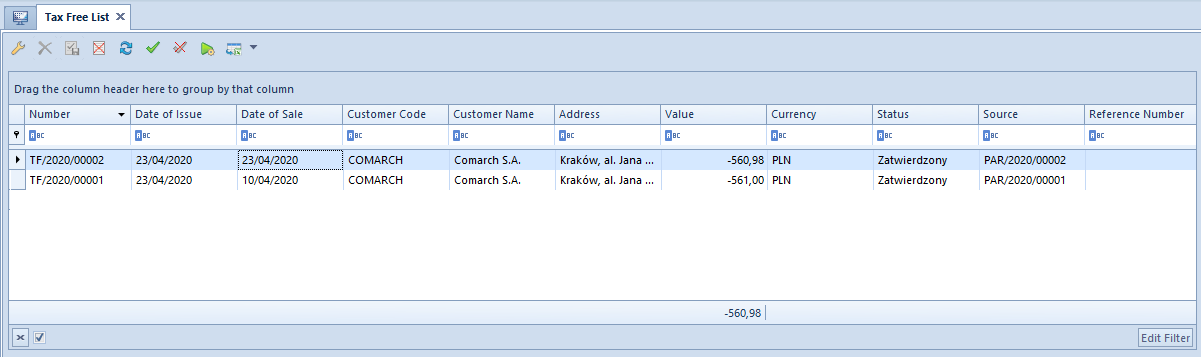

Invoices

General information

Sales (SI) and purchase (PI) invoices are trade documents. They constitute a basis for recording sales and purchase transactions of items. They result in a calculation of subtotal and total values, VAT tax and generate payment

