Contents

e-Tax Free

The Tax Free procedure allows travelers to receive a VAT refund on goods purchased in the EU and exported outside the customs territory of the European Community. From January 1st, 2022, a traveler may receive a VAT refund if:

- a vendor issues an e-Tax Free document and uploads it to the Tax Free system,

- the traveler exports the purchased goods outside of the European Union,

- the Customs and Tax Authority officer confirms the export of goods in the TAX FREE system after checking first the conformity of the traveler’s details provided in the e-Tax Free document with the data in the traveler’s passport or another ID document,

- the traveler shows a confirmed e-Tax Free document printout received from the vendor – if the traveler leaves the European Union from a member state other than Poland.

With the introduction of digitalization of payments and document flow, from January 2022 online cash registers must be used for registering sales transaction (changes introduced by the amendment of the VAT Act within the so-called VAT SLIM package).

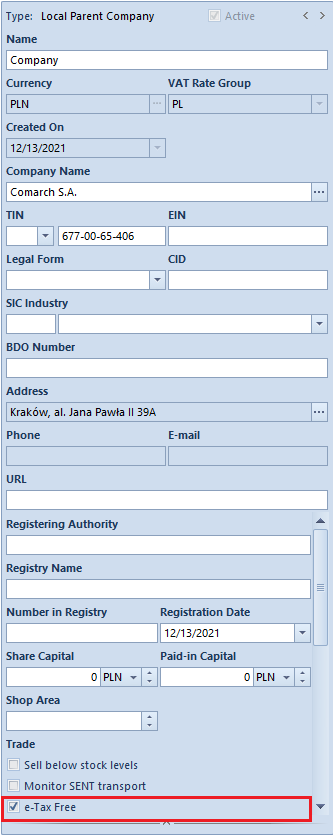

Changes on company form

On the company form, there is a new e-Tax Free parameter that determines the availability of:

- e-Tax Free-related fields in a document

- actions responsible, among other, for sending, invalidating and receiving a Tax Free status

Selecting the parameter activates also a Tax Free tab where the following has to be specified:

- Tax Free intermediary – customer/vendor being a Tax Free intermediary

- login and password used to communicate with the Web Service

- certificate thumprint and its validity

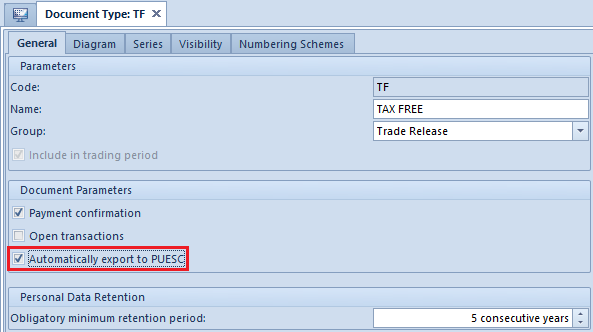

Furthermore, in the TF document definition in the company where the above-mentioned parameter is selected, an option for uploading automatically TF documents during their confirmation has been added – Automatically export to PUESC available under Document Parameters section.

