A payment for purchased goods or services with the use of the split payment mechanism is made in a total amount. Next, a relevant VAT amount is transferred by a bank to a separate account. As a result, the payment is divided into:

- a subtotal amount on an account selected by the vendor

- a VAT amount on the dedicated VAT account

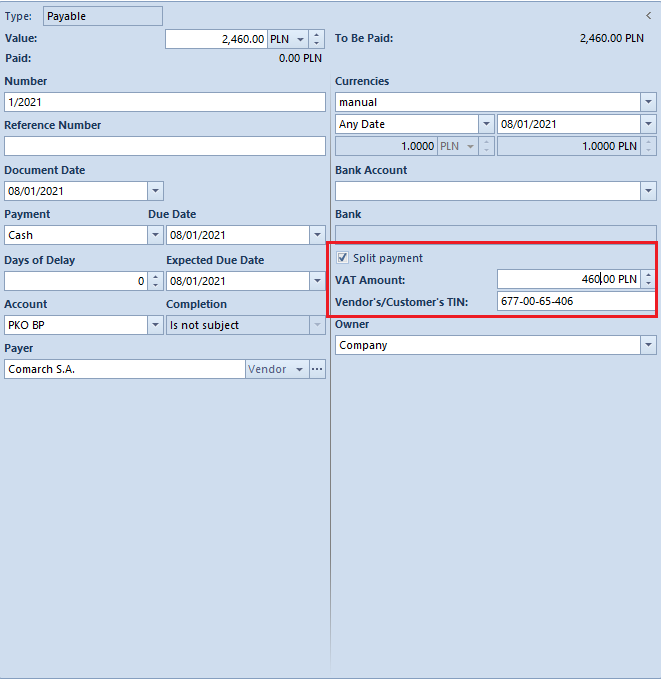

In the side panel of a payment, Split payment parameter is available. Selecting it displays additional fields:

- VAT Amount

- Vendor’s/Customer’s TIN

The values of these fields are completed automatically on the basis of the source document.

The Split payment parameter is active in a payment window only if the payment is in the PLN currency. If a payment has the Split payment parameter selected, and the user wants to change the PLN currency, the system will display the message: “The payment is tagged to be made in the form of Split Payment. By changing the currency, the Split payment option will be blocked. Payments will be fixed as regular payments. Would you like to change the currency? Yes/No”. Selecting option Yes will change the currency into a different one, deactivate the Split payment parameter. Selecting the option No does not make any changes in the payment document.

The parameter Split payment is checked by default on a payment, if on its source document a payment form of Bank type is selected and on the form of the customer/vendor indicated on the source document, the parameter Split payment is checked. In addition, checking the parameter Split payment in an invoice header automatically checks the parameter Split payment in all payments of the document, if:

- Payment currency = PLN

- Payment form is of the Bank type

- The payment is not included in a SRO

- The payment is not completed

This rule regards payments of the documents:

- PI, PIQC, PIVC

- SI, SIQC, SIVC

- R, RQC, RVC

- API, APIVC, ASI, ASIVC

- VSI, VSIC, VPI, VPIC

- SO, PO

- SQ, PQ

In the case of payments for AN and OB documents, the parameter is always deactivated by default, with a possibility to activate it by the user.

In case of splitting payment marked as Split payment, the parameter Split payment will be automatically checked on newly created payments, with a possibility to change it. The system completes customer’s/vendor’s TIN number and VAT amount on new payments (proportionally to the payment amount) and updates VAT amount on the split payment.

- Payment 1: 700 PLN

- VAT Amount = 700 / 1230 * 230 = 130.89 PLN

The system automatically completes the VAT amount in the payment as 130,89 PLN

- Payment 2: 530,00 PLN

- VAT Amount = 530 / 1230 * 230 = 99.11 PLN

The system automatically completes the VAT amount in the payment as 99,11 PLN

If the user changes the VAT amount on a split payment into an amount lower than the VAT amount resulting from the source document and, then, divides the payment, the VAT amount on newly created payments will be completed automatically, whereas, it will not be updated on the split payment.

The user may change a VAT amount in a split payment. The threshold value is the difference between the VAT amount of the entire document and the sum of the VAT amounts of all other split payments in that document.

