Defining cash and bank accounts

Cash/bank accounts are accounting tools used to register transactions related to cash flow, that is cash inflows and outflows within a cash register or bank account. Each cash account corresponds to one checkout, and each bank account corresponds to one account in a bank.

The list of cash/bank accounts can be accessed in the menu Finances after selecting the button [Cash/Bank Accounts].

The list displays all cash/bank accounts available at a given company.

On the list, there are standard buttons and, additionally:

[Read Account Balance] – this button is active only for accounts of Bank type associated with a bank for which the parameter Exchange Data via Web Service is checked. After selecting the button, connection with the service address indicated in the import format of Web service type, is established. Upon the balance is retrieved in a correct way, Current Account Balance window is displayed, in which information regarding bank account number in IBAN format, posted balance and available funds, is available.

Defining a new cash/bank account

In order to define a new account, it is necessary to select the button [Add] in the button group List.

The account form contains the following elements:

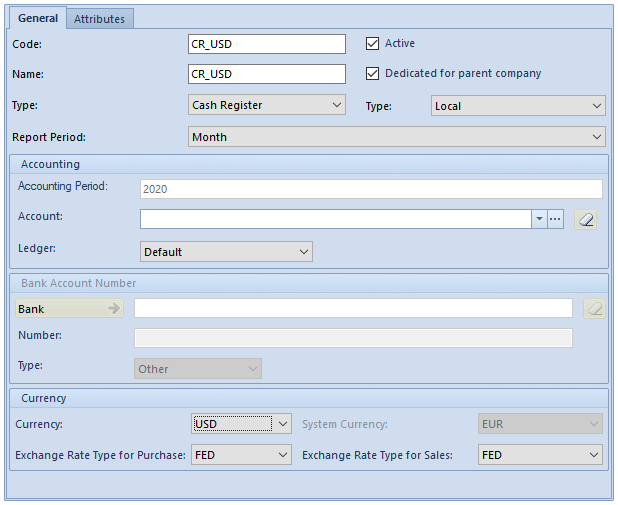

General tab

General section

Required fields:

- Code – it presents a shortened account name. It can be composed of up to 50 characters (letters and/or digits) and must be unique.

- Name – it can be composed of up to 50 characters (letters and/or digits)

Remaining fields:

- Type – it defines an account type selected from a drop-down list. The available types are Cash Register and Bank.

- Type (2) – it defines an account type selected from a drop-down list. The available values are Local and Distant.

- Report Period – it defines a default report expiration period for a given account. The available values are Month, Week, Day, and Freely Defined. A period selected for an account is later suggested in newly created reports, with a possibility to change it by the user.

- Active – this parameter is selected by default and specifies whether an account is active. Deselecting the parameter deactivates a given account and makes it impossible to further use it in the system.

- Dedicated for parent company – this parameter decides whether an account is dedicated to be used in the parent company. It is inactive if a given account is attached to any center of the Company By default, the parameter is set as follows:

- When adding a new cash/bank account on the list by a user logged in to the parent company or a center located directly below the parent company – the parameter is selected, with a possibility to deselect it

- When adding a new cash/bank account on the list by a user logged in to a center of the Company type or a center subordinate to a center of the Company type – the parameter is deselected, with no possibility to select it

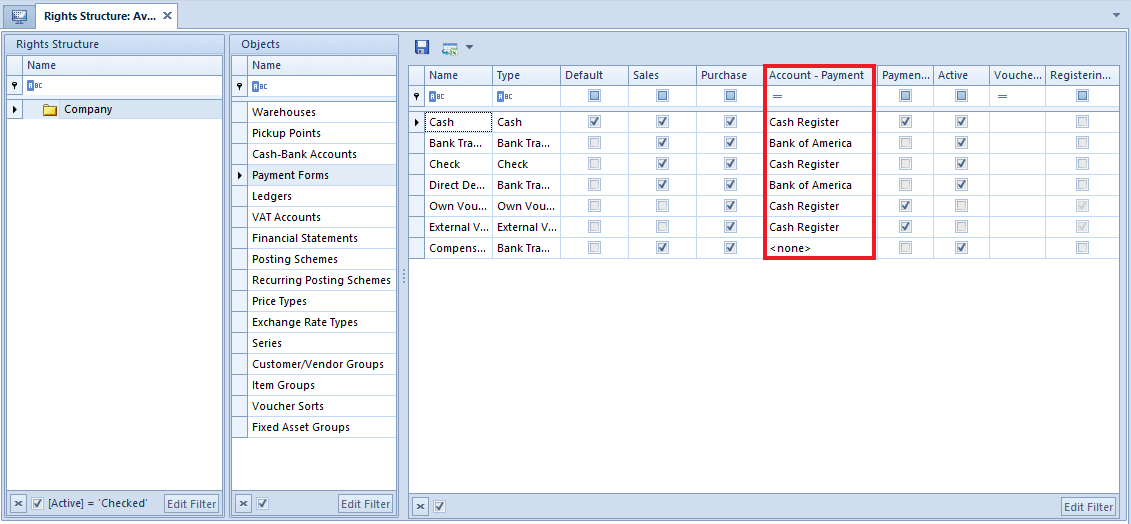

- When adding a new cash/bank account on the rights structure list at the parent company – the parameter is selected, with a possibility to deselect it

- When adding a new cash/bank account on the rights structure list in a center of the Company type – the parameter is deselected, with no possibility to select it

Accounting section

- Accounting Period – it presents a current accounting period; the field is non-editable

- Account – it enables the user to select an account from the chart of accounts. Selecting the button

removes the selected account from the field.

removes the selected account from the field. - Ledger – it enables the user to select a ledger from the list of ledgers

Bank Account Number section

- Bank – it presents the name of a bank keeping a given bank account. Selecting the button

opens the list of banks defined in the system.

opens the list of banks defined in the system. - Number – it presents a bank account number

- Type – it presents a numbering type used by a bank. The available types include IBAN, NRB_PL, and Other. IBAN stands for the International Bank Account Number, which is used by banks to identify bank accounts across national borders; NRB_PL is used to identify national bank accounts in Poland.

Currency section

- Currency – it presents the symbol of a currency in which the new account is to be kept. A relevant currency can be selected from the list.

If the user selects a currency different than the system currency, the Currency section displays additional fields:

- System Currency – it presents the system currency of a given company; the field is non-editable

- Exchange Rate Type for Purchase – it enables the user to select an exchange rate for purchase documents. More information on this subject may be found in the article Currency accounts.

- Exchange Rate Type for Sales – it enables the user to select an exchange rate for sales documents. More information on this subject may be found in the article Currency accounts.

While adding a new cash/bank account or editing an existing one, it is possible to define a new currency or exchange rate type by selecting either the button [Add] or [Add Exchange Rate Type].

Change History and Attributes tabs

A detailed description of these tabs may be found in the article Tabs Discount Codes, Analytical Description, Attributes, Attachments, and Change History.