Defining cost allocation

The functionality of cost allocation control allows for verifying whether journal entries fulfil the conditions as regards their allocation by type and function. It can also be used to control other associated posting operations. The program can verify cost allocation automatically on a current basis during posting or manually on a recurring basis.

The cost allocation control functionality is available, if in System → Configuration → Accounting, the parameter Control cost allocation is checked.

List of cost allocations

The list of cost allocations is available from the level of menu Configuration → Accounting, under [Cost Allocations] button.

The list contains standard buttons and, additionally:

- [Import] − allows for uploading definition from a file

- [Export] − allows for exporting selected definitions to a file

- [Update] − allows for updating definition of allocation based on the data from a previous accounting period. Only new cost allocations with symbols which do not exist in a given accounting period are added.

Permissions of operator groups to read, add, modify and delete cost allocations depend on granting them appropriate permissions to the object Cost Allocation (Configuration → Company Structure → Operator Groups → edition of a given operator group → Tab Objects → Accounting area). Definitions of cost allocations are associated with particular accounting period.

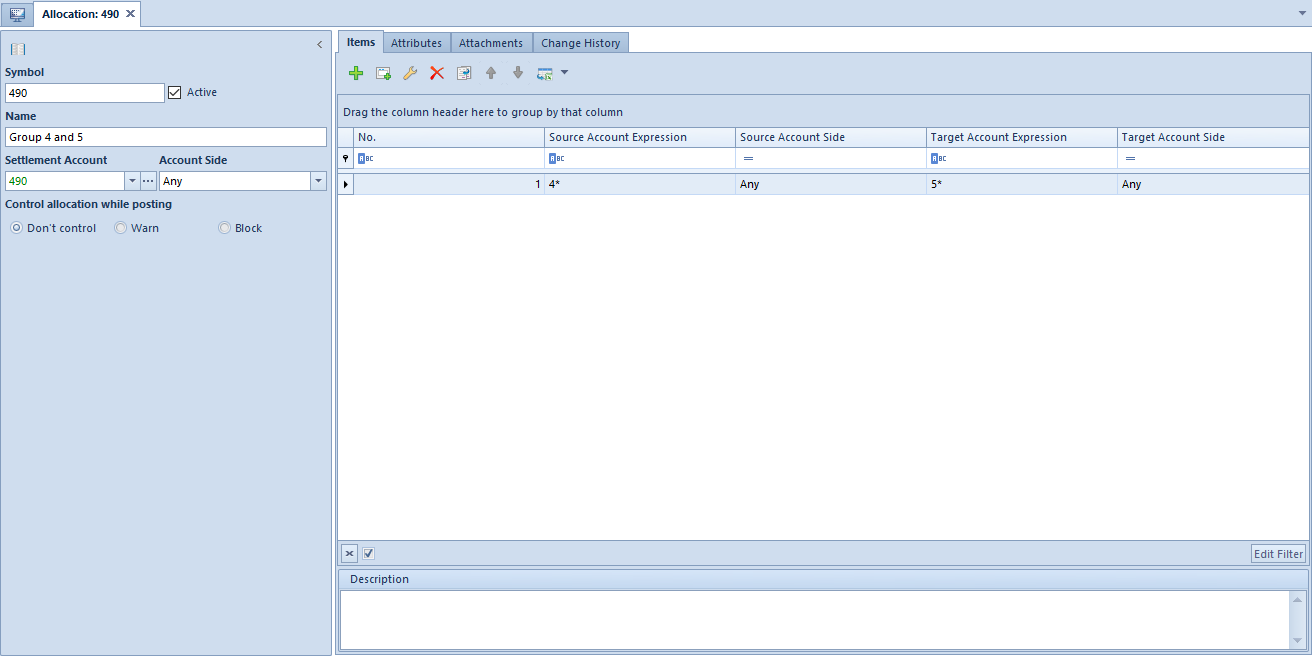

Defining cost allocation

To add a new cost allocation, it is necessary to select [Add] button. A form of cost allocation definition is opened.

The form is composed of the following elements:

- Symbol − mandatory field, the system controls its uniqueness within an accounting period

- Active − parameter for determining activity status of cost allocation. Only active cost allocations can be used.

- Name − name of cost allocation

- Settlement account − account taking part in settlement, optional field

- Account Side − side of settlement account, this field is activated upon completing the settlement account field. The following options are available:

- Any − default value, control regards those journal entries, which are registered on both account sides (turnover on Debit side is retrieved with a minus sign and turnover on Credit side is retrieved with plus sign)

- DR − only journal entries registered on Debit side are registered

- CR − only journal entries registered on Credit side are included

- Control allocation while posting − parameter receives one of the following values:

- Don’t control − default value, the system does not verify conditions specified in cost allocation definition

- Warn − the system displays a warning if the conditions are not fulfilled

- Block − the system blocks posting in case the conditions are not fulfilled

- Description − field for providing additional description

Tab Items

In the system, it is possible to add cost allocation items in two ways: directly in the table or through form.