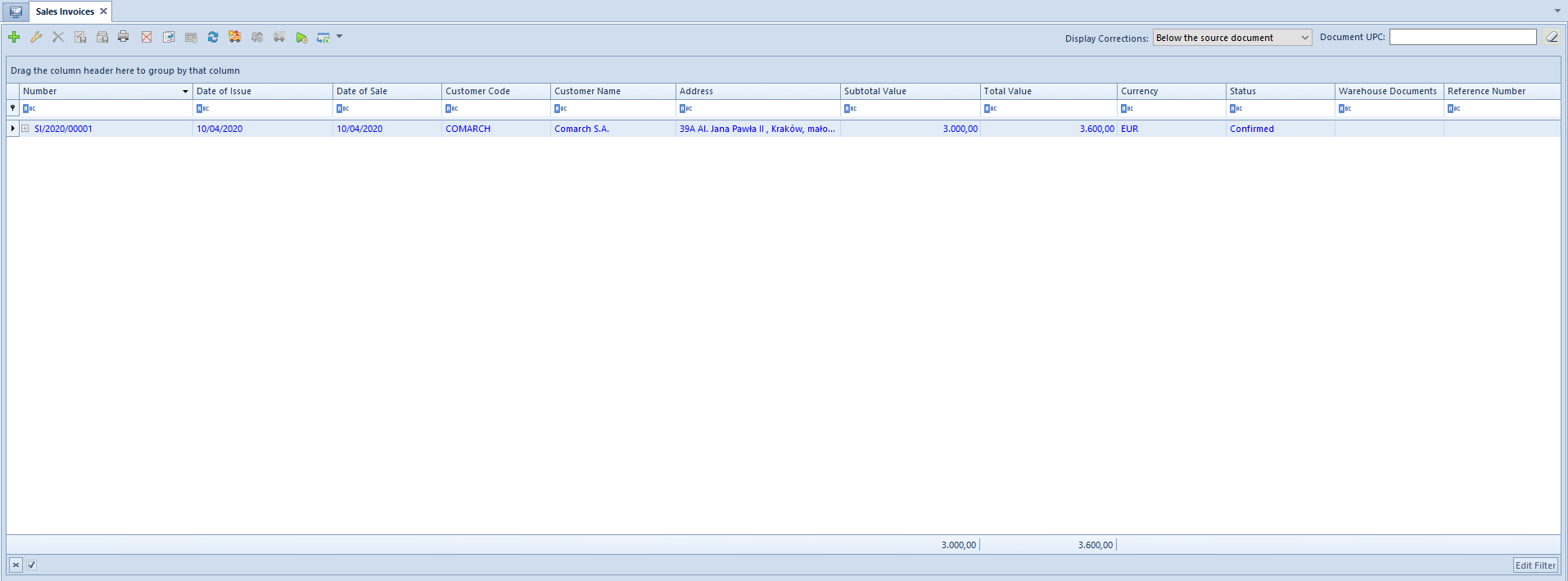

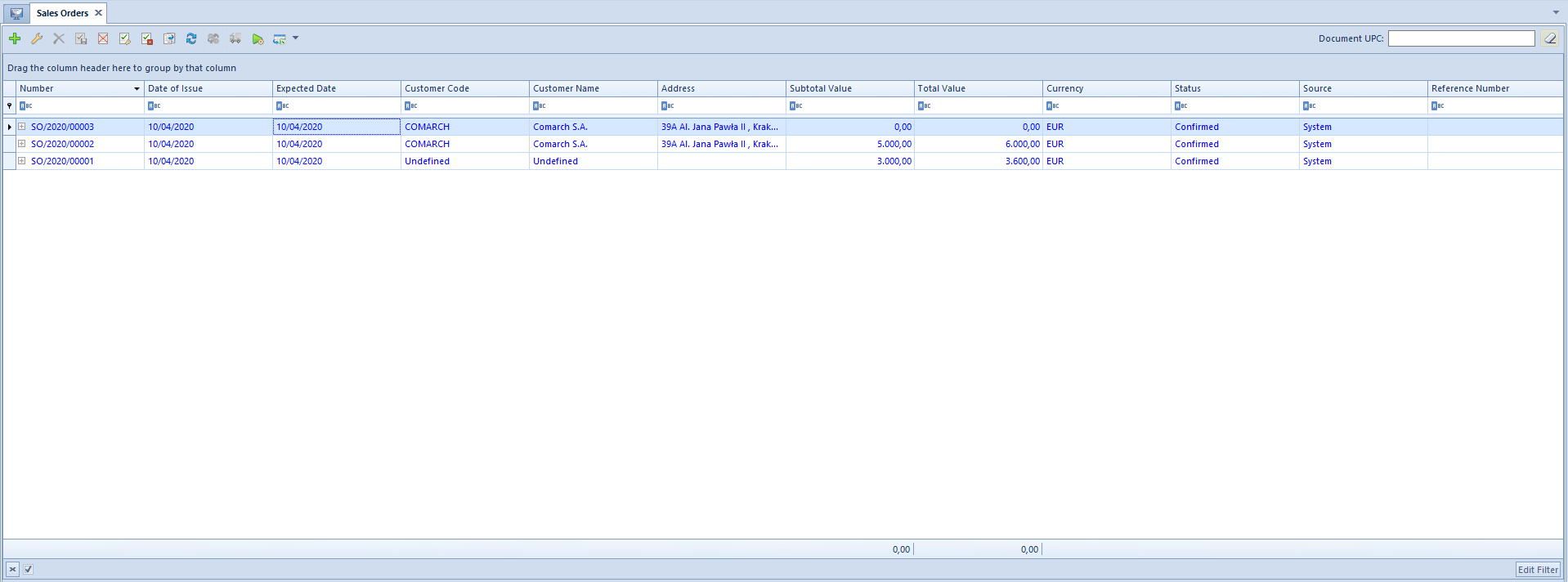

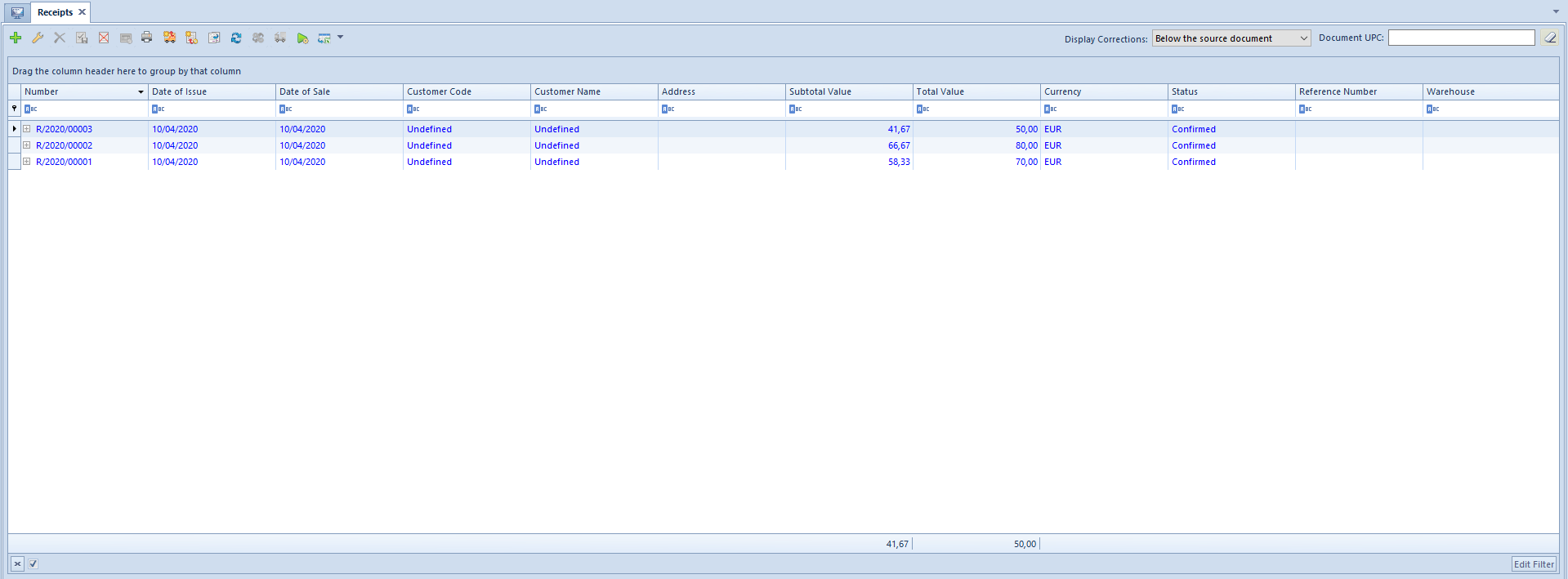

