Memos are used for decreasing/increasing a payable of a customer/vendor resulting from a trade transaction. They are also used in case of sales of vouchers.

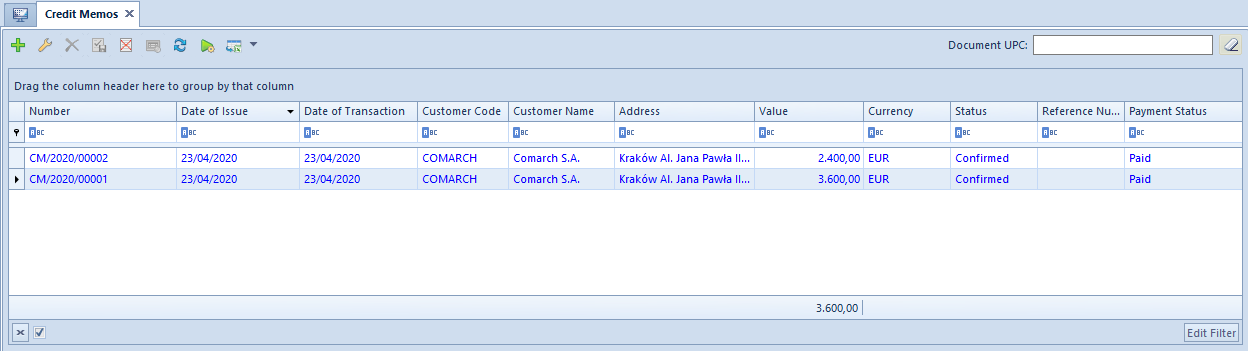

The list of credit/debit memos registered in the system is available from the level of the module Sales/Purchase → Credit Memos/Debit Memos.

The list of documents has been described in article List of documents.

A list of memos, except from standard information available in the majority of lists, presents also Payment Status, which allows to quickly verify whether a given memo has been already completed or not.

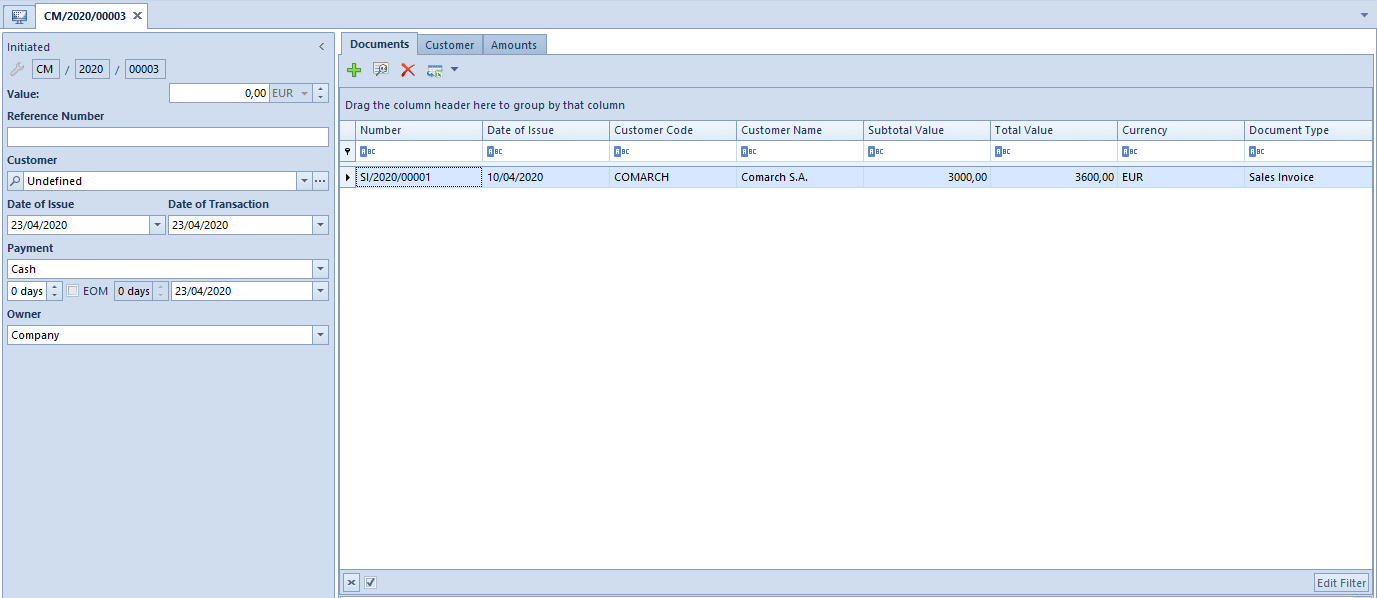

In order to register a new credit/debit memo, click the button [Add] from the List button group, which opens a new form. For both types of memos, the form is nearly identical. The primary difference is the subtab – Vouchers, available in a debit memo form, in which it is possible to register the sale of fixed amount vouchers.

The document form and its tabs have been described in subcategory Document forms.

Characterictics of memos:

- A memo can only be issued in the system currency.

- A condition required to be able to confirm a memo is indicating a customer/vendor and introducing memo value higher than 0. The exception is a situation when a note registers sale of vouchers. Then, such a document can be issued for undefined customer/vendor.

- In order to complete a sales/purchase invoice from a credit/debit memo, it is necessary to edit the payment created in the invoice and select the parameter Compensations which can be found in the Payments tab. Then, in a list of documents to be paid relevant memos, which have yet not completed any other document, appear.

Credit memo

A credit memo is issued by a vendor to record payables in respect of a customer, but in contrast to corrections it does not contain elements (items).

Credit memos can be used in the following situations:

- issuing a memo as a result of incorrect invoicing of the quantity or value in comparison with the actual delivery. A larger quantity or greater value of merchandise has been invoiced than it was actually delivered. In this case, a credit memo is issued which enables a customer to receive a discount in the amount of the memo received during subsequent purchases.

- issuing a memo on the basis of an earlier agreement under which it is stipulated that after purchasing merchandise for a specific amount a customer can receive a discount in the form of a credit memo

Debit memo

Debit memo is used in situations that are opposite to situations involving credit memo, if quantity or value of provided merchandise is superior to the quantity or value indicated in an invoice. It is used in order to document debits associated with payments not subject to VAT taxation.

The source document for a debit memo can be a credit memo document issued by vendor or an internal document which constitutes basis for charging a given customer.

A debit memo can also register the sales of gift vouchers, because only the use of a voucher, that is the physical purchase of goods by a vendor making a payment by handing a goods voucher (a gift card), will be the activity taxable with VAT.

Detailed description of registering vouchers can be found in article Adding vouchers to the system.