Configuration of paramerters in the Accounting area

Configuration of paramerters in the Accounting area

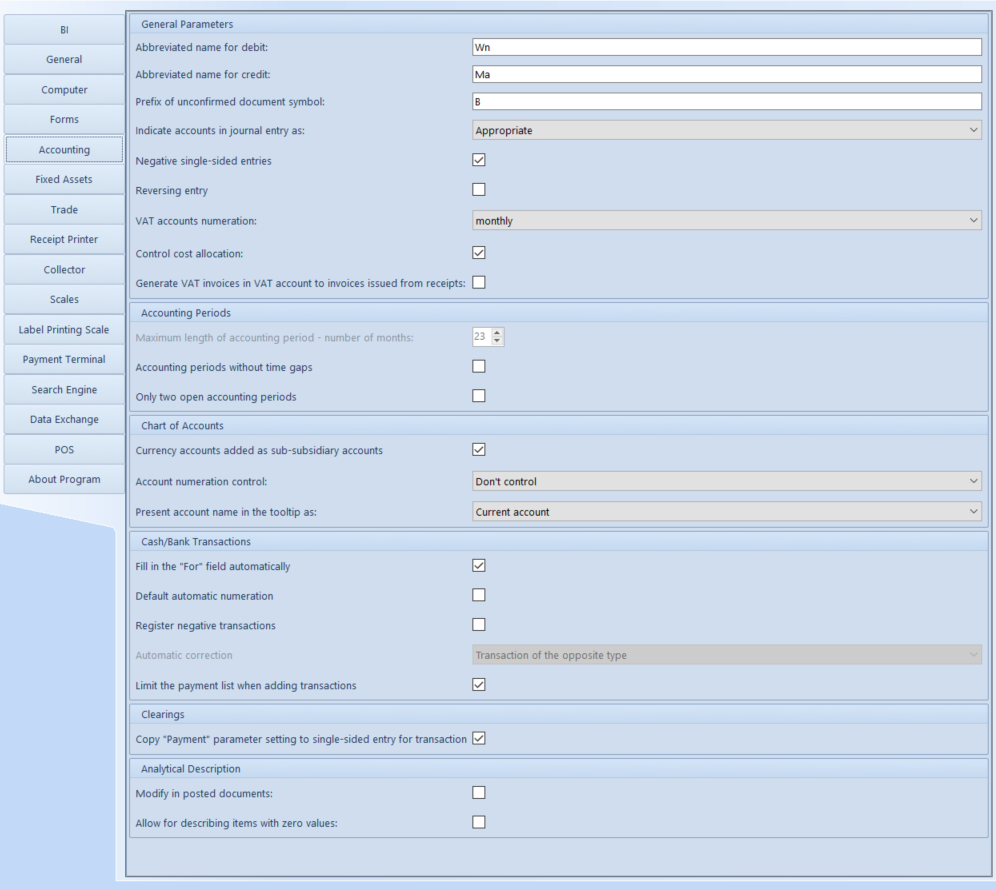

Main accounting parameters can be defined from the level of System → Configuration → Accounting. Accounting parameters set in the system configuration refer to the entire company structure.

General Parameters

- Abbreviated name for debit − allows for defining the name of account’s debit side.

- Abbreviated name for credit − allows for defining the name of account’s credit side.

- Prefix of unconfirmed document symbol − allows for defining a letter which will appear by the name of an unconfirmed document.

- Indicate accounts in journal entry as

- Appropriate − entries can be added both with and without a contra account

- Single-sided − entries can be added only on one account side

- Double-sided − entries can be added only on both account sides

- Negative single-sided entries − after selecting the parameter, the system allows for entering negative single-sided entries in journal entry. It is recommended to uncheck the parameter for companies active on the territory of the United States.

- Reversing entry − when the parameter is checked, when deleting a confirmed journal entry, the system generates single-sided entries amounting to a positive value on opposite sides of a corrected entry. If the parameter is unchecked, the system operates on principle of correcting entry, which means that the system generates correcting single-sided entries amounting to a negative value on the same side of a corrected entry.

