There are two distinct models of work in regard to handling of bank accounts of a business entity:

- Registration on the basis of a received bank statement – registration of operations related with transactions made on a bank account only after receiving a bank statement (in form of a file or paper printout). Then, transactions are registered and later posted. It is in force, for example, in Poland.

- Registration of transactions on a regular basis and using so-called Bank Reconciliation – registration of operations related with transactions made on a bank account on a regular basis that is, a bank transaction is registered when a bank transfer order is issued to a bank. Upon receiving a bank statement, completeness of transactions is verified on both sides – in company’s registry and in a bank. It is in force, for example, in France.

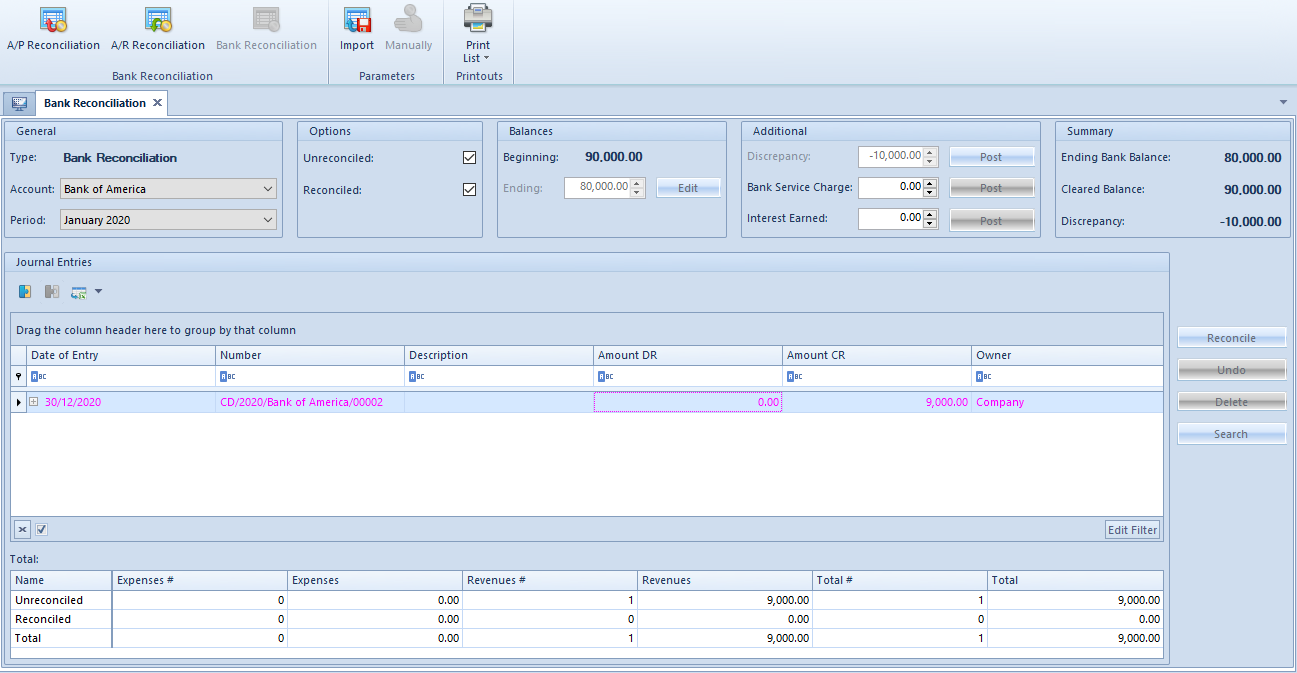

The form Bank Reconciliation is available from the level of the menu Accounting, under the [Bank Reconciliation] button. It is created within a company and refers to its system currency.

In the menu of the reconciliation form, there are standard buttons and, additionally:

[A/P Reconciliation] – button active until it is selected. Upon its selection, it becomes deactivated and in the Type field, the value A/P Reconciliation is set.

[A/R Reconciliation] – button active until it is selected. Upon its selection, it becomes deactivated and in the Type field, the value A/R Reconciliation is set.

[Bank Reconciliation] – button active until it is selected. Upon its selection, it becomes deactivated and in the Type field, the value Bank Reconciliation is set. This operation is default after opening the Bank Reconciliation form.

[Import] – button available after selecting account and period. It allows for loading a bank statement item.

[Manually] – button available after selecting account and period. It becomes active after loading a bank statement item. It allows for getting back to making payments for a given month in a manual manner. After selecting the button, the message “If you return to a Manual Reconciliation you will lose all of your progress for this month. Are you sure you would like to return to a Manual Reconciliation?” is displayed and the user can decide whether to continue or not.