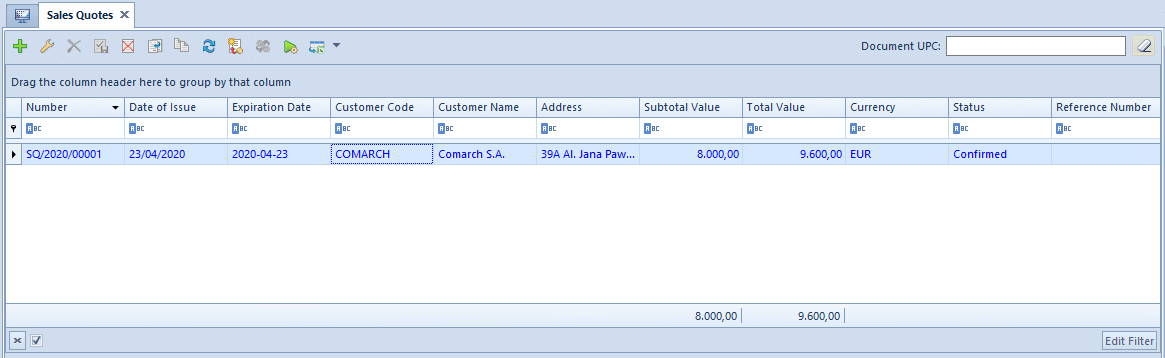

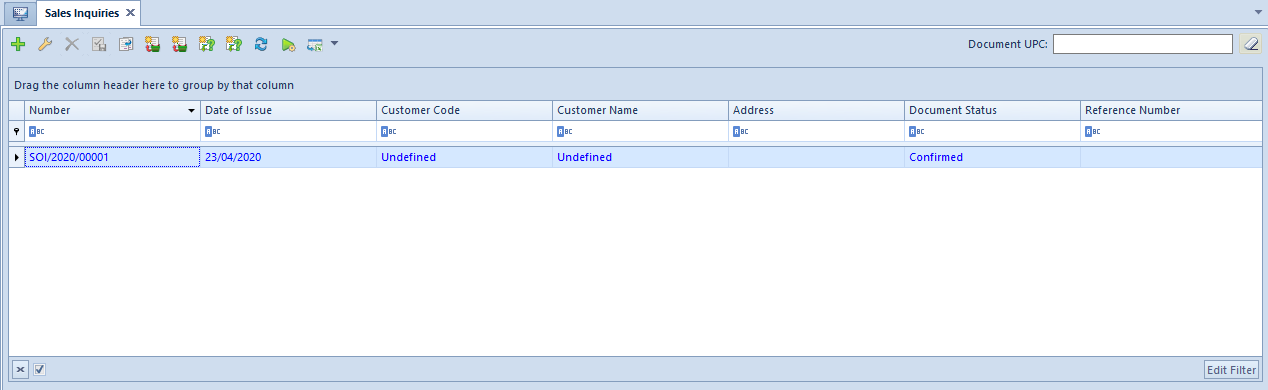

From the level of modules Sales and Purchase are available, respectively, the list of sales invoices and the list of purchase invoices.

The list of documents has been described in article List of documents.

