Contents

Defining accounting period

Accounting period is a period for which financial statements are made in mode provided by legal rules. It can be calendar year or another period used for tax purposes. Accounting period or its changes are defined by status or agreement on which basis a unit was created. If unit had started its activity in the second half of defined accounting period, then financial statement and the books for this period can be connected with financial statement and the books of the next year.

In multi-company structures, each company has its own accounting period along with partial periods. Each accounting period has its own chart of accounts, its own set of ledgers and general ledger. As in the case of other accounting objects, an accounting period added to a center of Company type is inherited by all its child centers.

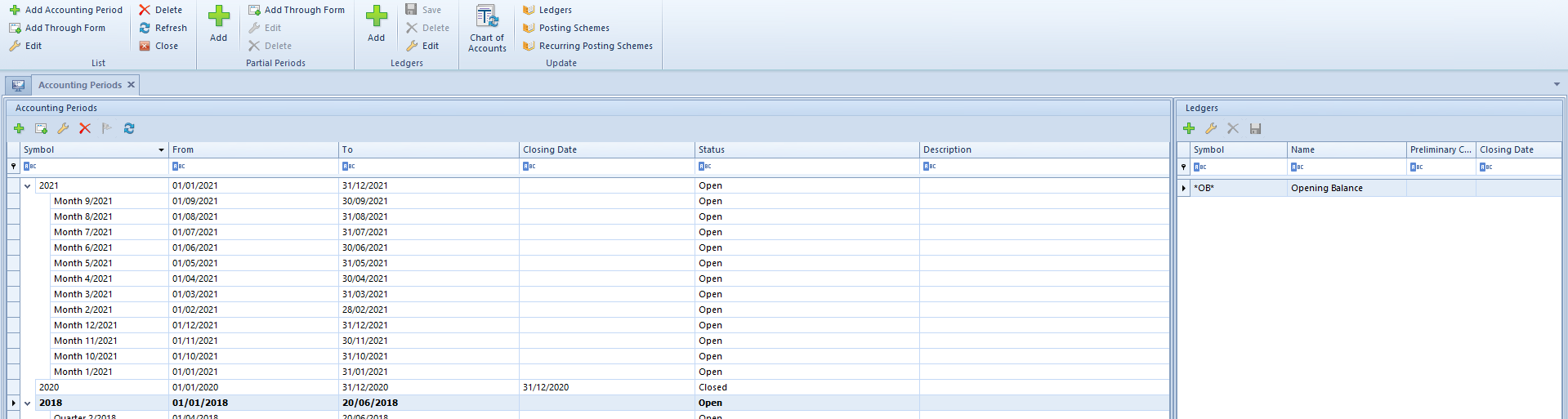

The list of accounting periods is available in the Configuration → Accounting, under button [Accounting Periods].

Methods of adding accounting period:

- by clicking on [Add Accounting Period] button available directly in the table. A user must fill in field Symbol Fields Opening/Closing dates are filled in automatically with the possibility of changing them. An accounting period does not have to last 12 moths, so it does not have to coincide with calendar year. It can last longer than 12 months and can be shorter than 1 month if such need occurs. In Polish and French language version of the system, accounting period is 23 months maximum.

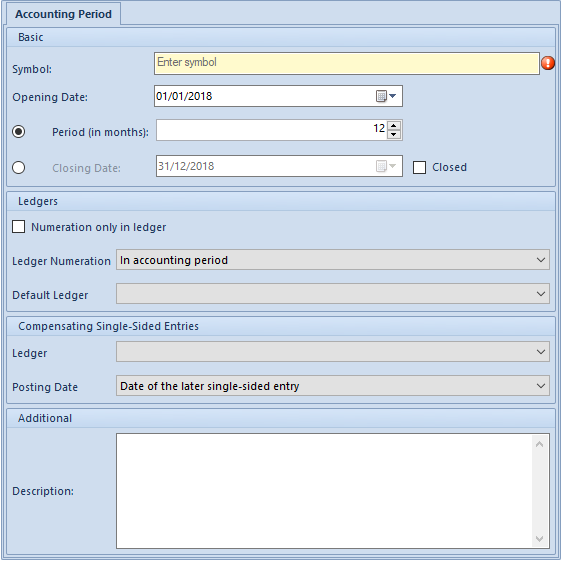

- by clicking on [Add Through Form] button – after selecting this option, the form of a new accounting period is opened

The form is composed of the following elements:

Section Basic

- Symbol − mandatory field, allowing for entering up to 50 characters (letters or digits), used for identifying each period. It must be unique within a given company.

