Contents

General information

A ZD notification can be:

- Generated during the first recalculation of a VAT-7 tax return

During the first recalculation of a VAT-7 tax return the following message is displayed: “Would you like to generate a ZD notification?”. A user can deny the operation by selecting the option No, in which case a ZD notification will not be generated or accept the operation by selecting the option Yes, in which case a ZD notification will be generated as unconfirmed, provided that there are documents in the system, which fulfill the conditions of including them in the ZD notification. If this being the case, the value of the field Notification about corrected tax base and the amount of tax due (Zawiadomienie o skorygowaniu podstawy opodatkowania oraz kwoty podatku należnego (VAT-ZD) of the tax return VAT-7(17) be automatically set to Yes. If none of the documents fulfills the conditions of inclusion in ZD notification at the time of recalculating the tax return VAT-7 (17), a notification will not be generated and the following message will then be displayed: “There are no documents in the system that satisfy statutory criteria of inclusion in ZD notification. A ZD notification has not been generated”.

- Generated after selecting value Yes in appropriate tax-return field

In case ZD notification is not generated during first recalculation of VAT-7 tax return, it is possible to generate it by selecting the option Yes in the column Value in the field Notification about corrected tax base and the amount of tax due of the VAT-7(17) tax return and then recalculating the tax return.

Only invoices are included in the notification, correcting documents are not taken into account. Each invoice is listed in as many records as there are payments.

If an invoice payment is included in a ZD notification, it is not possible to:

- divide the invoice payment

- change the invoice’s due date

- change the payment’s entity

- delete the invoice from the system

In the menu of the window ZD Notification, there are standard buttons and, additionally:

- [Recalculate All] – button active for unconfirmed notifications. It recalculates all the tabs of a ZD notification.

- [Accept] – button active for unconfirmed notification

- [Accept] – button active for unconfirmed and accepted notification

- [Open] – button active for accepted notification It allows for restoring Unconfirmed status for a notification.

- [Generate Correcting Documents] – allows for generating lacking correcting documents

- [Recalculate] – button active for unconfirmed notification It recalculates currently open tab of a ZD notification.

- [Add] – button active for unconfirmed notification. It opens VAT-ZD tab in VAT accounts filtered to those documents that <<can be included in ZD notification>>.

- [Delete] – button active for unconfirmed notification after selecting an invoice. It deletes selected items.

- [Edit] – button active after selecting an invoice. After clicking on the button, a list of the following options becomes available:

- Edit Document – opens VAT invoice form for a selected item

- Edit Payment – opens payment form for a selected item

- Edit correction – opens VAT invoice form of a correction generated for a selected item

- [Taxpayer Status] – button active for unconfirmed notification. After selecting the button, in a currently opened tab an additional column Active Taxpayer is added and the taxpayer status will be verified on the day of verification according to the settings on customer/vendor form. If the customer/vendor is no longer an active taxpayer on the day of recalculating the notification, then he/she should not be included in the notification and the records relating to such customer/vendor must be deleted.

- [VAT Accounts] – opens the list of VAT accounts in the VAT-ZD tab

- [Tax Returns] – opens the list of tax returns

- [Corrections in VAT Accounts] – button available upon selecting accepted or confirmed ZD notification It opens the ZD Notification Corrections window, presenting correcting documents generated to a specific ZD notification with division into the following tabs Creditor, Debtor, Creditor – Paid Documents, Debtor – Paid Documents.

