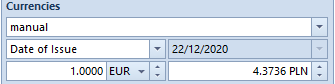

Adding of a VAT invoice in a foreign currency is performed the same way as in case of adding such invoice in the system currency. In this case, it is also necessary to select appropriate currency and specify its exchange rate in the Currencies section in the side panel of VAT invoice form.

In case the currency assigned to a given entity is inactive, the system currency is set in a document. Upon changing a customer/vendor, data in a document is recalculated according to the new currency and a user is notified about it in an appropriate message.

It is possible to select a different currency than the one assigned to a customer/vendor specified in a document.

A currency exchange rate is retrieved on the basis of the settings specified in the definition of given document type (menu Configuration → Company Structure → Rights Structure → edited company form → Documents tab)

Currency exchange rates can be updated in the menu Configuration → Currencies

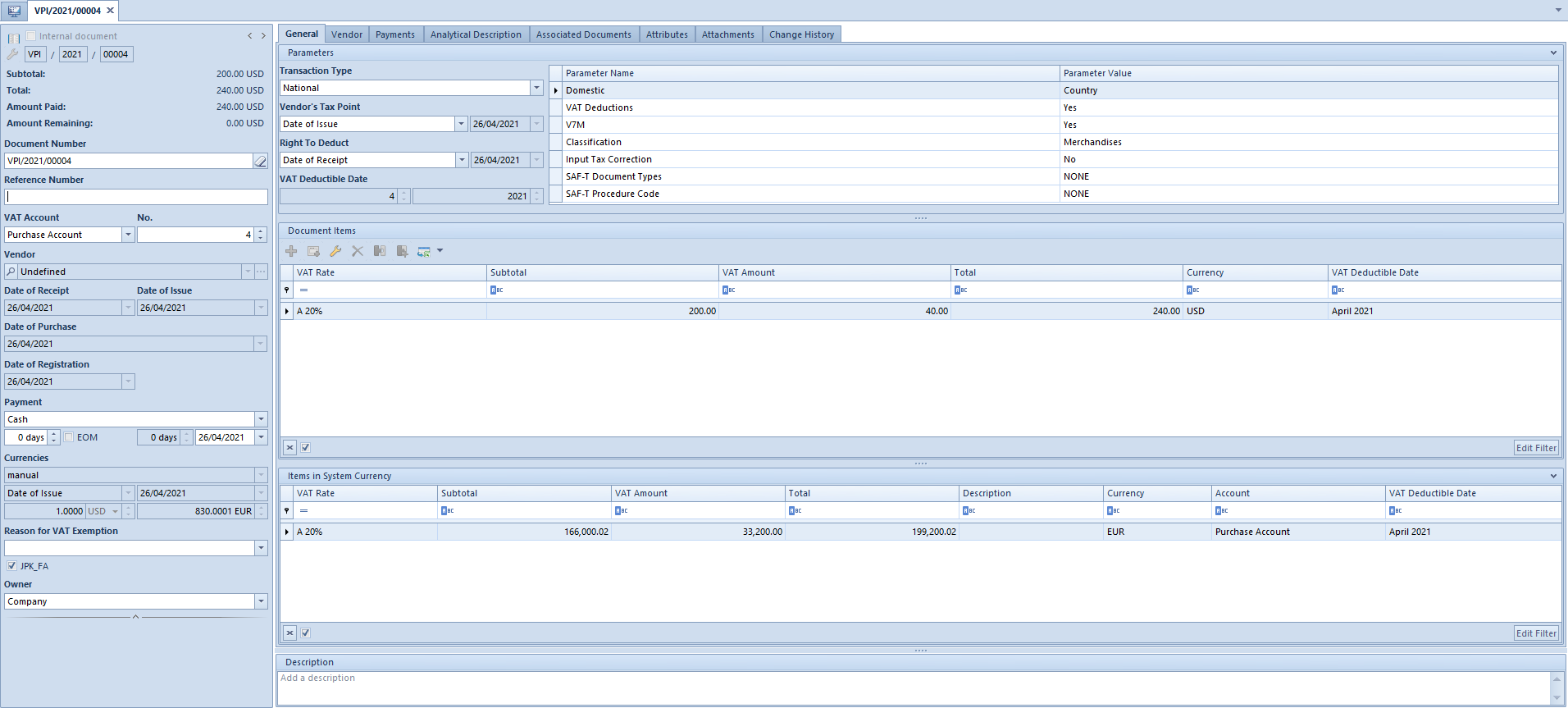

After selecting a document a foreign currency, an additional section – Items in System Currency is displayed on VAT document form in tab General. Values in the foreign currency, which are presented in this section, are recalculated by a specified exchange rate into amounts denominated in system currency.

Editing VAT purchase invoice in a foreign currency

Documents: VPI and VPIC are specific documents for which edited values denominated in a given currency do not recalculate the values denominated in the currency different than the “edited” currency.

