A purchase cost statement (PCS) is based on documents registering the release of items from a warehouse, and it presents the purchase or acquisition cost of these items. Additionally, a purchase cost statement allows the user to determine a margin obtained from a given document.

The PCS list is available in the menu Warehouse → (Resources) → PCS List.

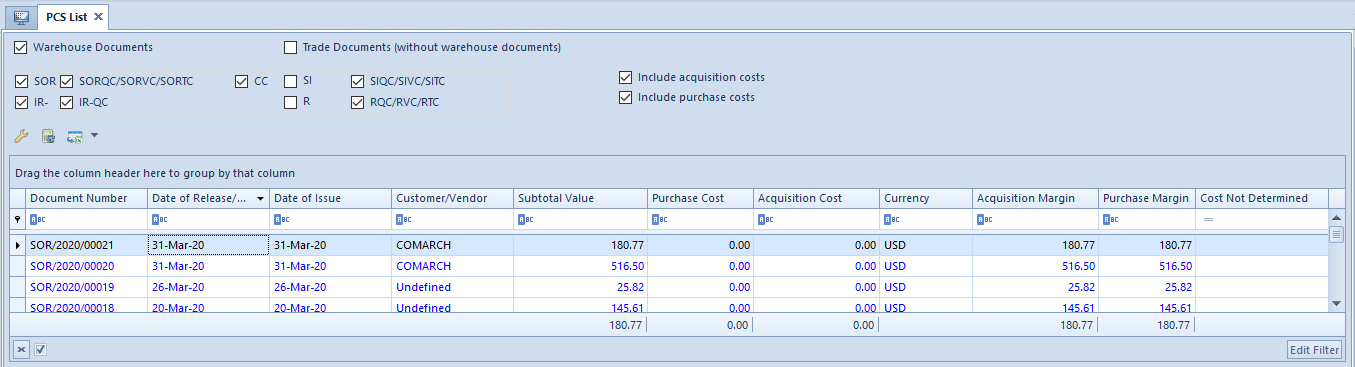

Purchase cost statements may be analyzed on the basis of:

- Warehouse documents – SOR, SORQC, SORVC, SORTC, IR-, IR-QC, and CC

- Trade documents (excluding warehouse documents) – SI, SIQC/SIVC/SITC, R, and RQC/RVC/RTC

Selecting the parameter Warehouse Documents or Trade Documents automatically selects all documents belonging to a given group. Once at least one document type is deselected, the parameter of a given group is also deselected and the user may select any documents.

Next, it is necessary to specify costs to be included in the calculation:

- Acquisition costs – the list presents the columns Acquisition Cost and Acquisition Margin

- Purchase costs – the list presents the columns Purchase Cost and Purchase Margin

- Both acquisition and purchase costs – the list presents all columns related to acquisition and purchase costs, as well as acquisition and purchase margins

After the user defines conditions and selects the button [Recalculate], the list displays all documents meeting the specified criteria – excluding canceled and initiated documents.

Details presented by the list include:

- Document number

- Date of release/sale specified in a given document

- Document date of issue

- Customer for whom a document has been issued

- Document subtotal value presented in the system currency

- Purchase and acquisition cost based on the value of resources retrieved to a document

- Purchase and acquisition margin based on the prices of document items

- Cost not determined – if a prime sales cost has not been determined in a document, a relevant column displays an exclamation mark

- Currency – the system displays the symbol of the system currency of a company owning a document