In the system, it is possible to add a correction that is not associated with any document or add a correction to a VAT invoice.

To add a correction not associated with a VAT invoice, select [Manual Correction] in the List button group.

To add a correction to a document registered in the system, mark appropriate VAT invoice in the list and then select [Correct] in the List button group.

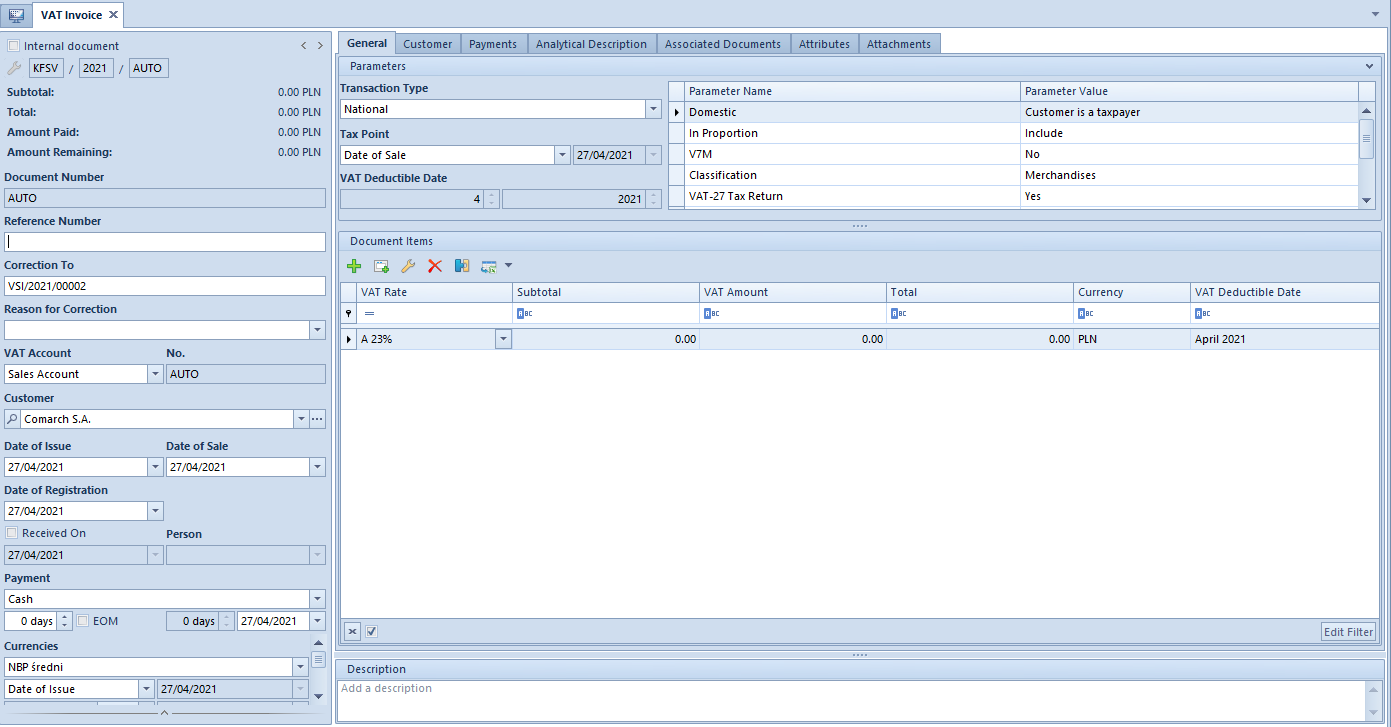

Except for the additional field Correction To, in which number of a document being corrected must be entered, the form of VAT invoice correction does not differ from that of a regular VAT invoice. The other fields are the same as on the invoice form.