Adding cost allocation items in table

To add an item to cost allocation in table, it is necessary to click on [Add] button placed in Items group of buttons. A row in which it is possible to enter data, appears in the table. A user must fill in the following columns: ….

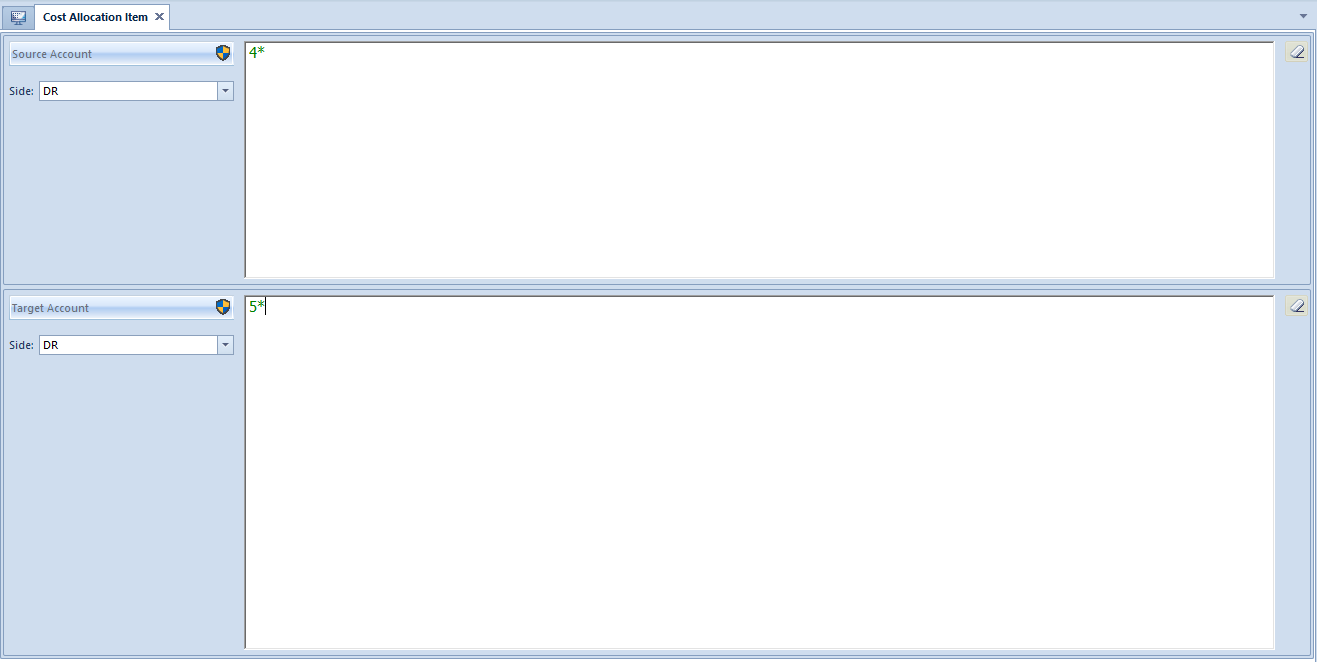

Adding cost allocation items through form

To add an item to cost allocation in table, it is necessary to click on [Add Through Form] button placed in Items group of buttons.

The form is composed of the following elements:

- Source Account − account on which a journal entry will be registered

- Source account side – posting side onto source account, parameter available after completing the field Source Account. Available options:

- Any − default value (turnover on Debit side is retrieved with a plus sign and turnover on Credit side is retrieved with minus sign)

- DR − only journal entries registered on Debit side are registered

- CR − only journal entries registered on Credit side are included

- Target Account − cross posting/parallel posting account

- Target account side − posting side onto target account, available options are:

- Any − default value (turnover on Debit side is retrieved with a plus sign and turnover on Credit side is retrieved with minus sign)

- DR − only journal entries registered on Debit side are registered

- CR − only journal entries registered on Credit side are included

In fields: Source account, Target account, it is possible to enter particular numbers of book accounts or use an account format. Available types of account formats:

- ? − Any character

- * − Any string of characters

- [] − Character included in string

- [-] − Character included in range

- [^] − character not included in string

- [^-] − character not included in range

- (|) − or

Tabs Attributes, Attachments, Change History

Detailed description of tabs can be found in articles: <LINK>