- Opening Date − date of beginning of accounting period. The date cane be entered manually or

selected from a built-in calendar which is expanded by clicking on the arrow. This date is presented in the column From on the list of accounting periods. - Period (in months) – field used for defining length of accounting period exact to month, e.g. when Opening Date is set to 2019-01-01 and Period (in months) to 6 months, then in Closing Date field automatically will appear date 2019-06-30 which cannot be changed. The maximum number of months that can be entered is specified in the parameter <<Maximum length of accounting period – number of months>> which is available from the level of System → Configuration → Accounting → section Accounting Period. In Polish and French versions of the application it is 23 months, whereas in Spanish version it is 12 months and those values are not changeable. The minimum length of an accounting period is 1 month. The number of months can be entered manually or with the use of arrows up – down.

- Closing Date − allows for entering precise date of closing of an accounting period. It is used in situations when user wants to enter an accounting period which does not las for a full number of months, but, e.g., for 2 months and 2 days. The date can be entered manually or selected from a built-in calendar. This date is presented in the column To on the list of accounting periods. When adding an accounting period, the system automatically sets Period (in months) to active, whereas Closing Date field cannot be edited. A user can activate them by selecting option Closing Date.

- Closed − this parameter is presented only if a user has granted <<permission to close accounting periods>>. Checking it means that an accounting period is already closed. No ledgers or accounting operations can be added to it, it cannot be modified. An accounting period is not closed automatically after exceeding the closing date. It should be closed by a user.

Detailed description of closing accounting period can be found in article <<CLOSING ACCOUNTING PERIOD>>.

Section Ledgers

- Numeration Only in Ledger – the user abandons the number within the general ledger and the numeration is made only in the ledger. Thanks to that, it is possible to confirm journal entries in particular ledgers. Detailed description can be found in article <<Numeration of journal entries??>>.

- Ledger closing − this parameter is available only if the parameter Numeration Only in Ledger is activated. Detailed description can be found in article Closing ledgers.

- Ledger Numeration − journal entries can be numbered annually or monthly. Detailed description can be found in article <<Numeration of journal entries>>. Monthly type of numbering allows for entering journal entries in a closed month, if confirmation of entries in subsequent month has been already started. Selecting monthly type of numbering results in adding two new segments:

- Calendar Year − it is necessary due to the unusual accounting period and the necessity of retaining the uniqueness of numbers. Otherwise, it may come to duplication of the same numbers in the same month of the following calendar year.

- Month

- Default Ledger − ledger selected by a user as default. When adding first accounting period, a predefined ledger is set as default. A user can change it after defining ledgers in the system. A ledger indicated as default is set, by default, when adding an accounting note, manual journal entry or an accounting scheme.

Section Compensating single-sided entries

- Ledger − posting ledger in which compensating single-sided entries are registered

- Posting Date − date with which the single-sided entry was registered in the books. Dates available for selection: Date of the later single-sided entry or System date

- Description − allows for entering an additional description Description is presented in the list of accounting periods.

Current accounting period

After defining parameters on accounting period form, it is possible to save it by clicking on [Save] button placed in Period group of buttons and, at the same time, set is as current accounting period.

If a user saves newly added accounting period and does not indicate it as a current accounting period, he/she can do it later. To do so, it is necessary to select the proper period from the list of accounting periods and select button [Set As Current]. A period set as current is displayed as bold element on the list of accounting periods. In the system, only one current period can be set for a given company and it cannot be a closed accounting period.

An accounting period is set as current for a given operator. It means that each operator can have different accounting period set as current.

Updating accounting objects

When saving an accounting period, the system asks whether a user wants to transfer the chart of accounts, account, numbering schemes, cost allocations, ledgers and accounting schemes from the previous accounting period.

A user can also transfer the above-mentioned objects later, from the previous accounting period, by selecting the buttons listed below from the section Update placed on the list of accounting periods or from the level of the list of particular objects.

- Chart of Accounts − chart of accounts, definitions of cost allocations and numbering schemes are transferred from the previous accounting period

- Ledgers − ledgers are transferred from the previous accounting period

- Ledgers − ledgers are transferred from the previous accounting period. If in a newly added accounting period, there is already a scheme with the same type and symbol as in the previous accounting period, it is not transferred.