In case of correction issued to a VAT invoice, the data on the correcting document is filled in automatically on the basis of document being corrected. The rules for setting dates on such document are as follows:

- Registration date is retrieved from account settings

- Date of purchase/sale is retrieved from date of purchase/sale on a corrected document

- Other dates are set according to the current date

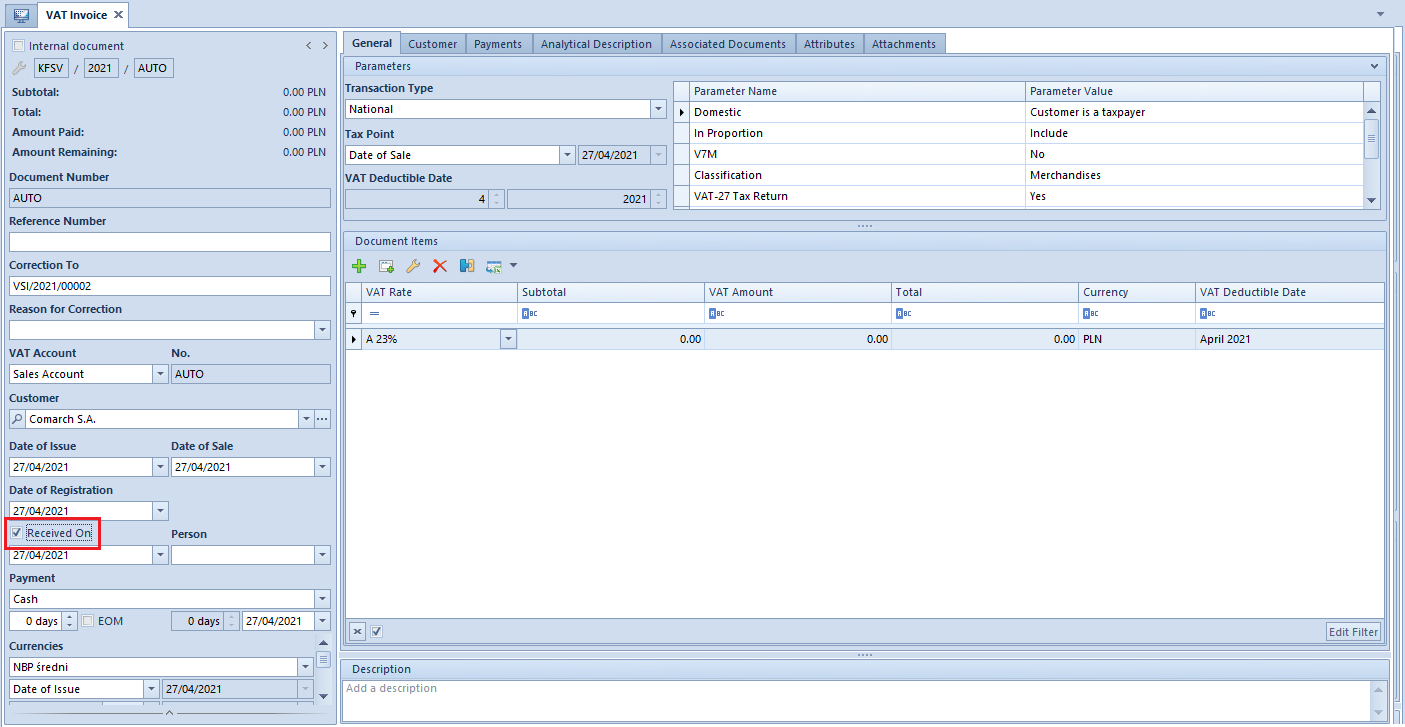

On a VAT invoice correction form (in Polish version of the system) it is possible to specify whether a given correction has been received by a customer or not and define a person confirming that receipt. In field By it is possible to select one of the contact persons of a customer (tab Contact Persons on customer form).

Moreover, the correction date of receipt can be specified. In this case, upon selecting option Date of Sale/Receipt Conf. Date in Tax Point field, the system automatically indicates receipt confirmation date as a date of including a VAT invoice correction in tax return, whereas the sales invoice itself will be included in the tax return

according to the date of sale.