- VAT amount in the first payment 76,67 PLN

- VAT amount in the second payment 76,67 PLN

- VAT amount in the third payment: 76,66 PLN

The user may change the VAT amount’s value within the range: 0,00 PLN – 76,66 PLN

- The first payment with the amount of 410 PLN has been tagged as split payment. The system automatically completes its VAT amount as 76,67 PLN

- The second payment with the amount of 410 PLN has not been tagged as split payment.

- The third payment with the amount of 410 PLN has been tagged as split payment.

The system automatically completes its VAT amount as 76,67 PLN. The user may change the VAT amount’s value within the range: 0,00 PLN – 153,33 PLN.

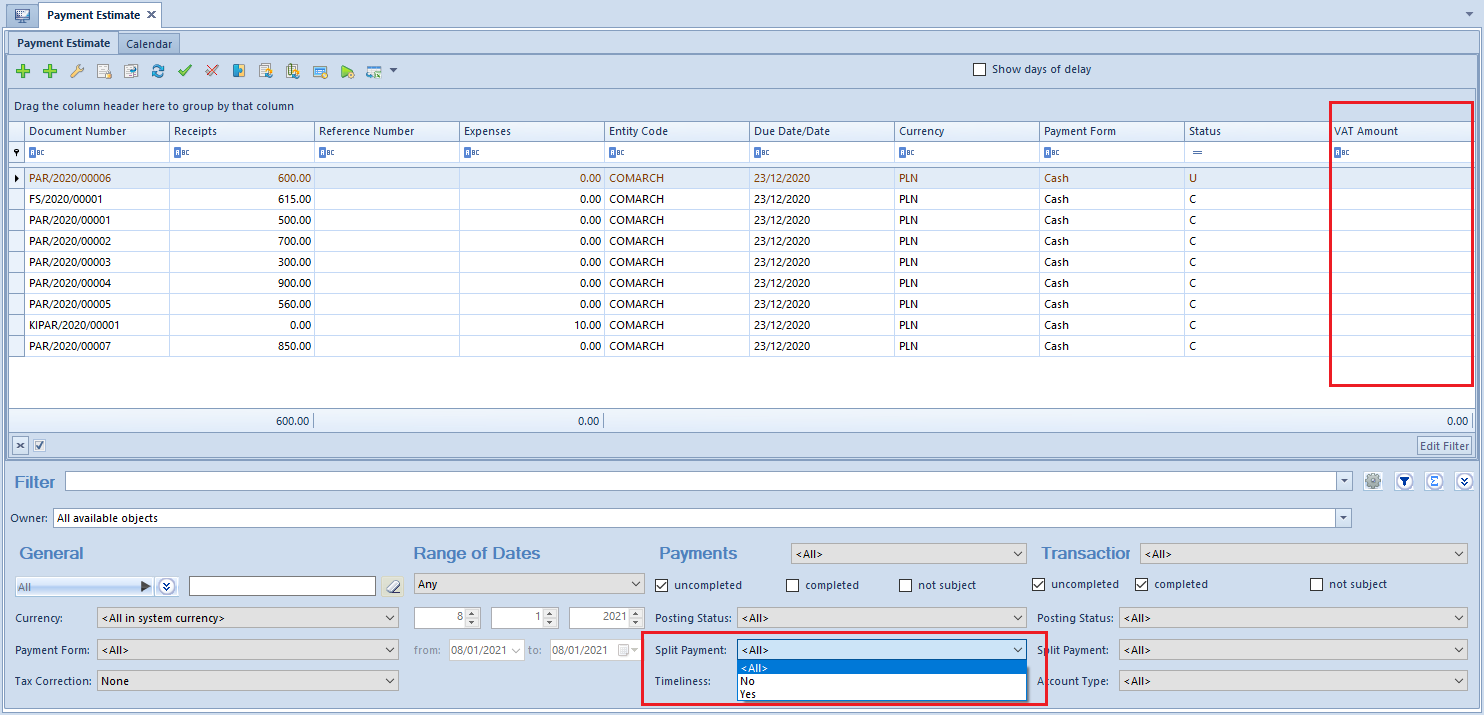

On the lists <<Payment Estimate>> and <<Customer/Vendor Payments>>, the user may filter payments of the split payment type and display columns presenting VAT amounts in such payments.