- Posting schemes − posting schemes are transferred from the previous accounting period. If in a newly added accounting period, there is already a scheme with the same type and symbol as in the previous accounting period, it is not transferred.

Partial accounting period

The system allows for dividing an accounting period into partial periods by means of the following options:

- [Divide Into Months] −this button automatically divides selected accounting period into partial periods. Periods created as a result of the division are listed chronologically (month by month). On the list of accounting periods, next to the symbol of divided period, a marker appears, which an be used for expanding and collapsing the list of partial periods.

- [Divide Into Quarters] − this button automatically divides selected accounting period into quarters, that is into three-month periods.

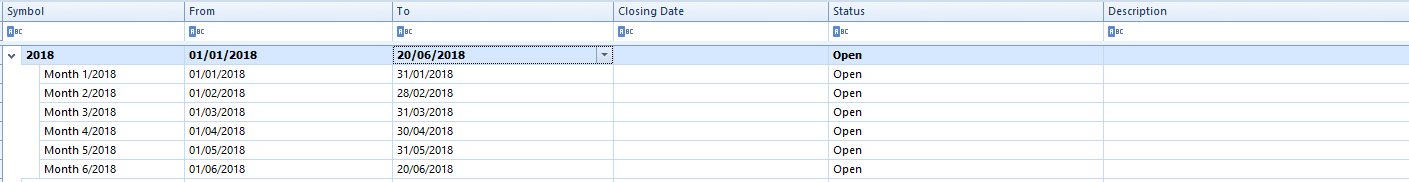

Division of an accounting period which lasts e.g. from 01/01/2018 to 6/20/2018:

- Division into monthly partial accounting periods

The system divides the period into six partial accounting periods, five of which will last for one month each one and the sixth period will last for twenty days.

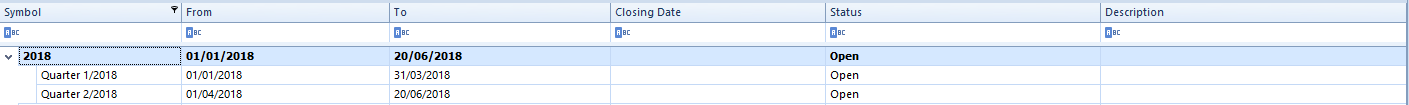

- Division into quarterly partial accounting periods

The system divides the period into two quarters, one of which will last for three months and the second one will last for two months and twenty days.

An accounting period can be added also manually, with the use of the following buttons:

- [Add in Table] (adding accounting period directly on the list)

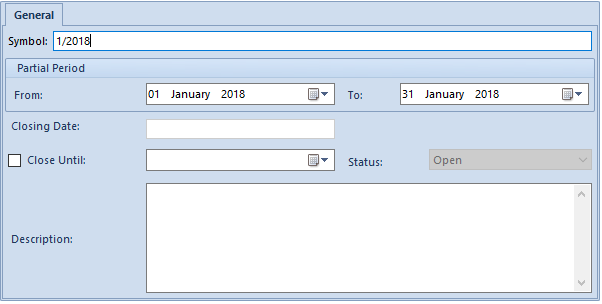

- [Add Through Form] − these options allow for adding manually any partial period. After selecting an accounting period and clicking on [Add Through Form] button, a form of a partial accounting period opens.

The form of a partial accounting period is composed of the following elements:

- Symbol − mandatory field, allowing for entering up to 50 characters (letters or digits), used for identifying each partial period, e.g. name abbreviation. It mus have a unique value. Symbol is visible only upon expanding the list of partial periods within a given accounting period.

[Alert]It is not possible to add several partial periods with the same symbol within a given company. [/alert]

- Opening Date − allows for entering date of opening of a partial period, that is the date of the beginning of the validity of partial period. The date is visible only upon expanding the list of partial periods within a given accounting period.

- Closing Date − allows for entering date of closing of a partial period, that is the date of the end of the validity of partial period. The date is visible only upon expanding the list of partial periods within a given accounting period.

The dates can be entered manually or selected from a built-in calendar. Dates of validity of partial periods cannot exceed dates of validity of accounting period. The system blocks inserting invalid dates. Date of opening and date of closing of partial periods can “overlap”.

- Description − allows for entering an additional description Description is visible on the list of partial periods in a given accounting period.