- Collective posting − the parameter is available for French and Spanish version of the system. If the parameter is checked, when performing a collective posting, one common journal entry is generated.

- VAT accounts numerations − parameter determining the way ordinal numbers are assigned to documents in VAT accounts (No.). Possible period numeration options are: yearly and monthly.

- Posting scheme symbol for discrepancy − the parameter is available for French and English version of the system. It is used for specifying a posting scheme for discrepancy presented on bank reconciliation form by entering a symbol of previously defined scheme.

- Posting scheme symbol for bank service charges − the parameter is available for French and English version of the system. It is used for specifying a posting scheme for bank service charges presented on bank reconciliation form by entering a symbol of previously defined scheme.

- Posting scheme symbol for interest earned − the parameter is available for French and English version of the system. It is used for specifying a posting scheme for earned interest presented on bank reconciliation form by entering a symbol of previously defined scheme.

- Control cost allocation − this parameter is responsible for the activation of cost allocation control functionalities. In Polish version of the database, the parameter is checked by default. Detailed description of cost allocation control can be found in category Cost allocation control.

- Generate VAT invoices to invoices issued from receipts − the parameter is available for Polish version of the system. It determines whether at the moment of confirming an invoice (or its corrections) generated to a receipt, a VAT invoice (or VAT invoice correction) should be created in a VAT sales account.