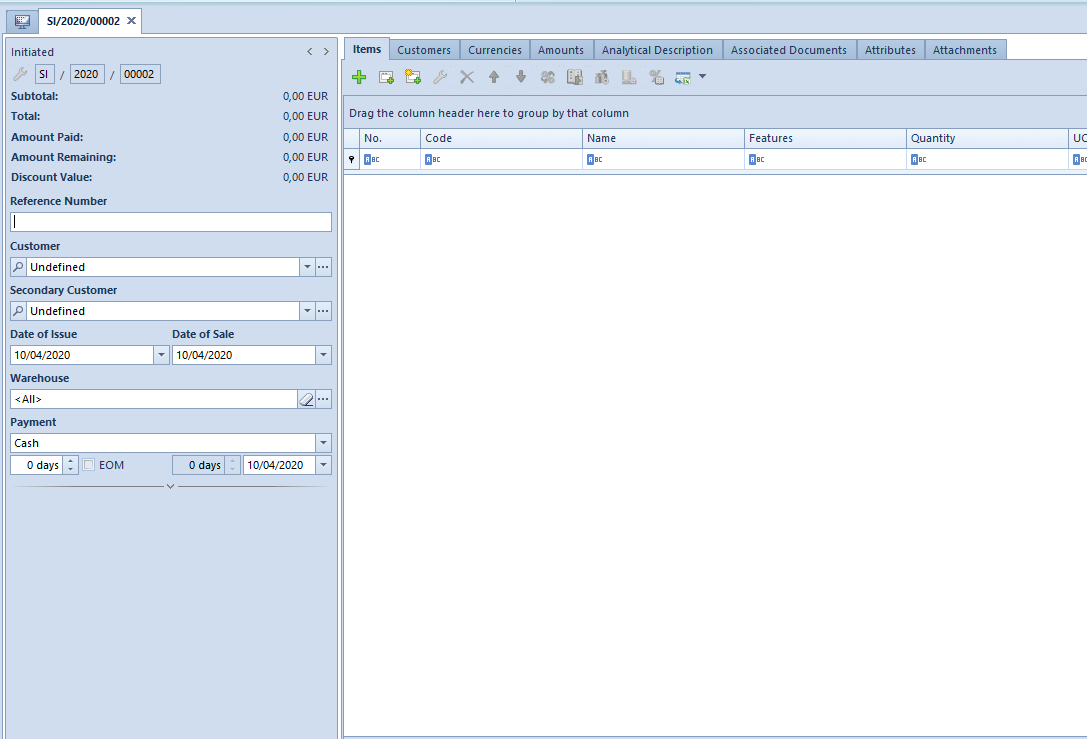

Detailed description of the document form can be found in subcategory Document forms.

Each confirmed invoice should be associated with an appropriate warehouse document – a sales invoice with a SOR, a purchase invoice with a POR. SI/PI documents, both unconfirmed and confirmed, affect only the reserved/orders quantity of items that is displayed in a list of items as well as warehouse resources in column Blocking Reservations/Orders. They do not result in the items being recorded in the stock records

In the system, there is also a possibility of printing invoices on a receipt printer, which has been described in article Printing invoices on a receipt printer.

Clearing an invoice from the document level

There are several methods of clearing a document from the level of trade area:

- from a list of documents – button [Pay]

- from a list of documents – button [Confirm]

- from a list of documents – button [Confirm and Post]

- from details of a document – button [Pay] (available only for SI documents)

- from details of a document – button [Confirm]

- from details of a document – button [Confirm and Post]

The methods of clearing documents have been described in articles from the category Clearings.

