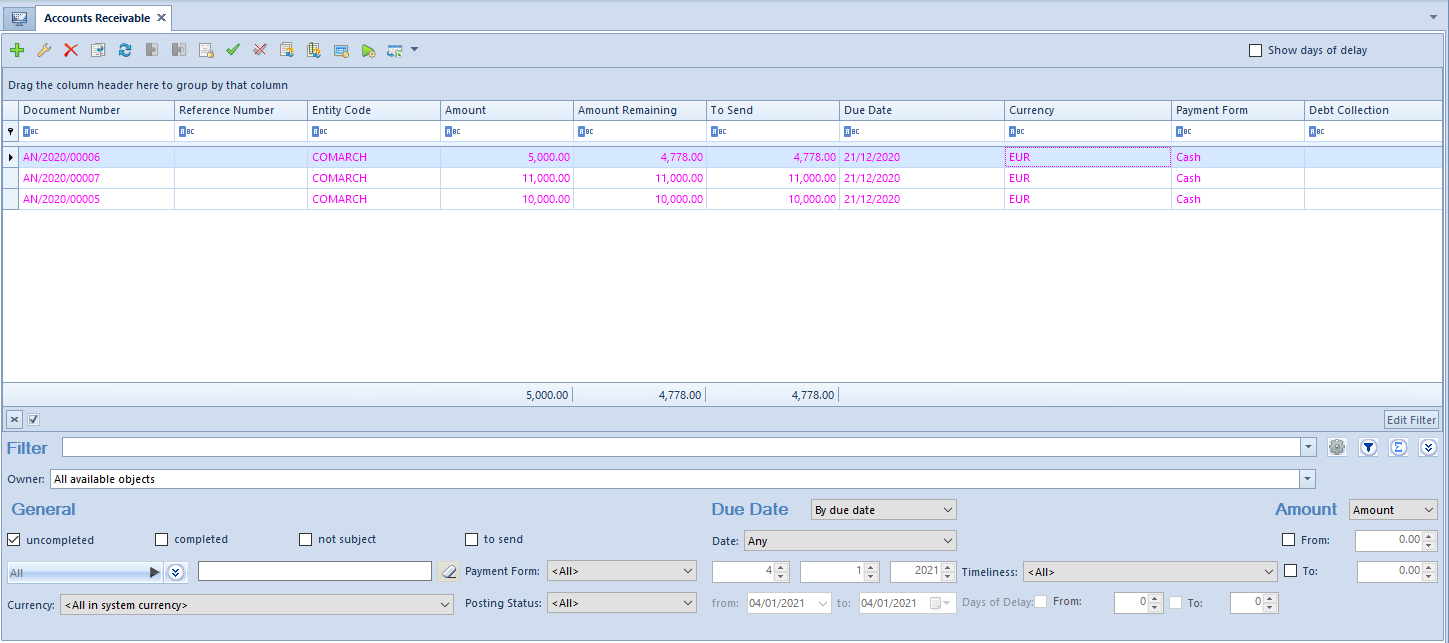

List of Receivables/Payables

Lists of Receivables/Payables is available from the level of Finances, under the [Receivables]/[Payables] button.

The visibility of data in a payment estimate depends on the center to which an operator is logged-in. The document is presented in the list, if:

- it was added by a current center (center to which an operator is logged-in)

- it was added by a center which is subordinate to the current center

- it was added by a center which makes it available (by specifiying its visibility for document types) for the current center or its child center

The list contains standard buttons and, additionally:

[Import Transfer Statuses] – button available on the list Payables only. It is used for updating the status of a payment sent with the use of the web service. After clicking on the button, a window, in which the following parameters are defined, is displayed:

- Import Format – transfer formats of Web Service type can be selected

- Account – accounts associated with ING bank with checked parameter Exchange data via Web Service can be selected