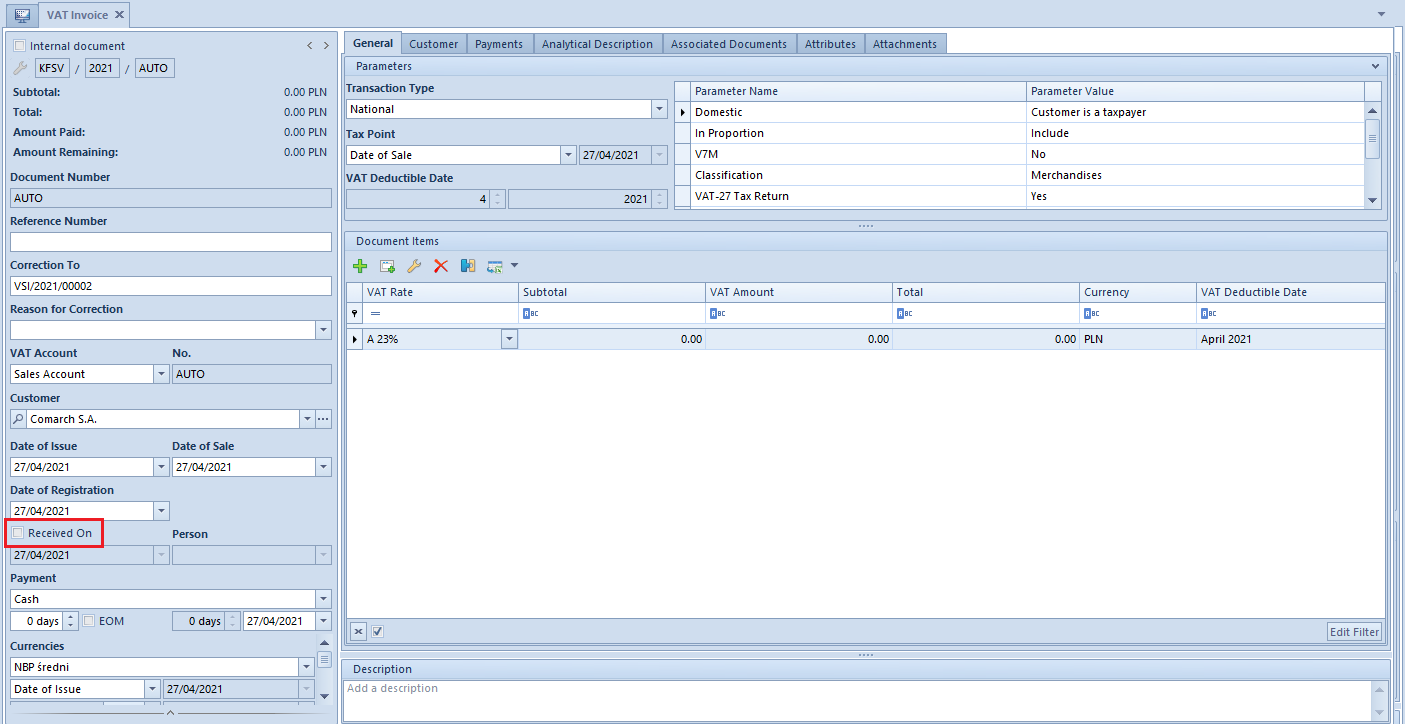

If parameter Received On is unchecked, VAT sales invoice correction will not be included in a tax return.

Variant A

In case of including corrections in a tax return according to corrected document date of issue, in definition of an account in which corrections are registered, tax point date should be set as Date of Issue. Upon analyzing the correcting invoices, they can be transferred (for instance, with the use of batch change of account option) to an account where Receipt Confirmation was defined as the tax point date. A given tax point definition must be previously specified in Configuration → Accounting → Tax Point with condition set as From the date of receipt confirmation. Upon transferring the corrections to the given account, receipt confirmation will be unchecked, that is, documents will not be included in the tax return until the parameter confirming receipt of correction is checked (for instance, with the use of batch confirmation of receipt option).

Variant B

In case if a tax return includes only corrections whose receipt has been confirmed, in definition of an account the tax point date should be set as Date of Sale/Receipt Conf. Date (if the account contains invoices and their corrections) or Receipt Confirmation (if the account contains only invoice corrections). In such case, correcting documents (in the first case also invoices) will be included in a tax return only after Received On parameter is selected.

VAT invoices corrections and corrections of trade documents are closely associated, that is, changing data on a VSIC results in update of relevant data on the associated SIQC/SIVC.