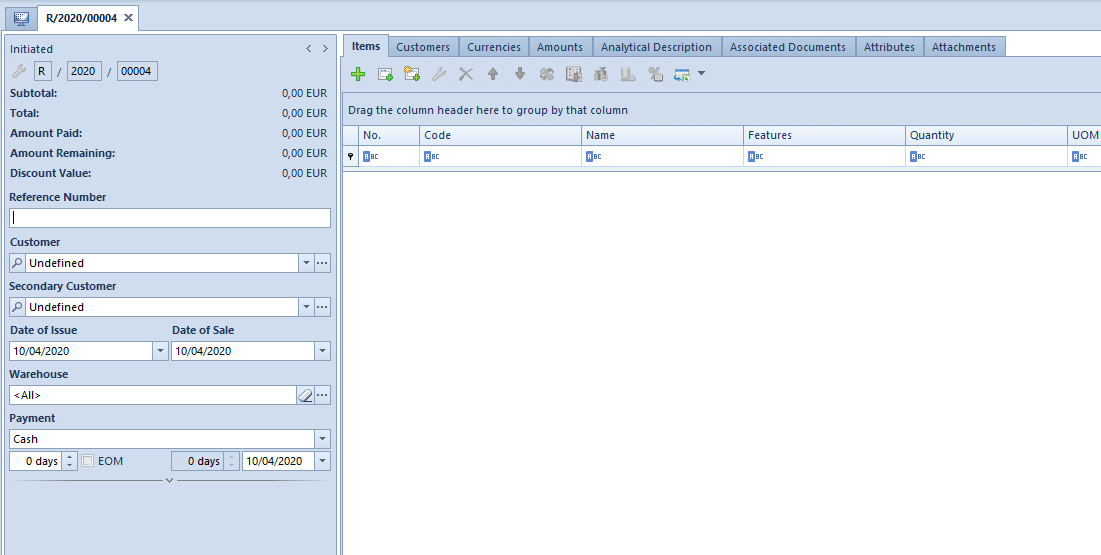

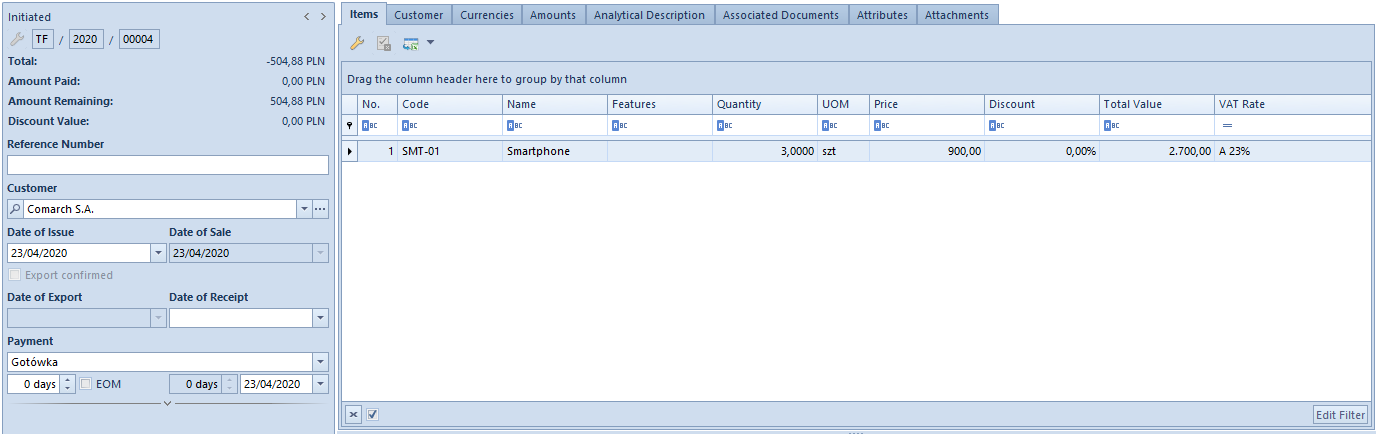

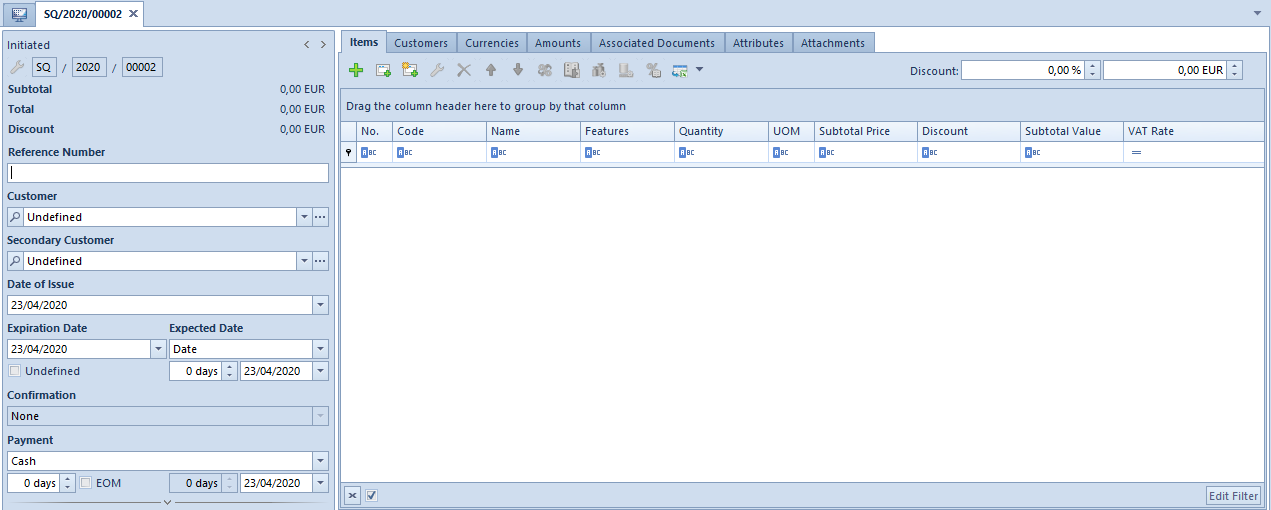

Sales invoice

The functionalities relating to sales invoices are available from the level of the tab Sales → Invoices.

