According to the regulation of the Ministry of Finance, in order to recognize the bad debt relief, it is necessary to generate a VAT-ZD attachment (notification about the corrected tax base and the amount of tax due).

A ZD notification is used for listing all the invoices that fulfill all of the following conditions:

- invoice unpaid or partially paid

- it has already been 150 days since their due dates

- it has not been 2 years since the date of issue of the invoice

- transaction type: National

- VAT-7 Tax Return parameter Yes

- in the case of purchase in voices VAT Deductions: Yes or Conditionally

- VAT-ZD parameter Yes (with the possibility of changing it from the level of the document payment)

- ZD Notification parameter No

- parameter Active Taxpayer (checked)

- parameter In liquidation unchecked

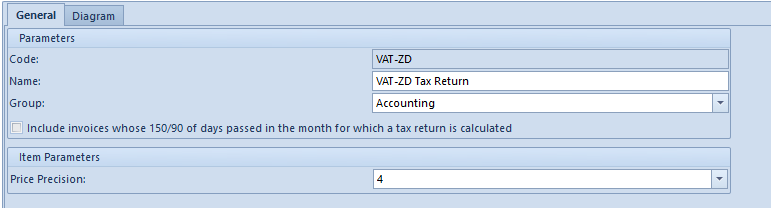

Depending on the setting of the parameter Include invoices whose 150/90 of days passed in the month for which a tax return is calculated that is available in VAT-ZD document definition (Configuration → Types → VAT-ZD document), a ZD notification:

- lists the invoices in the case of which additional 150/90 days have passed since their due dates in the month for which the notification is being calculated – if the parameter is checked

- lists the invoices in the case of which additional 150/90 days have passed since their due dates in the month for which the notification is being calculated – when the parameter is checked

During recalculation of VAT-7 tax return along with a VAT-ZD notification:

with deselected parameter Include invoices whose 150/90 of days passed in the month for which a tax return is calculated – the VPI will be listed in a VAT-ZD notification issued for the month of March

with selected parameter Include invoices whose 150/90 of days passed in the month for which a tax return is calculated – the VPI will not be listed in a VAT-ZD notification issued for the month of March

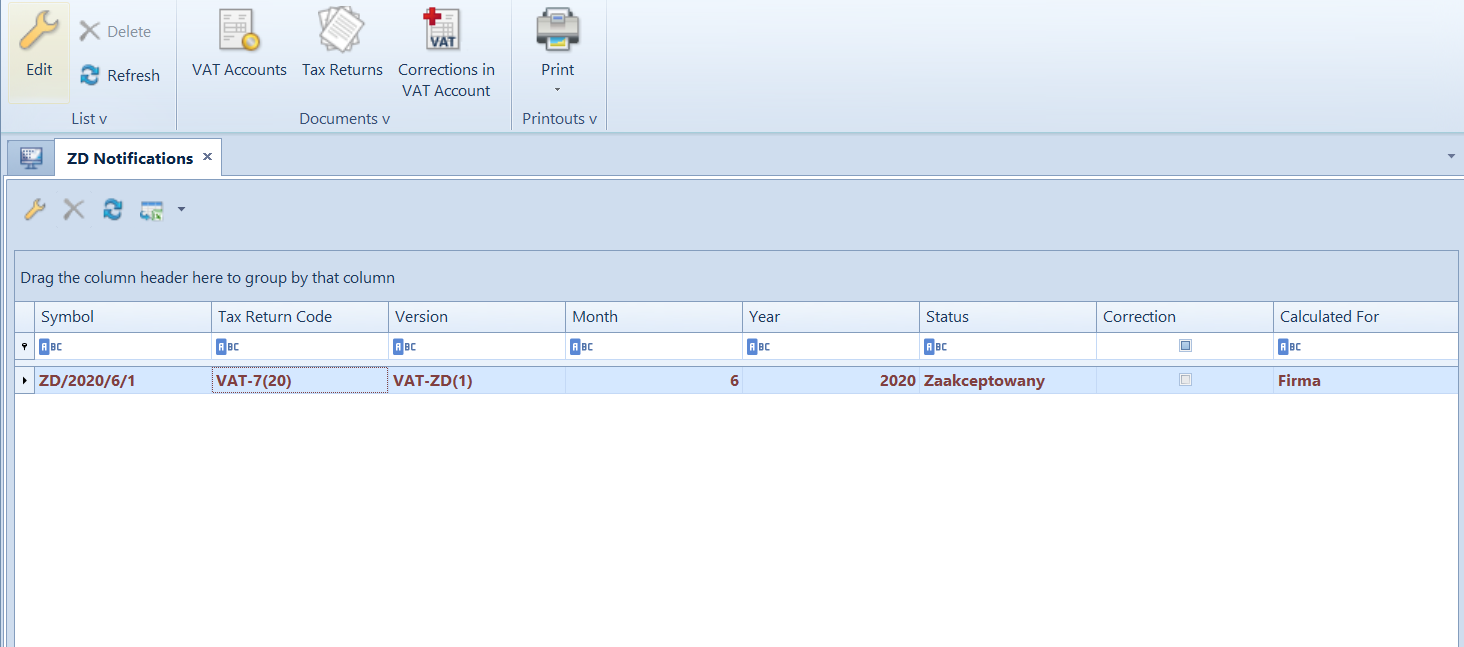

The list of ZD notifications is available under the button [ZD Notifications] available in the menu Accounting.

The list contains <<standard buttons>> and, additionally:

- [VAT Accounts] – opens VAT-ZD tab in VAT accounts

- [Tax Returns] – opens the list of tax returns

- [Corrections in VAT Accounts] – button available upon selecting accepted or confirmed ZD notification on the list. It opens ZD Notification Corrections window, presenting correcting documents generated to a specific ZD notification with division into the following tabs: Creditor, Debtor, Creditor – Paid Documents, Debtor – Paid Documents

A ZD notification document can be deleted from the level of the list ZD Notifications, with the use of the button [Delete] or along with deleting the VAT–7 tax return to which it was generated.

The list of ZD notifications is composed of the following columns:

- Symbol – ZD notification symbol

- Tax Return Code – VAT-7 tax return symbol

- Version – version of VAT-ZD attachment form

- Month – month of recalculation of notification

- Year – year of recalculation of notification

- Status – notification status

- Correction – information whether notification is a correction

- Calculated for – center for which the notification is calculated

and columns hidden by default:

- Correcting Documents – information whether correcting documents were generated to the notification

- E-Tax Return status – information regarding the status of forwarding VAT tax return for which ZD notification was created

- Creditor – information whether a notification contains the tab Creditor

- Owner – ZD notification owner

Detailed description of functioning of the filters can be found in category <<Searching and filtering data>>>