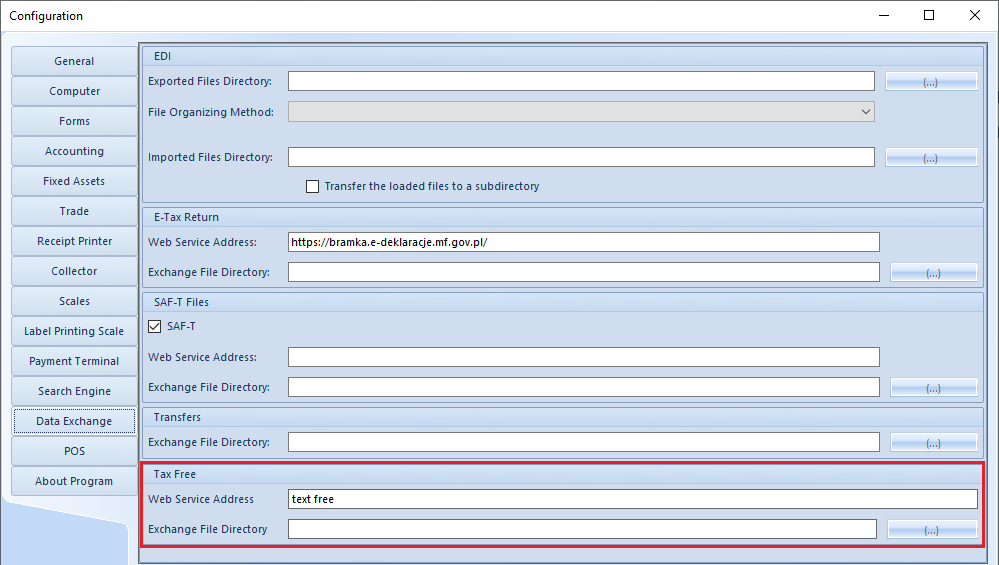

Configuration of Tax Free data exchange

In system configuration: System → Configuration → Data Exchange, there is a new section with Tax Free parameters, which stores the data necessary to log on to PUESC and XML files directory. This section becomes available after selecting the Tax Free parameter in the company/center to which the operator is logged in. Fields is this section are the following:

- Web Service Address

- Exchange File Directory to which all XML files will be uploaded and received

Changes on customer/vendor form

On employee form, there is a new tab Tax Free available only if the e-Tax Free parameter is selected on the company form. Fields in this tab, whose values are retrieved from an account in PUESC, are the following:

- E-mail Address and Password

- SISC ID

Changes to Tax Free document

Tax Free document has been adapted to exchange data with PUESC and extended with additional fields used during electronic communication:

- Intermediary – retrieved, by default, from the Tax Free Intermediary field in the center of Company type (changeable)

- USN Number – unique document number assigned by PUESC

- e-Document Status – informs about documents status in PUESC

- Date Sent – date a document was uploaded to PUESC, it updates the e-document status to Registered

- Date Exported – date on which the goods left a member state

- Date Received – export confirmation date

- Amount To Refund – amount of VAT refund – completed manually with the Tax Free Payment action

- Refund Date – VAT refund date – completed manually with the Tax Free Payment action

Following fields have been added in the Customer tab of TF document:

- Date of Birth – this field value is retrieved from the customer form and for Undefined customer it can be completed manually

- Bank Account Number – retrieved from the customer form and changeable if more than one bank account is assigned to the customer

Following additional columns have been added to optimize the work with TF document list: e-Document Status and Unique System Number.

In addition, in order to export a document to the PUESC platform and perform the related action, a new button group e-Tax Free has been added in the ribbon with the following actions:

- Export TF – the button is active only, if the document is confirmed, and the e-document status is Sent. After selecting the export action and following correct system validation, the TF document receives a system number and its status is updated to Registered.

- Get Status – the button is active for documents with e-document status: Registered, Export Confirmed, Export Partially Confirmed.

- Invalidate TF – invalidates a document that should not be uploaded to PUESC (active only for Registered documents). Selecting this button opens an additional window in which it is possible to enter a reason for invalidation. Once the action is confirmed, the document status changes to Invalidated.

- Pay TF – action available only for TF with Export Confirmed and Export Partially Confirmed Document needs to be paid if the traveler leaves the EU member state other than Poland and wants to receive a VAT refund. The traveler must in such case provide to the vendor the export confirmation stamped by customs officers of a given country and based on such confirmation the vendor must register payment of the Tax Free document in the system. Selecting this button opens an additional window with the fields below:

- Date of Export – date from the document delivered by the traveler, which confirms that the goods were exported outside of the EU state (only when accounted for at the border of an EU country other than Poland)

- Exporting Country – EU member state from which the goods were exported

- Refund Date – date the traveler is to receive a VAT refund

- Amount To Refund – refundable VAT value, the amount should neither be greater than the amount of TF document nor less than 0

After the data is verified and updated in the system, a message communicating the Refunded status is returned.

Tax Free batch operations

Above the TF document list, there is a new button group e-Tax Free with the following buttons used for batch operations:

- Export TF

- Get Status

After an operation is performed in a single batch in a dedicated window, a log file informing about the operation status is displayed.

Tax Free printout

Due to the introduced changes, the previous printout has been developed with new mandatory data:

- Non-cash refund

- Cash refund

- Unique system number

- (customer’s) Date of birth

- Cash register number

- Issuer’s full name

- SISC ID

- Document confirmation date and time

- I have received a VAT refund in the amount of ………. pln …… gr, – text to be completed manually