A 347 information return is sent to an appropriate institution in order to provide details about transactions executed in a previous year.

To generate a 347-information return, go to the menu Accounting and select the option [347 Information Return].

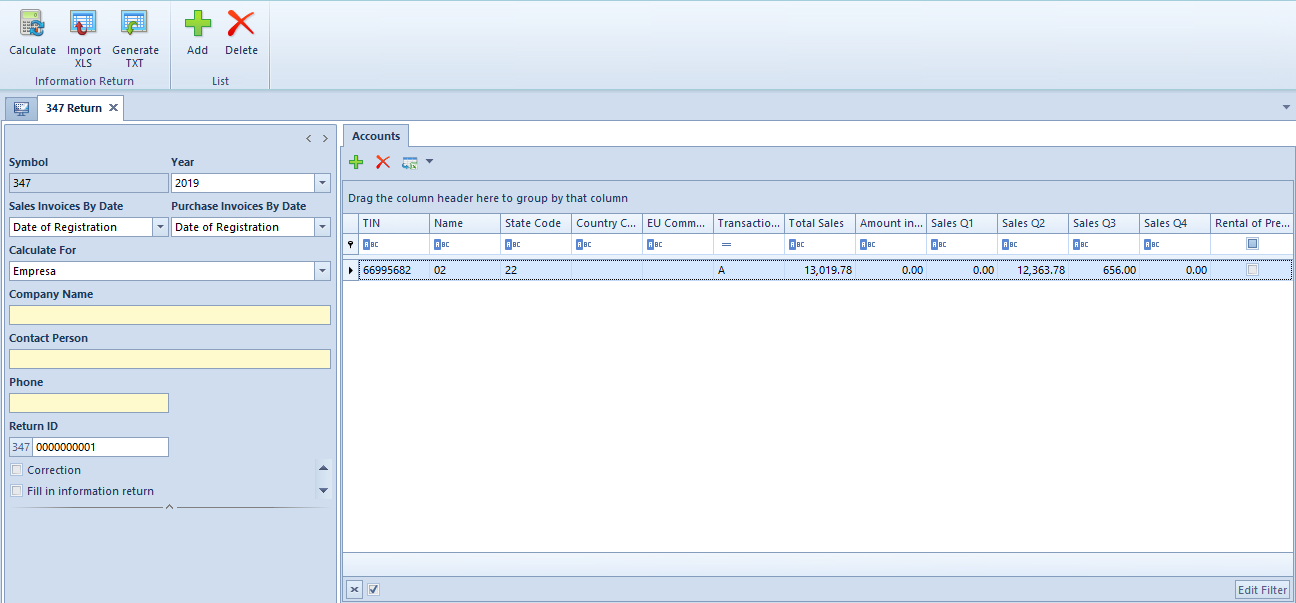

In the menu of 347 information return, there are standard buttons and, additionally:

- [Calculate] – it is used to calculate tax returns on the basis of VAT invoices.

- [Import XLS] – allows for importing data from a file with .xls or .xlsx. extension. First row of the file to be imported should contain the names of columns by which the data will be imported. The system allows for importing data also when there are items already added to the list.

- [Generate TXT] – button active if there are items added to the tab Accounts. Allows for saving the information return by generating a text file. The structure of a generated file is compatible with the required structure for submitting a return in an electronic form.

The form of 347 information return is composed of the following elements:

Side panel

Symbol – information and non-editable field

Year – field for selecting an accounting period for which a return must be calculated. The latest selectable accounting year is current year. A default year is always the year preceding current year. A default year is always the year preceding current year.

If a user changes the year for which to calculate an already calculated information return, the following message will be displayed: “Changing the year will recalculate the return. Would you like to continue?” with Yes or No respond options.

Sales Invoices By Date/Purchase Invoices By Date – field for determining the date by which to include sales/purchase invoices in the information return. Available options:

- Date of Registration, Date of Issue, Date of Sale – for Sales Invoices By Date field

- Date of Registration, Date of Issue, Date of Purchase, Date of Receipt – for Purchase Invoices By Date field

Calculate For – field for selecting a center for which a return must be calculated. A 347 return can be calculated only for the logged-on company. When a user is logged in to parent company, a return can be calculated for a selected company or parent company.

Company Name – mandatory field. A company name is by default displayed on the basis of the name of the customer/vendor associated with the company selected in field Calculate For. Company name can be changed in 347-return, but this alteration does affect the customer/vendor name on customer/vendor form.

Contact Person – mandatory field for selecting a contact person

Phone – mandatory field for providing a contact person’s phone number

Return ID – declaration number. By default, it is set to 0000000001 and it is changeable.

Correction – used for marking return as a correction. Its selection activates an additional field Previous Return ID for providing the number of the 347-return to which a correction is being submitted.

Fill in information return – used for marking return as a complementary list of transactions which were not included in a previous return. Its selection activates an additional field Previous Return ID for providing the number of the 347-return to which a complementary return is being submitted.

Previous Return ID – field presented after selecting the parameter: Correction or Fill in information return. It is intended for providing the number of the 347-return to which a correction or a complementary return is being submitted.

Accounts tab

A 347 return can be calculated upon selecting the button [Calculate].

Calculated values present total consumer dealings in a given accounting period by quarters. Sales and purchase transactions are registered as separate records with a corresponding key A or B.

Records of 347 return are created on the basis of the following rules:

- if total value of VAT sales invoices and their corrections for a given customer in the year for which a return was calculated exceeds 3 005,06 EUR, a record with B key is generated

- if total value of VAT sales invoices and their corrections for a given customer in the year for which a return was calculated exceeds 3 005,06 EUR, a record with B key is generated

- if total cash CD transactions for a given customer in the year for which a return was calculated exceeds 6000,00 EUR, given transactions are listed in the column Amount in Cash in the record with B key, including VSI

The data on the list can be modified freely by a user (excluding Total Sales column).

The tab Accounts is composed of the following columns:

- TIN – customer’s/vendor’s TIN

- Name – mandatory field, customer/vendor name

- Stat Code – mandatory field, for national customers/vendors it is filled in with two first digits of the postal code of the default main customer/vendor address, for the others, the value is 99

- Country Code – field filled in only for customers/vendors different than national ones, on the basis of the TIN number prefix. If the prefix is not provided, then the field is filled in on the basis of the default main customer/vendor address.

- EU Community Operator – field filled in only for European Union customers with their TIN numbers

- Transaction Key – information whether a transaction is related to a purchase (A) or sales (B)

- Total Sales – total of sales with a given customer/vendor in the year for which the return is being calculated. The column cannot by edited.

- Amount in Cash – total value of CD transactions

- Sales Q1, Sales Q2, Sales Q3, Sales Q4 – total value of transactions of a given type divided into quarters

- Rental of Premises – information whether transactions were related to the rental of premises