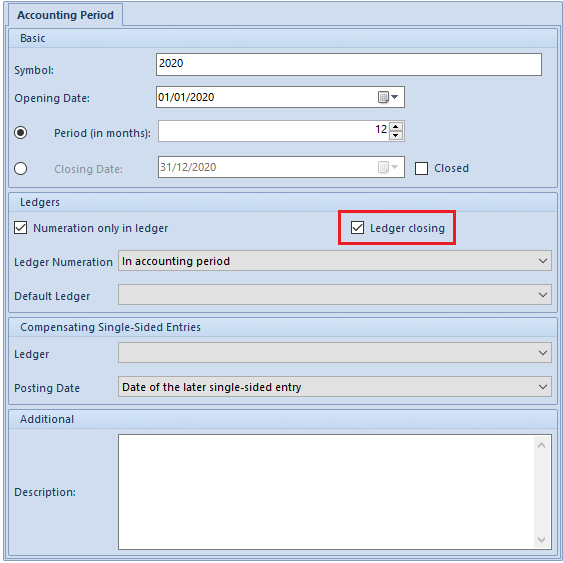

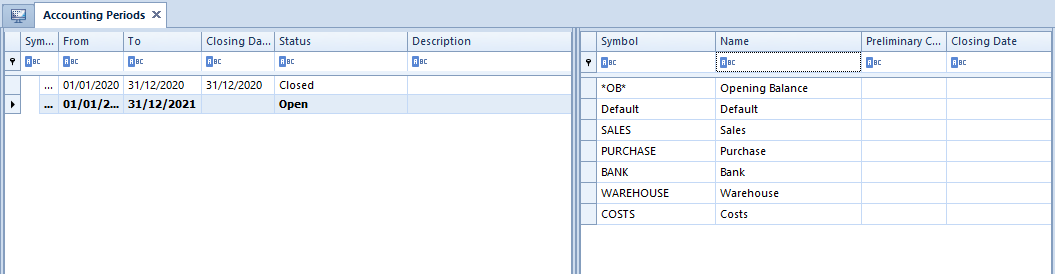

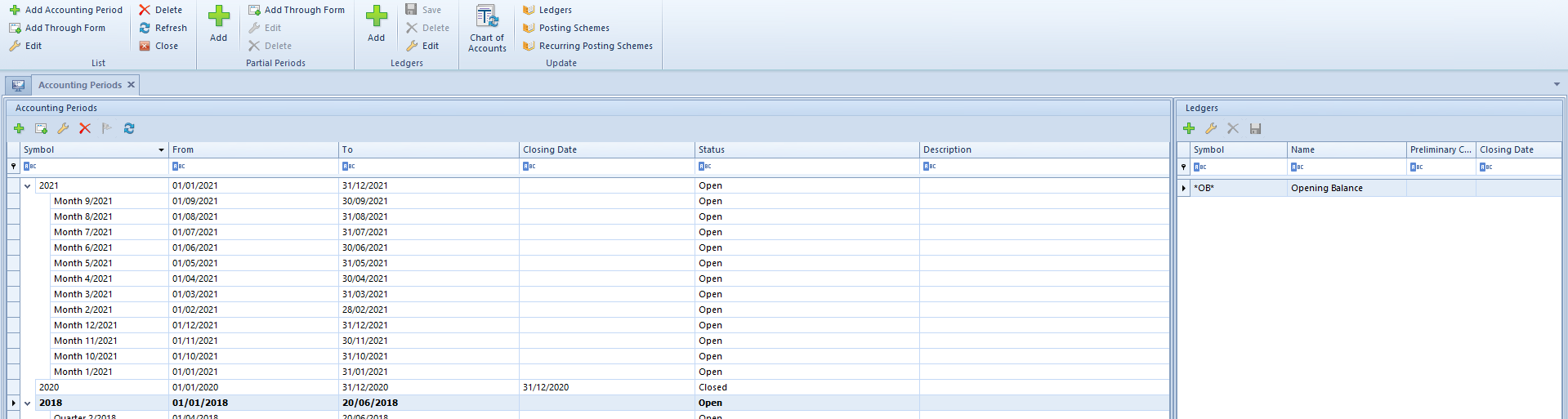

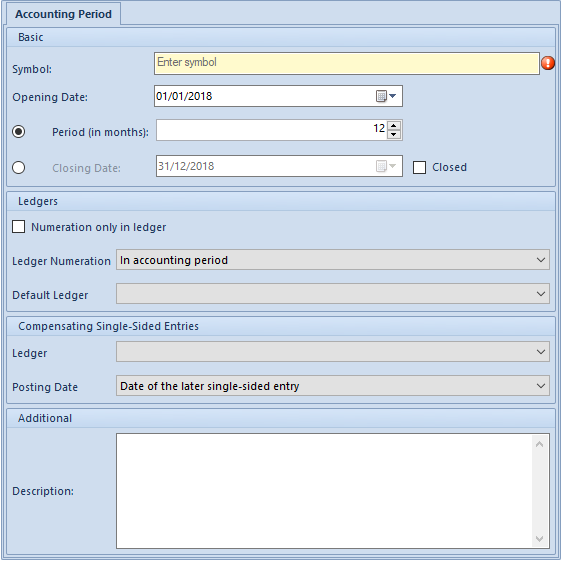

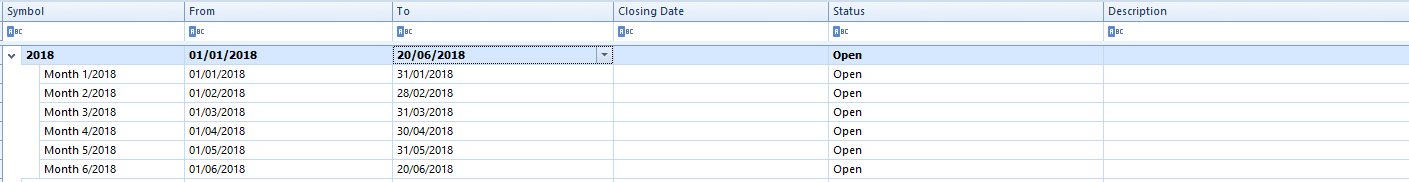

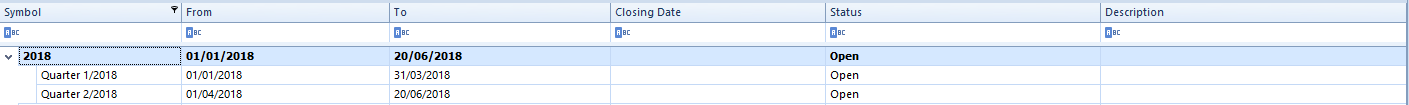

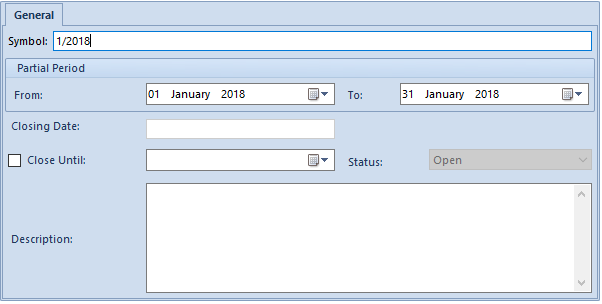

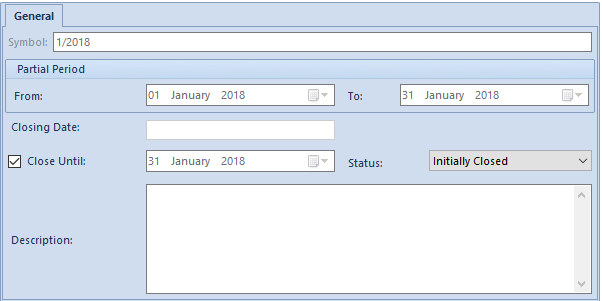

Accounting Periods

- Maximum length of accounting period − number of months − setting the maximum number of months composing an account period. In Polish and French versions of the application it is 23 months, whereas in Spanish version it is 12 months and those values are not changeable.

- Accounting periods without time gaps − in the French system version, during the creation and conversion of a database, this parameter is checked by default, and it cannot be unchecked. If the parameter is checked:

- while defining accounting periods, the system verifies the closing date of the previous accounting period, whereas the opening date is set to the day following the closing date

- when editing accounting periods and attempting to change the closing date, the system verifies whether the next accounting period exists. If the next accounting period is defined, changing of closing date is blocked.

If the parameter is not checked, then when defining accounting periods, it is possible to define any opening date of the next period.

- Only two open accounting periods − in the French system version, this parameter is checked by default, and it cannot be unchecked. If in a database there are more than two accounting periods or open accounting periods are not do not follow one another, it will not be possible to check the parameter. When defining an accounting period:

- if this parameter is checked, then while defining the accounting periods, the system verifies the number of the open accounting periods. It will not be possible to add a third accounting period if the first period is not confirmed.

- if the parameter is not checked, then while defining the accounting periods, it will be possible to specify any number of the open accounting periods.

Chart of Accounts