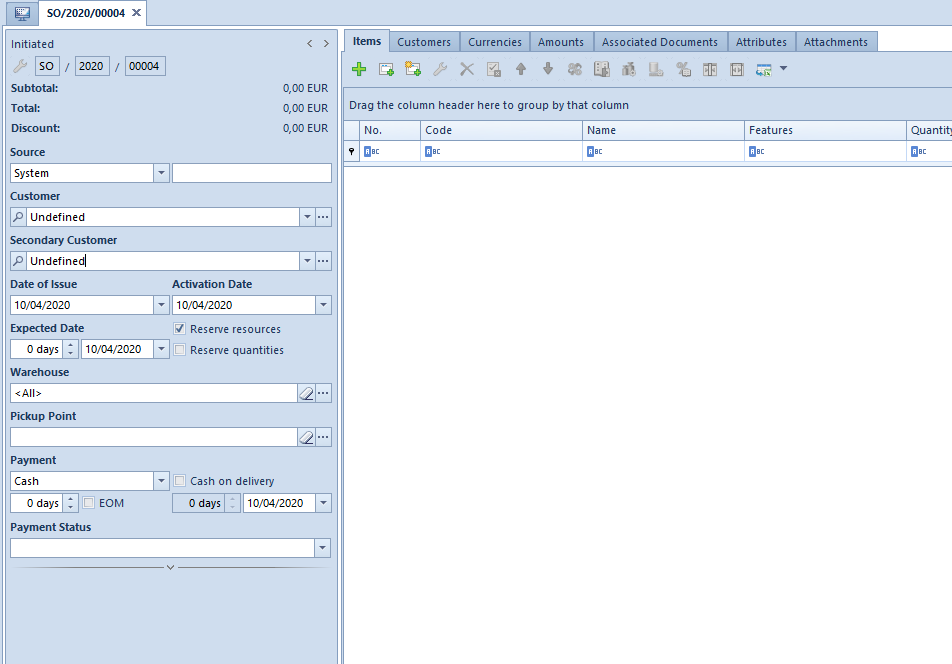

A SI can be created:

- manually, by clicking on the button [Add] on the sales invoices list

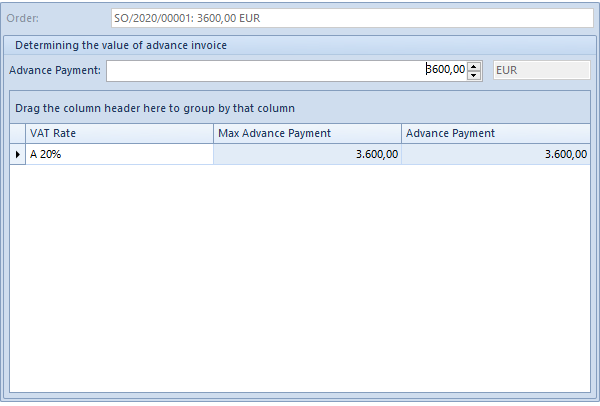

- by generating it from trade documents R, SO

- by generating it from a warehouse document SOR

What is characteristic for a SI document is the possibility of selling below stock levels, therefore a SI can be issued for an item whose stock levels amount to zero. More information about selling below stock levels can be found in Sales below stock levels.

Purchase invoice

The functionalities relating to purchase invoices are available from the level of the tab Purchase → Invoices.

A PI can be created:

- manually, by clicking on the button [Add] on the purchase invoices list

- by generating it from a trade document PO

- by generating it from a warehouse document POR

Characteristics of sales and purchase invoices

A saved (unconfirmed) invoice has the following characteristics:

- it is subject to edition

- it can be deleted, which results in deleting an order (PI) or reservations/shortages from a warehouse

(SI) - it can be confirmed from the level of a document form or from the level of a list of invoices

- it is not possible to post it

- it generates an uncleared payment

- it is not possible to generate any other document (SOR/POR) from it

- it is not possible to generate an advance invoice from it

- it is not possible to generate any corrections from it

A confirmed invoice has the following characteristics:

- it is not subject to edition – it is only possible to preview details of a document or of an item, without a possibility of editing it

- it does not affect item quantity in a warehouse, it only creates reservation or order

- it cannot be deleted, but only canceled, which results in decreasing quantity in the column Quantity Reserved (Blocked)/Orders and can create shortages

- it can be posted

- it generates a payment which, depending on selected payment form, can be cleared or uncleared

- it generates an entry in VAT account

- it is possible to generate another document from it (SOR/POR)

- it is possible to generate quantity and value corrections to it

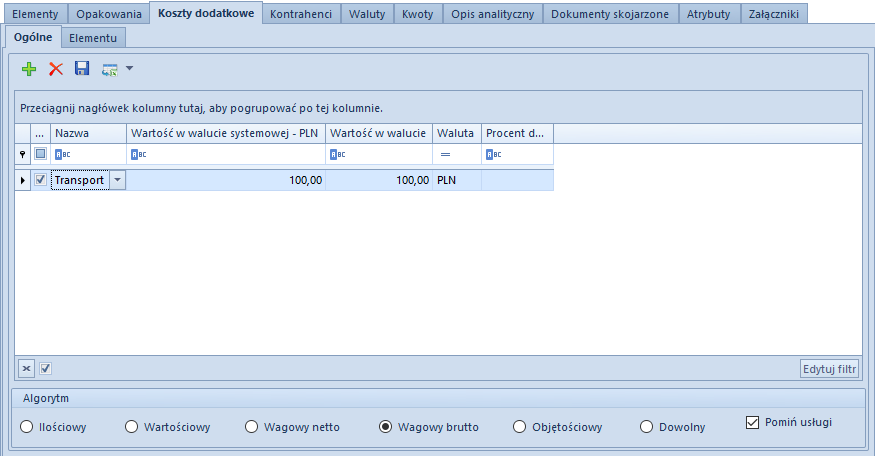

Additional costs

On a PI document form, in the tab Additional Costs -> General, are defined costs included in calculation of an acquisition price of a resource of a given item. These costs can be introduced manually in system currency or through indicating cost documents.

From the level of the list it is possible to add, edit and delete individual additional costs, with a breakdown of additional costs into general costs and costs assigned to a specified item.

Below the table of additional costs, the user has a possibility to define an algorithm of additional costs breakdown for individual items of an invoice.

Among available options, it is possible one of the following algorithms:

- Quantitative – it apportions the costs proportionally to the quantities of individual items of a purchase invoice

- Value-based –it apportions the costs proportionally to the values of individual items of a purchase invoice.

- Weighed Net – it apportions the costs proportionally to the net weight of individual items of a purchase invoice upon recalculating them into basic weight unit according to conversion calculator from definition of weight unit of an item. Value in the basic unit is used for calculation for calculation of the cost. The weights are defined for each unit of measure of an item in the item form.

- Weighed Gross – it apportions the costs proportionally to the gross weight of individual items of a purchase invoice upon recalculating them into basic weight unit according to conversion calculator from definition of weight unit of an item. Value in the basic unit is used for calculation for calculation of the cost. The weights are defined for each unit of measure of an item in the item form.

- Volumetric – it apportions the costs evenly in accordance with the volumes of items entered in a purchase invoice upon recalculating them into basic weight unit according to conversion calculator from definition of weight unit of an item. Value in the basic unit is used for calculation for calculation of the cost. The volume of an item is defined for each unit of measure of a given item in the item form.

- Any – it allows apportioning the costs at the discretion of a user. After selecting the method Any the definition of the proportions in which the costs are to be apportioned will be entered in the tab Additional Costs.

Moreover, additional costs in a PI document possess the following features:

- addition and edition of additional cost can be performed on an unconfirmed document only

- to a PI document generated in a consignment process cannot be added additional costs affecting acquisition price

- it is not possible to include additional costs in VAT tax base in a PI document