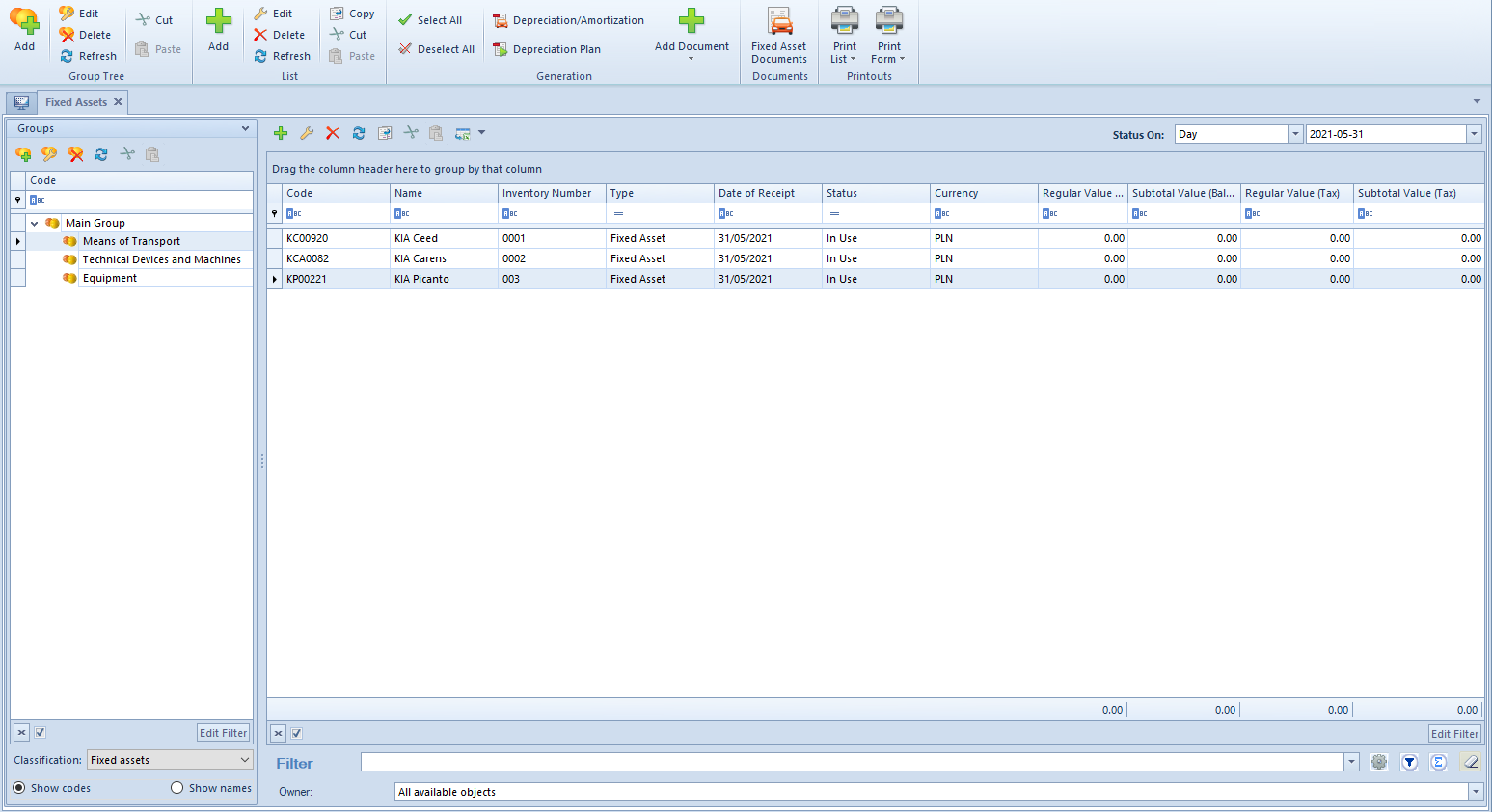

The list of fixed assets is available in the menu Fixed Assets under the button [Fixed Assets] and is composed of section related to fixed asset groups as well as the fixed asset list. From the level of this list, it is possible to add new fixed assets and review the existing fixed asset records.

On the list of fixed assets, there are <<standard buttons>> and additionally:

- [Copy] – allows for copying fixed asset form. The following values are copied to the form of a new fixed assets: value of the parameter Under Construction, Code, Name, Type, FAC, Location, Custodian, Purchase Method, Depreciation Method, Depreciation Rate, Coefficient, Number of Months, Seasonality, Depreciation Suspension, Analytical Description, Attributes and Attachments

- [Depreciation/Amortization] – <<generates write-offs>> for selected fixed assets

- [Depreciation Plan] – <<generated depreciation plan>> for selected fixed assets

- [Add Document] – allows for adding <<fixed asset documents>>

- [Fixed Asset Documents] – allows for previewing documents of fixed assets. The button is available, if one fixed asset is marked on the list. Clicking on the button opens the <<list of documents>> of the marked fixed assets, from the level of which it is possible to add, edit, delete, post or print fixed asset documents.

The fixed asset list is a historical list. On this list it is possible to verify the data on a specified day selected in the field Balance On. By default, the list of fixed assets presents balance as of the current date.

For the parameter Balance On, it is possible to select one of the following values:

- Day – presents the values of fixed assets on a selected day

- Month – presents the values of fixed assets on the last day of the selected month

- Year – presents the values of fixed assets on the last day of the selected calendar year

The list of fixed assets is composed of the following columns:

- Code

- Name

- Inventory Number

- Type

- Date of Receipt – date of receipt retrieved from the form of fixes asset or empty column in the case of a fixed asset under construction

- Status – receives such values as In Use, Disposed or Sold depending on the selected date: Date of Disposal/Date of Sale on a <<fixed asset form>>

- Currency

- Regular Value (Balance-sheet/Tax/IAS) – the number of columns presenting a regular value depends on the number of depreciation areas activated in the <<system configuration window>>

- Subtotal Value (Balance-sheet/Tax/IAS) – the number of columns presenting a subtotal value depends on the number of depreciation areas activated in the system configuration window

Columns hidden by default

- Date of Disposal

- Date of Sale

- FAC

- Location of Use

- Description

- Custodian

- Under Construction – non-editable column. The option is checked, if on the form of a fixed asset, the parameter Under Construction is checked.

- Current Total Value (Balance-sheet/Tax/IAS) – the number of columns presenting a total value depends on the number of depreciation areas activated in the system configuration window

- Depreciated By Multiple Areas – non-editable column. The option is checked, if on the form of a fixed asset, more than one depreciation area has been activated.

- Owner

- Attachment – attachment miniature is presented in this column

Disposed fixed assets are highlighted on the list in red, whereas sold fixed assets are presented in orange.

Detailed description of the functioning of filters can be found in category <<Searching and filtering data>>.