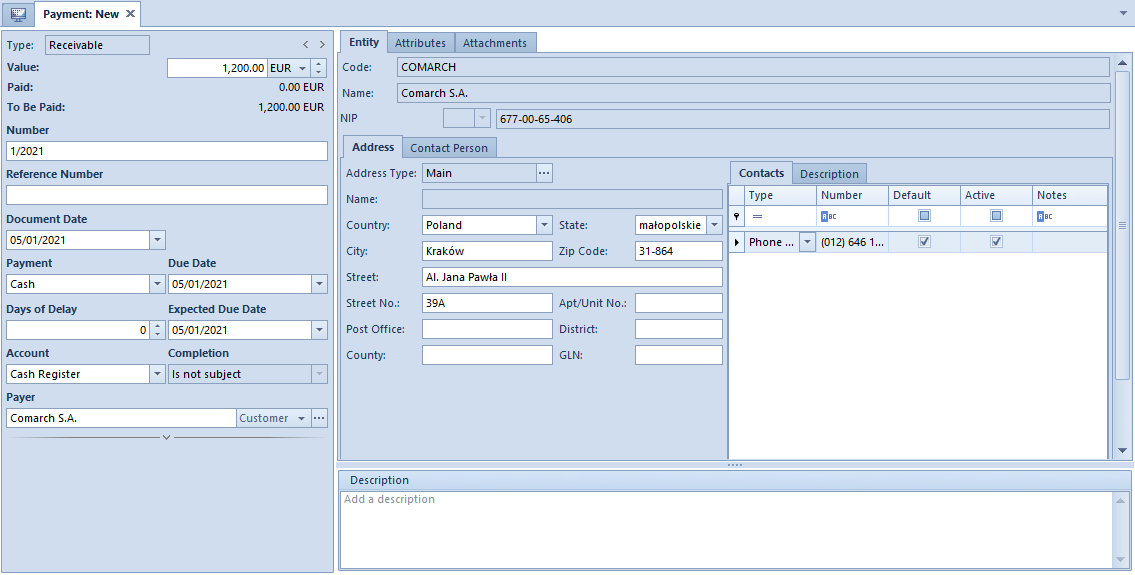

[Combine] − allows for combining several payments in one payment

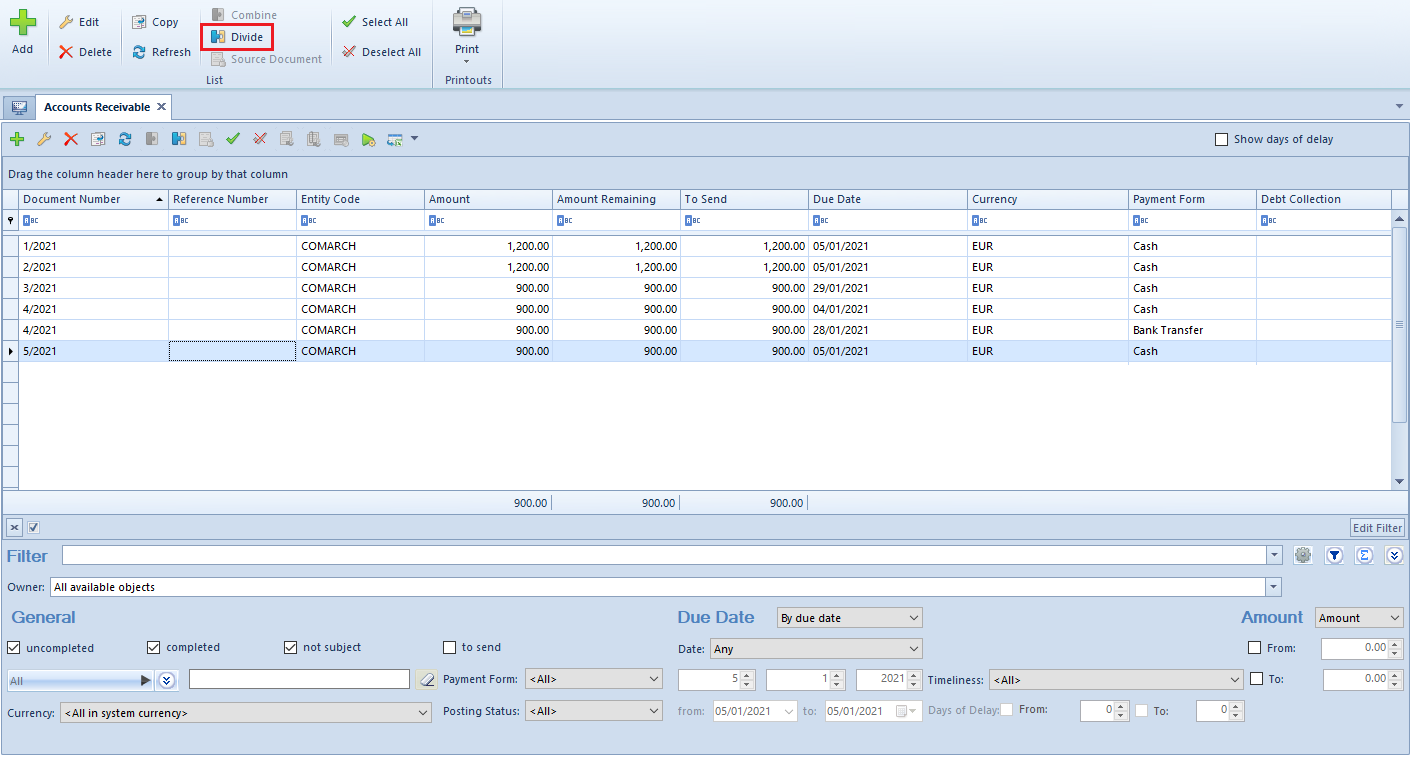

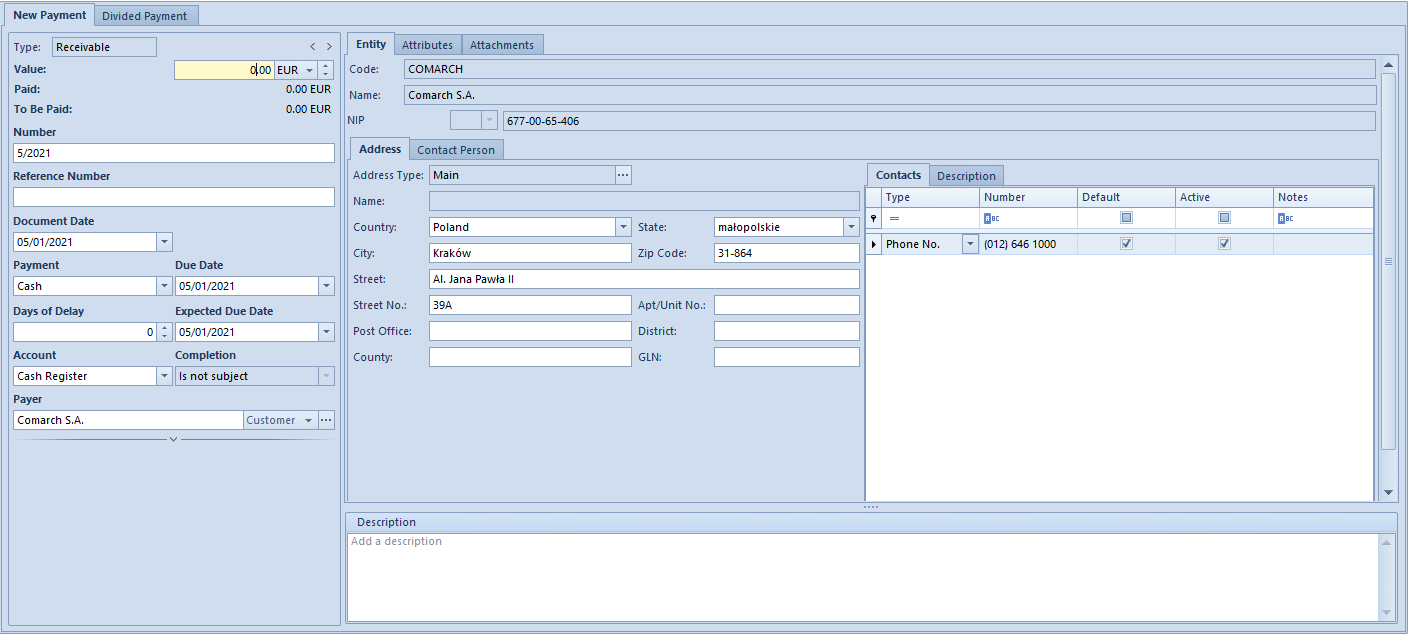

[Divide] − allows for dividing payment

[Source Document] − this button is active only form payment created automatically when adding a document. Allows for displaying the source document of a payment.

