The functionality allows for handling of tax returns for tourists – Tax Free. Natural persons without permanent place of residence within the European Union’s territory are entitled to receive a return of tax payed when purchasing items on a country’s territory, which were exported undamaged outside the European Union. A vendor issues a printable receipt to a customer, with tax calculated according to national rates. Moreover, a filled in Tax Free document form is attached to the receipt, including items, their prices and paid tax amount.

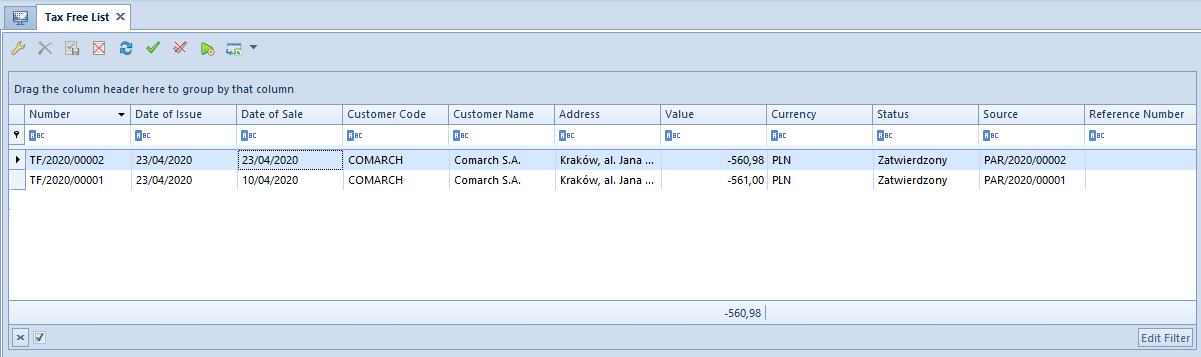

The list of Tax Free documents is available from the level of main menu, in the tab Sales → Tax Free.

The list of documents has been described in article List of documents.

A TAX FREE document can be generated from a receipt printed on receipt printer. It is not possible to add a document manually to the system.

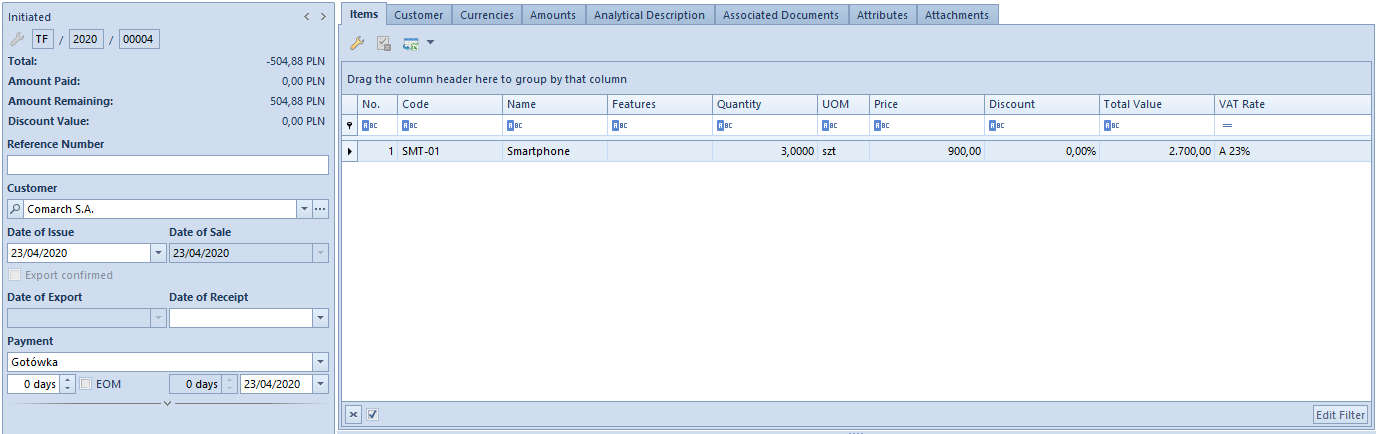

Upon selecting a R document in the list of receipts and clicking on the button [TF] placed in the group Generation, a form of a new TAX FREE document appears.

Detailed description of the document form and its tabs can be found in subcategory Document forms.

A TAX FREE document can be generated:

- only from a receipt printed on receipt printer, it is not possible to generate a TAX FREE from a receipt correction

- from one receipt

- if a receipt has Confirmed or Posted status

- if a receipt does not have any corrections or all its corrections have been canceled

- if no sales invoice has been issued to a receipt

- from a receipt to which no TAX FREE document has been generated or TAX FREE document generated to it has been canceled

In a TAX FREE document, it is possible to check parameter Export Confirmed. By default, the parameter is unchecked and can be edited only in a confirmed document. In case the parameter gets:

- checked – a payment (debit) for document amount is created

- unchecked – the payment is deleted

The parameter is not available for edition, if:

- a TAX FREE document has been included in CRS

- a TAX FREE document has been posted

- the payment has been settled (?) in full or partially

- the payment has been included in SRO or SPO

It is possible to issue a TAX FREE document for an item of service type in accordance with the data included in the receipt. If TAX FREE document is to be generated only for an item of merchandise type, it is necessary to issue separate receipts for merchandise and services.