The bank reconciliation form is divided into three sections:

Section General

The following parameters are available in the section:

- Type – value set on the basis of the buttons [A/P Reconciliation], [A/R Reconciliation] and [Bank Reconciliation]. Depending on the option selected in sections Journal Entries and Bank Statements, CP operations, CW operations or both types are presented.

- Account – allows for selecting an account of Bank type

- Period – allows for defining a month of accounting period to which the user is logged-in

Section Options

The following parameters are available in the section:

- Mark Manually – parameter available after importing a bank statement. If the parameter is unchecked, after selecting an item in one of the lists, the system automatically searches and marks corresponding items on the other list. If the parameter is checked, the user needs to mark them in the other list manually.

- Unreconciled – if the parameter is checked, the system displays unreconciled journal entries. If unchecked, the unreconciled journal entries are hidden.

- Reconciled – if the parameter is checked, the system displays reconciled journal entries. If unchecked, the reconciled journal entries are hidden.

Section Balances

The following fields are available in the section:

- Beginning – this field can be completed during the first reconciliation with bank account. In successive months the beginning balance is completed on the basis of the ending balance of the previous month, without a possibility of editing it.

- Ending – mandatory field, completed manually. In case it is necessary to edit an entered value, it is possible to use the [Edit] button.

Section Additional

The following fields are available in the section:

- Discrepancy – non-editable field, calculated automatically as a difference between the beginning and the ending balance

- Bank Service Charge – field completed manually

- Bank Service Charge – field completed manually

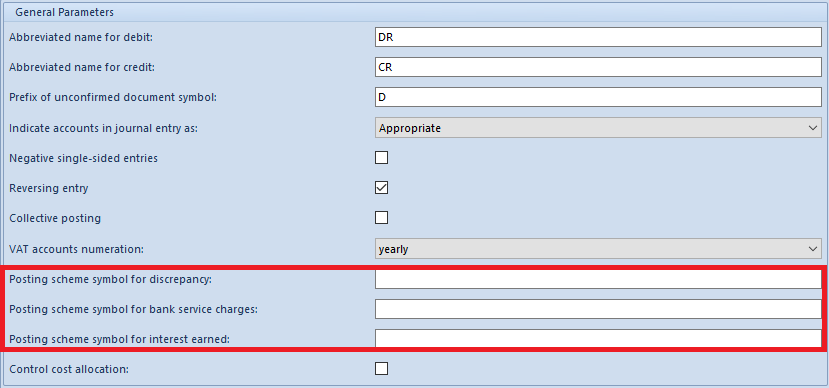

In order to post the values of those field, it is necessary to select the [Post] button which is available next to the amount field. To be able to post those amounts, first it is necessary to define posting schemes for each type of discrepancy in the system configuration (System → Configuration → Accounting → General Parameters section). Assigned schemes should be added within the Cash-Bank Transaction document type. Detailed description of the functionality of posting schemes can be found in category Document posting.

Section Summary

Section is composed of non-editable fields which are provided for information purposes:

- Ending Bank Balance – value from the field Ending of the Balances section

- Cleared Balance – value calculated on the basis of the beginning balance and the value of reconciled transactions

- Discrepancy – value calculated as a difference between the beginning balance and the cleared balance

Section Journal Entries

This section is divided into a list containing journal entries and a table with a summary of reconciled and unreconciled values.

Buttons related with journal entries reconciliation:

- [Reconcile] – allows for reconciling selected journal entry

- [Undo] – cancels reconciliation of a selected journal entry

- [Delete] – in the case of an imported transaction, allows for deleting items which have been imported and remain unreconciled

- [Search] – allows for searching a journal entry which is not included in defined period. After clicking on the button, the list of c/b transaction is displayed and the user can select a journal entry which will be added to the list of journal entries in the bank reconciliation window

- [Reconcile All] – allows for reconciling all journal entries corresponding to the transaction at the same time. The button is visible in case of importing a transaction.

Section Bank Statement

Section available after importing a bank statement with the use of the [Import] button.

It contains information regarding loaded items of the bank statement which are supposed to be reconciled with the journal entries.

Sections Journal Entries and Bank Statement contain summaries of reconciled and unreconciled transaction with divided into the following columns:

- Name – reconciliation status: Unreconciled, Reconciled, Total

- Expenses #, Revenues #, Total # – number of items of a specific type and in total, divided into statuses

- Expenses, Revenues, Total – value of items of a specific type and in total, by status