[Complete] − allows for completing a given payment

[Compensate] − allows for compensating a given payment

[Pay] − opens a form Payment Confirmation by means of which it is possible to make a payment by automatic creation of a cash/bank transaction

[Payment Reminders] − button available on the list of receivables only. Allows for generating payment reminders for selected payments.

[Dunning Letters] − button available on the list of receivables only. Allows for generating dunning letters for selected payments.

[Late Fees] − button available on the list of receivables only. Allows for generating late fees for selected payments.

The list Receivables/Payables is composed of the following columns:

- Reference Number − number entered by a user for providing an additional identification

- Entity Code − payer’s code indicated on payment

- Value − payment value

- Amount Remaining − amount remaining to be cleared

- To Send − transfer amount remaining to be sent

- Date − date of payment

- Currency − document currency, depends on the settings in the filter

- Payment Form

- Debt Collection − column available on the list of receivables only. It displays the number of a debt collection document containing a given payment.

and columns hidden by default:

- Document Date – date of the document from the form of registered payment

- Date of Receipt − date of receipt from the source document and if case there is no source document, document date from the payments

- Cash Register/Bank – name of account selected on payment

- VAT Amount – displayed only for payments with checked parameter Split Payment

- Entity Code − payer’s code indicated on payment

- Voucher Number – number of voucher indicated on payment

- Description – description entered in payment

- Document Description – description of payment source document

- Voucher Sort – sort of voucher indicated on payment

- Applied − amount cleared by now

- Split Payment − informs whether the parameter Split Payment has been checked on a given payment

- Expected Date − expected payment date

- Status

- C − Completed

- U − Uncompleted

- NS − Not Subject

- SEPA – column available on the Payables list only. Informs whether the payment is made via SEPA transfer.

- Currency − system currency of a company in which the document has been issued

- Owner − center of the company structure which is the issuer of a document

- Affects Balance − indicates whether a given payment affects the balance of the account

- Web Service Send Date – column available on the Payables list. It displays the date of sending the transfer with a given payment to the bank.

- Web Service Message – column available on the Payables list only.

- Web Service Message Date – column available on the Payables list only. Displays the date of reception of the last message from the bank.

[Alert] The status of partially completed receivables/payables is U − Uncompleted. [/alert]

In the upper right corner of the list, two parameters are available:

- Show days of delay − after checking the parameter, additional colum Days of Delay appears on the list, where the number of days after the due date is presented

- Terms Date − by default, the current date is suggested, without the possibility of changing it. The terms date affects calculation of To send amount on the statemen of remittance orders. More information can be found in article Statement of remittance orders.

The list of Receivables/Payables contains the following filtering areas:

- General − allows filtering by:

- Payment status − uncompleted, completed, not subject to completion, to send

- Entity indicated on payment − All, Customer, All customers, Employee, All employees, Institution, All institutions, Bank, All banks

- Currencies − <All>, <All in system currency> and active currencies defined from the level of Configuration →Currencies.

- Payment forms – <All> and acrive payment forms defined from the level of Configuration →Finances →Payment Forms

- Document status − <All>, Posted, Unposted

- Due Date − allows for filtering by the following values:

- By due date − payment date. Available options: Any, Day, Month, Range of Dates, Previous Month, Current Month. The range of dates allows for selecting a specific time interval.

- By expected due date − expected payment date. Available options: Any, Day, Month, Range of Dates, Previous Month, Current Month. The range of dates allows for selecting a specific time interval.

- Timeliness − <All>, Not overdue, Overdue, Today’s

- Days of Delay − available upon checking the parameter Show days of delay. The range of days allows for selecting a specific time interval.

- Amount − the following options are available within this filter:

- Amount – total payment amount. Range of amounts allows for selecting a specific amount interval.

- Amount Remaining − amount remaining to be cleared. Range of amounts allows for selecting a specific amount interval.

[Alert] Totaling on the list Receivables/Payables is possible only after selecting a specific amount in the filter or the option All in system currency. If system currency of displayed payments, value 0 is displayed in the summary. [/alert]

Detailed description of functioning of the filters can be found in category Searching and filtering data.