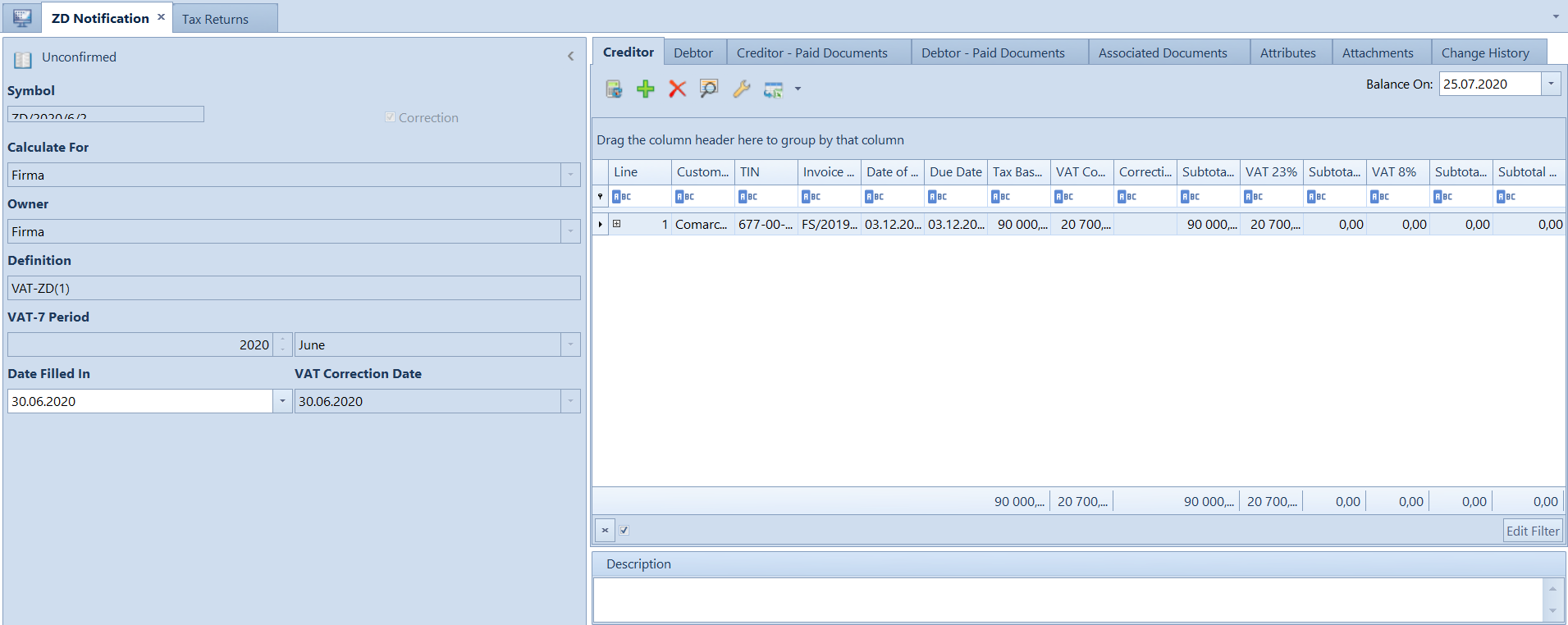

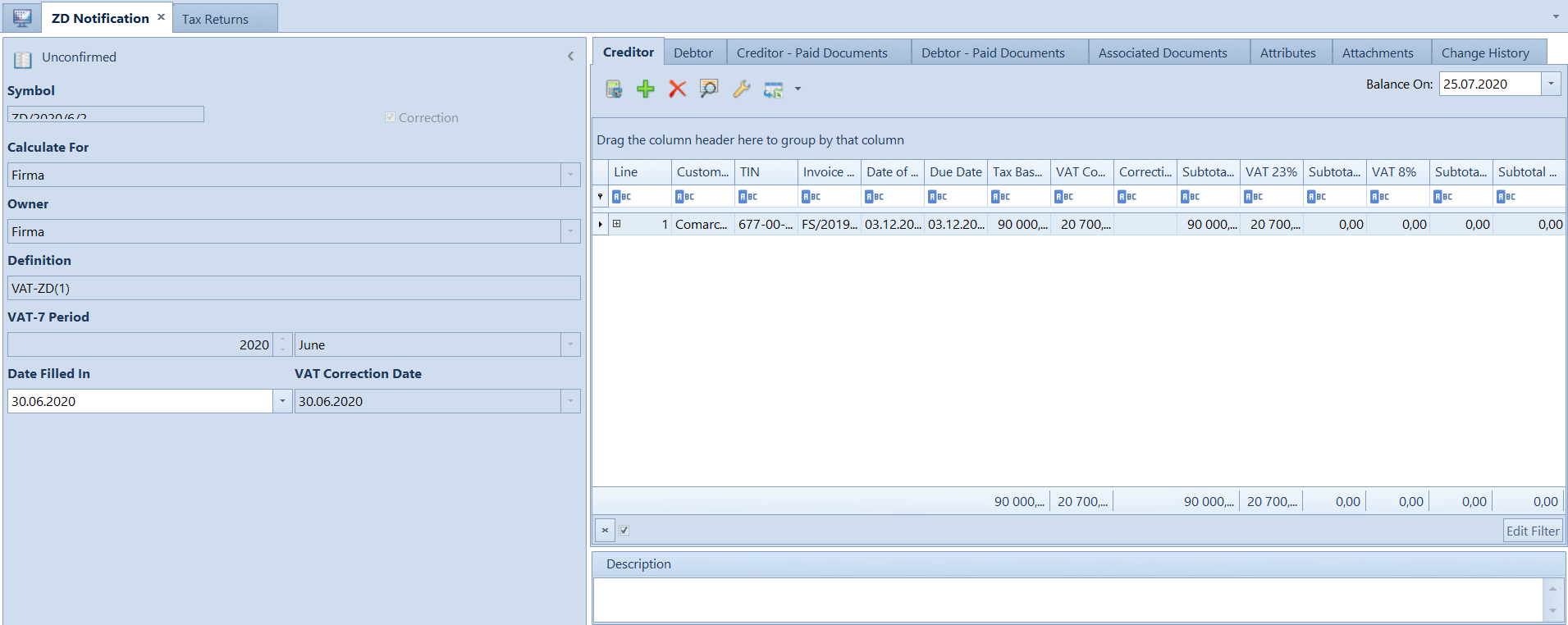

ZD notification form is composed of the following elements:

Side panel

Status – ZD notification can receive on the following statuses: Unconfirmed, Accepted, Confirmed

Symbol – ZD notification number, cannot be edited by the user

Correction – it is selected if ZD notification is generated to the correction of VAT-7 tax return; otherwise, the parameter is deselected

Calculate For – non-editable field, its value is completed based on the field Calculate For of VAT-7 tax return to which a ZD notification has been generated

Owner – non-editable field, its value is completed based on the field Owner of VAT-7 tax return to which a ZD notification has been generated

Definition – field for selecting the definition of VAT-ZD attachment form. By default, the definition valid in the period for which a tax return is being calculated, is set.

VAT-7 Period – non-editable field completed on the basis of the field Month in VAT-7 tax return to which a ZD notification has been generate

Date Filled In – completed on the basis of the field Date Filled In in VAT-7 tax return to which a ZD notification has been generated. It is editable until the ZD notification is accepted or confirmed.

VAT Correction Date – non-editable field completed with the last day of the month for which VAT-7 tax return was calculated, to which a ZD notification has been generated.

Tab Creditor

This tab presents the list of sales invoices which fulfill the statutory criteria of including them in a ZD notification and will be the basis for generating corrections of tax base and output tax.

This tab is visible if value in the field Notification about the corrected tax base and the amount of the output tax (VATZD)) of VAT-7 tax return, is set to Yes.

On the basis of the data from this tab, a VAT-ZD attachment is generated and then sent via the Internet to the Tax Office. If the tab Creditor is not visible or it does not contain at least one invoice, a VAT-ZD attachment is not generated.

This tab is recalculated according to the field Balance On which value is, by default, set to the 25th day of the next month for which the notification is being submitted. If date in the field Balance On is changed, it is necessary to recalculate the tab.