The abovementioned rule results from the necessity of ensuring flexibility of calculations in the face of ambiguous regulations relating to VAT calculation method on documents denominated in a foreign currency. The application of a more rigorous calculation principle would disable registration of purchase invoice with values consistent with a document received from a vendor.

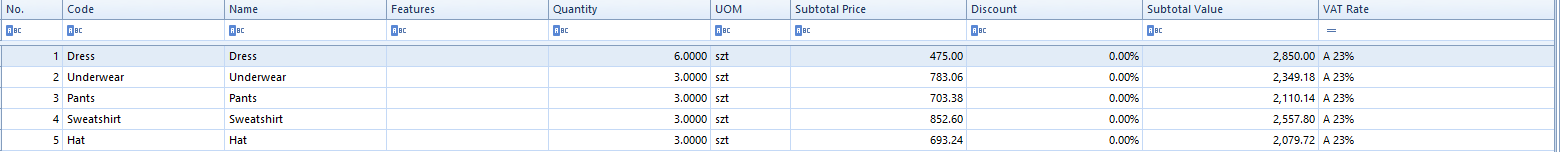

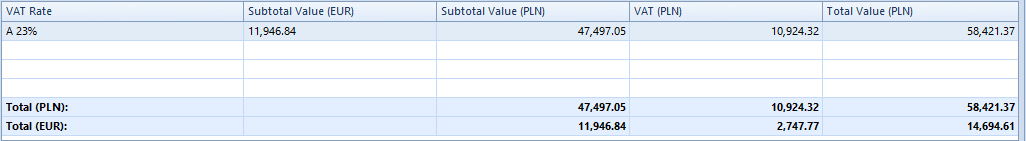

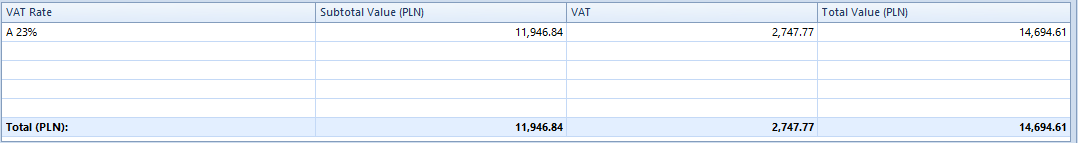

Thus, the total amount of the invoice is: Depending on VAT calculation method, VAT amounts in Comarch ERP Standard system are the following: In order to ensure consistency between the registered document and the one from the vendor, it will be possible to edit the following:

Subtotal VAT Total

EUR 11 946.84 2747.77 14 694.61

PLN 10 924.31

The change of values on a VAT invoice denominated in a foreign currency does not recalculate the values denominated in a different currency. Thus, changing the value denominated in the currency USD does not affect the value denominated in the currency PLN. When making such change, appropriate information is displayed – that information appears only when the value is edited in a document for the first time, the information no longer appears during edition of values in the following columns. It will be displayed again not until the document is re-edited and changes in values are made. Such information concerns only VPI and VPIC documents having currency other than the system currency defined in the header.