button [Add Report] is activated in the menu. The user may then add a report to which a given transaction should be added. The field is required.

Record No. – this field is automatically filled in as a subsequent number within a given report

Payment Status – in this field, it is possible to select either the option Is subject or Is not subject

Balance – this parameter determines whether the transaction is to affect account balance

Entity – in this field, it is possible to select an entity associated with the transaction. For revenue transactions, the system prompts the entity type Customer, while for expense transactions it prompts Vendor. The user may change the entity type to one of the following values: Vendor, Customer, Employee, Bank, Institution. Upon selecting the value Customer, the user may open a list the content of which depends on the value of the parameter Show separated customers and vendors:

- The list of customers only is displayed if the parameter Show separated customers and vendors is selected

- The list of customers/vendors narrowed down to customers with the filter Classification is displayed if the parameter Show separated customers and vendors is The user may change the value set in the filter.

After selecting the value Vendor, the mechanism of the list works in the same manner.

Filling in the Entity field on the transaction form is not required. If no entity is set, the system displays the following notification upon an attempt to save/confirm the transaction: “Transaction entity has not been specified. Are you sure you want to save this cash/bank transaction?”. The user may deactivate this notification by selecting the parameter Do not show this message again.

Additionally, if no entity is selected, and a bookkeeping account associated with an entity is set in the field Account (2), the system displays the following notification upon an attempt to save the transaction: “Transaction entity has not been specified and you have selected a directory account. Are you sure you want to save this cash/bank transaction?”. Answering No returns to the transaction form. Answering Yes, in turn, saves the transaction.

Account (2)

- If an account is marked in green, it means that the account is missing on the chart of accounts and has been suggested by the system. Selecting the parameter Create account automatically adds an account for a selected entity after the transaction is saved.

- If an account is marked in black, it means that the account exists on the chart of accounts

Rules for account suggestions in transactions:

- The system retrieves an account assigned to a given directory (customer/vendor, employee, bank, or institution) at a company to which the user is logged in

- If no entity is selected, a bookkeeping account is not suggested

- It is not possible to change the number of a bookkeeping account on the form of a cash/bank transaction if the transaction’s owner is not a company to which the user is logged in

- If the parameter Show separated customers and vendors is selected:

- A customer’s account is suggested for a revenue transaction

- A vendor’s account is suggested for an expense transaction

- If the parameter Show separated customers and vendors is deselected but a given entity is either a customer only or a vendor only:

- After selecting a customer, the customer’s account is suggested

- After selecting a vendor, the vendor’s account is suggested

- In the case of:

- An employee – a remuneration account is suggested

- A bank – a payment account is suggested

- A customs office – a duty account is suggested

- A tax office – an income tax account is suggested

- In the case of imported transactions, an account is only suggested if an operator importing the transactions has had the current accounting period set

Create account – selecting this parameter automatically creates a bookkeeping account for a relevant entity if it has not existed before. The account may only be created by an operator who has the current accounting period set.

For – in this field, it is possible to enter the name/title of a transaction in order to facilitate its classification. The field may be filled in automatically if the parameter Fill in “For” field automatically is selected in the system configuration. While posting a transaction through a contra account, the content of the For field is copied to the transaction’s journal entry.

Bank Account – in this field, the system automatically sets the default bank account number of an entity selected for a given transaction. The user may select a different bank account from among the entity’s active accounts.

Bank – it presents the code and name of a bank defined for a given entity. Once a bank account is selected, this field is filled in automatically. The field is non-editable.

Currencies – in this field, the user may select an exchange rate type. The system automatically suggests a default type set for a cash/bank account as part of which a given cash/bank transaction is being added. If a currency exchange rate is defined on a given date for the selected exchange rate type, the exchange rate is retrieved into documents automatically. Otherwise, the following notification is displayed: “A different date of exchange rate has been retrieved”. It means that the exchange rate has been retrieved from the date for which it was defined the last time.