Tab Debtor

This tab presents the list of purchase invoices which fulfill the statutory criteria of including them in a ZD notification and will be the basis for generating corrections of tax base and input tax

This tab is recalculated according to the field Balance On which value is, by default, set to the last day of the month for which the notification is being submitted. If date in the field Balance On is changed, it is necessary to recalculate the tab.

Tab Creditor – Paid Documents

This tab presents the list of sales invoices which either were listed in a ZD notification, in the Creditor tab, as unpaid within 150 or 90 days since their due dates and correcting documents were generated to them or value Beyond the system was selected on their payments in the VAT-ZD field. Once these sales invoices are partially or entirely paid, they are qualified again in the ZD notification in the Creditor – Paid Documents tab.

This tab is recalculated according to the field Balance On which value is, by default, set to the last day of the month for which the notification is being submitted. If date in the field Balance On is changed, it is necessary to recalculate the tab.

Tab Debtor – Paid Documents

This tab presents the list of sales invoices which either were listed in a ZD notification, in the Creditor tab, as unpaid within 150 or 90 days since their due dates and correcting documents were generated to them or value Beyond the system was selected on their payments in the VAT-ZD field. Once these sales invoices are partially or entirely paid, they are qualified again in the ZD notification in the Debtor – Paid Documents tab.

This tab is recalculated according to the field Balance On which value is, by default, set to the last day of the month for which the notification is being submitted. If date in the field Balance On is changed, it is necessary to recalculate the tab.

Tab Associated Documents

This tab presents the list of tax returns and correcting documents associated with ZD notification.

Tabs: Attributes, Attachments, Change History

Detailed description of tabs can be found in article <<Tab Discount Codes, Analytical Description, Attributes, Attachments and Change History>>.

Accepting ZD notification

In order to accept a ZD notification, it is necessary to click on the [Accept] button, placed in the List group of buttons. When accepting a ZD notification, the user decides whether to generate straightaway the documents correcting the tax base and value.

Correcting documents are generated as internal documents and are tagged with an uneditable parameter VAT-ZD Correction available in the side panel of the document. The parameter is not subject to edition. Correcting documents can also be generated by selecting the button [Generate Correcting Documents]. Correcting documents are generated separately for particular invoices.

Acceptance of ZD notification can be undone with the use of [Undo Acceptance] option, which changes document status back to Unconfirmed, provided that correcting documents have not yet been generated to it and that the VAT-7 tax return, to which the notification applies, is still unconfirmed. If correcting documents are generated to the VAT-ZD, they must first be deleted. The user can find correcting documents in VAT accounts or from the level of a ZD notification, by clicking on the [Corrections in VAT Account] button. The button opens the ZD Notification Corrections list, where it is possible to delete, preview, print or post correction documents.

Confirming ZD notification

In order to accept a ZD notification, it is necessary to click on the [Confirm] button, placed in the List group of buttons. ZD notification can be confirmed provided that correcting documents have been generated to it. As in the case of tax-return, once a TRA document is downloaded, the status of a ZD notification will be automatically changed to Confirmed.

A confirmed ZD notification can be restored back to status Accepted with the use of option [Undo Confirmation] which is available on ZD notification list under the right mouse button. This operation can only be performed when VAT-7 tax return has not been confirmed.

ZD notification correction

Along with a correction to VAT-7, a ZD notification correction is also generated, which in the document side panel is tagged with a non-editable parameter Correction. Similarly, as VAT-7 tax return correction, ZD notification correction is a holistic document. It lists all the documents qualified as to be included in a given month.

If a given document is already included in a ZD notification, it cannot be removed from ZD notification correction. The following message will be displayed: “This document is included in the ZD notification [ZD notification number] and cannot be deleted.”

Particular records in ZD notification correction are presented as Before and Currently. The system compares the data from the source notification and the current data. When correcting a ZD notification, the system generates documents correcting tax base and value only for those documents which have not been included in the notification or have changed in reference to a previous ZD notification.