- Currency accounts added as sub-subsidiary accounts − after selecting this option, it is possible to create currency accounts for directory accounts as separate sub-subsidiary accounts. In case a document is posted with the use of a posting scheme, it is necessary to check the parameter Currency posting. The parameter refers also to automatic creation of an account during posting with a posting scheme.

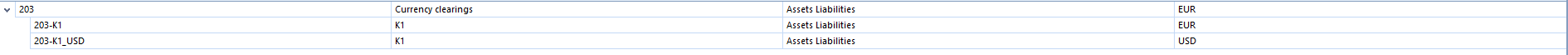

In such case the chart of accounts looks as follows:

If the parameter is unchecked, in the same situation, the chart of accounts looks as below:

- Add general directory accounts − the parameter is available in the German version of the system only. If this option is checked, it is possible to add a general account of directory type.

- Account numeration control

- Don’t control − disabled account numeration control. During database creation and conversion numeration control is disabled by default.

- Warn − when saving an account which does not fulfill conditions specified in numeration scheme assigned to it, the system displays appropriate message, but allows for saving such account.

- Block − the system will not allow for saving an account which does not fulfill conditions specified in numeration scheme assigned to it.

- Present account name in the tooltip as− allows for defining method of presenting the name of the account selected on objects or lists. The system allows for selecting one of the following options:

- Current account − the name of the current account selected on an object or a list is displayed

- Full path of account name − a full path of account name, that is the names of all parent accounts in reference to an indicated account is displayed as well as the name of the indicated account beginning from the name of the lowest−level account.

Analytical Description

- Modify in posted documents− activating this parameter allows for changing analytical description in posted documents. The parameter is unchecked by default. A user can check it at any moment during the work with the system.

- Allow for describing items with zero values− activating this parameter allows for saving of analytical description item with zero value. The parameter is unchecked by default. A user can check it at any moment during work with the system.