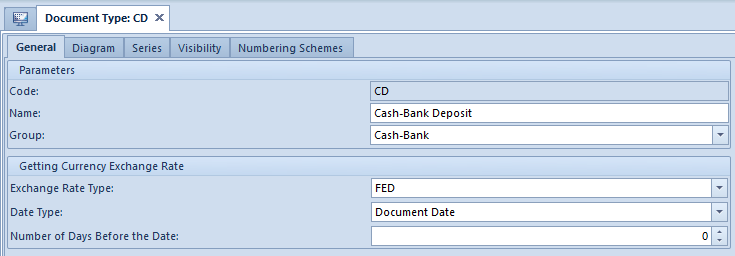

The user may define parameters concerning the date of retrieving a currency exchange rate – it is possible to set a date to be considered and define how many days before that date the exchange rate date must be set. This can be done in the document definition (Cash-Bank Deposit or Cash-Bank Withdrawal) available within a given center of the company structure.

Payments tab

The Payments tab is composed of two sections: Documents To Be Paid and Paid Documents; also, it contains the field Description.

The list Documents To Be Paid displays receivables/payables depending on the value of a given deposit/withdrawal:

- For positive-value deposits – all unpaid receivables with a value greater than zero, associated with the same customer

- For positive-value withdrawals – all unpaid payables with a value greater than zero, associated with the same vendor

- For negative-value deposits – all unpaid payables with a value greater than zero, associated with the same customer

- For negative–value withdrawals – all unpaid receivables with a value greater than zero, associated with the same vendor

Above the Documents To Be Paid list, there is the Compensation parameter. Selecting it displays on the list Documents To Be Paid all payments of an opposite type associated with the same customer/vendor (e.g. for a positive-value deposit, the list displays unpaid withdrawals with a positive value and unpaid deposits with a negative value). A detailed description of compensations may be found in the category Compensations.

Next to the Compensation parameter, there is the field Owner, which allows the user to narrow down documents displayed on the list to documents issued within a selected center only. The default value of this field is All available objects. If the user has no permission to reading a given transaction, it is not displayed on the list.

The list Documents To Be Paid is composed of the following columns:

- Document Number

- Reference Number

- Entity Code

- Amount – it is the amount of a transaction/payment

- To Be Paid – it is the amount still to be settled

- Due Date – it is a document date for a cash/bank transaction and a due date for a payment

- Currency

- Owner – it displays a center of the company structure which issues the document

Hidden by default:

- Amount In System Currency

- Entity Name

- To Be Paid In System Currency – it is the amount still to be settled presented in the system currency

- Paid – it is the settled amount

- Paid In System Currency – it is the already settled amount presented in the system currency

- For

The list Paid Documents presents documents with which a given transaction has been settled or compensated. Documents to which the user has no permissions are displayed with hidden data. The list is composed of the following documents:

- Document Number

- Reference Number

- Entity Code

- Paid – it is the settled amount

- To Be Paid – it is the amount still to be settled

- Due Date – it is a document date for a cash/bank transaction and a due date for a payment

- Currency

Hidden by default:

- To Be Paid In System Currency – it is the amount still to be settled presented in the system currency

- Amount – it is the amount of a transaction/payment

- Settlement Amount – it is the amount settled with a given transaction

- Settlement Amount – it is the amount settled with a given transaction, presented in the system currency

- Amount In System Currency – it is the value of a transaction/payment presented in the system currency

- Paid In System Currency – it is the already settled amount presented in the system currency

- For

- Owner – it presents a center of the company structure issuing a given document

A detailed description of transaction payments made on the tab Payments may be found in the article Making payments with the use of the buttons [Combine], [Combine Selected], [Complete], [Pay].

Entity tab

The Entity tab contains data on an entity associated with a given transaction. Information on this tab is filled in automatically after selecting an entity in the transaction header.

Associated Documents tab

The Associated Documents tab displays documents with which a given transaction has been settled.

Tabs Analytical Description, Attributes, Change History, and Attachments

A detailed description of these tabs may be found in the article Tabs Discount Codes, Analytical Description, Attributes, Attachments, and Change History.

Adding a transaction with the button [Add]

While adding a transaction using the button [Add] in Finances → C/B Transactions, a transaction type can be selected directly on the form. By default, the system suggests the type Revenue. Changing a transaction type is only possible before saving the transaction or before settling a complete/partial payment for it. Each change of a transaction type updates the entity type and documents to be paid.